444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain pouch packaging market represents a dynamic and rapidly evolving segment within the European packaging industry, characterized by innovative flexible packaging solutions that cater to diverse consumer needs. Pouch packaging has emerged as a preferred choice for manufacturers across multiple sectors, including food and beverages, pharmaceuticals, personal care, and household products. The market demonstrates robust growth momentum driven by changing consumer preferences toward convenient, sustainable, and cost-effective packaging solutions.

Market dynamics in Spain reflect broader European trends toward flexible packaging adoption, with significant emphasis on sustainability and environmental consciousness. The Spanish market benefits from advanced manufacturing capabilities, strategic geographical positioning, and strong domestic demand from both traditional and emerging industries. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 6.2%, reflecting increasing adoption across various end-use applications.

Consumer behavior shifts toward on-the-go consumption, portion control, and premium product experiences have fundamentally transformed packaging requirements in Spain. The market encompasses various pouch formats including stand-up pouches, flat pouches, spouted pouches, and retort pouches, each serving specific functional and aesthetic requirements. Technological advancements in barrier properties, printing capabilities, and closure systems continue to drive market innovation and expansion opportunities.

The Spain pouch packaging market refers to the comprehensive ecosystem of flexible packaging solutions manufactured, distributed, and consumed within Spanish territory, encompassing various pouch formats designed for product protection, preservation, and consumer convenience. Pouch packaging represents a versatile packaging format characterized by flexible materials, innovative closure systems, and customizable designs that provide superior product protection while offering enhanced consumer experience through convenience and portability.

Flexible packaging solutions within this market include laminated structures combining multiple material layers to achieve specific barrier properties, mechanical strength, and visual appeal. The market encompasses both converter operations that transform raw materials into finished pouches and brand owner requirements across diverse industry sectors. Value chain integration extends from raw material suppliers through converting operations to end-user applications, creating a comprehensive market ecosystem.

Market scope includes various pouch configurations such as three-side sealed pouches, stand-up pouches with or without spouts, retort pouches for shelf-stable products, and specialty pouches for specific applications. The definition encompasses both domestic production capabilities and import activities that serve Spanish market demand, reflecting the interconnected nature of European packaging supply chains.

Strategic market analysis reveals that Spain’s pouch packaging sector represents a mature yet dynamic market experiencing steady growth driven by evolving consumer preferences and technological innovations. The market demonstrates strong fundamentals supported by robust domestic demand, advanced manufacturing infrastructure, and favorable regulatory environment promoting sustainable packaging solutions. Key growth drivers include increasing adoption in food and beverage applications, pharmaceutical sector expansion, and rising demand for premium packaging solutions.

Competitive landscape features a mix of international packaging giants and specialized regional converters, creating a diverse supplier ecosystem capable of serving varied customer requirements. The market benefits from technological advancement in barrier films, printing technologies, and sustainable materials, enabling innovative packaging solutions that meet evolving consumer and regulatory demands. Sustainability initiatives represent approximately 35% of new product development activities, reflecting industry commitment to environmental responsibility.

Market segmentation reveals food and beverage applications dominating demand, accounting for significant market share, followed by pharmaceutical and personal care sectors. Regional distribution shows concentration in major industrial centers including Madrid, Barcelona, and Valencia, with emerging growth in secondary markets. Future prospects indicate continued expansion driven by e-commerce growth, sustainability requirements, and innovative packaging formats addressing specific consumer needs.

Market intelligence reveals several critical insights shaping the Spain pouch packaging landscape. Consumer preference shifts toward convenient, portable packaging formats have accelerated adoption across multiple product categories, with particular strength in ready-to-eat meals, snack foods, and beverage applications. The market demonstrates resilience and adaptability in responding to changing consumer behaviors and regulatory requirements.

Emerging trends include smart packaging integration, premium aesthetic designs, and specialized barrier properties for extended shelf life applications. The market shows strong correlation between packaging innovation and brand differentiation strategies employed by Spanish manufacturers and international brands serving the Spanish market.

Primary growth drivers propelling the Spain pouch packaging market encompass diverse factors ranging from consumer behavior changes to technological innovations and regulatory influences. Convenience culture represents the most significant driver, with Spanish consumers increasingly seeking packaging solutions that offer portability, easy opening, and portion control capabilities. This trend particularly impacts food and beverage sectors where on-the-go consumption patterns continue expanding.

Sustainability imperatives drive substantial market transformation as brands and consumers prioritize environmentally responsible packaging solutions. Spanish companies demonstrate strong commitment to reducing packaging waste and improving recyclability, with material lightweighting achieving average weight reductions of 15-20% compared to traditional packaging formats. Regulatory support for sustainable packaging initiatives creates favorable market conditions for innovative pouch solutions.

E-commerce expansion significantly influences packaging requirements, with pouches offering superior protection during shipping while minimizing dimensional weight charges. The growth of online retail channels demands packaging solutions that maintain product integrity throughout complex distribution networks. Cost optimization drives adoption as pouches typically offer material cost savings of 25-30% compared to rigid packaging alternatives while providing comparable or superior product protection.

Technological capabilities enable advanced barrier properties, extended shelf life, and enhanced visual appeal through high-quality printing and finishing options. Manufacturing efficiency improvements in pouch production equipment reduce conversion costs and enable economical short-run production for specialized applications and seasonal products.

Market constraints affecting Spain’s pouch packaging sector include several structural and operational challenges that influence growth trajectories and market development patterns. Raw material price volatility represents a persistent challenge, with petroleum-based polymer costs subject to global commodity price fluctuations that impact converter margins and customer pricing strategies. Supply chain dependencies on international raw material suppliers create vulnerability to disruptions and currency exchange variations.

Technical limitations in certain applications restrict pouch adoption where rigid packaging provides superior product protection or consumer convenience. Barrier property requirements for ultra-long shelf life products may necessitate complex laminate structures that increase costs and environmental impact. Consumer perception challenges persist in premium product categories where traditional packaging formats maintain associations with quality and authenticity.

Regulatory complexity surrounding food contact materials and pharmaceutical packaging creates compliance burdens that require specialized expertise and testing capabilities. Recycling infrastructure limitations in certain regions constrain the development of fully circular packaging solutions, potentially limiting market growth in sustainability-focused segments. Competition from alternative packaging formats including rigid containers and traditional flexible packaging maintains pressure on market share expansion.

Investment requirements for advanced converting equipment and quality control systems create barriers for smaller market participants. Skilled workforce availability in specialized technical roles impacts industry capacity for innovation and quality improvement initiatives essential for long-term competitiveness.

Strategic opportunities within Spain’s pouch packaging market reflect evolving consumer needs, technological capabilities, and market gaps that present significant growth potential. Pharmaceutical sector expansion offers substantial opportunities as healthcare companies increasingly adopt flexible packaging for improved patient compliance, product protection, and cost efficiency. Specialty applications in nutraceuticals, medical devices, and diagnostic products represent high-value market segments with specific technical requirements.

Premium food segments present opportunities for innovative pouch solutions that combine superior functionality with aesthetic appeal, particularly in organic, artisanal, and gourmet product categories. Portion control applications align with health-conscious consumer trends, creating demand for smaller format pouches that support dietary management and waste reduction objectives. Ready-to-eat meal categories show growth potential of 8-12% annually, driven by busy lifestyles and convenience preferences.

Sustainability innovation creates opportunities for companies developing recyclable, compostable, and bio-based pouch materials that meet environmental objectives without compromising performance. Smart packaging integration enables value-added features including freshness indicators, tamper evidence, and consumer engagement through digital connectivity. Export market development leverages Spain’s strategic location for serving North African and Latin American markets with similar consumer preferences.

Industrial applications including chemicals, lubricants, and agricultural products offer diversification opportunities beyond traditional consumer goods sectors. Customization capabilities through digital printing and variable data printing enable personalized packaging solutions for special events, promotional campaigns, and limited edition products.

Market dynamics in Spain’s pouch packaging sector reflect complex interactions between supply-side capabilities, demand-side requirements, and external influences that shape competitive positioning and growth trajectories. Supply chain integration has become increasingly important as converters seek to optimize material sourcing, production efficiency, and customer service levels through strategic partnerships and vertical integration initiatives.

Competitive intensity varies significantly across market segments, with commodity applications experiencing price-based competition while specialty and high-barrier applications support premium pricing strategies. Innovation cycles accelerate as companies invest in research and development to differentiate products and capture emerging market opportunities. Customer consolidation in key end-use sectors creates opportunities for preferred supplier relationships while intensifying competition for major account business.

Technology adoption drives market evolution through improved production capabilities, enhanced product performance, and new application possibilities. Digital transformation initiatives enable better customer service, supply chain visibility, and operational efficiency improvements. Regulatory evolution continues shaping market requirements, particularly regarding food safety, environmental impact, and consumer protection standards.

Economic factors including GDP growth, consumer spending patterns, and industrial production levels influence market demand across different sectors. Demographic trends toward urbanization, aging population, and changing household compositions create evolving packaging requirements that drive market adaptation and innovation. Global trade dynamics affect raw material availability, competitive pressures, and export opportunities for Spanish producers.

Comprehensive research methodology employed for analyzing Spain’s pouch packaging market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, technical specialists, and key stakeholders across the value chain, providing firsthand insights into market trends, competitive dynamics, and future outlook perspectives.

Secondary research encompasses analysis of industry publications, company reports, regulatory documents, and trade statistics to establish market context and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market trends, segment growth rates, and competitive positioning metrics. Market sizing methodologies combine top-down and bottom-up approaches to ensure comprehensive coverage of market segments and applications.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to assess the reliability of key findings and projections. Industry expert consultations provide specialized knowledge on technical developments, regulatory changes, and emerging market opportunities. Market surveillance activities monitor ongoing developments, competitive actions, and regulatory changes that may impact market dynamics.

Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive understanding of market structure and competitive dynamics. Forecasting models utilize regression analysis, scenario planning, and Monte Carlo simulations to generate robust projections under different market conditions and assumption sets.

Regional market distribution across Spain reveals significant concentration in major industrial and population centers, with Madrid region accounting for approximately 28% of market demand driven by headquarters locations of major consumer goods companies and proximity to distribution networks. Catalonia region, centered around Barcelona, represents another 25% market share benefiting from strong manufacturing base, port facilities, and international business connections.

Valencia region demonstrates robust market presence with 18% market share, supported by agricultural processing industries, ceramic manufacturing, and strategic Mediterranean port access. Andalusia region shows growing market importance with 12% market share, driven by agricultural exports, tourism-related food service, and emerging industrial development. Basque Country maintains 8% market share with focus on high-value applications including pharmaceuticals and specialty chemicals.

Regional specialization patterns reflect local industry strengths and competitive advantages. Madrid region concentrates on consumer goods packaging, pharmaceutical applications, and premium food products. Catalonia emphasizes export-oriented manufacturing, technical applications, and innovative packaging solutions. Valencia region focuses on agricultural product packaging, citrus exports, and ceramic industry applications.

Infrastructure advantages in major regions include proximity to international airports, major ports, and highway networks that facilitate efficient distribution. Emerging regions including Galicia, Asturias, and Murcia show growth potential driven by industrial development, agricultural modernization, and tourism sector expansion. Cross-border trade with Portugal and France creates additional market opportunities for Spanish producers.

Competitive environment in Spain’s pouch packaging market features diverse participant categories including multinational packaging corporations, regional converters, and specialized niche players. Market leadership positions are held by companies combining scale advantages, technical capabilities, and customer relationship strength across multiple market segments.

Competitive strategies emphasize innovation, sustainability, customer service, and operational efficiency. Market differentiation occurs through technical capabilities, application expertise, geographic coverage, and value-added services. Strategic partnerships between converters and raw material suppliers enable technology development and market expansion initiatives.

Acquisition activity continues shaping market structure as larger players seek to expand capabilities, geographic reach, and customer relationships. Investment priorities focus on sustainable materials, digital printing capabilities, and automation technologies that improve efficiency and quality.

Market segmentation analysis reveals distinct categories based on material composition, application sectors, pouch formats, and end-use requirements. Material-based segmentation includes polyethylene-based pouches, polypropylene structures, polyester laminates, and specialty barrier films designed for specific performance requirements. Multi-layer constructions dominate high-performance applications requiring superior barrier properties and mechanical strength.

Application segmentation demonstrates food and beverage sector dominance with approximately 65% market share, encompassing snack foods, ready meals, beverages, and fresh produce packaging. Pharmaceutical applications represent 15% market share with focus on solid dose medications, medical devices, and diagnostic products. Personal care and household products account for 12% market share, while industrial applications comprise the remaining 8% market share.

Format-based segmentation includes stand-up pouches, flat pouches, spouted pouches, retort pouches, and specialty configurations. Stand-up pouches represent the largest segment due to shelf appeal and consumer convenience benefits. Spouted pouches show strong growth in beverage and liquid food applications. Retort pouches serve shelf-stable food products requiring thermal processing.

Size segmentation ranges from single-serving portions to bulk packaging formats, with portion control applications driving growth in smaller sizes. Barrier property segmentation includes standard barrier, high barrier, and ultra-high barrier categories serving different shelf life and product protection requirements.

Food and beverage category represents the dominant market segment with diverse subcategories demonstrating varying growth patterns and requirements. Snack food packaging emphasizes barrier properties for freshness retention, visual appeal for shelf impact, and convenience features for consumer satisfaction. Ready meal applications require heat resistance, puncture resistance, and microwave compatibility for consumer convenience.

Beverage pouches show strong growth in juice, smoothie, and alcoholic beverage applications, with spouted configurations providing superior consumer experience compared to traditional packaging. Fresh produce packaging utilizes specialized films with controlled permeability for extended shelf life while maintaining product quality. Dairy product applications require high barrier properties and tamper evidence for food safety assurance.

Pharmaceutical category demands stringent quality standards, regulatory compliance, and specialized barrier properties for product stability and patient safety. Solid dose packaging emphasizes moisture protection, light barrier, and child-resistant features. Medical device packaging requires sterile barrier properties and easy opening for healthcare professional use.

Personal care applications focus on aesthetic appeal, dispensing convenience, and product protection for cosmetics, toiletries, and health products. Household product packaging emphasizes chemical compatibility, puncture resistance, and consumer safety features. Industrial applications require specialized barrier properties, chemical resistance, and bulk packaging efficiency for lubricants, chemicals, and agricultural products.

Comprehensive benefits accrue to various stakeholders participating in Spain’s pouch packaging market ecosystem, creating value through operational efficiency, market opportunities, and competitive advantages. Brand owners benefit from reduced packaging costs, improved product protection, enhanced shelf appeal, and sustainability credentials that support marketing objectives and consumer preference alignment.

Converter benefits include operational efficiency through high-speed production capabilities, material optimization opportunities, and value-added service potential that strengthens customer relationships. Equipment suppliers gain from technology advancement requirements, retrofit opportunities, and expanding market applications that drive equipment demand. Raw material suppliers benefit from growing demand for specialized films, adhesives, and barrier coatings.

Consumer benefits include convenience, portion control, product freshness, and environmental consciousness through sustainable packaging choices. Retailer advantages encompass shelf space optimization, inventory efficiency, and reduced product damage during handling and display.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping Spain’s pouch packaging market reflect broader industry evolution toward sustainability, digitalization, and consumer-centric solutions. Sustainable packaging transition represents the most significant trend, with companies investing heavily in recyclable materials, bio-based polymers, and circular economy solutions. Material innovation focuses on reducing environmental impact while maintaining performance standards required for product protection and shelf life.

Digital printing adoption accelerates across market segments, enabling short-run customization, variable data printing, and rapid product launch capabilities. Smart packaging integration incorporates QR codes, NFC technology, and freshness indicators that enhance consumer engagement and provide supply chain visibility. Premiumization trends drive demand for high-quality graphics, tactile finishes, and innovative structural designs that differentiate products in competitive markets.

Convenience enhancement continues driving innovation in closure systems, opening features, and dispensing mechanisms that improve consumer experience. Portion control applications align with health consciousness trends and waste reduction objectives. Multi-functional packaging combines primary packaging with secondary functions such as reusability, display features, or promotional elements.

Supply chain optimization trends emphasize local sourcing, reduced transportation impacts, and inventory efficiency through packaging design improvements. Automation integration in converting operations improves quality consistency, production efficiency, and cost competitiveness. Collaborative innovation between converters, brand owners, and material suppliers accelerates development of application-specific solutions.

Recent industry developments demonstrate the dynamic nature of Spain’s pouch packaging market with significant investments, technological advances, and strategic initiatives shaping competitive positioning. Capacity expansion projects by major converters reflect confidence in market growth prospects and commitment to serving increasing demand across multiple sectors.

Sustainability initiatives include development of recyclable pouch structures, bio-based material adoption, and circular economy partnerships that address environmental concerns while maintaining performance standards. Technology investments in digital printing capabilities, barrier coating technologies, and quality control systems enhance competitive capabilities and customer service levels.

Strategic partnerships between converters and raw material suppliers facilitate innovation development, cost optimization, and market expansion initiatives. Acquisition activities continue consolidating market structure as larger players seek to expand geographic coverage, technical capabilities, and customer relationships. Regulatory compliance investments ensure adherence to evolving food safety, environmental, and consumer protection standards.

Innovation launches include advanced barrier films, smart packaging features, and specialized pouch formats addressing emerging market needs. Export market development initiatives leverage Spain’s strategic location and manufacturing capabilities to serve international customers. Workforce development programs address skill requirements for advanced manufacturing technologies and quality management systems.

Strategic recommendations for market participants emphasize the importance of sustainability integration, technology advancement, and customer-centric innovation to maintain competitive positioning in Spain’s evolving pouch packaging market. MarkWide Research analysis suggests that companies should prioritize investment in recyclable material technologies and circular economy solutions to address growing environmental concerns and regulatory requirements.

Innovation focus should emphasize smart packaging capabilities, digital printing technologies, and application-specific solutions that provide differentiated value propositions. Market expansion strategies should consider export opportunities, particularly in North African and Latin American markets where Spanish companies possess cultural and linguistic advantages. Partnership development with technology providers, raw material suppliers, and end-use customers can accelerate innovation and market penetration.

Operational excellence initiatives should focus on automation, quality management, and supply chain optimization to improve cost competitiveness and customer service levels. Talent development programs addressing technical skills, sustainability expertise, and digital capabilities will support long-term competitive advantages. Customer relationship management should emphasize collaborative innovation, technical support, and value-added services that strengthen partnership bonds.

Risk management strategies should address raw material price volatility, regulatory changes, and competitive pressures through diversification, hedging, and operational flexibility. Investment priorities should balance growth opportunities with financial prudence, focusing on projects with clear return on investment and strategic value creation potential.

Future market prospects for Spain’s pouch packaging sector appear positive, supported by favorable demand trends, technological advancement opportunities, and strategic positioning advantages. Growth projections indicate continued market expansion at compound annual growth rates of 6-8% over the next five years, driven by sustainability transitions, e-commerce growth, and application diversification across multiple industry sectors.

Sustainability transformation will fundamentally reshape market dynamics as recyclable and bio-based materials gain market acceptance and regulatory support. Technology integration including smart packaging, digital printing, and automation will create new value propositions and competitive advantages for innovative companies. Market consolidation trends may continue as scale advantages become increasingly important for technology investment and customer service capabilities.

Application expansion into pharmaceutical, industrial, and specialty sectors will diversify revenue streams and reduce dependence on traditional food packaging markets. Export opportunities will grow as Spanish manufacturers leverage quality reputation, strategic location, and competitive cost structures to serve international markets. Innovation acceleration will be driven by collaborative partnerships between converters, material suppliers, and end-use customers.

Regulatory evolution will continue shaping market requirements, particularly regarding environmental impact, food safety, and consumer protection standards. Consumer preference changes toward convenience, sustainability, and premium experiences will drive continued innovation in packaging formats and features. Economic resilience will be supported by diverse end-market exposure and essential product nature of packaging solutions.

Spain’s pouch packaging market represents a dynamic and growing sector characterized by innovation, sustainability focus, and diverse application opportunities. The market demonstrates strong fundamentals supported by advanced manufacturing capabilities, strategic geographic positioning, and robust domestic demand across multiple industry sectors. Growth momentum continues driven by consumer preference shifts toward convenient packaging, sustainability requirements, and technological advancement opportunities.

Competitive landscape features diverse participants ranging from multinational corporations to specialized regional converters, creating a vibrant ecosystem capable of serving varied customer requirements. Innovation priorities emphasize sustainable materials, smart packaging capabilities, and application-specific solutions that provide differentiated value propositions. Market opportunities exist across pharmaceutical, premium food, and export market segments that leverage Spanish manufacturing strengths.

Future success will depend on companies’ ability to adapt to evolving sustainability requirements, invest in advanced technologies, and develop strong customer partnerships that support collaborative innovation. Strategic positioning should emphasize operational excellence, technical capabilities, and market responsiveness to capitalize on growth opportunities while managing competitive pressures and regulatory changes. The Spain pouch packaging market is well-positioned for continued expansion and value creation across the packaging value chain.

What is Pouch Packaging?

Pouch packaging refers to flexible packaging solutions that are made from various materials, typically used for food, beverages, and consumer goods. This type of packaging is designed to be lightweight, portable, and often resealable, making it convenient for consumers.

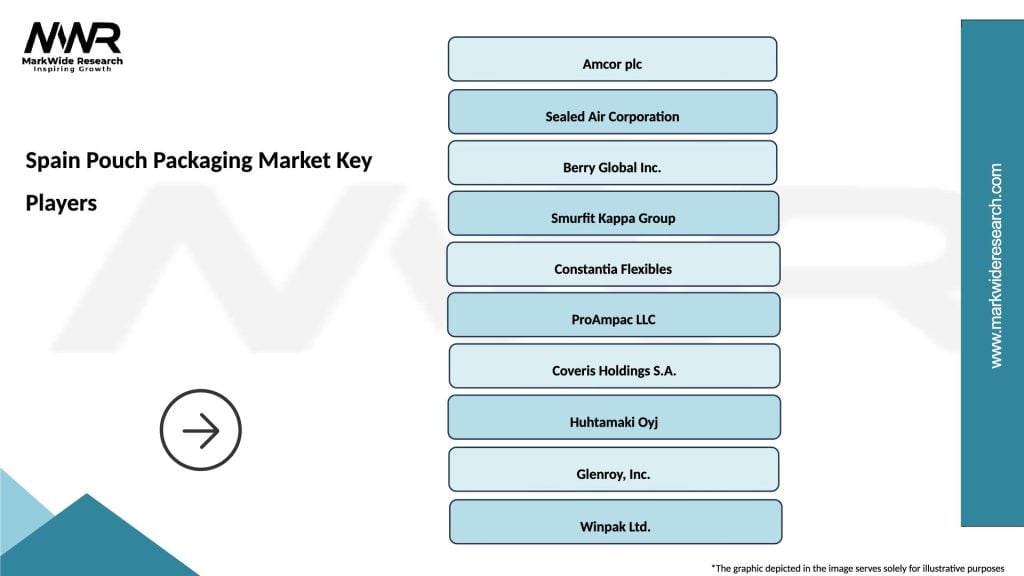

What are the key players in the Spain Pouch Packaging Market?

Key players in the Spain Pouch Packaging Market include Amcor, Mondi Group, and Smurfit Kappa, which are known for their innovative packaging solutions and extensive product ranges. These companies focus on sustainability and meeting consumer demands for convenience, among others.

What are the growth factors driving the Spain Pouch Packaging Market?

The Spain Pouch Packaging Market is driven by increasing consumer demand for convenient packaging, the rise of e-commerce, and a growing focus on sustainability. Additionally, innovations in materials and design are enhancing the appeal of pouch packaging across various sectors.

What challenges does the Spain Pouch Packaging Market face?

Challenges in the Spain Pouch Packaging Market include competition from alternative packaging solutions, regulatory pressures regarding recyclability, and the need for continuous innovation to meet changing consumer preferences. These factors can impact market growth and profitability.

What opportunities exist in the Spain Pouch Packaging Market?

Opportunities in the Spain Pouch Packaging Market include the development of eco-friendly materials, expansion into new product categories, and the potential for customization to meet specific consumer needs. Brands are increasingly looking to differentiate themselves through unique packaging solutions.

What trends are shaping the Spain Pouch Packaging Market?

Trends in the Spain Pouch Packaging Market include the rise of stand-up pouches, increased use of biodegradable materials, and the integration of smart packaging technologies. These trends reflect a shift towards more sustainable and consumer-friendly packaging options.

Spain Pouch Packaging Market

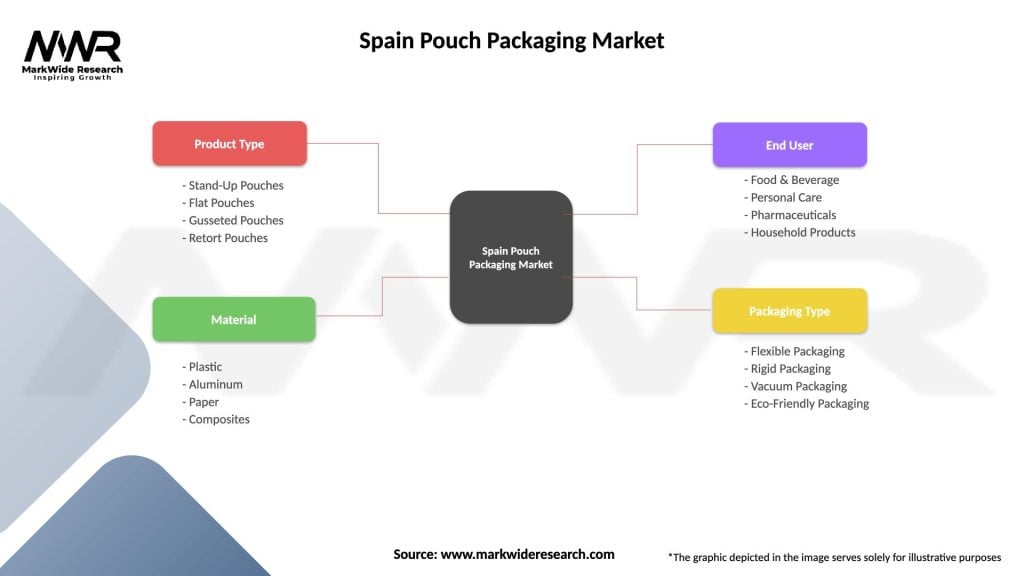

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Flat Pouches, Gusseted Pouches, Retort Pouches |

| Material | Plastic, Aluminum, Paper, Composites |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Vacuum Packaging, Eco-Friendly Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Pouch Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at