444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The sugar alcohol market has witnessed significant growth in recent years, driven by the increasing demand for low-calorie and diabetic-friendly alternatives to sugar. Sugar alcohols, also known as polyols, are a type of sweetener that are commonly used as sugar substitutes in various food and beverage products. They are derived from natural sources such as fruits and vegetables or manufactured through industrial processes.

Sugar alcohols are a class of carbohydrates that have a chemical structure similar to both sugars and alcohols. Unlike traditional sugars, sugar alcohols are not fully absorbed by the body, resulting in reduced calorie intake. They provide a sweet taste but have a lower glycemic index, making them suitable for individuals with diabetes or those following a low-sugar diet.

Executive Summary

The global sugar alcohol market has experienced steady growth in recent years and is expected to continue its upward trajectory. The market is driven by the rising health-consciousness among consumers, growing prevalence of diabetes and obesity, and increasing demand for sugar-free and reduced-calorie products. Key players in the market are focusing on product innovation and expanding their product portfolios to meet the evolving consumer preferences.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

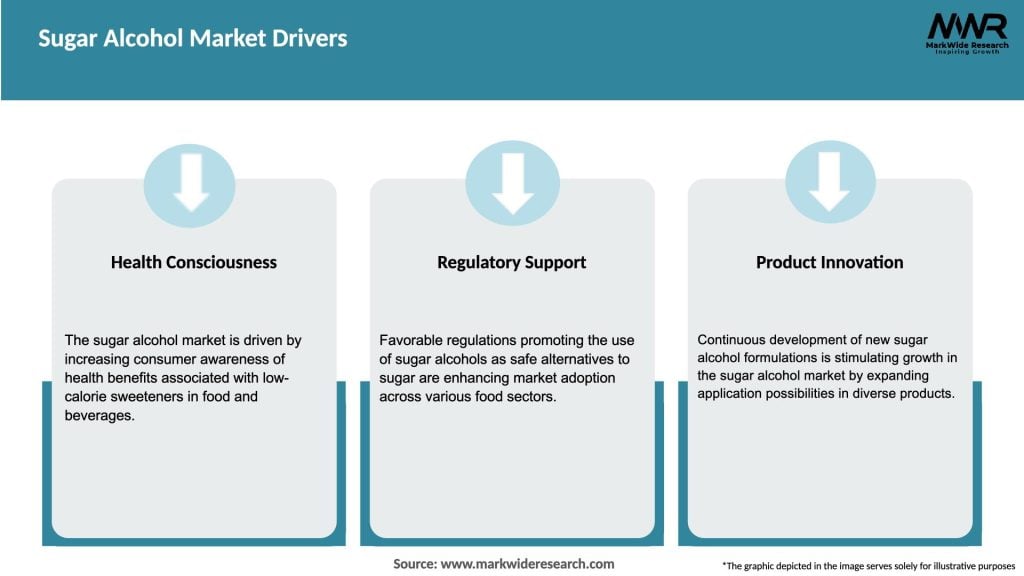

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The sugar alcohol market is highly dynamic, driven by changing consumer preferences, advancements in manufacturing processes, and regulatory developments. Key factors influencing the market dynamics include:

Regional Analysis

The sugar alcohol market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading companies in the Sugar Alcohol Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The sugar alcohol market can be segmented based on product type, application, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the sugar alcohol market. While there was a temporary disruption in the supply chain and distribution channels, the demand for sugar-free and low-calorie products remained strong. With increasing health consciousness and a focus on building a strong immune system, consumers have been actively seeking healthier food and beverage options, including those sweetened with sugar alcohols. However, the market also experienced challenges due to changes in consumer purchasing patterns and the closure of foodservice establishments.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the sugar alcohol market looks promising, with sustained growth expected in the coming years. Factors such as increasing health consciousness, rising prevalence of diabetes and obesity, and the demand for low-calorie and sugar-free products will continue to drive market growth. Additionally, advancements in manufacturing technologies and the expanding applications of sugar alcohols in various industries provide significant opportunities for market players. However, companies need to address challenges related to cost competitiveness, consumer awareness, and regulatory compliance to maintain their market position.

Conclusion

The sugar alcohol market is witnessing steady growth driven by the rising demand for low-calorie and diabetic-friendly alternatives to sugar. Sugar alcohols provide a sweet taste with reduced calorie intake and are widely used in the food and beverage, pharmaceutical, and personal care sectors. With increasing health consciousness and the prevalence of lifestyle diseases, the market presents significant opportunities for industry participants. However, challenges related to cost, consumer awareness, and regulations need to be addressed. Overall, the future outlook for the sugar alcohol market is positive, and companies should focus on innovation, market expansion, and consumer education to thrive in this dynamic industry.

What are sugar alcohols?

Sugar alcohols are a type of carbohydrate that are used as sweeteners and bulking agents in various food products. They are commonly found in sugar-free and low-calorie foods, providing sweetness with fewer calories than traditional sugars.

What are the key companies in the Sugar Alcohol Market?

Key companies in the Sugar Alcohol Market include Archer Daniels Midland Company, Cargill, Ingredion Incorporated, and Roquette Frères, among others.

What are the main drivers of growth in the Sugar Alcohol Market?

The growth of the Sugar Alcohol Market is driven by increasing consumer demand for low-calorie and sugar-free products, rising health consciousness, and the expanding use of sugar alcohols in the food and beverage industry.

What challenges does the Sugar Alcohol Market face?

The Sugar Alcohol Market faces challenges such as potential digestive issues associated with excessive consumption, competition from alternative sweeteners, and regulatory scrutiny regarding labeling and health claims.

What opportunities exist in the Sugar Alcohol Market?

Opportunities in the Sugar Alcohol Market include the development of new formulations for health-conscious consumers, the expansion of sugar alcohols in the pharmaceutical industry, and increasing applications in the cosmetics sector.

What trends are shaping the Sugar Alcohol Market?

Trends in the Sugar Alcohol Market include a growing preference for natural sweeteners, innovations in product formulations, and an increase in the availability of sugar alcohols in various food categories, such as snacks and beverages.

Sugar Alcohol Market

| Segmentation | Details |

|---|---|

| Type | Sorbitol, Xylitol, Erythritol, Others |

| Application | Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sugar Alcohol Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at