444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sweden data center construction market represents a rapidly expanding sector driven by increasing digitalization, cloud computing adoption, and the country’s commitment to sustainable technology infrastructure. Sweden’s strategic position as a Nordic technology hub, combined with its abundant renewable energy resources and favorable climate conditions, has positioned the nation as an attractive destination for data center investments.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over the recent forecast period. The country’s advanced telecommunications infrastructure, political stability, and progressive regulatory environment continue to attract both domestic and international data center operators seeking to establish or expand their Nordic presence.

Key market drivers include the accelerating demand for cloud services, edge computing requirements, and Sweden’s reputation for reliable power supply sourced predominantly from renewable energy. The market benefits from government support for digital infrastructure development and favorable policies that encourage sustainable technology investments.

Regional concentration shows significant activity in major metropolitan areas, particularly Stockholm, Gothenburg, and Malmö, where approximately 75% of data center construction projects are concentrated. These urban centers offer superior connectivity, skilled workforce availability, and proximity to major business hubs across Scandinavia.

The Sweden data center construction market refers to the comprehensive ecosystem encompassing the planning, design, construction, and commissioning of data center facilities across Swedish territory. This market includes various facility types ranging from hyperscale cloud data centers to edge computing facilities and enterprise-specific installations.

Market scope encompasses all construction activities related to data center development, including site preparation, structural construction, mechanical and electrical installations, cooling systems implementation, and security infrastructure deployment. The sector involves multiple stakeholders including construction companies, technology providers, real estate developers, and end-user organizations.

Construction categories within this market span new facility development, existing facility expansions, modernization projects, and retrofit initiatives aimed at improving energy efficiency and operational capacity. The market also includes specialized construction services for disaster recovery facilities and backup data centers.

Sweden’s data center construction market demonstrates exceptional growth momentum, driven by the country’s unique combination of renewable energy abundance, favorable climate conditions, and robust digital infrastructure. The market has emerged as a critical component of Northern Europe’s digital transformation landscape.

Key growth factors include increasing cloud adoption rates, with enterprise cloud migration reaching 68% among Swedish businesses, and the expanding requirements for edge computing infrastructure to support emerging technologies. The market benefits from Sweden’s commitment to carbon neutrality and its position as a leader in sustainable technology practices.

Investment patterns show strong interest from international hyperscale operators, colocation providers, and enterprise clients seeking to establish strategic Nordic presence. The construction sector has adapted to meet demanding requirements for energy efficiency, with new facilities achieving Power Usage Effectiveness (PUE) ratios below 1.2 in many cases.

Market challenges include skilled labor availability, supply chain considerations, and increasing land costs in prime locations. However, these factors are offset by strong government support, excellent infrastructure connectivity, and the country’s reputation for regulatory stability and business-friendly policies.

Strategic market insights reveal several critical trends shaping the Sweden data center construction landscape:

Digital transformation acceleration serves as the primary catalyst for Sweden’s data center construction market expansion. Organizations across industries are migrating to cloud-based solutions, creating substantial demand for modern, efficient data center facilities capable of supporting diverse workloads and applications.

Renewable energy abundance positions Sweden as an attractive destination for energy-intensive data center operations. The country’s commitment to sustainable power generation, with renewable sources accounting for 65% of total energy production, appeals to environmentally conscious operators seeking to minimize their carbon footprint.

Government digitalization initiatives continue to drive infrastructure investment and create favorable conditions for data center development. Public sector digital transformation programs require robust infrastructure support, while regulatory frameworks encourage private sector investment in advanced technology facilities.

Geographic advantages include Sweden’s strategic location for serving Northern European markets, stable political environment, and excellent international connectivity. The country’s position as a gateway between European and global markets enhances its appeal for multinational organizations establishing regional data center presence.

Climate benefits provide natural cooling advantages that reduce operational costs and environmental impact. Sweden’s temperate climate enables efficient free cooling solutions for significant portions of the year, contributing to improved energy efficiency and reduced operational expenses.

Skilled workforce limitations present ongoing challenges for the Sweden data center construction market. The specialized nature of data center construction requires expertise in advanced mechanical, electrical, and technology systems, creating competition for qualified professionals across the Nordic region.

Land availability constraints in prime locations, particularly near major urban centers and connectivity hubs, can limit development opportunities and increase project costs. Premium locations with optimal connectivity and infrastructure access command higher prices, impacting overall project economics.

Supply chain complexities affect project timelines and costs, particularly for specialized equipment and components required for advanced data center systems. Global supply chain disruptions and component shortages can delay construction schedules and increase material costs.

Regulatory compliance requirements while generally supportive, can add complexity and cost to construction projects. Environmental regulations, building codes, and data protection requirements necessitate careful planning and specialized expertise to ensure full compliance.

Initial capital intensity of data center construction projects requires significant upfront investment, potentially limiting market participation to well-capitalized organizations. The high-tech nature of modern facilities demands substantial financial resources for both construction and ongoing operations.

Edge computing expansion creates substantial opportunities for distributed data center construction across Sweden’s urban and suburban areas. The growing need for low-latency computing solutions drives demand for smaller, strategically located facilities that can support emerging applications and services.

Sustainable technology leadership positions Sweden to attract environmentally conscious organizations seeking carbon-neutral data center solutions. The country’s renewable energy resources and commitment to sustainability create competitive advantages for attracting international investments.

5G network deployment generates new infrastructure requirements that benefit the data center construction market. The rollout of fifth-generation wireless networks necessitates edge computing capabilities and distributed infrastructure to support enhanced connectivity and reduced latency requirements.

International connectivity expansion through submarine cables and terrestrial fiber networks enhances Sweden’s position as a regional data hub. Improved connectivity infrastructure creates opportunities for larger-scale facilities serving broader geographic markets.

Public-private partnerships offer collaborative opportunities for infrastructure development that can accelerate market growth while sharing investment risks and leveraging complementary expertise from both sectors.

Supply and demand dynamics in Sweden’s data center construction market reflect the interplay between increasing digital infrastructure requirements and the country’s capacity to deliver advanced facilities. Demand growth consistently outpaces supply additions, creating favorable conditions for construction companies and developers.

Technology evolution drives continuous adaptation in construction approaches and facility specifications. The integration of artificial intelligence, machine learning, and advanced automation systems requires sophisticated infrastructure capabilities that influence design and construction methodologies.

Competitive dynamics involve both domestic construction companies and international specialists entering the Swedish market. This competition drives innovation in construction techniques, project delivery methods, and cost optimization strategies while maintaining high quality standards.

Investment flows from international sources continue to support market expansion, with foreign direct investment in Swedish data center projects showing annual growth rates exceeding 12%. These investments bring capital, expertise, and global best practices to the local market.

Regulatory evolution adapts to changing technology requirements and environmental considerations, creating both opportunities and challenges for market participants. Ongoing policy development aims to balance growth promotion with sustainability objectives and data protection requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Sweden’s data center construction market. The research approach combines quantitative data analysis with qualitative industry expertise to provide holistic market understanding.

Primary research activities include extensive interviews with industry stakeholders, including construction companies, data center operators, technology providers, and regulatory officials. These discussions provide firsthand insights into market trends, challenges, and opportunities from diverse perspectives.

Secondary research sources encompass government publications, industry reports, academic studies, and trade association data to establish comprehensive market context and validate primary research findings. Multiple data sources ensure research accuracy and completeness.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews for clarification, and applying statistical analysis techniques to identify trends and patterns. This rigorous approach ensures research reliability and credibility.

Market modeling techniques utilize advanced analytical tools to project future market developments, assess growth scenarios, and evaluate the impact of various factors on market evolution. These models provide valuable insights for strategic planning and decision-making.

Stockholm region dominates Sweden’s data center construction market, accounting for approximately 45% of total construction activity. The capital area benefits from superior connectivity infrastructure, proximity to major businesses, and availability of skilled technical workforce. Major international operators have established significant presence in the Stockholm metropolitan area.

Gothenburg area represents the second-largest regional market, capturing roughly 25% of construction projects. The city’s strategic location on Sweden’s west coast, excellent port facilities, and strong industrial base create favorable conditions for data center development. The region attracts both domestic and international investments.

Malmö and southern Sweden account for approximately 20% of market activity, benefiting from proximity to continental Europe and the Øresund Bridge connection to Denmark. This region offers competitive advantages for organizations seeking to serve broader European markets while maintaining Nordic operational benefits.

Northern regions including Umeå, Luleå, and surrounding areas represent emerging opportunities, comprising about 10% of current construction activity. These areas offer abundant renewable energy resources, favorable cooling conditions, and lower land costs, attracting operators focused on sustainability and cost efficiency.

Regional development patterns show increasing diversification as edge computing requirements drive construction activity beyond traditional metropolitan centers. MarkWide Research analysis indicates growing interest in secondary cities that offer strategic advantages for specific applications and market segments.

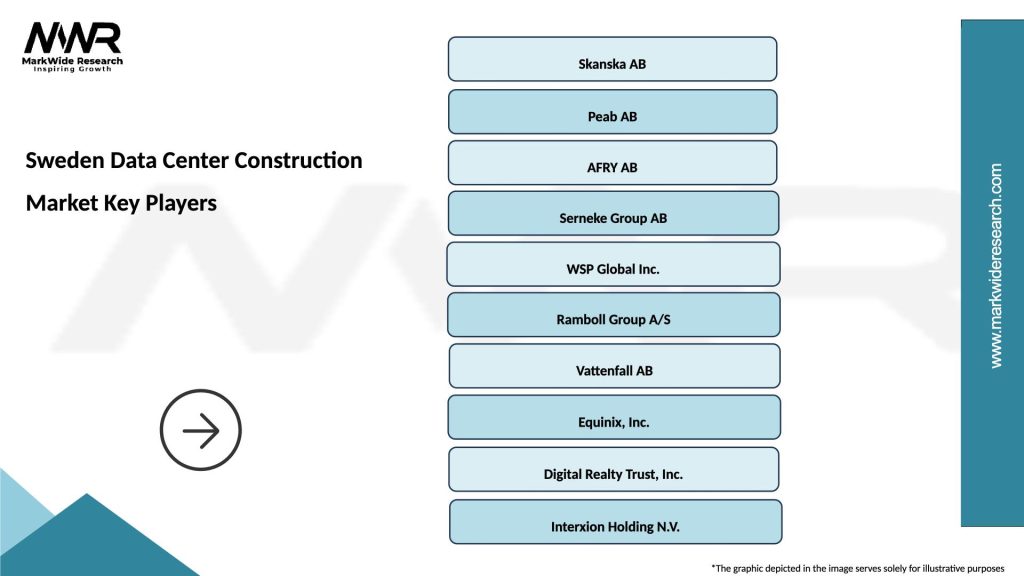

Market leadership in Sweden’s data center construction sector involves both established domestic construction companies and international specialists with Nordic expertise. The competitive environment emphasizes technical capability, sustainability credentials, and project delivery excellence.

Key market participants include:

Competitive differentiation focuses on sustainability credentials, technical expertise, project delivery speed, and cost efficiency. Companies invest in specialized capabilities, advanced construction technologies, and skilled workforce development to maintain competitive advantages.

Strategic partnerships between construction companies, technology providers, and facility operators create integrated service offerings that enhance market competitiveness and project delivery capabilities.

By Facility Type:

By Construction Type:

By End User:

Hyperscale segment represents the fastest-growing category in Sweden’s data center construction market, driven by major cloud providers expanding their Nordic presence. These facilities require specialized construction approaches to accommodate massive scale, advanced cooling systems, and high-density computing environments.

Colocation facilities continue to show steady growth as organizations seek flexible, cost-effective alternatives to private data center ownership. Construction of these facilities emphasizes modularity, scalability, and multi-tenant design considerations that support diverse customer requirements.

Edge computing facilities emerge as a rapidly expanding category, with construction activity increasing by 35% annually as 5G networks and IoT applications drive demand for distributed computing infrastructure. These smaller facilities require different construction approaches optimized for urban environments and rapid deployment.

Enterprise data centers maintain steady demand, particularly among organizations with specific security, compliance, or performance requirements that necessitate dedicated facilities. Construction trends in this segment emphasize efficiency improvements and modernization of existing facilities.

Sustainable construction practices have become standard across all categories, with environmental certification requirements influencing design and construction approaches. Green building standards and energy efficiency targets drive innovation in construction materials, methods, and systems integration.

Construction companies benefit from the growing data center market through access to high-value, technically sophisticated projects that showcase advanced capabilities and generate substantial revenue opportunities. The sector offers long-term growth prospects and opportunities for specialization in emerging technologies.

Technology providers gain from increased demand for advanced systems and components required for modern data center construction. The market creates opportunities for innovation in cooling systems, power distribution, automation technologies, and sustainable building solutions.

Real estate developers benefit from strong demand for suitable land and facilities in strategic locations. The data center construction boom creates opportunities for specialized development projects and long-term lease arrangements with stable, creditworthy tenants.

Local communities gain from job creation, tax revenue generation, and infrastructure improvements associated with data center construction projects. These facilities often bring high-paying technical jobs and contribute to local economic development.

End users benefit from improved access to advanced data center facilities that support their digital transformation initiatives. Modern facilities offer enhanced reliability, efficiency, and scalability compared to older infrastructure options.

Government stakeholders benefit from increased foreign investment, job creation, and advancement of national digitalization objectives. Data center construction supports broader economic development goals and enhances Sweden’s position as a technology leader.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has become the dominant trend in Sweden’s data center construction market, with virtually all new projects incorporating renewable energy sources, advanced cooling technologies, and environmentally responsible construction materials. This trend aligns with Sweden’s national climate objectives and attracts environmentally conscious investors.

Modular construction approaches are gaining significant traction, with prefabricated components accounting for 40% of new construction projects. This trend reduces construction timelines, improves quality control, and enables more predictable project delivery schedules while maintaining high technical standards.

Edge computing proliferation drives demand for smaller, distributed data center facilities positioned closer to end users. This trend requires new construction approaches optimized for urban environments, rapid deployment, and integration with existing infrastructure systems.

Artificial intelligence integration in facility design and construction processes improves efficiency, reduces costs, and enhances project outcomes. AI-powered tools assist with design optimization, construction planning, and predictive maintenance system integration.

Hyperscale facility expansion continues as major cloud providers establish larger, more efficient facilities to serve growing demand. These projects push the boundaries of construction scale and technical complexity while driving innovation in building systems and methodologies.

Security enhancement becomes increasingly important as cyber threats evolve, requiring sophisticated physical security measures integrated into facility design and construction. This trend influences site selection, building design, and systems integration approaches.

Major investment announcements from international hyperscale operators have significantly impacted Sweden’s data center construction market. These commitments demonstrate confidence in Sweden’s long-term potential and create substantial construction opportunities for domestic and international contractors.

Government policy initiatives supporting digital infrastructure development have created favorable conditions for market expansion. Recent policy changes streamline permitting processes, provide tax incentives for sustainable construction, and encourage foreign investment in technology infrastructure.

Submarine cable projects connecting Sweden to global networks enhance the country’s appeal as a data center location. These connectivity improvements create new opportunities for facilities serving international markets and support the development of larger-scale projects.

Educational partnerships between industry and academic institutions address skilled workforce requirements through specialized training programs. These initiatives ensure adequate talent pipeline for the growing data center construction sector.

Technology innovations in cooling systems, power distribution, and automation have been successfully implemented in recent Swedish projects. MWR analysis indicates that these innovations contribute to improved facility efficiency and reduced operational costs.

Sustainability certifications have become standard requirements for new data center construction projects, driving adoption of green building practices and renewable energy integration. This development positions Sweden as a leader in sustainable data center construction.

Strategic positioning recommendations for market participants emphasize the importance of developing specialized capabilities in sustainable construction practices and advanced technology integration. Companies should invest in training, certifications, and equipment necessary to compete effectively in this sophisticated market segment.

Partnership development with international technology providers and facility operators can provide access to global best practices, advanced technologies, and larger project opportunities. These relationships enable local companies to participate in major international projects while building valuable expertise.

Workforce development initiatives should focus on specialized skills required for data center construction, including advanced mechanical and electrical systems, automation technologies, and sustainable building practices. Collaboration with educational institutions can help address skill gaps and ensure talent availability.

Geographic diversification beyond traditional metropolitan centers can provide competitive advantages as edge computing and distributed infrastructure requirements grow. Companies should evaluate opportunities in secondary cities and emerging markets within Sweden.

Technology investment in construction methodologies, project management systems, and quality control processes can improve competitiveness and project delivery capabilities. Advanced technologies enable better project outcomes and enhanced client satisfaction.

Sustainability leadership development positions companies favorably for future market opportunities as environmental requirements continue to strengthen. Investment in green construction capabilities and certifications creates competitive differentiation and market access advantages.

Long-term growth prospects for Sweden’s data center construction market remain highly positive, supported by continued digitalization, cloud adoption, and the country’s strategic advantages in renewable energy and connectivity. MarkWide Research projects sustained growth momentum with expanding opportunities across multiple market segments.

Technology evolution will continue to influence construction requirements, with emerging technologies like quantum computing, advanced AI systems, and next-generation networking creating new infrastructure demands. These developments will drive innovation in facility design and construction approaches.

Sustainability requirements are expected to become even more stringent, with carbon neutrality targets driving 85% of construction decisions by the end of the decade. This trend will favor Sweden’s renewable energy advantages and drive continued innovation in green construction practices.

Market consolidation may occur as smaller construction companies seek partnerships or acquisitions to compete effectively in the increasingly sophisticated data center market. This consolidation could create larger, more capable organizations with enhanced technical capabilities.

International expansion opportunities may emerge for successful Swedish construction companies as Nordic expertise becomes valued in other markets with similar climate and sustainability requirements. This development could create new revenue streams and growth opportunities.

Edge computing proliferation will drive distributed construction activity across Sweden’s urban and suburban areas, creating opportunities for specialized contractors focused on smaller, rapid-deployment projects. This trend will diversify the market and create new competitive dynamics.

Sweden’s data center construction market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by digitalization trends, sustainability leadership, and strategic geographic advantages. The market benefits from strong government support, abundant renewable energy resources, and excellent infrastructure connectivity that position Sweden as a premier destination for data center investments.

Market fundamentals remain robust, with sustained demand from cloud providers, enterprises, and emerging edge computing applications creating diverse opportunities for construction companies and related service providers. The emphasis on sustainability and environmental responsibility aligns perfectly with Sweden’s national objectives and competitive advantages.

Future success in this market will require continued investment in specialized capabilities, workforce development, and technology innovation. Companies that can effectively combine technical expertise with sustainability leadership and project delivery excellence will be best positioned to capitalize on the substantial opportunities ahead in Sweden’s thriving data center construction market.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These constructions are essential for supporting cloud computing, data storage, and processing needs across various industries.

What are the key players in the Sweden Data Center Construction Market?

Key players in the Sweden Data Center Construction Market include companies like Skanska, NCC, and Peab, which are known for their expertise in large-scale construction projects. These companies often collaborate with technology firms to ensure that data centers meet the latest standards and requirements, among others.

What are the main drivers of the Sweden Data Center Construction Market?

The main drivers of the Sweden Data Center Construction Market include the increasing demand for cloud services, the growth of big data analytics, and the rise in internet traffic. Additionally, Sweden’s favorable climate for cooling data centers and supportive government policies further enhance market growth.

What challenges does the Sweden Data Center Construction Market face?

The Sweden Data Center Construction Market faces challenges such as high construction costs, regulatory hurdles, and environmental concerns. Additionally, the need for sustainable practices and energy efficiency in data center operations adds complexity to construction projects.

What opportunities exist in the Sweden Data Center Construction Market?

Opportunities in the Sweden Data Center Construction Market include the potential for green data centers and the integration of renewable energy sources. As businesses increasingly prioritize sustainability, there is a growing demand for innovative construction solutions that reduce carbon footprints.

What trends are shaping the Sweden Data Center Construction Market?

Trends shaping the Sweden Data Center Construction Market include the adoption of modular construction techniques and the use of advanced cooling technologies. Additionally, the focus on automation and smart technologies is transforming how data centers are designed and operated.

Sweden Data Center Construction Market

| Segmentation Details | Description |

|---|---|

| Type | Modular, Containerized, Traditional, Hybrid |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Providers, Enterprises, Government |

| Installation | On-premises, Off-site, Remote, Co-location |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sweden Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at