444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain prefabricated buildings market represents a dynamic and rapidly evolving sector within the country’s construction industry. Prefabricated construction has gained significant momentum across Spain, driven by increasing demand for sustainable, cost-effective, and time-efficient building solutions. The market encompasses various segments including residential, commercial, industrial, and institutional applications, with modular construction technologies leading the transformation of traditional building practices.

Market dynamics indicate substantial growth potential, with the sector experiencing a 12.5% annual growth rate in adoption across key metropolitan areas. Spanish construction companies are increasingly embracing off-site manufacturing techniques to address housing shortages, reduce construction timelines, and meet stringent environmental regulations. The integration of Building Information Modeling (BIM) and advanced manufacturing technologies has enhanced the precision and quality of prefabricated structures throughout Spain.

Regional distribution shows concentrated activity in major urban centers including Madrid, Barcelona, Valencia, and Seville, where 65% of prefabricated projects are currently concentrated. The market benefits from supportive government policies promoting sustainable construction practices and energy-efficient building solutions, creating favorable conditions for continued expansion of the prefabricated buildings sector.

The Spain prefabricated buildings market refers to the comprehensive ecosystem of companies, technologies, and services involved in the design, manufacturing, and assembly of building components that are constructed off-site in controlled factory environments before being transported and assembled at their final locations. This market encompasses various construction methodologies including modular construction, panelized systems, and volumetric prefabrication.

Prefabricated construction in Spain involves the systematic production of building elements such as walls, floors, roofs, and complete structural modules in specialized manufacturing facilities. These components are then transported to construction sites where they are assembled using standardized connection systems and construction techniques. The approach represents a fundamental shift from traditional stick-built construction methods toward more industrialized and efficient building processes.

Key characteristics of the Spanish prefabricated buildings market include emphasis on quality control, reduced construction waste, enhanced safety protocols, and improved project scheduling predictability. The market serves diverse applications ranging from single-family homes and multi-story residential complexes to commercial offices, educational facilities, and industrial structures throughout Spain’s varied geographic and climatic regions.

Spain’s prefabricated buildings market demonstrates robust growth trajectory supported by evolving consumer preferences, technological advancements, and regulatory frameworks favoring sustainable construction practices. The sector has experienced significant transformation over recent years, with modern prefabrication techniques gaining acceptance among developers, architects, and end-users across residential and commercial segments.

Market penetration has reached approximately 18% of new construction projects in major Spanish cities, indicating substantial room for continued expansion. The residential segment leads market adoption, driven by housing affordability challenges and growing awareness of energy-efficient building solutions. Commercial and institutional segments are experiencing accelerated growth as organizations recognize the benefits of faster project delivery and reduced construction disruption.

Technological innovation serves as a primary market driver, with Spanish manufacturers investing heavily in automated production systems, digital design tools, and sustainable material technologies. The integration of renewable energy systems and smart building technologies into prefabricated structures has enhanced their market appeal and competitive positioning against traditional construction methods.

Regional expansion beyond major metropolitan areas presents significant opportunities, with smaller cities and rural communities increasingly considering prefabricated solutions for housing developments, educational facilities, and healthcare infrastructure projects throughout Spain’s diverse regional markets.

Strategic market insights reveal several critical trends shaping the Spain prefabricated buildings landscape. The following key observations provide comprehensive understanding of current market dynamics:

Market maturation is evident through increased standardization of connection systems, improved transportation logistics, and development of comprehensive supply chain networks supporting prefabricated construction projects across Spain’s diverse geographic regions.

Primary market drivers propelling growth in Spain’s prefabricated buildings sector encompass economic, environmental, and technological factors that collectively create favorable conditions for continued market expansion. These driving forces reflect broader trends in construction industry evolution and changing societal priorities regarding building practices.

Housing affordability challenges represent a fundamental driver, with prefabricated construction offering cost-effective solutions for addressing Spain’s housing shortage. The ability to reduce construction costs through economies of scale in manufacturing and reduced on-site labor requirements makes prefabricated buildings attractive to developers and homebuyers facing budget constraints.

Environmental sustainability requirements are increasingly influencing construction decisions, with prefabricated buildings offering superior energy efficiency and reduced environmental impact compared to traditional construction methods. Factory-controlled production environments enable precise installation of insulation systems and building envelope components, resulting in enhanced thermal performance and reduced energy consumption.

Labor shortage issues in Spain’s construction industry are driving adoption of prefabricated solutions that require fewer on-site workers and specialized trades. The controlled factory environment allows for more efficient use of skilled labor while reducing dependency on weather conditions and site-specific challenges that can impact traditional construction projects.

Technological advancement in manufacturing processes, including automation and digital design tools, is making prefabricated construction more precise, efficient, and cost-effective. The integration of Building Information Modeling (BIM) throughout the design and manufacturing process enhances coordination and reduces errors that commonly occur in traditional construction projects.

Market restraints affecting the Spain prefabricated buildings sector include various challenges that may limit growth potential and market penetration. Understanding these constraints is essential for stakeholders developing strategies to overcome barriers and capitalize on market opportunities.

Traditional construction preferences among consumers and construction professionals represent a significant restraint, with many stakeholders maintaining skepticism about prefabricated building quality and durability. Overcoming these perceptions requires continued demonstration of superior performance and long-term reliability of modern prefabricated structures.

Regulatory complexities can create challenges for prefabricated construction projects, particularly when building codes and approval processes are designed primarily for traditional construction methods. Navigating municipal approval processes and ensuring compliance with local building standards may require additional time and resources compared to conventional construction approaches.

Transportation limitations pose logistical challenges, especially for larger prefabricated modules that require specialized transportation equipment and may face restrictions on certain roadways. The need to coordinate delivery schedules with assembly activities can create scheduling complexities that impact project timelines.

Initial capital investment requirements for establishing prefabricated manufacturing facilities represent a barrier for smaller construction companies seeking to enter the market. The specialized equipment and facility requirements may limit market participation to larger organizations with sufficient financial resources.

Design standardization requirements inherent in prefabricated construction may limit architectural flexibility compared to traditional building methods, potentially reducing appeal for projects requiring unique or highly customized design solutions.

Significant market opportunities exist within Spain’s prefabricated buildings sector, driven by evolving market conditions, technological innovations, and changing consumer preferences. These opportunities represent potential areas for growth and market expansion across various segments and applications.

Rural housing development presents substantial opportunities as prefabricated construction can provide cost-effective housing solutions in areas where traditional construction may be less economically viable. The ability to transport completed modules to remote locations opens new markets for residential development throughout Spain’s rural regions.

Educational facility construction offers significant potential, with schools and universities seeking faster construction methods to address growing enrollment demands. Prefabricated classroom modules and educational buildings can be deployed rapidly to meet urgent capacity requirements while maintaining high-quality learning environments.

Healthcare infrastructure expansion represents an emerging opportunity, particularly following increased focus on healthcare capacity and emergency response capabilities. Prefabricated medical facilities can be constructed and deployed quickly to address healthcare access challenges in underserved areas.

Tourism accommodation development presents opportunities for prefabricated hospitality structures, including hotels, resorts, and vacation rental properties. The ability to construct attractive, sustainable accommodations with reduced environmental impact aligns with growing eco-tourism trends.

Industrial applications including warehouses, manufacturing facilities, and logistics centers offer substantial growth potential as businesses seek flexible, expandable building solutions that can adapt to changing operational requirements. The 35% growth rate in e-commerce logistics facilities creates particular opportunities for prefabricated industrial structures.

Market dynamics within Spain’s prefabricated buildings sector reflect complex interactions between supply-side capabilities, demand-side requirements, and external factors influencing market evolution. These dynamics create both challenges and opportunities that shape competitive positioning and strategic decision-making.

Supply chain optimization has emerged as a critical dynamic, with manufacturers developing integrated networks of suppliers, transportation providers, and assembly contractors. The efficiency of these supply chains directly impacts project costs, delivery schedules, and overall market competitiveness of prefabricated solutions.

Technology adoption rates vary significantly across different market segments, with larger construction companies typically leading in implementation of advanced prefabrication technologies. This creates competitive advantages for early adopters while potentially limiting market access for traditional contractors lacking technological capabilities.

Regulatory evolution continues to influence market dynamics as building codes and standards adapt to accommodate prefabricated construction methods. Progressive regulatory frameworks that recognize the benefits of factory-built construction create more favorable market conditions and reduce barriers to adoption.

Consumer acceptance is gradually shifting toward greater appreciation of prefabricated building benefits, driven by successful project demonstrations and improved understanding of modern prefabrication capabilities. This evolution in market perception creates positive momentum for continued sector growth.

Competitive intensity is increasing as more companies enter the prefabricated buildings market, leading to innovation in design capabilities, manufacturing processes, and service offerings. This competition benefits customers through improved quality and competitive pricing while challenging companies to differentiate their market positioning.

Comprehensive research methodology employed in analyzing Spain’s prefabricated buildings market incorporates multiple data collection and analysis techniques to ensure accurate and reliable market insights. The research approach combines quantitative analysis with qualitative assessments to provide holistic understanding of market conditions and trends.

Primary research activities include structured interviews with industry executives, construction professionals, architects, and end-users to gather firsthand insights about market conditions, challenges, and opportunities. These interviews provide valuable perspectives on market dynamics that may not be apparent through secondary research alone.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and academic studies related to prefabricated construction in Spain. This research provides historical context and quantitative data supporting market analysis and trend identification.

Market segmentation analysis examines different applications, technologies, and regional markets to identify specific growth opportunities and competitive dynamics within each segment. This detailed segmentation provides targeted insights for stakeholders focusing on particular market niches.

Competitive landscape assessment evaluates key market participants, their capabilities, market positioning, and strategic initiatives. This analysis helps identify competitive advantages and potential areas for market differentiation among prefabricated building providers.

Trend analysis incorporates examination of technological developments, regulatory changes, and market evolution patterns to identify emerging opportunities and potential challenges facing the prefabricated buildings sector in Spain.

Regional market analysis reveals significant variations in prefabricated buildings adoption across Spain’s diverse geographic regions, with distinct patterns reflecting local economic conditions, regulatory environments, and market maturity levels. Understanding these regional differences is crucial for developing targeted market strategies.

Madrid region leads the Spanish prefabricated buildings market, accounting for approximately 28% of national market activity. The region benefits from strong economic growth, supportive regulatory framework, and concentration of construction industry expertise. Major residential and commercial prefabricated projects in Madrid demonstrate the viability and benefits of modern prefabrication technologies.

Catalonia region, centered around Barcelona, represents the second-largest regional market with 22% market share. The region’s emphasis on sustainable construction practices and architectural innovation creates favorable conditions for prefabricated building adoption. Catalonia’s manufacturing capabilities and logistics infrastructure support efficient prefabricated construction supply chains.

Valencia region shows strong growth potential in prefabricated construction, particularly in residential and tourism-related applications. The region’s coastal location and growing population create demand for efficient construction methods that can deliver quality housing and commercial facilities rapidly.

Andalusia region presents emerging opportunities for prefabricated buildings, especially in rural housing development and tourism infrastructure. The region’s large geographic area and diverse economic activities create varied applications for prefabricated construction solutions.

Northern regions including Basque Country and Galicia demonstrate increasing interest in prefabricated buildings for industrial and commercial applications, leveraging the regions’ manufacturing expertise and export-oriented economies.

Competitive landscape within Spain’s prefabricated buildings market includes diverse participants ranging from specialized prefabrication manufacturers to traditional construction companies expanding into off-site construction capabilities. The market structure reflects ongoing evolution as new technologies and business models reshape competitive dynamics.

Market positioning varies significantly among competitors, with some focusing on cost leadership through standardized products while others emphasize customization and premium design capabilities. The competitive environment encourages innovation in manufacturing processes, design flexibility, and customer service offerings.

Strategic partnerships between prefabrication companies and traditional construction firms are becoming increasingly common, allowing market participants to leverage complementary capabilities and expand market reach while sharing risks and resources.

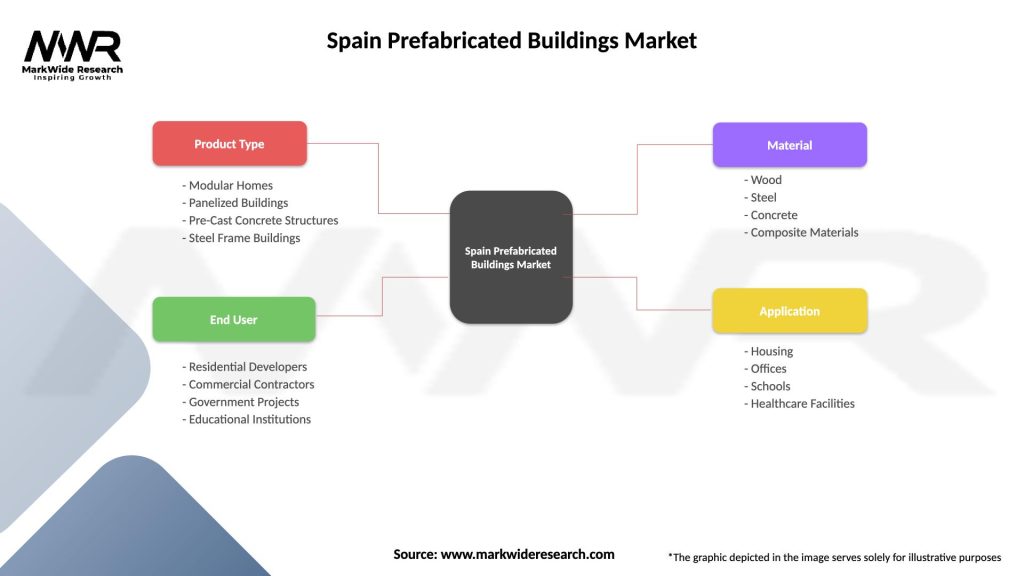

Market segmentation within Spain’s prefabricated buildings sector reveals distinct categories based on application, construction method, material type, and end-user requirements. This segmentation provides detailed insights into specific market dynamics and growth opportunities across different building categories.

By Application:

By Construction Method:

By Material Type:

Category-specific insights provide detailed understanding of performance and growth potential across different segments of Spain’s prefabricated buildings market. Each category demonstrates unique characteristics, challenges, and opportunities that influence strategic decision-making and market positioning.

Residential Category: The residential segment dominates market activity with 42% of total prefabricated construction projects. Single-family homes lead this category, driven by consumer demand for affordable, energy-efficient housing solutions. Multi-family residential developments are experiencing accelerated growth as developers recognize the benefits of reduced construction timelines and improved quality control.

Commercial Category: Commercial prefabricated buildings show strong growth momentum, particularly in office and retail applications. The category benefits from business requirements for flexible, expandable building solutions that can adapt to changing operational needs. Sustainable design features and rapid occupancy capabilities make prefabricated commercial buildings increasingly attractive to corporate tenants.

Industrial Category: Industrial prefabricated structures demonstrate consistent demand driven by logistics and manufacturing sector growth. Warehouse and distribution center applications lead this category, with standardized building systems providing cost-effective solutions for rapidly expanding e-commerce and logistics operations.

Institutional Category: Educational and healthcare applications within the institutional category show significant growth potential. Schools and universities utilize prefabricated classroom modules to address capacity constraints, while healthcare facilities benefit from controlled manufacturing environments that ensure compliance with stringent hygiene and safety requirements.

Technology Integration: Advanced building technologies including smart building systems and renewable energy integration are becoming standard features across all categories, enhancing the value proposition of prefabricated buildings compared to traditional construction alternatives.

Industry participants and stakeholders in Spain’s prefabricated buildings market realize numerous benefits that contribute to improved business performance, enhanced customer satisfaction, and sustainable growth opportunities. These benefits extend across the entire value chain from manufacturers to end-users.

For Manufacturers:

For Developers and Contractors:

For End-Users:

SWOT Analysis provides comprehensive evaluation of internal strengths and weaknesses alongside external opportunities and threats affecting Spain’s prefabricated buildings market. This analysis supports strategic planning and risk management for market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Spain’s prefabricated buildings sector reflect evolving industry practices, technological innovations, and changing customer expectations. These trends provide insights into future market direction and strategic opportunities for industry participants.

Sustainable Construction Focus: Environmental sustainability has become a primary trend, with green building certifications and energy-efficient design features becoming standard requirements for prefabricated buildings. Manufacturers are incorporating renewable materials, solar energy systems, and advanced insulation technologies to meet growing environmental expectations.

Digital Integration: The integration of digital technologies throughout the design, manufacturing, and assembly process is transforming prefabricated construction. Building Information Modeling (BIM), virtual reality design tools, and automated manufacturing systems are enhancing precision and efficiency while reducing errors and rework.

Customization Capabilities: Modern prefabrication systems increasingly offer mass customization options that combine manufacturing efficiency with design flexibility. Advanced manufacturing technologies enable cost-effective production of customized building components while maintaining standardized production processes.

Smart Building Integration: Prefabricated buildings increasingly incorporate smart building technologies including automated climate control, security systems, and energy management capabilities. Factory installation of these systems ensures proper integration and testing before building delivery.

Modular Expansion: Growing demand for expandable building solutions is driving development of modular systems that can be easily modified or expanded to meet changing space requirements. This trend particularly benefits commercial and institutional applications where future growth is anticipated.

Quality Transparency: Increased focus on quality documentation and performance verification is building customer confidence in prefabricated construction. Manufacturers are providing detailed quality reports and performance guarantees to address traditional concerns about prefabricated building quality.

Recent industry developments within Spain’s prefabricated buildings market demonstrate ongoing innovation and market evolution. These developments reflect strategic initiatives by market participants and broader industry trends that influence competitive dynamics and market opportunities.

Manufacturing Facility Expansions: Several leading prefabrication companies have announced significant expansions of their manufacturing capabilities to meet growing market demand. These investments include advanced automation equipment and expanded production capacity to serve larger projects and new market segments.

Technology Partnerships: Strategic partnerships between prefabrication manufacturers and technology companies are accelerating innovation in building design and manufacturing processes. These collaborations focus on digital design tools, automated production systems, and smart building integration capabilities.

Regulatory Developments: Spanish building authorities have introduced updated standards and guidelines specifically addressing prefabricated construction methods. These regulatory developments provide clearer frameworks for quality assurance and building approval processes, reducing barriers to market adoption.

Sustainability Initiatives: Industry participants are launching comprehensive sustainability programs focusing on carbon footprint reduction, renewable material usage, and circular economy principles. These initiatives align with broader environmental objectives and customer expectations for sustainable building solutions.

Market Consolidation: Strategic acquisitions and mergers within the prefabricated buildings sector are creating larger, more capable organizations with enhanced manufacturing capabilities and broader market reach. This consolidation trend is improving industry competitiveness and service capabilities.

International Expansion: Spanish prefabrication companies are increasingly pursuing international market opportunities, leveraging their expertise and manufacturing capabilities to serve markets throughout Europe and Latin America. These expansion initiatives demonstrate the maturity and competitiveness of Spanish prefabrication capabilities.

Strategic recommendations for stakeholders in Spain’s prefabricated buildings market focus on capitalizing on growth opportunities while addressing market challenges and competitive pressures. MarkWide Research analysis suggests several key strategic priorities for market participants.

Technology Investment: Companies should prioritize investments in advanced manufacturing technologies including automation systems, digital design tools, and quality control equipment. These investments enhance production efficiency, product quality, and competitive positioning while reducing long-term operational costs.

Market Education: Continued efforts to educate customers, architects, and construction professionals about the benefits and capabilities of modern prefabricated construction are essential for market development. Demonstration projects and case studies showcasing successful prefabricated buildings can help overcome traditional perceptions and build market confidence.

Supply Chain Optimization: Developing robust supply chain networks including material suppliers, transportation providers, and assembly contractors is crucial for operational efficiency and customer satisfaction. Strategic partnerships throughout the supply chain can improve service delivery and reduce project risks.

Regulatory Engagement: Active participation in regulatory development processes helps ensure that building codes and standards accommodate prefabricated construction methods. Industry collaboration with regulatory authorities can facilitate streamlined approval processes and reduced administrative barriers.

Sustainability Leadership: Positioning prefabricated buildings as sustainable construction solutions through environmental certifications, energy efficiency features, and sustainable material usage can differentiate offerings and appeal to environmentally conscious customers.

Market Diversification: Expanding into new application areas and geographic regions can reduce market concentration risks and capitalize on emerging opportunities. Rural markets and specialized applications present particular growth potential for prefabricated building solutions.

Future market outlook for Spain’s prefabricated buildings sector indicates continued growth and evolution driven by technological advancement, changing construction industry practices, and increasing acceptance of off-site construction methods. MWR projections suggest sustained market expansion across multiple building segments and geographic regions.

Growth trajectory analysis indicates the market will experience accelerated adoption rates over the next five years, with penetration rates potentially reaching 30% of new construction projects in major metropolitan areas. This growth reflects improving market awareness, technological capabilities, and competitive economics of prefabricated construction solutions.

Technology evolution will continue driving market development through enhanced manufacturing capabilities, improved design flexibility, and integrated smart building features. Artificial intelligence and machine learning applications in design optimization and manufacturing processes will further improve efficiency and customization capabilities.

Market maturation will result in improved standardization, enhanced quality assurance processes, and more sophisticated supply chain networks supporting prefabricated construction projects. This maturation will reduce market barriers and improve customer confidence in prefabricated building solutions.

Regional expansion beyond current market concentrations will create new growth opportunities as prefabricated construction becomes more widely accepted and accessible throughout Spain. Rural markets and smaller cities represent significant untapped potential for various prefabricated building applications.

International competitiveness of Spanish prefabrication companies will continue improving, creating export opportunities and potential for technology transfer to other markets. This international expansion will contribute to industry growth and technological advancement.

Sustainability integration will become increasingly sophisticated, with prefabricated buildings incorporating advanced environmental technologies and achieving superior performance compared to traditional construction methods. This environmental leadership will support continued market growth and regulatory support.

Spain’s prefabricated buildings market represents a dynamic and rapidly evolving sector with substantial growth potential across residential, commercial, industrial, and institutional applications. The market benefits from favorable economic conditions, technological advancement, and increasing recognition of prefabricated construction benefits including improved quality, reduced timelines, and enhanced sustainability performance.

Market fundamentals remain strong, supported by housing demand, construction industry labor challenges, and regulatory frameworks favoring sustainable building practices. The integration of advanced manufacturing technologies, digital design tools, and smart building features continues to enhance the value proposition of prefabricated buildings compared to traditional construction methods.

Strategic opportunities exist for market participants willing to invest in technology, develop comprehensive service capabilities, and address evolving customer requirements. Success in this market requires understanding of local conditions, regulatory environments, and customer preferences while maintaining focus on quality, efficiency, and innovation.

Future prospects for the Spain prefabricated buildings market appear favorable, with continued growth expected across all major segments and geographic regions. Companies that successfully navigate current challenges while capitalizing on emerging opportunities will be well-positioned to benefit from the ongoing transformation of Spain’s construction industry toward more efficient, sustainable, and technologically advanced building practices.

What is Prefabricated Buildings?

Prefabricated buildings are structures that are manufactured off-site in advance, typically in standard sections that can be easily transported and assembled. They are commonly used in residential, commercial, and industrial applications due to their efficiency and cost-effectiveness.

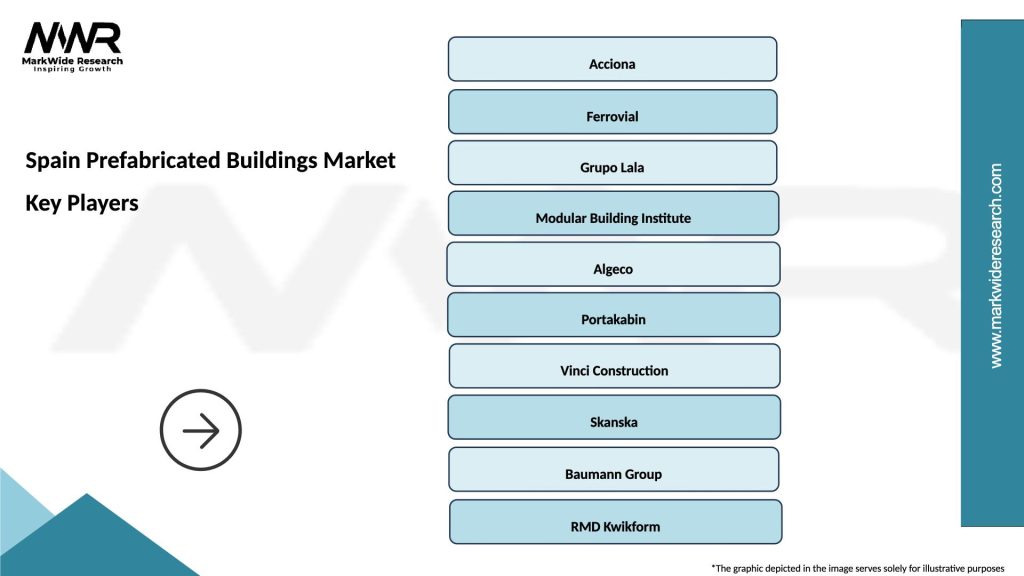

What are the key players in the Spain Prefabricated Buildings Market?

Key players in the Spain Prefabricated Buildings Market include companies like Grupo Lobe, Modulo, and Acciona, which specialize in various prefabricated construction solutions. These companies are known for their innovative designs and sustainable building practices, among others.

What are the growth factors driving the Spain Prefabricated Buildings Market?

The Spain Prefabricated Buildings Market is driven by factors such as the increasing demand for affordable housing, the need for rapid construction solutions, and a growing emphasis on sustainable building practices. Additionally, advancements in technology are enhancing the efficiency of prefabricated construction.

What challenges does the Spain Prefabricated Buildings Market face?

Challenges in the Spain Prefabricated Buildings Market include regulatory hurdles, potential quality control issues, and the perception of prefabricated buildings as lower quality compared to traditional construction. These factors can impact market growth and consumer acceptance.

What opportunities exist in the Spain Prefabricated Buildings Market?

The Spain Prefabricated Buildings Market presents opportunities in areas such as modular construction for urban housing, eco-friendly building materials, and smart building technologies. These trends are likely to attract investment and innovation in the sector.

What trends are shaping the Spain Prefabricated Buildings Market?

Trends in the Spain Prefabricated Buildings Market include the increasing use of sustainable materials, the integration of smart technologies in building design, and a shift towards modular construction methods. These trends are influencing how buildings are designed and constructed.

Spain Prefabricated Buildings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Homes, Panelized Buildings, Pre-Cast Concrete Structures, Steel Frame Buildings |

| End User | Residential Developers, Commercial Contractors, Government Projects, Educational Institutions |

| Material | Wood, Steel, Concrete, Composite Materials |

| Application | Housing, Offices, Schools, Healthcare Facilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Prefabricated Buildings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at