444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Food additives play a crucial role in the modern food industry by enhancing the taste, texture, appearance, and shelf life of various food products. The Spain food additives market has witnessed significant growth in recent years, driven by increasing consumer demand for processed and convenience foods, as well as the growing awareness of the importance of food safety and quality. As one of the largest markets for food additives in Europe, Spain offers promising opportunities for both domestic and international players. In this comprehensive report, we delve into the key insights, market dynamics, regional analysis, competitive landscape, and future outlook of the Spain food additives market.

Meaning

Food additives are substances added to food products during production or processing to preserve, flavor, texture, and enhance their overall quality. These additives are typically used in minimal quantities and are carefully regulated by food safety authorities to ensure they pose no harm to consumers. Some common types of food additives include preservatives, sweeteners, emulsifiers, stabilizers, colors, and flavor enhancers. Each additive serves a specific purpose, and their proper use is essential to maintain food safety standards and meet consumer expectations.

Executive Summary

The executive summary provides an overview of the Spain food additives market, including its size, growth rate, and key market trends. It highlights the significant market drivers and restraints influencing the industry’s trajectory and identifies potential opportunities for industry participants. The section also outlines the impact of the COVID-19 pandemic on the market and concludes with future outlook and analyst suggestions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Spain Food Additives Market is defined by several critical insights that underscore its current dynamics and future potential:

These insights emphasize the market’s resilience and its ability to adapt to changing consumer preferences and regulatory landscapes.

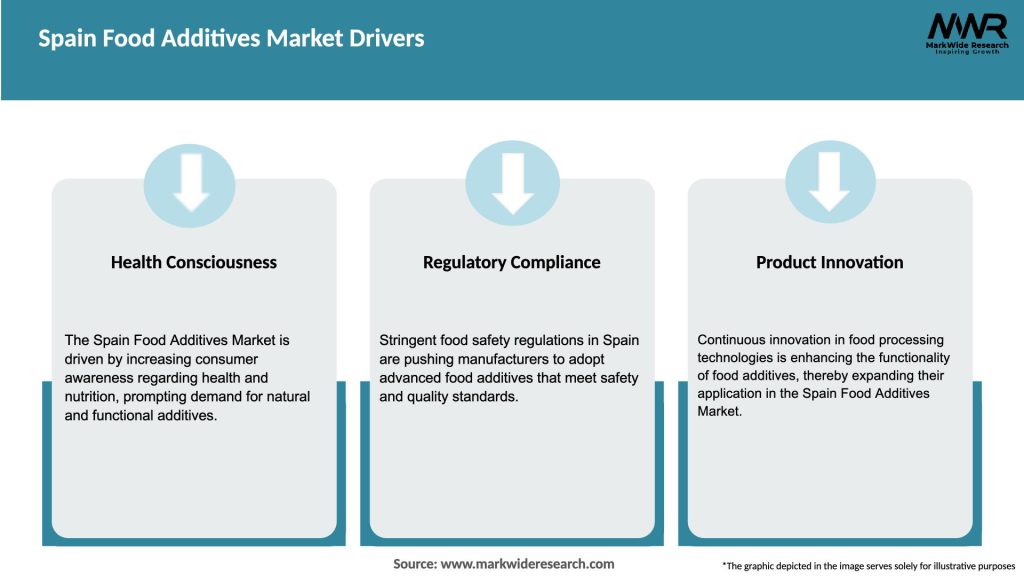

Market Drivers

Several factors are fueling the growth of the Spain Food Additives Market:

Market Restraints

Despite strong growth prospects, the Spain Food Additives Market faces several challenges:

Market Opportunities

The Spain Food Additives Market presents numerous opportunities for growth and innovation:

Market Dynamics

The dynamics of the Spain Food Additives Market are shaped by a complex interplay of supply and demand factors, technological advancements, and economic conditions:

Supply Side Factors:

Demand Side Factors:

Economic Factors:

Regional Analysis

The Spain Food Additives Market exhibits diverse trends across different regions within the country:

Catalonia and Madrid:

These regions serve as key hubs for food processing and innovation, hosting numerous multinational and local food manufacturers that drive the demand for high-quality additives.

Andalusia:

Known for its agricultural output and food processing industries, Andalusia has a strong demand for additives that enhance the shelf life and quality of local food products.

Valencia and the Mediterranean Coast:

The thriving culinary culture in this region, combined with a focus on exports, drives the adoption of premium additives to maintain high food standards.

Northern Spain:

Regions in the north, with a robust industrial base and a focus on dairy and meat processing, contribute significantly to the overall market growth through their consistent demand for functional additives.

Competitive Landscape

Leading Companies in Spain Food Additives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Spain Food Additives Market can be segmented based on type, application, and distribution channel to provide a comprehensive understanding of its structure:

By Type:

By Application:

By Distribution Channel:

Category-wise Insights

Within the Spain Food Additives Market, each additive type serves specific roles:

Key Benefits for Industry Participants and Stakeholders

The adoption of innovative food additives in Spain offers several benefits for manufacturers, suppliers, and consumers alike:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the Spain Food Additives Market:

Covid-19 Impact

The Covid-19 pandemic has influenced the Spain Food Additives Market in several ways:

Key Industry Developments

The Spain Food Additives Market has seen several important developments:

Analyst Suggestions

Based on market trends and current challenges, analysts recommend the following strategies for stakeholders in the Spain Food Additives Market:

Future Outlook

The future of the Spain Food Additives Market appears promising, with continued growth expected over the coming years. As consumer preferences shift toward natural and sustainable food products, manufacturers will increasingly invest in innovative additive solutions that offer both functionality and health benefits. Technological advancements in formulation and quality control will further drive the market, while strategic collaborations and supply chain optimizations will enhance operational efficiency. Despite potential challenges such as regulatory changes and economic uncertainties, the market is well-positioned to capitalize on emerging opportunities and expand both domestically and internationally.

What is Food Additives?

Food additives are substances added to food to enhance its flavor, appearance, or preservation. They can include preservatives, colorants, flavor enhancers, and emulsifiers, among others.

What are the key players in the Spain Food Additives Market?

Key players in the Spain Food Additives Market include companies like Givaudan, BASF, and DuPont, which provide a range of additives for various food applications, among others.

What are the growth factors driving the Spain Food Additives Market?

The Spain Food Additives Market is driven by increasing consumer demand for processed foods, the rise in health-conscious eating habits, and the need for longer shelf life in food products.

What challenges does the Spain Food Additives Market face?

Challenges in the Spain Food Additives Market include stringent regulations on food safety, consumer skepticism towards artificial additives, and the need for transparency in ingredient labeling.

What opportunities exist in the Spain Food Additives Market?

Opportunities in the Spain Food Additives Market include the growing trend towards natural and organic additives, innovations in food technology, and the increasing demand for clean-label products.

What trends are shaping the Spain Food Additives Market?

Trends in the Spain Food Additives Market include a shift towards plant-based additives, the use of biotechnology in additive production, and a focus on sustainability in sourcing and manufacturing processes.

Spain Food Additives Market

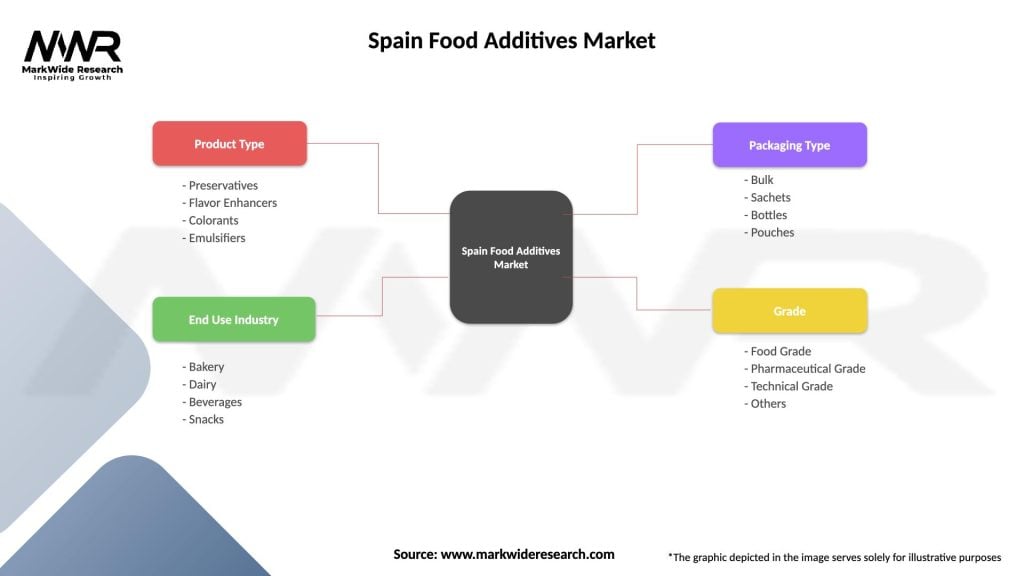

| Segmentation Details | Description |

|---|---|

| Product Type | Preservatives, Flavor Enhancers, Colorants, Emulsifiers |

| End Use Industry | Bakery, Dairy, Beverages, Snacks |

| Packaging Type | Bulk, Sachets, Bottles, Pouches |

| Grade | Food Grade, Pharmaceutical Grade, Technical Grade, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Spain Food Additives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at