444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview:

Sri Lanka Life and Non-Life Insurance Market: Ensuring Protection and Security

In today’s uncertain world, insurance plays a vital role in safeguarding individuals, businesses, and assets. The insurance industry in Sri Lanka encompasses both life and non-life insurance, providing comprehensive coverage and financial support to policyholders. This article delves into the nuances of the Sri Lankan insurance market, exploring its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, and more. We will also examine the impact of Covid-19 on the industry, key industry developments, and provide an outlook for the future. So, let’s begin our journey into the world of insurance in Sri Lanka.

Meaning:

Insurance is a contract between an individual or entity and an insurance company, wherein the policyholder pays premiums to the insurer in exchange for financial protection against specific risks. Life insurance offers coverage for the policyholder’s life, while non-life insurance, also known as general insurance, covers various other risks such as property damage, health issues, travel mishaps, and more. The Sri Lanka insurance market provides diverse policies tailored to meet the unique needs of its customers.

Executive Summary:

The Sri Lanka Life and Non-Life Insurance Market has witnessed steady growth over the years, driven by increasing awareness about the importance of insurance, favorable government policies, and rising disposable incomes. The market has become increasingly competitive, with several local and international insurance companies vying for market share. Despite challenges such as regulatory complexities and economic fluctuations, the industry remains resilient, striving to cater to the evolving needs of consumers.

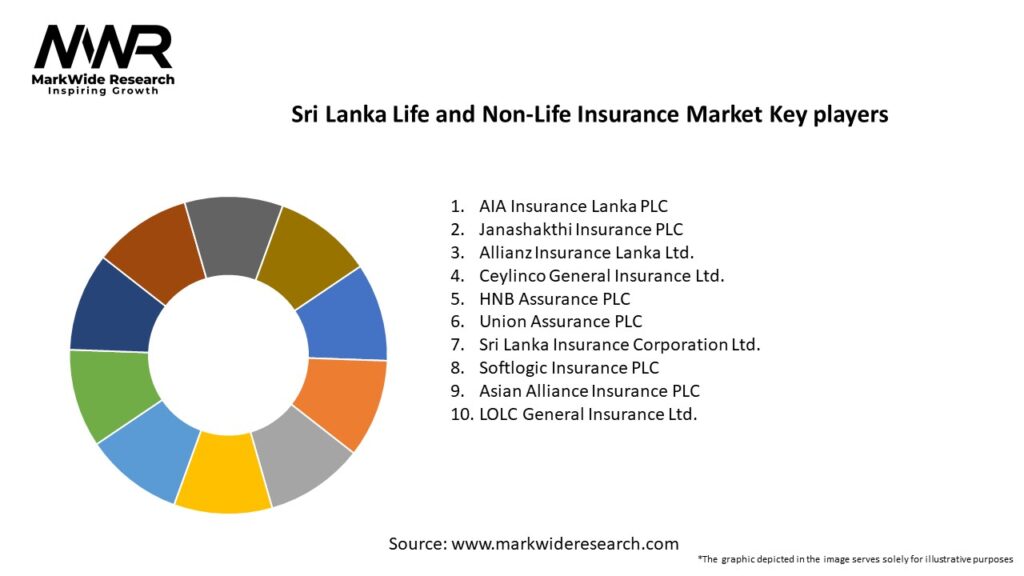

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Size: The Sri Lanka Life and Non-Life Insurance Market is expected to grow at a compound annual growth rate (CAGR) of XX% from 2024 to 2030, reflecting rising awareness and demand.

Rising Income and Awareness: An increase in disposable income, combined with government efforts to promote financial literacy, is boosting insurance adoption across the country.

Government Initiatives: Regulatory reforms, tax incentives, and awareness campaigns are key drivers of market growth, making insurance products more accessible to a broader segment of the population.

Health and Motor Insurance: The demand for health and motor insurance is growing, with rising healthcare costs and a higher number of vehicles on the road.

Market Drivers

Several factors are driving the growth of the Sri Lanka Life and Non-Life Insurance Market:

Economic Growth: The gradual improvement in the country’s economy has led to a rise in disposable incomes, increasing the ability and willingness of consumers to invest in life and non-life insurance products.

Government Support: Government initiatives, including regulatory changes and tax incentives for policyholders, are encouraging people to purchase life and non-life insurance policies.

Financial Literacy and Awareness: Financial literacy programs and media campaigns aimed at educating consumers about the importance of insurance have contributed to increased awareness and adoption of insurance products.

Population Demographics: Sri Lanka’s aging population is fueling demand for life insurance products, especially retirement and pension plans, to secure the financial well-being of older citizens.

Rising Healthcare Costs: The increasing costs of healthcare have spurred greater demand for health insurance, especially in light of the COVID-19 pandemic, which highlighted the need for medical coverage.

Market Restraints

Despite growth, the Sri Lanka Life and Non-Life Insurance Market faces several challenges:

Low Insurance Penetration: Although growing, the penetration of insurance in Sri Lanka remains low compared to global standards, with many individuals still unaware of the full benefits of insurance products.

Cultural Barriers: There remains a cultural reluctance to invest in long-term financial products like life insurance, with many preferring to focus on short-term financial needs rather than long-term security.

Economic Instability: Sri Lanka’s economic challenges, including inflation and political instability, can reduce consumer spending power and lead to slower adoption of insurance products.

Underdeveloped Distribution Channels: Limited access to insurance products in rural areas due to underdeveloped distribution channels can hinder the market’s full growth potential.

Regulatory Constraints: While regulatory reforms are encouraging, complex regulations and bureaucracy may limit the ability of insurance companies to operate efficiently, especially in a growing market.

Market Opportunities

The Sri Lanka Life and Non-Life Insurance Market offers numerous opportunities for expansion and innovation:

Digital Transformation: The increasing use of mobile technology and online platforms presents an opportunity for insurance companies to expand their reach, offering digital insurance products and improving accessibility.

Health and Wellness Products: With growing health concerns and increasing healthcare costs, there is an opportunity for insurers to expand their product offerings with health and wellness-related products, such as critical illness insurance and telemedicine services.

Microinsurance: The growing middle class and rural population present opportunities for affordable microinsurance products, tailored to individuals and businesses with lower income levels.

Sustainability and Green Insurance: As global awareness of climate change and environmental risks increases, insurers can explore offering green insurance products that cover renewable energy, electric vehicles, and eco-friendly infrastructure.

Partnerships and Collaboration: Strategic partnerships between insurers, fintech companies, and digital platforms can help drive innovation, expand distribution channels, and offer more customer-centric solutions.

Market Dynamics

The Sri Lanka Life and Non-Life Insurance Market is influenced by several dynamic factors:

Technological Advancements: The growing use of technology in insurance operations, such as AI for risk assessment, big data for personalized pricing, and automation for claims processing, is transforming the industry.

Consumer Demand for Customization: Consumers increasingly expect personalized products that cater to their specific needs, prompting insurers to offer more tailored life and non-life insurance policies.

Regulatory Reforms: Changes in regulations, including the introduction of insurance penetration targets, compulsory coverage for certain types of insurance (like motor insurance), and stricter guidelines on policyholder protection, will shape the market’s future trajectory.

Increased Competition: The entry of international insurers and the growing competition among local players will spur innovation, improve service quality, and offer consumers more competitive pricing.

Regional Analysis

The Sri Lanka Life and Non-Life Insurance Market is driven by varying regional dynamics:

Western Region: Colombo and surrounding areas are home to the majority of insurance policyholders, where urbanization and higher income levels foster greater insurance uptake.

Southern Region: The southern part of the country has a growing middle class and increasing insurance adoption, particularly in motor and property insurance, as new businesses and housing developments rise.

Northern and Eastern Regions: The northern and eastern parts of the country are showing rising demand for both life and non-life insurance products as these regions experience reconstruction and development post-conflict.

Competitive Landscape

Leading Companies in the Sri Lanka Life and Non-Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Sri Lanka Life and Non-Life Insurance Market can be segmented as follows:

By Insurance Type: Life Insurance, Non-Life Insurance.

By Product Type: Health Insurance, Motor Insurance, Property Insurance, Liability Insurance, Retirement/Pension Plans.

By Distribution Channel: Direct Sales, Brokers, Agents, Online Sales.

By End User: Individuals, SMEs, Large Enterprises.

Category-wise Insights

Life Insurance: Covers policies like term life, whole life, health, and pension plans. Life insurance is increasingly being used for long-term savings and securing the financial future of families.

Non-Life Insurance: Includes health, auto, property, and liability insurance. Auto and health insurance are seeing strong growth, driven by the rising number of vehicles and healthcare costs in Sri Lanka.

Key Benefits for Industry Participants and Stakeholders

Growth Opportunities: The increasing demand for life and non-life insurance products offers significant growth potential for insurers.

Market Expansion: Strategic expansions into rural markets and digital solutions will provide a competitive advantage for insurers.

Customer Trust: Offering secure, reliable, and transparent insurance products helps build customer trust and loyalty.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Digitization: The increasing shift toward digital insurance platforms and online policy management.

Regulatory Reforms: The government’s focus on improving insurance coverage and penetration.

Covid-19 Impact

The COVID-19 pandemic highlighted the importance of health and life insurance. The market has experienced increased demand for health insurance policies, while the pandemic also brought challenges in policy distribution and claims processing.

Key Industry Developments

Analyst Suggestions:

Future Outlook:

The future of the Sri Lanka Life and Non-Life Insurance Market appears promising. With a growing economy, increasing awareness, and technological advancements, the industry is expected to witness continued expansion. Policymakers, insurers, and other stakeholders must collaborate to address challenges and unlock the sector’s full potential.

Conclusion:

The Sri Lanka insurance market serves as a vital pillar of support for individuals, businesses, and the economy as a whole. With an array of life and non-life insurance products, it provides protection and security against various risks and uncertainties. As the market evolves, embracing innovation, increasing insurance penetration, and adapting to changing customer preferences will be key to ensuring sustained growth and resilience in this dynamic sector. By prioritizing customer needs, leveraging technology, and fostering a competitive landscape, the Sri Lankan insurance industry is poised to create a more secure and prosperous future for the nation.

What is Life and Non-Life Insurance?

Life and Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the Sri Lanka Life and Non-Life Insurance Market?

Key players in the Sri Lanka Life and Non-Life Insurance Market include Sri Lanka Insurance Corporation, Ceylinco Insurance, and HNB General Insurance. These companies offer a range of products catering to both life and non-life insurance needs, among others.

What are the growth factors driving the Sri Lanka Life and Non-Life Insurance Market?

The growth of the Sri Lanka Life and Non-Life Insurance Market is driven by increasing awareness of insurance products, a growing middle class, and the expansion of distribution channels. Additionally, the rise in health-related concerns and property ownership contributes to market growth.

What challenges does the Sri Lanka Life and Non-Life Insurance Market face?

Challenges in the Sri Lanka Life and Non-Life Insurance Market include regulatory compliance issues, low penetration rates, and competition from informal insurance providers. These factors can hinder the growth and development of the insurance sector.

What opportunities exist in the Sri Lanka Life and Non-Life Insurance Market?

Opportunities in the Sri Lanka Life and Non-Life Insurance Market include the potential for digital transformation, the introduction of innovative insurance products, and the increasing demand for microinsurance. These trends can help expand the customer base and improve service delivery.

What trends are shaping the Sri Lanka Life and Non-Life Insurance Market?

Trends in the Sri Lanka Life and Non-Life Insurance Market include the adoption of technology for better customer engagement, the rise of personalized insurance products, and a focus on sustainability in insurance practices. These trends are influencing how companies operate and interact with customers.

Sri Lanka Life and Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Endowment, Universal Life |

| Customer Type | Individual, Corporate, SME, Government |

| Distribution Channel | Direct Sales, Brokers, Banks, Online |

| Service Type | Claims Processing, Underwriting, Policy Administration, Risk Assessment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Sri Lanka Life and Non-Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at