444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain satellite communications market represents a dynamic and rapidly evolving sector within the country’s telecommunications infrastructure. Satellite communications in Spain encompass a comprehensive range of services including direct-to-home broadcasting, mobile satellite services, fixed satellite services, and emerging applications in Internet of Things connectivity. The market has experienced substantial growth driven by increasing demand for high-speed internet connectivity, particularly in rural and remote areas where terrestrial infrastructure remains limited.

Spain’s strategic position in southwestern Europe makes it a crucial gateway for satellite communications serving both European and North African markets. The country’s satellite communications infrastructure supports diverse applications ranging from traditional broadcasting and telecommunications to advanced services including maritime communications, aviation connectivity, and emergency response systems. Recent technological advances in high-throughput satellites and low Earth orbit constellations have significantly enhanced the market’s growth prospects.

Market dynamics indicate robust expansion with the sector experiencing approximately 8.5% annual growth in recent years. The integration of satellite communications with 5G networks and the increasing adoption of satellite-based broadband services in underserved regions continue to drive market momentum. Government initiatives supporting digital infrastructure development and the European Space Agency’s programs have further strengthened Spain’s position in the satellite communications landscape.

The Spain satellite communications market refers to the comprehensive ecosystem of satellite-based communication services, infrastructure, and technologies operating within Spanish territory and serving Spanish consumers, businesses, and government entities. This market encompasses the deployment, operation, and utilization of satellite systems for various communication purposes including voice, data, video, and specialized applications across multiple sectors.

Satellite communications in this context include geostationary satellite services, medium Earth orbit systems, and emerging low Earth orbit constellations that provide connectivity solutions. The market covers both space segment services provided by satellite operators and ground segment infrastructure including satellite dishes, terminals, and associated equipment. Service categories range from traditional fixed satellite services and mobile satellite communications to advanced applications such as satellite internet, machine-to-machine communications, and Internet of Things connectivity.

The market definition also encompasses value-added services including satellite-based navigation, earth observation applications, and integrated communication solutions that combine satellite and terrestrial technologies. This comprehensive approach reflects the evolving nature of satellite communications as a critical component of Spain’s digital infrastructure and economic development strategy.

Spain’s satellite communications market demonstrates remarkable resilience and growth potential, positioning itself as a key player in the European satellite communications landscape. The market benefits from strong government support, strategic geographic location, and increasing demand for reliable connectivity solutions across diverse sectors. Key growth drivers include the expansion of broadband services to rural areas, maritime and aviation connectivity requirements, and the integration of satellite communications with emerging technologies.

Market segmentation reveals diverse opportunities across fixed satellite services, mobile satellite communications, and satellite broadcasting. The fixed satellite services segment maintains the largest market share at approximately 45% of total market activity, while mobile satellite services show the highest growth potential with increasing adoption in maritime and land mobile applications. Broadcasting services continue to represent a stable revenue stream, though facing challenges from streaming and terrestrial alternatives.

Technological innovation drives market transformation with high-throughput satellites, software-defined satellites, and low Earth orbit constellations creating new service possibilities. The market’s future outlook remains positive with projected growth rates exceeding 7% annually through the forecast period. Strategic partnerships between Spanish companies and international satellite operators, combined with supportive regulatory frameworks, position the market for sustained expansion and technological advancement.

Critical market insights reveal several transformative trends shaping Spain’s satellite communications landscape. The following key insights provide strategic understanding of market dynamics:

Primary market drivers propelling Spain’s satellite communications sector encompass technological, economic, and regulatory factors that create sustained growth momentum. Digital transformation initiatives across government and private sectors generate substantial demand for reliable, high-capacity communication solutions that satellite systems uniquely provide.

Rural broadband expansion represents a fundamental driver as Spain addresses connectivity gaps in remote and mountainous regions. Government programs supporting digital inclusion create market opportunities for satellite internet services, with rural connectivity projects showing 18% annual growth in satellite service adoption. Geographic challenges in Spain’s diverse terrain make satellite communications essential for achieving universal broadband coverage goals.

Maritime industry requirements drive significant demand for satellite communications services. Spain’s position as a major maritime nation, combined with increasing regulatory requirements for vessel tracking and communication systems, creates sustained market growth. Commercial shipping, fishing fleets, and recreational boating sectors contribute to expanding mobile satellite services demand.

Emergency preparedness and disaster recovery applications increasingly rely on satellite communications for resilient connectivity. Recent natural disasters have highlighted the critical importance of satellite-based backup communications, leading to increased investment in satellite emergency response capabilities. Public safety agencies and critical infrastructure operators recognize satellite communications as essential for operational continuity.

Market restraints present challenges that satellite communications providers must navigate to achieve optimal growth in the Spanish market. High infrastructure costs associated with satellite deployment and ground segment development create barriers for new market entrants and limit service expansion in price-sensitive segments.

Regulatory complexity poses ongoing challenges as satellite communications operators must comply with national, European, and international regulatory frameworks. Spectrum allocation procedures and licensing requirements can delay service launches and increase operational complexity. Cross-border coordination requirements for satellite services add administrative burden and potential delays in service deployment.

Competition from terrestrial alternatives intensifies as fiber optic networks expand and 5G deployment accelerates. Terrestrial broadband services often provide lower latency and higher bandwidth at competitive prices in urban and suburban areas, limiting satellite communications to specific use cases and geographic regions. Technology perception challenges persist as some consumers associate satellite communications with older, less capable technologies.

Weather-related service interruptions can impact customer satisfaction and market adoption, particularly for applications requiring consistent connectivity. Atmospheric conditions specific to Spain’s climate patterns occasionally affect satellite signal quality, requiring robust system design and backup solutions. Technical complexity of satellite systems may deter some potential customers who prefer simpler terrestrial alternatives.

Significant market opportunities emerge from technological advancement, regulatory support, and evolving customer requirements in Spain’s satellite communications sector. Low Earth orbit satellite constellations create new possibilities for high-speed, low-latency satellite internet services that can compete directly with terrestrial broadband in many applications.

5G network integration presents substantial opportunities as satellite communications provide essential backhaul and coverage extension capabilities. Hybrid connectivity solutions combining satellite and terrestrial technologies offer enhanced reliability and performance for enterprise customers. Network slicing capabilities enable customized satellite communication services for specific industry verticals and applications.

Internet of Things applications represent a rapidly expanding opportunity segment with satellite communications enabling connectivity for remote sensors, agricultural monitoring systems, and asset tracking solutions. Smart agriculture initiatives in Spain’s significant agricultural sector create demand for satellite-based monitoring and communication systems. Environmental monitoring applications benefit from satellite communications’ ability to provide connectivity in remote and challenging locations.

Government digitalization programs create structured opportunities for satellite communications providers to participate in large-scale connectivity projects. Public-private partnerships enable collaborative approaches to expanding satellite communications infrastructure and services. European Union funding for digital infrastructure projects provides additional resources for satellite communications development and deployment.

Market dynamics in Spain’s satellite communications sector reflect the interplay of technological innovation, competitive pressures, and evolving customer demands. Technology convergence between satellite and terrestrial systems creates new service possibilities while challenging traditional market boundaries. Software-defined satellites enable more flexible and cost-effective service delivery, improving market competitiveness.

Competitive intensity increases as international satellite operators expand their Spanish operations and domestic companies enhance their service offerings. Market consolidation trends create larger, more capable service providers while potentially reducing competitive options for customers. Strategic partnerships between satellite operators and terrestrial network providers enable comprehensive connectivity solutions.

Customer expectations evolve toward higher performance, lower latency, and more affordable satellite communications services. Service quality requirements increase as satellite communications become integral to business operations and daily life. Pricing pressure intensifies as terrestrial alternatives improve and customer price sensitivity increases.

Regulatory evolution influences market dynamics through spectrum allocation decisions, licensing procedures, and international coordination requirements. European Space Agency initiatives and national space programs create opportunities while establishing technical and operational standards. Environmental considerations increasingly influence satellite system design and operation, with sustainability becoming a competitive differentiator.

Comprehensive research methodology employed for analyzing Spain’s satellite communications market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, satellite operators, service providers, and key customers across various sectors utilizing satellite communications services.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and government publications related to satellite communications and telecommunications infrastructure. Market data validation involves cross-referencing multiple sources and conducting expert interviews to verify market trends and projections. MarkWide Research analysts utilize proprietary databases and industry contacts to gather comprehensive market intelligence.

Quantitative analysis employs statistical modeling techniques to project market growth, segment performance, and competitive dynamics. Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis to provide context and interpretation for quantitative findings. Market segmentation analysis utilizes both top-down and bottom-up approaches to ensure comprehensive coverage of all market segments.

Data collection spans multiple time periods to identify trends and validate projections. Industry surveys and customer interviews provide insights into adoption patterns, satisfaction levels, and future requirements. Regulatory analysis examines policy developments and their potential impact on market dynamics and growth prospects.

Regional analysis of Spain’s satellite communications market reveals distinct patterns of adoption and growth across different geographic areas. Madrid and Barcelona metropolitan areas represent the largest markets for satellite communications services, accounting for approximately 35% of total market activity despite having extensive terrestrial infrastructure alternatives.

Coastal regions demonstrate strong demand for satellite communications driven by maritime industry requirements and tourism sector needs. Andalusia and Valencia regions show particular strength in satellite communications adoption, with maritime applications and rural connectivity driving growth. Galicia’s extensive coastline and fishing industry create sustained demand for mobile satellite services.

Rural and mountainous regions including parts of Castile and León, Extremadura, and Aragón represent high-growth markets for satellite internet services. Geographic challenges in these areas make satellite communications essential for achieving connectivity goals. Agricultural applications in these regions increasingly utilize satellite communications for precision farming and monitoring systems.

Island territories including the Balearic and Canary Islands rely heavily on satellite communications for backup connectivity and specialized applications. Tourism industry requirements in these regions drive demand for high-capacity satellite communications services. Strategic importance of these regions for Spain’s economy ensures continued investment in satellite communications infrastructure.

The competitive landscape of Spain’s satellite communications market features a diverse mix of international satellite operators, domestic service providers, and specialized technology companies. Market leadership is distributed among several key players, each with distinct strengths and market positioning strategies.

Competitive strategies emphasize service differentiation, technology innovation, and strategic partnerships to capture market opportunities. Market consolidation trends create opportunities for larger players to expand their Spanish operations through acquisitions and partnerships.

Market segmentation analysis reveals distinct categories within Spain’s satellite communications market, each with unique characteristics and growth dynamics. By Service Type segmentation provides the primary framework for understanding market structure and opportunities.

By Service Type:

By Application:

By Technology:

Fixed Satellite Services dominate the Spanish market with comprehensive enterprise and residential broadband offerings. High-throughput satellites enable competitive broadband services in rural areas where terrestrial infrastructure remains limited. Enterprise customers increasingly adopt satellite communications for backup connectivity and primary services in remote locations. Service quality improvements and competitive pricing enhance market attractiveness for fixed satellite services.

Mobile Satellite Services experience robust growth driven by maritime industry requirements and expanding land mobile applications. Fishing fleets and commercial shipping companies represent core customer segments with regulatory compliance driving adoption. Emergency services and disaster recovery applications create additional demand for mobile satellite communications. Technology advances in mobile satellite terminals improve service quality and reduce costs.

Satellite Broadcasting maintains market stability despite competition from streaming services and terrestrial alternatives. Direct-to-home television services continue serving customers in areas with limited terrestrial broadcasting coverage. Content distribution applications support Spain’s media industry with reliable, high-capacity connectivity. Ultra-high-definition broadcasting creates new opportunities for satellite operators with advanced capacity.

Emerging Applications including Internet of Things connectivity and machine-to-machine communications show significant growth potential. Agricultural monitoring systems utilize satellite communications for remote sensor networks and precision farming applications. Asset tracking and logistics applications benefit from satellite communications’ global coverage capabilities. Smart city initiatives incorporate satellite communications for comprehensive connectivity solutions.

Industry participants in Spain’s satellite communications market benefit from diverse opportunities and strategic advantages. Satellite operators gain access to a sophisticated European market with strong regulatory framework and growing demand for advanced communications services. Geographic diversity within Spain provides multiple market segments and application opportunities.

Service providers benefit from expanding customer base and increasing demand for satellite communications across multiple sectors. Technology integration opportunities enable comprehensive connectivity solutions combining satellite and terrestrial services. Government support for digital infrastructure development creates structured market opportunities and funding possibilities.

Equipment manufacturers benefit from growing demand for satellite terminals, ground stations, and associated infrastructure. Technology advancement requirements drive innovation and product development opportunities. Export potential exists as Spanish companies develop expertise and solutions applicable to international markets.

End customers benefit from improved connectivity options, competitive pricing, and enhanced service quality. Rural communities gain access to high-speed internet services previously unavailable through terrestrial infrastructure. Enterprise customers obtain reliable backup connectivity and specialized communication solutions. Government agencies enhance emergency preparedness and public service delivery capabilities through satellite communications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shape the evolution of Spain’s satellite communications market, creating new opportunities and challenges for industry participants. Low Earth orbit satellite constellations represent the most significant trend, offering dramatically improved performance characteristics including reduced latency and higher throughput capabilities.

Software-defined satellites enable more flexible and cost-effective service delivery through programmable payloads and dynamic resource allocation. Artificial intelligence integration optimizes satellite operations, improves service quality, and enables predictive maintenance capabilities. Edge computing applications bring processing capabilities closer to end users, reducing latency and improving application performance.

Hybrid connectivity solutions combining satellite and terrestrial technologies create seamless communication experiences for customers. Network slicing capabilities enable customized satellite communication services tailored to specific industry requirements and applications. Sustainability initiatives drive development of more environmentally friendly satellite systems and operations.

5G integration creates new opportunities for satellite communications as backhaul providers and coverage extension solutions. Internet of Things applications expand rapidly with satellite communications enabling connectivity for remote sensors and devices. Cybersecurity enhancement becomes increasingly important as satellite communications handle more sensitive and critical applications. According to MarkWide Research analysis, these trends collectively drive market transformation and create new growth opportunities.

Recent industry developments demonstrate the dynamic nature of Spain’s satellite communications market and highlight significant investments and strategic initiatives. Hispasat’s expansion of high-throughput satellite capacity enhances service capabilities for Spanish and international customers. New satellite launches increase available capacity and improve service quality across multiple market segments.

Strategic partnerships between satellite operators and terrestrial network providers create integrated connectivity solutions. Government contracts for rural broadband expansion provide structured growth opportunities for satellite communications providers. Technology investments in ground infrastructure and satellite terminals improve service quality and reduce costs.

Regulatory developments including spectrum allocation decisions and licensing procedures influence market dynamics and competitive positioning. European Space Agency programs support technology development and market expansion initiatives. International cooperation agreements enhance Spain’s position in global satellite communications markets.

Customer adoption of satellite communications accelerates across multiple sectors including agriculture, maritime, and emergency services. Service innovations including managed satellite services and cloud-based applications create new revenue opportunities. Market consolidation activities reshape competitive landscape and create larger, more capable service providers.

Strategic recommendations for satellite communications market participants focus on leveraging emerging opportunities while addressing market challenges. Technology investment in next-generation satellite systems and ground infrastructure remains essential for maintaining competitive positioning. Service differentiation through specialized applications and vertical market solutions creates sustainable competitive advantages.

Partnership strategies with terrestrial network operators enable comprehensive connectivity solutions and market expansion opportunities. Customer education initiatives help overcome technology perception challenges and demonstrate satellite communications capabilities. Regulatory engagement ensures favorable policy development and spectrum allocation decisions.

Market expansion into emerging applications including Internet of Things and smart city initiatives provides growth opportunities. International collaboration leverages Spain’s strategic position for serving broader European and North African markets. Sustainability initiatives address environmental concerns and create competitive differentiation.

Investment priorities should focus on low Earth orbit technologies, software-defined capabilities, and artificial intelligence integration. Customer relationship management becomes increasingly important as market competition intensifies. MWR analysis suggests that companies adopting comprehensive digital transformation strategies will achieve superior market performance and customer satisfaction.

The future outlook for Spain’s satellite communications market remains highly positive with sustained growth expected across multiple segments and applications. Market expansion will be driven by technological advancement, increasing demand for connectivity, and supportive regulatory environment. Growth projections indicate the market will maintain momentum with annual growth rates exceeding 7.5% through the forecast period.

Technology evolution will continue transforming market dynamics with low Earth orbit constellations, software-defined satellites, and artificial intelligence integration creating new service possibilities. 5G network deployment will create additional opportunities for satellite communications as backhaul and coverage extension solutions. Internet of Things applications will drive demand for satellite-based connectivity in remote and challenging environments.

Market consolidation trends will likely continue as companies seek scale advantages and comprehensive service capabilities. International expansion opportunities will emerge as Spanish companies develop expertise and competitive advantages. Government support for digital infrastructure and space technology development will continue providing market opportunities and funding resources.

Emerging applications including smart agriculture, environmental monitoring, and disaster management will create new market segments and revenue opportunities. Sustainability considerations will increasingly influence satellite system design and operations. Customer expectations for higher performance, lower costs, and integrated solutions will drive continued innovation and service development. MarkWide Research projects that companies successfully adapting to these trends will achieve superior market performance and sustainable competitive advantages.

Spain’s satellite communications market represents a dynamic and rapidly evolving sector with substantial growth potential and diverse opportunities for industry participants. Market fundamentals remain strong with increasing demand for connectivity, supportive government policies, and technological advancement driving sustained expansion. Strategic positioning as a European gateway and advanced telecommunications infrastructure provide competitive advantages for Spanish market participants.

Technology transformation through low Earth orbit constellations, software-defined satellites, and artificial intelligence integration creates new service possibilities and market opportunities. Market segmentation across fixed satellite services, mobile satellite communications, and emerging applications provides multiple growth vectors and revenue streams. Competitive landscape evolution through consolidation and strategic partnerships enhances market capabilities and service offerings.

Future success in Spain’s satellite communications market will depend on effective technology adoption, strategic partnerships, and customer-focused service development. Industry participants who successfully navigate market challenges while capitalizing on emerging opportunities will achieve sustainable growth and competitive positioning. The market’s positive outlook, supported by strong fundamentals and favorable trends, positions Spain’s satellite communications sector for continued expansion and technological leadership in the European market.

What is Satellite Communications?

Satellite communications refer to the use of satellite technology to transmit data, voice, and video signals across long distances. This technology is essential for various applications, including television broadcasting, internet services, and military communications.

What are the key players in the Spain Satellite Communications Market?

Key players in the Spain Satellite Communications Market include Hispasat, Eutelsat, and SES S.A. These companies provide a range of satellite services, including broadband internet, television broadcasting, and data transmission, among others.

What are the growth factors driving the Spain Satellite Communications Market?

The growth of the Spain Satellite Communications Market is driven by increasing demand for high-speed internet services, the expansion of broadcasting services, and the rising need for reliable communication in remote areas. Additionally, advancements in satellite technology are enhancing service capabilities.

What challenges does the Spain Satellite Communications Market face?

The Spain Satellite Communications Market faces challenges such as high operational costs, regulatory hurdles, and competition from terrestrial communication technologies. These factors can impact the profitability and growth potential of satellite service providers.

What opportunities exist in the Spain Satellite Communications Market?

Opportunities in the Spain Satellite Communications Market include the growing demand for satellite-based IoT solutions, the potential for expanding services in rural areas, and advancements in satellite technology that enable new applications. These factors can lead to increased market penetration and service diversification.

What trends are shaping the Spain Satellite Communications Market?

Trends shaping the Spain Satellite Communications Market include the shift towards high-throughput satellites, the integration of satellite and terrestrial networks, and the increasing use of satellite communications for disaster recovery and emergency response. These trends are enhancing the overall efficiency and reliability of satellite services.

Spain Satellite Communications Market

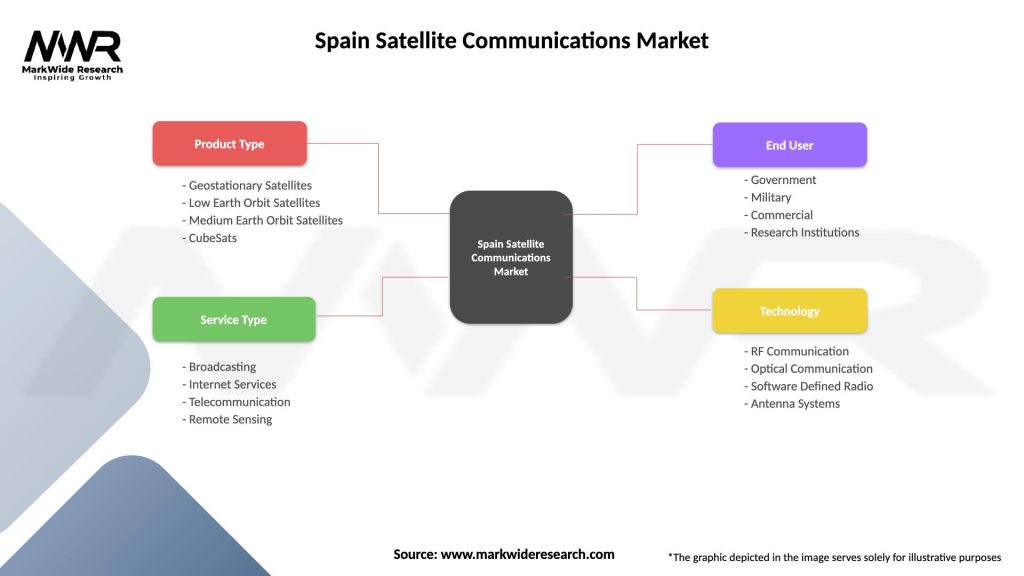

| Segmentation Details | Description |

|---|---|

| Product Type | Geostationary Satellites, Low Earth Orbit Satellites, Medium Earth Orbit Satellites, CubeSats |

| Service Type | Broadcasting, Internet Services, Telecommunication, Remote Sensing |

| End User | Government, Military, Commercial, Research Institutions |

| Technology | RF Communication, Optical Communication, Software Defined Radio, Antenna Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Satellite Communications Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at