444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sri Lanka used car market represents a dynamic and rapidly evolving automotive sector that has become increasingly significant in the nation’s transportation landscape. This market encompasses the buying, selling, and trading of pre-owned vehicles across various segments, from compact cars to luxury vehicles, serving diverse consumer needs throughout the island nation. Market dynamics indicate substantial growth potential driven by economic factors, changing consumer preferences, and evolving financing options that make vehicle ownership more accessible to middle-income families.

Consumer behavior patterns in Sri Lanka’s used car market demonstrate a strong preference for reliable, fuel-efficient vehicles that offer value for money. The market has experienced notable transformation with the introduction of digital platforms, improved vehicle inspection services, and enhanced financing mechanisms. Growth trajectories suggest the market is expanding at approximately 8.5% annually, reflecting increased urbanization, rising disposable incomes, and the growing need for personal transportation solutions across both urban and rural areas.

Regional distribution shows concentrated activity in major cities like Colombo, Kandy, and Galle, while rural areas increasingly participate through improved connectivity and mobile-based trading platforms. The market’s resilience has been demonstrated through various economic cycles, with used cars often serving as more affordable alternatives to new vehicles during periods of economic uncertainty.

The Sri Lanka used car market refers to the comprehensive ecosystem of pre-owned vehicle transactions, encompassing dealerships, private sales, online platforms, and related services that facilitate the buying and selling of second-hand automobiles throughout the country. This market includes various vehicle categories, financing options, inspection services, and regulatory frameworks that govern used car transactions.

Market participants include licensed dealers, individual sellers, automotive financing companies, inspection service providers, and digital platform operators who collectively create a structured marketplace for used vehicle transactions. The market operates under specific regulatory guidelines established by the Department of Motor Traffic and other relevant authorities to ensure consumer protection and transaction transparency.

Value proposition centers around providing affordable transportation solutions, enabling vehicle upgrades, and creating opportunities for entrepreneurship within the automotive sector. The market serves as a crucial bridge between new car ownership aspirations and budget constraints, offering diverse options across price ranges and vehicle conditions.

Strategic analysis of Sri Lanka’s used car market reveals a sector characterized by steady growth, technological adoption, and evolving consumer preferences that favor reliability and fuel efficiency. The market has demonstrated remarkable adaptability to changing economic conditions, with digital transformation playing an increasingly important role in connecting buyers and sellers across the island.

Key performance indicators show that approximately 75% of vehicle purchases in Sri Lanka involve used cars, highlighting the market’s critical role in meeting transportation needs. The sector benefits from a growing middle class, improved access to financing, and the practical necessity of personal transportation in a developing economy where public transport options may be limited in certain areas.

Market segmentation reveals diverse opportunities across compact cars, sedans, SUVs, and commercial vehicles, with Japanese and Korean brands maintaining strong market presence due to their reputation for reliability and parts availability. The integration of digital platforms has enhanced market transparency and expanded reach, particularly benefiting rural consumers who previously had limited access to diverse vehicle options.

Consumer preferences in Sri Lanka’s used car market demonstrate clear patterns that drive purchasing decisions and market dynamics:

Economic accessibility serves as the primary driver of Sri Lanka’s used car market, with pre-owned vehicles offering significantly lower entry costs compared to new cars. This affordability factor enables broader population segments to access personal transportation, supporting economic mobility and improving quality of life across diverse income levels.

Urbanization trends continue to fuel market growth as more people migrate to cities for employment opportunities, creating increased demand for personal transportation solutions. The expansion of urban areas and development of suburban communities has made car ownership more practical and necessary for daily commuting and business activities.

Infrastructure development including road network improvements and fuel station expansion has made car ownership more viable across the island. Better connectivity between regions has increased the practical utility of personal vehicles, driving demand in previously underserved areas where public transportation options remain limited.

Financing evolution has transformed market accessibility through improved loan products, flexible payment terms, and streamlined approval processes. Banks and financial institutions have developed specialized used car financing products that cater to different income segments, making vehicle ownership achievable for middle-income families.

Digital transformation has revolutionized how consumers discover, evaluate, and purchase used vehicles. Online platforms provide comprehensive vehicle information, price comparisons, and connection opportunities between buyers and sellers, significantly improving market efficiency and transparency.

Import regulations and government policies significantly impact used car availability and pricing in Sri Lanka. Periodic changes in import duties, age restrictions, and emission standards can create market volatility and affect consumer purchasing decisions, particularly for imported used vehicles.

Economic volatility including currency fluctuations, inflation, and interest rate changes can substantially impact market dynamics. During economic downturns, consumers may delay vehicle purchases or opt for older, less expensive options, affecting overall market growth and dealer profitability.

Quality concerns remain a persistent challenge in the used car market, with buyers often uncertain about vehicle history, maintenance records, and potential hidden problems. Limited standardized inspection services and documentation can create trust issues between buyers and sellers, potentially hindering market growth.

Financing limitations still restrict market access for certain population segments, particularly those with irregular income or limited credit history. High interest rates on used car loans compared to new vehicle financing can make ownership less attractive for cost-conscious consumers.

Infrastructure constraints in rural areas, including limited service networks and parts availability, can discourage used car ownership in certain regions. Poor road conditions in some areas may also accelerate vehicle depreciation and increase maintenance costs, affecting market appeal.

Digital platform expansion presents significant opportunities for market growth through improved online marketplaces, virtual vehicle inspections, and enhanced buyer-seller matching services. Technology integration can streamline transactions, improve transparency, and expand market reach to previously underserved segments.

Certified pre-owned programs offer substantial potential for market development by addressing quality concerns and building consumer confidence. Standardized inspection processes, warranty offerings, and quality certifications can differentiate premium used car segments and justify higher pricing.

Rural market penetration represents untapped potential as infrastructure development and economic growth extend to previously underserved areas. Mobile service units, regional financing programs, and localized marketing strategies can unlock demand in emerging markets across the island.

Electric and hybrid vehicle segments are emerging as growth opportunities as environmental consciousness increases and fuel costs rise. The used electric vehicle market could develop rapidly as early adopters upgrade and more affordable electric options become available in the secondary market.

Value-added services including extended warranties, maintenance packages, and insurance bundling can create additional revenue streams while enhancing customer satisfaction and loyalty. Service integration can differentiate dealers and create competitive advantages in an increasingly crowded marketplace.

Supply and demand equilibrium in Sri Lanka’s used car market fluctuates based on new car sales, import policies, and economic conditions. When new car sales decline due to economic factors, the used car market often experiences increased activity as consumers seek more affordable alternatives, creating dynamic pricing conditions.

Seasonal variations influence market activity, with increased sales typically occurring during festival seasons, salary increment periods, and favorable weather conditions. Understanding these cyclical patterns helps dealers optimize inventory management and marketing strategies to maximize sales opportunities.

Technology integration continues reshaping market dynamics through digital platforms, mobile applications, and online financing tools. MarkWide Research analysis indicates that digital adoption has improved market efficiency by approximately 25%, reducing transaction times and expanding buyer reach significantly.

Competitive landscape evolution shows increasing professionalization of used car dealerships, with larger players investing in standardized processes, quality assurance programs, and customer service improvements. This trend toward professionalization is raising industry standards and improving overall market credibility.

Regulatory environment changes periodically impact market dynamics through modifications to import policies, emission standards, and safety requirements. Dealers and consumers must adapt to these regulatory shifts, which can create both challenges and opportunities depending on their nature and timing.

Primary research approach employed comprehensive data collection through structured interviews with used car dealers, automotive financing professionals, and consumer surveys across major cities and rural areas. This methodology ensured representation of diverse market segments and geographic regions throughout Sri Lanka.

Secondary data analysis incorporated government statistics, automotive industry reports, and economic indicators to provide contextual framework for market assessment. Department of Motor Traffic registration data, import statistics, and economic surveys provided quantitative foundation for market size and trend analysis.

Market observation techniques included on-site visits to major used car markets, dealerships, and online platform analysis to understand operational dynamics and consumer behavior patterns. This direct observation approach provided insights into actual market practices and emerging trends.

Stakeholder consultations involved discussions with industry associations, regulatory bodies, and financial institutions to gain comprehensive understanding of market challenges, opportunities, and future development prospects. These consultations provided strategic insights into policy implications and market evolution.

Data validation processes ensured accuracy through cross-referencing multiple sources, statistical verification, and expert review. The methodology incorporated both quantitative metrics and qualitative insights to provide balanced market assessment and reliable projections for stakeholder decision-making.

Western Province dominance is evident in Sri Lanka’s used car market, with Colombo and surrounding areas accounting for approximately 45% of total market activity. This concentration reflects higher population density, greater economic activity, and better infrastructure supporting automotive transactions and services.

Central Province markets including Kandy and surrounding hill country areas demonstrate steady growth driven by tourism, agriculture, and educational institutions. The region’s unique terrain requirements favor SUVs and vehicles with good ground clearance, creating specific market segments with distinct preferences.

Southern Province expansion shows promising growth potential, particularly in Galle and Matara districts, driven by economic development, port activities, and tourism growth. Coastal areas demonstrate preference for reliable, corrosion-resistant vehicles suitable for humid, salt-air environments.

Northern and Eastern Provinces represent emerging markets with significant growth potential as post-conflict development continues and infrastructure improvements enhance connectivity. These regions show increasing demand for commercial vehicles and practical transportation solutions supporting agricultural and business activities.

Rural market characteristics across all provinces emphasize utility and durability over luxury features, with pickup trucks, SUVs, and compact cars being most popular. Rural consumers often prioritize vehicles with proven reliability, easy maintenance, and good resale value due to practical transportation needs.

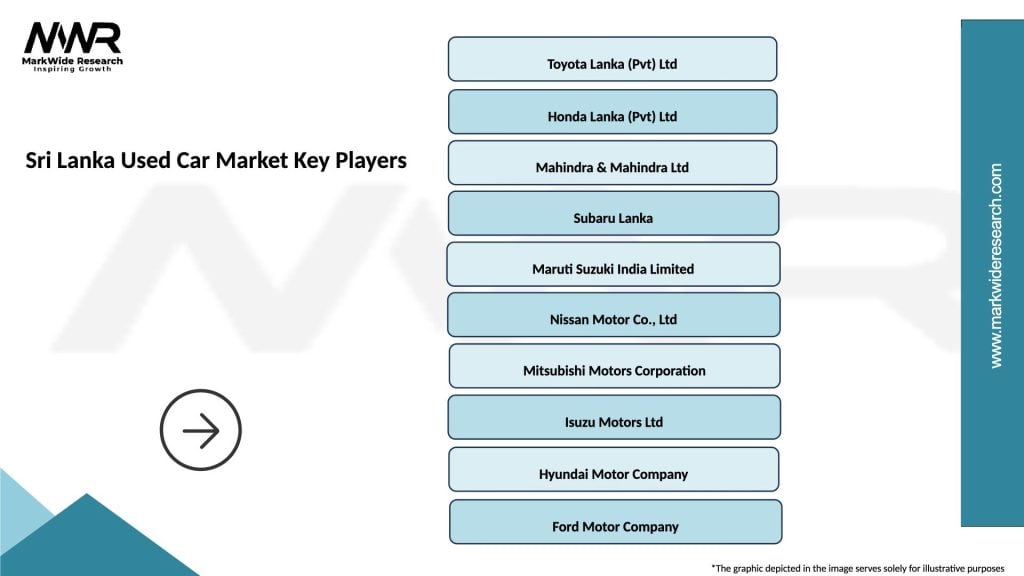

Market leadership in Sri Lanka’s used car sector is distributed among several key players who have established strong market positions through different strategies:

Competitive strategies vary significantly across market players, with established dealers focusing on quality assurance and customer service, while digital platforms emphasize convenience, transparency, and market reach expansion.

By Vehicle Type:

By Age Category:

By Price Range:

Compact car segment dominates the used car market with approximately 40% market share, driven by urban density, fuel efficiency requirements, and affordability considerations. Popular models include Toyota Vitz, Honda Fit, and Suzuki Swift, which offer reliable performance and low maintenance costs suitable for city driving conditions.

SUV and crossover categories have experienced rapid growth, expanding their market share by 20% over recent years as consumers seek versatile vehicles capable of handling diverse road conditions. This segment benefits from Sri Lanka’s varied terrain and the practical advantages of higher ground clearance and cargo capacity.

Hybrid vehicle adoption is accelerating within the used car market as fuel costs rise and environmental awareness increases. MWR data suggests hybrid vehicles now represent approximately 15% of premium used car sales, with Toyota Prius and Honda Insight leading this growing segment.

Commercial vehicle segment serves essential business and agricultural needs, with pickup trucks and small commercial vehicles maintaining steady demand. This category benefits from economic growth and entrepreneurial activities requiring reliable transportation for goods and services.

Luxury vehicle segment remains niche but stable, serving affluent consumers seeking premium brands and features. German and Japanese luxury brands maintain strong resale values and appeal to status-conscious buyers willing to pay premium prices for prestige and advanced features.

Dealers and retailers benefit from steady demand, diverse inventory opportunities, and multiple revenue streams through sales, financing, and after-sales services. The used car market offers lower inventory investment requirements compared to new car dealerships while providing opportunities for value-added services and customer relationship building.

Financial institutions gain access to expanding lending opportunities with used car financing representing a growing segment of automotive loans. This market provides diversified loan portfolios, manageable risk profiles, and opportunities to serve broader customer segments including first-time car buyers and middle-income families.

Consumers enjoy significant cost savings, wider vehicle selection, and faster depreciation curves that preserve value better than new car purchases. The used car market enables access to higher-end vehicles at affordable prices and provides opportunities for vehicle upgrades as economic circumstances improve.

Service providers including mechanics, parts suppliers, and insurance companies benefit from expanded customer bases and steady demand for maintenance and support services. The used car market creates ecosystem opportunities for various automotive service businesses.

Government and economy benefit from increased tax revenue, employment generation, and improved transportation accessibility that supports economic development and social mobility across different income segments and geographic regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital marketplace evolution is transforming how consumers discover and purchase used vehicles, with online platforms becoming increasingly sophisticated in providing detailed vehicle information, virtual inspections, and seamless transaction processes. This trend is particularly significant in reaching younger, tech-savvy consumers who prefer digital-first shopping experiences.

Quality standardization initiatives are emerging as dealers and industry associations work to establish consistent inspection standards, certification programs, and transparency measures. These efforts aim to build consumer confidence and differentiate professional dealers from informal market participants.

Financing innovation includes development of specialized used car loan products, flexible payment terms, and integration of financing with vehicle purchase processes. Banks and financial institutions are creating more accessible lending criteria and streamlined approval processes to capture growing market demand.

Sustainability consciousness is influencing consumer preferences toward fuel-efficient and hybrid vehicles, driven by rising fuel costs and environmental awareness. This trend is creating premium demand for eco-friendly used vehicles and influencing inventory strategies among dealers.

Service integration shows dealers expanding beyond simple vehicle sales to offer comprehensive packages including financing, insurance, maintenance, and warranty services. This trend toward full-service offerings aims to improve customer satisfaction and create additional revenue streams.

Regulatory framework improvements have enhanced consumer protection through better documentation requirements, standardized sales processes, and dispute resolution mechanisms. Recent policy changes have aimed to increase market transparency and reduce fraudulent activities in used car transactions.

Technology platform launches have introduced sophisticated online marketplaces with advanced search capabilities, price comparison tools, and integrated financing options. These platforms are democratizing market access and improving price transparency across different vehicle segments and geographic regions.

Financing product innovations include introduction of specialized used car loans with competitive interest rates, flexible terms, and simplified approval processes. Several banks have launched dedicated automotive financing divisions focusing specifically on used car market opportunities.

Quality assurance programs have been implemented by major dealers offering certified pre-owned vehicles with standardized inspection processes, limited warranties, and quality guarantees. These programs aim to address consumer concerns about used car reliability and build brand differentiation.

Infrastructure development including expansion of service networks, parts availability, and road improvements has enhanced the practical viability of used car ownership across different regions of Sri Lanka, supporting market growth in previously underserved areas.

Market participants should prioritize digital transformation initiatives to remain competitive in an increasingly technology-driven marketplace. Investment in online platforms, customer relationship management systems, and digital marketing capabilities will be essential for reaching modern consumers and improving operational efficiency.

Quality assurance implementation represents a critical success factor for dealers seeking to differentiate themselves and build customer loyalty. Developing standardized inspection processes, offering limited warranties, and maintaining transparent vehicle history records can justify premium pricing and improve customer satisfaction.

Geographic expansion strategies should focus on underserved rural markets where infrastructure development and economic growth are creating new opportunities. Mobile service units, regional partnerships, and localized marketing approaches can effectively penetrate these emerging markets.

Financing partnerships with banks and financial institutions can significantly expand customer reach and improve sales conversion rates. Dealers should develop relationships with multiple lenders to offer competitive financing options and serve diverse customer segments with varying credit profiles.

Service diversification beyond vehicle sales to include maintenance, insurance, and extended warranty services can create sustainable competitive advantages and improve customer lifetime value. Integrated service offerings address complete customer needs and generate recurring revenue streams.

Market growth projections indicate continued expansion of Sri Lanka’s used car market, driven by economic development, urbanization, and improving access to financing. MarkWide Research analysis suggests the market will maintain steady growth momentum with increasing professionalization and technology adoption enhancing overall market efficiency.

Technology integration will accelerate with artificial intelligence, virtual reality, and blockchain technologies potentially revolutionizing vehicle inspection, pricing, and transaction processes. These technological advances will improve market transparency, reduce fraud, and enhance customer experience across all market segments.

Sustainability trends will increasingly influence market dynamics as environmental consciousness grows and fuel costs continue rising. The used electric and hybrid vehicle segments are expected to expand significantly as early adopters upgrade and more affordable options become available in the secondary market.

Regulatory evolution may introduce stricter quality standards, emission requirements, and consumer protection measures that will favor professional dealers and certified programs over informal market participants. These changes will likely improve overall market credibility and consumer confidence.

Regional development will create new market opportunities as infrastructure improvements and economic growth extend to previously underserved areas. Rural markets represent significant untapped potential that will likely drive future market expansion and geographic diversification of industry participants.

Sri Lanka’s used car market represents a dynamic and essential component of the nation’s automotive sector, providing affordable transportation solutions while supporting economic mobility and business development across diverse population segments. The market’s resilience and adaptability have been demonstrated through various economic cycles, with steady growth driven by practical consumer needs and evolving market dynamics.

Strategic opportunities abound for market participants willing to embrace digital transformation, quality standardization, and customer-centric service approaches. The integration of technology platforms, financing solutions, and professional service standards will likely determine competitive success in an increasingly sophisticated marketplace that demands transparency and reliability.

Future prospects remain positive as economic development, infrastructure improvements, and technological advancement continue supporting market growth and evolution. The sector’s ability to adapt to changing consumer preferences, regulatory requirements, and economic conditions positions it well for sustained expansion and increasing contribution to Sri Lanka’s transportation ecosystem and economic development objectives.

What is Used Car?

The used car refers to any vehicle that has had one or more previous owners. In the context of the Sri Lanka used car market, it encompasses a wide range of vehicles, including sedans, SUVs, and hatchbacks, that are resold after their initial purchase.

What are the key players in the Sri Lanka Used Car Market?

Key players in the Sri Lanka used car market include companies like Carmudi, Ikman.lk, and AutoLanka, which facilitate the buying and selling of used vehicles through online platforms and dealerships, among others.

What are the growth factors driving the Sri Lanka Used Car Market?

The growth of the Sri Lanka used car market is driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for affordable transportation options among consumers.

What challenges does the Sri Lanka Used Car Market face?

Challenges in the Sri Lanka used car market include issues related to vehicle financing, fluctuating fuel prices, and the lack of consumer trust in the quality of used vehicles, which can hinder market growth.

What opportunities exist in the Sri Lanka Used Car Market?

Opportunities in the Sri Lanka used car market include the potential for online sales platforms to expand, the rise of electric and hybrid vehicles, and increasing demand for certified pre-owned cars among consumers.

What trends are shaping the Sri Lanka Used Car Market?

Trends in the Sri Lanka used car market include the growing popularity of online car sales, the increasing importance of vehicle history reports, and a shift towards more environmentally friendly vehicle options.

Sri Lanka Used Car Market

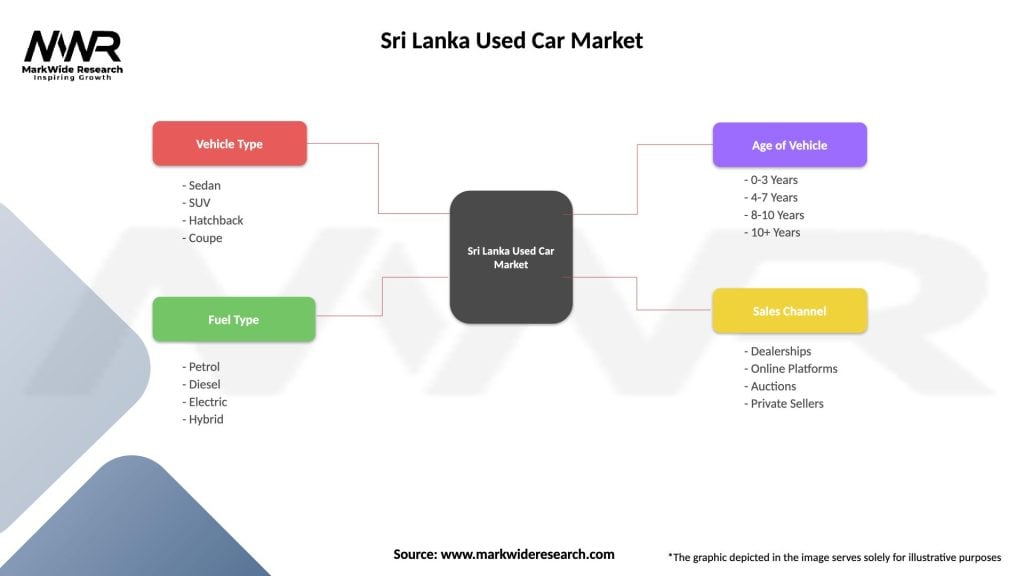

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age of Vehicle | 0-3 Years, 4-7 Years, 8-10 Years, 10+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sri Lanka Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at