444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain snack bar industry market represents a dynamic and rapidly evolving segment of the country’s food and beverage sector. This thriving market encompasses a diverse range of establishments, from traditional tapas bars to modern quick-service outlets, catering to Spain’s rich culinary culture and evolving consumer preferences. The industry has demonstrated remarkable resilience and adaptability, particularly in response to changing lifestyle patterns and urbanization trends across major Spanish cities.

Market dynamics indicate that the Spanish snack bar sector is experiencing robust growth, driven by increasing consumer demand for convenient, high-quality food options. The industry benefits from Spain’s strong tourism sector, with millions of international visitors contributing significantly to revenue generation. Growth projections suggest the market is expanding at a steady CAGR of 6.2%, reflecting the sector’s ability to innovate and adapt to contemporary consumer needs.

Regional distribution shows that major metropolitan areas, including Madrid, Barcelona, Valencia, and Seville, account for approximately 68% of total market activity. The industry’s success stems from its ability to blend traditional Spanish culinary heritage with modern service concepts, creating unique value propositions that resonate with both domestic consumers and international tourists.

The Spain snack bar industry market refers to the comprehensive ecosystem of food service establishments specializing in quick-service meals, light refreshments, and casual dining experiences throughout Spain. This market encompasses traditional tapas bars, modern snack outlets, coffee shops with food offerings, and innovative quick-service restaurants that cater to consumers seeking convenient, affordable, and quality food options.

Industry definition includes establishments that primarily serve light meals, snacks, beverages, and quick-service food items, typically characterized by faster service times compared to full-service restaurants. These venues range from family-owned traditional bars to franchised modern concepts, each contributing to Spain’s vibrant food culture and hospitality sector.

Market scope extends beyond simple food service to include cultural gathering spaces where social interaction, business meetings, and leisure activities converge. The industry plays a crucial role in preserving Spanish culinary traditions while simultaneously embracing international food trends and innovative service models.

Strategic analysis reveals that Spain’s snack bar industry is positioned for sustained growth, driven by favorable demographic trends, tourism recovery, and evolving consumer preferences. The market demonstrates strong fundamentals with increasing penetration of modern service concepts alongside traditional establishments that maintain cultural authenticity.

Key performance indicators show that consumer spending on quick-service food options has increased by 12% annually over recent periods, reflecting growing acceptance of casual dining experiences. The industry benefits from Spain’s robust tourism sector, which contributes approximately 35% of total industry revenue during peak seasons.

Competitive landscape features a healthy mix of independent operators and emerging franchise concepts, with traditional family-owned establishments maintaining approximately 58% market share. Innovation in menu offerings, service delivery, and customer experience continues to drive differentiation and market expansion across all segments.

Future prospects indicate continued market evolution with increasing integration of technology, sustainability initiatives, and health-conscious menu options. The industry’s ability to adapt to changing consumer behaviors while preserving cultural authenticity positions it favorably for long-term growth and development.

Consumer behavior analysis reveals significant shifts in dining preferences, with Spanish consumers increasingly valuing convenience, quality, and authentic experiences. The market benefits from strong local food culture combined with growing international influence, creating opportunities for innovative concepts that blend traditional and contemporary elements.

Primary growth drivers for Spain’s snack bar industry include robust tourism recovery, urbanization trends, and evolving consumer lifestyle preferences. The country’s position as a leading European tourist destination ensures consistent demand from international visitors seeking authentic Spanish dining experiences combined with convenient service options.

Demographic trends support market expansion, with younger consumers demonstrating increased willingness to spend on food experiences outside traditional meal times. Urban professionals increasingly rely on quick-service options for breakfast, lunch, and after-work socializing, driving consistent demand throughout business districts and commercial areas.

Economic factors contribute positively to market growth, including rising disposable income levels, increased employment rates, and growing consumer confidence. The industry benefits from Spain’s economic recovery and strengthening domestic consumption patterns, particularly in major metropolitan areas where spending power continues to increase.

Cultural evolution plays a significant role in market development, as traditional Spanish dining culture adapts to incorporate international influences while maintaining authentic elements. This cultural flexibility creates opportunities for innovative concepts that respect tradition while meeting contemporary consumer expectations for convenience and quality.

Operational challenges facing the Spanish snack bar industry include rising labor costs, increasing rent prices in prime locations, and complex regulatory requirements. These factors particularly impact smaller independent operators who may lack the resources to navigate changing business conditions effectively.

Economic pressures include inflation affecting ingredient costs, energy expenses, and overall operational overhead. The industry must balance cost management with maintaining quality standards and competitive pricing, creating ongoing pressure on profit margins across all market segments.

Regulatory compliance requirements continue to evolve, particularly regarding food safety, labor regulations, and environmental standards. These changing requirements demand ongoing investment in training, systems, and processes, which can strain resources for smaller operators while favoring larger, well-capitalized businesses.

Market saturation in certain prime locations creates intense competition for customer traffic and qualified staff. High-traffic areas experience significant rental cost increases, while competition for experienced workers drives up labor costs, particularly affecting establishments in tourist-heavy districts.

Expansion opportunities exist in emerging suburban markets and secondary cities where demand for quality snack bar concepts continues to grow. These markets offer lower operational costs while serving increasingly sophisticated consumer bases seeking convenient dining options beyond traditional urban centers.

Technology integration presents significant opportunities for operational efficiency and customer experience enhancement. Digital ordering systems, mobile payment solutions, and customer relationship management platforms can drive revenue growth while reducing operational complexity and improving service quality.

Health and wellness trends create opportunities for innovative menu development focusing on nutritious, locally-sourced ingredients. Consumer demand for healthier options, including plant-based alternatives and allergen-free choices, opens new market segments and differentiation opportunities.

Franchise development offers growth potential for successful concepts seeking rapid market expansion. The franchise model enables proven business concepts to scale efficiently while providing entrepreneurs with established operational frameworks and brand recognition benefits.

Competitive dynamics within Spain’s snack bar industry reflect a complex interplay between traditional establishments and modern concepts, each serving distinct consumer segments while competing for market share. MarkWide Research analysis indicates that successful operators increasingly focus on differentiation through unique value propositions rather than direct price competition.

Supply chain considerations significantly impact market dynamics, with successful operators developing strong relationships with local suppliers to ensure consistent quality and competitive pricing. The emphasis on locally-sourced ingredients aligns with consumer preferences while supporting operational efficiency and cost management objectives.

Consumer preferences continue evolving toward experiences that combine convenience with authenticity, creating opportunities for operators who can successfully balance traditional Spanish hospitality with modern service efficiency. This trend drives innovation in service delivery while maintaining cultural authenticity that attracts both domestic and international customers.

Seasonal fluctuations create both challenges and opportunities, with tourism-dependent locations experiencing significant revenue variations throughout the year. Successful operators develop strategies to maximize peak season performance while maintaining viability during slower periods through menu adaptation and cost management initiatives.

Data collection methods for analyzing Spain’s snack bar industry market employ comprehensive primary and secondary research approaches, including industry surveys, consumer behavior studies, and competitive analysis frameworks. Research methodologies incorporate both quantitative metrics and qualitative insights to provide complete market understanding.

Primary research involves direct engagement with industry stakeholders, including operators, suppliers, consumers, and industry associations. This approach ensures current market insights while capturing emerging trends and challenges that may not be reflected in historical data or published reports.

Secondary research utilizes government statistics, industry publications, trade association data, and economic indicators to establish market context and validate primary research findings. This comprehensive approach ensures research accuracy while providing historical perspective on market development patterns.

Analytical frameworks incorporate statistical modeling, trend analysis, and comparative benchmarking to identify market patterns and project future developments. The methodology emphasizes data triangulation to ensure research reliability and provide stakeholders with actionable market intelligence for strategic decision-making.

Madrid region represents the largest market segment, accounting for approximately 28% of national industry activity. The capital’s diverse population, strong business district presence, and significant tourist traffic create ideal conditions for various snack bar concepts, from traditional tapas bars to international franchise operations.

Catalonia region, centered around Barcelona, contributes roughly 24% of market share and demonstrates strong growth in innovative dining concepts. The region’s international outlook and cultural diversity support experimental menu offerings and service formats that often influence national market trends.

Andalusia region maintains approximately 18% market share, with strong performance driven by tourism in cities like Seville, Granada, and Málaga. The region’s deep culinary traditions provide authentic experiences that attract both domestic and international consumers seeking genuine Spanish dining culture.

Valencia region accounts for about 12% of market activity, benefiting from coastal tourism and growing urban development. The region demonstrates balanced growth across traditional and modern concepts, with particular strength in establishments that emphasize local seafood and agricultural products.

Emerging markets in regions like Galicia, Basque Country, and Castile and León collectively represent the remaining market share, showing increasing sophistication in consumer preferences and growing demand for quality snack bar concepts beyond major metropolitan areas.

Market leadership in Spain’s snack bar industry is distributed among various operator categories, with no single dominant player controlling significant market share. This fragmented structure creates opportunities for both established operators and new entrants to capture market segments through differentiation and superior execution.

Competitive strategies focus increasingly on customer experience differentiation rather than price competition alone. Successful operators invest in staff training, menu innovation, and operational efficiency to build customer loyalty and sustainable competitive advantages in their respective market segments.

Market consolidation trends show gradual increase in multi-location operators, though the industry maintains its characteristic diversity and local flavor. This evolution creates opportunities for successful concepts to scale while preserving the authentic experiences that define Spanish snack bar culture.

By Service Format:

By Location Type:

By Price Segment:

Traditional tapas segment continues to demonstrate strong performance, maintaining approximately 42% of overall market activity. These establishments benefit from cultural authenticity and tourist appeal while adapting service methods to meet contemporary efficiency expectations without compromising traditional charm.

Modern quick-service concepts show rapid growth, particularly in urban business districts where time-conscious consumers value convenience and consistent quality. This segment benefits from technology integration and standardized operations that enable efficient service delivery during peak demand periods.

Coffee-centric establishments with expanded food offerings represent a growing market segment, capitalizing on Spanish coffee culture while providing additional revenue streams through complementary food items. These venues often serve as social gathering spaces throughout the day, maximizing location utilization.

Specialty dietary concepts including vegetarian, vegan, and gluten-free focused establishments show strong growth potential as consumer awareness of dietary preferences and restrictions continues expanding. These concepts often command premium pricing while serving dedicated customer bases.

Operators benefit from Spain’s strong food culture, which creates consistent demand for quality dining experiences across various price points and service formats. The market’s diversity allows operators to find profitable niches while building sustainable businesses that serve both local communities and tourist populations.

Suppliers gain from the industry’s emphasis on fresh, local ingredients and authentic preparation methods. This focus creates opportunities for agricultural producers, specialty food manufacturers, and beverage suppliers to develop long-term partnerships with establishments committed to quality and authenticity.

Real estate investors benefit from consistent demand for prime commercial locations, particularly in high-traffic urban areas and tourist destinations. The industry’s resilience and growth trajectory support stable rental income and property value appreciation in well-positioned commercial real estate.

Employment opportunities abound throughout the industry, from entry-level service positions to management and entrepreneurial roles. The sector provides career development pathways while contributing to local economic development through job creation and skills development programs.

Tourism stakeholders benefit from the industry’s role in enhancing visitor experiences and supporting Spain’s reputation as a premier culinary destination. Quality snack bar establishments contribute to overall tourism satisfaction while generating economic activity that supports broader hospitality sector growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives are becoming increasingly important across the Spanish snack bar industry, with operators implementing eco-friendly practices including waste reduction, sustainable sourcing, and energy-efficient operations. These initiatives respond to growing consumer environmental consciousness while potentially reducing operational costs.

Technology adoption accelerates throughout the industry, with digital ordering systems, contactless payments, and customer relationship management platforms becoming standard operational tools. MWR data suggests that technology-enabled establishments demonstrate 15% higher customer satisfaction rates compared to traditional operations.

Health-conscious menu development reflects changing consumer preferences toward nutritious, transparent ingredient sourcing. Operators increasingly offer plant-based options, allergen-free alternatives, and locally-sourced ingredients to meet evolving dietary preferences and health awareness trends.

Experience-focused concepts emphasize creating memorable customer experiences beyond simple food service, incorporating elements like live music, cooking demonstrations, and interactive dining formats. These approaches help differentiate establishments in competitive markets while building customer loyalty and social media engagement.

Delivery and takeaway integration continues expanding as operators adapt to changing consumer convenience expectations. Many establishments now offer multiple service channels including dine-in, takeaway, and delivery options to maximize revenue opportunities and serve diverse customer preferences.

Franchise expansion activity has increased significantly, with both domestic and international concepts establishing presence in major Spanish markets. These developments bring standardized operations and proven business models while adapting to local tastes and cultural preferences.

Investment activity in the sector includes both private equity involvement in established operators and venture capital funding for innovative technology-enabled concepts. This financial support enables market expansion and operational improvements across various industry segments.

Regulatory updates continue affecting industry operations, particularly regarding food safety standards, labor regulations, and environmental compliance requirements. Operators must adapt to these evolving requirements while maintaining operational efficiency and profitability.

Partnership developments between operators and technology providers, suppliers, and real estate developers create new opportunities for operational efficiency and market expansion. These collaborations often result in improved customer experiences and enhanced competitive positioning.

Market consolidation trends show gradual increase in multi-location operators, though the industry maintains its characteristic diversity. This evolution creates opportunities for successful concepts to scale while preserving authentic experiences that define Spanish snack bar culture.

Operational excellence should remain the primary focus for industry participants, with emphasis on consistent quality, efficient service delivery, and positive customer experiences. Successful operators invest in staff training, operational systems, and customer feedback mechanisms to maintain competitive advantages.

Technology integration represents a critical success factor for future market competitiveness. Operators should evaluate digital solutions that enhance customer convenience while improving operational efficiency, including ordering systems, payment processing, and inventory management platforms.

Market positioning strategies should emphasize authentic differentiation rather than price competition alone. Successful concepts develop unique value propositions that resonate with target customer segments while maintaining sustainable profit margins and operational viability.

Location strategy requires careful analysis of demographic trends, competition levels, and long-term market potential. Operators should consider emerging suburban markets and secondary cities where competition may be less intense while demand continues growing.

Financial management discipline becomes increasingly important as operational costs continue rising. Successful operators implement robust cost control systems while investing strategically in areas that drive customer satisfaction and revenue growth.

Growth projections for Spain’s snack bar industry remain positive, with continued expansion expected across multiple market segments. The industry’s ability to adapt to changing consumer preferences while maintaining cultural authenticity positions it favorably for sustained development over the coming years.

Market evolution will likely emphasize technology integration, sustainability initiatives, and health-conscious offerings while preserving the authentic Spanish hospitality experiences that define the industry. This balance between innovation and tradition creates opportunities for operators who can successfully navigate both requirements.

Consumer trends indicate continued demand for convenient, high-quality food experiences that provide value beyond simple sustenance. Successful operators will focus on creating memorable experiences that encourage repeat visits and positive word-of-mouth recommendations.

Investment opportunities will likely concentrate in technology-enabled concepts, sustainable operations, and underserved geographic markets where demand exceeds current supply. These areas offer potential for strong returns while contributing to overall industry development and modernization.

MarkWide Research analysis suggests that operators who successfully combine traditional Spanish hospitality with modern operational efficiency will capture the greatest market opportunities, achieving sustainable growth while contributing to the industry’s continued evolution and success.

Spain’s snack bar industry represents a dynamic and resilient market segment that successfully balances cultural tradition with contemporary consumer demands. The industry’s strong fundamentals, including robust tourism integration, diverse operator landscape, and evolving consumer preferences, support continued growth and development across multiple market segments.

Strategic opportunities exist for operators who can effectively combine authentic Spanish hospitality with operational efficiency and modern convenience features. The market’s fragmented structure creates space for both traditional family operations and innovative new concepts, each serving distinct customer segments while contributing to overall industry vitality.

Future success in this market will depend on operators’ ability to adapt to changing consumer preferences while maintaining the cultural authenticity that defines Spanish snack bar experiences. Technology integration, sustainability initiatives, and health-conscious offerings will become increasingly important differentiators in competitive markets.

Long-term prospects for Spain’s snack bar industry remain favorable, supported by the country’s strong tourism sector, evolving urban demographics, and continued consumer appreciation for quality food experiences. Operators who invest in operational excellence, customer experience, and strategic market positioning will be best positioned to capitalize on emerging opportunities while contributing to the industry’s continued growth and evolution.

What is Spain Snack Bar Industry?

The Spain Snack Bar Industry encompasses businesses that provide a variety of snack foods and beverages, often in casual settings. This includes establishments like cafes, kiosks, and food trucks that cater to consumers looking for quick and convenient food options.

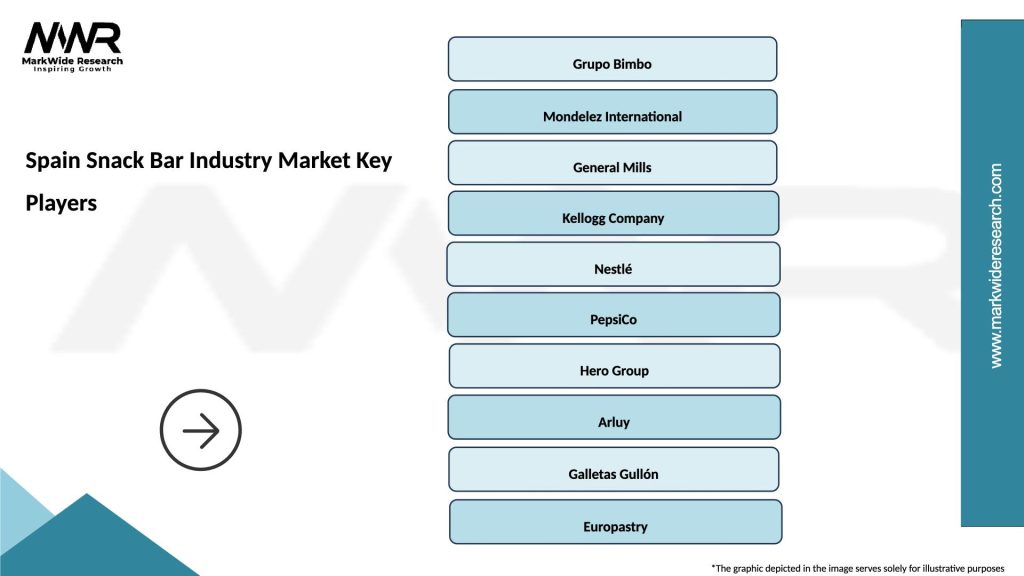

What are the key players in the Spain Snack Bar Industry Market?

Key players in the Spain Snack Bar Industry Market include companies like Grupo Bimbo, Pepsico, and Mondelez International, which offer a range of snack products. These companies compete in various segments such as packaged snacks, healthy options, and traditional Spanish snacks, among others.

What are the growth factors driving the Spain Snack Bar Industry Market?

The growth of the Spain Snack Bar Industry Market is driven by changing consumer preferences towards on-the-go snacking, the rise of health-conscious choices, and the increasing popularity of gourmet snack options. Additionally, urbanization and busy lifestyles contribute to the demand for convenient snack solutions.

What challenges does the Spain Snack Bar Industry Market face?

The Spain Snack Bar Industry Market faces challenges such as intense competition, fluctuating ingredient prices, and changing regulations regarding food safety and labeling. These factors can impact profit margins and operational efficiency for snack bar businesses.

What opportunities exist in the Spain Snack Bar Industry Market?

Opportunities in the Spain Snack Bar Industry Market include the growing trend of plant-based snacks, the expansion of online food delivery services, and the potential for innovative flavor combinations. These trends can attract a broader consumer base and enhance market growth.

What trends are shaping the Spain Snack Bar Industry Market?

Trends shaping the Spain Snack Bar Industry Market include the increasing demand for organic and natural ingredients, the rise of functional snacks that offer health benefits, and the popularity of artisanal and locally sourced products. These trends reflect a shift towards healthier and more sustainable snacking options.

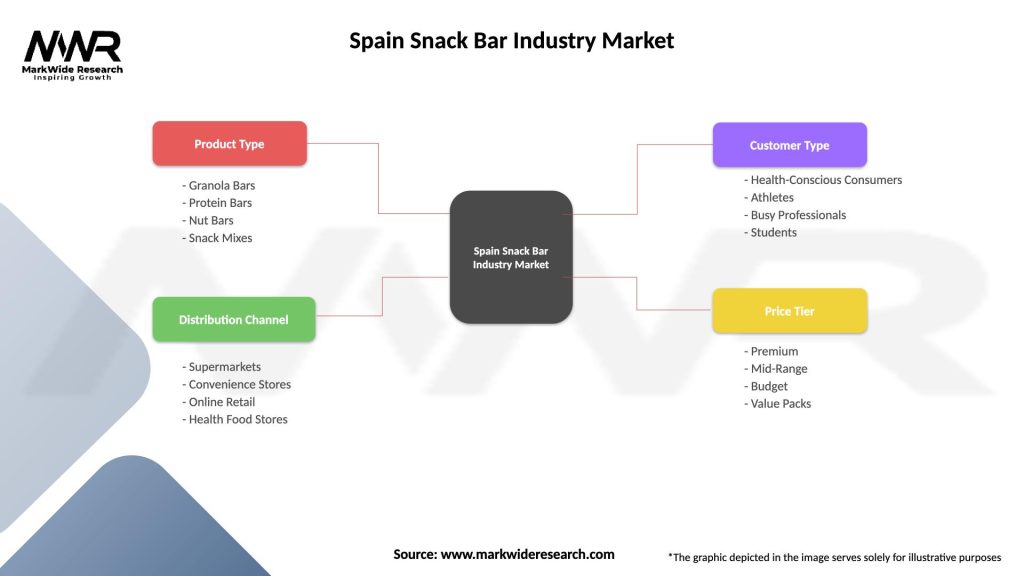

Spain Snack Bar Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Granola Bars, Protein Bars, Nut Bars, Snack Mixes |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Health Food Stores |

| Customer Type | Health-Conscious Consumers, Athletes, Busy Professionals, Students |

| Price Tier | Premium, Mid-Range, Budget, Value Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Snack Bar Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at