444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sweden life insurance market represents a sophisticated and mature financial services sector that has evolved significantly over the past decade. Swedish consumers demonstrate high levels of financial literacy and insurance awareness, contributing to robust market penetration rates across various demographic segments. The market is characterized by strong regulatory frameworks, innovative digital solutions, and a growing emphasis on sustainable investment practices that align with Sweden’s environmental consciousness.

Market dynamics indicate substantial growth potential driven by demographic shifts, including an aging population and increasing awareness of retirement planning needs. The Swedish life insurance sector benefits from a stable economic environment, high disposable income levels, and a culture that values long-term financial security. Digital transformation has become a key differentiator, with insurers investing heavily in technology platforms to enhance customer experience and operational efficiency.

Regulatory compliance remains a cornerstone of market operations, with Swedish authorities maintaining stringent oversight to protect consumer interests. The market exhibits strong competition among domestic and international players, fostering innovation in product offerings and service delivery. Sustainable investing has emerged as a significant trend, with approximately 78% of life insurance providers incorporating ESG criteria into their investment strategies, reflecting Sweden’s commitment to environmental responsibility.

The Sweden life insurance market refers to the comprehensive ecosystem of financial institutions, products, and services that provide life insurance coverage and related financial protection to Swedish residents and businesses. This market encompasses traditional life insurance policies, unit-linked insurance plans, pension products, and hybrid investment-insurance solutions designed to meet diverse customer needs across different life stages.

Life insurance products in Sweden serve multiple purposes, including income replacement for beneficiaries, estate planning, tax optimization, and retirement savings. The market includes both individual and group insurance policies, with employers often providing life insurance as part of comprehensive employee benefit packages. Swedish life insurers operate under strict regulatory guidelines established by the Swedish Financial Supervisory Authority, ensuring consumer protection and market stability.

Market participants include traditional insurance companies, banks offering insurance products, mutual insurance societies, and international insurers with Swedish operations. The sector plays a crucial role in Sweden’s broader financial services landscape, contributing to economic stability through long-term capital formation and risk management solutions for individuals and businesses.

Sweden’s life insurance market demonstrates remarkable resilience and growth potential, driven by favorable demographic trends and increasing consumer awareness of financial protection needs. The market benefits from Sweden’s stable economic environment, high living standards, and sophisticated financial infrastructure that supports innovative insurance solutions.

Key market drivers include an aging population requiring enhanced retirement planning, growing wealth accumulation among middle-class consumers, and increasing demand for flexible insurance products that combine protection with investment opportunities. Digital adoption rates have accelerated significantly, with approximately 85% of insurance transactions now conducted through digital channels, reflecting changing consumer preferences and technological advancement.

Competitive landscape features both established Swedish insurers and international companies competing for market share through product innovation, competitive pricing, and superior customer service. The market shows strong growth momentum in unit-linked insurance products, which have gained popularity due to their investment flexibility and potential for higher returns compared to traditional whole life policies.

Future prospects remain positive, supported by regulatory stability, technological innovation, and evolving consumer needs. The integration of artificial intelligence and data analytics is transforming underwriting processes and customer engagement, while sustainable investing continues to gain traction among environmentally conscious Swedish consumers.

Market penetration in Sweden’s life insurance sector reveals several critical insights that shape industry dynamics and growth strategies. The following key insights provide a comprehensive understanding of market characteristics:

Demographic transformation serves as the primary catalyst driving Sweden’s life insurance market expansion. The country’s aging population creates increasing demand for retirement planning solutions and estate protection products. Life expectancy increases and declining birth rates contribute to a demographic shift that necessitates enhanced financial planning and insurance coverage across all age groups.

Economic prosperity and rising disposable income levels enable Swedish consumers to invest in comprehensive life insurance products. The country’s stable economic environment, low unemployment rates, and strong social safety net create favorable conditions for long-term financial planning. Wealth accumulation among middle and upper-middle-class segments drives demand for sophisticated insurance products that offer both protection and investment growth opportunities.

Digital innovation revolutionizes customer expectations and service delivery methods throughout the life insurance sector. Swedish consumers, known for their technology adoption, increasingly demand seamless digital experiences, instant policy processing, and mobile-first insurance solutions. Technological advancement enables insurers to reduce operational costs while improving customer satisfaction and market reach.

Regulatory support provides a stable foundation for market growth through clear guidelines, consumer protection measures, and prudential oversight. The Swedish Financial Supervisory Authority’s balanced approach encourages innovation while maintaining market integrity. Tax advantages associated with certain life insurance products further incentivize consumer adoption and long-term policy retention.

Economic uncertainty poses significant challenges to Sweden’s life insurance market, particularly during periods of global financial instability. Interest rate fluctuations affect the attractiveness of traditional life insurance products, especially when low rates reduce guaranteed returns and make alternative investments more appealing to consumers seeking higher yields.

Regulatory complexity creates operational challenges for insurance providers, requiring substantial compliance investments and limiting product innovation speed. Solvency II requirements impose capital adequacy standards that may constrain growth strategies and require careful balance between expansion and regulatory compliance.

Market saturation in certain segments limits growth opportunities, particularly for traditional whole life insurance products. High market penetration rates among affluent demographics mean insurers must compete intensively for market share, often resulting in margin pressure and increased customer acquisition costs.

Consumer behavior changes present ongoing challenges as younger generations demonstrate different financial priorities and risk tolerance levels compared to traditional insurance buyers. Alternative investment options, including direct stock market participation and cryptocurrency investments, compete for consumer attention and disposable income that might otherwise be directed toward life insurance products.

Digital transformation creates unprecedented opportunities for Swedish life insurers to enhance customer engagement and operational efficiency. Artificial intelligence and machine learning technologies enable personalized product recommendations, automated underwriting processes, and predictive analytics that improve risk assessment accuracy while reducing processing times.

Sustainable investing represents a significant growth opportunity as Swedish consumers increasingly prioritize environmental and social responsibility in their financial decisions. ESG-compliant products attract environmentally conscious consumers and align with Sweden’s national sustainability goals, creating competitive advantages for insurers that embrace green investment strategies.

Cross-border expansion within the Nordic region offers growth potential for established Swedish insurers leveraging their expertise and regulatory knowledge. Market integration initiatives within the European Union facilitate expansion opportunities while maintaining familiar regulatory frameworks and cultural similarities.

Product innovation in hybrid insurance-investment solutions addresses evolving consumer preferences for financial flexibility and growth potential. Parametric insurance products and usage-based policies represent emerging opportunities that leverage technology to create more personalized and responsive insurance solutions.

Competitive intensity characterizes Sweden’s life insurance market as established players and new entrants compete for market share through product differentiation and service excellence. Market dynamics reflect the interplay between traditional insurance companies, banking institutions offering insurance products, and innovative fintech companies disrupting conventional business models.

Customer expectations continue evolving toward greater transparency, flexibility, and digital convenience in insurance transactions. Service quality has become a key differentiator, with insurers investing in customer experience improvements and omnichannel service delivery to maintain competitive positioning.

Pricing strategies reflect market maturity and competitive pressure, with insurers balancing profitability requirements against customer acquisition and retention objectives. Value proposition development focuses on comprehensive financial solutions that extend beyond traditional insurance coverage to include wealth management and financial planning services.

Technology integration drives operational efficiency improvements and enables new product development capabilities. Data analytics enhance risk assessment accuracy and enable personalized pricing strategies that better reflect individual risk profiles while maintaining competitive market positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Sweden’s life insurance market dynamics. Primary research includes structured interviews with industry executives, regulatory officials, and consumer focus groups to gather firsthand perspectives on market trends and challenges.

Secondary research incorporates analysis of regulatory filings, industry reports, financial statements, and market data from authoritative sources. Quantitative analysis examines market size, growth rates, competitive positioning, and consumer behavior patterns through statistical modeling and trend analysis techniques.

MarkWide Research methodology emphasizes data triangulation, combining multiple information sources to validate findings and ensure research accuracy. Market segmentation analysis provides detailed insights into customer demographics, product preferences, and regional variations that influence market dynamics.

Forecasting models incorporate economic indicators, demographic projections, and regulatory developments to project future market trends and growth opportunities. Scenario analysis examines potential market outcomes under different economic and regulatory conditions to provide comprehensive strategic insights.

Stockholm region dominates Sweden’s life insurance market, accounting for approximately 42% of total market activity due to high population density, elevated income levels, and concentration of financial services infrastructure. Metropolitan areas demonstrate higher insurance penetration rates and greater demand for sophisticated financial products compared to rural regions.

Gothenburg and surrounding areas represent the second-largest regional market, characterized by strong industrial presence and affluent consumer base. Regional preferences show variations in product demand, with urban areas favoring unit-linked insurance products while rural regions maintain preference for traditional whole life policies.

Northern Sweden presents unique market characteristics influenced by lower population density, seasonal employment patterns, and different risk profiles. Distribution strategies in these regions rely more heavily on digital channels and remote service delivery to overcome geographic challenges.

Southern Sweden benefits from proximity to European markets and demonstrates strong cross-border insurance activity. Regional growth rates vary significantly, with urban areas experiencing faster expansion while rural regions show steady but modest growth patterns that reflect demographic and economic differences.

Market leadership in Sweden’s life insurance sector is distributed among several key players, each bringing distinct strengths and strategic approaches to market competition. The competitive environment fosters innovation and customer-centric service delivery across the industry.

Product segmentation in Sweden’s life insurance market reflects diverse consumer needs and financial objectives across different demographic groups. Market segments demonstrate varying growth rates and profitability characteristics that influence insurer strategic focus and resource allocation.

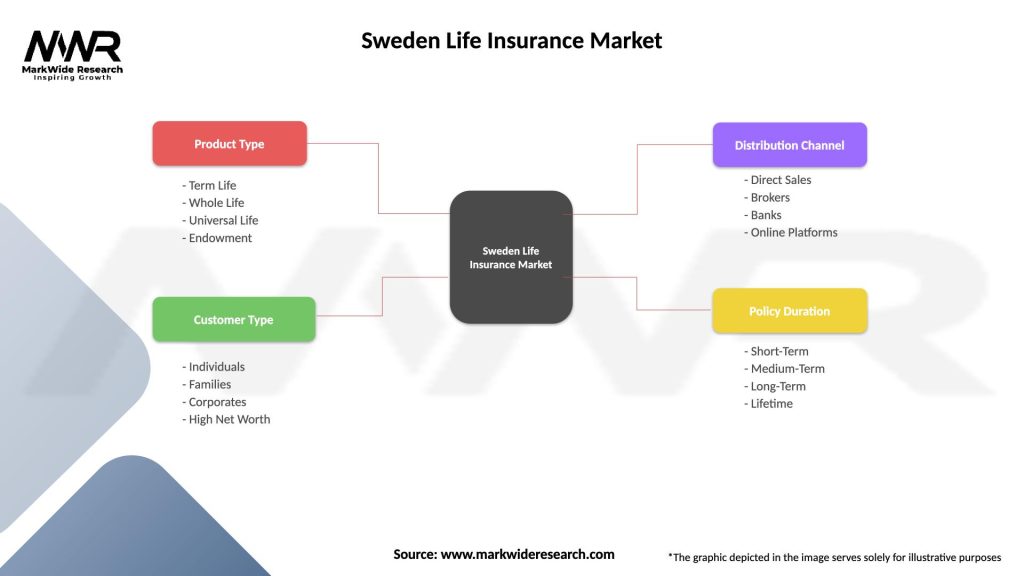

By Product Type:

By Distribution Channel:

Individual life insurance represents the largest market category, driven by personal financial planning needs and increasing awareness of income protection requirements. Consumer preferences show growing interest in flexible products that adapt to changing life circumstances and financial objectives.

Group life insurance through employer-sponsored programs continues expanding as companies enhance employee benefit packages to attract and retain talent. Corporate adoption rates have increased by approximately 23% over recent years, reflecting competitive labor market conditions and employee expectations for comprehensive benefits.

Unit-linked insurance plans demonstrate the strongest growth trajectory, appealing to consumers seeking investment growth potential combined with life insurance protection. Market share for unit-linked products has expanded to represent approximately 38% of new policy sales, indicating shifting consumer preferences toward market-linked returns.

Traditional whole life policies maintain steady demand among conservative investors and older demographic segments valuing guaranteed returns and predictable cash value accumulation. Product evolution in this category focuses on enhanced features and competitive guaranteed interest rates to maintain market relevance.

Insurance companies benefit from Sweden’s stable regulatory environment, sophisticated consumer base, and strong economic fundamentals that support sustainable business growth. Market opportunities include expanding digital capabilities, developing innovative products, and leveraging data analytics to improve operational efficiency and customer satisfaction.

Consumers gain access to comprehensive life insurance products that provide financial security, investment growth potential, and tax advantages. Product diversity enables individuals to select insurance solutions that align with their specific financial goals, risk tolerance, and life stage requirements.

Regulatory authorities benefit from industry cooperation in maintaining market stability, consumer protection, and financial system integrity. Collaborative relationships between regulators and insurers facilitate effective oversight while encouraging innovation and market development.

Distribution partners including banks, brokers, and digital platforms gain revenue opportunities through insurance product sales and cross-selling initiatives. Partnership arrangements create mutual benefits through expanded customer reach and enhanced service offerings that strengthen competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping Sweden’s life insurance landscape through advanced technology adoption and customer experience enhancement. Artificial intelligence applications in underwriting, claims processing, and customer service are becoming standard industry practices, improving efficiency while reducing operational costs.

Sustainable investing has emerged as a dominant trend, with Swedish insurers increasingly incorporating environmental, social, and governance criteria into their investment strategies. Green insurance products attract environmentally conscious consumers and align with Sweden’s national sustainability objectives, creating competitive advantages for forward-thinking insurers.

Personalization through data analytics enables insurers to develop customized products and pricing strategies that better reflect individual risk profiles and preferences. Customer segmentation becomes more sophisticated, allowing for targeted marketing and product development that improves customer satisfaction and retention rates.

Hybrid products combining insurance protection with investment opportunities gain popularity among consumers seeking financial flexibility and growth potential. Product innovation focuses on creating solutions that adapt to changing life circumstances while maintaining competitive returns and comprehensive coverage benefits.

Regulatory evolution in Sweden’s life insurance sector includes updated solvency requirements and enhanced consumer protection measures that strengthen market stability. Policy changes reflect ongoing efforts to balance innovation encouragement with prudential oversight and consumer interest protection.

Technology partnerships between traditional insurers and fintech companies accelerate digital transformation and product innovation capabilities. Collaborative arrangements enable established insurers to leverage cutting-edge technology while maintaining regulatory compliance and customer trust.

Market consolidation through strategic mergers and acquisitions reshapes the competitive landscape, creating larger, more efficient organizations capable of investing in technology and expanding market reach. Industry restructuring reflects efforts to achieve economies of scale and enhance competitive positioning.

Product launches featuring enhanced digital capabilities and sustainable investment options demonstrate industry responsiveness to evolving consumer preferences and market demands. Innovation initiatives focus on creating differentiated value propositions that attract new customers while retaining existing policyholders.

MarkWide Research analysis suggests that Swedish life insurers should prioritize digital transformation investments to maintain competitive positioning and meet evolving customer expectations. Technology adoption should focus on customer experience enhancement, operational efficiency improvement, and data analytics capabilities that enable personalized product development.

Product diversification strategies should emphasize sustainable investing options and hybrid insurance-investment solutions that appeal to environmentally conscious consumers seeking financial growth opportunities. Innovation focus should address changing demographic needs and lifestyle preferences among younger consumer segments.

Distribution channel optimization requires balancing digital convenience with personalized service delivery, particularly for complex financial planning needs. Omnichannel strategies should integrate online platforms with traditional service channels to provide seamless customer experiences across all touchpoints.

Regulatory compliance investments should be viewed as competitive advantages rather than operational burdens, with proactive approaches to regulatory changes enabling faster market adaptation and customer confidence maintenance. Risk management capabilities should incorporate advanced analytics and scenario planning to navigate uncertain economic conditions effectively.

Long-term prospects for Sweden’s life insurance market remain positive, supported by demographic trends, technological advancement, and regulatory stability that encourage sustained industry growth. Market evolution will likely emphasize digital-first service delivery, personalized product offerings, and sustainable investment strategies that align with consumer values and preferences.

Growth projections indicate continued expansion in unit-linked insurance products and hybrid solutions that combine protection with investment opportunities. Market dynamics suggest increasing importance of customer experience differentiation and technology-enabled service delivery as key competitive factors.

Industry transformation will accelerate through artificial intelligence adoption, data analytics integration, and sustainable investing practices that reshape traditional business models. Innovation opportunities include parametric insurance products, usage-based policies, and integrated financial planning solutions that address comprehensive customer needs.

Competitive landscape evolution will favor organizations that successfully balance regulatory compliance with innovation capabilities, customer-centric service delivery, and operational efficiency. Market leadership will increasingly depend on digital capabilities, sustainable practices, and ability to adapt to changing consumer preferences and regulatory requirements.

Sweden’s life insurance market demonstrates remarkable resilience and growth potential, driven by favorable demographic trends, technological innovation, and strong regulatory foundations. The market’s evolution toward digital-first service delivery, sustainable investing practices, and personalized product offerings positions it well for continued expansion and customer satisfaction improvement.

Strategic opportunities abound for insurers willing to invest in technology, embrace sustainable practices, and develop innovative products that meet evolving consumer needs. The integration of artificial intelligence, data analytics, and customer experience enhancement will determine competitive success in an increasingly sophisticated market environment.

Future success will require balancing regulatory compliance with innovation capabilities, maintaining customer trust while embracing technological advancement, and developing sustainable business models that create long-term value for all stakeholders. Sweden’s life insurance market stands poised for continued growth and evolution, offering significant opportunities for forward-thinking industry participants.

What is Life Insurance?

Life insurance is a financial product that provides a monetary benefit to beneficiaries upon the death of the insured individual. It serves as a safety net for families, ensuring financial stability in the event of a loss, and can also include savings or investment components.

What are the key players in the Sweden Life Insurance Market?

Key players in the Sweden Life Insurance Market include companies such as Skandia, Folksam, and Länsförsäkringar. These companies offer a range of life insurance products tailored to meet the needs of individuals and families, among others.

What are the growth factors driving the Sweden Life Insurance Market?

The Sweden Life Insurance Market is driven by factors such as an aging population, increasing awareness of financial planning, and a growing demand for retirement products. Additionally, the rise in disposable income has led to more individuals seeking life insurance for financial security.

What challenges does the Sweden Life Insurance Market face?

Challenges in the Sweden Life Insurance Market include regulatory changes, intense competition among providers, and the need for digital transformation. These factors can impact profitability and customer acquisition strategies for insurance companies.

What opportunities exist in the Sweden Life Insurance Market?

Opportunities in the Sweden Life Insurance Market include the development of innovative insurance products, the integration of technology for better customer service, and the potential for expanding into underserved demographics. These trends can enhance market growth and customer engagement.

What trends are shaping the Sweden Life Insurance Market?

Trends in the Sweden Life Insurance Market include the increasing use of digital platforms for policy management, a focus on personalized insurance solutions, and the growing importance of sustainability in product offerings. These trends reflect changing consumer preferences and technological advancements.

Sweden Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Universal Life, Endowment |

| Customer Type | Individuals, Families, Corporates, High Net Worth |

| Distribution Channel | Direct Sales, Brokers, Banks, Online Platforms |

| Policy Duration | Short-Term, Medium-Term, Long-Term, Lifetime |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sweden Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at