444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain warehousing market represents a dynamic and rapidly evolving sector that serves as a critical backbone for the country’s logistics and supply chain infrastructure. Spain’s strategic position as a gateway between Europe, Africa, and the Americas has positioned its warehousing industry as a vital component of international trade flows. The market encompasses traditional storage facilities, modern distribution centers, automated warehouses, and specialized cold storage solutions across major industrial hubs including Madrid, Barcelona, Valencia, and Seville.

Market growth in Spain’s warehousing sector has been particularly robust, driven by the expansion of e-commerce activities, increased international trade, and the modernization of supply chain operations. The sector is experiencing a compound annual growth rate (CAGR) of 6.2%, reflecting strong demand from retail, manufacturing, and logistics companies seeking efficient storage and distribution solutions. Industrial real estate development has accelerated significantly, with new warehouse construction focusing on sustainability, automation, and strategic location advantages.

Technology integration has become a defining characteristic of Spain’s modern warehousing landscape, with facilities increasingly adopting warehouse management systems, robotics, and IoT solutions. The market benefits from 65% of facilities now incorporating some form of digital technology to enhance operational efficiency and inventory management capabilities.

The Spain warehousing market refers to the comprehensive ecosystem of storage, distribution, and logistics facilities that provide essential infrastructure for goods movement, inventory management, and supply chain operations throughout the Spanish territory. This market encompasses various facility types including general merchandise warehouses, specialized storage centers, distribution hubs, fulfillment centers, and temperature-controlled facilities that serve diverse industries from automotive and textiles to food and beverage sectors.

Warehousing operations in Spain involve the systematic storage, handling, and distribution of goods through strategically located facilities that optimize supply chain efficiency and reduce transportation costs. The market includes both traditional storage solutions and advanced automated systems that leverage cutting-edge technology to enhance productivity and accuracy in inventory management processes.

Spain’s warehousing market has emerged as one of Europe’s most attractive logistics destinations, benefiting from strategic geographic positioning, robust infrastructure development, and increasing demand from e-commerce and international trade activities. The sector demonstrates remarkable resilience and growth potential, with significant investments in modernization and expansion projects across key industrial corridors.

Key market drivers include the rapid growth of online retail, which accounts for 12% of total retail sales, necessitating sophisticated fulfillment and distribution capabilities. The market has witnessed substantial foreign investment, particularly from international logistics providers and e-commerce giants seeking to establish strategic footholds in the Iberian Peninsula and broader European markets.

Technological advancement represents a crucial differentiator, with modern facilities incorporating automated storage and retrieval systems, advanced inventory management software, and sustainable energy solutions. The integration of artificial intelligence and machine learning technologies is enhancing operational efficiency and predictive analytics capabilities across the warehousing value chain.

Strategic location advantages position Spain as a premier warehousing destination within the European logistics network. The following insights highlight critical market characteristics:

E-commerce expansion serves as the primary catalyst driving Spain’s warehousing market growth, with online retail penetration increasing rapidly and requiring sophisticated fulfillment infrastructure. The surge in digital commerce has created unprecedented demand for strategically located distribution centers capable of supporting same-day and next-day delivery services across urban and rural markets.

International trade growth continues to fuel warehousing demand as Spain strengthens its position as a European gateway for goods flowing between continents. The country’s membership in the European Union, combined with its strategic Mediterranean and Atlantic coastlines, creates significant opportunities for import-export warehousing operations and transshipment activities.

Supply chain modernization initiatives across various industries are driving demand for technologically advanced warehousing solutions. Companies are increasingly seeking facilities equipped with automated systems, real-time inventory tracking, and integrated logistics management capabilities to enhance operational efficiency and reduce costs.

Urban population growth and changing consumer preferences toward faster delivery times are creating demand for urban warehousing solutions and micro-fulfillment centers. The trend toward omnichannel retail strategies requires flexible warehousing infrastructure that can support both traditional distribution and direct-to-consumer fulfillment operations.

Land availability constraints in prime logistics locations present significant challenges for warehousing market expansion, particularly around major metropolitan areas where demand is highest. Limited developable land near transportation hubs and urban centers has led to increased competition and rising real estate costs that can impact project feasibility.

Regulatory complexities related to zoning, environmental compliance, and construction permits can create delays and additional costs for warehouse development projects. The bureaucratic processes associated with large-scale industrial real estate development may deter some investors and slow market expansion in certain regions.

Labor market challenges including skills shortages in logistics and warehouse operations can constrain market growth and operational efficiency. The increasing complexity of modern warehousing operations requires specialized technical skills that may be in limited supply, particularly for automated and technology-intensive facilities.

Economic uncertainties and potential fluctuations in international trade patterns can impact demand for warehousing services, particularly for facilities heavily dependent on import-export activities. Global economic conditions and trade policy changes may influence investment decisions and market expansion plans.

Automation integration presents substantial opportunities for warehousing operators to enhance efficiency, reduce operational costs, and improve service quality through advanced robotics and artificial intelligence systems. The implementation of automated storage and retrieval systems, autonomous mobile robots, and predictive analytics can significantly transform warehouse operations and create competitive advantages.

Sustainability initiatives offer opportunities for market differentiation through green building certifications, renewable energy integration, and environmentally responsible operations. Companies focusing on sustainable warehousing solutions can attract environmentally conscious tenants and potentially benefit from government incentives and regulatory preferences.

Cold chain expansion represents a growing opportunity driven by increasing demand for fresh food, pharmaceuticals, and temperature-sensitive products. The development of specialized refrigerated and frozen storage facilities can serve expanding markets in food retail, healthcare, and biotechnology sectors.

Cross-border e-commerce growth creates opportunities for specialized international fulfillment centers that can handle customs clearance, multi-currency transactions, and diverse regulatory requirements. Spain’s strategic position makes it ideal for serving European e-commerce markets from a single distribution point.

Supply and demand dynamics in Spain’s warehousing market reflect a complex interplay between growing logistics requirements and constrained development capacity in prime locations. MarkWide Research analysis indicates that demand growth consistently outpaces new supply additions, creating a favorable environment for existing facility owners and developers with pipeline projects.

Rental rate trends demonstrate steady appreciation across major markets, with prime logistics locations commanding premium pricing due to limited availability and strong tenant demand. The market has experienced rental growth of 4.8% annually in key corridors, reflecting the fundamental supply-demand imbalance and quality of available facilities.

Investment activity remains robust with both domestic and international capital targeting Spanish warehousing assets. The market benefits from stable returns, long-term lease structures, and growth potential that attracts institutional investors, real estate investment trusts, and logistics companies seeking strategic expansion opportunities.

Tenant requirements are evolving toward larger, more technologically sophisticated facilities with enhanced sustainability features and flexible lease terms. Modern occupiers prioritize locations with excellent transportation connectivity, automation capabilities, and scalability to accommodate future growth requirements.

Primary research methodologies employed in analyzing Spain’s warehousing market include comprehensive surveys of industry participants, structured interviews with key stakeholders, and direct engagement with warehouse operators, developers, and logistics service providers. This approach ensures access to current market intelligence and forward-looking insights from industry professionals.

Secondary research incorporates analysis of government statistics, industry reports, real estate transaction data, and economic indicators that influence warehousing market performance. The methodology includes examination of construction permits, zoning approvals, and development pipeline information to assess future supply additions.

Market validation processes involve cross-referencing multiple data sources, conducting expert interviews, and analyzing historical trends to ensure accuracy and reliability of market assessments. The research framework incorporates both quantitative metrics and qualitative insights to provide comprehensive market understanding.

Data collection spans multiple time periods to identify trends, seasonal variations, and cyclical patterns that influence market dynamics. The methodology ensures representative sampling across different geographic regions, facility types, and market segments within Spain’s diverse warehousing landscape.

Madrid region dominates Spain’s warehousing market, accounting for approximately 35% of total warehouse space and serving as the primary distribution hub for central Spain and national logistics networks. The area benefits from excellent transportation infrastructure, proximity to the capital’s consumer base, and strategic location for nationwide distribution operations.

Catalonia region, centered around Barcelona, represents the second-largest warehousing market with 28% market share, driven by its industrial heritage, port connectivity, and proximity to European markets. The region serves as a crucial gateway for Mediterranean trade and benefits from strong manufacturing and logistics clusters.

Valencia region has emerged as a significant warehousing destination, capturing 18% of market activity due to its strategic coastal location, modern port facilities, and growing importance in agricultural and automotive logistics. The area offers competitive real estate costs and excellent connectivity to both domestic and international markets.

Andalusia region, particularly around Seville, accounts for 12% of warehousing activity and serves as an important distribution point for southern Spain and North African trade routes. The region benefits from lower operational costs and strategic positioning for cross-border logistics operations.

International logistics providers maintain strong positions in Spain’s warehousing market through strategic facility networks and comprehensive service offerings. The competitive environment includes both global operators and specialized regional players competing across different market segments and geographic areas.

Market consolidation trends indicate increasing concentration among major players while creating opportunities for specialized operators focusing on niche segments such as cold storage, urban logistics, or automated facilities.

By Facility Type:

By End-User Industry:

E-commerce warehousing represents the fastest-growing segment, driven by online retail expansion and evolving consumer delivery expectations. These facilities require sophisticated sortation systems, flexible storage configurations, and proximity to urban markets to support rapid order fulfillment and last-mile delivery operations.

Cold storage facilities demonstrate strong growth potential due to increasing demand for fresh food products, pharmaceutical storage, and temperature-sensitive goods. The segment benefits from specialized operational requirements that create barriers to entry and support premium pricing structures.

Automated warehousing solutions are gaining traction among large-scale operators seeking to improve efficiency, reduce labor costs, and enhance accuracy in inventory management. The category requires significant capital investment but offers long-term operational advantages and competitive differentiation.

Urban logistics facilities are emerging as a critical category to support last-mile delivery requirements and omnichannel retail strategies. These smaller, strategically located facilities command premium rents due to land scarcity and proximity to dense consumer populations.

Warehouse operators benefit from stable cash flows, long-term lease agreements, and growing demand across multiple industry sectors. The market offers opportunities for operational efficiency improvements through technology adoption and sustainable practices that can enhance profitability and tenant satisfaction.

Real estate investors gain access to a resilient asset class with steady income generation, capital appreciation potential, and portfolio diversification benefits. Spanish warehousing assets provide exposure to European logistics growth while offering attractive risk-adjusted returns compared to other real estate sectors.

Logistics service providers can leverage modern warehouse facilities to enhance service quality, expand geographic coverage, and improve operational efficiency. Strategic facility locations enable better customer service and cost optimization across supply chain operations.

E-commerce companies benefit from access to sophisticated fulfillment infrastructure that supports rapid growth, seasonal flexibility, and customer satisfaction through faster delivery times. Modern warehousing solutions enable scalable operations and competitive advantage in digital commerce markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation adoption is accelerating across Spanish warehousing facilities, with operators implementing robotic systems, automated storage solutions, and artificial intelligence to enhance productivity and reduce operational costs. This trend is particularly pronounced in large-scale distribution centers serving e-commerce and retail sectors.

Sustainability focus has become a defining characteristic of modern warehouse development, with new facilities incorporating renewable energy systems, energy-efficient designs, and green building certifications. Environmental considerations are increasingly influencing tenant selection criteria and investment decisions.

Urban logistics expansion reflects the growing need for last-mile delivery capabilities and omnichannel retail support. Developers are creating smaller, strategically located facilities in urban areas to serve dense population centers and support rapid delivery requirements.

Flexible space solutions are gaining popularity as tenants seek adaptable facilities that can accommodate changing business requirements and seasonal fluctuations. Modern warehouses incorporate modular designs and flexible lease structures to meet evolving market demands.

Major infrastructure investments are transforming Spain’s logistics landscape, including port expansions, railway improvements, and highway upgrades that enhance warehouse connectivity and operational efficiency. These developments strengthen Spain’s position as a European logistics gateway and support continued market growth.

Technology partnerships between warehouse operators and technology providers are accelerating the implementation of advanced systems including warehouse management software, IoT sensors, and predictive analytics. These collaborations are creating more efficient and responsive logistics operations.

International expansion by global logistics companies continues to drive market development, with major operators establishing Spanish operations to serve European markets. This trend brings capital investment, operational expertise, and international best practices to the local market.

Regulatory initiatives supporting logistics sector development include streamlined permitting processes, tax incentives for sustainable facilities, and infrastructure investment programs. Government support is facilitating market expansion and attracting international investment.

Strategic location selection remains critical for successful warehousing investments, with analysts recommending focus on transportation corridors, proximity to major population centers, and access to multimodal transportation networks. MWR analysis suggests prioritizing locations that offer long-term growth potential and operational flexibility.

Technology integration should be a primary consideration for warehouse operators seeking competitive advantages and operational efficiency improvements. Analysts recommend gradual implementation of automation systems, starting with warehouse management software and progressing to more advanced robotics and AI solutions.

Sustainability initiatives are becoming essential for attracting quality tenants and achieving premium rental rates. Industry experts suggest incorporating green building features, renewable energy systems, and environmental certifications in new development projects.

Market timing considerations favor current investment and development activities, given strong demand fundamentals and limited supply in prime locations. Analysts recommend securing strategic sites and development opportunities before land costs increase further and competition intensifies.

Long-term growth prospects for Spain’s warehousing market remain highly favorable, supported by continued e-commerce expansion, international trade growth, and supply chain modernization initiatives. The market is projected to maintain robust growth rates of 5.8% annually over the next five years, driven by structural demand factors and technological advancement.

Technology evolution will continue reshaping warehouse operations, with increased adoption of artificial intelligence, machine learning, and autonomous systems. Future facilities will likely incorporate advanced predictive analytics, real-time inventory optimization, and seamless integration with transportation networks.

Sustainability requirements will become increasingly important, with environmental regulations and tenant preferences driving demand for green-certified facilities. Future warehouse development will prioritize carbon neutrality, renewable energy integration, and circular economy principles.

Market consolidation trends suggest continued concentration among major operators while creating opportunities for specialized service providers. The future landscape will likely feature fewer but larger, more technologically sophisticated facilities serving broader geographic areas and multiple industry sectors.

Spain’s warehousing market represents a compelling investment opportunity characterized by strong fundamentals, strategic advantages, and significant growth potential. The sector benefits from the country’s optimal geographic positioning, robust infrastructure, and growing importance in European and international logistics networks.

Market dynamics favor continued expansion driven by e-commerce growth, supply chain modernization, and increasing demand for sophisticated logistics solutions. The integration of advanced technologies, sustainability initiatives, and flexible facility designs positions the market for sustained long-term growth and operational excellence.

Future success in Spain’s warehousing market will depend on strategic location selection, technology adoption, and responsiveness to evolving tenant requirements. The sector offers attractive opportunities for investors, operators, and logistics service providers seeking exposure to one of Europe’s most dynamic and strategically important warehousing markets.

What is Warehousing?

Warehousing refers to the process of storing goods and materials in a designated space, typically for distribution or manufacturing purposes. It plays a crucial role in supply chain management by ensuring that products are available when needed.

What are the key players in the Spain Warehousing Market?

Key players in the Spain Warehousing Market include companies like Prologis, Goodman Group, and Segro, which provide logistics and warehousing solutions. These companies are known for their extensive networks and modern facilities, catering to various industries such as retail and e-commerce, among others.

What are the growth factors driving the Spain Warehousing Market?

The Spain Warehousing Market is driven by the growth of e-commerce, increasing demand for efficient supply chain solutions, and the expansion of logistics infrastructure. Additionally, the rise in consumer expectations for faster delivery times is pushing companies to invest in warehousing capabilities.

What challenges does the Spain Warehousing Market face?

Challenges in the Spain Warehousing Market include rising operational costs, labor shortages, and the need for technological advancements. Companies must also navigate regulatory requirements and environmental concerns related to warehousing operations.

What opportunities exist in the Spain Warehousing Market?

Opportunities in the Spain Warehousing Market include the adoption of automation and smart technologies, which can enhance efficiency and reduce costs. Additionally, the growth of omnichannel retailing presents new avenues for warehousing solutions tailored to diverse consumer needs.

What trends are shaping the Spain Warehousing Market?

Trends in the Spain Warehousing Market include the increasing use of robotics and AI for inventory management, the shift towards sustainable practices, and the integration of advanced data analytics. These trends are helping companies optimize their operations and improve service delivery.

Spain Warehousing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Storage, Pallet Racking, Shelving Systems, Mezzanine Floors |

| End User | Retail, E-commerce, Manufacturing, Logistics |

| Technology | Warehouse Management Systems, Robotics, IoT Solutions, RFID |

| Service Type | Third-Party Logistics, Inventory Management, Order Fulfillment, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

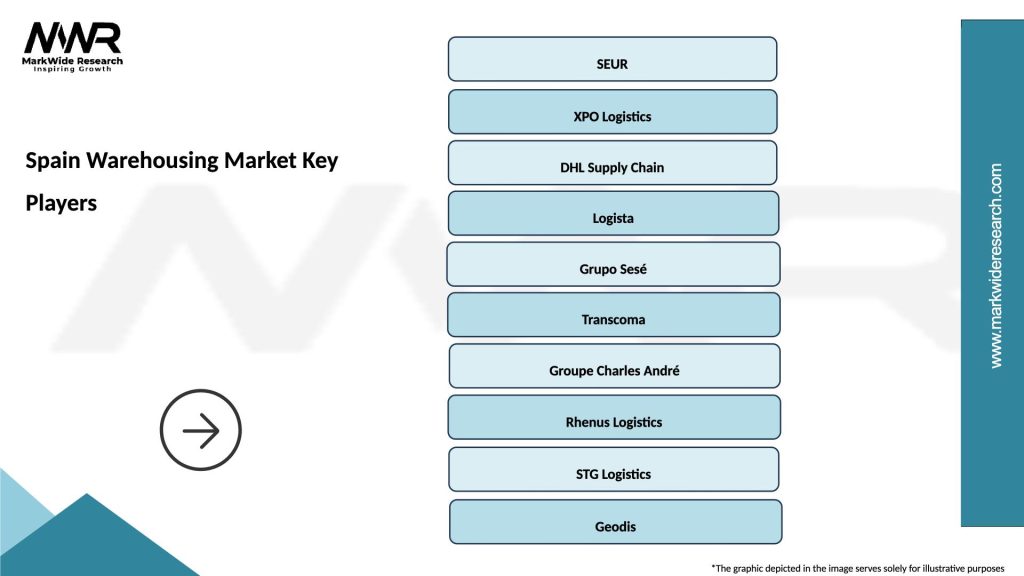

Leading companies in the Spain Warehousing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at