444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The sub sea pumps market represents a critical segment of the offshore oil and gas industry, encompassing sophisticated pumping systems designed to operate in the challenging underwater environment. These specialized pumps are engineered to handle extreme pressures, corrosive seawater conditions, and remote operational requirements that characterize deepwater and ultra-deepwater applications. The market has experienced substantial growth driven by increasing offshore exploration activities, technological advancements in subsea engineering, and the global demand for energy resources from previously inaccessible underwater reserves.

Market dynamics indicate robust expansion with the industry witnessing a compound annual growth rate (CAGR) of 6.2% over recent years. This growth trajectory reflects the increasing adoption of subsea processing systems, enhanced oil recovery techniques, and the development of marginal offshore fields. The market encompasses various pump types including centrifugal pumps, positive displacement pumps, and specialized multiphase pumps designed for subsea boosting applications.

Regional distribution shows significant concentration in key offshore regions including the North Sea, Gulf of Mexico, Brazil’s pre-salt fields, and emerging markets in West Africa and Asia-Pacific. The market’s evolution is closely tied to technological innovations in subsea engineering, with manufacturers focusing on developing more reliable, efficient, and remotely operable pumping solutions that can withstand the harsh subsea environment for extended periods.

The sub sea pumps market refers to the specialized industry segment focused on the design, manufacturing, installation, and maintenance of pumping systems specifically engineered for underwater operations in offshore oil and gas applications. These pumps are critical components of subsea production systems, designed to boost reservoir pressure, transport hydrocarbons from seabed to surface facilities, and facilitate various subsea processing operations.

Subsea pumps differ significantly from conventional surface pumps due to their unique operational requirements. They must operate reliably in high-pressure environments, resist corrosion from seawater exposure, function remotely without direct human intervention, and maintain performance over extended periods typically ranging from 20 to 25 years. The market encompasses various technologies including electric submersible pumps, hydraulically driven pumps, and advanced multiphase pumping systems.

Key applications include subsea boosting to enhance production rates, water injection for reservoir pressure maintenance, seawater lift for processing operations, and artificial lift systems for mature fields. The market serves primarily offshore oil and gas operators, subsea equipment manufacturers, and engineering procurement construction companies involved in deepwater projects.

The subsea pumps market demonstrates strong growth momentum driven by increasing offshore exploration activities and technological advancements in deepwater production systems. Industry analysis reveals a market characterized by high barriers to entry, significant technological complexity, and substantial capital investment requirements. The sector benefits from growing global energy demand and the need to access hydrocarbon reserves in increasingly challenging offshore environments.

Market segmentation reveals diverse applications across various pump types, with centrifugal pumps holding approximately 45% market share due to their reliability and proven performance in subsea applications. The geographic distribution shows strong concentration in established offshore regions, while emerging markets in Southeast Asia and Latin America present significant growth opportunities.

Competitive landscape features a limited number of specialized manufacturers with extensive subsea expertise, creating a concentrated market structure. Key success factors include technological innovation, proven reliability records, comprehensive service capabilities, and strong relationships with major oil and gas operators. The market outlook remains positive with increasing investments in offshore projects and growing adoption of subsea processing technologies.

Strategic analysis of the subsea pumps market reveals several critical insights that shape industry dynamics and future growth prospects:

Primary growth drivers propelling the subsea pumps market include the increasing global demand for energy resources and the necessity to access hydrocarbon reserves in deeper and more challenging offshore environments. As conventional onshore and shallow water reserves become depleted, oil and gas companies are investing heavily in deepwater and ultra-deepwater projects, creating substantial demand for specialized subsea equipment including advanced pumping systems.

Technological advancements in subsea engineering serve as a significant market driver, enabling the development of more reliable and efficient pumping solutions. Innovations in materials science, seal technology, and remote monitoring systems have improved pump performance and extended operational life, making subsea projects more economically viable. The integration of digital technologies and artificial intelligence in pump monitoring and control systems enhances operational efficiency and reduces maintenance costs.

Enhanced oil recovery techniques increasingly rely on subsea pumping systems to maintain reservoir pressure and optimize production rates. Water injection pumps, in particular, play a crucial role in extending field life and maximizing hydrocarbon recovery. The growing adoption of subsea processing and boosting systems, which can increase production efficiency by 25-40%, drives demand for sophisticated pumping solutions capable of handling multiphase fluids and operating reliably in remote subsea locations.

High capital investment requirements represent a significant restraint for the subsea pumps market, as these specialized systems require substantial upfront costs for development, manufacturing, and installation. The complex engineering requirements and stringent quality standards necessary for subsea applications result in lengthy development cycles and expensive certification processes, creating barriers for new market entrants and limiting market expansion.

Technical complexity and operational challenges associated with subsea pump systems pose ongoing market restraints. The harsh underwater environment, extreme pressures, and corrosive conditions require sophisticated engineering solutions and high-quality materials, increasing system complexity and potential failure points. Maintenance and repair operations in subsea environments are extremely challenging and costly, requiring specialized vessels and equipment.

Regulatory compliance and environmental concerns create additional market constraints, as subsea operations must meet stringent safety and environmental standards. The approval process for new subsea technologies can be lengthy and expensive, delaying market introduction of innovative pumping solutions. Additionally, fluctuating oil and gas prices can impact investment decisions for offshore projects, affecting demand for subsea pumping equipment during market downturns.

Emerging offshore markets present substantial growth opportunities for subsea pump manufacturers, particularly in regions such as Southeast Asia, West Africa, and Latin America where offshore exploration activities are expanding rapidly. These markets offer significant potential for companies with proven subsea expertise and the capability to adapt their technologies to local operating conditions and regulatory requirements.

Technological innovation creates numerous opportunities for market expansion, including the development of more efficient multiphase pumping systems, advanced materials for improved corrosion resistance, and smart monitoring technologies for predictive maintenance. The integration of renewable energy sources with subsea operations and the development of hybrid power systems for remote subsea installations represent emerging opportunities for specialized pumping solutions.

Service market expansion offers significant revenue opportunities as operators increasingly focus on maximizing asset performance and extending equipment life. Comprehensive lifecycle services, including remote monitoring, predictive maintenance, and performance optimization, can generate recurring revenue streams representing 40-60% of total project value over the equipment lifecycle. The growing emphasis on digitalization and data analytics in subsea operations creates opportunities for advanced service offerings and value-added solutions.

Supply chain dynamics in the subsea pumps market are characterized by complex relationships between specialized manufacturers, component suppliers, and end-users. The market operates on long-term contracts with extensive qualification processes, creating stable but concentrated supplier relationships. MarkWide Research analysis indicates that supply chain resilience has become increasingly important following recent global disruptions, driving companies to diversify supplier bases and strengthen local manufacturing capabilities.

Demand patterns fluctuate with offshore investment cycles, oil and gas prices, and regulatory changes affecting offshore operations. The market experiences cyclical behavior aligned with broader energy sector trends, with demand typically lagging oil price movements by 12-18 months due to project development timelines. Recent trends show increasing demand for standardized pumping solutions that can reduce costs and improve reliability across multiple projects.

Competitive dynamics feature intense competition among a limited number of qualified suppliers, with success dependent on technological capabilities, proven track records, and comprehensive service offerings. Market consolidation continues as companies seek to achieve scale economies and broaden their technological portfolios. The increasing importance of digital capabilities and data analytics is reshaping competitive positioning, with companies investing heavily in smart technologies and remote monitoring capabilities.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary research methodologies to provide accurate and reliable market insights. Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the subsea pumps value chain, including manufacturers, operators, service companies, and regulatory bodies.

Secondary research encompasses detailed analysis of industry reports, technical publications, patent filings, and regulatory documents to understand market trends, technological developments, and competitive positioning. Financial analysis of key market participants provides insights into market structure, profitability trends, and investment patterns affecting market development.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. Market sizing and forecasting models incorporate various scenarios and sensitivity analyses to account for market volatility and uncertainty. The research methodology adheres to international standards for market research and maintains strict quality control procedures throughout the analysis process.

North America represents a mature and significant market for subsea pumps, driven by extensive offshore activities in the Gulf of Mexico and growing interest in deepwater developments. The region benefits from established infrastructure, experienced operators, and advanced technological capabilities. Market share in North America accounts for approximately 35% of global demand, with strong emphasis on technology innovation and operational efficiency.

Europe maintains a strong market position, particularly in the North Sea region where mature fields require enhanced recovery techniques and subsea boosting systems. The European market is characterized by stringent environmental regulations, advanced technology adoption, and strong focus on operational safety. Scandinavian countries lead in subsea technology development, contributing significantly to global innovation in pumping systems.

Asia-Pacific emerges as the fastest-growing regional market, with offshore developments in Australia, Malaysia, Indonesia, and other Southeast Asian countries driving demand for subsea pumping solutions. The region shows growth rates exceeding 8% annually, supported by increasing energy demand and significant offshore resource potential. MWR projections indicate continued strong growth as regional operators invest in deepwater capabilities.

Latin America presents substantial opportunities, particularly in Brazil’s pre-salt fields and emerging offshore developments in Mexico and other regional markets. The region’s unique geological conditions require specialized pumping solutions, creating opportunities for technology adaptation and local partnerships. Africa’s offshore markets, particularly in West Africa, show increasing activity with several major projects driving demand for subsea equipment.

Market leadership is concentrated among a select group of specialized manufacturers with extensive subsea expertise and proven track records in challenging offshore environments. The competitive landscape features high barriers to entry due to technical complexity, qualification requirements, and substantial investment needs for product development and testing.

Competitive strategies focus on technological innovation, service excellence, and strategic partnerships with major operators. Companies invest heavily in research and development to improve pump reliability, efficiency, and operational life. The trend toward integrated solutions and comprehensive lifecycle services creates opportunities for differentiation and value creation.

By Pump Type:

By Application:

By Water Depth:

Centrifugal pumps dominate the subsea market due to their proven reliability, relatively simple design, and ability to handle large volumes efficiently. These pumps are particularly well-suited for subsea boosting applications where continuous operation and high reliability are critical. Recent innovations focus on improved materials, better seal designs, and enhanced monitoring capabilities to extend operational life and reduce maintenance requirements.

Multiphase pumps represent a growing category with significant technological advancement, capable of handling mixed gas-liquid flows without separation. This capability is particularly valuable in subsea applications where traditional separation equipment would be impractical. The segment shows annual growth rates of 12-15% as operators increasingly adopt subsea processing technologies to improve production efficiency and reduce surface facility requirements.

Electric submersible pumps adapted for subsea applications offer advantages in terms of efficiency and control precision. These systems benefit from advances in power transmission, motor design, and control systems that enable reliable operation in subsea environments. The category serves both production enhancement and artificial lift applications, with growing adoption in mature fields requiring production optimization.

Hydraulic pumps provide advantages in certain applications where electric power transmission is challenging or where specific operational characteristics are required. These systems offer flexibility in power transmission and can be particularly suitable for remote or temporary installations. The category maintains steady market share in specialized applications despite the general trend toward electric systems.

Oil and gas operators benefit significantly from advanced subsea pumping systems through improved production rates, extended field life, and enhanced recovery factors. Subsea boosting can increase production by 30-50% compared to natural flow, while water injection systems enable enhanced oil recovery techniques that can improve ultimate recovery factors by 15-25%. These benefits translate directly into improved project economics and increased asset value.

Equipment manufacturers gain access to high-value market opportunities with long-term revenue potential through equipment sales and lifecycle services. The specialized nature of subsea pumps creates barriers to entry that protect market position for established players. Successful manufacturers can achieve premium pricing for proven technologies and benefit from recurring service revenues throughout the equipment lifecycle.

Service companies benefit from growing demand for specialized installation, maintenance, and monitoring services. The complexity of subsea operations creates opportunities for value-added services including remote monitoring, predictive maintenance, and performance optimization. Service revenues can represent 40-60% of total project value over the equipment lifecycle, providing stable and recurring income streams.

Technology providers find opportunities in developing innovative solutions for monitoring, control, and optimization of subsea pumping systems. Digital technologies, artificial intelligence, and advanced materials create new market segments and enable differentiation through superior performance and reliability. The integration of renewable energy sources with subsea operations presents emerging opportunities for hybrid power systems and energy storage solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and smart technologies represent the most significant trend transforming the subsea pumps market. Advanced monitoring systems, predictive analytics, and artificial intelligence enable real-time performance optimization and predictive maintenance strategies. These technologies can reduce unplanned downtime by 25-30% and extend equipment life through optimized operating parameters and early fault detection.

Standardization initiatives gain momentum as operators and manufacturers seek to reduce costs and improve reliability through common specifications and interfaces. Industry collaboration on standardized designs and qualification procedures can significantly reduce development costs and time-to-market for new technologies. This trend particularly benefits smaller operators and emerging markets where customized solutions may not be economically viable.

Environmental sustainability becomes increasingly important as the industry faces pressure to reduce environmental impact and improve energy efficiency. Advanced pump designs focus on minimizing power consumption, reducing emissions, and incorporating environmentally friendly materials. The integration of renewable energy sources with subsea operations creates opportunities for hybrid power systems and energy storage solutions.

Modular and scalable designs enable more flexible and cost-effective deployment strategies. Modular pumping systems can be configured for specific applications and easily expanded or modified as field conditions change. This approach reduces initial capital investment and provides greater operational flexibility throughout the field lifecycle.

Recent technological breakthroughs include the development of advanced materials for improved corrosion resistance and extended operational life. New seal technologies and bearing systems enable longer intervals between maintenance interventions, reducing operational costs and improving system reliability. Magnetic coupling systems eliminate the need for dynamic seals, significantly improving reliability in high-pressure subsea applications.

Strategic partnerships between equipment manufacturers and technology companies accelerate innovation in digital monitoring and control systems. Collaborative development programs focus on integrating artificial intelligence, machine learning, and advanced analytics into subsea pumping systems. These partnerships enable faster technology development and more comprehensive solution offerings.

Qualification programs for new technologies continue to evolve, with industry initiatives aimed at reducing qualification time and costs while maintaining safety and reliability standards. Joint industry projects bring together operators, manufacturers, and regulatory bodies to develop common qualification procedures and accelerate technology adoption.

Market consolidation continues as companies seek to achieve scale economies and broaden their technological capabilities. Recent acquisitions and mergers create larger, more integrated companies capable of providing comprehensive subsea solutions. This consolidation trend is expected to continue as the market matures and competition intensifies.

Investment priorities should focus on digital technologies and advanced monitoring systems that can provide competitive differentiation and create new revenue opportunities. Companies should prioritize development of predictive maintenance capabilities, remote monitoring systems, and artificial intelligence applications that can improve operational efficiency and reduce lifecycle costs.

Market expansion strategies should target emerging offshore markets in Asia-Pacific and Africa where growing energy demand and offshore resource development create significant opportunities. MarkWide Research recommends establishing local partnerships and adapting technologies to regional operating conditions and regulatory requirements to maximize market penetration success.

Technology development should emphasize standardization and modular designs that can reduce costs and improve deployment flexibility. Companies should invest in advanced materials research, improved seal technologies, and energy-efficient designs that address environmental concerns and operational requirements. Collaboration with research institutions and technology partners can accelerate innovation and reduce development risks.

Service capabilities should be expanded to capture growing demand for lifecycle services and performance optimization. Companies should develop comprehensive service offerings including remote monitoring, predictive maintenance, and performance analytics that can generate recurring revenue streams and strengthen customer relationships. Digital service platforms can enable scalable service delivery and improve service efficiency.

Market growth prospects remain positive with continued expansion expected over the next decade, driven by increasing offshore activities and growing adoption of subsea processing technologies. The market is projected to maintain steady growth rates of 6-8% annually as operators invest in deepwater developments and enhanced recovery projects. Emerging markets in Asia-Pacific and Africa are expected to contribute significantly to this growth trajectory.

Technological evolution will continue to drive market development with advances in digital technologies, materials science, and system integration creating new opportunities for performance improvement and cost reduction. The integration of artificial intelligence and machine learning will enable more sophisticated monitoring and control capabilities, while advances in materials technology will extend equipment life and improve reliability.

Market structure is expected to remain concentrated among specialized manufacturers with extensive subsea expertise, though new entrants may emerge in specific technology niches or regional markets. The trend toward integrated solutions and comprehensive service offerings will continue, with successful companies providing complete lifecycle support for subsea pumping systems.

Regulatory environment will likely become more stringent regarding environmental protection and operational safety, driving demand for more efficient and environmentally friendly pumping solutions. Companies that proactively address these requirements through innovative technologies and sustainable practices will be best positioned for long-term success in the evolving market landscape.

The subsea pumps market represents a specialized but critical segment of the offshore energy industry, characterized by high technical complexity, substantial growth potential, and significant barriers to entry. The market benefits from increasing global energy demand, growing offshore activities, and technological advances that enable access to previously inaccessible hydrocarbon reserves in challenging deepwater environments.

Key success factors include technological innovation, proven reliability, comprehensive service capabilities, and strong relationships with major operators. Companies that can demonstrate superior performance, reliability, and lifecycle value will be best positioned to capture market opportunities and achieve sustainable competitive advantages in this demanding market environment.

Future market development will be shaped by continued technological innovation, particularly in digital technologies and advanced materials, growing demand from emerging offshore markets, and increasing emphasis on environmental sustainability and operational efficiency. The market outlook remains positive with substantial opportunities for companies that can successfully navigate the technical challenges and market dynamics that characterize this specialized industry segment.

What is Sub Sea Pumps?

Sub Sea Pumps are specialized pumps designed for underwater applications, primarily used in the oil and gas industry for transporting fluids from the seabed to the surface. They play a crucial role in enhancing production efficiency and managing subsea infrastructure.

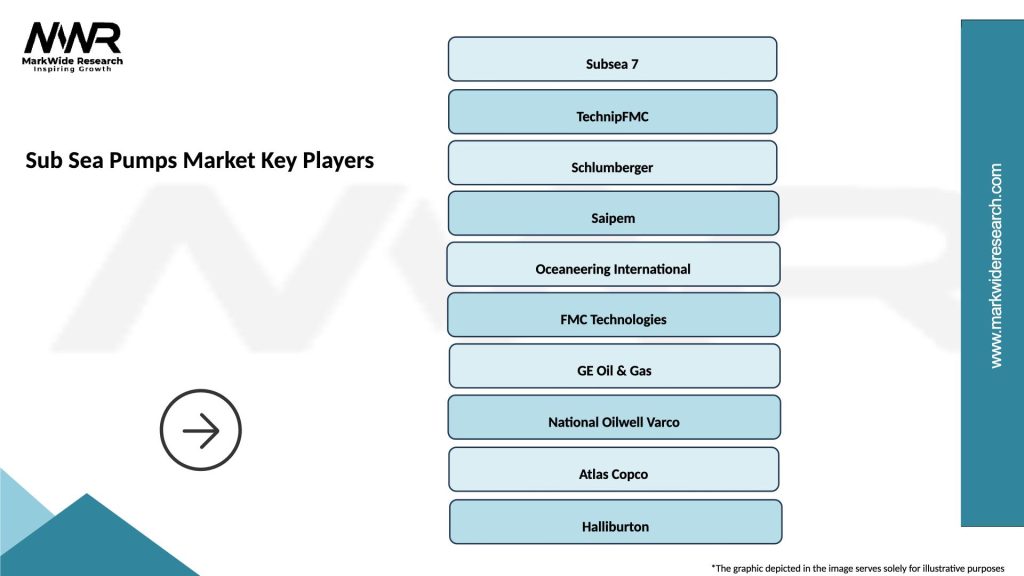

What are the key players in the Sub Sea Pumps Market?

Key players in the Sub Sea Pumps Market include companies like TechnipFMC, Aker Solutions, and Schlumberger, which are known for their innovative subsea technologies and solutions. These companies focus on enhancing pump efficiency and reliability in challenging underwater environments, among others.

What are the main drivers of growth in the Sub Sea Pumps Market?

The main drivers of growth in the Sub Sea Pumps Market include the increasing demand for oil and gas, advancements in subsea technology, and the need for efficient fluid management in offshore operations. Additionally, the push for deeper water exploration is also contributing to market expansion.

What challenges does the Sub Sea Pumps Market face?

The Sub Sea Pumps Market faces challenges such as high operational costs, technical complexities in deep-water installations, and environmental regulations that can impact project timelines. These factors can hinder the adoption of new technologies and limit market growth.

What opportunities exist in the Sub Sea Pumps Market?

Opportunities in the Sub Sea Pumps Market include the development of more efficient and environmentally friendly pump technologies, as well as the expansion of subsea infrastructure in emerging markets. Additionally, the increasing focus on renewable energy sources presents new avenues for innovation.

What trends are shaping the Sub Sea Pumps Market?

Trends shaping the Sub Sea Pumps Market include the integration of digital technologies for monitoring and maintenance, the rise of electric submersible pumps, and a growing emphasis on sustainability in subsea operations. These trends are driving innovation and improving operational efficiency.

Sub Sea Pumps Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Pumps, Hydraulic Pumps, Pneumatic Pumps, Mechanical Pumps |

| Technology | Submersible Technology, Vertical Technology, Horizontal Technology, Multistage Technology |

| End User | Oil & Gas Industry, Marine Industry, Mining Industry, Aquaculture |

| Installation | Onshore, Offshore, Subsea, Surface |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sub Sea Pumps Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at