444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain pharmaceutical logistics market represents a critical component of the nation’s healthcare infrastructure, encompassing the complex network of storage, transportation, and distribution systems that ensure safe and timely delivery of pharmaceutical products throughout the country. This sophisticated ecosystem supports Spain’s robust healthcare system by maintaining the integrity of temperature-sensitive medications, managing inventory across multiple distribution channels, and ensuring regulatory compliance throughout the supply chain.

Market dynamics in Spain’s pharmaceutical logistics sector are driven by increasing demand for specialized cold chain solutions, growing emphasis on regulatory compliance, and the expanding role of e-commerce in pharmaceutical distribution. The market has experienced significant transformation with the integration of advanced technologies including IoT sensors, blockchain tracking systems, and automated warehouse management solutions that enhance visibility and control throughout the distribution process.

Growth trajectory indicators suggest the market is expanding at a robust CAGR of 6.2%, driven primarily by aging demographics, increased pharmaceutical consumption, and stringent regulatory requirements for drug safety and traceability. The sector benefits from Spain’s strategic geographic position as a gateway to European and North African markets, making it an attractive hub for pharmaceutical distribution operations.

Key market characteristics include the dominance of third-party logistics providers, increasing adoption of digital technologies for supply chain optimization, and growing investment in specialized infrastructure for biologics and biosimilar products. The market serves diverse stakeholders including pharmaceutical manufacturers, wholesalers, hospitals, pharmacies, and direct-to-patient delivery services.

The Spain pharmaceutical logistics market refers to the comprehensive ecosystem of services, infrastructure, and technologies involved in the storage, handling, transportation, and distribution of pharmaceutical products within Spain’s borders. This market encompasses specialized logistics operations designed to maintain product integrity, ensure regulatory compliance, and deliver medications safely to end users including hospitals, pharmacies, and patients.

Core components of this market include temperature-controlled warehousing facilities, specialized transportation fleets equipped with monitoring systems, inventory management solutions, and last-mile delivery services tailored to pharmaceutical requirements. The market also encompasses value-added services such as packaging, labeling, serialization, and track-and-trace capabilities that ensure product authenticity and prevent counterfeiting.

Regulatory framework compliance represents a fundamental aspect of pharmaceutical logistics in Spain, with operations governed by European Union Good Distribution Practice (GDP) guidelines, Spanish health authority regulations, and international standards for pharmaceutical supply chain management. This regulatory environment ensures that all logistics activities maintain the highest standards of product safety and quality throughout the distribution process.

Spain’s pharmaceutical logistics market stands as a vital pillar supporting the nation’s healthcare delivery system, characterized by sophisticated infrastructure, advanced technology adoption, and stringent regulatory compliance. The market demonstrates strong growth momentum driven by demographic trends, technological innovation, and evolving healthcare delivery models that prioritize patient access and medication safety.

Market leadership is concentrated among established third-party logistics providers who have invested heavily in specialized infrastructure and technology platforms. These providers offer comprehensive solutions ranging from primary distribution from manufacturers to final delivery to healthcare providers and patients, with particular emphasis on cold chain management for temperature-sensitive products.

Technology integration has emerged as a key differentiator, with leading providers implementing IoT-enabled monitoring systems, artificial intelligence for demand forecasting, and blockchain solutions for enhanced traceability. These technological advances contribute to improved operational efficiency, reduced waste, and enhanced patient safety through better supply chain visibility.

Growth drivers include Spain’s aging population requiring increased pharmaceutical interventions, expansion of specialty drug categories requiring specialized handling, and growing adoption of direct-to-patient delivery models. The market also benefits from Spain’s role as a regional distribution hub serving broader European and Mediterranean markets.

Strategic positioning of Spain within the European pharmaceutical supply chain has created significant opportunities for logistics providers to establish regional distribution centers serving multiple markets. This geographic advantage, combined with well-developed transportation infrastructure, positions Spain as an attractive location for pharmaceutical logistics operations.

Demographic transformation represents the primary driver of growth in Spain’s pharmaceutical logistics market, with an aging population requiring increased access to medications and healthcare services. The proportion of citizens over 65 continues to expand, creating sustained demand for pharmaceutical products and specialized distribution services that ensure reliable access to essential medications.

Regulatory evolution has intensified requirements for pharmaceutical supply chain management, with new serialization mandates, enhanced traceability requirements, and stricter temperature monitoring protocols driving investment in advanced logistics infrastructure. These regulatory changes create opportunities for specialized service providers who can ensure compliance while maintaining operational efficiency.

Technology advancement enables new service capabilities and operational efficiencies that were previously unattainable. IoT sensors, artificial intelligence, and blockchain technologies provide unprecedented visibility into supply chain operations, enabling proactive management of potential disruptions and ensuring product integrity throughout the distribution process.

Healthcare digitization is transforming pharmaceutical distribution models, with electronic prescriptions, telemedicine consultations, and direct-to-patient delivery services creating new logistics requirements. This digital transformation drives demand for flexible, technology-enabled logistics solutions that can adapt to evolving healthcare delivery models.

Specialty drug expansion continues to reshape logistics requirements, with biologics, cell and gene therapies, and personalized medicines requiring specialized handling, storage, and transportation capabilities. These high-value, temperature-sensitive products demand sophisticated logistics solutions that ensure product efficacy and patient safety.

Regulatory complexity presents significant challenges for pharmaceutical logistics providers, with evolving compliance requirements necessitating continuous investment in training, systems, and infrastructure. The complexity of maintaining compliance across multiple regulatory frameworks can create barriers to entry for smaller providers and increase operational costs for established players.

Infrastructure limitations in certain regions of Spain can constrain the expansion of pharmaceutical logistics services, particularly in rural areas where transportation networks may be less developed. These geographic constraints can impact service delivery times and increase distribution costs, particularly for time-sensitive pharmaceutical products.

Cost pressures from healthcare payers and pharmaceutical manufacturers create ongoing challenges for logistics providers seeking to maintain profitability while investing in advanced technologies and infrastructure. Pressure to reduce healthcare costs can limit the pricing flexibility of logistics services, constraining investment in innovation and capacity expansion.

Skilled workforce shortage affects the pharmaceutical logistics sector, with specialized knowledge requirements for handling temperature-sensitive products, regulatory compliance, and advanced technology systems creating recruitment and retention challenges. This talent gap can limit operational capacity and service quality improvements.

Cybersecurity risks pose increasing threats to pharmaceutical supply chains, with digitization creating new vulnerabilities that could compromise patient safety and regulatory compliance. The need for robust cybersecurity measures adds complexity and cost to logistics operations while requiring ongoing investment in protective technologies.

Digital health integration presents substantial opportunities for pharmaceutical logistics providers to develop new service offerings that support telemedicine, remote patient monitoring, and personalized healthcare delivery. These emerging healthcare models require innovative logistics solutions that can deliver medications directly to patients while maintaining safety and compliance standards.

Sustainability initiatives create opportunities for logistics providers to differentiate their services through environmentally responsible operations. Green logistics solutions, including electric delivery vehicles, renewable energy-powered facilities, and sustainable packaging materials, can attract environmentally conscious pharmaceutical companies and healthcare providers.

Advanced therapy expansion offers significant growth potential as Spain becomes a hub for cell and gene therapy distribution. These revolutionary treatments require ultra-specialized logistics capabilities, creating opportunities for providers who can develop the necessary infrastructure and expertise to handle these complex products.

Cross-border expansion leverages Spain’s strategic geographic position to serve broader European and North African markets. Pharmaceutical logistics providers can capitalize on Spain’s transportation infrastructure and regulatory alignment with EU standards to establish regional distribution networks serving multiple countries.

Technology partnerships enable logistics providers to enhance their service capabilities through collaboration with technology companies developing innovative solutions for pharmaceutical supply chains. These partnerships can accelerate the adoption of cutting-edge technologies while sharing development costs and risks.

Competitive landscape in Spain’s pharmaceutical logistics market is characterized by the presence of both global logistics giants and specialized regional providers, each offering distinct value propositions to pharmaceutical companies and healthcare providers. This competitive environment drives continuous innovation in service offerings, technology adoption, and operational efficiency improvements.

Supply chain integration has become increasingly important as pharmaceutical companies seek end-to-end visibility and control over their distribution networks. Logistics providers are responding by offering comprehensive solutions that encompass primary, secondary, and tertiary distribution, along with value-added services such as packaging, labeling, and patient support programs.

Customer expectations continue to evolve, with pharmaceutical companies and healthcare providers demanding higher levels of service reliability, transparency, and flexibility. These changing expectations drive logistics providers to invest in advanced tracking systems, predictive analytics, and customer portal technologies that enhance service visibility and responsiveness.

Regulatory harmonization across European markets creates opportunities for standardized logistics solutions that can serve multiple countries efficiently. This regulatory alignment enables logistics providers to develop scalable service platforms that leverage economies of scale while maintaining compliance across different jurisdictions.

Market consolidation trends are evident as larger logistics providers acquire specialized capabilities and regional coverage through strategic acquisitions. This consolidation creates more comprehensive service offerings while potentially reducing the number of independent providers in the market.

Comprehensive market analysis was conducted through a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporated quantitative data analysis, qualitative stakeholder interviews, and industry expert consultations to develop a complete understanding of market dynamics and trends.

Primary research activities included structured interviews with key stakeholders across the pharmaceutical logistics value chain, including logistics service providers, pharmaceutical manufacturers, healthcare distributors, and regulatory officials. These interviews provided insights into market challenges, opportunities, and future development priorities from multiple perspectives.

Secondary research sources encompassed industry reports, regulatory publications, company financial statements, and academic research papers relevant to pharmaceutical logistics in Spain. This comprehensive literature review ensured that all relevant market factors and trends were considered in the analysis.

Data validation processes were implemented to ensure the accuracy and reliability of all market information and statistics included in the analysis. Multiple sources were cross-referenced to verify key data points, and industry experts reviewed findings to confirm their alignment with market realities.

Market segmentation analysis was conducted to identify distinct market segments based on service type, customer category, technology adoption, and geographic coverage. This segmentation approach enables a detailed understanding of market dynamics within specific market niches and customer groups.

Madrid region dominates Spain’s pharmaceutical logistics market, accounting for approximately 35% of total logistics activity due to its central location, excellent transportation connectivity, and concentration of pharmaceutical companies and healthcare institutions. The region benefits from proximity to major airports and highways, making it an ideal hub for national and international distribution operations.

Catalonia region represents the second-largest market segment, with 28% market share, driven by its strong pharmaceutical manufacturing base and proximity to European markets. Barcelona serves as a key distribution center for pharmaceutical products destined for Southern Europe and Mediterranean markets, leveraging its port facilities and transportation infrastructure.

Andalusia region has emerged as a growing logistics hub, capturing 18% of market activity through strategic investments in distribution infrastructure and its advantageous position for serving North African markets. The region’s logistics parks and free trade zones provide attractive locations for pharmaceutical distribution operations.

Valencia region contributes 12% of market volume, benefiting from its Mediterranean port facilities and growing pharmaceutical sector presence. The region’s logistics infrastructure supports both domestic distribution and export operations to international markets.

Northern regions including the Basque Country and Galicia collectively account for 7% of market share, serving local healthcare needs while also supporting cross-border trade with France and Portugal. These regions benefit from specialized logistics providers focused on regional healthcare distribution requirements.

Market leadership in Spain’s pharmaceutical logistics sector is distributed among several key players, each bringing distinct capabilities and market positioning to serve the diverse needs of pharmaceutical companies and healthcare providers.

Competitive strategies focus on technology differentiation, service specialization, and geographic expansion to capture market share and enhance customer relationships. Leading providers invest heavily in automation, digitization, and sustainability initiatives to maintain competitive advantages.

By Service Type:

By Customer Type:

By Product Category:

Cold chain logistics represents the fastest-growing segment within Spain’s pharmaceutical logistics market, driven by increasing adoption of biologics and specialty medications that require precise temperature control throughout the distribution process. This segment demands sophisticated infrastructure including temperature-controlled vehicles, monitoring systems, and specialized storage facilities that maintain product integrity from manufacturer to patient.

Last-mile delivery services have experienced significant expansion due to growing consumer expectations for convenient access to medications and the rise of e-pharmacy platforms. This segment requires flexible delivery options, real-time tracking capabilities, and specialized handling procedures to ensure patient safety and regulatory compliance.

Hospital logistics continues to evolve with increasing emphasis on just-in-time delivery, inventory optimization, and integrated supply chain management. Healthcare institutions seek logistics partners who can provide comprehensive solutions including emergency deliveries, inventory management, and specialized handling for complex medical products.

Cross-border distribution leverages Spain’s strategic geographic position to serve European and North African markets. This segment benefits from regulatory harmonization within the EU and growing demand for Spanish pharmaceutical products in international markets.

Technology-enabled services are becoming increasingly important as pharmaceutical companies seek greater supply chain visibility and control. Services incorporating IoT monitoring, blockchain tracking, and artificial intelligence for demand forecasting represent high-growth opportunities within the market.

Pharmaceutical manufacturers benefit from specialized logistics services that ensure product integrity, regulatory compliance, and market access while reducing internal logistics costs and complexity. Professional logistics providers offer expertise in handling complex products, managing regulatory requirements, and optimizing distribution networks for maximum efficiency.

Healthcare providers gain access to reliable supply chains that ensure medication availability, reduce inventory costs, and improve patient care outcomes. Advanced logistics services provide real-time visibility into product availability, automated ordering systems, and emergency delivery capabilities that support clinical operations.

Patients benefit from improved medication access, faster delivery times, and enhanced safety through professional handling of pharmaceutical products. Modern logistics services enable convenient delivery options, medication synchronization, and adherence support programs that improve health outcomes.

Logistics providers can leverage specialized pharmaceutical expertise to command premium pricing, develop long-term customer relationships, and expand into high-growth market segments. The pharmaceutical logistics market offers opportunities for service differentiation and value creation through technology innovation and specialized capabilities.

Healthcare systems benefit from optimized pharmaceutical supply chains that reduce costs, improve efficiency, and enhance patient safety. Professional logistics services contribute to healthcare system sustainability by reducing waste, improving inventory management, and ensuring reliable access to essential medications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues to reshape pharmaceutical logistics operations in Spain, with providers implementing advanced technologies including artificial intelligence, machine learning, and blockchain to enhance supply chain visibility, optimize operations, and ensure regulatory compliance. These digital initiatives enable predictive analytics, automated decision-making, and real-time monitoring capabilities that improve service quality and operational efficiency.

Sustainability initiatives are gaining momentum as pharmaceutical companies and logistics providers prioritize environmental responsibility. Green logistics solutions including electric delivery vehicles, renewable energy-powered facilities, and sustainable packaging materials are becoming increasingly important for competitive differentiation and regulatory compliance.

Personalized medicine logistics represents an emerging trend as Spain becomes a hub for advanced therapies including cell and gene treatments. These revolutionary products require ultra-specialized handling, storage, and transportation capabilities that demand new logistics infrastructure and expertise.

Direct-to-patient delivery models are expanding rapidly, driven by consumer convenience expectations and healthcare digitization trends. This shift requires logistics providers to develop new capabilities for home delivery, patient communication, and medication adherence support.

Supply chain resilience has become a critical focus following recent global disruptions, with pharmaceutical companies and logistics providers investing in redundant capabilities, alternative sourcing strategies, and risk management systems to ensure continuous medication availability.

Infrastructure investments by major logistics providers have expanded Spain’s pharmaceutical distribution capacity, with new temperature-controlled facilities, automated warehouses, and advanced monitoring systems enhancing service capabilities. These investments support growing demand for specialized pharmaceutical logistics services and enable expansion into new market segments.

Regulatory updates including enhanced serialization requirements and stricter GDP compliance standards have driven technology adoption and process improvements throughout the pharmaceutical logistics sector. These regulatory changes create opportunities for providers who can demonstrate superior compliance capabilities and risk management.

Strategic partnerships between logistics providers and technology companies have accelerated innovation in pharmaceutical supply chain management. These collaborations enable the development of advanced solutions for inventory optimization, demand forecasting, and supply chain visibility that benefit all stakeholders.

Market consolidation through acquisitions and mergers has created larger, more capable logistics providers with enhanced geographic coverage and service capabilities. This consolidation trend enables providers to offer more comprehensive solutions while achieving operational efficiencies through scale.

Sustainability certifications and green logistics initiatives have become important differentiators for pharmaceutical logistics providers seeking to attract environmentally conscious customers and comply with evolving regulatory requirements for environmental responsibility.

Technology investment should remain a top priority for pharmaceutical logistics providers seeking to maintain competitive advantages and meet evolving customer expectations. MarkWide Research analysis indicates that providers investing in advanced technologies achieve higher customer satisfaction rates and stronger financial performance compared to those relying on traditional approaches.

Specialization strategies can help logistics providers differentiate their services and command premium pricing in competitive markets. Focus areas should include cold chain excellence, specialty drug handling, and direct-to-patient delivery capabilities that align with market growth trends and customer needs.

Partnership development with pharmaceutical manufacturers, technology providers, and healthcare institutions can create competitive advantages through enhanced service capabilities and market access. Strategic alliances enable providers to offer comprehensive solutions while sharing development costs and risks.

Geographic expansion leveraging Spain’s strategic position can unlock new growth opportunities in European and international markets. Providers should consider establishing regional distribution hubs that serve multiple countries while maintaining compliance with local regulatory requirements.

Sustainability integration into logistics operations will become increasingly important for competitive positioning and regulatory compliance. Providers should develop comprehensive environmental strategies that address energy consumption, transportation emissions, and packaging waste throughout their operations.

Market expansion is expected to continue at a steady pace of 6.2% CAGR over the next five years, driven by demographic trends, healthcare digitization, and growing demand for specialized pharmaceutical products. This growth trajectory reflects the fundamental importance of pharmaceutical logistics in supporting Spain’s healthcare system and the ongoing evolution of healthcare delivery models.

Technology adoption will accelerate as pharmaceutical companies and logistics providers recognize the competitive advantages of digital transformation. Advanced analytics, automation, and connectivity solutions will become standard capabilities rather than differentiators, requiring continuous innovation to maintain market position.

Regulatory evolution will continue to shape market dynamics, with new requirements for supply chain transparency, product authentication, and environmental responsibility creating both challenges and opportunities for logistics providers. Companies that proactively address regulatory changes will gain competitive advantages.

Service integration will become increasingly important as customers seek comprehensive solutions from fewer providers. The most successful logistics companies will offer end-to-end capabilities spanning primary distribution, warehousing, transportation, and value-added services through integrated platforms.

International expansion opportunities will grow as Spain’s pharmaceutical logistics providers leverage their expertise and infrastructure to serve broader European and global markets. MWR projections suggest that cross-border services could represent 40% of total market activity within the next decade, reflecting Spain’s strategic importance as a regional distribution hub.

Spain’s pharmaceutical logistics market represents a dynamic and essential component of the nation’s healthcare infrastructure, characterized by strong growth prospects, technological innovation, and evolving service requirements. The market benefits from Spain’s strategic geographic position, advanced infrastructure, and alignment with European regulatory standards, creating opportunities for both domestic and international logistics providers.

Key success factors for market participants include technology adoption, specialized capabilities, regulatory compliance, and customer-centric service delivery. Providers who can demonstrate excellence in these areas while adapting to evolving market requirements will capture the greatest opportunities for growth and profitability in this essential healthcare sector.

Future market development will be shaped by demographic trends, healthcare digitization, regulatory evolution, and sustainability requirements that create both challenges and opportunities for pharmaceutical logistics providers. The companies that successfully navigate these trends while maintaining operational excellence will establish leadership positions in Spain’s growing pharmaceutical logistics market.

What is Pharmaceutical Logistics?

Pharmaceutical logistics refers to the processes involved in the storage, transportation, and distribution of pharmaceutical products. This includes managing the supply chain for medications, ensuring compliance with regulations, and maintaining product integrity throughout the logistics process.

What are the key players in the Spain Pharmaceutical Logistics Market?

Key players in the Spain Pharmaceutical Logistics Market include companies like DHL Supply Chain, Kuehne + Nagel, and Geodis. These companies provide specialized logistics services tailored to the pharmaceutical sector, ensuring efficient distribution and compliance with health regulations, among others.

What are the main drivers of growth in the Spain Pharmaceutical Logistics Market?

The main drivers of growth in the Spain Pharmaceutical Logistics Market include the increasing demand for pharmaceuticals, advancements in cold chain logistics, and the rise of e-commerce in healthcare. Additionally, the need for efficient supply chain management to ensure timely delivery of medications is also a significant factor.

What challenges does the Spain Pharmaceutical Logistics Market face?

The Spain Pharmaceutical Logistics Market faces challenges such as stringent regulatory requirements, the complexity of managing temperature-sensitive products, and the need for advanced tracking technologies. These factors can complicate logistics operations and increase costs.

What opportunities exist in the Spain Pharmaceutical Logistics Market?

Opportunities in the Spain Pharmaceutical Logistics Market include the expansion of telemedicine, the growth of personalized medicine, and the increasing focus on sustainability in logistics practices. These trends present avenues for innovation and improved service delivery.

What trends are shaping the Spain Pharmaceutical Logistics Market?

Trends shaping the Spain Pharmaceutical Logistics Market include the adoption of automation and digital technologies, the rise of integrated logistics solutions, and an emphasis on sustainability. These trends are driving efficiency and enhancing the overall effectiveness of pharmaceutical supply chains.

Spain Pharmaceutical Logistics Market

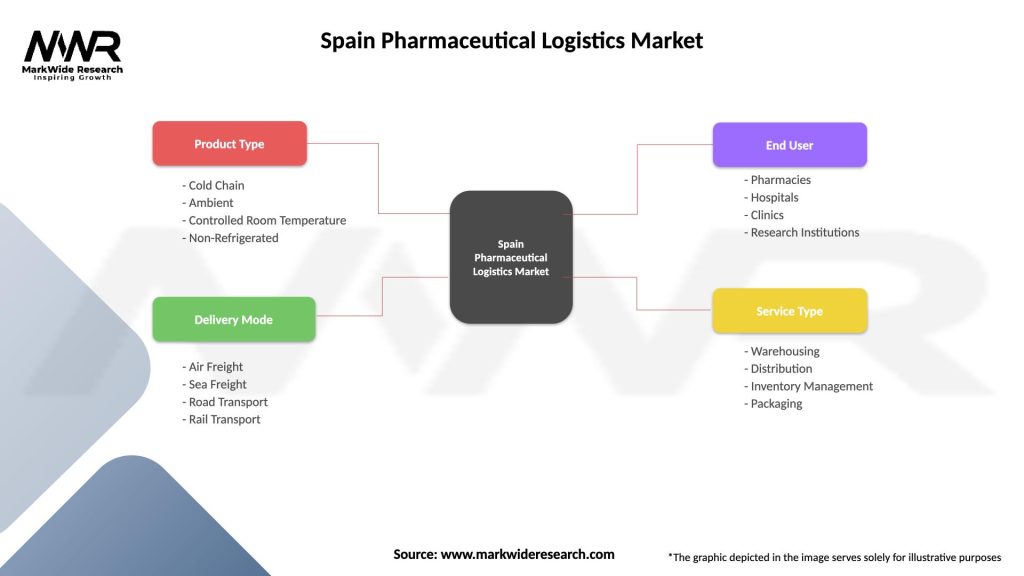

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Chain, Ambient, Controlled Room Temperature, Non-Refrigerated |

| Delivery Mode | Air Freight, Sea Freight, Road Transport, Rail Transport |

| End User | Pharmacies, Hospitals, Clinics, Research Institutions |

| Service Type | Warehousing, Distribution, Inventory Management, Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Pharmaceutical Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at