444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain satellite imagery services market represents a rapidly evolving sector that has gained significant momentum in recent years. Satellite imagery services encompass the collection, processing, and distribution of high-resolution images captured by earth observation satellites, providing valuable data for various industries and applications. Spain’s strategic geographic position, combined with its growing technological infrastructure and increasing demand for geospatial intelligence, has positioned the country as a key player in the European satellite imagery landscape.

Market dynamics in Spain reflect a robust growth trajectory, driven by expanding applications across agriculture, urban planning, environmental monitoring, and defense sectors. The integration of artificial intelligence and machine learning technologies has enhanced the analytical capabilities of satellite imagery services, making them more accessible and valuable to end-users. Government initiatives supporting digital transformation and space technology development have further accelerated market expansion, with the sector experiencing a compound annual growth rate of 12.3% over recent years.

Regional demand for satellite imagery services has intensified due to Spain’s diverse geographical features, including extensive coastlines, agricultural regions, and urban centers requiring continuous monitoring. The market encompasses various service types, from basic image acquisition to advanced analytics and custom solutions tailored to specific industry needs. Commercial applications now account for approximately 68% of market demand, while government and defense applications represent the remaining share.

The Spain satellite imagery services market refers to the comprehensive ecosystem of companies, technologies, and services involved in capturing, processing, analyzing, and distributing satellite-based earth observation data within the Spanish territory and for Spanish organizations operating globally. This market encompasses both domestic and international satellite operators providing imagery services to Spanish customers, as well as local value-added service providers that enhance raw satellite data with analytical insights and customized solutions.

Satellite imagery services include various offerings such as high-resolution optical imagery, synthetic aperture radar (SAR) data, multispectral and hyperspectral imaging, and real-time monitoring capabilities. These services support decision-making processes across multiple sectors by providing accurate, timely, and comprehensive geospatial information. The market also includes software platforms, data analytics tools, and consulting services that help organizations extract meaningful insights from satellite imagery data.

Spain’s satellite imagery services market has emerged as a dynamic and rapidly expanding sector, characterized by increasing adoption across diverse industries and growing technological sophistication. The market benefits from Spain’s strategic position in Europe, strong agricultural sector, and commitment to digital innovation. Key growth drivers include the rising demand for precision agriculture solutions, urban planning applications, environmental monitoring requirements, and infrastructure development projects.

Market segmentation reveals that commercial applications dominate the landscape, with agriculture representing the largest end-user segment at approximately 35% market share. The integration of advanced analytics, artificial intelligence, and cloud-based platforms has transformed traditional satellite imagery services into comprehensive geospatial intelligence solutions. Competitive dynamics feature a mix of international satellite operators, local service providers, and emerging technology companies offering specialized solutions.

Future prospects remain highly favorable, with projected growth driven by increasing awareness of satellite imagery benefits, expanding application areas, and continued technological advancement. The market is expected to benefit from European Space Agency initiatives, national space programs, and growing private sector investment in space technology and earth observation capabilities.

Strategic insights from the Spain satellite imagery services market reveal several critical trends and developments shaping the industry landscape:

Primary market drivers propelling the Spain satellite imagery services market include a combination of technological, economic, and regulatory factors that create favorable conditions for sustained growth and expansion.

Agricultural modernization represents the most significant driver, as Spanish farmers increasingly adopt precision agriculture techniques to optimize crop yields, reduce resource consumption, and improve sustainability. The country’s extensive agricultural sector, covering diverse crops from olives and grapes to cereals and vegetables, requires sophisticated monitoring solutions that satellite imagery provides. Crop health assessment, irrigation management, and yield prediction capabilities have become essential tools for modern agricultural operations, driving consistent demand for satellite-based services.

Urban development pressures across major Spanish cities create substantial demand for satellite imagery services in urban planning and infrastructure management. Rapid urbanization, combined with sustainability goals and smart city initiatives, requires comprehensive monitoring and analysis capabilities. Land use planning, construction monitoring, and environmental impact assessment applications rely heavily on high-resolution satellite imagery to support decision-making processes.

Environmental regulations and climate change monitoring requirements drive significant market demand, particularly for environmental consulting firms, government agencies, and research institutions. Spain’s commitment to European environmental standards and climate goals necessitates continuous monitoring of forests, coastlines, water bodies, and urban environments. Regulatory compliance applications account for approximately 22% of market demand, reflecting the importance of environmental monitoring in the current regulatory landscape.

Market restraints affecting the Spain satellite imagery services market include several challenges that may limit growth potential or create barriers to adoption across certain segments and applications.

High implementation costs remain a significant barrier for small and medium-sized enterprises seeking to adopt satellite imagery services. While costs have decreased over time, the initial investment required for comprehensive satellite imagery solutions, including software licenses, training, and integration services, can be prohibitive for smaller organizations. Budget constraints particularly affect agricultural cooperatives, small municipalities, and emerging technology companies that could benefit from satellite imagery but lack sufficient financial resources.

Technical complexity and the need for specialized expertise create adoption challenges across various user segments. Many potential users lack the technical knowledge required to effectively interpret and analyze satellite imagery data, limiting market penetration. Skills gaps in geospatial analysis, remote sensing, and data interpretation require significant training investments, which may deter some organizations from adopting satellite imagery services.

Data privacy and security concerns pose ongoing challenges, particularly for sensitive applications in defense, critical infrastructure, and commercial operations. Regulatory requirements regarding data handling, storage, and cross-border transfer create compliance complexities that may limit market growth. Security protocols and data sovereignty requirements add operational complexity and costs for service providers operating in the Spanish market.

Emerging opportunities in the Spain satellite imagery services market present significant potential for growth and innovation across multiple sectors and application areas.

Artificial intelligence integration offers transformative opportunities for enhancing satellite imagery services through automated analysis, pattern recognition, and predictive analytics capabilities. The development of AI-powered solutions for crop monitoring, urban planning, and environmental assessment creates new value propositions and market segments. Machine learning applications enable more sophisticated analysis of satellite data, providing actionable insights that were previously unavailable or required extensive manual processing.

Small satellite constellations and emerging space technologies present opportunities for more frequent, cost-effective imagery acquisition and enhanced temporal resolution. The proliferation of CubeSats and other small satellite platforms enables new service models and pricing structures that could expand market accessibility. New space economy developments create opportunities for Spanish companies to participate in satellite operations, data processing, and value-added services.

Climate change adaptation and sustainability initiatives create expanding market opportunities as organizations seek to understand and respond to environmental challenges. Applications in carbon monitoring, renewable energy site selection, and climate impact assessment represent growing market segments. Green technology integration with satellite imagery services supports Spain’s sustainability goals and creates new business opportunities for service providers.

Market dynamics in the Spain satellite imagery services sector reflect a complex interplay of technological advancement, regulatory evolution, and changing user requirements that shape competitive positioning and growth trajectories.

Technology convergence represents a fundamental dynamic driving market evolution, as satellite imagery services increasingly integrate with other technologies such as IoT sensors, drones, and ground-based monitoring systems. This convergence creates comprehensive monitoring solutions that provide enhanced value to end-users while creating new competitive advantages for service providers. Platform integration capabilities have become critical differentiators in the market, with successful providers offering seamless data fusion and analysis capabilities.

Competitive intensity has increased significantly as the market attracts both established aerospace companies and emerging technology startups. International satellite operators compete with local service providers and specialized analytics companies, creating a diverse competitive landscape. Market consolidation trends are emerging as larger companies acquire specialized capabilities and smaller firms seek partnerships to access broader markets and resources.

User sophistication continues to evolve, with customers demanding more automated, user-friendly solutions that require minimal technical expertise. This trend drives innovation in user interfaces, automated analysis tools, and cloud-based platforms that democratize access to satellite imagery services. Service customization has become increasingly important as users seek solutions tailored to specific industry requirements and operational needs.

Research methodology for analyzing the Spain satellite imagery services market employs a comprehensive approach combining primary and secondary research techniques to ensure accurate, reliable, and actionable market insights.

Primary research activities include structured interviews with key industry stakeholders, including satellite operators, service providers, technology vendors, and end-users across various sectors. Survey methodologies capture quantitative data on market trends, adoption patterns, and user preferences, while in-depth interviews provide qualitative insights into market dynamics and future opportunities. Industry expert consultations with geospatial professionals, technology specialists, and market analysts enhance the depth and accuracy of market analysis.

Secondary research encompasses comprehensive analysis of industry reports, government publications, academic studies, and company financial statements to establish market context and validate primary research findings. Data triangulation techniques ensure consistency and reliability across multiple information sources, while statistical analysis methods provide robust market sizing and forecasting capabilities.

Market modeling approaches utilize both top-down and bottom-up methodologies to develop accurate market estimates and projections. Scenario analysis techniques account for various market conditions and potential disruptions, providing comprehensive insights into market evolution possibilities. Validation processes include peer review, expert consultation, and cross-referencing with established market benchmarks to ensure research quality and reliability.

Regional analysis of the Spain satellite imagery services market reveals distinct patterns of adoption, growth, and opportunity across different geographic areas and administrative regions within the country.

Madrid region dominates the market landscape, accounting for approximately 28% of national demand, driven by the concentration of government agencies, technology companies, and research institutions. The capital region serves as the primary hub for satellite imagery service providers and hosts major decision-making centers for both public and private sector applications. Government procurement and defense applications represent significant market segments within the Madrid region, while growing commercial demand from consulting firms and technology companies drives continued expansion.

Catalonia region represents the second-largest market segment at approximately 24% market share, reflecting the area’s strong industrial base, agricultural sector, and technological innovation ecosystem. Barcelona’s position as a major European technology hub attracts international satellite imagery service providers and supports the development of local analytics capabilities. Agricultural applications in rural Catalonia, combined with urban planning needs in metropolitan areas, create diverse demand patterns across the region.

Andalusia region shows significant growth potential, particularly in agricultural applications, given its extensive farming operations and diverse crop types. The region’s large agricultural sector, combined with environmental monitoring needs related to water management and coastal protection, drives steady demand for satellite imagery services. Precision agriculture adoption rates in Andalusia have increased by 18% annually, reflecting growing awareness of satellite imagery benefits among farming communities.

Valencia and Murcia regions demonstrate strong market presence in agricultural applications, particularly for citrus and vegetable production monitoring. These regions benefit from intensive agricultural practices that require sophisticated monitoring and optimization solutions. Export-oriented agriculture in these areas drives demand for quality assurance and traceability applications using satellite imagery data.

Competitive landscape analysis reveals a diverse ecosystem of players operating in the Spain satellite imagery services market, ranging from global satellite operators to specialized local service providers and emerging technology companies.

International satellite operators maintain strong market positions through comprehensive satellite constellations and established distribution networks:

Local service providers and value-added resellers play crucial roles in market development by offering specialized solutions and local expertise:

Technology partnerships and strategic alliances shape competitive dynamics, with companies collaborating to offer comprehensive solutions that combine satellite imagery with complementary technologies and services. Market positioning strategies vary from broad-based platforms serving multiple sectors to specialized solutions targeting specific applications or industries.

Market segmentation analysis provides detailed insights into the various dimensions of the Spain satellite imagery services market, revealing distinct patterns of demand, growth, and opportunity across different categories.

By Application Segment:

By Service Type:

By End-User Category:

Category-wise analysis reveals distinct characteristics, growth patterns, and opportunities within each major segment of the Spain satellite imagery services market.

Agricultural Applications Category: This dominant segment benefits from Spain’s diverse agricultural landscape and increasing adoption of precision farming techniques. Crop monitoring services represent the largest sub-segment, with vineyard monitoring showing particularly strong growth due to Spain’s significant wine industry. Olive grove monitoring and cereal crop assessment also drive substantial demand. Seasonal demand patterns align with agricultural cycles, creating predictable revenue streams for service providers. Integration with IoT sensors and weather data enhances the value proposition of satellite imagery services in agricultural applications.

Urban Planning Category: Growing urbanization and smart city initiatives drive consistent demand in this segment. Construction monitoring applications show strong growth as municipalities seek to track development projects and ensure compliance with planning regulations. Infrastructure assessment and maintenance planning represent emerging opportunities as aging infrastructure requires continuous monitoring. 3D modeling and change detection services provide additional value for urban planning applications, supporting comprehensive city management solutions.

Environmental Monitoring Category: Regulatory requirements and climate change concerns fuel growth in this segment. Coastal monitoring applications are particularly relevant for Spain given its extensive coastline and tourism industry. Forest fire risk assessment and water resource monitoring represent critical applications with strong government support. Carbon monitoring and sustainability reporting applications show emerging growth potential as organizations seek to meet environmental commitments and regulatory requirements.

Defense and Security Category: This specialized segment requires high-resolution imagery and secure data handling capabilities. Border monitoring and maritime surveillance applications drive consistent government demand. Critical infrastructure protection and emergency response applications represent growing sub-segments as security concerns evolve. Real-time capabilities and rapid data delivery are essential requirements in this category, creating opportunities for specialized service providers.

Industry participants and stakeholders in the Spain satellite imagery services market realize significant benefits through participation in this dynamic and growing sector.

Service Providers Benefits:

End-User Benefits:

Economic Benefits:

SWOT analysis provides comprehensive assessment of the Spain satellite imagery services market’s internal capabilities and external environment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Spain satellite imagery services market reflect broader technological, economic, and social developments influencing industry evolution and growth trajectories.

Artificial Intelligence Integration represents the most significant trend transforming satellite imagery services. Machine learning algorithms now enable automated feature detection, change analysis, and predictive modeling capabilities that were previously impossible or extremely time-consuming. AI-powered solutions reduce the technical expertise required for satellite imagery analysis, democratizing access to geospatial intelligence. Computer vision technologies enable real-time processing of satellite data streams, supporting applications requiring immediate insights and rapid response capabilities.

Cloud-Based Platform Migration continues to reshape service delivery models and user accessibility. Software-as-a-Service platforms eliminate the need for expensive local infrastructure and specialized technical staff, making satellite imagery services accessible to smaller organizations. Cloud platforms enable scalable processing capabilities and collaborative workflows that support distributed teams and multi-stakeholder projects. API-driven architectures facilitate integration with existing business systems and enable automated data workflows.

Real-Time and Near Real-Time Capabilities have become increasingly important across applications requiring immediate situational awareness. Rapid revisit satellites and automated processing pipelines enable delivery of imagery within hours of acquisition, supporting emergency response, security monitoring, and operational applications. The trend toward real-time capabilities drives demand for enhanced communication infrastructure and edge computing solutions.

Sustainability and ESG Applications show accelerating growth as organizations seek to measure and report environmental impact. Carbon monitoring, biodiversity assessment, and supply chain sustainability applications represent emerging market segments with significant growth potential. According to MarkWide Research analysis, sustainability-related applications have grown by 25% annually as companies respond to stakeholder expectations and regulatory requirements.

Key industry developments in the Spain satellite imagery services market reflect ongoing innovation, strategic partnerships, and market expansion activities that shape competitive dynamics and growth opportunities.

Technology Partnerships and Collaborations have intensified as companies seek to combine complementary capabilities and expand market reach. Strategic alliances between satellite operators and local service providers enable enhanced customer support and customized solutions. International partnerships facilitate technology transfer and knowledge sharing, strengthening the Spanish market’s capabilities and competitiveness. Academic collaborations with Spanish universities and research institutions support innovation and workforce development initiatives.

Government Initiative Expansion includes increased funding for space technology development and earth observation applications. National space programs support domestic capability development and create opportunities for Spanish companies to participate in satellite missions and data processing activities. European Space Agency collaborations provide access to advanced satellite systems and funding for research and development projects. Public-private partnerships facilitate market development and technology demonstration projects.

Platform and Service Innovation continues to drive market evolution through enhanced user interfaces, automated analysis capabilities, and integrated solution offerings. Mobile applications and field-ready solutions enable real-time access to satellite imagery and analysis tools for field personnel. Advanced visualization technologies, including augmented reality and 3D modeling, enhance the value and usability of satellite imagery services. Subscription-based models and flexible pricing structures improve accessibility for diverse customer segments.

Market Consolidation Activities include acquisitions and mergers that strengthen competitive positions and expand service capabilities. Vertical integration strategies enable companies to control more of the value chain from satellite operations to end-user applications. Horizontal expansion through acquisitions provides access to new customer segments and geographic markets. Investment activities from venture capital and private equity firms support emerging companies and technology development initiatives.

Analyst recommendations for stakeholders in the Spain satellite imagery services market focus on strategic positioning, capability development, and market expansion opportunities that can drive sustainable growth and competitive advantage.

For Service Providers:

For End-Users:

For Investors and Policymakers:

Future outlook for the Spain satellite imagery services market remains highly positive, with multiple growth drivers and emerging opportunities supporting continued expansion and innovation over the coming years.

Technology Evolution will continue to drive market transformation through enhanced satellite capabilities, improved processing technologies, and expanded analytical capabilities. Next-generation satellites with higher resolution, increased revisit frequency, and advanced sensors will provide more comprehensive and timely data for diverse applications. Artificial intelligence and machine learning technologies will become increasingly sophisticated, enabling automated insights and predictive capabilities that transform satellite imagery from descriptive to prescriptive analytics. Edge computing and 5G connectivity will enable real-time processing and analysis capabilities that support time-critical applications.

Market Expansion is expected to accelerate as awareness of satellite imagery benefits increases and costs continue to decline. SME adoption rates are projected to grow significantly as cloud-based platforms and simplified user interfaces reduce technical barriers. New application areas, including supply chain monitoring, insurance assessment, and financial services, will create additional market opportunities. MWR projections indicate that market penetration in agricultural applications could reach 75% of eligible operations within the next five years.

Regulatory Environment developments will likely support market growth through continued investment in space programs, environmental monitoring requirements, and digital transformation initiatives. European Green Deal policies will drive demand for environmental monitoring and sustainability reporting applications. Data governance and privacy regulations will mature, providing clearer frameworks for satellite imagery services while ensuring appropriate protection of sensitive information.

Competitive Landscape evolution will feature increased specialization, strategic partnerships, and technology integration as companies seek to differentiate their offerings and expand market presence. Market consolidation may accelerate as larger companies acquire specialized capabilities and smaller firms seek access to broader markets and resources. International expansion opportunities will grow as Spanish companies develop expertise and capabilities that can serve global markets.

The Spain satellite imagery services market represents a dynamic and rapidly evolving sector with significant growth potential driven by technological advancement, expanding applications, and increasing market awareness. Market fundamentals remain strong, supported by Spain’s strategic geographic position, diverse economic sectors, and commitment to digital transformation and sustainability initiatives.

Key success factors for market participants include investment in advanced technologies, development of specialized industry solutions, and building comprehensive partnership ecosystems that enhance service capabilities and market reach. The integration of artificial intelligence, cloud computing, and real-time processing capabilities will continue to differentiate successful providers and expand market accessibility.

Growth prospects remain favorable across all major application segments, with agriculture, urban planning, and environmental monitoring showing particularly strong potential. The market’s evolution toward more automated, user-friendly solutions will drive adoption among smaller organizations and create new opportunities for service providers who can effectively address diverse customer needs.

Strategic positioning for long-term success requires balancing technological innovation with practical application development, ensuring that advanced capabilities translate into tangible value for end-users. As the market matures, companies that can demonstrate clear return on investment and provide comprehensive support services will be best positioned to capture growth opportunities and build sustainable competitive advantages in the expanding Spain satellite imagery services market.

What is Satellite Imagery Services?

Satellite Imagery Services refer to the collection, processing, and distribution of images captured by satellites. These services are utilized in various applications such as agriculture, urban planning, and environmental monitoring.

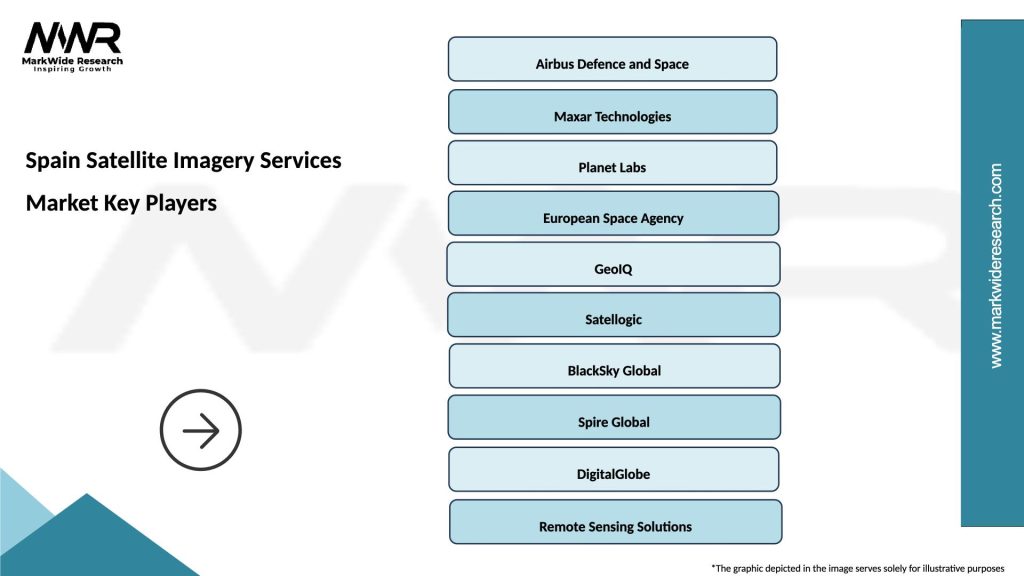

What are the key players in the Spain Satellite Imagery Services Market?

Key players in the Spain Satellite Imagery Services Market include Airbus, Maxar Technologies, and Planet Labs, among others. These companies provide advanced satellite imagery solutions for various sectors including defense, agriculture, and disaster management.

What are the growth factors driving the Spain Satellite Imagery Services Market?

The growth of the Spain Satellite Imagery Services Market is driven by increasing demand for geospatial data, advancements in satellite technology, and the rising need for environmental monitoring. Additionally, applications in smart city development and agriculture are contributing to market expansion.

What challenges does the Spain Satellite Imagery Services Market face?

The Spain Satellite Imagery Services Market faces challenges such as high operational costs, regulatory hurdles, and data privacy concerns. These factors can hinder the adoption of satellite imagery solutions across various industries.

What opportunities exist in the Spain Satellite Imagery Services Market?

Opportunities in the Spain Satellite Imagery Services Market include the growing use of artificial intelligence for image analysis, the expansion of Internet of Things (IoT) applications, and increasing investments in smart agriculture. These trends are likely to enhance service offerings and market reach.

What trends are shaping the Spain Satellite Imagery Services Market?

Trends shaping the Spain Satellite Imagery Services Market include the integration of machine learning for improved data processing, the rise of small satellite constellations, and enhanced collaboration between public and private sectors. These innovations are expected to drive efficiency and accessibility in satellite imagery services.

Spain Satellite Imagery Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Orthophoto, 3D Mapping, Remote Sensing, Aerial Surveying |

| Technology | Multispectral, Hyperspectral, LiDAR, Radar |

| End User | Agriculture, Urban Planning, Environmental Monitoring, Defense |

| Application | Disaster Management, Land Use Planning, Infrastructure Development, Climate Research |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Satellite Imagery Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at