444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sri Lanka life and non-life insurance market represents a dynamic and evolving sector within the country’s financial services landscape. This comprehensive market encompasses both traditional life insurance products and diverse non-life insurance offerings, serving millions of Sri Lankan consumers and businesses. Market dynamics indicate robust growth potential driven by increasing awareness of financial protection, regulatory reforms, and digital transformation initiatives across the insurance ecosystem.

Insurance penetration in Sri Lanka has shown steady improvement, with the sector experiencing significant modernization over the past decade. The market demonstrates strong resilience despite economic challenges, with insurance adoption rates reaching approximately 12.5% of the eligible population. Digital transformation has emerged as a key catalyst, enabling insurers to expand their reach and improve customer engagement through innovative distribution channels and product offerings.

Regulatory framework enhancements have strengthened market stability and consumer confidence, positioning Sri Lanka as an attractive destination for insurance investment in the South Asian region. The market benefits from a well-established regulatory environment that promotes fair competition while ensuring adequate consumer protection measures.

The Sri Lanka life and non-life insurance market refers to the comprehensive ecosystem of insurance providers, products, and services operating within Sri Lanka’s regulatory framework to offer financial protection and risk management solutions to individuals, families, and businesses. This market encompasses life insurance policies that provide financial security for beneficiaries, alongside non-life insurance products covering property, casualty, health, and specialized commercial risks.

Life insurance components include term life, whole life, endowment policies, and unit-linked insurance plans designed to provide long-term financial security and investment opportunities. Non-life insurance segments encompass motor insurance, property insurance, marine insurance, health insurance, and various commercial lines that protect against specific risks and liabilities.

Market participants include domestic and international insurance companies, reinsurers, insurance brokers, agents, and digital platforms that facilitate policy distribution and customer service. The market operates under the supervision of regulatory authorities ensuring compliance with established standards and consumer protection requirements.

Sri Lanka’s insurance market demonstrates remarkable resilience and growth potential, driven by increasing consumer awareness and regulatory support for market development. The sector has experienced substantial transformation through digital innovation, product diversification, and enhanced customer service capabilities. Market growth is projected at a compound annual growth rate of 8.2% over the forecast period, reflecting strong underlying demand and improving economic conditions.

Key market drivers include rising disposable incomes, urbanization trends, and growing recognition of insurance as essential financial planning tool. The life insurance segment maintains dominant market position, while non-life insurance shows accelerating growth driven by mandatory motor insurance requirements and expanding commercial insurance adoption.

Digital transformation initiatives have revolutionized customer acquisition and service delivery, with approximately 35% of new policies now originated through digital channels. Product innovation continues to drive market expansion, with insurers introducing customized solutions for emerging customer segments and specialized risk categories.

Competitive landscape features both established domestic players and international insurers, creating a dynamic environment that benefits consumers through improved product offerings and competitive pricing structures.

Market penetration analysis reveals significant opportunities for expansion across both urban and rural segments, with current penetration levels indicating substantial room for growth. Consumer behavior studies demonstrate increasing sophistication in insurance purchasing decisions, with customers seeking comprehensive coverage options and value-added services.

Technology integration has become a critical differentiator, with leading insurers investing heavily in artificial intelligence, machine learning, and data analytics to enhance operational efficiency and customer satisfaction. Mobile insurance platforms are gaining significant traction, particularly among younger demographics seeking convenient and accessible insurance solutions.

Economic development serves as a fundamental driver for insurance market expansion, with improving GDP growth and rising per capita income creating favorable conditions for insurance adoption. Urbanization trends contribute significantly to market growth, as urban populations demonstrate higher insurance awareness and purchasing power compared to rural counterparts.

Regulatory initiatives have played a crucial role in market development, with government policies promoting insurance penetration and financial inclusion. Mandatory insurance requirements for motor vehicles and certain commercial activities provide stable demand foundation for non-life insurance segments.

Demographic changes including aging population and changing family structures drive demand for life insurance and retirement planning products. Healthcare cost inflation has increased awareness of health insurance importance, leading to rapid growth in medical insurance adoption rates.

Corporate sector growth drives demand for commercial insurance products, while small and medium enterprise development creates opportunities for specialized business insurance solutions. Tourism industry expansion generates additional demand for travel and hospitality insurance products.

Economic volatility poses significant challenges to insurance market growth, with currency fluctuations and inflation affecting consumer purchasing power and insurer profitability. Limited insurance awareness in rural areas continues to constrain market penetration, despite ongoing educational initiatives.

Regulatory complexity can create operational challenges for insurers, particularly smaller companies with limited compliance resources. High distribution costs associated with traditional agent-based sales models impact profitability and pricing competitiveness.

Claims processing delays and customer service issues have historically affected consumer confidence in certain market segments. Product complexity and inadequate consumer education sometimes lead to misunderstandings about policy terms and coverage limitations.

Reinsurance costs and availability can impact pricing and product development, particularly for specialized or high-risk coverage areas. Fraud concerns continue to challenge the industry, requiring ongoing investment in detection and prevention systems.

Digital transformation presents unprecedented opportunities for market expansion and operational efficiency improvement. Insurtech innovation enables development of new products and services that address previously underserved market segments and emerging risk categories.

Rural market penetration represents substantial growth potential, with microinsurance and mobile-based distribution models making insurance accessible to previously unreached populations. Health insurance expansion offers significant opportunities given rising healthcare costs and increasing health consciousness among consumers.

Corporate insurance growth driven by expanding business sector and increasing risk awareness among enterprises creates opportunities for specialized commercial products. Bancassurance partnerships provide efficient distribution channels for reaching broader customer bases.

Cross-selling opportunities within existing customer bases enable revenue growth without proportional acquisition costs. Regional expansion and international partnerships offer potential for market diversification and growth acceleration.

Competitive dynamics in Sri Lanka’s insurance market reflect a balance between established domestic players and international entrants, creating an environment that fosters innovation and customer-focused service delivery. Market consolidation trends are reshaping the competitive landscape, with strategic mergers and acquisitions enabling companies to achieve greater scale and operational efficiency.

Technology adoption has become a critical differentiator, with insurers investing heavily in digital platforms to enhance customer experience and operational efficiency. Data analytics capabilities are increasingly important for risk assessment, pricing optimization, and fraud detection, with leading companies achieving operational efficiency improvements of 25% through advanced analytics implementation.

Customer expectations continue to evolve, with demand for seamless digital experiences, personalized products, and rapid claims processing driving industry transformation. Regulatory evolution supports market development while ensuring adequate consumer protection and financial stability.

Distribution channel diversification has accelerated, with traditional agent networks complemented by digital platforms, bancassurance partnerships, and direct-to-consumer channels. Product innovation cycles have shortened significantly, with insurers rapidly developing solutions for emerging risks and customer needs.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Sri Lanka’s insurance market dynamics. Primary research includes extensive interviews with industry executives, regulatory officials, and key stakeholders across the insurance value chain.

Secondary research encompasses analysis of regulatory filings, company annual reports, industry publications, and government statistics to provide comprehensive market understanding. Data triangulation methods ensure accuracy and reliability of market insights and projections.

Market modeling utilizes advanced statistical techniques and econometric analysis to project market trends and growth patterns. Qualitative analysis incorporates expert opinions and industry insights to provide context for quantitative findings.

Data validation processes ensure information accuracy and reliability through cross-referencing multiple sources and expert verification. Continuous monitoring of market developments enables real-time updates to research findings and projections.

Western Province dominates Sri Lanka’s insurance market, accounting for approximately 55% of total premium volume, driven by Colombo’s concentration of businesses and higher-income households. Urban centers demonstrate significantly higher insurance penetration rates compared to rural areas, reflecting income disparities and awareness levels.

Central Province shows growing insurance adoption, particularly in commercial segments related to tea and agricultural industries. Southern Province benefits from tourism-related insurance demand and expanding commercial activities in coastal areas.

Northern and Eastern Provinces represent emerging markets with substantial growth potential as post-conflict reconstruction and development continue. Rural market penetration remains below 8% across most provinces, indicating significant expansion opportunities for insurers willing to invest in distribution infrastructure and customer education.

Regional development initiatives by government and private sector are expected to drive insurance demand growth in previously underserved areas. Infrastructure improvements and economic development programs create opportunities for expanded insurance distribution and product offerings.

Market leadership is distributed among several established players, each with distinct competitive advantages and market positioning strategies. Domestic insurers maintain strong market presence through extensive distribution networks and deep local market understanding.

Competitive strategies increasingly focus on digital transformation, customer experience enhancement, and product innovation. Market consolidation through strategic partnerships and acquisitions is reshaping competitive dynamics and creating opportunities for operational synergies.

International players bring global expertise and capital resources, while domestic insurers leverage local market knowledge and established customer relationships. Niche players are emerging in specialized segments such as health insurance and commercial lines.

Life insurance segmentation encompasses traditional whole life policies, term insurance, endowment plans, and unit-linked insurance products. Individual life insurance represents the largest segment, while group life insurance shows rapid growth driven by employee benefit programs.

Non-life insurance segments include motor insurance, property insurance, marine insurance, health insurance, and miscellaneous commercial lines. Motor insurance maintains the largest share within non-life segments, benefiting from mandatory coverage requirements and growing vehicle ownership.

By Distribution Channel:

Customer segmentation includes individual consumers, small and medium enterprises, large corporations, and government entities. Product segmentation reflects diverse risk categories and coverage needs across different customer groups and industries.

Life Insurance Category demonstrates steady growth driven by increasing financial planning awareness and retirement security concerns. Term life insurance gains popularity among younger demographics seeking affordable protection, while investment-linked products appeal to customers seeking wealth accumulation opportunities.

Motor Insurance Category benefits from mandatory coverage requirements and expanding vehicle ownership, with comprehensive coverage adoption increasing as vehicle values rise. Commercial vehicle insurance shows strong growth aligned with transportation sector expansion.

Health Insurance Category experiences rapid growth driven by rising healthcare costs and increased health consciousness. Individual health plans complement employer-provided coverage, while family health insurance addresses comprehensive household healthcare needs.

Property Insurance Category grows with real estate development and increasing property values, with homeowner’s insurance adoption rising among middle-class households. Commercial property insurance expands with business sector growth and risk awareness.

Insurance Companies benefit from expanding market opportunities, improved operational efficiency through technology adoption, and enhanced customer engagement capabilities. Digital transformation enables cost reduction while improving service quality and market reach.

Consumers gain access to comprehensive risk protection, financial security, and wealth accumulation opportunities through diverse insurance products. Competitive market dynamics result in better pricing, improved service quality, and innovative product offerings.

Regulatory Authorities achieve improved market stability, enhanced consumer protection, and better risk management across the financial services sector. Standardization initiatives promote fair competition and market transparency.

Distribution Partners including agents, brokers, and bancassurance partners benefit from expanding product portfolios and improved commission structures. Technology platforms enhance productivity and customer service capabilities.

Technology Providers benefit from increasing demand for insurance technology solutions, while Reinsurers gain opportunities for portfolio diversification and market expansion in the South Asian region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first strategies are transforming customer acquisition and service delivery, with insurers investing heavily in mobile applications, online platforms, and artificial intelligence capabilities. Customer experience optimization has become a primary competitive differentiator, driving investments in user-friendly interfaces and streamlined processes.

Personalization trends are reshaping product development, with insurers using data analytics to create customized coverage options and pricing models. Sustainability focus is emerging as companies develop products addressing climate risks and environmental concerns.

Insurtech collaboration is accelerating, with traditional insurers partnering with technology startups to enhance innovation capabilities and market agility. Blockchain adoption shows promise for improving claims processing efficiency and reducing fraud risks.

Regulatory technology implementation is improving compliance efficiency and reducing operational risks. Data-driven underwriting enables more accurate risk assessment and competitive pricing strategies.

Regulatory reforms have strengthened market oversight and consumer protection, with new guidelines promoting transparency and fair business practices. Digital payment integration has simplified premium collection and claims settlement processes, improving customer satisfaction and operational efficiency.

Strategic partnerships between insurers and technology companies are accelerating innovation and market expansion. MarkWide Research analysis indicates that collaborative initiatives have resulted in operational efficiency improvements of 30% among participating companies.

Product launches addressing emerging risks such as cyber threats and climate change demonstrate industry responsiveness to evolving customer needs. Market consolidation through mergers and acquisitions is creating stronger, more competitive entities with enhanced capabilities.

Sustainability initiatives are gaining momentum, with insurers incorporating environmental, social, and governance considerations into business strategies and investment decisions.

Market expansion strategies should prioritize rural penetration through innovative distribution models and affordable product offerings. Digital transformation investments remain critical for long-term competitiveness and operational efficiency improvement.

Product diversification into emerging segments such as cyber insurance and parametric products can create new revenue streams and competitive advantages. Customer experience enhancement through technology adoption and service quality improvement should remain a strategic priority.

Partnership strategies with fintech companies, banks, and technology providers can accelerate innovation and market reach expansion. Talent development initiatives are essential for building capabilities required for digital transformation and market growth.

Operational efficiency improvements through process automation and technology integration can enhance profitability while maintaining competitive pricing. Brand building and customer trust development remain fundamental for long-term market success.

Market growth prospects remain positive, with MWR projecting sustained expansion driven by economic development, regulatory support, and increasing insurance awareness. Digital transformation will continue reshaping industry dynamics, creating opportunities for innovative companies while challenging traditional business models.

Technology integration is expected to accelerate, with artificial intelligence, machine learning, and blockchain technologies becoming mainstream within the next five years. Customer expectations will continue evolving, demanding more personalized, convenient, and transparent insurance solutions.

Market consolidation trends are likely to continue, with strategic mergers and acquisitions creating stronger market players capable of investing in technology and innovation. Regulatory evolution will support market development while ensuring adequate consumer protection and financial stability.

Emerging segments including cyber insurance, climate insurance, and health technology integration present significant growth opportunities. Rural market penetration is expected to accelerate through microinsurance products and mobile-based distribution platforms, potentially increasing overall market penetration to 18% by 2028.

International expansion opportunities may emerge as Sri Lankan insurers build capabilities and seek regional growth prospects. Sustainability considerations will increasingly influence product development and investment strategies across the industry.

Sri Lanka’s life and non-life insurance market stands at a pivotal juncture, characterized by substantial growth potential, technological transformation, and evolving customer expectations. The market demonstrates remarkable resilience and adaptability, with industry participants successfully navigating economic challenges while positioning for future expansion.

Digital transformation has emerged as a fundamental driver of competitive advantage, enabling insurers to enhance operational efficiency, improve customer experience, and expand market reach. Regulatory support and favorable economic trends create a conducive environment for sustained market development and innovation.

Growth opportunities remain abundant, particularly in rural market penetration, emerging product segments, and technology-enabled service delivery. Market participants who successfully balance innovation with operational excellence while maintaining strong customer focus are positioned to capture disproportionate value from market expansion.

The future outlook for Sri Lanka’s insurance market remains optimistic, with continued growth expected across both life and non-life segments. Strategic investments in technology, talent development, and customer experience will determine long-term success in this dynamic and evolving marketplace.

What is Life & Non-Life Insurance?

Life & Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the Sri Lanka Life & Non-Life Insurance Market?

Key players in the Sri Lanka Life & Non-Life Insurance Market include Sri Lanka Insurance Corporation, Ceylinco Insurance, and HNB General Insurance, among others. These companies offer a range of products catering to both life and non-life insurance needs.

What are the growth factors driving the Sri Lanka Life & Non-Life Insurance Market?

The growth of the Sri Lanka Life & Non-Life Insurance Market is driven by increasing awareness of insurance benefits, a growing middle class, and the expansion of distribution channels. Additionally, the rise in health-related concerns has led to a higher demand for health insurance products.

What challenges does the Sri Lanka Life & Non-Life Insurance Market face?

The Sri Lanka Life & Non-Life Insurance Market faces challenges such as regulatory compliance issues, low penetration rates, and competition from informal insurance providers. These factors can hinder market growth and consumer trust.

What opportunities exist in the Sri Lanka Life & Non-Life Insurance Market?

Opportunities in the Sri Lanka Life & Non-Life Insurance Market include the potential for digital transformation, the introduction of innovative insurance products, and the expansion into underserved rural areas. These factors can enhance accessibility and customer engagement.

What trends are shaping the Sri Lanka Life & Non-Life Insurance Market?

Trends shaping the Sri Lanka Life & Non-Life Insurance Market include the increasing adoption of technology for policy management, the rise of microinsurance products, and a focus on customer-centric services. These trends aim to improve efficiency and meet evolving consumer needs.

Sri Lanka Life & Non-Life Insurance Market

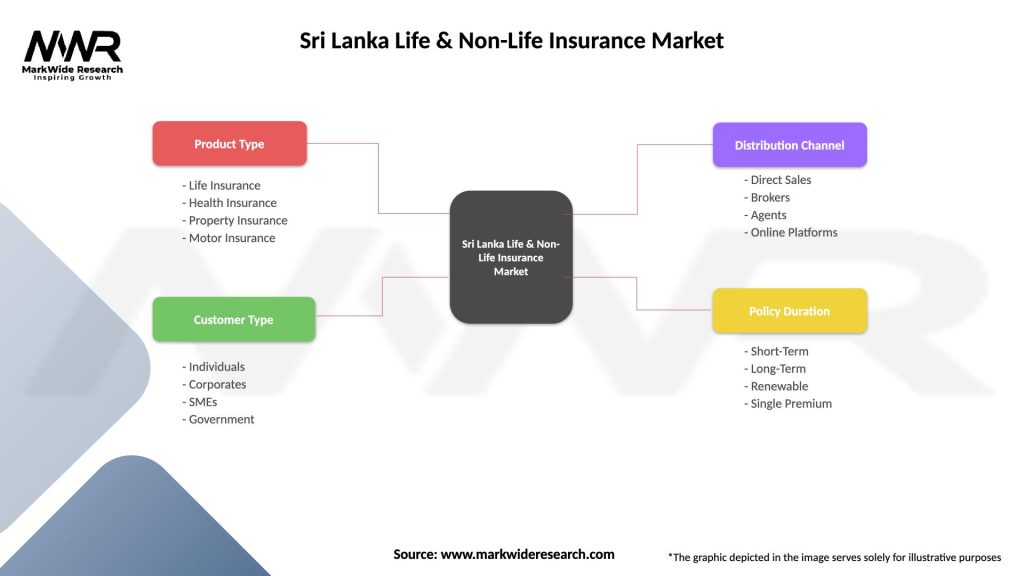

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Motor Insurance |

| Customer Type | Individuals, Corporates, SMEs, Government |

| Distribution Channel | Direct Sales, Brokers, Agents, Online Platforms |

| Policy Duration | Short-Term, Long-Term, Renewable, Single Premium |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sri Lanka Life & Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at