444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The Sri Lanka Cyber Insurance Market is a burgeoning sector within the insurance industry that caters specifically to cyber-related risks and liabilities. With the rapid advancement of technology and the growing reliance on digital platforms, cyber threats have become more prevalent and sophisticated. As businesses and individuals in Sri Lanka increasingly embrace digitalization, they face an elevated risk of cyberattacks, data breaches, and other cyber incidents. This has led to a heightened demand for cyber liability insurance, which helps mitigate financial losses and legal liabilities arising from cyber incidents.

Meaning

Cyber (Liability) Insurance, also known as cyber risk insurance or cyber liability insurance, is a specialized insurance product designed to protect businesses and individuals from the financial losses and legal liabilities resulting from cyber incidents. These incidents may include data breaches, hacking attacks, malware infections, denial-of-service (DoS) attacks, and other cyber-related crimes. Cyber insurance policies can offer coverage for various aspects, such as data restoration, breach notification costs, legal expenses, regulatory fines, and customer compensation.

Executive Summary

The Sri Lanka Cyber Insurance Market has witnessed significant growth in recent years, driven by the escalating number of cyber threats and the increasing awareness of cyber risks among businesses. This market analysis aims to provide key insights into the current state and future prospects of the cyber insurance market in Sri Lanka. It delves into the market drivers, restraints, opportunities, and the impact of the COVID-19 pandemic on the market. Additionally, the report includes a competitive landscape analysis, segmentation, and SWOT analysis, empowering industry participants and stakeholders to make informed decisions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Sri Lanka Cyber Insurance Market exhibits several key insights that shape its growth and development. First and foremost, the increasing frequency and severity of cyberattacks are driving the adoption of cyber liability insurance. Businesses are keen to protect their sensitive data, financial assets, and reputation from potential cyber threats. Additionally, regulatory mandates and guidelines concerning data protection and privacy are further compelling organizations to invest in cyber insurance to ensure compliance.

Market Drivers

1. Escalating Cyber Threats: The rising frequency and sophistication of cyberattacks have propelled businesses to seek robust insurance coverage against potential cyber incidents.

2. Data Protection Regulations: Compliance with data protection regulations, such as the Personal Data Protection Act, has become a crucial driver for the adoption of cyber insurance among businesses.

3. Digital transformation: The ongoing digital transformation of industries has expanded the attack surface for cybercriminals, necessitating cyber liability insurance to mitigate risks.

Market Restraints

1. Lack of Awareness: Many small and medium-sized enterprises (SMEs) in Sri Lanka remain unaware of the importance of cyber insurance, leading to slower adoption rates.

2. Cost Concerns: Some organizations perceive cyber insurance as an additional expense, especially when they have limited budgets for risk management.

Market Opportunities

1. Untapped SME Segment: Penetrating the SME segment offers significant growth opportunities as these businesses increasingly become targets of cyberattacks.

2. Innovative Insurance Products: Introducing specialized and tailored insurance products can attract more customers and expand the market.

Market Dynamics

The Sri Lanka Cyber Insurance Market is dynamic and influenced by various factors. The market experiences fluctuations due to emerging cyber threats, changes in regulations, and evolving customer needs. Insurance providers need to stay vigilant and proactive in adapting their offerings to address the ever-changing landscape of cyber risks.

Regional Analysis

The demand for cyber liability insurance in Sri Lanka is not evenly distributed across regions. Major business hubs like Colombo and other metropolitan areas show higher demand due to the concentration of enterprises. However, as awareness increases, businesses in other regions are also showing interest in cyber insurance to safeguard their digital assets.

Competitive Landscape

Leading Companies in the Sri Lanka Cyber (Liability) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

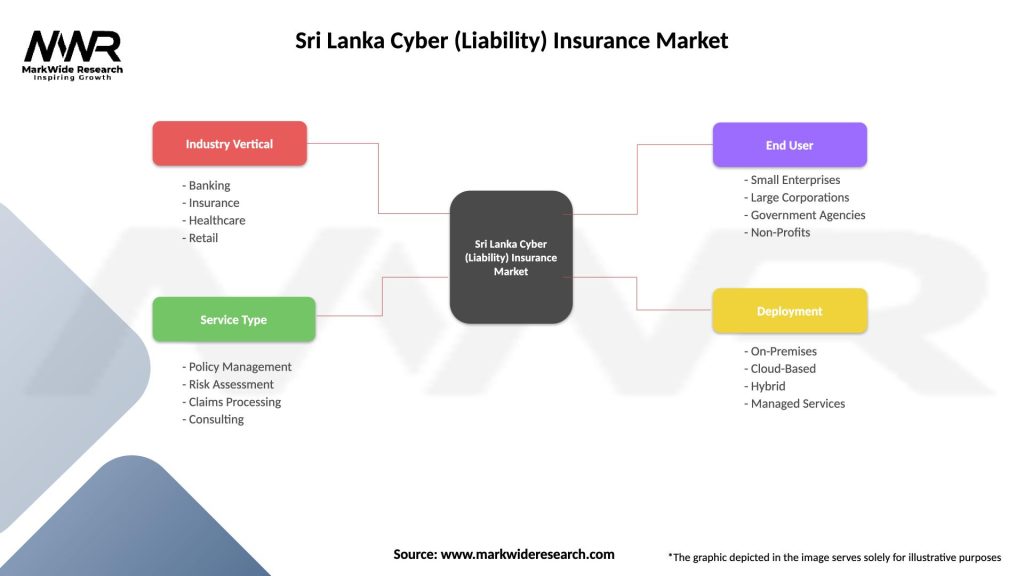

Segmentation

The Sri Lanka Cyber Insurance Market can be segmented based on the size of the insured organization (small, medium, large), industry sectors (finance, healthcare, IT, etc.), and the extent of coverage required (basic, comprehensive). Each segment has its unique risk profile and insurance needs.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the Sri Lanka Cyber Insurance Market can enjoy several benefits by actively participating in the market:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic accelerated the digital transformation of businesses in Sri Lanka. With more employees working remotely and an increased reliance on digital platforms, cyber risks intensified. As a result, there was a growing awareness of cyber liability insurance among businesses seeking to protect their digital assets.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Sri Lanka Cyber Insurance Market is expected to experience significant growth in the coming years. As cyber threats continue to evolve, businesses will increasingly recognize the value of cyber liability insurance to safeguard their digital assets and reputation. The market will witness innovative products and partnerships, providing customers with more comprehensive coverage options.

Conclusion

The Sri Lanka Cyber Insurance Market presents a promising opportunity for insurance providers and stakeholders to cater to the rising demand for protection against cyber risks. With the escalating frequency of cyberattacks and the ever-changing cybersecurity landscape, businesses are recognizing the necessity of cyber liability insurance to ensure their financial stability and reputation. By embracing innovative solutions, fostering partnerships, and conducting extensive awareness campaigns, the market can achieve sustained growth and effectively mitigate the potential impact of cyber incidents on Sri Lanka’s businesses and economy.

What is Cyber (Liability) Insurance?

Cyber (Liability) Insurance provides coverage for businesses against risks associated with cyber attacks, data breaches, and other digital threats. It helps organizations manage the financial impact of these incidents, including legal fees, data recovery costs, and reputational damage.

What are the key players in the Sri Lanka Cyber (Liability) Insurance Market?

Key players in the Sri Lanka Cyber (Liability) Insurance Market include companies like Sri Lanka Insurance Corporation, HNB General Insurance, and Janashakthi Insurance, among others. These companies offer various cyber insurance products tailored to the needs of businesses in the region.

What are the growth factors driving the Sri Lanka Cyber (Liability) Insurance Market?

The growth of the Sri Lanka Cyber (Liability) Insurance Market is driven by increasing digitalization, rising cyber threats, and the growing awareness of data protection regulations. Businesses are increasingly recognizing the need for comprehensive coverage to mitigate potential financial losses from cyber incidents.

What challenges does the Sri Lanka Cyber (Liability) Insurance Market face?

The Sri Lanka Cyber (Liability) Insurance Market faces challenges such as a lack of awareness among businesses about cyber risks and insurance options. Additionally, the evolving nature of cyber threats makes it difficult for insurers to assess risks accurately.

What opportunities exist in the Sri Lanka Cyber (Liability) Insurance Market?

Opportunities in the Sri Lanka Cyber (Liability) Insurance Market include the potential for product innovation and the development of tailored insurance solutions for small and medium-sized enterprises. As businesses continue to digitize, the demand for specialized coverage is expected to grow.

What trends are shaping the Sri Lanka Cyber (Liability) Insurance Market?

Trends shaping the Sri Lanka Cyber (Liability) Insurance Market include the increasing adoption of cloud services, the rise of remote work, and the integration of advanced technologies like AI for risk assessment. These factors are influencing how insurers develop and market their cyber insurance products.

Sri Lanka Cyber (Liability) Insurance Market

| Segmentation Details | Description |

|---|---|

| Industry Vertical | Banking, Insurance, Healthcare, Retail |

| Service Type | Policy Management, Risk Assessment, Claims Processing, Consulting |

| End User | Small Enterprises, Large Corporations, Government Agencies, Non-Profits |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Sri Lanka Cyber (Liability) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at