444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The sprayed concrete market represents a specialized and technologically advanced segment within the global construction materials industry, characterized by innovative application techniques, expanding infrastructure development, and growing adoption across underground construction, slope stabilization, and structural repair applications. This sophisticated sector encompasses the production, distribution, and application of concrete materials delivered at high velocity through spray nozzles, including both dry-mix and wet-mix shotcrete processes utilized in tunneling, mining, underground construction, architectural applications, and rehabilitation projects requiring rapid application and excellent bond strength. Sprayed concrete offers distinct advantages over conventional cast-in-place methods including ability to conform to complex geometries, rapid application speeds, excellent adhesion to substrates, reduced formwork requirements, and suitability for overhead and vertical applications where traditional concrete placement proves challenging or impossible.

The market demonstrates robust growth momentum driven by accelerating infrastructure investments globally, expanding urban underground development creating space optimization needs, growing mining sector requiring ground support solutions, tunnel construction proliferation for transportation and utilities, and increasing awareness of sprayed concrete benefits for repair and rehabilitation applications. Application techniques span dry-mix processes where cement and aggregates are mixed with water at the nozzle providing flexibility and reduced equipment requirements, wet-mix methods offering superior quality control and reduced rebound, and robotic application systems enabling precise automated placement in hazardous or confined environments. Regional dynamics reveal concentrated demand in Asia-Pacific driven by massive infrastructure programs and mining operations, substantial European market with extensive tunnel networks and rehabilitation projects, and growing North American adoption supported by aging infrastructure renewal and mining sector activity.

According to MarkWide Research analysis, the sector is experiencing significant expansion with projected growth at a CAGR of 7.6% through the forecast period. Industry participants include specialized construction contractors with shotcrete expertise, equipment manufacturers producing spraying machinery and pumps, concrete admixture suppliers developing accelerators and performance enhancers, and integrated construction companies offering comprehensive underground and specialized concrete solutions serving diverse applications from metro tunnel construction through swimming pool installations and architectural features globally requiring rapid, versatile, and high-performance concrete placement capabilities.

The sprayed concrete market refers to the global industry encompassing production, application, and services related to concrete materials pneumatically projected at high velocity onto surfaces. This includes shotcrete for underground construction and tunneling, gunite for swimming pools and architectural applications, dry-mix sprayed concrete systems, wet-mix shotcrete processes, fiber-reinforced sprayed concrete, accelerated setting formulations, and specialized application services requiring trained technicians operating spray equipment delivering concrete for ground support, structural applications, protective coatings, and repair projects across mining, infrastructure, commercial, and residential construction sectors.

Market transformation in sprayed concrete reflects construction industry evolution toward specialized techniques enabling projects impossible through conventional methods while improving speed, safety, and performance outcomes. The sector has progressed from niche mining and tunnel applications to mainstream construction material utilized across diverse applications including structural support, architectural finishes, slope stabilization, and infrastructure rehabilitation. Key growth drivers include unprecedented infrastructure investment globally particularly in transportation and utilities, urban underground space development for metro systems and underground facilities, mining sector expansion requiring ground support and shaft lining, tunnel construction proliferation for highways and railways, and growing recognition of sprayed concrete advantages for repair and strengthening existing structures.

The market landscape features diverse stakeholders including specialized sprayed concrete contractors possessing equipment and expertise, ready-mix concrete suppliers adapting facilities for shotcrete production, equipment manufacturers producing spraying machines and robotic systems, admixture companies developing accelerators and performance enhancers, and engineering firms specifying sprayed concrete solutions for complex projects. Technical requirements demand skilled applicators understanding substrate preparation, mix design optimization, application techniques, quality control procedures, and safety protocols ensuring successful outcomes in demanding applications. Quality assurance through testing protocols, certification programs, and performance monitoring ensures sprayed concrete meets structural requirements with approximately 92-97% compaction density achievable through proper application technique compared to cast concrete’s typical 100% density.

Application complexity varies from relatively straightforward slope stabilization through highly technical tunnel crown applications in water-bearing ground requiring precise execution and immediate structural contribution. The construction ecosystem demonstrates increasing sophistication with robotic application systems reducing labor requirements and improving consistency, fiber reinforcement technologies enhancing ductility and crack control, accelerator innovations enabling faster setting without compromising final strength, and sustainability initiatives utilizing supplementary cementitious materials reducing environmental impacts while maintaining or improving performance characteristics across applications ranging from major infrastructure projects through residential pool construction serving global markets where rapid application, excellent adhesion, and complex geometry accommodation prove essential for project success and economic viability.

Critical market dynamics shaping the sprayed concrete landscape include:

Multiple catalysts propel growth in the sprayed concrete market. Infrastructure investment acceleration globally particularly in developing nations pursuing modernization and developed countries addressing aging systems drives tunnel construction, underground facilities, and rehabilitation projects. Urban underground development optimizing limited surface space through metro systems, utility tunnels, underground parking, and commercial facilities creates substantial sprayed concrete demand. Mining sector expansion with increasing commodity demand necessitates deeper extraction requiring extensive ground support and shaft lining applications. Transportation tunnel proliferation for highways, railways, and pedestrian passages improving connectivity while minimizing surface disruption utilizes sprayed concrete extensively. Hydroelectric development with dam construction, pressure tunnels, and water conveyance systems employs sprayed concrete for lining and structural applications. Slope stabilization requirements along highways, railways, and development areas preventing erosion and rockfall utilize sprayed concrete extensively.

Structural repair and rehabilitation of bridges, buildings, and infrastructure restoring capacity and extending service life increasingly specifies sprayed concrete for efficient application. Seismic retrofitting programs strengthening existing structures against earthquake damage employs sprayed concrete for structural enhancement. Swimming pool construction utilizing gunite application methods maintains steady residential and commercial demand. Architectural applications creating sculptural forms, feature walls, and unique finishes leverage sprayed concrete’s versatility. Underground storage facilities for petroleum products, natural gas, and strategic reserves require extensive lining applications. Water and wastewater infrastructure modernization including treatment facilities and conveyance systems utilizes sprayed concrete for rehabilitation and new construction. Robotic application technology improving safety, consistency, and productivity in hazardous environments expands feasible applications, with automation adoption increasing approximately 8-12% annually in major tunnel projects reducing labor requirements while improving quality consistency and worker safety in challenging underground environments worldwide.

Significant challenges constrain market growth despite favorable overall dynamics. Skilled labor shortage with specialized training requirements for nozzle operators limits contractor capacity and project execution capability globally. Equipment investment requirements including spraying machines, compressors, and ancillary equipment create capital barriers for companies entering market. Quality control complexity ensuring proper mix design, application technique, and curing produces specified strength creates technical barriers and potential liability concerns. Rebound waste generation particularly in dry-mix processes with material loss ranging from minimal to significant percentages depending on application conditions creates cost and environmental concerns. Dust generation issues especially in dry-mix applications create health concerns for workers and require ventilation and dust control measures in confined spaces. Accelerator cost and handling with some accelerator chemicals being expensive, potentially hazardous, and requiring careful handling increases material costs and safety requirements.

Weather and temperature sensitivity affects application with extreme conditions requiring special measures or preventing application entirely. Substrate preparation requirements demanding clean, sound, and properly prepared surfaces for adequate bond creates additional labor and potential complications. Competition from alternative methods including precast concrete, steel supports, and traditional cast-in-place approaches in applications where sprayed concrete advantages prove less compelling. Specification variations globally with different standards, testing requirements, and acceptance criteria across regions complicating international operations and product development. Safety concerns around high-pressure equipment operation, confined space work, and dust exposure require comprehensive programs and potentially limit workforce availability. Project cyclicality with lumpy demand patterns tied to large infrastructure projects creates revenue volatility for specialized contractors and suppliers.

Substantial opportunities exist for market participants across the value chain. Infrastructure modernization programs in developed nations replacing aging systems create sustained long-term demand for repair, rehabilitation, and reconstruction applications. Emerging market urbanization with massive metro system construction, underground development, and transportation infrastructure drives substantial sprayed concrete consumption. Mining sector expansion particularly in Africa, Latin America, and Asia creates ground support and shaft lining demand. Robotic application technology development enabling safer, more consistent, and productive application expands addressable applications while differentiating technology providers. Fiber reinforcement advancement through steel, synthetic, and hybrid fiber systems enhancing performance characteristics expands structural applications.

Sustainable formulation development utilizing supplementary cementitious materials, recycled content, and reduced-carbon cements addresses environmental concerns while maintaining performance. Accelerator innovation developing alkali-free and low-toxicity alternatives improves safety and environmental profiles while maintaining setting performance. Training and certification programs addressing skilled labor shortages create service opportunities while improving industry quality and safety standards. Prepackaged systems simplifying mix design and quality control enable broader contractor adoption beyond specialized firms. Underground space development for data centers, storage, and commercial uses creates new application categories. Disaster recovery and resilience projects strengthening infrastructure against natural hazards utilize sprayed concrete for efficient structural enhancement. 3D concrete printing integration potentially combining sprayed concrete principles with digital fabrication creates innovative construction approaches.

Complex interactions between infrastructure spending, technological advancement, and regulatory environments shape market evolution. Government infrastructure budgets directly impact market activity with public sector projects dominating tunnel construction, metro development, and major civil works utilizing sprayed concrete. Mining commodity prices influence mining sector capital expenditure affecting ground support and shaft lining demand as companies adjust development based on economic conditions. Urbanization rates particularly in developing nations drive underground construction as surface space limitations necessitate subterranean development. Technology transfer from developed to emerging markets accelerates as international contractors and equipment suppliers support projects introducing advanced techniques. Regulatory evolution around worker safety, environmental protection, and quality standards influences application practices and potentially creates barriers or catalysts for adoption.

Supply chain consolidation among ready-mix concrete suppliers and admixture manufacturers creates larger entities with resources for technical service and product development. Contractor specialization sees firms focusing on sprayed concrete developing expertise, equipment fleets, and project track records creating competitive advantages. Engineering practice advancement with improved design methods and modeling capabilities enables more sophisticated sprayed concrete applications. Research and development investment by material suppliers, equipment manufacturers, and construction companies advances capabilities and addresses limitations. International collaboration through industry associations and technical committees promotes best practice sharing and standards development. Economic cycles affect infrastructure spending and construction activity though essential transportation and utility projects provide some demand stability. Climate considerations including extreme weather events and sea level concerns potentially drive infrastructure adaptation and protection projects, with wet-mix methods capturing approximately 65-70% market share in developed markets due to quality advantages while dry-mix maintains presence in remote locations and smaller projects where equipment simplicity and flexibility prove advantageous despite higher material waste and quality control challenges.

Comprehensive research underpinning this analysis employed multiple methodologies ensuring accuracy and market insight. Primary research included structured interviews with sprayed concrete contractors, equipment manufacturers, ready-mix concrete suppliers, admixture companies, mining engineers, tunnel designers, and industry consultants providing firsthand perspectives on market trends, technical developments, and competitive dynamics. Project database analysis examined major infrastructure developments, mining operations, and tunnel construction identifying sprayed concrete utilization patterns and volume estimates. Secondary research synthesized information from construction industry publications, mining journals, tunneling association reports, and infrastructure investment data understanding market sizing and growth trajectories. Regional analysis investigated market characteristics across geographies considering infrastructure development stages, mining activity levels, construction practices, and regulatory environments. Application segment assessment evaluated sprayed concrete usage across tunneling, mining, slope stabilization, swimming pools, architectural applications, and repair work understanding volume distributions and growth patterns.

Technology evaluation examined dry-mix versus wet-mix adoption patterns, robotic application development, fiber reinforcement trends, and admixture innovations. Competitive landscape research analyzed major market participants including contractors, equipment manufacturers, and material suppliers assessing capabilities, market positioning, and strategic priorities. Value chain mapping traced material flows from cement and aggregate suppliers through ready-mix producers and specialized contractors to end-use applications understanding value creation and distribution. Standards and specifications review examined technical requirements, testing protocols, and certification programs across major markets. Expert validation involved consulting with tunneling engineers, sprayed concrete specialists, and construction materials experts verifying findings and incorporating nuanced insights reflecting practical application realities and technical considerations affecting market development and adoption patterns.

Asia-Pacific dominates the global market with approximately 46% market share, driven by massive infrastructure investment in China, India, and Southeast Asia combined with substantial mining operations and rapid urbanization creating underground development needs. China represents the largest single market with extensive metro construction across dozens of cities, highway tunnel development through mountainous terrain, hydroelectric projects, and mining operations consuming vast quantities of sprayed concrete. India demonstrates rapid growth with metro expansions in major cities, tunnel construction for transportation and hydropower, and mining sector development. Japan maintains sophisticated market with extensive tunnel maintenance and seismic retrofitting programs utilizing advanced sprayed concrete techniques. Australia shows strong demand driven by mining sector requiring ground support and shaft lining across numerous operations. Europe represents mature sophisticated market with approximately 28% global share, characterized by extensive tunnel networks, comprehensive metro systems, and substantial rehabilitation activity.

Switzerland, Austria, and Norway demonstrate world-leading tunnel expertise with challenging alpine projects utilizing advanced sprayed concrete applications. Germany and France maintain substantial markets with infrastructure maintenance and expansion programs. United Kingdom shows growing adoption particularly for infrastructure renewal and Crossrail-type mega projects. Scandinavia demonstrates extensive mining and hydropower applications alongside transportation infrastructure. North America exhibits growing market with increasing infrastructure investment addressing aging systems and expanding urban transportation. United States shows accelerating adoption particularly for highway tunnel projects, metro extensions, and mining applications in western states. Canada maintains strong mining sector demand alongside transportation infrastructure development. Latin America demonstrates emerging potential with Brazil, Chile, and Peru showing mining sector strength and growing infrastructure investment. Middle East exhibits selective demand through major infrastructure programs and underground development in Gulf countries. Africa shows growing potential particularly in mining applications across South Africa, West Africa, and emerging mining regions though limited civil infrastructure development constrains overall market size currently.

The competitive environment features diverse participants with varying specializations:

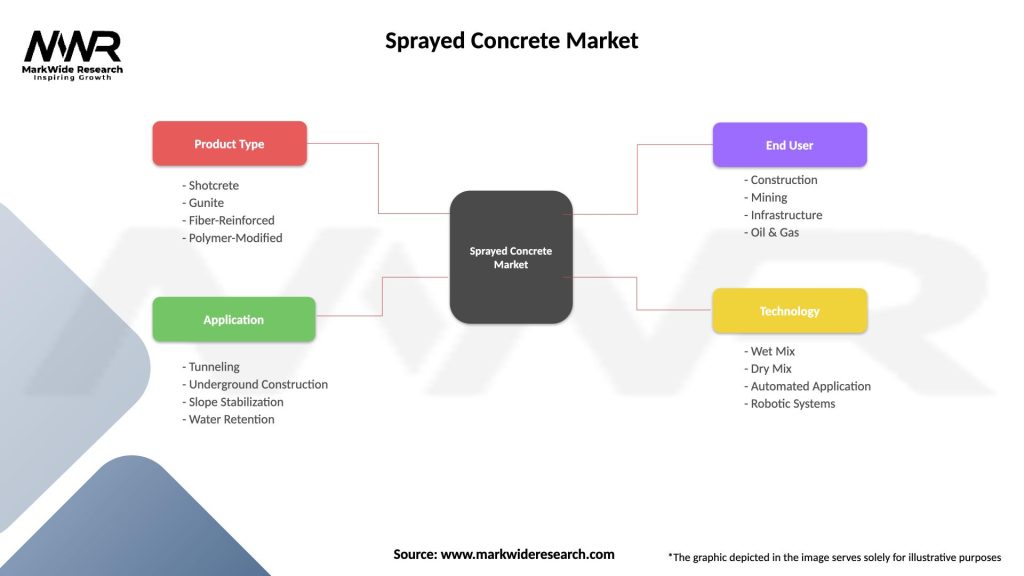

By Process Type: The market segments into wet-mix sprayed concrete where all ingredients including water are mixed before pumping providing superior quality control and reduced rebound, and dry-mix processes where dry materials are pneumatically conveyed with water added at nozzle offering equipment simplicity and flexibility. Wet-mix methods dominate large infrastructure projects while dry-mix serves remote locations and smaller applications requiring mobility.

By Application: Classification includes underground mining for ground support and shaft lining, tunneling and underground construction for transportation and utilities, water retaining structures including swimming pools and reservoirs, repair and rehabilitation of existing concrete structures, slope stabilization and soil retention, architectural and decorative applications, and protective coatings for industrial facilities. Underground construction represents the largest application segment accounting for majority of total volume.

By End-Use Industry: Segments encompass infrastructure and transportation including highways, railways, and metros; mining operations requiring ground support; water and wastewater treatment facilities; commercial construction including underground parking and facilities; residential applications primarily swimming pools; and industrial projects including power plants and manufacturing facilities. Infrastructure sector dominates demand driving market growth patterns.

By System Type: Categories include manual application by skilled nozzle operators, mechanized systems with robotic arms or automated placement, and specialized equipment for specific applications like swimming pool gunite machines. Manual application remains predominant though robotic systems demonstrate fastest growth particularly in large tunneling projects.

By Reinforcement: Segments include unreinforced sprayed concrete for non-structural applications, steel fiber reinforced providing ductility and crack control, synthetic fiber reinforced offering corrosion resistance and impact resistance, and mesh or rebar reinforced for highest structural capacity. Fiber reinforcement increasingly replaces traditional mesh in many applications improving application speed and performance.

Tunneling Applications represent the largest and most technically demanding sprayed concrete category serving transportation, utility, and mining tunnels. Initial support immediately after excavation provides temporary and often permanent ground stabilization. Final lining in some tunnel designs utilizes sprayed concrete rather than cast-in-place segments. Crown applications overhead work demands precise technique and immediate adhesion to prevent fallout. Water ingress management through drainage systems and shotcrete application seals formations and controls groundwater. Quality requirements include strength development, durability, adhesion, and uniformity verified through extensive testing programs. Safety considerations around confined spaces, dust control, and rebound material removal demand comprehensive protocols.

Mining Ground Support utilizes sprayed concrete extensively for roof and wall support in underground mines. Immediate application following excavation stabilizes rock mass preventing deterioration and failure. Mesh reinforcement traditionally used though increasingly replaced by steel fiber reinforcement improving application speed. Thickness requirements vary based on ground conditions from thin protective layers to substantial structural support. Accelerators enable rapid strength gain critical for maintaining production schedules in mining operations. Remote application through robotic systems improves safety by removing operators from active mining areas. Shaft lining applications in vertical openings utilize specialized techniques and equipment.

Slope Stabilization Projects prevent erosion and rockfall along highways, railways, and development areas. Soil nailing integration combines drilled anchors with sprayed concrete facing creating composite retention systems. Rock face protection seals fractured rock preventing weathering and stabilizing loose blocks. Drainage incorporation within or behind sprayed concrete prevents water pressure buildup. Aesthetic finishes through coloring, texturing, or sculpting create visually acceptable appearances in visible locations. Vegetation integration in some designs enables eventual greening of stabilized slopes. Application logistics often involve working from ropes, lifts, or specialized equipment accessing steep terrain.

Swimming Pool Construction primarily utilizes gunite application methods creating watertight durable shells. Shape flexibility enables custom designs impossible with preformed pool systems. Structural capacity withstands earth pressure and water loading with proper reinforcement and thickness. Surface finish provides substrate for tile, plaster, or aggregate finishes completing pool interior. Residential market dominates though commercial aquatic facilities represent substantial projects. Specialized contractors focus exclusively on pool gunite application developing expertise and regional presence. Equipment scale smaller than infrastructure applications with trailer-mounted units serving residential projects.

Structural Repair and Rehabilitation increasingly utilizes sprayed concrete for efficient restoration of damaged or deteriorated structures. Bridge repairs including pier caps, abutments, and deck soffits utilize overhead and vertical application capabilities. Building restoration replaces damaged concrete while conforming to existing geometries. Seismic retrofitting adds structural capacity to existing buildings and bridges. Surface preparation including removal of deteriorated material proves critical for repair success. Compatibility with existing concrete regarding strength, modulus, and shrinkage requires careful mix design. Application logistics often involve confined access, occupied structures, and coordination with other trades, with fiber-reinforced formulations capturing 55-60% of structural applications replacing traditional mesh reinforcement improving installation speed while providing enhanced crack control and impact resistance across tunneling, mining, and infrastructure rehabilitation projects globally.

Construction Contractors gain versatile technique enabling projects impossible through conventional methods while potentially improving speed and reducing formwork costs. Specialization opportunities in sprayed concrete create competitive differentiation and access to premium infrastructure and mining projects. Equipment investment creates barriers to competition while generating recurring maintenance and operator training revenues.

Infrastructure Owners benefit from rapid construction enabling faster project delivery and reduced traffic disruption particularly for tunnel and underground work. Design flexibility accommodates complex geometries and ground conditions challenging for alternative construction methods. Durability performance when properly applied provides long service life with minimal maintenance requirements.

Mining Operations utilize sprayed concrete for safe efficient ground support enabling ore extraction while protecting workers. Application speed minimizes production delays compared to alternative support methods. Performance reliability in demanding conditions provides confidence in safety and production continuity.

Equipment Manufacturers serve growing market with specialized machinery commanding premium pricing and generating recurring parts, service, and upgrade revenues throughout equipment lifecycles.

Material Suppliers including cement producers and admixture companies benefit from premium products and technical service relationships differentiating beyond commodity concrete supply.

End Users ultimately benefit from infrastructure improvements, safe mining operations, and effective structural repairs enabled by sprayed concrete technology and application expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Robotic Application Systems transform sprayed concrete from manual craft toward automated precision process. Remote-controlled manipulators enable application in hazardous environments removing operators from dangerous locations. Laser-guided systems ensure uniform thickness and profile accuracy improving quality consistency. Automated mixing and pumping integration optimizes material delivery and reduces variability. Programming capabilities enable complex surface following and repeatable application patterns. Safety improvements through worker removal from active spray areas reduce injury risks. Productivity gains through continuous operation and faster cycle times improve project economics. Quality enhancement via consistent technique eliminates human variability and skill dependencies.

Fiber Reinforcement Adoption increasingly replaces traditional mesh reinforcement improving application efficiency and performance. Steel fibers provide structural capacity and crack control while eliminating mesh handling and positioning. Synthetic fibers offer corrosion resistance and impact toughness for protective applications. Hybrid systems combining fiber types optimize multiple performance characteristics. Application speed improvement through elimination of mesh installation accelerates project completion. Rebound reduction with fibers incorporated in mix rather than captured in mesh improves material utilization. Durability enhancement through crack control and reduced permeability extends service life. Specification evolution increasingly permits or requires fiber reinforcement rather than traditional mesh.

Sustainable Material Development addresses environmental concerns while maintaining or improving performance. Supplementary cementitious materials including fly ash, slag, and silica fume reduce carbon footprint while enhancing durability properties. Recycled aggregates incorporation reduces virgin material consumption though requires quality control ensuring performance. Low-carbon cements utilizing alternative production methods or chemistries reduce greenhouse gas emissions. Alkali-free accelerators eliminate caustic compounds improving worker safety and reducing environmental impacts. Rebound recycling systems capture and reprocess waste material improving material efficiency. Lifecycle assessment quantifying environmental impacts informs material selection and process optimization. Carbon capture integration potentially incorporating CO2 into concrete provides sequestration pathway.

Quality Control Technology advances monitoring and verification of application quality. Laser scanning systems measure applied thickness in real-time ensuring specification compliance. Non-destructive testing including ground-penetrating radar and impact-echo methods evaluate internal quality without coring. Early strength testing through penetration resistance or pullout tests verify strength development. Digital documentation capturing application parameters, locations, and results enables comprehensive quality records. Machine learning applications potentially predict quality outcomes based on material properties and application parameters. Automated core extraction and testing improves testing efficiency and reduces disruption to production schedules.

Admixture Innovation enhances sprayed concrete performance across multiple characteristics. Set-accelerating admixtures enable rapid strength development critical for immediate ground support while maintaining final strength. Viscosity-modifying admixtures reduce rebound and improve pumpability optimizing fresh properties. Shrinkage-reducing admixtures minimize cracking and improve durability. Corrosion-inhibiting admixtures protect reinforcement in aggressive environments. Hydration-stabilizing admixtures extend working time in hot conditions or long transport distances. Performance optimization through admixture combinations balances multiple requirements including workability, setting time, ultimate strength, and durability achieving 28-day compressive strengths commonly exceeding 40-50 MPa in structural applications while maintaining application characteristics necessary for successful placement and achieving immediate ground support functions critical for safety and production continuity in tunneling and mining operations globally.

Recent years have witnessed numerous significant developments influencing market trajectories. Major infrastructure programs including China’s Belt and Road Initiative, European Union transportation networks, and various national metro expansions created substantial sustained demand for tunneling and underground construction applications. Robotic application technology commercialization by equipment manufacturers enabled automated consistent application in major tunnel projects improving safety and quality outcomes. Fiber reinforcement standardization through specifications and codes permitted broader adoption replacing traditional mesh reinforcement in many applications. Alkali-free accelerator development provided safer alternatives to traditional caustic accelerators addressing worker health and environmental concerns. Sustainability initiatives by cement producers and admixture suppliers introduced lower-carbon formulations and recycled content materials. Training and certification programs by industry associations established standards for operator qualifications improving quality and safety across projects. Mining sector consolidation created larger operators with standardized ground support specifications and centralized procurement influencing product requirements. Digital documentation systems integrating application monitoring with project management platforms improved quality control and traceability. Research collaborations between academia and industry advanced understanding of material performance and application optimization. Standards harmonization efforts across regions reduced specification inconsistencies facilitating international project execution and equipment deployment.

Strategic positioning for sprayed concrete market participants should emphasize technical expertise, quality leadership, and comprehensive solutions rather than competing purely on price in specialized applications demanding performance reliability. Technology investment in robotic application systems, quality monitoring equipment, and advanced mixing capabilities differentiates capabilities while improving efficiency and safety outcomes. Geographic expansion following major infrastructure programs and mining developments creates growth opportunities though requires understanding local practices, specifications, and competitive dynamics. Training program development addressing skilled labor shortages while establishing industry leadership and potentially creating revenue streams through contractor training services.

Product development priorities should balance advancing performance characteristics against addressing practical application challenges including rebound reduction, accelerator safety, and environmental impact. Sustainable formulation development utilizing supplementary cementitious materials and lower-carbon cements positions products favorably as environmental requirements intensify. Alkali-free accelerator adoption improves safety profiles and regulatory compliance while maintaining setting performance. Fiber reinforcement optimization through fiber type selection, dosage rates, and hybrid systems enhances structural performance while improving application efficiency. Prepackaged systems with optimized mix designs and quality control simplification enable broader contractor adoption beyond specialized firms with extensive technical resources.

Quality assurance investment through robust testing protocols, monitoring systems, and documentation practices builds customer confidence and reduces liability risks in structural applications. Certification programs for operators and supervisors demonstrate commitment to quality while potentially creating competitive advantages. Real-time monitoring technologies enabling immediate feedback and correction improve outcomes while documenting compliance. Third-party testing through independent laboratories validates performance and provides objective verification reducing disputes and building trust. Performance databases tracking long-term outcomes inform mix design improvements and application technique refinement.

Safety culture emphasis protecting workers from equipment hazards, confined space risks, and material exposure differentiates responsible companies while reducing incident costs and regulatory exposure. Dust control systems protecting respiratory health in underground and confined applications require equipment investment and procedural discipline. Equipment maintenance programs ensuring proper operation and preventing failures reduce safety incidents while optimizing reliability. Training emphasis on proper techniques, hazard recognition, and emergency procedures creates knowledgeable workforce. Safety performance increasingly influences client selection particularly for major infrastructure projects with stringent requirements.

Customer relationship development through technical service, application support, and performance partnerships creates value beyond material supply enabling premium positioning. Design collaboration with engineers and owners during project planning ensures optimal specifications and application approaches. Field technical support during critical applications provides troubleshooting expertise and builds confidence. Performance monitoring throughout construction and service life demonstrates commitment and gathers feedback informing continuous improvement. Educational programs for designers, specifiers, and contractors promote best practices while positioning companies as thought leaders and trusted advisors.

Sustainability leadership transparently communicating environmental initiatives and performance metrics differentiates brands while addressing growing customer and regulatory expectations. Carbon footprint reduction through material selection, manufacturing optimization, and logistics efficiency demonstrates commitment to climate objectives. Circular economy approaches including rebound recycling and lifecycle extension through durability maximization reduce waste. Transparency reporting documenting environmental impacts and improvement progress builds stakeholder trust. Industry collaboration on sustainability standards and practices advances collective progress while preventing competitive disadvantages from unilateral action.

Innovation partnerships between equipment manufacturers, material suppliers, and contractors accelerate technology development while sharing risks and rewards. Robotic system development requires collaboration optimizing materials for automated application while ensuring equipment reliability. Admixture compatibility with application equipment and processes demands joint testing and optimization. Monitoring system integration combining equipment sensors with material performance data enables comprehensive quality control. Research funding through university partnerships advances fundamental understanding while training future industry professionals. Pilot projects demonstrating innovations in real applications build confidence supporting broader adoption.

Long-term prospects for the sprayed concrete market remain fundamentally positive supported by global infrastructure investment, urbanization trends, and expanding mining activities creating sustained demand for specialized concrete applications. MarkWide Research projects continued robust growth with the sector achieving steady expansion as major economies pursue infrastructure modernization, emerging markets develop underground transportation systems, and mining operations extend deeper requiring extensive ground support applications. Infrastructure investment particularly in developing nations pursuing economic development and developed countries addressing aging systems drives tunnel construction and underground facility development creating core demand foundation.

Urbanization continuation globally concentrates populations in cities where surface space limitations necessitate underground development for transportation, utilities, parking, and commercial uses. Metro system expansion in dozens of cities worldwide creates sustained tunneling demand over decades as networks develop and expand. Highway and railway tunnels improving connectivity while minimizing surface disruption increasingly specified rather than cut-and-cover approaches. Utility tunnel construction creating protected corridors for multiple services improves reliability while facilitating maintenance and expansion. Underground storage for various purposes including logistics, data centers, and strategic reserves creates new application categories beyond traditional infrastructure focus.

Mining sector outlook remains fundamentally positive despite cyclicality as commodity demand grows and accessible deposits require deeper extraction utilizing extensive ground support. Technology advancement enabling deeper safer mining relies heavily on sprayed concrete ground support systems. Underground mining shift from surface operations due to environmental considerations and deposit characteristics increases ground support intensity. Automation integration in mining operations includes robotic ground support application improving safety while maintaining production continuity. Safety regulation strengthening globally potentially mandates more comprehensive ground support increasing sprayed concrete utilization per unit of extraction.

Technology evolution continues advancing application automation, quality control, and performance optimization expanding addressable applications while improving outcomes. Robotic application transitions from specialized large projects toward broader adoption as equipment costs decline and capabilities improve. Artificial intelligence integration potentially optimizes real-time application parameters based on substrate conditions and material properties. Digital twins enabling virtual project planning and operator training reduce risks and improve efficiency. Sensor integration monitoring applied concrete properties and substrate conditions enables adaptive application approaches. 3D printing convergence potentially combining sprayed concrete principles with digital fabrication creates novel construction possibilities.

Material innovation advances sustainability, durability, and performance characteristics addressing evolving requirements and constraints. Ultra-high-performance formulations achieving exceptional strength and durability serve demanding applications including long-span tunnels and deep mines. Self-healing concrete incorporating bacteria or encapsulated healing agents extends service life and reduces maintenance. Graphene and nanomaterial integration potentially enhances strength, durability, and functionality though cost and scalability challenges moderate near-term adoption. Bio-based materials including organic fibers and alternative binders address sustainability objectives though performance validation requirements slow commercialization. Waste material utilization incorporating industrial byproducts reduces virgin material consumption while potentially improving properties.

Regulatory environment evolution around worker safety, environmental protection, and quality standards influences practices while potentially creating compliance costs and barriers. Silica dust regulations requiring exposure controls drive wet-mix adoption and ventilation system investments. Accelerator restrictions on caustic compounds mandate alkali-free alternatives increasing material costs. Carbon reduction policies potentially favor low-carbon cement formulations and supplementary cementitious materials. Quality certification requirements for structural applications may intensify demanding more rigorous testing and documentation. Sustainability reporting obligations increasingly apply to construction materials and processes requiring transparency and improvement demonstration.

Competitive dynamics likely experience consolidation among contractors and suppliers creating larger entities with resources for equipment investment, technology development, and geographic expansion. Vertical integration sees some ready-mix concrete producers developing specialized shotcrete capabilities while contractors potentially backward integrate into material production. International expansion by major contractors and equipment manufacturers follows infrastructure investment across regions. Technology companies potentially enter market providing automation, monitoring, and optimization solutions disrupting traditional equipment and service models. Niche specialists maintain presence serving specific applications or geographic markets where scale advantages prove less decisive.

Regional growth patterns vary with Asia-Pacific maintaining fastest expansion driven by infrastructure investment and urbanization while developed markets focus on rehabilitation and system expansion. China continues substantial infrastructure development though potentially moderating from historic peaks. India and Southeast Asia demonstrate accelerating activity with major metro projects and transportation infrastructure programs. Africa and Latin America show growing potential as infrastructure investment increases and mining sectors develop. Middle East selective markets pursue ambitious underground development projects creating concentrated demand. Europe and North America emphasize infrastructure renewal, system expansion, and mining applications providing stable mature markets.

Market size expansion results from both volume growth as applications expand and value increase as technology advancement and quality requirements drive premium products and services adoption achieving projected compound annual growth sustaining mid-to-high single digits globally through forecast period as infrastructure investment momentum, urbanization imperatives, mining sector development, and technology capability advancement collectively support expanding sprayed concrete utilization across underground construction, ground support, rehabilitation, and specialized applications requiring rapid versatile concrete placement serving essential infrastructure and resource extraction activities fundamental to economic development and urbanization globally.

The sprayed concrete market represents a critical and specialized segment within construction materials industry, characterized by technical sophistication, essential infrastructure applications, and sustained growth driven by urbanization and resource extraction requirements globally. Technical versatility enabling concrete placement in challenging configurations including overhead applications, complex geometries, and confined spaces positions sprayed concrete as irreplaceable technology for tunneling, mining, and specialized construction applications. Despite facing challenges including skilled labor requirements, quality control complexity, and equipment investment barriers, the sector demonstrates resilience and innovation through automation advancement, material performance improvement, and expanding application sophistication addressing diverse needs from metro tunnel construction through swimming pool installations. Diverse stakeholders including specialized contractors, equipment manufacturers, admixture suppliers, and ready-mix concrete producers collectively advance capabilities while serving growing demand across infrastructure development, mining operations, and structural rehabilitation projects. Regional dynamics reveal Asia-Pacific market dominance driven by massive infrastructure programs and mining sector strength while developed markets emphasize rehabilitation and quality advancement serving mature applications.

Technology evolution through robotic application systems, fiber reinforcement adoption, sustainable material development, and quality monitoring advancement transforms sprayed concrete from manual craft toward automated precision process improving safety, consistency, and performance outcomes. Infrastructure investment globally particularly in underground transportation systems, utility tunnels, and connectivity improvements creates sustained long-term demand foundation for tunneling applications representing core market segment. Mining sector dependence on ground support for safe efficient extraction maintains steady demand though commodity price sensitivity creates cyclical volatility requiring market diversification. Urbanization imperatives driving underground space utilization as surface constraints intensify supports metro construction, underground facilities, and subterranean development creating expanding application categories beyond traditional tunnel focus. Quality assurance emphasis through testing protocols, certification programs, and performance monitoring ensures structural applications meet safety and durability requirements building confidence and supporting premium positioning for superior products and services. Sustainability considerations increasingly shape material selection and process optimization as construction industry addresses environmental impacts through lower-carbon formulations, waste reduction, and lifecycle extension initiatives. Automation advancement particularly through robotic application systems addresses skilled labor constraints while improving safety by removing operators from hazardous environments and enhancing consistency through precise repeatable technique eliminating human variability. Fiber reinforcement adoption increasingly replaces traditional mesh reinforcement improving application efficiency, reducing rebound waste, and enhancing crack control and durability performance across structural applications.

The sprayed concrete market exemplifies specialized construction technology enabling essential infrastructure and resource extraction projects impossible through conventional concrete placement methods while continuously evolving through material innovation, equipment advancement, and application technique refinement. As global infrastructure investment sustains momentum addressing transportation needs and system modernization, urbanization drives underground development optimizing limited surface space, mining operations expand serving commodity demand, and technology capabilities advance through automation and material science innovation, the sector appears positioned for continued growth serving fundamental construction and engineering challenges requiring rapid versatile high-performance concrete placement. Industry participants demonstrating technical excellence through skilled application and quality management, investing in automation and monitoring technologies improving safety and consistency, developing sustainable formulations reducing environmental impacts while maintaining performance, and building comprehensive service capabilities supporting customers throughout project lifecycles appear best positioned to capitalize on opportunities while contributing to infrastructure development, resource extraction, and structural preservation essential for economic progress and quality of life globally where sprayed concrete’s unique capabilities enable projects and applications fundamental to modern civilization’s built environment and resource needs.

What is Sprayed Concrete?

Sprayed concrete, also known as shotcrete, is a method of applying concrete that involves spraying a mixture of cement, aggregates, and water onto a surface. This technique is commonly used in construction for applications such as tunnel linings, slope stabilization, and swimming pool construction.

What are the key players in the Sprayed Concrete Market?

Key players in the Sprayed Concrete Market include companies like BASF SE, Sika AG, and CEMEX, which are known for their innovative solutions and extensive product offerings in the construction sector. These companies focus on enhancing the performance and durability of sprayed concrete applications, among others.

What are the main drivers of the Sprayed Concrete Market?

The main drivers of the Sprayed Concrete Market include the increasing demand for infrastructure development, the growing need for repair and rehabilitation of existing structures, and the advantages of sprayed concrete in terms of speed and efficiency in construction projects.

What challenges does the Sprayed Concrete Market face?

The Sprayed Concrete Market faces challenges such as the high initial costs of equipment and the need for skilled labor to ensure proper application. Additionally, environmental concerns regarding the materials used in concrete production can pose challenges for market growth.

What opportunities exist in the Sprayed Concrete Market?

Opportunities in the Sprayed Concrete Market include the increasing adoption of advanced technologies such as robotic spraying and the growing trend towards sustainable construction practices. These innovations can enhance the efficiency and environmental performance of sprayed concrete applications.

What trends are shaping the Sprayed Concrete Market?

Trends shaping the Sprayed Concrete Market include the rising use of fiber-reinforced concrete for improved strength and durability, as well as the integration of smart technologies for monitoring and quality control. These trends are driving advancements in construction techniques and material performance.

Sprayed Concrete Market

| Segmentation Details | Description |

|---|---|

| Product Type | Shotcrete, Gunite, Fiber-Reinforced, Polymer-Modified |

| Application | Tunneling, Underground Construction, Slope Stabilization, Water Retention |

| End User | Construction, Mining, Infrastructure, Oil & Gas |

| Technology | Wet Mix, Dry Mix, Automated Application, Robotic Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Sprayed Concrete Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at