444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sweden electric bike market represents one of the most dynamic and rapidly evolving segments within the Nordic region’s sustainable transportation ecosystem. Sweden’s commitment to environmental sustainability, combined with robust government initiatives and increasing consumer awareness about eco-friendly mobility solutions, has positioned the country as a leader in electric bicycle adoption across Europe. The market demonstrates exceptional growth momentum with a projected compound annual growth rate (CAGR) of 8.2% through the forecast period, driven by urbanization trends, technological advancements, and shifting consumer preferences toward sustainable transportation alternatives.

Market dynamics in Sweden reflect a sophisticated understanding of electric mobility, where consumers increasingly prioritize environmental responsibility alongside practical transportation needs. The Swedish electric bike landscape encompasses diverse segments including city bikes, mountain bikes, cargo bikes, and specialized commercial applications. Urban centers like Stockholm, Gothenburg, and Malmö have emerged as key growth drivers, with infrastructure development and bike-sharing programs significantly contributing to market expansion. The integration of smart technologies, improved battery performance, and enhanced design aesthetics continues to attract both traditional cyclists and new market entrants seeking efficient urban mobility solutions.

Government support through subsidies, tax incentives, and infrastructure investments has created a favorable environment for electric bike adoption. Sweden’s national cycling strategy emphasizes the role of electric bicycles in achieving carbon neutrality goals by 2045, with electric bikes representing approximately 23% of all bicycle sales in major urban markets. The market benefits from strong domestic manufacturing capabilities, innovative design approaches, and a well-established distribution network that ensures accessibility across urban and rural regions.

The Sweden electric bike market refers to the comprehensive ecosystem encompassing the production, distribution, sale, and servicing of electrically-assisted bicycles within Swedish territory. This market includes various stakeholders such as manufacturers, retailers, component suppliers, service providers, and end-users who collectively drive the adoption and utilization of electric bicycles across different applications and user segments.

Electric bicycles, also known as e-bikes or pedelecs, represent a hybrid transportation solution that combines traditional pedaling with electric motor assistance to enhance riding efficiency, reduce physical exertion, and extend travel distances. In the Swedish context, these vehicles serve multiple purposes including daily commuting, recreational activities, cargo transportation, and commercial applications. The market encompasses both domestically manufactured products and imported solutions, with emphasis on quality, durability, and environmental compatibility.

Market scope extends beyond mere product sales to include supporting infrastructure such as charging stations, maintenance services, insurance products, and financing solutions. The Swedish electric bike market operates within a regulatory framework that ensures safety standards, environmental compliance, and consumer protection while promoting innovation and market growth through supportive policies and incentives.

Sweden’s electric bike market demonstrates remarkable resilience and growth potential, establishing itself as a cornerstone of the country’s sustainable transportation strategy. The market benefits from strong consumer acceptance, with electric bike penetration reaching 31% among cycling enthusiasts in metropolitan areas. Key market drivers include environmental consciousness, government incentives, technological improvements, and changing urban mobility patterns that favor flexible, eco-friendly transportation solutions.

Market segmentation reveals diverse applications spanning personal transportation, commercial delivery services, tourism, and recreational activities. The premium segment dominates sales volume, reflecting Swedish consumers’ willingness to invest in high-quality, durable electric bikes that offer superior performance and longevity. Distribution channels have evolved to include traditional bike shops, specialized e-bike retailers, online platforms, and corporate sales programs that cater to different customer preferences and purchasing behaviors.

Competitive landscape features a mix of international brands and domestic manufacturers, with companies focusing on innovation, customer service, and sustainable manufacturing practices. The market shows strong potential for continued expansion, supported by ongoing infrastructure development, technological advancements, and increasing integration with smart city initiatives across Swedish municipalities.

Consumer behavior analysis reveals significant shifts in transportation preferences, with Swedish consumers increasingly viewing electric bikes as viable alternatives to cars for short to medium-distance travel. Age demographics show broad appeal across generations, with particularly strong adoption among professionals aged 25-45 who prioritize efficiency and environmental responsibility in their daily commuting choices.

Market maturity indicators suggest evolution from early adoption phase to mainstream acceptance, with standardization of features, improved service networks, and established consumer education programs supporting continued growth and market development.

Environmental sustainability stands as the primary driver propelling Sweden’s electric bike market forward. The country’s ambitious climate goals and commitment to carbon neutrality by 2045 create strong governmental and consumer support for electric mobility solutions. Electric bikes offer significant environmental benefits compared to traditional vehicles, with lifecycle carbon emissions reduced by approximately 89% compared to conventional cars for equivalent transportation distances.

Government incentives play a crucial role in market acceleration, with subsidies covering up to 25% of purchase costs for qualifying electric bikes. These financial incentives, combined with tax benefits and preferential treatment in urban planning, create compelling economic arguments for electric bike adoption. Municipal initiatives including dedicated bike lanes, secure parking facilities, and integration with public transportation systems further enhance the value proposition for potential buyers.

Technological advancements continue to drive market growth through improved battery performance, enhanced motor efficiency, and sophisticated control systems. Modern electric bikes offer ranges exceeding 100 kilometers on single charges, with fast-charging capabilities and smart features that appeal to tech-savvy Swedish consumers. Design innovations focusing on aesthetics, ergonomics, and functionality address diverse user needs while maintaining the premium quality standards expected in the Swedish market.

Urbanization trends and changing work patterns, accelerated by remote work adoption, create new mobility requirements that electric bikes effectively address. The flexibility to combine exercise, transportation, and environmental responsibility resonates strongly with Swedish lifestyle preferences and urban planning philosophies.

High initial costs remain a significant barrier to widespread electric bike adoption, despite government subsidies and long-term economic benefits. Premium electric bikes often require substantial upfront investments that may deter price-sensitive consumers, particularly in rural areas where income levels may be lower than urban centers. Financing options and leasing programs help address this challenge, but accessibility remains a concern for certain demographic segments.

Weather conditions present ongoing challenges for year-round electric bike usage in Sweden’s climate. While winter-specific models and accessories exist, harsh weather conditions can limit usage patterns and affect battery performance. Seasonal demand fluctuations create inventory management challenges for retailers and impact consistent market growth throughout the year.

Infrastructure limitations in certain regions, particularly rural areas, constrain market expansion potential. While major cities offer excellent cycling infrastructure, smaller communities may lack adequate charging facilities, secure parking, and maintenance services. Range anxiety and charging infrastructure gaps can discourage adoption among potential users who require longer-distance travel capabilities.

Regulatory complexities surrounding electric bike classifications, speed limitations, and usage restrictions create confusion among consumers and retailers. Different regulations for various e-bike categories can complicate purchasing decisions and limit market accessibility for certain user groups seeking specific performance characteristics.

Corporate mobility programs represent substantial growth opportunities as Swedish companies increasingly adopt sustainable transportation policies for employees. Employer-sponsored bike programs, salary sacrifice schemes, and corporate fleet solutions create new revenue streams while supporting environmental corporate social responsibility initiatives. Companies recognize electric bikes as cost-effective alternatives to company cars for urban business travel.

Tourism sector integration offers significant expansion potential, with electric bikes enhancing Sweden’s appeal as an eco-tourism destination. Rental services, guided tours, and hospitality partnerships create new business models while promoting sustainable tourism practices. The ability to explore Sweden’s natural landscapes with electric assistance appeals to diverse tourist demographics and extends seasonal tourism opportunities.

Cargo and delivery applications present emerging opportunities as e-commerce growth drives demand for sustainable last-mile delivery solutions. Commercial electric bikes offer efficient, environmentally-friendly alternatives to delivery vans in urban areas, with potential for significant market expansion as logistics companies prioritize sustainability and operational efficiency.

Smart city initiatives across Swedish municipalities create opportunities for integrated mobility solutions combining electric bikes with public transportation, digital payment systems, and urban planning strategies. Data analytics and IoT integration enable new service models and enhanced user experiences that differentiate premium offerings in competitive markets.

Supply chain dynamics in Sweden’s electric bike market reflect global trends while maintaining focus on quality and sustainability. Component sourcing strategies balance cost efficiency with environmental responsibility, with increasing emphasis on European suppliers to reduce transportation emissions and ensure supply security. Battery technology improvements drive performance enhancements while addressing environmental concerns about lithium mining and recycling.

Competitive dynamics show intensifying rivalry among established brands and emerging manufacturers, with differentiation strategies focusing on technology integration, design innovation, and customer service excellence. Market consolidation trends indicate potential for strategic partnerships and acquisitions as companies seek to expand market share and distribution capabilities.

Consumer dynamics reveal evolving preferences toward premium products with advanced features, sustainable manufacturing practices, and comprehensive service support. Brand loyalty develops through positive ownership experiences, with word-of-mouth recommendations playing crucial roles in market expansion. Social media influence and community engagement significantly impact purchasing decisions, particularly among younger demographics.

Regulatory dynamics continue evolving to balance safety requirements with market growth objectives. Standards harmonization across European markets facilitates trade and reduces compliance costs, while safety regulations ensure consumer protection and market credibility. Policy developments regarding infrastructure investment and incentive programs directly influence market trajectory and growth potential.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Sweden’s electric bike market dynamics. Primary research includes structured interviews with industry stakeholders, consumer surveys, and expert consultations to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and academic studies to establish market context and historical trends. Data triangulation techniques ensure accuracy and reliability by cross-referencing multiple information sources and validating findings through different analytical approaches.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. Scenario analysis considers various market conditions and external factors that could influence market development, providing comprehensive insights for strategic decision-making.

Qualitative analysis examines market dynamics, competitive positioning, and consumer behavior patterns through detailed case studies and expert insights. Quantitative analysis focuses on market sizing, growth rates, and statistical relationships between market variables to provide measurable insights and projections.

Stockholm region dominates Sweden’s electric bike market, accounting for approximately 42% of national sales volume. The capital’s comprehensive cycling infrastructure, high population density, and strong environmental consciousness create ideal conditions for electric bike adoption. Government initiatives including congestion charges and parking restrictions for cars further enhance electric bike attractiveness for urban commuting.

Gothenburg area represents the second-largest regional market, with strong growth driven by industrial workforce commuting patterns and university student populations. The region’s focus on sustainable transportation and well-developed public transit integration supports electric bike adoption across diverse user segments. Port city characteristics create unique opportunities for cargo bike applications in logistics and delivery services.

Malmö region benefits from proximity to Copenhagen and cross-border commuting patterns that favor electric bike usage. The area’s flat topography and mild climate relative to northern Sweden create favorable conditions for year-round cycling. International connectivity influences market trends and product preferences through exposure to broader European electric bike developments.

Northern regions including Umeå and Luleå show emerging market potential despite challenging climate conditions. University towns drive demand through student populations and research initiatives, while mining and forestry industries explore electric bikes for specialized applications. Winter-specific product development addresses regional climate challenges and extends market opportunities.

Market leadership in Sweden’s electric bike sector features a diverse mix of international brands and domestic manufacturers, each bringing unique strengths and market positioning strategies. Competition intensity continues increasing as market growth attracts new entrants and existing players expand their product portfolios and distribution networks.

Competitive strategies emphasize differentiation through technology innovation, customer service excellence, and sustainable manufacturing practices. Market positioning varies from premium luxury offerings to practical utility-focused solutions, with successful companies maintaining clear value propositions and target market focus.

Product segmentation in Sweden’s electric bike market reflects diverse consumer needs and usage patterns across multiple categories. City bikes dominate sales volume with practical designs optimized for urban commuting, featuring comfortable riding positions, integrated lighting, and weather protection accessories.

By Technology:

By Application:

By Price Range:

Urban commuter bikes represent the largest and fastest-growing category, with sales increasing by 12.4% annually as more professionals adopt electric bikes for daily transportation. These bikes feature practical designs with integrated accessories, weather protection, and reliable performance for year-round usage. Battery range typically exceeds 60 kilometers to accommodate longer commutes and reduce charging frequency concerns.

Mountain and trekking e-bikes appeal to Sweden’s outdoor recreation culture, offering enhanced capabilities for exploring forests, trails, and countryside areas. Performance characteristics include robust construction, advanced suspension systems, and powerful motors capable of handling challenging terrain. This segment shows strong seasonal patterns with peak demand during summer months.

Cargo bikes experience rapid growth as families and businesses recognize their utility for transportation and delivery applications. Design innovations include modular cargo systems, child seating options, and weather protection features that extend usability across different applications. Commercial adoption drives significant volume growth in urban areas.

Folding electric bikes cater to multimodal transportation needs, particularly among commuters who combine cycling with public transit. Compact designs and lightweight construction enable easy storage and transportation, while maintaining performance standards comparable to traditional electric bikes. This category shows strong growth potential in urban markets with space constraints.

Manufacturers benefit from Sweden’s sophisticated market that values quality, innovation, and sustainability, creating opportunities for premium positioning and healthy profit margins. Brand development in Sweden often translates to broader Nordic and European market success, providing strategic advantages for expansion initiatives.

Retailers gain from strong consumer demand and government support that reduce market development costs and accelerate adoption rates. Service opportunities including maintenance, accessories, and financing create additional revenue streams beyond initial product sales. The educated consumer base appreciates expert advice and professional service, supporting specialized retail models.

Component suppliers benefit from Sweden’s focus on quality and performance, creating demand for advanced batteries, motors, and electronic systems. Innovation partnerships with Swedish manufacturers and research institutions drive technology development and market differentiation opportunities.

Infrastructure providers including charging station operators and parking solution companies find growing opportunities as electric bike adoption increases. Smart city initiatives create demand for integrated solutions that combine physical infrastructure with digital services and data analytics capabilities.

Consumers enjoy comprehensive benefits including environmental impact reduction, health improvements, cost savings compared to car ownership, and enhanced mobility options. Government incentives and supportive infrastructure make electric bike ownership increasingly attractive and practical for diverse transportation needs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as a dominant trend, with electric bikes incorporating GPS navigation, smartphone apps, theft protection, and performance monitoring capabilities. Data analytics enable personalized riding experiences and predictive maintenance, while connectivity features support integration with smart city infrastructure and mobility-as-a-service platforms.

Sustainability focus extends beyond electric propulsion to encompass entire product lifecycles, with manufacturers emphasizing recyclable materials, responsible sourcing, and circular economy principles. Carbon footprint transparency becomes increasingly important to environmentally conscious Swedish consumers who evaluate products based on comprehensive environmental impact assessments.

Customization and personalization trends reflect consumer desires for unique products that match individual preferences and usage patterns. Modular designs enable component upgrades and configuration changes, while direct-to-consumer sales models facilitate personalized ordering and customer engagement.

Service model evolution shifts from traditional retail toward comprehensive mobility solutions including subscriptions, leasing, and maintenance packages. Mobility-as-a-Service concepts integrate electric bikes with other transportation modes, creating seamless multimodal experiences for urban travelers.

Performance enhancement continues through battery technology improvements, motor efficiency gains, and lightweight materials adoption. Range extension and fast-charging capabilities address key consumer concerns while maintaining reliability and durability standards expected in the Swedish market.

Infrastructure expansion accelerates across Swedish municipalities, with major cities investing significantly in dedicated cycling lanes, secure parking facilities, and charging infrastructure. Stockholm’s cycling strategy includes plans for 300 kilometers of new bike lanes and 10,000 additional parking spaces specifically designed for electric bikes, demonstrating municipal commitment to sustainable transportation.

Technology partnerships between electric bike manufacturers and Swedish technology companies drive innovation in battery management, motor control, and connectivity solutions. Collaboration initiatives with universities and research institutions focus on cold-weather performance improvements and sustainable manufacturing processes tailored to Nordic conditions.

Retail channel evolution includes expansion of specialized e-bike stores, online sales platforms, and corporate sales programs. Service network development ensures comprehensive coverage across urban and rural areas, with mobile service units addressing maintenance needs in remote locations.

Regulatory developments include updated safety standards, classification systems, and insurance requirements that provide clarity for consumers and businesses while ensuring market safety and credibility. Incentive program extensions and modifications reflect government commitment to electric mobility goals and market development objectives.

International expansion by Swedish companies and increased foreign investment in the domestic market demonstrate growing recognition of Sweden’s electric bike market potential and strategic importance within the broader European mobility ecosystem.

Market participants should prioritize winter performance capabilities and cold-weather accessories to address Sweden’s unique climate challenges and extend usage seasons. Product development focusing on battery performance in low temperatures, weather protection, and winter-specific features can differentiate offerings and capture year-round demand.

Distribution strategy optimization should emphasize omnichannel approaches combining online convenience with physical showroom experiences that allow customers to test products before purchase. Service network expansion into rural areas and smaller cities can capture underserved market segments and support national market penetration.

Partnership development with employers, municipalities, and tourism operators can create new sales channels and market opportunities beyond traditional retail models. Corporate mobility programs represent particularly attractive opportunities given Swedish companies’ sustainability commitments and employee benefit priorities.

Technology integration should focus on features that enhance safety, security, and user experience while maintaining simplicity and reliability. Smart connectivity features should provide genuine value rather than complexity, with emphasis on theft protection and maintenance monitoring capabilities that address key consumer concerns.

Sustainability messaging and transparent environmental impact reporting can strengthen brand positioning and appeal to environmentally conscious Swedish consumers. Circular economy initiatives including battery recycling programs and component upgrade services can create competitive advantages and support long-term customer relationships.

Market trajectory indicates continued strong growth with electric bike penetration expected to reach 45% of total bicycle sales by 2028, driven by infrastructure improvements, technology advancements, and evolving consumer preferences. MarkWide Research projections suggest sustained momentum across all market segments, with particular strength in urban commuting and cargo applications.

Technology evolution will focus on battery improvements, smart connectivity, and integration with broader mobility ecosystems. Autonomous features and advanced safety systems may emerge as differentiating factors, while sustainable manufacturing processes become standard requirements rather than premium features.

Infrastructure development will accelerate with smart city initiatives and climate action plans driving comprehensive cycling network expansion. Charging infrastructure integration with renewable energy sources and smart grid systems will enhance environmental benefits and operational efficiency.

Market consolidation may occur as successful companies expand through acquisitions and partnerships, while new entrants focus on niche segments and innovative business models. Service-based models including subscriptions and mobility-as-a-service offerings will gain prominence alongside traditional ownership models.

International influence from Sweden’s market development will extend to other Nordic countries and European markets, with Swedish companies potentially becoming regional leaders in electric bike technology and market development strategies.

Sweden’s electric bike market represents a compelling success story of sustainable transportation adoption, driven by environmental consciousness, government support, and technological innovation. The market demonstrates exceptional growth potential with strong fundamentals including affluent consumers, supportive infrastructure, and comprehensive policy frameworks that favor electric mobility solutions.

Key success factors include the alignment of market dynamics with national sustainability goals, creating synergies between consumer preferences, government policies, and business opportunities. The sophisticated Swedish market demands high-quality products and comprehensive service support, creating opportunities for premium positioning and healthy profit margins for industry participants.

Future prospects remain highly positive, with continued growth expected across all market segments and geographic regions. Technology advancements, infrastructure improvements, and evolving mobility patterns will drive sustained market expansion while creating new opportunities for innovation and business model development.

Strategic implications for industry stakeholders emphasize the importance of quality, sustainability, and customer service in capturing market share and building long-term competitive advantages. The Swedish market’s influence on broader Nordic and European electric bike adoption makes it a strategic priority for companies seeking regional leadership positions in sustainable transportation solutions.

What is Electric Bike?

Electric bikes, or e-bikes, are bicycles equipped with an electric motor that assists with pedaling. They are designed to enhance the cycling experience by providing additional power, making it easier to travel longer distances and tackle challenging terrains.

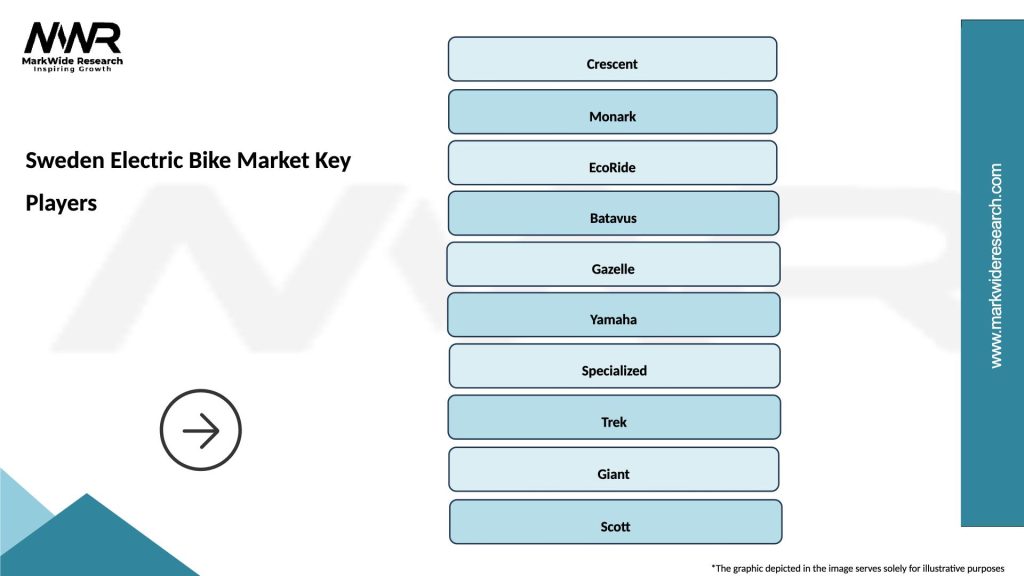

What are the key players in the Sweden Electric Bike Market?

Key players in the Sweden Electric Bike Market include companies like Pedelec, Crescent, and Moustache Bikes, which offer a range of electric bicycles catering to different consumer needs. These companies are known for their innovative designs and technology, contributing to the growing popularity of e-bikes in Sweden, among others.

What are the growth factors driving the Sweden Electric Bike Market?

The Sweden Electric Bike Market is driven by factors such as increasing environmental awareness, the rising popularity of sustainable transportation, and government initiatives promoting cycling. Additionally, advancements in battery technology and the growing urban population are contributing to market growth.

What challenges does the Sweden Electric Bike Market face?

Challenges in the Sweden Electric Bike Market include regulatory hurdles regarding safety standards and the need for adequate infrastructure to support e-bike usage. Additionally, competition from traditional bicycles and public transportation can hinder market expansion.

What opportunities exist in the Sweden Electric Bike Market?

The Sweden Electric Bike Market presents opportunities such as the development of smart e-bikes with integrated technology and the expansion of rental services in urban areas. Furthermore, increasing interest in outdoor activities and tourism can boost e-bike sales.

What trends are shaping the Sweden Electric Bike Market?

Trends in the Sweden Electric Bike Market include the rise of connected e-bikes with GPS and smartphone integration, as well as a growing focus on lightweight materials for better performance. Additionally, the trend towards eco-friendly commuting options is influencing consumer preferences.

Sweden Electric Bike Market

| Segmentation Details | Description |

|---|---|

| Product Type | City Bikes, Mountain Bikes, Folding Bikes, Cruiser Bikes |

| Technology | Hub Motor, Mid-Drive Motor, Battery Management System, Regenerative Braking |

| End User | Commuters, Recreational Users, Delivery Services, Tourists |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sweden Electric Bike Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at