444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sweden new construction market represents a dynamic and rapidly evolving sector that plays a crucial role in the nation’s economic development and urban transformation. Sweden’s construction industry has demonstrated remarkable resilience and growth, driven by increasing urbanization, sustainable building practices, and government initiatives promoting energy-efficient infrastructure. The market encompasses residential, commercial, and industrial construction projects, with a strong emphasis on green building technologies and innovative construction methodologies.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% annual growth rate in recent years. The Swedish construction landscape is characterized by advanced building standards, stringent environmental regulations, and a commitment to achieving carbon neutrality by 2045. Urban development projects in major cities like Stockholm, Gothenburg, and Malmö continue to drive demand for new construction, while rural areas benefit from infrastructure modernization initiatives.

Technological innovation remains at the forefront of Sweden’s construction sector, with increasing adoption of Building Information Modeling (BIM), prefabricated construction methods, and smart building technologies. The market benefits from strong government support, favorable financing conditions, and a skilled workforce that embraces sustainable construction practices. Housing shortage in metropolitan areas has created significant opportunities for residential developers, while commercial construction thrives due to Sweden’s robust economy and business-friendly environment.

The Sweden new construction market refers to the comprehensive sector encompassing all newly built structures, infrastructure projects, and development activities within Swedish territory. This market includes residential housing projects, commercial buildings, industrial facilities, public infrastructure, and specialized construction such as healthcare facilities, educational institutions, and transportation hubs.

New construction specifically excludes renovation, refurbishment, or maintenance activities, focusing solely on ground-up development projects that add to Sweden’s built environment. The market encompasses various construction methodologies, from traditional building techniques to innovative modular construction and sustainable building practices that align with Sweden’s environmental objectives.

Market participants include construction companies, real estate developers, architectural firms, engineering consultancies, material suppliers, and technology providers. The sector operates within a framework of strict building codes, environmental regulations, and quality standards that position Sweden as a global leader in sustainable construction practices and energy-efficient building design.

Sweden’s new construction market demonstrates exceptional strength and growth potential, driven by urbanization trends, housing demand, and commitment to sustainable development. The market benefits from strong economic fundamentals, government support for green building initiatives, and advanced construction technologies that enhance efficiency and environmental performance.

Key market drivers include population growth in urban centers, increasing demand for energy-efficient buildings, and substantial infrastructure investment programs. The residential segment accounts for approximately 45% of total construction activity, while commercial and industrial projects contribute significantly to market expansion. Sustainable construction practices have become mandatory rather than optional, with nearly all new projects incorporating renewable energy systems and environmentally friendly materials.

Market challenges include skilled labor shortages, rising material costs, and complex regulatory requirements. However, these challenges are offset by strong demand fundamentals, technological innovation, and Sweden’s reputation as a leader in green construction. The market outlook remains positive, with continued growth expected across all segments, particularly in sustainable housing and smart building technologies.

Strategic insights reveal several critical factors shaping Sweden’s new construction landscape:

Population growth and urbanization trends serve as primary drivers for Sweden’s new construction market. Major cities experience continuous population influx, creating sustained demand for residential housing, commercial spaces, and supporting infrastructure. Stockholm region alone accounts for significant construction activity, with new residential projects addressing acute housing shortages.

Government initiatives promoting sustainable development and carbon neutrality goals drive demand for energy-efficient buildings and green infrastructure. Sweden’s commitment to achieving net-zero emissions by 2045 necessitates extensive construction of sustainable buildings and renovation of existing structures. Public investment in infrastructure, healthcare facilities, and educational institutions provides steady market demand.

Economic prosperity and low interest rates facilitate construction financing and real estate investment. Sweden’s stable economy, strong employment rates, and favorable business environment attract both domestic and international investment in construction projects. Corporate expansion and industrial development create demand for commercial and industrial construction.

Technological advancement in construction methods, materials, and building systems drives market innovation and efficiency improvements. Digital transformation enables better project management, cost control, and quality assurance, making construction projects more attractive to investors and developers.

Skilled labor shortages present significant challenges for Sweden’s construction industry, with demand for qualified workers exceeding supply across multiple trades. The aging workforce and limited vocational training programs exacerbate this constraint, potentially limiting market growth and increasing project costs. Construction companies face difficulties recruiting experienced professionals, particularly in specialized areas like sustainable building technologies.

Rising material costs and supply chain disruptions impact project economics and timeline management. Global commodity price fluctuations, transportation costs, and availability of specialized building materials create uncertainty for construction planning and budgeting. Steel, concrete, and timber price volatility particularly affects large-scale construction projects.

Regulatory complexity and lengthy approval processes can delay project initiation and increase development costs. While Sweden’s building standards ensure quality and sustainability, the comprehensive regulatory framework requires extensive documentation, environmental assessments, and compliance verification. Permitting delays can extend project timelines and impact market responsiveness.

Land availability and high land costs in prime urban locations constrain development opportunities and affect project viability. Competition for suitable construction sites, particularly in Stockholm and other major cities, drives up land prices and limits affordable housing development.

Sustainable construction presents enormous opportunities as Sweden transitions toward carbon neutrality. The growing demand for green buildings, renewable energy integration, and circular economy principles creates new market segments and revenue streams. Construction companies specializing in sustainable technologies and materials are well-positioned for growth.

Smart building technologies offer significant opportunities for innovation and differentiation. Integration of IoT sensors, automation systems, and energy management platforms creates value-added services and recurring revenue opportunities. PropTech solutions and building management systems represent growing market segments.

Modular and prefabricated construction methods present opportunities for efficiency improvements and cost reduction. Factory-built components and standardized building systems can address labor shortages while maintaining quality standards. Off-site construction techniques enable faster project delivery and reduced environmental impact.

Infrastructure modernization creates opportunities in transportation, utilities, and digital infrastructure development. Sweden’s commitment to maintaining world-class infrastructure requires continuous investment in new construction and system upgrades. 5G network infrastructure and electric vehicle charging stations represent emerging construction opportunities.

Supply and demand dynamics in Sweden’s new construction market reflect strong underlying fundamentals with persistent housing shortages driving residential construction demand. Urban population growth continues to outpace housing supply, creating favorable conditions for residential developers and construction companies. Commercial construction benefits from Sweden’s robust economy and business expansion activities.

Competitive dynamics feature both large international construction companies and specialized local firms competing across different market segments. Market consolidation trends see larger companies acquiring specialized capabilities in sustainable construction and technology integration. Competition increasingly focuses on sustainability credentials, technological innovation, and project delivery efficiency.

Pricing dynamics reflect material cost pressures, labor market constraints, and quality requirements. While construction costs have increased, strong demand and limited supply support pricing power for construction companies. Value engineering and efficiency improvements help offset cost pressures while maintaining profitability.

Innovation dynamics drive continuous improvement in construction methods, materials, and project management approaches. Digital transformation initiatives enhance productivity, reduce waste, and improve project outcomes. Collaboration between construction companies, technology providers, and research institutions accelerates innovation adoption.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Sweden’s new construction market. Primary research includes extensive interviews with industry executives, construction company leaders, government officials, and market participants to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of government statistics, industry reports, construction permits data, and economic indicators. MarkWide Research utilizes proprietary databases and analytical tools to process large datasets and identify market patterns, growth trends, and competitive dynamics.

Quantitative analysis involves statistical modeling, trend analysis, and market sizing methodologies to provide accurate market assessments. Data validation through multiple sources ensures reliability and accuracy of market insights. Qualitative analysis incorporates expert opinions, industry knowledge, and market intelligence to provide context and interpretation for quantitative findings.

Market segmentation analysis examines different construction categories, geographic regions, and customer segments to provide detailed market understanding. Competitive landscape analysis evaluates market participants, their strategies, and market positioning to provide comprehensive market intelligence.

Stockholm region dominates Sweden’s new construction market, accounting for approximately 35% of total construction activity. The capital region benefits from strong economic growth, population influx, and government investment in infrastructure and housing projects. Residential construction addresses acute housing shortages, while commercial development supports the region’s role as Scandinavia’s business hub.

Gothenburg metropolitan area represents the second-largest construction market, driven by port activities, industrial development, and urban renewal projects. The region’s focus on sustainable transportation and green logistics creates opportunities for specialized construction projects. West Sweden benefits from proximity to Norway and Denmark, attracting cross-border investment and development.

Malmö and southern Sweden experience significant construction activity due to the Öresund Bridge connection with Copenhagen and integration with the greater Copenhagen metropolitan area. Cross-border commuting and business activities drive demand for residential and commercial construction. The region leads in sustainable urban development initiatives.

Northern Sweden presents unique opportunities in mining-related infrastructure, renewable energy projects, and specialized industrial construction. While representing a smaller portion of total market activity, the region offers high-value projects in green steel production, data centers, and renewable energy infrastructure.

Market leadership in Sweden’s new construction sector features a mix of large international companies and strong domestic players, each bringing specialized capabilities and market expertise:

Competitive strategies emphasize sustainability credentials, technological innovation, and specialized expertise in green building technologies. Companies increasingly differentiate through digital construction capabilities, modular building expertise, and comprehensive project delivery services.

By Construction Type:

By Building Method:

By Sustainability Level:

Residential Construction dominates market activity, driven by persistent housing shortages and urbanization trends. Multi-family housing projects represent the largest segment, addressing demand in metropolitan areas. Sustainable housing initiatives and energy-efficient designs have become standard requirements, with passive house standards increasingly adopted in new developments.

Commercial Construction benefits from Sweden’s strong economy and business expansion activities. Office buildings incorporate flexible workspace designs and smart building technologies to meet evolving workplace requirements. Retail construction adapts to changing consumer behaviors, emphasizing experiential retail and mixed-use developments.

Industrial Construction focuses on advanced manufacturing facilities, logistics centers, and specialized industrial buildings. Green steel production facilities and renewable energy infrastructure represent high-growth segments. Data centers and technology facilities require specialized construction expertise and advanced building systems.

Infrastructure Construction encompasses transportation improvements, utility upgrades, and public facility development. Sustainable transportation infrastructure, including electric vehicle charging networks and public transit systems, drives significant construction activity. Digital infrastructure projects support Sweden’s technology leadership.

Construction Companies benefit from strong market demand, government support for sustainable construction, and opportunities for technological innovation. Specialization in green building technologies and modular construction methods provides competitive advantages and premium pricing opportunities. Long-term infrastructure investment programs ensure steady project pipelines.

Real Estate Developers enjoy favorable market conditions with strong demand for residential and commercial properties. Sustainable development projects attract premium valuations and tenant interest. Government incentives for energy-efficient buildings improve project economics and market appeal.

Technology Providers find expanding opportunities in smart building systems, construction automation, and digital project management tools. PropTech solutions and building management systems create recurring revenue streams and long-term client relationships.

Material Suppliers benefit from consistent demand and opportunities to develop innovative, sustainable building materials. Local sourcing preferences and environmental requirements create opportunities for specialized material providers and circular economy solutions.

Financial Institutions participate in a stable, growing market with strong government support and favorable regulatory environment. Green financing products and sustainability-linked loans align with market trends and regulatory requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has evolved from optional feature to mandatory requirement, with all new construction projects incorporating environmental considerations. Carbon-neutral buildings and circular economy principles guide design and construction decisions. Energy performance standards continue to tighten, driving innovation in building systems and materials.

Digital Transformation accelerates across all construction phases, from design and planning to project management and building operations. Building Information Modeling (BIM) becomes standard practice, while artificial intelligence and machine learning optimize construction processes. Digital twins and IoT integration enable predictive maintenance and operational efficiency.

Modular Construction Growth addresses labor shortages and efficiency requirements through factory-built components and standardized building systems. Off-site construction reduces project timelines, improves quality control, and minimizes environmental impact. Hybrid construction methods combine traditional and modular approaches for optimal results.

Smart Building Integration transforms buildings into intelligent, connected environments that optimize energy use, enhance occupant comfort, and provide valuable data insights. PropTech solutions and building automation systems become standard features in commercial and residential developments.

Regulatory Evolution continues with updated building codes emphasizing energy efficiency, sustainability, and climate resilience. New regulations mandate life-cycle assessments and carbon footprint calculations for major construction projects. Building standards align with Sweden’s carbon neutrality goals and EU sustainability directives.

Technology Partnerships between construction companies and technology providers accelerate innovation adoption and capability development. Strategic alliances focus on digital construction tools, sustainable materials, and smart building systems. Research collaborations with universities and institutes drive breakthrough innovations.

Market Consolidation sees larger construction companies acquiring specialized firms to expand capabilities in sustainable construction and technology integration. Vertical integration strategies include material suppliers, technology providers, and property management services. International expansion and cross-border partnerships increase market reach.

Investment Initiatives in construction technology, sustainable materials, and workforce development strengthen industry capabilities. Government funding supports research and development in green building technologies and construction innovation. Private investment in PropTech and construction automation accelerates market transformation.

Strategic Focus on sustainability and technology integration will differentiate successful construction companies in Sweden’s evolving market. MWR analysis indicates that companies investing in green building expertise and digital construction capabilities achieve superior market positioning and profitability. Specialization in high-growth segments like modular construction and smart buildings provides competitive advantages.

Workforce Development initiatives should address critical skill shortages through training programs, apprenticeships, and technology adoption that augments human capabilities. Construction companies must invest in employee development and retention strategies to maintain competitive advantages. Partnerships with educational institutions and vocational training programs ensure sustainable talent pipelines.

Technology Investment in digital construction tools, project management systems, and building automation platforms enhances efficiency and market competitiveness. Early adoption of emerging technologies like artificial intelligence, robotics, and advanced materials provides first-mover advantages. Integration of technology across all business functions improves operational performance.

Market Expansion strategies should consider geographic diversification within Sweden and potential Nordic market opportunities. Urban focus remains critical given population concentration and development demand, while specialized opportunities exist in northern Sweden’s industrial and renewable energy sectors.

Long-term growth prospects for Sweden’s new construction market remain highly positive, supported by demographic trends, urbanization, and sustainability imperatives. MarkWide Research projects continued market expansion driven by housing demand, infrastructure modernization, and green building requirements. The market is expected to maintain robust growth rates exceeding 5% annually over the next decade.

Sustainability transformation will accelerate with stricter environmental regulations and carbon neutrality goals driving demand for advanced green building technologies. Net-zero buildings will become standard rather than exceptional, creating opportunities for companies with specialized expertise in sustainable construction methods and materials.

Technology integration will fundamentally transform construction processes, project management, and building operations. Artificial intelligence and automation will address labor shortages while improving efficiency and quality. Smart buildings will become the norm, integrating IoT sensors, energy management systems, and predictive maintenance capabilities.

Market evolution toward more efficient, sustainable, and intelligent construction practices positions Sweden as a global leader in advanced building technologies. International expansion opportunities for Swedish construction companies and technology providers will grow as global markets adopt similar sustainability standards and technological approaches.

Sweden’s new construction market stands at the forefront of global construction innovation, combining strong economic fundamentals with unwavering commitment to sustainability and technological advancement. The market demonstrates exceptional resilience and growth potential, driven by urbanization trends, housing demand, and comprehensive government support for green building initiatives.

Market opportunities abound in sustainable construction, smart building technologies, and modular construction methods that address efficiency and environmental requirements. While challenges exist in labor availability and material costs, the overall market outlook remains highly positive with continued expansion expected across all construction segments.

Strategic success in this market requires focus on sustainability expertise, technology integration, and innovative construction methods that deliver superior performance and environmental benefits. Companies that embrace digital transformation, invest in workforce development, and specialize in green building technologies will capture the greatest opportunities in Sweden’s dynamic construction landscape. The market’s evolution toward carbon-neutral, intelligent buildings positions Sweden as a global leader in sustainable construction practices and advanced building technologies.

What is New Construction?

New construction refers to the process of building new structures, including residential, commercial, and industrial buildings. It encompasses various stages such as planning, design, and execution, often involving multiple stakeholders like architects, contractors, and regulatory bodies.

What are the key players in the Sweden New Construction Market?

Key players in the Sweden New Construction Market include Skanska, NCC, and Peab, which are involved in various construction projects ranging from residential developments to large infrastructure works. These companies are known for their innovative approaches and commitment to sustainability, among others.

What are the growth factors driving the Sweden New Construction Market?

The Sweden New Construction Market is driven by factors such as urbanization, increasing demand for housing, and government investments in infrastructure. Additionally, the focus on sustainable building practices is encouraging new construction projects across the country.

What challenges does the Sweden New Construction Market face?

Challenges in the Sweden New Construction Market include rising material costs, labor shortages, and regulatory hurdles. These factors can lead to project delays and increased expenses, impacting overall market growth.

What opportunities exist in the Sweden New Construction Market?

Opportunities in the Sweden New Construction Market include the growing demand for eco-friendly buildings and smart city developments. Additionally, advancements in construction technology present new avenues for efficiency and innovation in project execution.

What trends are shaping the Sweden New Construction Market?

Trends in the Sweden New Construction Market include a shift towards modular construction, increased use of digital tools for project management, and a focus on energy-efficient designs. These trends are transforming how construction projects are planned and executed.

Sweden New Construction Market

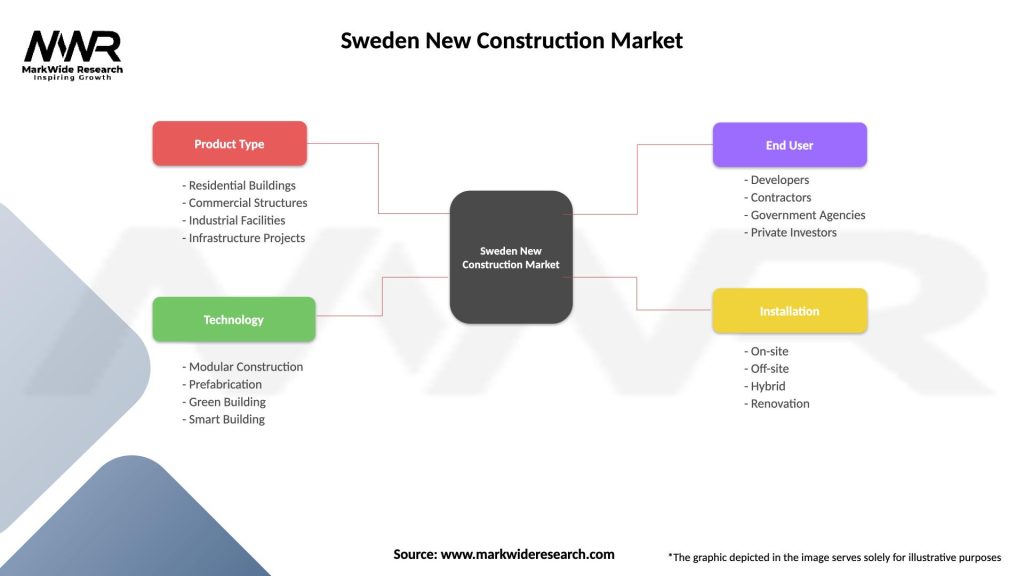

| Segmentation Details | Description |

|---|---|

| Product Type | Residential Buildings, Commercial Structures, Industrial Facilities, Infrastructure Projects |

| Technology | Modular Construction, Prefabrication, Green Building, Smart Building |

| End User | Developers, Contractors, Government Agencies, Private Investors |

| Installation | On-site, Off-site, Hybrid, Renovation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sweden New Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at