444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain location-based services market represents a rapidly evolving technological landscape that has transformed how businesses and consumers interact with geographic information and spatial data. This dynamic sector encompasses a comprehensive range of services including navigation systems, geofencing applications, asset tracking solutions, and proximity marketing platforms that leverage GPS, cellular networks, and Wi-Fi positioning technologies. Market dynamics indicate substantial growth momentum driven by increasing smartphone penetration, advancing 5G infrastructure deployment, and growing demand for personalized digital experiences across various industry verticals.

Digital transformation initiatives across Spain have accelerated the adoption of location-based services, with businesses recognizing the strategic value of geographic intelligence for operational efficiency and customer engagement. The market demonstrates robust expansion with a projected compound annual growth rate of 12.4% through 2030, reflecting strong demand from retail, logistics, healthcare, and automotive sectors. Consumer behavior patterns show increasing acceptance of location-sharing applications, particularly among younger demographics who actively engage with location-aware mobile applications for social networking, commerce, and entertainment purposes.

Technological infrastructure improvements throughout Spain’s major metropolitan areas have created favorable conditions for advanced location-based service deployment. The integration of Internet of Things devices, artificial intelligence algorithms, and real-time analytics capabilities has enhanced service accuracy and expanded application possibilities. Regional adoption rates vary significantly, with Madrid and Barcelona leading in implementation while smaller cities demonstrate growing interest in location-based solutions for smart city initiatives and tourism enhancement programs.

The Spain location-based services market refers to the comprehensive ecosystem of technologies, applications, and platforms that utilize geographic positioning data to deliver contextually relevant information and services to users based on their physical location. These services encompass a broad spectrum of applications including navigation assistance, location-aware advertising, fleet management systems, emergency response coordination, and social networking features that connect users with nearby points of interest or other individuals.

Core functionality of location-based services relies on multiple positioning technologies including Global Positioning System satellites, cellular tower triangulation, Wi-Fi access point mapping, and Bluetooth beacon networks to determine precise user coordinates. The market includes both consumer-facing applications such as mapping services and ride-sharing platforms, as well as enterprise solutions for supply chain optimization, workforce management, and customer analytics. Service providers range from global technology giants offering comprehensive platforms to specialized local companies developing niche solutions for specific industry requirements.

Market participants include mobile network operators, software developers, hardware manufacturers, and system integrators who collaborate to deliver seamless location-aware experiences. The ecosystem supports various business models including subscription services, advertising-based platforms, and enterprise licensing agreements that generate revenue through location data monetization and value-added service offerings.

Strategic market analysis reveals that Spain’s location-based services sector has emerged as a critical component of the country’s digital economy, driven by widespread smartphone adoption and advancing telecommunications infrastructure. The market demonstrates exceptional growth potential with increasing integration across multiple industry verticals and expanding consumer acceptance of location-aware applications. Key growth drivers include rising demand for personalized marketing solutions, enhanced logistics optimization requirements, and growing emphasis on smart city development initiatives throughout Spanish municipalities.

Competitive landscape dynamics show a mix of international technology leaders and emerging local innovators competing for market share across different service categories. Major players focus on expanding their geographic coverage, improving location accuracy, and developing specialized solutions for vertical markets such as retail, transportation, and healthcare. Market penetration rates indicate that approximately 78% of Spanish smartphone users actively utilize location-based services, with highest adoption among urban populations and younger demographic segments.

Investment trends reflect growing confidence in the sector’s long-term prospects, with venture capital funding supporting innovative startups developing next-generation location intelligence platforms. The market benefits from favorable regulatory conditions and government support for digital transformation initiatives that encourage location-based service adoption across public and private sectors. Future growth projections suggest continued expansion driven by emerging technologies including augmented reality, autonomous vehicles, and advanced IoT implementations.

Market research findings indicate several critical insights that define the current state and future trajectory of Spain’s location-based services market. Consumer behavior analysis reveals increasing comfort levels with location sharing, particularly when users perceive clear value propositions such as personalized recommendations, improved navigation assistance, or enhanced safety features.

Primary growth catalysts propelling the Spain location-based services market include widespread smartphone proliferation, advancing telecommunications infrastructure, and increasing consumer demand for personalized digital experiences. Mobile device penetration has reached saturation levels in urban areas, with approximately 92% of Spanish adults owning smartphones capable of supporting sophisticated location-based applications. This extensive device adoption creates a substantial user base for service providers to target with innovative location-aware solutions.

5G network deployment across major Spanish cities has significantly enhanced the technical capabilities available to location-based service providers. Improved network speeds, reduced latency, and enhanced positioning accuracy enable more sophisticated applications including real-time augmented reality experiences, precise indoor navigation, and advanced IoT device integration. Infrastructure investments by telecommunications operators continue expanding coverage areas and improving service quality, particularly in previously underserved rural regions.

Business digitalization trends accelerated by recent global events have increased enterprise demand for location intelligence solutions. Companies across various industries recognize the strategic value of geographic data for operational optimization, customer engagement, and competitive advantage. E-commerce growth has particularly driven demand for delivery optimization, inventory management, and location-based marketing solutions that help businesses reach customers more effectively.

Government initiatives supporting smart city development and digital transformation have created favorable market conditions for location-based service adoption. Public sector investments in intelligent transportation systems, emergency response coordination, and citizen services platforms generate significant demand for specialized location-aware solutions. Tourism sector recovery following recent challenges has renewed interest in location-based applications that enhance visitor experiences and support local business discovery.

Privacy concerns represent the most significant constraint affecting Spain’s location-based services market growth. Consumer awareness of data collection practices has increased substantially, with many users expressing reluctance to share precise location information despite potential service benefits. Regulatory compliance requirements under European Union data protection frameworks add complexity and costs to service development and deployment processes, particularly for smaller companies with limited legal resources.

Technical limitations in certain geographic areas continue restricting service availability and quality. Rural and mountainous regions often experience inconsistent network coverage, limiting the effectiveness of location-based applications that require continuous connectivity. Indoor positioning challenges remain problematic for many applications, as GPS signals typically cannot penetrate building structures effectively, requiring alternative positioning technologies that increase implementation complexity and costs.

Battery consumption concerns associated with continuous location tracking affect user adoption rates, particularly for applications requiring frequent position updates. Many consumers disable location services to preserve device battery life, reducing the potential user base for location-dependent applications. Accuracy limitations in dense urban environments where tall buildings interfere with satellite signals can degrade service quality and user satisfaction levels.

Market fragmentation across different technology standards and platforms creates integration challenges for businesses seeking comprehensive location-based solutions. The lack of standardized protocols between different service providers can result in vendor lock-in situations and increased switching costs for enterprise customers. Economic uncertainties may also impact business investment decisions regarding location-based service implementations, particularly for small and medium enterprises with limited technology budgets.

Emerging technology convergence creates substantial opportunities for innovative location-based service applications in the Spanish market. The integration of artificial intelligence, machine learning, and advanced analytics with location data enables predictive services that anticipate user needs and provide proactive recommendations. Augmented reality applications represent a particularly promising opportunity, combining location awareness with immersive visual experiences for tourism, retail, and educational applications.

Smart city initiatives throughout Spain present significant growth opportunities for location-based service providers. Municipal governments increasingly seek integrated solutions for traffic management, public safety, environmental monitoring, and citizen engagement that rely heavily on location intelligence. Public-private partnerships in these areas can generate substantial revenue streams while contributing to urban development objectives.

Autonomous vehicle development and connected transportation systems create new market segments for specialized location-based services. As Spain prepares for autonomous vehicle deployment, demand increases for high-precision positioning services, real-time traffic optimization, and vehicle-to-infrastructure communication systems. Logistics sector evolution toward more sophisticated supply chain management also drives demand for advanced tracking, routing, and delivery optimization solutions.

Healthcare sector digitalization offers opportunities for location-based services in patient monitoring, emergency response, and healthcare facility management. The aging Spanish population creates demand for location-aware health monitoring systems that can provide family members and healthcare providers with real-time information about patient safety and well-being. Tourism industry recovery presents opportunities for innovative location-based applications that enhance visitor experiences while supporting local business promotion and cultural heritage preservation.

Competitive forces shaping the Spain location-based services market reflect a complex interplay between established technology giants, emerging local innovators, and specialized service providers targeting specific industry verticals. Market consolidation trends show larger companies acquiring smaller specialists to expand their service portfolios and geographic coverage, while new entrants focus on niche applications with differentiated value propositions.

Technology evolution cycles drive continuous market transformation as new positioning technologies, data processing capabilities, and user interface innovations emerge. The transition from 4G to 5G networks has particularly impacted service capabilities, enabling more sophisticated applications with improved accuracy and reduced latency. Consumer expectations continue rising as users become accustomed to seamless, accurate location-based experiences across different applications and platforms.

Regulatory environment changes significantly influence market dynamics, with data protection requirements affecting service design and implementation strategies. Companies must balance user privacy concerns with service functionality, often requiring innovative approaches to data collection, processing, and storage. Cross-border service provision within the European Union creates opportunities for Spanish companies to expand internationally while facing increased competition from foreign service providers.

Partnership ecosystem development has become crucial for market success, with companies forming strategic alliances to combine complementary technologies and capabilities. Integration complexity increases as businesses seek comprehensive solutions that work seamlessly across multiple platforms and devices. According to MarkWide Research analysis, successful market participants typically invest heavily in partnership development and ecosystem integration capabilities to maintain competitive advantages.

Comprehensive market analysis for the Spain location-based services market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include structured interviews with industry executives, technology providers, and end-user organizations across different sectors to gather firsthand perspectives on market trends, challenges, and opportunities. Survey research among Spanish consumers provides quantitative data on usage patterns, preferences, and adoption barriers.

Secondary research components involve extensive analysis of industry reports, government publications, academic studies, and company financial disclosures to establish market context and validate primary research findings. Data triangulation methods compare information from multiple sources to ensure consistency and identify potential discrepancies that require additional investigation.

Market sizing methodologies utilize bottom-up and top-down approaches to estimate market dimensions and growth projections. Bottom-up analysis examines individual market segments, service categories, and regional variations to build comprehensive market models. Top-down validation compares these estimates with broader technology market trends and macroeconomic indicators to ensure realistic projections.

Qualitative analysis techniques include competitive landscape mapping, value chain analysis, and strategic group identification to understand market structure and dynamics. Quantitative modeling incorporates statistical analysis, trend extrapolation, and scenario planning to develop robust market forecasts and identify key success factors for market participants.

Geographic market distribution across Spain reveals significant variations in location-based service adoption and implementation levels. Madrid metropolitan area leads in market development with approximately 35% of national market activity, driven by high population density, advanced telecommunications infrastructure, and concentration of technology companies and early adopters. The region benefits from extensive 5G network coverage and strong government support for digital transformation initiatives.

Catalonia region, anchored by Barcelona, represents approximately 28% of market share with particular strength in tourism-related location-based services and smart city applications. The region’s focus on innovation and technology development has attracted significant investment in location intelligence platforms and mobile application development. Coastal areas throughout Catalonia demonstrate high adoption rates for tourism and hospitality applications.

Andalusia region shows growing market presence with approximately 15% market share, primarily driven by tourism applications and agricultural technology implementations. The region’s diverse economy creates demand for various location-based service categories, from precision agriculture solutions to cultural heritage tourism applications. Infrastructure development in major cities like Seville and Málaga supports expanding service availability.

Valencia region contributes approximately 12% of market activity with strong focus on logistics and transportation applications due to its strategic location and port facilities. The region’s manufacturing sector drives demand for asset tracking and supply chain optimization solutions. Rural regions throughout Spain represent emerging opportunities as telecommunications infrastructure improvements expand service availability to previously underserved areas, though adoption rates remain lower than urban centers.

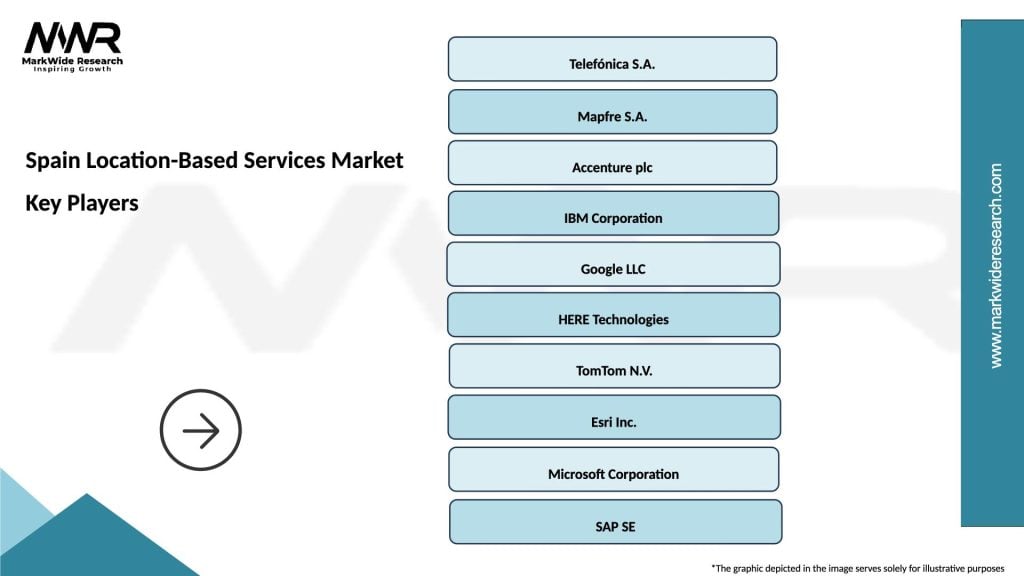

Market leadership positions in Spain’s location-based services sector are held by a combination of global technology giants and specialized regional providers. Competitive dynamics reflect ongoing innovation in service capabilities, geographic coverage expansion, and vertical market specialization strategies.

Competitive strategies focus on differentiation through specialized industry expertise, superior data accuracy, enhanced privacy protection, and comprehensive platform integration capabilities. Market entry barriers include significant technology development costs, regulatory compliance requirements, and the need for extensive partnership networks to achieve market scale.

Market segmentation analysis reveals distinct categories within Spain’s location-based services market, each characterized by unique customer requirements, technology approaches, and growth trajectories. Service type segmentation provides the primary framework for understanding market structure and competitive dynamics.

By Technology:

By Application:

By End-user:

Navigation and mapping services represent the largest market segment with widespread consumer adoption and continuous innovation in real-time traffic integration, route optimization, and point-of-interest discovery. Consumer engagement levels remain consistently high with approximately 85% of smartphone users regularly utilizing navigation applications for daily transportation needs. Enterprise adoption focuses on fleet management and logistics optimization solutions that provide significant operational efficiency improvements.

Location-based advertising demonstrates rapid growth as businesses recognize the value of geographically targeted marketing campaigns. Retail sector adoption has accelerated with proximity marketing solutions that deliver personalized offers to consumers near physical store locations. Privacy regulations have influenced implementation approaches, requiring transparent consent mechanisms and data handling practices that maintain consumer trust while enabling effective marketing outcomes.

Asset tracking applications show strong growth in logistics, healthcare, and manufacturing sectors where real-time visibility into equipment, inventory, and personnel locations provides operational advantages. IoT integration has expanded capabilities beyond simple location monitoring to include condition monitoring, predictive maintenance, and automated workflow optimization. The segment benefits from increasing adoption of connected devices and sensors throughout Spanish industries.

Social networking features integrated with location services have gained popularity among younger demographics who actively share location information with friends and discover nearby social activities. Privacy-conscious implementations allow users to control location sharing preferences while maintaining social connectivity features. Business applications include employee collaboration tools and customer community building platforms that leverage location context for enhanced user experiences.

Service providers benefit from expanding market opportunities across multiple industry verticals and geographic regions throughout Spain. Revenue diversification through various business models including subscription services, advertising platforms, and enterprise licensing agreements provides financial stability and growth potential. Technology providers can leverage their location intelligence capabilities to develop specialized solutions for emerging applications such as autonomous vehicles, smart cities, and augmented reality experiences.

Enterprise customers gain significant operational advantages through location-based service implementations including improved logistics efficiency, enhanced customer engagement, and better resource allocation. Cost reduction opportunities arise from optimized routing, reduced fuel consumption, and improved asset utilization rates. Customer analytics capabilities enable businesses to understand consumer behavior patterns and preferences for more effective marketing and service delivery strategies.

End-user consumers benefit from enhanced convenience, personalized experiences, and improved safety through location-aware applications. Navigation efficiency reduces travel time and stress while location-based recommendations help users discover relevant services and points of interest. Emergency service integration provides enhanced personal safety capabilities, particularly valuable for elderly users and those with medical conditions requiring monitoring.

Government stakeholders can leverage location-based services for improved public service delivery, emergency response coordination, and smart city development initiatives. Urban planning benefits include better traffic management, environmental monitoring, and citizen engagement platforms that enhance quality of life for Spanish residents. Economic development opportunities arise from supporting local technology companies and attracting international investment in location intelligence capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming Spain’s location-based services market. Machine learning algorithms enable predictive analytics that anticipate user needs, optimize routing decisions, and provide personalized recommendations based on historical behavior patterns and real-time context. AI-powered location intelligence platforms can process vast amounts of geographic data to identify trends, anomalies, and opportunities that human analysis might miss.

Privacy-first design approaches have become essential as consumers demand greater control over their location data. Differential privacy techniques and edge computing implementations allow service providers to deliver personalized experiences while minimizing data collection and retention. Transparent consent mechanisms and granular privacy controls help build user trust while maintaining service functionality.

Augmented reality convergence with location services creates immersive experiences that overlay digital information onto physical environments. Tourism applications provide historical information, navigation assistance, and cultural context through smartphone cameras, while retail implementations enable virtual product placement and interactive shopping experiences. The trend requires advanced positioning accuracy and real-time data processing capabilities.

Edge computing deployment reduces latency and improves reliability for location-based services by processing data closer to end users. Real-time applications such as autonomous vehicle navigation and emergency response systems benefit from reduced communication delays and improved system responsiveness. The trend supports more sophisticated applications while addressing privacy concerns through localized data processing.

Strategic partnerships between telecommunications operators and technology companies have accelerated location-based service innovation throughout Spain. Telefónica’s collaboration with various IoT platform providers has expanded enterprise location intelligence capabilities, while partnerships with automotive manufacturers prepare for connected vehicle deployments. These alliances combine network infrastructure expertise with specialized application development capabilities.

Government investment programs supporting smart city development have generated significant demand for integrated location-based solutions. Municipal projects in Madrid, Barcelona, and other major cities include intelligent transportation systems, environmental monitoring networks, and citizen engagement platforms that rely heavily on location intelligence. Public-private partnerships facilitate technology deployment while sharing implementation costs and risks.

Startup ecosystem growth has produced innovative location-based service applications targeting specific market niches. Venture capital investment in Spanish location technology companies has increased substantially, supporting development of specialized solutions for healthcare monitoring, precision agriculture, and cultural heritage preservation. These emerging companies often focus on addressing specific regional needs or industry requirements.

Regulatory framework evolution continues shaping market development through data protection requirements and privacy standards. MWR analysis indicates that successful companies proactively adapt their service designs to meet evolving regulatory requirements while maintaining competitive functionality. Industry collaboration on privacy standards and best practices helps establish market-wide approaches to compliance challenges.

Market entry strategies for new participants should focus on specialized vertical applications rather than competing directly with established general-purpose platforms. Niche market opportunities exist in sectors such as healthcare, agriculture, and cultural tourism where specialized knowledge and customized solutions provide competitive advantages. Companies should prioritize building strong local partnerships and understanding specific Spanish market requirements.

Technology investment priorities should emphasize privacy-preserving capabilities, artificial intelligence integration, and multi-platform compatibility. Service providers must balance functionality with privacy protection to maintain user trust and regulatory compliance. Investment in edge computing capabilities and real-time processing infrastructure will become increasingly important as applications demand lower latency and improved reliability.

Partnership development represents a critical success factor for sustained market growth. Ecosystem collaboration between technology providers, telecommunications operators, and industry-specific partners enables comprehensive solution delivery that addresses complex customer requirements. Companies should focus on developing complementary capabilities rather than attempting to build complete solutions independently.

Customer education initiatives can help address privacy concerns and increase adoption rates for location-based services. Transparent communication about data usage, security measures, and user benefits helps build trust and confidence among potential users. Service providers should invest in user experience design that makes privacy controls accessible and understandable for non-technical users.

Long-term market projections indicate sustained growth for Spain’s location-based services market driven by continued technological advancement and expanding application areas. 5G network maturation will enable more sophisticated services with enhanced accuracy, reduced latency, and improved reliability. The integration of artificial intelligence, Internet of Things devices, and edge computing capabilities will create new service categories and business opportunities.

Autonomous vehicle deployment represents a transformative opportunity that will require comprehensive location intelligence infrastructure. Connected transportation systems will demand high-precision positioning services, real-time traffic optimization, and vehicle-to-infrastructure communication capabilities. Spanish companies that develop expertise in automotive location services may gain significant competitive advantages as the market evolves.

Smart city development will continue driving demand for integrated location-based solutions that support urban management, citizen services, and environmental monitoring. Municipal digitalization initiatives will require comprehensive platforms that combine location intelligence with other smart city technologies. The trend creates opportunities for both large system integrators and specialized solution providers.

Consumer behavior evolution suggests increasing acceptance of location-based services as privacy controls improve and value propositions become clearer. Generational differences in privacy attitudes and technology adoption will influence market development, with younger users generally more willing to share location data in exchange for personalized services. According to MarkWide Research projections, market growth will accelerate as privacy-preserving technologies mature and consumer confidence increases.

Spain’s location-based services market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, increasing consumer adoption, and expanding enterprise applications. The market benefits from strong telecommunications infrastructure, government support for digital transformation, and a diverse economy that creates demand across multiple industry verticals. Key success factors include privacy-first design approaches, strategic partnership development, and specialization in vertical market applications.

Market challenges related to privacy concerns, regulatory compliance, and technical limitations require innovative solutions and proactive management strategies. Companies that successfully balance functionality with privacy protection while delivering clear value propositions will capture the greatest market opportunities. Competitive dynamics favor organizations that can combine technological expertise with deep understanding of local market requirements and customer preferences.

Future growth prospects remain positive with emerging technologies such as 5G networks, artificial intelligence, and augmented reality creating new application possibilities and market segments. The convergence of location intelligence with other digital technologies will enable more sophisticated and valuable services that transform how businesses operate and consumers interact with their physical environment. Strategic positioning in this evolving market requires continuous innovation, strong partnerships, and commitment to privacy-preserving service delivery that builds long-term customer trust and loyalty.

What is Location-Based Services?

Location-Based Services (LBS) refer to applications and services that utilize geographical data to provide information or services to users based on their location. These services are commonly used in navigation, local search, and location tracking.

What are the key players in the Spain Location-Based Services Market?

Key players in the Spain Location-Based Services Market include Telefónica, Google, and HERE Technologies, which provide various LBS solutions such as mapping, navigation, and location analytics, among others.

What are the growth factors driving the Spain Location-Based Services Market?

The growth of the Spain Location-Based Services Market is driven by the increasing adoption of smartphones, the rise in demand for real-time data, and the expansion of IoT applications in various sectors such as retail and transportation.

What challenges does the Spain Location-Based Services Market face?

Challenges in the Spain Location-Based Services Market include privacy concerns regarding user data, the need for high accuracy in location tracking, and competition among service providers, which can impact pricing and service quality.

What opportunities exist in the Spain Location-Based Services Market?

Opportunities in the Spain Location-Based Services Market include the integration of augmented reality in navigation apps, the growth of smart city initiatives, and the potential for personalized marketing based on location data.

What trends are shaping the Spain Location-Based Services Market?

Trends shaping the Spain Location-Based Services Market include the increasing use of AI for location analytics, the rise of geofencing for targeted advertising, and the growing importance of location data in enhancing customer experiences.

Spain Location-Based Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Navigation, Tracking, Fleet Management, Location Analytics |

| End User | Retail, Transportation, Healthcare, Hospitality |

| Technology | GPS, Wi-Fi, Bluetooth, Cellular |

| Application | Smart Cities, Emergency Services, Marketing, Asset Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Location-Based Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at