444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sri Lanka container glass market represents a vital segment of the nation’s manufacturing and packaging industry, serving diverse sectors including food and beverages, pharmaceuticals, cosmetics, and industrial applications. Container glass manufacturing in Sri Lanka has evolved significantly over the past decade, driven by increasing domestic demand and growing export opportunities across South Asian markets. The market demonstrates robust growth potential with expanding applications in sustainable packaging solutions and premium product segments.

Market dynamics indicate strong performance across multiple end-use industries, with the beverage sector accounting for approximately 45% of total demand. The pharmaceutical and healthcare segments contribute significantly to market expansion, particularly with increasing focus on quality packaging standards and regulatory compliance. Manufacturing capabilities have advanced considerably, with local producers investing in modern furnace technology and automated production systems to enhance efficiency and product quality.

Regional distribution shows concentrated manufacturing activities in the Western and Southern provinces, where established industrial infrastructure supports large-scale production operations. The market benefits from strategic geographical positioning, enabling efficient access to both domestic markets and export destinations in the Indian Ocean region. Growth projections suggest sustained expansion at approximately 6.2% CAGR through the forecast period, supported by increasing consumer preference for glass packaging and environmental sustainability initiatives.

The Sri Lanka container glass market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of glass containers manufactured within Sri Lankan borders for various packaging applications. This market includes diverse product categories such as bottles, jars, vials, and specialty containers designed for food preservation, beverage storage, pharmaceutical packaging, and cosmetic applications.

Container glass manufacturing involves the transformation of raw materials including silica sand, soda ash, limestone, and recycled glass cullet into finished packaging products through high-temperature melting and forming processes. The market encompasses both clear and colored glass varieties, with amber, green, and blue containers serving specific industry requirements for light protection and product differentiation.

Market scope extends beyond traditional packaging applications to include decorative containers, industrial storage solutions, and specialized pharmaceutical packaging that meets international quality standards. The definition encompasses the entire value chain from raw material sourcing and processing to final product delivery and end-user applications across multiple industry sectors.

Strategic analysis reveals the Sri Lanka container glass market as a dynamic and expanding sector with significant growth opportunities driven by increasing demand for sustainable packaging solutions and premium product applications. The market demonstrates strong fundamentals with established manufacturing infrastructure, skilled workforce, and favorable regulatory environment supporting continued expansion.

Key performance indicators highlight impressive market resilience, with domestic consumption growing at approximately 5.8% annually while export activities contribute increasingly to overall market value. The beverage industry remains the dominant end-user segment, followed by pharmaceutical and food packaging applications that demand high-quality container solutions.

Competitive landscape features a mix of established local manufacturers and international players, creating a balanced market structure that promotes innovation and quality improvements. Investment in modern production technology and environmental sustainability initiatives positions the market favorably for long-term growth and international competitiveness.

Future prospects indicate continued market expansion supported by growing consumer awareness of environmental benefits associated with glass packaging, increasing export opportunities, and ongoing industrial development initiatives. The market is well-positioned to capitalize on regional trade opportunities and sustainable packaging trends driving global demand for container glass products.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Sri Lanka container glass market. These insights provide valuable understanding of market dynamics, competitive positioning, and growth opportunities across different segments and applications.

Primary growth drivers propelling the Sri Lanka container glass market forward encompass a diverse range of economic, environmental, and consumer-related factors that create sustained demand for glass packaging solutions across multiple industry sectors.

Consumer preference shifts toward sustainable packaging alternatives represent a fundamental driver, with increasing awareness of environmental benefits associated with glass containers. This trend particularly influences the food and beverage sectors, where consumers actively seek products packaged in recyclable materials that preserve product quality and freshness while minimizing environmental impact.

Industrial expansion across key end-user sectors, including pharmaceuticals, cosmetics, and specialty foods, creates substantial demand for high-quality container glass products. The pharmaceutical industry’s growth, driven by increasing healthcare needs and regulatory requirements for secure packaging, particularly supports demand for amber and clear glass vials and bottles.

Export opportunities in regional markets provide significant growth momentum, with Sri Lankan manufacturers leveraging competitive production costs and strategic location to serve South Asian and Middle Eastern markets. Government initiatives supporting export promotion and trade facilitation further enhance market expansion potential.

Technological advancements in manufacturing processes enable improved product quality, cost efficiency, and production capacity, making Sri Lankan container glass products more competitive in both domestic and international markets. Investment in modern furnace technology and automated systems drives productivity improvements and quality consistency.

Significant challenges facing the Sri Lanka container glass market include various operational, economic, and competitive factors that may limit growth potential and market expansion across different segments and applications.

Raw material costs represent a primary constraint, with fluctuating prices for essential inputs including silica sand, soda ash, and energy affecting production economics. Import dependency for certain specialized raw materials exposes manufacturers to currency fluctuations and supply chain disruptions that impact cost competitiveness.

Energy intensity of glass manufacturing processes creates ongoing operational challenges, particularly with rising energy costs and environmental regulations. High-temperature furnace operations require substantial energy inputs, making manufacturers vulnerable to utility cost increases and power supply reliability issues.

Competition from alternatives poses increasing pressure, with plastic containers and flexible packaging solutions offering cost advantages in certain applications. Consumer price sensitivity in some market segments limits premium pricing opportunities for glass containers despite their environmental and quality benefits.

Infrastructure limitations in transportation and logistics can constrain market reach and increase distribution costs, particularly for export activities. Limited specialized handling equipment and packaging facilities may impact product quality during transportation and storage phases.

Skilled workforce availability presents ongoing challenges, with specialized technical expertise required for modern glass manufacturing operations. Training and retention of qualified personnel in technical and operational roles requires continuous investment and development programs.

Emerging opportunities within the Sri Lanka container glass market present substantial potential for growth and expansion across new applications, markets, and technological innovations that can drive future development and competitive positioning.

Premium packaging segments offer significant growth potential, particularly in cosmetics, specialty foods, and craft beverages where glass containers provide superior product presentation and brand differentiation. Increasing consumer willingness to pay premium prices for quality packaging creates opportunities for value-added products and specialized designs.

Export market expansion presents considerable opportunities, with growing demand in African, Middle Eastern, and Southeast Asian markets for quality container glass products. Strategic partnerships and trade agreements can facilitate market entry and establish long-term supply relationships with international customers.

Sustainable packaging initiatives create new market segments focused on environmental responsibility and circular economy principles. Corporate sustainability commitments and consumer environmental awareness drive demand for recyclable glass containers across multiple industry sectors.

Pharmaceutical sector growth offers substantial opportunities, with increasing healthcare needs and regulatory requirements for secure, sterile packaging solutions. Specialized pharmaceutical glass products, including vials, ampoules, and syringes, represent high-value market segments with strong growth potential.

Technology integration opportunities include smart packaging solutions, improved manufacturing processes, and quality control systems that enhance product value and operational efficiency. Investment in Industry 4.0 technologies can improve competitiveness and market positioning.

Complex market dynamics shape the Sri Lanka container glass market through interconnected factors including supply chain relationships, competitive pressures, regulatory influences, and technological developments that collectively determine market performance and future trajectory.

Supply chain integration plays a crucial role in market dynamics, with manufacturers developing strategic relationships with raw material suppliers, equipment providers, and end-user customers. Vertical integration initiatives and long-term supply agreements help stabilize operations and ensure consistent product quality and availability.

Competitive dynamics involve both domestic and international players competing across price, quality, and service dimensions. Market consolidation trends and strategic partnerships influence competitive positioning, while innovation and technological advancement create differentiation opportunities for market participants.

Regulatory environment significantly impacts market dynamics through environmental standards, quality requirements, and trade policies that affect manufacturing operations and market access. Compliance with international standards enables export opportunities while domestic regulations ensure product safety and environmental protection.

Economic factors including currency fluctuations, interest rates, and economic growth rates influence market demand, investment decisions, and competitive positioning. MarkWide Research analysis indicates that economic stability and growth prospects directly correlate with market expansion and investment activities.

Technological evolution continuously reshapes market dynamics through improved manufacturing processes, quality control systems, and product innovations that enhance competitiveness and create new market opportunities. Digital transformation and automation initiatives drive efficiency improvements and cost optimization.

Comprehensive research methodology employed for analyzing the Sri Lanka container glass market incorporates multiple data collection and analysis techniques to ensure accurate, reliable, and actionable market intelligence for stakeholders and decision-makers.

Primary research activities include extensive interviews with industry executives, manufacturing professionals, suppliers, distributors, and end-user customers to gather firsthand insights on market trends, challenges, and opportunities. Structured questionnaires and in-depth discussions provide qualitative and quantitative data on market dynamics and competitive positioning.

Secondary research sources encompass industry reports, government publications, trade association data, company financial statements, and regulatory documents to establish comprehensive market context and validate primary research findings. Historical data analysis enables trend identification and market evolution assessment.

Market segmentation analysis employs statistical techniques to identify and analyze different market segments based on product types, applications, end-user industries, and geographical regions. Cross-tabulation and correlation analysis reveal relationships between market variables and performance indicators.

Competitive intelligence gathering involves systematic analysis of major market participants, including company profiles, product portfolios, manufacturing capabilities, financial performance, and strategic initiatives. Benchmarking studies compare competitive positioning and identify market leadership factors.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and statistical verification techniques. Quality control measures maintain research integrity and reliability throughout the analysis process.

Regional market distribution across Sri Lanka reveals distinct patterns of manufacturing concentration, demand characteristics, and growth opportunities that reflect economic development, infrastructure availability, and industrial clustering effects.

Western Province dominates the container glass market, accounting for approximately 60% of total manufacturing capacity and hosting major production facilities of leading manufacturers. The region benefits from established industrial infrastructure, proximity to Colombo port for export activities, and access to skilled workforce and technical expertise. Manufacturing efficiency in this region typically exceeds national averages due to economies of scale and infrastructure advantages.

Southern Province represents the second-largest manufacturing region, contributing approximately 25% of national production capacity. The area’s industrial development initiatives and government support for manufacturing expansion create favorable conditions for container glass production. Strategic location advantages include access to raw material sources and transportation networks connecting to major markets.

Central Province shows emerging potential with growing industrial activities and infrastructure development projects supporting manufacturing expansion. The region’s 15% market share reflects increasing investment in production facilities and growing local demand from agricultural processing and beverage industries.

Northern and Eastern Provinces represent developing markets with significant growth potential as post-conflict reconstruction and economic development initiatives create new opportunities for industrial expansion and market development. Infrastructure improvements and investment incentives support future market growth in these regions.

Competitive environment within the Sri Lanka container glass market features a diverse mix of established domestic manufacturers, international players, and emerging companies competing across multiple dimensions including product quality, pricing, innovation, and customer service.

Market positioning strategies vary among competitors, with some focusing on high-volume, cost-competitive products while others target premium segments requiring specialized capabilities and superior quality standards. Innovation and technological advancement serve as key differentiators in competitive positioning.

Strategic partnerships and collaborations play important roles in competitive dynamics, with manufacturers forming alliances with suppliers, customers, and technology providers to enhance capabilities and market reach. Export partnerships particularly enable access to international markets and growth opportunities.

Market segmentation analysis reveals distinct categories within the Sri Lanka container glass market, each characterized by specific requirements, growth patterns, and competitive dynamics that influence strategic positioning and business development opportunities.

By Product Type:

By End-Use Industry:

By Glass Type:

Detailed category analysis provides specific insights into performance characteristics, growth patterns, and market opportunities within each major segment of the Sri Lanka container glass market.

Beverage Containers Category: This dominant segment demonstrates consistent growth driven by expanding brewery operations, soft drink manufacturing, and premium beverage trends. Quality requirements focus on durability, aesthetic appeal, and compatibility with automated filling and packaging systems. Innovation opportunities include lightweight designs, improved thermal resistance, and enhanced product differentiation through unique shapes and colors.

Pharmaceutical Packaging Category: Represents the fastest-growing segment with 8.3% annual expansion driven by healthcare sector development and regulatory compliance requirements. Technical specifications demand precise dimensional tolerances, chemical resistance, and sterile manufacturing conditions. Market opportunities include specialized drug delivery systems, prefilled syringes, and high-value pharmaceutical applications.

Food Packaging Category: Shows steady growth supported by food processing industry expansion and consumer preference for glass containers in premium food products. Market trends favor wide-mouth jars, easy-open designs, and microwave-safe products that enhance consumer convenience and product functionality.

Cosmetic Packaging Category: Premium segment characterized by high-value applications and emphasis on aesthetic appeal and brand differentiation. Design innovation drives market development with custom shapes, decorative treatments, and luxury packaging solutions commanding premium pricing and higher profit margins.

Comprehensive benefits accrue to various stakeholders within the Sri Lanka container glass market ecosystem, creating value through improved operations, enhanced competitiveness, and sustainable growth opportunities.

For Manufacturers:

For End-User Industries:

For Investors and Financial Stakeholders:

Strategic analysis of the Sri Lanka container glass market reveals key internal capabilities and external factors that influence competitive positioning and future development opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Significant market trends shaping the Sri Lanka container glass market reflect evolving consumer preferences, technological advancements, and industry developments that influence strategic planning and business development initiatives.

Sustainability Focus: Environmental consciousness drives increasing demand for recyclable glass containers, with 35% of purchasing decisions influenced by sustainability considerations. Manufacturers respond by implementing circular economy principles, increasing recycled content utilization, and developing eco-friendly production processes that minimize environmental impact.

Premium Packaging Demand: Consumer willingness to pay premium prices for quality packaging creates opportunities for value-added products and specialized designs. This trend particularly benefits cosmetic and specialty food applications where packaging serves as a key brand differentiator and quality indicator.

Automation Integration: Manufacturing facilities increasingly adopt automated systems for improved efficiency, quality consistency, and cost reduction. MWR analysis indicates that automation investments typically result in 15-20% productivity improvements while reducing labor dependency and operational risks.

Customization Requirements: End-user industries demand increasingly customized packaging solutions including unique shapes, colors, and decorative treatments that support brand differentiation and market positioning. This trend drives investment in flexible manufacturing capabilities and design expertise.

Export Market Development: Growing focus on international market expansion through strategic partnerships, trade promotion activities, and quality certifications that enable access to premium export markets and higher-value applications.

Digital Transformation: Implementation of digital technologies including IoT sensors, data analytics, and predictive maintenance systems that optimize manufacturing operations and improve decision-making capabilities throughout the production process.

Recent industry developments demonstrate the dynamic nature of the Sri Lanka container glass market, with significant investments, technological advancements, and strategic initiatives shaping future market direction and competitive positioning.

Manufacturing Capacity Expansion: Major manufacturers have announced substantial capacity expansion projects, with new furnace installations and production line additions designed to meet growing domestic demand and export opportunities. These investments typically involve modern technology adoption and environmental compliance improvements.

Technology Upgrades: Industry leaders implement advanced manufacturing technologies including automated forming systems, quality control equipment, and energy-efficient furnace designs that improve productivity and product quality while reducing operational costs and environmental impact.

Export Market Penetration: Sri Lankan manufacturers successfully establish presence in new international markets through strategic partnerships, quality certifications, and trade promotion activities. Recent export growth demonstrates market competitiveness and quality recognition in regional markets.

Sustainability Initiatives: Companies launch comprehensive sustainability programs including increased recycled content utilization, energy efficiency improvements, and waste reduction measures that align with global environmental trends and customer requirements.

Product Innovation: Development of specialized products including lightweight bottles, pharmaceutical packaging solutions, and premium cosmetic containers that address specific market needs and create competitive differentiation opportunities.

Strategic Partnerships: Formation of alliances with international technology providers, raw material suppliers, and distribution partners that enhance capabilities and market access while reducing operational risks and investment requirements.

Strategic recommendations for stakeholders in the Sri Lanka container glass market focus on capitalizing on growth opportunities while addressing operational challenges and competitive pressures through targeted initiatives and investments.

For Manufacturers: Priority should be placed on technology modernization and capacity optimization to improve cost competitiveness and product quality. Investment in automated systems and energy-efficient equipment can deliver 15-25% operational cost reductions while enhancing environmental performance and market positioning.

Export Development: Systematic approach to international market development through quality certifications, strategic partnerships, and targeted marketing initiatives can significantly expand revenue opportunities. Focus on high-value segments and regional markets where Sri Lankan manufacturers possess competitive advantages.

Product Diversification: Expansion into specialized applications including pharmaceutical packaging, premium cosmetics, and industrial containers can improve profit margins and reduce market concentration risks. These segments typically offer better pricing power and long-term growth potential.

Sustainability Leadership: Proactive implementation of environmental initiatives including recycling programs, energy efficiency improvements, and sustainable manufacturing practices can create competitive advantages and align with market trends favoring environmentally responsible suppliers.

Supply Chain Optimization: Development of strategic supplier relationships and inventory management systems can improve cost control and operational efficiency while ensuring consistent raw material availability and quality standards.

Workforce Development: Investment in training programs and technical skill development ensures availability of qualified personnel for modern manufacturing operations while supporting productivity improvements and quality consistency.

Future prospects for the Sri Lanka container glass market appear highly favorable, with multiple growth drivers supporting sustained expansion and market development across various segments and applications over the forecast period.

Market expansion is projected to continue at approximately 6.2% CAGR through the next five years, driven by increasing domestic demand, export growth, and new application development. The pharmaceutical segment is expected to lead growth with 8.3% annual expansion, while traditional beverage applications maintain steady development supported by industry growth and premium product trends.

Technology advancement will play a crucial role in future market development, with manufacturers investing in Industry 4.0 technologies, automation systems, and sustainable manufacturing processes that improve competitiveness and operational efficiency. MarkWide Research projections indicate that technology adoption will enable 20-30% productivity improvements over the forecast period.

Export opportunities present significant growth potential, with regional market demand expected to increase substantially as economic development and consumer spending growth drive packaging requirements. Strategic positioning in South Asian and Middle Eastern markets can provide sustained revenue growth and market diversification benefits.

Sustainability trends will increasingly influence market dynamics, with environmental regulations and consumer preferences favoring glass containers over alternative packaging materials. This trend supports long-term market growth and creates opportunities for premium positioning and value-added products.

Investment climate remains favorable with government support for manufacturing sector development, infrastructure improvements, and export promotion activities creating conducive conditions for business expansion and international competitiveness enhancement.

The Sri Lanka container glass market demonstrates strong fundamentals and promising growth prospects, supported by diverse end-use applications, competitive manufacturing capabilities, and favorable market conditions that position the industry for sustained expansion and development.

Market dynamics reveal a well-balanced ecosystem with established domestic demand, growing export opportunities, and increasing focus on premium applications that offer improved profitability and market positioning. The combination of traditional strengths in beverage packaging and emerging opportunities in pharmaceutical and specialty applications creates a robust foundation for future growth.

Strategic positioning of Sri Lankan manufacturers benefits from cost competitiveness, quality capabilities, and geographical advantages that enable effective competition in both domestic and international markets. Continued investment in technology, sustainability, and market development initiatives will further enhance competitive positioning and growth potential.

Future success in the Sri Lanka container glass market will depend on manufacturers’ ability to adapt to evolving market requirements, embrace technological advancement, and capitalize on emerging opportunities while maintaining operational efficiency and quality standards. The market’s trajectory toward sustainable growth and international expansion presents significant value creation opportunities for stakeholders across the entire industry value chain.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

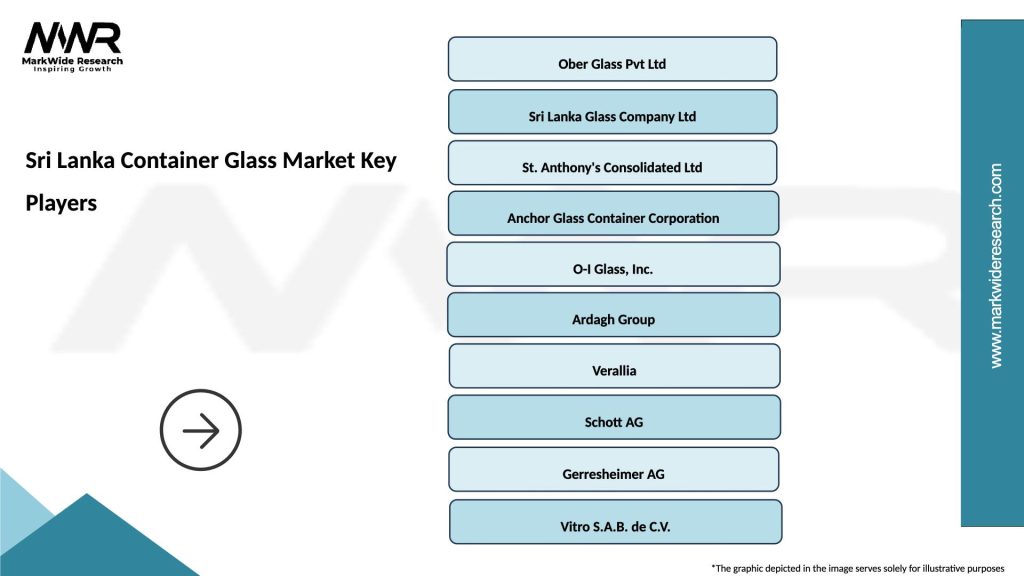

What are the key players in the Sri Lanka Container Glass Market?

Key players in the Sri Lanka Container Glass Market include Ceylon Glass Company, Piramal Glass, and St. Anthony’s Consolidated, among others. These companies are involved in the production and distribution of various glass containers for different industries.

What are the growth factors driving the Sri Lanka Container Glass Market?

The growth of the Sri Lanka Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and the growing trend of eco-friendly products. Additionally, the expansion of the food and pharmaceutical sectors contributes to market growth.

What challenges does the Sri Lanka Container Glass Market face?

The Sri Lanka Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials like plastics, and fluctuations in raw material prices. These factors can impact profitability and market stability.

What opportunities exist in the Sri Lanka Container Glass Market?

Opportunities in the Sri Lanka Container Glass Market include the increasing focus on recycling and sustainability, the potential for innovation in glass manufacturing technologies, and the expansion of export markets for glass products. These factors can enhance market growth and diversification.

What trends are shaping the Sri Lanka Container Glass Market?

Trends shaping the Sri Lanka Container Glass Market include a shift towards lightweight glass packaging, the adoption of smart packaging technologies, and an emphasis on reducing carbon footprints. These trends reflect consumer preferences for environmentally friendly and innovative packaging solutions.

Sri Lanka Container Glass Market

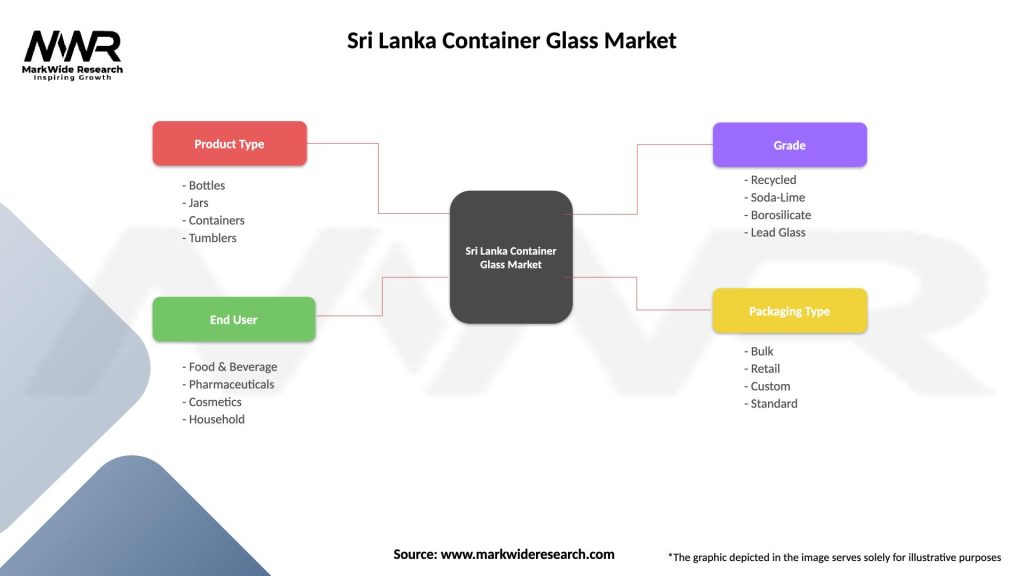

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Tumblers |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Grade | Recycled, Soda-Lime, Borosilicate, Lead Glass |

| Packaging Type | Bulk, Retail, Custom, Standard |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sri Lanka Container Glass Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at