444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The spices, dry seasoning mix, and herbal extract packaging market represents a dynamic and rapidly evolving sector within the global packaging industry. This specialized market encompasses the packaging solutions designed specifically for preserving, protecting, and presenting various spice products, seasoning blends, and herbal extracts to consumers worldwide. Market dynamics indicate substantial growth driven by increasing consumer demand for convenient, flavorful, and authentic culinary experiences.

Consumer preferences have shifted dramatically toward premium spice products, organic seasonings, and exotic herbal extracts, creating unprecedented opportunities for innovative packaging solutions. The market experiences robust expansion with a projected CAGR of 6.8% through the forecast period, reflecting the growing importance of effective packaging in maintaining product quality and extending shelf life.

Packaging innovations in this sector focus on moisture protection, aroma preservation, and convenience features that enhance user experience. Advanced barrier technologies, sustainable materials, and smart packaging solutions are transforming how spices and seasonings reach consumers, while maintaining their essential oils, flavors, and therapeutic properties.

Regional variations in spice consumption patterns and packaging preferences create diverse market opportunities across different geographical segments. The market demonstrates strong growth potential in emerging economies where traditional spice usage combines with modern packaging requirements, driving demand for sophisticated packaging solutions.

The spices, dry seasoning mix, and herbal extract packaging market refers to the comprehensive industry segment focused on developing, manufacturing, and supplying specialized packaging solutions for spice products, seasoning blends, and herbal extracts. This market encompasses various packaging formats including pouches, bottles, jars, sachets, and bulk containers designed to preserve product integrity while facilitating distribution and consumer use.

Packaging requirements for spices and seasonings differ significantly from other food products due to their unique characteristics including volatile oils, moisture sensitivity, and susceptibility to contamination. Effective packaging must provide barrier protection against light, oxygen, and humidity while maintaining the authentic flavors and aromas that define quality spice products.

Market scope includes primary packaging that directly contacts the product, secondary packaging for retail presentation, and tertiary packaging for distribution and logistics. The industry serves diverse end-users including spice manufacturers, food processors, retail chains, and specialty food companies requiring customized packaging solutions.

Market performance in the spices, dry seasoning mix, and herbal extract packaging sector demonstrates consistent growth momentum driven by evolving consumer lifestyles and increasing demand for convenient cooking solutions. The industry benefits from rising interest in international cuisines, health-conscious eating habits, and premium culinary experiences that require sophisticated packaging approaches.

Key growth drivers include the expansion of organized retail channels, increasing penetration of packaged spices in developing markets, and growing consumer awareness about product quality and safety. The market experiences particularly strong demand for sustainable packaging solutions, with approximately 42% of consumers expressing preference for environmentally friendly packaging options.

Technological advancements in packaging materials and manufacturing processes enable enhanced product protection, extended shelf life, and improved consumer convenience. Smart packaging technologies, including freshness indicators and tamper-evident features, are gaining traction among premium spice brands seeking differentiation in competitive markets.

Market challenges include raw material price volatility, regulatory compliance requirements across different regions, and the need for continuous innovation to meet evolving consumer expectations. Despite these challenges, the market maintains strong growth prospects supported by fundamental trends in food consumption and packaging technology development.

Consumer behavior analysis reveals significant shifts toward premium spice products and convenient packaging formats that support modern cooking lifestyles. The following insights highlight critical market developments:

Primary market drivers propelling growth in the spices, dry seasoning mix, and herbal extract packaging market stem from fundamental changes in consumer behavior, retail dynamics, and food industry requirements. These drivers create sustained demand for innovative packaging solutions across diverse market segments.

Rising disposable incomes in emerging markets enable consumers to purchase premium spice products requiring sophisticated packaging solutions. This economic factor drives demand for higher-quality packaging materials and advanced protection technologies that preserve product integrity and enhance consumer experience.

Urbanization trends significantly impact spice consumption patterns, with urban consumers preferring convenient, ready-to-use seasoning products packaged in user-friendly formats. The shift toward smaller household sizes and busy lifestyles creates opportunities for portion-controlled packaging and quick-preparation seasoning mixes.

Health consciousness among consumers drives demand for organic spices, herbal extracts, and natural seasoning products requiring specialized packaging that maintains therapeutic properties and prevents contamination. This trend supports premium packaging solutions with enhanced barrier properties and clean-label positioning.

E-commerce expansion necessitates robust packaging solutions capable of protecting products during shipping and handling while maintaining visual appeal for online presentation. The growth of online spice sales creates demand for packaging optimized for direct-to-consumer distribution channels.

Culinary diversity and increasing interest in international cuisines drive demand for authentic spice products requiring packaging that preserves traditional flavors while meeting modern safety and convenience standards.

Cost pressures represent significant challenges for packaging manufacturers and spice companies seeking to balance quality requirements with competitive pricing. Advanced packaging materials and technologies often carry premium costs that may limit adoption among price-sensitive market segments.

Regulatory compliance requirements vary significantly across different regions, creating complexity for companies operating in multiple markets. Food safety regulations, labeling requirements, and environmental standards necessitate substantial investments in compliance systems and documentation processes.

Raw material availability and price volatility affect packaging production costs and supply chain stability. Fluctuations in petroleum-based packaging materials and sustainable alternatives create planning challenges for manufacturers and end-users.

Technical limitations in packaging materials may restrict their suitability for certain spice products with specific protection requirements. Some herbal extracts and volatile spice compounds require specialized barrier properties that may not be available in cost-effective packaging formats.

Consumer education requirements for new packaging technologies and sustainable materials may slow adoption rates. Market acceptance of innovative packaging solutions often requires significant investment in consumer awareness and education programs.

Infrastructure constraints in developing markets may limit the adoption of advanced packaging technologies and distribution systems. Limited cold chain facilities and handling capabilities can restrict the effectiveness of sophisticated packaging solutions.

Sustainable packaging innovation presents substantial opportunities for companies developing environmentally friendly solutions that meet performance requirements while addressing consumer environmental concerns. The growing demand for eco-friendly packaging creates market space for biodegradable materials, recyclable designs, and reduced packaging waste solutions.

Smart packaging technologies offer significant potential for differentiation and value addition in premium spice markets. Opportunities exist for developing packaging with freshness indicators, temperature monitoring, and interactive features that enhance consumer engagement and product quality assurance.

Emerging market expansion provides growth opportunities as developing economies experience rising incomes and changing food consumption patterns. These markets offer potential for introducing modern packaging solutions while adapting to local preferences and distribution requirements.

Customization capabilities enable packaging suppliers to serve niche markets and specialty spice products requiring unique protection and presentation solutions. Custom packaging designs support brand differentiation and premium positioning strategies.

Functional packaging development creates opportunities for solutions that provide additional benefits beyond basic protection, including portion control, mixing capabilities, and storage optimization features that enhance user convenience.

Partnership opportunities with spice manufacturers, retail chains, and food service companies enable packaging suppliers to develop integrated solutions that address specific market needs and create competitive advantages through collaboration.

Supply chain dynamics in the spices, dry seasoning mix, and herbal extract packaging market reflect complex interactions between raw material suppliers, packaging manufacturers, spice producers, and retail channels. These relationships significantly influence market development and competitive positioning across different segments.

Demand fluctuations occur seasonally and regionally based on cultural preferences, cooking patterns, and festival seasons that drive spice consumption. Packaging suppliers must adapt production schedules and inventory management to accommodate these cyclical variations while maintaining service levels.

Technology adoption rates vary significantly across different market segments, with premium brands leading innovation adoption while mass-market products focus on cost optimization. This dynamic creates opportunities for differentiated packaging solutions serving diverse market requirements.

Competitive pressures drive continuous innovation in packaging design, materials, and manufacturing processes. Companies invest in research and development to create packaging solutions that provide superior protection, convenience, and sustainability while maintaining cost competitiveness.

Regulatory evolution influences market dynamics as governments implement new food safety standards, environmental regulations, and labeling requirements. These changes create both challenges and opportunities for packaging innovation and market development.

Consumer expectations continue evolving toward higher quality, greater convenience, and enhanced sustainability, driving market participants to develop solutions that balance multiple performance criteria while meeting cost targets.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the spices, dry seasoning mix, and herbal extract packaging market. The research approach combines quantitative data collection with qualitative analysis to provide complete market understanding.

Primary research involves direct engagement with industry stakeholders including packaging manufacturers, spice producers, retail chains, and consumers through structured interviews, surveys, and focus groups. This approach provides firsthand insights into market trends, challenges, and opportunities from multiple perspectives.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory documents, and trade publications to gather comprehensive market data and validate primary research findings. This methodology ensures thorough coverage of market dynamics and competitive landscape.

Market segmentation analysis examines different product categories, packaging formats, end-user segments, and geographical regions to identify growth opportunities and market trends. This detailed segmentation provides actionable insights for strategic decision-making.

Competitive intelligence gathering involves monitoring competitor activities, product launches, pricing strategies, and market positioning to understand competitive dynamics and identify differentiation opportunities.

Data validation processes ensure research accuracy through cross-verification of information sources, statistical analysis, and expert review to maintain research quality and reliability standards.

North American markets demonstrate strong demand for premium spice packaging solutions driven by diverse culinary preferences and high consumer spending on specialty food products. The region shows market share of approximately 28% with particular strength in organic and gourmet spice segments requiring sophisticated packaging approaches.

European markets emphasize sustainability and quality in spice packaging, with stringent regulatory requirements driving innovation in eco-friendly materials and advanced barrier technologies. The region leads in sustainable packaging adoption with penetration rates of 55% for recyclable packaging solutions.

Asia-Pacific regions represent the fastest-growing market segment, driven by large populations, traditional spice consumption, and increasing adoption of packaged spice products. The region experiences growth rates exceeding 8.5% annually as modern retail channels expand and consumer preferences evolve.

Latin American markets show increasing demand for convenient spice packaging formats as urbanization and changing lifestyles drive adoption of ready-to-use seasoning products. The region demonstrates strong potential for growth in both traditional and innovative packaging solutions.

Middle Eastern and African markets present opportunities for packaging solutions that accommodate traditional spice products while meeting modern retail requirements. These regions show growing interest in premium packaging that preserves authentic flavors and extends product shelf life.

Regional preferences vary significantly in packaging formats, materials, and design elements, requiring customized approaches that respect local cultures while meeting functional requirements for product protection and consumer convenience.

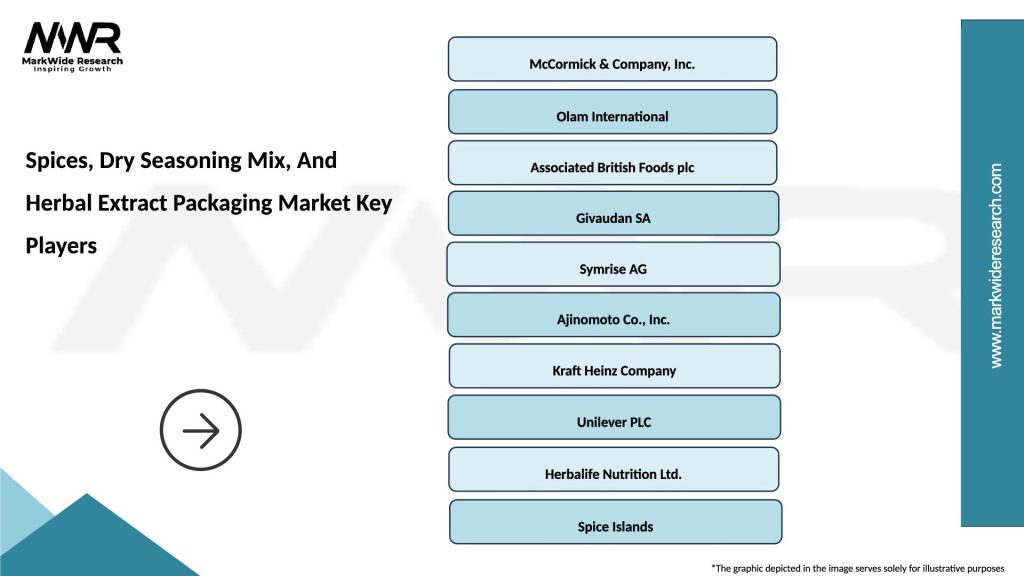

Market leadership in the spices, dry seasoning mix, and herbal extract packaging sector is distributed among several key players offering diverse packaging solutions across different market segments. The competitive environment encourages continuous innovation and strategic positioning.

Competitive strategies focus on technological innovation, sustainability leadership, and customer partnership development to create differentiated value propositions in increasingly competitive markets.

Product-based segmentation divides the market into distinct categories based on the types of products being packaged and their specific requirements for protection, presentation, and consumer convenience.

By Product Type:

By Packaging Format:

By Material Type:

Flexible packaging category dominates the market with significant growth driven by cost advantages, barrier performance, and design flexibility. This segment benefits from continuous innovation in materials and manufacturing processes that enhance product protection while reducing environmental impact.

Sustainable packaging solutions experience accelerating adoption as consumer environmental awareness influences purchasing decisions. MarkWide Research indicates that sustainable packaging options show adoption growth of 45% among premium spice brands seeking to align with consumer values.

Smart packaging technologies emerge as differentiating factors for premium products, with features including freshness indicators, tamper evidence, and interactive elements that enhance consumer engagement and brand loyalty.

Convenience packaging formats gain market share as busy lifestyles drive demand for easy-to-use, portion-controlled, and resealable packaging solutions that support modern cooking habits and storage requirements.

Premium packaging designs support brand differentiation and justify higher pricing for specialty spice products, with emphasis on visual appeal, tactile experience, and perceived quality that influences consumer purchasing decisions.

Bulk packaging solutions serve growing food service and industrial markets requiring cost-effective protection and handling efficiency while maintaining product quality throughout extended supply chains.

Spice manufacturers benefit from advanced packaging solutions that extend product shelf life, maintain quality, and support brand differentiation in competitive markets. Effective packaging reduces product waste, enables broader distribution, and enhances consumer satisfaction through improved convenience and freshness preservation.

Packaging suppliers gain opportunities for value-added solutions that command premium pricing while building long-term customer relationships through innovation and technical support. The growing market provides expansion opportunities across diverse geographical regions and product segments.

Retailers benefit from packaging solutions that optimize shelf space utilization, reduce handling costs, and enhance product presentation to drive consumer purchases. Effective packaging supports inventory management and reduces product losses due to quality deterioration.

Consumers enjoy improved product quality, extended freshness, and enhanced convenience through innovative packaging solutions that support modern lifestyles while providing value for money and environmental responsibility.

Food service operators benefit from bulk packaging solutions that reduce costs, improve handling efficiency, and maintain consistent product quality throughout preparation and service processes.

Environmental stakeholders benefit from sustainable packaging innovations that reduce waste, support recycling programs, and minimize environmental impact while maintaining product protection and quality standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the spices, dry seasoning mix, and herbal extract packaging market. Companies increasingly adopt recyclable materials, biodegradable options, and reduced packaging designs to meet environmental expectations and regulatory requirements.

Smart packaging adoption accelerates as brands seek differentiation through technology integration. Features including QR codes, freshness indicators, and interactive elements enhance consumer engagement while providing valuable product information and usage guidance.

Premiumization trends drive demand for high-quality packaging that supports brand positioning and justifies premium pricing. Luxury packaging designs, premium materials, and sophisticated printing techniques become important competitive factors in specialty spice markets.

Convenience enhancement continues driving packaging innovation with focus on resealable closures, portion control features, and easy-open designs that support modern cooking habits and storage requirements.

Customization capabilities enable packaging suppliers to serve niche markets and specialty products with tailored solutions that address specific protection requirements and brand positioning needs.

Digital integration transforms packaging into communication platforms through augmented reality features, recipe suggestions, and brand storytelling elements that create enhanced consumer experiences beyond basic product protection.

Material innovations continue advancing with development of new barrier technologies, sustainable materials, and multi-functional packaging solutions that address evolving market requirements. Recent breakthroughs in biodegradable polymers and paper-based barriers create new opportunities for environmentally responsible packaging.

Manufacturing technology improvements enable more efficient production processes, reduced waste, and enhanced quality control in packaging manufacturing. Advanced printing technologies support high-quality graphics and variable data printing for customized packaging solutions.

Partnership developments between packaging suppliers and spice manufacturers create integrated solutions that optimize product protection, supply chain efficiency, and consumer experience. These collaborations drive innovation and market expansion opportunities.

Regulatory approvals for new packaging materials and technologies enable market introduction of innovative solutions that meet safety requirements while providing enhanced performance characteristics.

Sustainability certifications become increasingly important for market acceptance, with various certification programs supporting environmental claims and consumer confidence in sustainable packaging choices.

Digital transformation initiatives integrate packaging with digital marketing strategies, supply chain optimization, and consumer engagement programs that create additional value beyond traditional packaging functions.

Investment priorities should focus on sustainable packaging innovation and smart technology integration to address evolving consumer expectations and regulatory requirements. Companies investing in these areas position themselves for long-term competitive advantage and market leadership.

Market expansion strategies should prioritize emerging economies where packaged spice adoption rates continue growing. MWR analysis suggests that targeted expansion in Asia-Pacific and Latin American markets offers the highest growth potential with projected expansion rates of 9.2% in key segments.

Partnership development with spice manufacturers and retail chains creates opportunities for integrated solutions that address specific market needs while building long-term customer relationships and competitive barriers.

Technology adoption should balance innovation with cost considerations, focusing on solutions that provide clear value propositions for both manufacturers and consumers while maintaining competitive pricing structures.

Sustainability leadership becomes increasingly important for market positioning and regulatory compliance. Companies should invest in developing comprehensive sustainable packaging portfolios that address environmental concerns without compromising performance.

Supply chain optimization requires attention to raw material sourcing, manufacturing efficiency, and distribution network development to maintain competitiveness in cost-sensitive market segments while supporting growth in premium categories.

Market growth prospects remain strong driven by fundamental trends in food consumption, packaging technology advancement, and consumer preference evolution. The industry expects continued expansion with projected growth rates of 7.2% CAGR through the next five years, supported by innovation and market development initiatives.

Technology evolution will continue transforming packaging capabilities with advances in barrier materials, smart packaging features, and sustainable solutions that address environmental concerns while maintaining superior product protection and consumer convenience.

Sustainability requirements will intensify as environmental regulations strengthen and consumer awareness increases. Companies developing comprehensive sustainable packaging solutions will gain competitive advantages and market leadership positions.

Market consolidation may occur as larger companies acquire specialized packaging suppliers to expand capabilities and market reach. This trend could create opportunities for innovation-focused companies while intensifying competition in commodity packaging segments.

Global expansion opportunities will continue developing as emerging markets adopt packaged spice products and modern retail channels expand. Companies with international capabilities and local market understanding will benefit from these growth opportunities.

Consumer expectations will continue evolving toward higher quality, greater convenience, and enhanced sustainability, driving continuous innovation requirements and market differentiation opportunities for forward-thinking companies.

The spices, dry seasoning mix, and herbal extract packaging market demonstrates robust growth potential driven by evolving consumer preferences, technological innovation, and expanding global food markets. The industry benefits from fundamental trends including urbanization, culinary diversity, and increasing demand for convenient, high-quality food products that require sophisticated packaging solutions.

Sustainability leadership emerges as a critical success factor as environmental consciousness influences consumer purchasing decisions and regulatory requirements intensify. Companies investing in sustainable packaging innovation position themselves for long-term competitive advantage while addressing important environmental challenges.

Technology integration creates differentiation opportunities through smart packaging features, enhanced barrier properties, and improved consumer convenience that support premium positioning and brand loyalty development. The convergence of packaging and digital technologies opens new possibilities for consumer engagement and value creation.

Market opportunities remain substantial across diverse geographical regions and product segments, with particular strength in emerging markets where packaged spice adoption continues expanding. Success requires balanced approaches that address local preferences while leveraging global capabilities and innovation resources.

Future success in the spices, dry seasoning mix, and herbal extract packaging market will depend on companies’ abilities to balance innovation, sustainability, and cost competitiveness while building strong partnerships with spice manufacturers and retail channels. The market outlook remains positive for companies that can navigate these complex requirements while delivering superior value to all stakeholders.

What is Spices, Dry Seasoning Mix, And Herbal Extract Packaging?

Spices, Dry Seasoning Mix, And Herbal Extract Packaging refers to the various methods and materials used to package spices, seasoning blends, and herbal extracts. This packaging is essential for preserving flavor, aroma, and shelf life while ensuring convenience for consumers.

What are the key players in the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market?

Key players in the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market include McCormick & Company, Olam International, and Kerry Group, among others. These companies are known for their innovative packaging solutions and extensive product ranges.

What are the growth factors driving the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market?

The growth of the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market is driven by increasing consumer demand for convenience foods, the rise of home cooking trends, and the growing popularity of ethnic cuisines. Additionally, the focus on sustainable packaging solutions is also contributing to market expansion.

What challenges does the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market face?

The Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market faces challenges such as fluctuating raw material prices, stringent regulations regarding food safety, and competition from alternative flavoring options. These factors can impact profitability and market dynamics.

What opportunities exist in the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market?

Opportunities in the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market include the development of eco-friendly packaging materials, the expansion of online retail channels, and the introduction of innovative product formats. These trends can enhance consumer engagement and market reach.

What trends are shaping the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market?

Trends shaping the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market include the increasing demand for organic and natural products, the use of smart packaging technologies, and the rise of personalized seasoning blends. These trends reflect changing consumer preferences and technological advancements.

Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Spices, Ground Spices, Seasoning Blends, Herbal Extracts |

| Packaging Type | Glass Jars, Plastic Containers, Pouches, Tins |

| End User | Food Manufacturers, Restaurants, Retailers, Home Cooks |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spices, Dry Seasoning Mix, And Herbal Extract Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at