444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Supply Chain Finance market focuses on financial solutions that optimize the management of working capital and liquidity along the supply chain. This report provides an overview of the Supply Chain Finance market, including its meaning, key insights, market drivers, restraints, opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants, SWOT analysis, key trends, impact of Covid-19, key industry developments, analyst suggestions, and a future outlook.

Meaning

Supply Chain Finance is a financial strategy that involves optimizing the flow of capital, information, and payments among suppliers, buyers, and financial institutions in a supply chain. It ensures efficient working capital management and enhances the financial health of all stakeholders involved.

Executive Summary

The Supply Chain Finance market is experiencing significant growth due to the increasing need for working capital optimization and improved cash flow management. This executive summary provides a concise overview of the market, highlighting key trends, technological advancements, and growth opportunities. The report discusses the market drivers, restraints, and opportunities, along with an analysis of the impact of Covid-19 and a future outlook for the Supply Chain Finance market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Supply Chain Finance market is influenced by several key insights, showcasing its potential for growth and efficiency in financial operations:

Understanding these insights is vital for stakeholders to navigate the evolving landscape of the Supply Chain Finance market.

Market Drivers

The Supply Chain Finance market is propelled by various drivers that fuel its growth and adoption:

Understanding these drivers is essential for stakeholders to capitalize on the opportunities presented by the Supply Chain Finance market.

Market Restraints

The Supply Chain Finance market faces several restraints that could potentially hinder its growth:

Addressing these restraints through strategic planning and education is crucial for the successful growth of the Supply Chain Finance market.

Market Opportunities

The Supply Chain Finance market presents numerous opportunities for growth and expansion:

Exploring these opportunities will enable stakeholders to enhance market penetration and provide valuable solutions for businesses seeking efficient supply chain financial management.

Market Dynamics

The Supply Chain Finance market is characterized by dynamic factors that influence its trajectory:

Understanding these dynamics is vital for stakeholders to adapt and innovate in this rapidly evolving market.

Regional Analysis

Understanding the regional variations in the Supply Chain Finance market is crucial for a comprehensive market understanding:

Analyzing these regional trends provides valuable insights for market entry strategies, customization of offerings, and understanding consumer preferences.

Competitive Landscape

Leading Companies in the Supply Chain Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

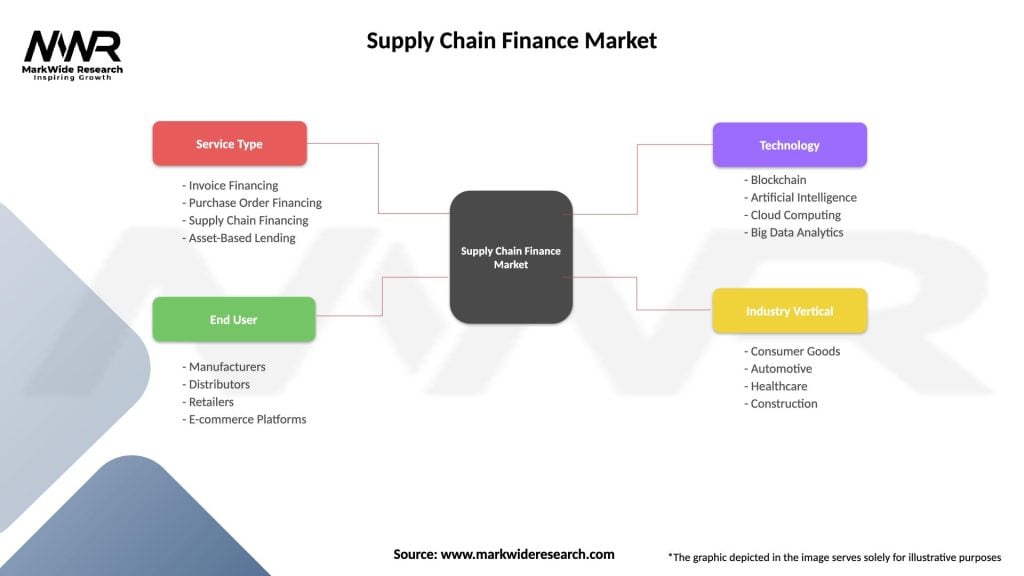

Segmentation

The Supply Chain Finance market is segmented based on various factors, allowing for a more comprehensive understanding of the market:

Analyzing these segments helps in understanding the diverse applications and preferences within the Supply Chain Finance market.

Category-wise Insights

Understanding the categories within the Supply Chain Finance market provides unique insights into the intricacies and nuances of the industry. These insights are essential for stakeholders to make informed decisions:

Analyzing these categories sheds light on the specific applications and use cases driving the Supply Chain Finance market.

Key Benefits for Industry Participants and Stakeholders

Engaging with the Supply Chain Finance market offers numerous benefits for industry participants and stakeholders:

Understanding these benefits is essential for maximizing the potential of Supply Chain Finance in enhancing financial operations across industries.

SWOT Analysis

A SWOT analysis provides a comprehensive view of the strengths, weaknesses, opportunities, and threats in the Supply Chain Finance market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors allows for strategic planning and risk mitigation within the market.

Market Key Trends

The Supply Chain Finance market is witnessing several key trends that are shaping its trajectory:

Understanding these trends provides valuable insights for businesses to stay ahead in this dynamic market.

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the Supply Chain Finance market. Disruptions in supply chains and financial uncertainties initially affected the demand for supply chain financing. However, the need for liquidity and financial stability during the pandemic emphasized the importance of supply chain finance. As the world recovers from the pandemic and businesses adapt to the new normal, the demand for efficient working capital management and liquidity optimization through supply chain finance is expected to rise.

Key Industry Developments

The Supply Chain Finance market has witnessed significant industry developments, indicative of its evolving nature:

Staying informed about these developments is vital for stakeholders to stay competitive and innovative in the market.

Analyst Suggestions

Based on the analysis and insights gathered, industry analysts offer the following suggestions for businesses and stakeholders in the Supply Chain Finance market:

Implementing these suggestions will help businesses navigate the evolving landscape of the Supply Chain Finance market effectively.

Future Outlook

The future of the Supply Chain Finance market is promising, marked by technological advancements, collaborative ecosystems, and a focus on sustainability. Key trends such as blockchain integration, data analytics, and AI adoption will drive the market’s growth. The industry’s alignment with sustainability goals and the increasing demand for efficient working capital management through supply chain finance will continue to fuel its adoption.

Conclusion

The Supply Chain Finance market will be shaped by an increased focus on sustainability and ethical financial practices. Supply chain finance will not only be about optimizing working capital but also about ensuring fair practices, environmental responsibility, and social impact. The integration of sustainability metrics into supply chain finance processes will be a key trend, allowing businesses to make informed decisions that align with their sustainability goals. In conclusion, the Supply Chain Finance market is on the brink of significant transformation, driven by technological advancements, sustainability imperatives, and the lessons learned from global challenges such as the Covid-19 pandemic.

What is Supply Chain Finance?

Supply Chain Finance refers to a set of technology-based solutions that optimize cash flow by improving the payment terms between buyers and suppliers. It involves various financial instruments and processes that enhance the efficiency of the supply chain.

What are the key players in the Supply Chain Finance Market?

Key players in the Supply Chain Finance Market include companies like C2FO, Taulia, and PrimeRevenue, which provide platforms for financing solutions. These companies facilitate better cash flow management and enhance supplier relationships, among others.

What are the main drivers of growth in the Supply Chain Finance Market?

The main drivers of growth in the Supply Chain Finance Market include the increasing need for liquidity among businesses, the rise of e-commerce, and the demand for efficient supply chain management solutions. Additionally, technological advancements in financial services are also contributing to market expansion.

What challenges does the Supply Chain Finance Market face?

The Supply Chain Finance Market faces challenges such as regulatory compliance issues, the complexity of integrating financial solutions with existing supply chain systems, and the risk of supplier dependency. These factors can hinder the adoption of supply chain finance solutions.

What opportunities exist in the Supply Chain Finance Market?

Opportunities in the Supply Chain Finance Market include the potential for growth in emerging markets, the increasing adoption of digital finance solutions, and the expansion of fintech innovations. These factors can lead to enhanced financial services tailored to supply chain needs.

What trends are shaping the Supply Chain Finance Market?

Trends shaping the Supply Chain Finance Market include the rise of blockchain technology for transparency, the integration of artificial intelligence for predictive analytics, and a growing focus on sustainability in supply chain practices. These trends are influencing how companies approach financing solutions.

Supply Chain Finance Market

| Segmentation Details | Description |

|---|---|

| Service Type | Invoice Financing, Purchase Order Financing, Supply Chain Financing, Asset-Based Lending |

| End User | Manufacturers, Distributors, Retailers, E-commerce Platforms |

| Technology | Blockchain, Artificial Intelligence, Cloud Computing, Big Data Analytics |

| Industry Vertical | Consumer Goods, Automotive, Healthcare, Construction |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Supply Chain Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at