444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain food flavor and enhancer market represents a dynamic and rapidly evolving sector within the country’s broader food processing industry. This market encompasses a comprehensive range of natural and artificial flavoring agents, taste enhancers, and aromatic compounds that are essential components in food manufacturing, restaurant operations, and culinary applications across Spain. Market dynamics indicate robust growth driven by changing consumer preferences, increased demand for processed foods, and the expansion of Spain’s food service industry.

Consumer behavior patterns in Spain show a growing preference for authentic flavors combined with convenience foods, creating substantial opportunities for flavor and enhancer manufacturers. The market benefits from Spain’s rich culinary heritage and the increasing popularity of Spanish cuisine globally, which drives demand for traditional and innovative flavor profiles. Growth projections suggest the market is expanding at a 6.2% CAGR, reflecting strong underlying demand across multiple food categories.

Regional distribution shows that major metropolitan areas including Madrid, Barcelona, Valencia, and Seville account for approximately 68% of market consumption, driven by higher concentrations of food processing facilities and restaurant establishments. The market’s evolution is closely tied to Spain’s position as a major food exporter within the European Union, creating additional demand for flavor solutions that meet international quality standards.

The Spain food flavor and enhancer market refers to the comprehensive ecosystem of natural and synthetic compounds, additives, and ingredients designed to improve, modify, or enhance the taste, aroma, and overall sensory experience of food products consumed within the Spanish market. This market encompasses flavor concentrates, essential oils, natural extracts, artificial flavoring agents, taste modulators, and various enhancement compounds used across food manufacturing, food service, and retail sectors.

Market scope includes both traditional Spanish flavor profiles such as saffron, paprika, and olive-based compounds, as well as international flavors adapted for local preferences. The market serves diverse applications including processed foods, beverages, confectionery, dairy products, meat processing, and restaurant operations throughout Spain’s culinary landscape.

Strategic analysis of the Spain food flavor and enhancer market reveals a sector characterized by steady growth, innovation, and increasing sophistication in consumer taste preferences. The market demonstrates resilience through economic fluctuations while adapting to evolving dietary trends, health consciousness, and demand for authentic culinary experiences.

Key market drivers include the expansion of Spain’s food processing industry, growing restaurant and hospitality sectors, increased consumer spending on premium food products, and rising demand for convenience foods with enhanced flavor profiles. Natural flavors represent approximately 42% of market preference, reflecting consumer trends toward clean-label products and natural ingredients.

Competitive landscape features a mix of international flavor houses, regional specialists, and local producers who understand Spanish culinary traditions. Market participants are investing in research and development to create innovative flavor solutions that balance traditional Spanish tastes with contemporary consumer expectations for variety and quality.

Market intelligence reveals several critical insights that define the current state and future trajectory of Spain’s food flavor and enhancer sector:

Primary growth drivers propelling the Spain food flavor and enhancer market forward include several interconnected factors that reflect broader economic, social, and consumer trends across the country.

Economic expansion in Spain’s food processing sector serves as a fundamental driver, with increased production capacity and technological advancement creating greater demand for sophisticated flavor solutions. The country’s robust agricultural sector provides abundant raw materials for natural flavor extraction, supporting domestic production capabilities and reducing import dependencies.

Consumer lifestyle changes significantly impact market dynamics, as urbanization and busy lifestyles drive demand for convenient, flavorful food options. Spanish consumers increasingly value culinary experiences that combine traditional flavors with modern convenience, creating opportunities for innovative flavor applications in ready-to-eat meals, snacks, and processed foods.

Tourism industry growth contributes substantially to market expansion, as Spain’s position as a leading global tourist destination creates demand for authentic Spanish flavors in restaurants, hotels, and food service establishments. International visitors seeking genuine Spanish culinary experiences drive demand for high-quality flavor solutions that deliver authentic taste profiles.

Export market opportunities provide additional growth momentum, as Spanish food manufacturers expand their international presence and require flavor systems that meet diverse regulatory requirements while maintaining product quality and consistency across different markets.

Regulatory challenges represent significant constraints within the Spain food flavor and enhancer market, as compliance with evolving European Union food safety regulations requires substantial investment in testing, documentation, and quality assurance systems. Regulatory complexity particularly affects smaller market participants who may lack resources for comprehensive compliance programs.

Raw material price volatility creates ongoing challenges for flavor manufacturers, as fluctuations in agricultural commodity prices, essential oil costs, and specialty ingredient availability can significantly impact production costs and profit margins. Supply chain disruptions occasionally affect ingredient availability, particularly for imported specialty compounds and natural extracts.

Consumer skepticism toward artificial additives and synthetic flavors presents market constraints, as health-conscious consumers increasingly scrutinize ingredient labels and prefer products with minimal processing. This trend requires manufacturers to invest in more expensive natural alternatives while maintaining cost competitiveness.

Economic sensitivity affects market growth during periods of economic uncertainty, as food manufacturers may reduce spending on premium flavor ingredients in favor of cost-effective alternatives. Market competition from low-cost imports and generic flavor solutions creates pricing pressure across various market segments.

Emerging opportunities within the Spain food flavor and enhancer market present substantial potential for growth and innovation across multiple sectors and applications.

Health and wellness trends create significant opportunities for developing functional flavors that combine taste enhancement with nutritional benefits. Functional ingredients such as probiotics, vitamins, and antioxidants can be incorporated into flavor systems, appealing to health-conscious consumers while adding value to food products.

Plant-based food revolution offers substantial growth potential, as the increasing popularity of vegetarian and vegan diets creates demand for sophisticated flavor solutions that enhance plant-based proteins and meat alternatives. Umami enhancement and savory flavor development represent particularly promising areas for innovation in this segment.

Premium and artisanal segments present opportunities for specialized flavor houses to develop unique, high-quality solutions for gourmet food manufacturers and upscale restaurants. Craft food movement in Spain drives demand for distinctive flavor profiles that differentiate products in competitive markets.

Digital transformation enables new business models and customer engagement strategies, including direct-to-consumer sales, customized flavor solutions, and data-driven product development based on consumer preferences and market trends.

Market dynamics in the Spain food flavor and enhancer sector reflect complex interactions between supply-side factors, demand patterns, competitive forces, and regulatory influences that shape market evolution and strategic decision-making.

Supply chain integration has become increasingly important, with successful companies developing closer relationships with raw material suppliers, food manufacturers, and end-users to ensure consistent quality and reliable delivery. Vertical integration strategies allow some market participants to control key aspects of production while reducing costs and improving quality control.

Technology adoption drives market transformation through advanced extraction methods, encapsulation technologies, and precision flavor delivery systems. Innovation cycles have accelerated, with companies investing approximately 8.5% of revenues in research and development to maintain competitive advantages and meet evolving consumer expectations.

Market consolidation trends show larger companies acquiring specialized flavor houses and regional producers to expand their capabilities and market reach. Strategic partnerships between flavor companies and food manufacturers have become more common, creating collaborative approaches to product development and market expansion.

Consumer education plays an increasingly important role in market dynamics, as companies invest in marketing and communication strategies to help consumers understand the value and safety of flavor enhancement technologies.

Comprehensive research methodology employed in analyzing the Spain food flavor and enhancer market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of market insights.

Primary research components include structured interviews with industry executives, flavor chemists, food manufacturers, restaurant operators, and regulatory experts across Spain’s major metropolitan areas. Survey methodologies capture quantitative data on market preferences, purchasing patterns, and growth projections from key market participants.

Secondary research analysis encompasses comprehensive review of industry publications, trade association reports, regulatory filings, company annual reports, and academic research related to food science and flavor technology. Market intelligence gathering includes analysis of import/export data, production statistics, and consumption patterns across different food categories.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert verification, and statistical analysis of market trends. Analytical frameworks include competitive analysis, SWOT assessment, market segmentation studies, and trend analysis to provide comprehensive market understanding.

MarkWide Research methodology incorporates both quantitative and qualitative research approaches, ensuring balanced perspective on market dynamics and future opportunities within Spain’s food flavor and enhancer sector.

Regional market distribution across Spain reveals distinct patterns of consumption, production, and growth opportunities that reflect the country’s diverse economic landscape and culinary traditions.

Madrid region represents the largest market segment, accounting for approximately 28% of national consumption, driven by high concentrations of food processing facilities, corporate headquarters, and sophisticated restaurant scenes. The region’s role as Spain’s economic center creates substantial demand for premium flavor solutions and innovative food products.

Catalonia region, centered around Barcelona, contributes roughly 24% of market activity, benefiting from strong industrial base, international trade connections, and vibrant culinary culture. The region’s proximity to France and Mediterranean influences create unique flavor preferences and market opportunities.

Valencia region shows significant growth potential with approximately 15% market share, supported by extensive agricultural production, food processing industries, and growing tourism sector. The region’s specialization in citrus fruits and rice production creates demand for specific flavor profiles and enhancement solutions.

Andalusia region represents about 18% of market consumption, driven by olive oil production, agricultural processing, and traditional food manufacturing. The region’s rich culinary heritage and export-oriented food industry create substantial opportunities for authentic Spanish flavor development.

Basque Country and other regions collectively account for the remaining 15% of market activity, with each area contributing unique flavor preferences and specialized market segments based on local culinary traditions and industrial capabilities.

Competitive environment within the Spain food flavor and enhancer market features diverse participants ranging from multinational corporations to specialized regional producers, each contributing unique capabilities and market positioning.

Market positioning strategies vary significantly among competitors, with some focusing on premium natural solutions while others emphasize cost-effective synthetic alternatives. Innovation capabilities and technical support services increasingly differentiate successful market participants from commodity suppliers.

Market segmentation analysis reveals distinct categories within the Spain food flavor and enhancer market, each characterized by unique demand patterns, growth trajectories, and competitive dynamics.

By Product Type:

By Application:

By End-User:

Natural flavors category demonstrates the strongest growth momentum within the Spanish market, driven by consumer preferences for clean-label products and authentic taste experiences. Premium positioning allows natural flavor producers to command higher margins while meeting increasing demand for transparency in food ingredients.

Beverage applications represent the most dynamic market segment, with craft beverages, functional drinks, and premium alcoholic beverages driving demand for innovative flavor solutions. Seasonal variations in beverage consumption create opportunities for specialized flavor profiles that align with Spanish cultural preferences and climate patterns.

Savory flavor segment shows particular strength in Spain, reflecting the country’s rich culinary traditions and preference for complex, layered taste profiles. Mediterranean influences drive demand for herb-based flavors, olive notes, and traditional Spanish spice combinations that enhance authentic culinary experiences.

Functional flavor category emerges as a growth area, combining taste enhancement with health benefits such as digestive support, immune system strengthening, and nutritional supplementation. Consumer wellness trends create opportunities for innovative products that deliver both sensory satisfaction and functional benefits.

Artisanal and craft segments demonstrate robust growth as Spanish consumers increasingly value unique, small-batch products with distinctive flavor profiles that reflect regional traditions and innovative culinary approaches.

Strategic advantages available to participants in the Spain food flavor and enhancer market create substantial value propositions across the entire supply chain, from raw material suppliers to end consumers.

For Flavor Manufacturers:

For Food Manufacturers:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Spain food flavor and enhancer market reflect broader shifts in consumer behavior, technology advancement, and industry evolution that will define future market development.

Clean Label Movement represents the most significant trend impacting the market, as Spanish consumers increasingly demand transparency in food ingredients and prefer products with recognizable, natural components. Ingredient simplification drives manufacturers to develop flavor solutions using fewer, more natural ingredients while maintaining taste quality and product appeal.

Sustainability Focus influences purchasing decisions across all market segments, with consumers and businesses prioritizing environmentally responsible sourcing, production methods, and packaging solutions. Carbon footprint reduction initiatives encourage local sourcing and efficient production processes that minimize environmental impact.

Personalization Trends create demand for customized flavor solutions that cater to individual preferences, dietary restrictions, and cultural backgrounds. Mass customization technologies enable flavor companies to offer tailored solutions while maintaining production efficiency and cost effectiveness.

Digital Integration transforms how flavor companies interact with customers, develop products, and manage supply chains. Data analytics enable more precise flavor development based on consumer preferences and market trends, while digital platforms facilitate direct customer engagement and feedback collection.

Functional Integration combines flavor enhancement with nutritional benefits, creating products that deliver both sensory satisfaction and health advantages. Nutraceutical flavors represent a growing segment where taste enhancement supports supplement and functional food applications.

Recent industry developments within the Spain food flavor and enhancer market demonstrate ongoing innovation, strategic positioning, and adaptation to changing market conditions.

Technology Investments by major market participants include advanced extraction methods, encapsulation technologies, and precision flavor delivery systems that improve product quality and application versatility. Research partnerships between flavor companies and Spanish universities accelerate innovation in natural flavor development and sustainable production methods.

Acquisition Activity shows larger international companies acquiring Spanish flavor specialists to gain access to local market knowledge, traditional flavor expertise, and regional distribution networks. Strategic consolidation enables companies to offer more comprehensive solutions while achieving operational efficiencies.

Regulatory Developments include updated EU guidelines on natural flavor definitions, labeling requirements, and safety assessments that influence product development and marketing strategies. Compliance initiatives require ongoing investment in quality systems and documentation processes.

Sustainability Programs launched by leading companies focus on responsible sourcing, waste reduction, and carbon footprint minimization. Circular economy principles guide development of production processes that maximize resource utilization and minimize environmental impact.

Market Expansion initiatives include new product launches targeting specific consumer segments, geographic expansion within Spain, and development of export-oriented flavor solutions that meet international market requirements.

Strategic recommendations for market participants in the Spain food flavor and enhancer sector focus on positioning for sustainable growth while addressing evolving consumer preferences and competitive challenges.

Investment Priorities should emphasize natural flavor development capabilities, sustainable sourcing infrastructure, and advanced technology platforms that enable efficient production and quality consistency. MWR analysis suggests companies allocating approximately 12% of revenues to research and development activities will maintain competitive advantages in innovation-driven market segments.

Market Positioning strategies should leverage Spain’s culinary heritage while embracing international trends and consumer preferences. Authenticity combined with innovation provides optimal positioning for companies seeking to differentiate their offerings in competitive markets.

Partnership Development with food manufacturers, restaurant chains, and retail organizations creates opportunities for collaborative product development and market expansion. Strategic alliances enable smaller companies to access larger markets while providing established players with specialized capabilities and market insights.

Geographic Expansion within Spain should focus on underserved regional markets while building export capabilities for international growth. Distribution network optimization ensures efficient market coverage and customer service delivery across diverse market segments.

Regulatory Compliance investments should anticipate future regulatory changes while ensuring current operations meet all applicable standards. Proactive compliance strategies provide competitive advantages and reduce operational risks associated with regulatory changes.

Future market trajectory for the Spain food flavor and enhancer market indicates continued growth driven by evolving consumer preferences, technological advancement, and expanding applications across food and beverage sectors.

Growth projections suggest the market will maintain robust expansion with projected compound annual growth rates of 6.8% over the next five years, supported by increasing demand for natural flavors, functional ingredients, and premium food experiences. Market maturation will likely favor companies with strong innovation capabilities and comprehensive product portfolios.

Technology evolution will continue transforming flavor development and delivery methods, with advances in encapsulation, controlled release, and precision flavor systems creating new application opportunities. Artificial intelligence and machine learning applications will enhance flavor development processes and consumer preference prediction capabilities.

Consumer trends toward health consciousness, sustainability, and authentic experiences will drive demand for natural, functional, and culturally relevant flavor solutions. Demographic shifts including aging population and increasing international residents will create diverse market opportunities requiring specialized flavor approaches.

Regulatory landscape evolution will likely emphasize transparency, sustainability, and safety, requiring ongoing adaptation of production methods and product formulations. International harmonization of standards may facilitate export market development and cross-border trade opportunities.

MarkWide Research projects that successful market participants will be those who effectively balance traditional Spanish flavor expertise with innovative technologies and sustainable business practices, creating value for customers while building resilient, growth-oriented operations.

Comprehensive analysis of the Spain food flavor and enhancer market reveals a dynamic, evolving sector with substantial growth potential driven by consumer preference changes, technological innovation, and expanding application opportunities across food and beverage industries.

Market fundamentals remain strong, supported by Spain’s rich culinary heritage, robust food processing industry, and strategic position within European markets. The combination of traditional flavor expertise and modern innovation capabilities creates unique competitive advantages for Spanish market participants while attracting international investment and partnership opportunities.

Strategic success factors include commitment to natural ingredient development, sustainable business practices, technological innovation, and deep understanding of evolving consumer preferences. Companies that effectively balance authenticity with innovation while maintaining operational excellence will capture the greatest market opportunities in this expanding sector.

The Spain food flavor and enhancer market represents a compelling investment opportunity for companies seeking growth in the European food industry, offering diverse applications, strong consumer demand, and favorable long-term market dynamics that support sustainable business development and value creation across the entire supply chain.

What is Food Flavor & Enhancer?

Food Flavor & Enhancer refers to substances added to food products to enhance their taste, aroma, and overall sensory experience. These can include natural and artificial flavors, spices, and seasoning blends used across various food categories.

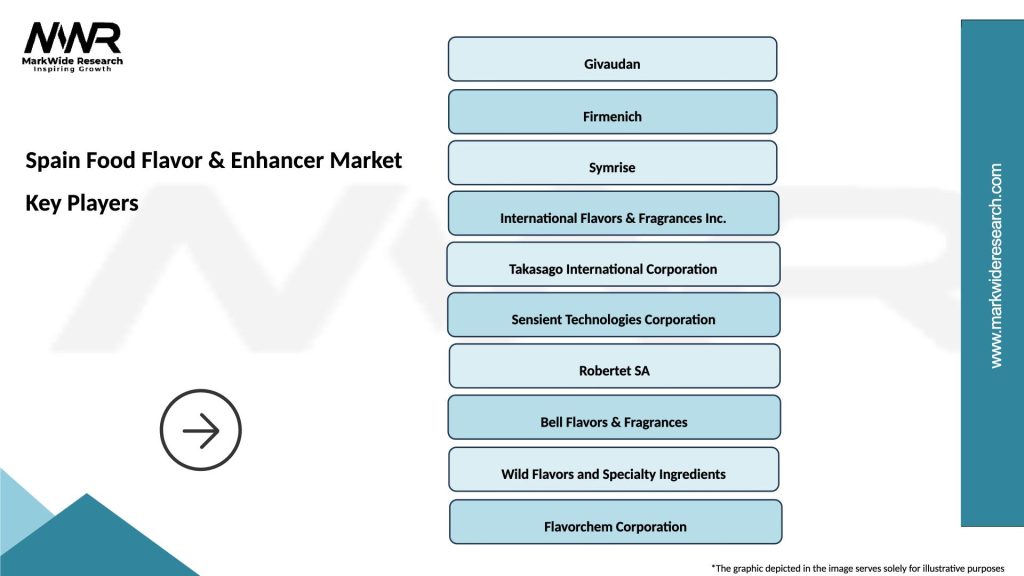

What are the key companies in the Spain Food Flavor & Enhancer Market?

Key companies in the Spain Food Flavor & Enhancer Market include Givaudan, Firmenich, and Symrise, which are known for their innovative flavor solutions and extensive product portfolios, among others.

What are the growth factors driving the Spain Food Flavor & Enhancer Market?

The growth of the Spain Food Flavor & Enhancer Market is driven by increasing consumer demand for natural flavors, the rise of plant-based food products, and the growing trend of gourmet cooking at home.

What challenges does the Spain Food Flavor & Enhancer Market face?

Challenges in the Spain Food Flavor & Enhancer Market include regulatory hurdles regarding food safety, the high cost of natural ingredients, and competition from synthetic alternatives that may offer lower prices.

What opportunities exist in the Spain Food Flavor & Enhancer Market?

Opportunities in the Spain Food Flavor & Enhancer Market include the growing interest in health-conscious products, the expansion of ethnic cuisines, and the increasing use of flavors in non-food applications such as beverages and cosmetics.

What trends are shaping the Spain Food Flavor & Enhancer Market?

Trends in the Spain Food Flavor & Enhancer Market include a shift towards clean label products, the incorporation of unique and exotic flavors, and the use of technology to develop innovative flavor profiles that cater to evolving consumer preferences.

Spain Food Flavor & Enhancer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Extracts, Artificial Flavors, Seasoning Blends, Flavor Enhancers |

| End User | Food Manufacturers, Beverage Producers, Restaurants, Catering Services |

| Application | Snacks, Sauces, Dairy Products, Bakery Items |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Wholesale Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Food Flavor & Enhancer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at