444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain OTC drugs market represents a dynamic and rapidly evolving segment of the pharmaceutical industry, characterized by increasing consumer awareness and growing demand for self-medication solutions. Over-the-counter medications in Spain have experienced substantial growth, driven by an aging population, rising healthcare costs, and enhanced consumer education about preventive healthcare measures. The market encompasses a diverse range of therapeutic categories, including pain management, cold and flu remedies, digestive health products, and vitamin supplements.

Market dynamics indicate that Spanish consumers are increasingly embracing self-care practices, with approximately 78% of adults regularly purchasing OTC medications for minor health conditions. This shift toward self-medication has been accelerated by improved product accessibility through pharmacies, supermarkets, and online platforms. Digital transformation has particularly influenced purchasing patterns, with e-commerce channels experiencing significant growth of 15.2% annually in OTC drug sales.

Regulatory frameworks established by Spanish health authorities have created a supportive environment for OTC drug market expansion while maintaining strict quality and safety standards. The market benefits from well-established distribution networks, professional pharmacy services, and comprehensive consumer education programs that promote responsible self-medication practices.

The Spain OTC drugs market refers to the comprehensive ecosystem of non-prescription pharmaceutical products available for direct consumer purchase without requiring a doctor’s prescription. These medications are specifically formulated and approved for treating minor health conditions, symptoms, and wellness maintenance through self-administration. OTC pharmaceuticals encompass therapeutic categories ranging from analgesics and antihistamines to nutritional supplements and topical treatments.

Self-medication practices form the cornerstone of this market, enabling consumers to take proactive control of their health management for common ailments such as headaches, digestive issues, seasonal allergies, and minor injuries. The market operates under stringent regulatory oversight to ensure product safety, efficacy, and appropriate labeling for consumer guidance.

Distribution channels include traditional pharmacies, parapharmacies, supermarkets, and increasingly popular online platforms that provide convenient access to OTC medications. This market segment plays a crucial role in Spain’s healthcare system by reducing the burden on medical professionals for minor health concerns while empowering consumers with accessible treatment options.

Spain’s OTC drugs market demonstrates robust growth potential driven by demographic shifts, changing consumer behaviors, and evolving healthcare paradigms. The market has established itself as an essential component of the country’s pharmaceutical landscape, offering comprehensive solutions for preventive care and minor health management. Consumer confidence in OTC medications has reached unprecedented levels, with market penetration rates exceeding 85% among Spanish households.

Key growth drivers include an aging population seeking convenient health solutions, increased health consciousness among younger demographics, and the rising costs of prescription healthcare services. The market benefits from strong pharmaceutical manufacturing capabilities, extensive retail networks, and progressive regulatory policies that balance consumer access with safety requirements.

Digital innovation has transformed market dynamics, with online sales channels experiencing accelerated adoption and mobile health applications providing enhanced consumer education. The market’s resilience was particularly evident during recent global health challenges, demonstrating its critical role in maintaining public health and wellness. Future projections indicate sustained growth across multiple therapeutic categories, supported by continuous product innovation and expanding consumer awareness initiatives.

Strategic market analysis reveals several fundamental insights that define the Spain OTC drugs market landscape. These insights provide valuable understanding of consumer behavior patterns, market dynamics, and growth opportunities that shape industry development.

Demographic transformation serves as a primary catalyst for Spain OTC drugs market expansion, with the country’s aging population creating sustained demand for accessible healthcare solutions. Population aging trends indicate that individuals over 65 years represent a growing consumer segment that increasingly relies on OTC medications for managing chronic conditions and maintaining quality of life.

Healthcare cost pressures have motivated consumers to seek cost-effective alternatives to prescription medications and medical consultations for minor health issues. This economic driver has been particularly influential in promoting self-medication practices, as consumers recognize the financial benefits of OTC solutions for routine health management.

Health consciousness evolution among Spanish consumers has created a cultural shift toward proactive wellness management. Modern consumers prioritize preventive healthcare measures, nutritional supplementation, and early intervention strategies that rely heavily on OTC pharmaceutical products. Wellness trends have expanded market opportunities beyond traditional therapeutic categories into lifestyle and beauty-related health products.

Digital accessibility has revolutionized how consumers discover, research, and purchase OTC medications. Online platforms provide comprehensive product information, customer reviews, and convenient delivery options that enhance the overall consumer experience. Mobile health applications further support informed decision-making by offering symptom checkers, medication reminders, and educational content.

Regulatory support from Spanish health authorities has facilitated market growth through streamlined approval processes for OTC medications while maintaining rigorous safety standards. Progressive policies have enabled the reclassification of certain prescription drugs to OTC status, expanding consumer access to effective treatments.

Regulatory complexities present significant challenges for market participants, particularly regarding product approval processes, labeling requirements, and advertising restrictions. Compliance costs associated with meeting European Union pharmaceutical regulations can be substantial, especially for smaller manufacturers seeking market entry or product line expansion.

Healthcare professional resistance occasionally emerges as doctors and pharmacists express concerns about inappropriate self-medication practices. Some medical professionals worry that increased OTC drug availability might delay necessary medical consultations for serious conditions that require professional diagnosis and treatment.

Consumer safety concerns regarding potential drug interactions, inappropriate dosing, and misuse of OTC medications create market hesitancy among certain demographic segments. Educational gaps about proper medication use can lead to adverse events that negatively impact consumer confidence and regulatory scrutiny.

Economic uncertainties affecting consumer spending power can constrain market growth, particularly for premium OTC products and non-essential wellness supplements. During economic downturns, consumers may prioritize essential medications while reducing purchases of preventive or lifestyle-related OTC products.

Competition from alternative therapies including natural remedies, homeopathic treatments, and traditional medicine practices can divert consumer attention and spending away from conventional OTC pharmaceuticals. This trend is particularly pronounced among health-conscious consumers seeking perceived “natural” alternatives.

Digital transformation initiatives present substantial opportunities for market expansion through enhanced consumer engagement, personalized health solutions, and innovative delivery mechanisms. E-commerce platforms can leverage artificial intelligence and machine learning to provide customized product recommendations, improving consumer satisfaction and driving sales growth.

Therapeutic area expansion offers significant potential for market development, particularly in emerging categories such as mental wellness, sleep health, and specialized nutrition. Consumer demand for holistic health solutions creates opportunities for innovative product formulations that address multiple health concerns simultaneously.

Strategic partnerships between pharmaceutical companies, technology firms, and healthcare providers can create integrated solutions that enhance the OTC drug experience. Collaborations with digital health platforms, telemedicine services, and wellness applications can provide comprehensive consumer support systems.

Geographic expansion within Spain’s regional markets presents opportunities for targeted marketing strategies that address local health preferences and cultural considerations. Rural market penetration through improved distribution networks and mobile pharmacy services can unlock previously underserved consumer segments.

Product innovation in delivery mechanisms, formulations, and packaging can differentiate brands and create competitive advantages. Sustainable packaging solutions and environmentally friendly formulations align with growing consumer environmental consciousness, potentially capturing market share from traditional products.

Supply chain evolution has fundamentally transformed how OTC drugs reach Spanish consumers, with traditional pharmacy-centric distribution expanding to include supermarkets, online retailers, and specialized health stores. This diversification has created competitive pricing pressures while improving consumer convenience and product accessibility across urban and rural areas.

Consumer behavior patterns demonstrate increasing sophistication in OTC drug selection, with Spanish consumers conducting extensive online research before making purchase decisions. Information accessibility through digital platforms has empowered consumers to make informed choices, leading to more targeted product demand and reduced impulse purchasing.

Seasonal demand fluctuations create dynamic market conditions that require strategic inventory management and marketing adaptations. Cold and flu seasons generate significant sales spikes, while summer months see increased demand for digestive aids, sun protection products, and travel-related health solutions.

Competitive landscape shifts have intensified as international pharmaceutical companies expand their Spanish market presence while domestic manufacturers strengthen their positions through innovation and strategic partnerships. Market consolidation trends have created larger, more efficient distribution networks that benefit consumers through improved product availability and competitive pricing.

Regulatory harmonization with European Union standards has facilitated cross-border trade and product standardization, enabling Spanish consumers to access a broader range of OTC medications while ensuring consistent quality and safety standards across the region.

Comprehensive market analysis for the Spain OTC drugs market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. Primary research involves extensive surveys and interviews with key stakeholders including consumers, pharmacists, healthcare professionals, manufacturers, and regulatory officials to gather firsthand market intelligence.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and pharmaceutical company financial statements to establish market trends, regulatory changes, and competitive dynamics. Data triangulation methods validate findings across multiple sources to ensure research credibility and minimize potential biases.

Quantitative analysis utilizes statistical modeling techniques to project market trends, consumer behavior patterns, and growth trajectories. Qualitative assessments provide contextual understanding of market drivers, consumer motivations, and industry challenges that influence strategic decision-making.

Market segmentation analysis examines therapeutic categories, distribution channels, consumer demographics, and geographic regions to identify specific growth opportunities and market dynamics. Competitive intelligence gathering involves monitoring company strategies, product launches, pricing policies, and market positioning tactics.

Regulatory monitoring tracks changes in pharmaceutical legislation, approval processes, and safety requirements that impact market access and product development strategies. This comprehensive approach ensures that market analysis reflects current conditions while anticipating future developments.

Madrid region dominates the Spanish OTC drugs market, accounting for approximately 23% of national consumption due to its large urban population, high disposable income levels, and extensive retail infrastructure. The capital region demonstrates strong adoption of digital purchasing channels and premium product categories, making it a key market for innovative OTC drug launches.

Catalonia represents the second-largest regional market, with Barcelona metropolitan area driving significant demand for wellness and preventive health products. The region’s international outlook and health-conscious population create favorable conditions for imported OTC brands and specialized therapeutic categories.

Andalusia shows robust market potential with its large population base and growing healthcare awareness. Regional preferences lean toward traditional pharmaceutical brands and value-oriented products, while coastal areas demonstrate increased demand for sun protection and travel health solutions during tourist seasons.

Valencia region exhibits balanced market characteristics with strong pharmaceutical manufacturing presence and diverse consumer demographics. The region benefits from excellent distribution networks and serves as a strategic hub for OTC drug logistics throughout eastern Spain.

Northern regions including Basque Country and Galicia demonstrate higher per-capita consumption of certain OTC categories, particularly those related to respiratory health and joint care, reflecting regional climate and demographic factors. Rural market penetration remains an ongoing opportunity across all regions, with mobile pharmacy services and online platforms addressing accessibility challenges.

Market leadership in Spain’s OTC drugs sector is characterized by a mix of international pharmaceutical giants and established domestic companies that have built strong consumer trust and extensive distribution networks. The competitive environment emphasizes brand recognition, product efficacy, and strategic retail partnerships.

Competitive strategies focus on product innovation, digital marketing initiatives, strategic pharmacy partnerships, and consumer education programs. Companies invest heavily in research and development to create differentiated products that address evolving consumer health needs while maintaining competitive pricing structures.

Therapeutic category segmentation reveals distinct market dynamics across various OTC drug classifications, each with unique growth patterns, consumer preferences, and competitive landscapes. Understanding these segments enables targeted marketing strategies and product development initiatives.

By Therapeutic Category:

By Distribution Channel:

Pain management products maintain market leadership through consistent consumer demand and brand loyalty, with market share reaching approximately 28% of total OTC drug sales. This category benefits from universal consumer need and established efficacy profiles of leading analgesic brands. Innovation opportunities focus on extended-release formulations, combination therapies, and targeted delivery mechanisms.

Digestive health solutions represent the fastest-growing category, driven by increased awareness of gut health importance and lifestyle-related digestive issues. Probiotic products have gained significant traction among health-conscious consumers, while traditional antacids maintain steady demand for immediate symptom relief.

Vitamin and supplement markets demonstrate robust growth potential, particularly in immune support, energy enhancement, and specialized nutrition categories. Consumer education initiatives have successfully promoted preventive health benefits, leading to sustained market expansion beyond traditional demographic boundaries.

Cold and flu remedies experience cyclical demand patterns with significant seasonal variations. Multi-symptom formulations have gained popularity among consumers seeking convenient, comprehensive treatment solutions. Recent health awareness trends have increased demand for immune-boosting products and preventive care solutions.

Dermatological products show steady growth driven by increased skin health awareness and aging population needs. Anti-aging formulations and specialized treatments for common skin conditions create opportunities for premium product positioning and higher profit margins.

Pharmaceutical manufacturers benefit from the Spain OTC drugs market through diversified revenue streams, reduced regulatory complexity compared to prescription drugs, and opportunities for brand building through direct consumer marketing. Market access advantages include shorter development timelines and lower clinical trial requirements for OTC product approvals.

Retail pharmacies gain significant advantages through OTC drug sales, including higher profit margins, increased customer traffic, and opportunities for professional consultation services. Customer relationship building through OTC recommendations enhances pharmacy loyalty and creates cross-selling opportunities for prescription medications and health services.

Healthcare systems benefit from reduced burden on medical professionals for minor health conditions, allowing doctors to focus on complex cases requiring specialized attention. Cost savings result from decreased healthcare utilization for routine ailments that consumers can effectively self-treat with appropriate OTC medications.

Consumers enjoy enhanced healthcare accessibility, cost-effective treatment options, and greater control over their health management decisions. Convenience benefits include immediate access to treatments without appointment scheduling and the ability to address health concerns promptly.

Digital platform providers capitalize on growing e-commerce demand through commission-based revenue models, data analytics opportunities, and integrated health service offerings. Technology integration creates value-added services that differentiate platforms and improve customer retention rates.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital health integration has emerged as a transformative trend, with consumers increasingly using mobile applications for symptom checking, medication reminders, and health tracking. Artificial intelligence and machine learning technologies are being integrated into consumer platforms to provide personalized health recommendations and improve medication adherence rates.

Personalized medicine approaches are gaining traction in the OTC space, with companies developing products tailored to specific demographic groups, genetic profiles, and lifestyle factors. Customization trends extend to packaging, dosing, and formulation preferences that address individual consumer needs and preferences.

Sustainability initiatives have become increasingly important, with consumers showing preference for environmentally friendly packaging, sustainable sourcing, and corporate social responsibility programs. Eco-conscious formulations and recyclable packaging solutions are becoming competitive differentiators in the market.

Preventive healthcare focus has shifted consumer attention toward products that support immune system function, stress management, and overall wellness maintenance rather than purely reactive treatment approaches. Wellness positioning has expanded traditional pharmaceutical marketing to include lifestyle and holistic health messaging.

Omnichannel retail strategies are becoming essential as consumers expect seamless experiences across online and offline purchasing channels. Click-and-collect services, prescription integration, and loyalty programs that span multiple touchpoints are becoming standard market expectations.

Regulatory modernization initiatives have streamlined OTC drug approval processes while maintaining safety standards, enabling faster market entry for innovative products and reformulations. Digital labeling requirements have enhanced consumer access to comprehensive product information through QR codes and mobile applications.

Strategic acquisitions and partnerships have reshaped the competitive landscape, with major pharmaceutical companies acquiring specialized OTC brands and digital health platforms to expand their market presence and capabilities. Consolidation trends have created more efficient distribution networks and enhanced research and development resources.

Technology investments in artificial intelligence, data analytics, and consumer engagement platforms have transformed how companies understand and respond to market demands. Predictive analytics enable more accurate demand forecasting and inventory management across seasonal and regional variations.

Sustainability commitments from major industry players have driven innovation in packaging materials, manufacturing processes, and supply chain optimization. Circular economy principles are being integrated into product lifecycle management and waste reduction strategies.

Consumer education programs have expanded through digital platforms, pharmacy partnerships, and healthcare provider collaborations to promote responsible self-medication practices and improve health outcomes. Educational initiatives focus on proper medication use, drug interaction awareness, and when to seek professional medical advice.

Market participants should prioritize digital transformation initiatives to capture growing online consumer segments and enhance customer engagement through personalized health solutions. Investment strategies should focus on e-commerce platform development, mobile application integration, and data analytics capabilities that provide competitive advantages in consumer understanding and service delivery.

Product portfolio diversification into wellness and preventive health categories presents significant growth opportunities, particularly for companies with strong research and development capabilities. Innovation focus should address emerging consumer needs in mental wellness, sleep health, and specialized nutrition while maintaining core therapeutic category leadership.

Strategic partnerships with technology companies, healthcare providers, and digital health platforms can create integrated solutions that enhance consumer value propositions and market differentiation. Collaboration opportunities include telemedicine integration, health monitoring systems, and comprehensive wellness ecosystems.

Regional expansion strategies should consider local market preferences, distribution network optimization, and targeted marketing approaches that resonate with specific demographic segments. Market penetration in underserved rural areas through mobile pharmacy services and online platforms can unlock additional growth potential.

Sustainability initiatives should be integrated into core business strategies to align with consumer environmental consciousness and regulatory trends. Long-term planning should incorporate circular economy principles, sustainable sourcing practices, and environmental impact reduction goals that create competitive advantages and brand differentiation.

Market projections indicate sustained growth for the Spain OTC drugs market, driven by demographic trends, technological advancement, and evolving consumer healthcare preferences. MarkWide Research analysis suggests that digital transformation will continue reshaping market dynamics, with online sales channels expected to capture increasing market share reaching 25% within the next five years.

Therapeutic innovation will likely focus on combination products, extended-release formulations, and targeted delivery systems that enhance consumer convenience and treatment efficacy. Personalized medicine approaches may gain traction through genetic testing integration and customized formulation services that address individual health profiles and preferences.

Regulatory evolution is expected to support market growth through continued modernization of approval processes, digital labeling initiatives, and harmonization with European Union standards. Policy developments may expand OTC drug categories through prescription-to-OTC switches, increasing consumer access to effective treatments.

Consumer behavior trends suggest continued emphasis on preventive healthcare, wellness maintenance, and self-care practices that support long-term market expansion. Demographic shifts toward an aging population will sustain demand for chronic condition management and quality-of-life enhancement products.

Technology integration will likely accelerate through artificial intelligence applications, Internet of Things connectivity, and blockchain supply chain management that enhance product authenticity and consumer trust. Digital health ecosystems may create comprehensive platforms that integrate OTC medications with health monitoring, telemedicine, and wellness coaching services.

Spain’s OTC drugs market represents a dynamic and resilient sector of the pharmaceutical industry, characterized by strong consumer adoption, comprehensive regulatory frameworks, and continuous innovation in product development and distribution channels. The market has demonstrated remarkable adaptability to changing consumer needs, technological advancement, and evolving healthcare paradigms while maintaining its essential role in the country’s healthcare ecosystem.

Growth prospects remain robust, supported by favorable demographic trends, increasing health consciousness, and expanding digital accessibility that enhances consumer engagement and market reach. The successful integration of traditional pharmaceutical expertise with modern technology platforms positions the market for sustained expansion across multiple therapeutic categories and consumer segments.

Strategic opportunities abound for market participants who can effectively balance innovation with consumer trust, digital transformation with professional guidance, and growth ambitions with regulatory compliance. The market’s evolution toward personalized, preventive, and digitally-enabled healthcare solutions creates compelling value propositions for consumers, healthcare providers, and industry stakeholders alike, ensuring continued relevance and growth in Spain’s evolving healthcare landscape.

What is OTC Drugs?

OTC Drugs, or over-the-counter drugs, are medications available without a prescription, used for treating various common ailments such as headaches, colds, and allergies.

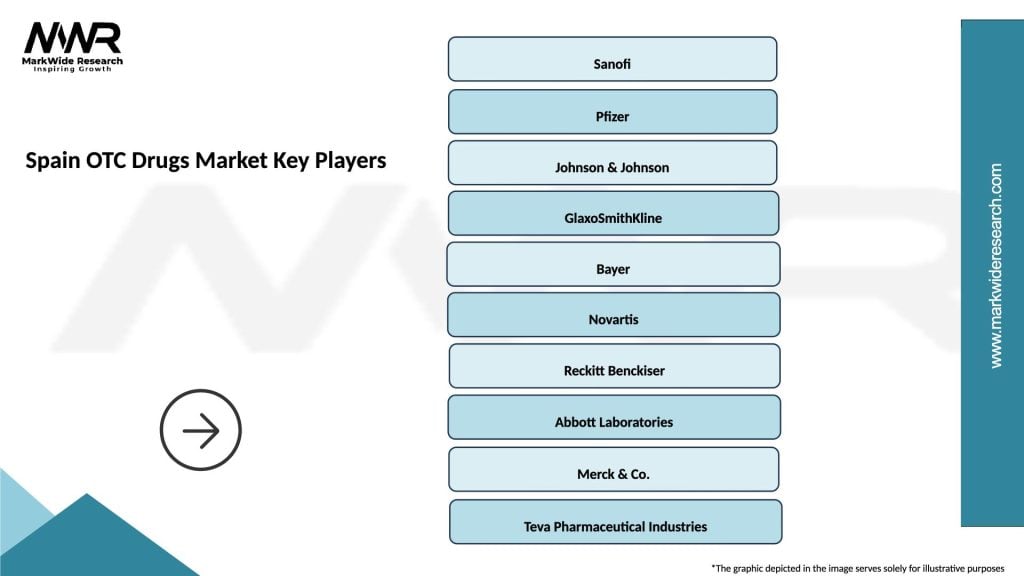

What are the key players in the Spain OTC Drugs Market?

Key players in the Spain OTC Drugs Market include companies like Bayer, GlaxoSmithKline, and Sanofi, which offer a range of products from pain relievers to cold medications, among others.

What are the growth factors driving the Spain OTC Drugs Market?

The Spain OTC Drugs Market is driven by factors such as increasing consumer awareness of self-medication, a growing aging population, and the rising prevalence of chronic diseases that require ongoing management.

What challenges does the Spain OTC Drugs Market face?

Challenges in the Spain OTC Drugs Market include regulatory hurdles, competition from prescription drugs, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Spain OTC Drugs Market?

Opportunities in the Spain OTC Drugs Market include the expansion of e-commerce platforms for drug sales, the development of natural and herbal OTC products, and increasing demand for personalized medicine solutions.

What trends are shaping the Spain OTC Drugs Market?

Trends in the Spain OTC Drugs Market include a shift towards digital health solutions, the rise of preventive healthcare products, and an increasing focus on sustainability in product development.

Spain OTC Drugs Market

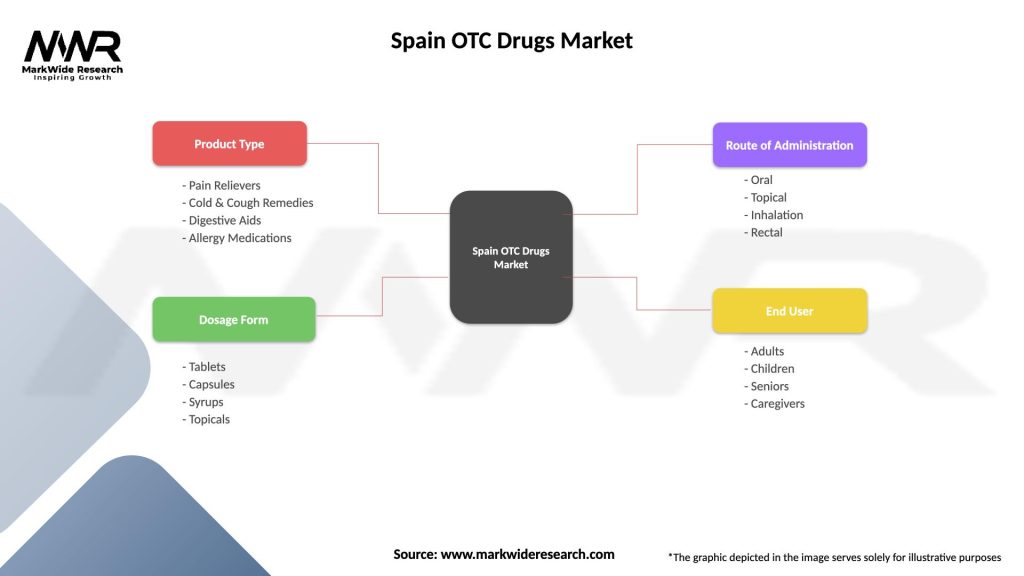

| Segmentation Details | Description |

|---|---|

| Product Type | Pain Relievers, Cold & Cough Remedies, Digestive Aids, Allergy Medications |

| Dosage Form | Tablets, Capsules, Syrups, Topicals |

| Route of Administration | Oral, Topical, Inhalation, Rectal |

| End User | Adults, Children, Seniors, Caregivers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain OTC Drugs Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at