444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The stock trading in Netherlands market represents a sophisticated and technologically advanced financial ecosystem that serves as a cornerstone of European capital markets. Netherlands stock trading has evolved significantly over the past decade, driven by digital transformation, regulatory harmonization, and increasing retail investor participation. The market demonstrates robust growth patterns with trading volumes increasing by 23% annually over recent years, reflecting heightened investor confidence and market accessibility.

Euronext Amsterdam stands as the primary stock exchange, facilitating trading across diverse sectors including technology, energy, financial services, and consumer goods. The market’s infrastructure supports both institutional and retail trading activities, with retail investor participation reaching 34% of total trading volume. Digital trading platforms have revolutionized market access, enabling seamless transactions and real-time market data analysis.

Market dynamics indicate strong momentum driven by favorable economic conditions, supportive regulatory frameworks, and increasing financial literacy among Dutch investors. The integration of artificial intelligence and algorithmic trading systems has enhanced market efficiency while maintaining transparency and fairness. Cross-border trading capabilities have expanded significantly, with international investors accounting for 42% of market activity, demonstrating the Netherlands’ position as a gateway to European markets.

The stock trading in Netherlands market refers to the comprehensive ecosystem of financial activities involving the buying, selling, and exchange of equity securities within Dutch capital markets. This market encompasses various trading venues, including the primary Euronext Amsterdam exchange, alternative trading systems, and over-the-counter markets that facilitate securities transactions for both domestic and international investors.

Stock trading activities in the Netherlands involve multiple participants including individual retail investors, institutional investors, market makers, brokers, and financial intermediaries. The market operates under stringent regulatory oversight provided by the Autoriteit Financiële Markten (AFM) and adheres to European Union financial regulations, ensuring transparency, fairness, and investor protection.

Modern stock trading in the Netherlands leverages advanced technological infrastructure, including high-frequency trading systems, mobile trading applications, and sophisticated risk management tools. The market facilitates trading across various asset classes, including equities, exchange-traded funds, derivatives, and structured products, providing comprehensive investment opportunities for diverse investor profiles.

Netherlands stock trading market demonstrates exceptional resilience and growth potential, characterized by increasing digitalization, regulatory compliance, and expanding investor participation. The market has experienced significant transformation through technological innovation, with mobile trading adoption reaching 67% among retail investors, fundamentally changing how Dutch citizens engage with capital markets.

Key market drivers include favorable economic policies, robust corporate governance standards, and increasing financial inclusion initiatives. The market benefits from the Netherlands’ strategic position within the European Union, facilitating seamless cross-border trading and investment flows. Institutional investment continues to dominate trading volumes, while retail investor engagement has grown substantially through improved market access and educational programs.

Market challenges encompass regulatory compliance costs, cybersecurity concerns, and increasing competition from international trading platforms. However, these challenges are offset by strong market fundamentals, including stable economic conditions, transparent regulatory frameworks, and continuous technological advancement. Future growth prospects remain positive, supported by ongoing digitalization efforts and expanding market participation across demographic segments.

Strategic market analysis reveals several critical insights that define the Netherlands stock trading landscape. The market demonstrates strong correlation with broader European financial markets while maintaining unique characteristics that attract both domestic and international investors.

Primary market drivers propelling Netherlands stock trading growth encompass technological advancement, regulatory support, and evolving investor preferences. Digital infrastructure development has fundamentally transformed market accessibility, enabling real-time trading capabilities and comprehensive market analysis tools for all investor categories.

Economic stability within the Netherlands provides a solid foundation for stock market growth, with consistent GDP growth and low unemployment rates encouraging investment activities. The country’s business-friendly environment attracts international companies to list on Dutch exchanges, expanding market depth and trading opportunities. Financial literacy programs have increased retail investor participation by 28% over recent years, creating a broader investor base.

Regulatory harmonization with European Union directives has streamlined cross-border trading processes, reducing transaction costs and complexity for international investors. Technological innovation continues driving market evolution, with artificial intelligence, machine learning, and blockchain technologies enhancing trading efficiency and security. Low interest rate environments have encouraged investors to seek higher returns through equity investments, boosting overall market activity and liquidity levels.

Market constraints affecting Netherlands stock trading include regulatory compliance costs, cybersecurity threats, and increasing competition from international platforms. Compliance requirements under European financial regulations impose significant operational costs on market participants, particularly smaller brokerages and trading firms seeking to maintain market access.

Cybersecurity challenges pose ongoing threats to market infrastructure, requiring continuous investment in security systems and risk management protocols. Market concentration among major institutional investors can limit price discovery efficiency and create potential systemic risks during market stress periods. High-frequency trading activities, while enhancing liquidity, may create market volatility and disadvantage traditional investors.

Economic uncertainties stemming from global events, geopolitical tensions, and monetary policy changes can significantly impact investor confidence and trading volumes. Competition from international markets and alternative investment platforms challenges traditional stock exchanges to maintain market share and investor engagement. Technological complexity may create barriers for less sophisticated investors, potentially limiting market participation across certain demographic segments.

Significant opportunities exist within the Netherlands stock trading market through technological innovation, market expansion, and product diversification. Artificial intelligence integration presents opportunities to enhance trading algorithms, risk assessment capabilities, and personalized investment advisory services for retail and institutional clients.

Sustainable investing trends create opportunities for developing specialized ESG-focused trading platforms and investment products that align with growing environmental and social consciousness among investors. Cryptocurrency integration and digital asset trading represent emerging opportunities to attract younger investors and expand market reach beyond traditional securities.

Cross-border expansion opportunities exist through strategic partnerships with international exchanges and development of global trading capabilities. Educational technology platforms can enhance financial literacy and attract new investor segments through gamification and interactive learning experiences. Robo-advisory services present opportunities to democratize investment management and provide automated portfolio optimization for retail investors seeking professional-grade investment strategies.

Market dynamics within Netherlands stock trading reflect complex interactions between technological advancement, regulatory evolution, and changing investor behavior patterns. Supply and demand forces are increasingly influenced by algorithmic trading systems that can execute thousands of transactions per second, fundamentally altering traditional price discovery mechanisms.

Liquidity provision has improved significantly through market maker programs and electronic trading systems, with bid-ask spreads narrowing by 15% across major equity indices. Market volatility patterns demonstrate increased correlation with global events and social media sentiment, requiring sophisticated risk management approaches from market participants.

Investor behavior has shifted toward more active trading strategies, supported by commission-free trading platforms and real-time market data access. Institutional trading continues to dominate volume metrics while retail investor influence on price movements has grown substantially. Market microstructure evolution includes fragmentation across multiple trading venues, requiring smart order routing systems to optimize execution quality and minimize transaction costs for all investor types.

Comprehensive research methodology employed for analyzing the Netherlands stock trading market incorporates quantitative data analysis, qualitative market assessment, and stakeholder interviews across the financial services ecosystem. Primary research includes surveys of retail investors, institutional traders, and market intermediaries to understand behavior patterns, preferences, and market outlook perspectives.

Secondary research encompasses analysis of regulatory filings, exchange data, academic studies, and industry reports to establish market trends and performance metrics. Data collection methods include real-time trading data analysis, historical performance evaluation, and comparative analysis with other European markets to identify unique characteristics and competitive positioning.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project future market developments and identify potential growth opportunities. Validation processes include cross-referencing multiple data sources, expert consultations, and peer review procedures to ensure accuracy and reliability of research findings and market projections.

Regional market distribution within the Netherlands demonstrates concentrated activity in major financial centers, with Amsterdam accounting for 78% of total trading volume through Euronext Amsterdam and associated trading platforms. Rotterdam and The Hague serve as secondary financial hubs, hosting regional offices of international brokerages and investment firms.

Geographic investor distribution shows strong participation from urban areas, with metropolitan regions generating 65% of retail trading activity. Rural areas demonstrate growing engagement through digital platforms, with mobile trading adoption increasing by 31% in smaller municipalities over recent years. Cross-border trading activity reflects the Netherlands’ position as a European financial gateway, with significant volumes from German, Belgian, and French investors.

Regional economic factors influence trading patterns, with technology-focused regions showing higher growth stock preferences while traditional industrial areas favor dividend-paying securities. Infrastructure development across regions supports market access equality, with high-speed internet connectivity and digital banking services enabling nationwide participation in stock trading activities.

Competitive environment within Netherlands stock trading encompasses traditional brokerages, digital-first platforms, and international market entrants competing for market share across retail and institutional segments. Market leadership is distributed among several key players offering differentiated services and value propositions.

Market segmentation within Netherlands stock trading encompasses multiple dimensions including investor type, trading platform, asset class, and investment approach. Investor segmentation reveals distinct characteristics and preferences across retail, institutional, and high-net-worth individual categories.

By Investor Type:

By Trading Platform:

Category analysis reveals distinct trends and performance characteristics across different segments of the Netherlands stock trading market. Retail trading demonstrates the highest growth rates, driven by improved market access and educational initiatives that have increased participation among younger demographics.

Institutional trading maintains market dominance in terms of volume and value, with pension funds contributing 45% of total institutional activity. Asset management companies show increasing preference for passive investment strategies, driving growth in exchange-traded fund trading volumes. Insurance companies focus on long-term equity investments to match liability profiles and regulatory requirements.

Technology sector trading represents the most active category, reflecting Netherlands’ position as a European technology hub. Sustainable investing categories show exceptional growth, with ESG-focused securities trading increasing by 52% annually. International equity trading through Dutch platforms demonstrates strong growth as investors seek global diversification opportunities and exposure to emerging markets.

Industry participants in the Netherlands stock trading market realize substantial benefits through technological advancement, regulatory clarity, and market efficiency improvements. Brokerages and trading firms benefit from reduced operational costs through automation, improved client acquisition through digital channels, and enhanced risk management capabilities.

Retail investors gain access to previously institutional-only investment opportunities, reduced transaction costs, and comprehensive market research tools. Educational resources and user-friendly platforms democratize investment knowledge and enable informed decision-making across all experience levels. Portfolio diversification opportunities expand through access to international markets and alternative investment products.

Institutional investors benefit from improved execution quality, reduced market impact costs, and enhanced liquidity across asset classes. Regulatory compliance is streamlined through standardized reporting systems and automated monitoring tools. Market makers realize improved profitability through sophisticated pricing algorithms and risk management systems that optimize inventory management and reduce capital requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the Netherlands stock trading market reflect broader technological and social developments reshaping financial services globally. Artificial intelligence integration is revolutionizing trading strategies, risk management, and customer service delivery across all market segments.

Sustainable investing has evolved from niche interest to mainstream investment approach, with ESG-focused trading volumes growing by 48% annually. Social trading platforms enable investors to follow and replicate successful trading strategies, democratizing access to professional-level investment expertise. Fractional share trading allows retail investors to purchase portions of high-priced securities, improving market accessibility and portfolio diversification opportunities.

Mobile-first trading continues gaining momentum, with smartphone applications becoming primary interfaces for retail investor market engagement. Real-time market data and advanced charting tools previously available only to professionals are now standard features on consumer platforms. Gamification elements in trading applications attract younger investors while educational components ensure responsible investment practices and risk awareness.

Recent industry developments demonstrate the dynamic nature of the Netherlands stock trading market and its continuous evolution toward greater efficiency and accessibility. Regulatory modernization initiatives have streamlined market entry procedures for new participants while maintaining stringent investor protection standards.

Technology partnerships between traditional financial institutions and fintech companies have accelerated innovation in trading platforms and customer experience delivery. MarkWide Research indicates that collaboration between established brokerages and technology startups has resulted in operational efficiency improvements of 35% across major market participants.

Infrastructure investments in high-speed trading systems and data centers have reduced latency and improved execution quality for all investor categories. Cross-border connectivity enhancements facilitate seamless trading across European markets, while new product launches include innovative structured products and alternative investment vehicles. Educational initiatives by industry associations and regulatory bodies have increased financial literacy and responsible investing practices among retail investors.

Strategic recommendations for Netherlands stock trading market participants focus on technology adoption, customer experience enhancement, and regulatory compliance optimization. Digital transformation should prioritize mobile platform development, artificial intelligence integration, and cybersecurity infrastructure strengthening to maintain competitive positioning.

Market expansion strategies should emphasize sustainable investing products, international market access, and educational content development to attract and retain diverse investor segments. Operational efficiency improvements through automation and process optimization can reduce costs while enhancing service quality and regulatory compliance capabilities.

Risk management protocols require continuous updating to address evolving cybersecurity threats, market volatility patterns, and regulatory changes. Partnership opportunities with fintech companies, educational institutions, and international exchanges can accelerate innovation and market reach expansion. Customer segmentation strategies should recognize distinct needs across retail, institutional, and high-net-worth investor categories, enabling targeted service delivery and product development initiatives.

Future prospects for the Netherlands stock trading market remain exceptionally positive, supported by continued technological advancement, regulatory stability, and expanding investor participation. Market growth is projected to accelerate with trading volumes expected to increase by 18% annually over the next five years, driven by digital platform adoption and international investor attraction.

Technology evolution will continue reshaping market dynamics through artificial intelligence, blockchain integration, and quantum computing applications in trading algorithms and risk management systems. Sustainable investing will become increasingly mainstream, with ESG-focused securities potentially representing the majority of new investment flows within the decade.

Regulatory developments are expected to further harmonize European market standards while maintaining Netherlands’ competitive advantages in market efficiency and investor protection. MWR analysis suggests that cross-border trading capabilities will expand significantly, positioning the Netherlands as the primary European gateway for global investment flows. Demographic shifts toward younger, technology-savvy investors will drive continued innovation in platform design, educational content, and investment product development.

Netherlands stock trading market represents a sophisticated and rapidly evolving financial ecosystem that successfully balances innovation with regulatory excellence and investor protection. The market’s strong fundamentals, including advanced technological infrastructure, strategic European positioning, and comprehensive regulatory framework, provide a solid foundation for continued growth and development.

Key success factors include the successful integration of digital technologies, growing retail investor participation, and strong institutional investor base that ensures market liquidity and stability. Future opportunities in sustainable investing, artificial intelligence applications, and international market expansion position the Netherlands as a leader in European financial market innovation.

Market participants who embrace technological advancement, prioritize customer experience, and maintain regulatory compliance will be best positioned to capitalize on emerging opportunities and navigate evolving market dynamics. The stock trading in Netherlands market continues demonstrating resilience, adaptability, and growth potential that makes it an attractive destination for both domestic and international investors seeking efficient, transparent, and secure trading environments.

What is Stock Trading?

Stock trading refers to the buying and selling of shares in publicly traded companies. It involves various strategies and can take place on stock exchanges or over-the-counter markets.

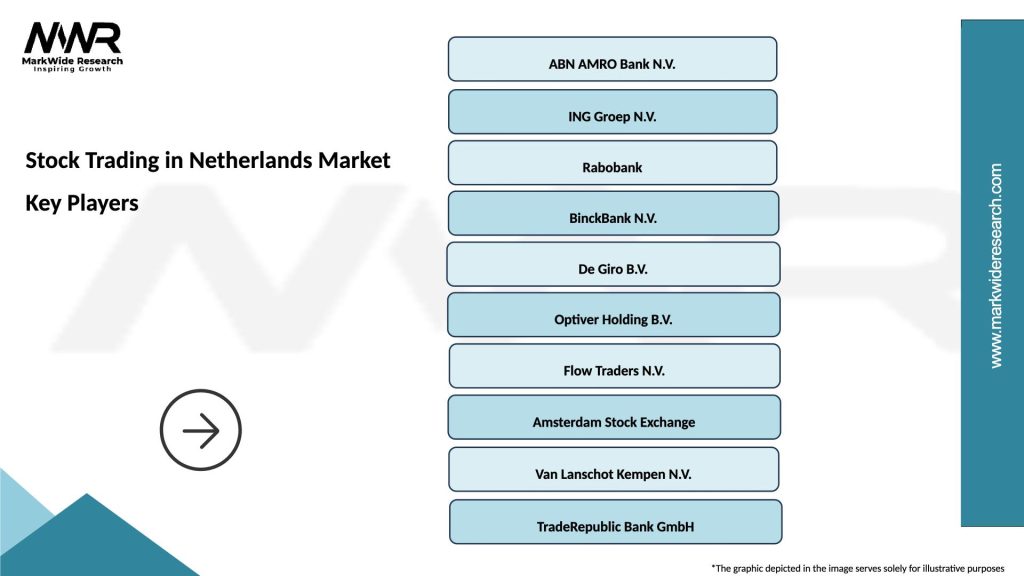

What are the key players in Stock Trading in Netherlands Market?

Key players in the Stock Trading in Netherlands Market include companies like ABN AMRO, ING Group, and Euronext Amsterdam, which facilitate trading and investment services, among others.

What are the growth factors driving Stock Trading in Netherlands Market?

Factors driving growth in the Stock Trading in Netherlands Market include increasing investor participation, advancements in trading technology, and a growing interest in sustainable investments.

What challenges does Stock Trading in Netherlands Market face?

Challenges in the Stock Trading in Netherlands Market include regulatory compliance, market volatility, and the need for investor education to navigate complex trading environments.

What opportunities exist in Stock Trading in Netherlands Market?

Opportunities in the Stock Trading in Netherlands Market include the rise of fintech solutions, increased access to international markets, and the potential for innovative trading platforms to attract new investors.

What trends are shaping Stock Trading in Netherlands Market?

Trends shaping the Stock Trading in Netherlands Market include the growing popularity of algorithmic trading, the integration of artificial intelligence in trading strategies, and a shift towards more environmentally responsible investment practices.

Stock Trading in Netherlands Market

| Segmentation Details | Description |

|---|---|

| Customer Type | Retail Investors, Institutional Investors, Hedge Funds, Family Offices |

| Trading Platform | Web-Based, Mobile App, Desktop Software, Algorithmic Trading |

| Investment Strategy | Day Trading, Swing Trading, Value Investing, Growth Investing |

| Market Segment | Equities, Derivatives, ETFs, Forex |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Stock Trading in Netherlands Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at