444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain endoscopes market represents a dynamic and rapidly evolving segment of the country’s healthcare technology landscape. Medical endoscopy has become an indispensable diagnostic and therapeutic tool across Spanish healthcare institutions, driving substantial growth in demand for advanced endoscopic equipment. The market encompasses a comprehensive range of endoscopic devices including flexible endoscopes, rigid endoscopes, capsule endoscopes, and associated accessories used in various medical specialties.

Spanish healthcare providers are increasingly adopting cutting-edge endoscopic technologies to enhance patient outcomes and improve diagnostic accuracy. The market is experiencing robust expansion driven by an aging population, rising prevalence of gastrointestinal disorders, and growing awareness about early disease detection. Minimally invasive procedures have gained significant traction among Spanish medical professionals, with endoscopic interventions showing growth rates of approximately 8.5% annually across major healthcare facilities.

Technological advancement remains a key catalyst for market growth, with Spanish hospitals and clinics investing heavily in next-generation endoscopic systems. The integration of artificial intelligence, high-definition imaging, and wireless connectivity has transformed endoscopic procedures, making them more precise and efficient. Regional healthcare expenditure on endoscopic equipment has increased substantially, with public hospitals accounting for approximately 70% of total procurement in the Spanish market.

The Spain endoscopes market refers to the comprehensive ecosystem of medical devices, technologies, and services related to endoscopic procedures within the Spanish healthcare system. Endoscopes are sophisticated medical instruments equipped with cameras and light sources that enable healthcare professionals to visualize internal body structures for diagnostic and therapeutic purposes without requiring major surgical interventions.

Market scope encompasses various endoscope categories including gastrointestinal endoscopes, bronchoscopes, arthroscopes, laparoscopes, and specialized endoscopic accessories. The Spanish market specifically addresses the unique regulatory requirements, healthcare infrastructure, and clinical practices prevalent within Spain’s medical system. Healthcare providers utilize these devices across multiple specialties including gastroenterology, pulmonology, orthopedics, gynecology, and general surgery.

Economic significance extends beyond device sales to include maintenance services, training programs, and technological upgrades that support Spain’s healthcare modernization initiatives. The market reflects Spain’s commitment to providing advanced medical care while managing healthcare costs through efficient, minimally invasive treatment options that reduce patient recovery times and hospital stays.

Spain’s endoscopes market demonstrates remarkable resilience and growth potential, positioning itself as a significant contributor to the country’s medical technology sector. The market benefits from Spain’s well-established healthcare infrastructure, skilled medical professionals, and strong government support for healthcare innovation. Market dynamics are shaped by increasing demand for minimally invasive procedures, technological advancements, and evolving patient expectations for better healthcare outcomes.

Key growth drivers include the aging Spanish population, rising incidence of chronic diseases, and expanding applications of endoscopic procedures across medical specialties. The market has witnessed substantial adoption of digital endoscopy systems, with penetration rates reaching approximately 65% in major urban hospitals. Spanish healthcare institutions are increasingly prioritizing equipment modernization, creating opportunities for advanced endoscopic technologies.

Competitive landscape features both international medical device manufacturers and emerging Spanish companies developing innovative endoscopic solutions. The market structure supports healthy competition while ensuring quality standards and regulatory compliance. Regional distribution shows concentration in major metropolitan areas, with Madrid and Barcelona accounting for approximately 45% of total market activity. Future prospects remain optimistic, supported by continued healthcare investment and technological innovation.

Strategic insights reveal several critical factors shaping the Spain endoscopes market landscape. The market demonstrates strong correlation between technological advancement and adoption rates, with Spanish healthcare providers showing preference for integrated endoscopic systems that offer comprehensive diagnostic capabilities.

Demographic trends serve as primary catalysts for Spain’s endoscopes market expansion. The country’s aging population creates increasing demand for diagnostic and therapeutic procedures, with individuals over 65 years representing a growing segment requiring regular endoscopic examinations. Chronic disease prevalence continues to rise, particularly gastrointestinal disorders, respiratory conditions, and musculoskeletal problems that benefit from endoscopic intervention.

Healthcare modernization initiatives supported by Spanish government policies drive substantial investment in medical technology infrastructure. Public healthcare systems are prioritizing equipment upgrades to maintain competitive standards and improve patient care quality. Minimally invasive surgery adoption rates have increased significantly, with Spanish surgeons embracing endoscopic techniques that reduce patient trauma and accelerate recovery times.

Technological advancement creates compelling value propositions for healthcare providers seeking to enhance diagnostic accuracy and procedural efficiency. Integration of artificial intelligence, machine learning algorithms, and advanced imaging capabilities enables more precise diagnoses and better patient outcomes. Spanish medical professionals demonstrate strong enthusiasm for innovative technologies that improve clinical decision-making and procedural success rates.

Economic factors including healthcare cost containment pressures encourage adoption of endoscopic procedures that reduce overall treatment expenses. Outpatient procedures enabled by advanced endoscopic technologies help hospitals optimize resource utilization while maintaining high-quality care standards. Insurance coverage expansion for endoscopic procedures further stimulates market demand across diverse patient populations.

Financial constraints within Spain’s healthcare system pose significant challenges for endoscope market growth. Budget limitations in public hospitals can delay equipment procurement and technology upgrades, particularly for advanced endoscopic systems with higher acquisition costs. Economic pressures following recent global events have intensified focus on cost-effective healthcare solutions, potentially limiting adoption of premium endoscopic technologies.

Technical complexity associated with modern endoscopic systems creates barriers for healthcare institutions lacking adequate technical support infrastructure. Training requirements for medical staff to effectively utilize advanced endoscopic equipment demand substantial time and resource investments. Smaller healthcare facilities may struggle to justify comprehensive training programs for specialized endoscopic procedures with limited patient volumes.

Regulatory challenges including stringent European medical device regulations can complicate market entry for new endoscopic technologies. Compliance costs and lengthy approval processes may discourage innovation and limit availability of cutting-edge endoscopic solutions in the Spanish market. Healthcare providers must navigate complex regulatory frameworks while ensuring patient safety and quality standards.

Maintenance and operational costs associated with sophisticated endoscopic equipment can strain healthcare budgets over equipment lifecycles. Sterilization requirements and infection control protocols add operational complexity and expense, particularly for high-volume endoscopy centers. Competition for healthcare resources may limit investment in endoscopic technology upgrades despite clinical benefits.

Emerging applications for endoscopic technology present substantial growth opportunities within Spain’s healthcare landscape. Therapeutic endoscopy is expanding beyond traditional diagnostic procedures to include complex interventions such as endoscopic surgery, tumor removal, and minimally invasive treatments. Spanish medical centers are exploring innovative endoscopic applications in specialties including cardiology, neurology, and pediatric medicine.

Digital health integration offers significant potential for endoscope manufacturers to develop comprehensive solutions that connect with hospital information systems and telemedicine platforms. Remote consultation capabilities enabled by advanced endoscopic systems could revolutionize healthcare delivery in rural Spanish regions with limited specialist access. Artificial intelligence integration presents opportunities for automated diagnosis assistance and procedure optimization.

Private healthcare sector expansion creates new market segments for premium endoscopic equipment and services. Medical tourism growth in Spain drives demand for state-of-the-art endoscopic facilities that attract international patients seeking high-quality minimally invasive procedures. Specialized endoscopy centers focusing on specific conditions or procedures represent emerging business models with strong growth potential.

Training and education services present lucrative opportunities for companies offering comprehensive endoscopic procedure training programs. Simulation technologies and virtual reality training systems for endoscopic procedures are gaining traction among Spanish medical institutions. Partnerships with medical schools and continuing education providers could expand market reach and establish long-term relationships with healthcare professionals.

Supply chain dynamics within Spain’s endoscopes market reflect complex interactions between international manufacturers, local distributors, and healthcare end-users. Global supply chains have experienced disruptions that impact equipment availability and pricing, prompting Spanish healthcare providers to diversify supplier relationships and maintain strategic inventory levels. Local distribution networks play crucial roles in providing technical support and maintenance services.

Competitive pressures drive continuous innovation and pricing optimization among endoscope manufacturers serving the Spanish market. Technology differentiation becomes increasingly important as healthcare providers seek advanced features that justify premium pricing. Market consolidation trends may reshape competitive dynamics, potentially affecting product availability and pricing structures for Spanish healthcare institutions.

Regulatory environment continues evolving with updated European medical device regulations impacting product development, market entry, and quality assurance processes. Compliance requirements influence manufacturer strategies and may favor established companies with robust regulatory expertise. Spanish healthcare providers must adapt procurement processes to ensure regulatory compliance while meeting clinical needs.

Technology adoption cycles in Spain’s healthcare system demonstrate varying speeds across different institution types and geographic regions. Urban hospitals typically adopt new endoscopic technologies more rapidly than rural facilities, creating market segmentation opportunities. Economic recovery patterns following recent challenges may influence technology investment priorities and procurement timelines across Spanish healthcare institutions.

Comprehensive market analysis for Spain’s endoscopes market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with key stakeholders including hospital administrators, endoscopy department heads, procurement managers, and medical device distributors across major Spanish cities. Survey methodologies capture quantitative data on equipment utilization, procurement preferences, and technology adoption patterns.

Secondary research encompasses analysis of healthcare industry reports, government healthcare statistics, medical device registration databases, and academic publications related to endoscopic procedures in Spain. Market intelligence gathering includes monitoring of tender announcements, equipment procurement patterns, and technology adoption trends across Spanish healthcare institutions. Regulatory documentation and compliance requirements provide insights into market entry barriers and quality standards.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert consultation with Spanish healthcare industry professionals. Statistical analysis employs appropriate methodologies to identify market trends, growth patterns, and correlation factors affecting endoscope adoption. Qualitative insights complement quantitative findings to provide comprehensive market understanding.

Market segmentation analysis utilizes demographic data, healthcare utilization statistics, and technology adoption patterns to identify distinct market segments and growth opportunities. Competitive intelligence gathering includes analysis of manufacturer market positioning, product portfolios, and strategic initiatives within the Spanish market. Research findings undergo rigorous review processes to ensure reliability and actionable insights for market participants.

Geographic distribution of Spain’s endoscopes market reveals significant concentration in major metropolitan areas with advanced healthcare infrastructure. Madrid region represents the largest market segment, accounting for approximately 28% of total endoscope installations, driven by numerous large hospitals, specialized medical centers, and research institutions. The capital’s healthcare ecosystem supports both public and private endoscopy facilities serving diverse patient populations.

Catalonia region, centered around Barcelona, constitutes another major market hub with approximately 22% market share. The region’s strong healthcare infrastructure, medical research capabilities, and international connectivity attract advanced endoscopic technology adoption. Valencia region demonstrates steady growth in endoscope utilization, particularly in gastrointestinal and respiratory applications, supported by expanding healthcare facilities and medical tourism initiatives.

Andalusia region shows promising growth potential with increasing healthcare investment and modernization programs. Basque Country maintains high technology adoption rates with approximately 8% of national endoscope market activity, reflecting the region’s advanced healthcare system and economic prosperity. Northern regions including Galicia and Asturias demonstrate growing demand for endoscopic equipment as healthcare infrastructure expands.

Rural healthcare challenges create opportunities for mobile endoscopy solutions and telemedicine-enabled endoscopic consultations. Island territories including the Balearic and Canary Islands require specialized logistics and support services for endoscopic equipment maintenance and upgrades. Regional healthcare policies and funding mechanisms influence procurement patterns and technology adoption timelines across different Spanish autonomous communities.

Market leadership in Spain’s endoscopes sector is characterized by strong presence of established international medical device manufacturers alongside emerging Spanish companies developing innovative solutions. The competitive environment fosters continuous innovation while maintaining high quality standards and regulatory compliance.

Competitive strategies focus on technology differentiation, comprehensive service offerings, and strategic partnerships with Spanish healthcare institutions. Market consolidation trends may reshape competitive dynamics, while emerging companies introduce disruptive technologies and business models. Local distribution partnerships remain crucial for market success in Spain’s healthcare environment.

Product segmentation within Spain’s endoscopes market reflects diverse clinical applications and technological capabilities. Flexible endoscopes dominate market share due to widespread use in gastrointestinal and pulmonary procedures across Spanish healthcare facilities. These devices offer superior maneuverability and patient comfort, making them preferred choices for diagnostic and therapeutic interventions.

By Technology:

By Application:

By End User:

Gastrointestinal endoscopy represents the most mature and substantial category within Spain’s endoscopes market. Colonoscopy procedures show consistent growth driven by colorectal cancer screening programs and aging population demographics. Spanish gastroenterologists increasingly adopt advanced imaging technologies including narrow band imaging and chromoendoscopy for enhanced diagnostic accuracy. Therapeutic applications such as endoscopic mucosal resection and endoscopic submucosal dissection are gaining traction in specialized centers.

Surgical endoscopy demonstrates rapid expansion across multiple specialties within Spanish healthcare institutions. Laparoscopic procedures have become standard practice for many surgical interventions, driving demand for advanced visualization systems and surgical instruments. Minimally invasive surgery adoption rates continue increasing, with Spanish surgeons embracing technologies that reduce patient trauma and improve outcomes. Single-port laparoscopy and natural orifice transluminal endoscopic surgery represent emerging frontiers with significant growth potential.

Diagnostic endoscopy benefits from technological advancement in imaging quality and artificial intelligence integration. High-definition endoscopy has become standard requirement for new equipment procurement in major Spanish hospitals. Computer-aided detection systems are being evaluated for polyp detection and lesion characterization, potentially revolutionizing diagnostic accuracy. Capsule endoscopy adoption continues expanding for small bowel evaluation and patient-friendly diagnostic approaches.

Therapeutic endoscopy represents a high-growth category with expanding applications across medical specialties. Interventional endoscopy procedures including stent placement, balloon dilation, and tissue ablation are increasingly performed in Spanish healthcare facilities. Endoscopic ultrasound applications continue growing for both diagnostic and therapeutic interventions, requiring specialized equipment and training investments.

Healthcare providers benefit significantly from advanced endoscopic technologies through improved patient outcomes, enhanced diagnostic accuracy, and operational efficiency gains. Minimally invasive procedures enabled by modern endoscopes reduce patient recovery times, decrease complication rates, and improve overall satisfaction scores. Spanish hospitals report cost savings through reduced length of stay and improved resource utilization when implementing comprehensive endoscopy programs.

Medical professionals gain access to advanced diagnostic and therapeutic capabilities that enhance clinical decision-making and procedural success rates. Training opportunities associated with new endoscopic technologies support professional development and career advancement for Spanish healthcare workers. Improved ergonomics and user-friendly interfaces in modern endoscopic systems reduce physician fatigue and enhance procedural efficiency.

Patients experience substantial benefits including reduced procedural discomfort, faster recovery times, and improved diagnostic accuracy. Outpatient procedures enabled by advanced endoscopic technologies allow patients to return home the same day, minimizing disruption to daily activities. Early detection capabilities of modern endoscopic systems improve treatment outcomes and long-term prognosis for various medical conditions.

Healthcare systems achieve improved resource utilization, cost containment, and quality metrics through strategic endoscopy program implementation. Preventive care enabled by accessible endoscopic screening reduces long-term healthcare costs and improves population health outcomes. Technology integration with electronic health records and hospital information systems streamlines workflows and enhances care coordination across Spanish healthcare institutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming Spain’s endoscopes market. AI-powered diagnostic assistance systems are being implemented in major Spanish hospitals to enhance polyp detection rates and improve diagnostic accuracy. Machine learning algorithms trained on vast endoscopic image databases help identify subtle abnormalities that might be missed during routine examinations, potentially revolutionizing screening effectiveness.

Wireless and portable endoscopy solutions are gaining momentum as Spanish healthcare providers seek flexible and cost-effective diagnostic options. Capsule endoscopy adoption continues expanding beyond traditional small bowel applications to include colon screening and gastric evaluation. Portable endoscopic systems enable point-of-care diagnostics in emergency departments and outpatient settings, improving patient access and clinical workflow efficiency.

Single-use endoscopes are emerging as viable alternatives to traditional reusable systems, particularly in infection-sensitive environments. Disposable endoscopy solutions eliminate reprocessing requirements and reduce infection risks, appealing to Spanish healthcare facilities prioritizing patient safety. Cost-effectiveness analysis and clinical validation studies are driving broader adoption of single-use endoscopic technologies.

Telemedicine integration enables remote endoscopic consultations and expert guidance for complex procedures. Digital connectivity allows Spanish specialists to provide real-time consultation during endoscopic procedures performed in remote locations, improving access to specialized care. Cloud-based image storage and analysis platforms facilitate collaboration and continuing education among Spanish endoscopy professionals.

Recent technological breakthroughs have significantly impacted Spain’s endoscopes market landscape. MarkWide Research analysis indicates that Spanish healthcare institutions are increasingly investing in next-generation endoscopic platforms that integrate multiple advanced technologies. 4K ultra-high-definition imaging systems are becoming standard requirements for new endoscopy suite installations, providing unprecedented visualization quality for diagnostic and therapeutic procedures.

Strategic partnerships between international endoscope manufacturers and Spanish healthcare institutions are accelerating technology adoption and clinical innovation. Collaborative research programs focusing on endoscopic technique development and clinical outcome improvement are establishing Spain as a European leader in minimally invasive medicine. Several major Spanish hospitals have become reference centers for advanced endoscopic procedures, attracting international patients and medical professionals.

Regulatory developments including updated European Medical Device Regulation compliance requirements have influenced market dynamics and product development strategies. Quality assurance and clinical evidence requirements have become more stringent, favoring established manufacturers with robust regulatory expertise. Spanish healthcare providers are adapting procurement processes to ensure compliance while maintaining access to innovative endoscopic technologies.

Investment initiatives by Spanish government and private healthcare organizations are driving market expansion and technology modernization. Digital transformation programs include substantial allocations for endoscopic equipment upgrades and integration with hospital information systems. Public-private partnerships are facilitating access to advanced endoscopic technologies across diverse healthcare settings throughout Spain.

Market participants should prioritize technology differentiation and comprehensive service offerings to succeed in Spain’s competitive endoscopes market. Value-based procurement strategies are becoming increasingly important as Spanish healthcare providers seek solutions that demonstrate clear clinical and economic benefits. Manufacturers should focus on developing integrated platforms that address multiple clinical needs while providing cost-effective ownership models.

Training and education investments represent critical success factors for endoscope manufacturers entering or expanding within the Spanish market. Comprehensive support programs including hands-on training, simulation-based learning, and ongoing technical assistance help healthcare providers maximize technology investments. Partnerships with Spanish medical societies and educational institutions can facilitate market penetration and professional relationship development.

Regional market strategies should account for significant differences in healthcare infrastructure, procurement processes, and clinical preferences across Spanish autonomous communities. Local distribution partnerships with established Spanish medical device companies can provide valuable market insights and customer relationships. Tailored approaches for public versus private healthcare segments may optimize market penetration and customer satisfaction.

Innovation focus should align with Spanish healthcare priorities including patient safety, clinical outcomes, and operational efficiency. Digital health integration capabilities are becoming essential requirements for new endoscopic systems, enabling seamless workflow integration and data management. Sustainability considerations and environmental impact reduction may influence future procurement decisions in Spanish healthcare institutions.

Long-term prospects for Spain’s endoscopes market remain highly positive, supported by favorable demographic trends, technological advancement, and healthcare system modernization initiatives. MWR projections indicate sustained growth driven by expanding clinical applications and increasing adoption of minimally invasive procedures across medical specialties. The market is expected to benefit from continued government investment in healthcare infrastructure and technology upgrades.

Technology evolution will continue reshaping market dynamics with artificial intelligence, robotics, and advanced imaging systems becoming standard features in next-generation endoscopic platforms. Integration capabilities with hospital information systems and electronic health records will become essential requirements for new equipment procurement. Spanish healthcare providers are expected to prioritize comprehensive solutions that enhance clinical workflows and patient outcomes.

Market expansion opportunities include growing applications in pediatric endoscopy, interventional cardiology, and neurosurgical procedures. Therapeutic endoscopy is projected to experience particularly strong growth as Spanish medical professionals embrace advanced minimally invasive treatment options. Emerging technologies such as molecular imaging and targeted therapy delivery through endoscopic systems may create new market segments.

Competitive landscape evolution will likely feature increased consolidation among manufacturers and distributors, potentially affecting pricing dynamics and product availability. Innovation cycles are expected to accelerate, requiring continuous adaptation by market participants to maintain competitive positioning. Spanish healthcare institutions will increasingly demand evidence-based value propositions demonstrating clear clinical and economic benefits from endoscopic technology investments.

Spain’s endoscopes market represents a dynamic and rapidly evolving sector within the country’s healthcare technology landscape, characterized by strong growth potential and continuous innovation. The market benefits from Spain’s advanced healthcare infrastructure, skilled medical professionals, and supportive regulatory environment that encourages adoption of cutting-edge endoscopic technologies. Demographic trends including population aging and increasing chronic disease prevalence create sustained demand for endoscopic procedures across multiple medical specialties.

Technological advancement remains the primary catalyst for market transformation, with artificial intelligence integration, advanced imaging systems, and digital connectivity reshaping clinical practice and patient outcomes. Spanish healthcare providers demonstrate strong commitment to adopting innovative endoscopic solutions that enhance diagnostic accuracy, improve procedural efficiency, and reduce patient recovery times. Market segmentation reveals diverse opportunities across product categories, applications, and end-user segments, each with distinct growth drivers and competitive dynamics.

Strategic success in Spain’s endoscopes market requires comprehensive understanding of local healthcare priorities, regulatory requirements, and clinical preferences. Market participants must balance technology innovation with cost-effectiveness while providing robust training and support services to healthcare professionals. Future growth prospects remain highly favorable, supported by continued healthcare investment, expanding clinical applications, and evolving patient expectations for minimally invasive treatment options that define the modern Spanish healthcare experience.

What is Endoscopes?

Endoscopes are medical instruments used to examine the interior of a body organ or cavity. They are commonly utilized in procedures such as gastrointestinal examinations, respiratory assessments, and minimally invasive surgeries.

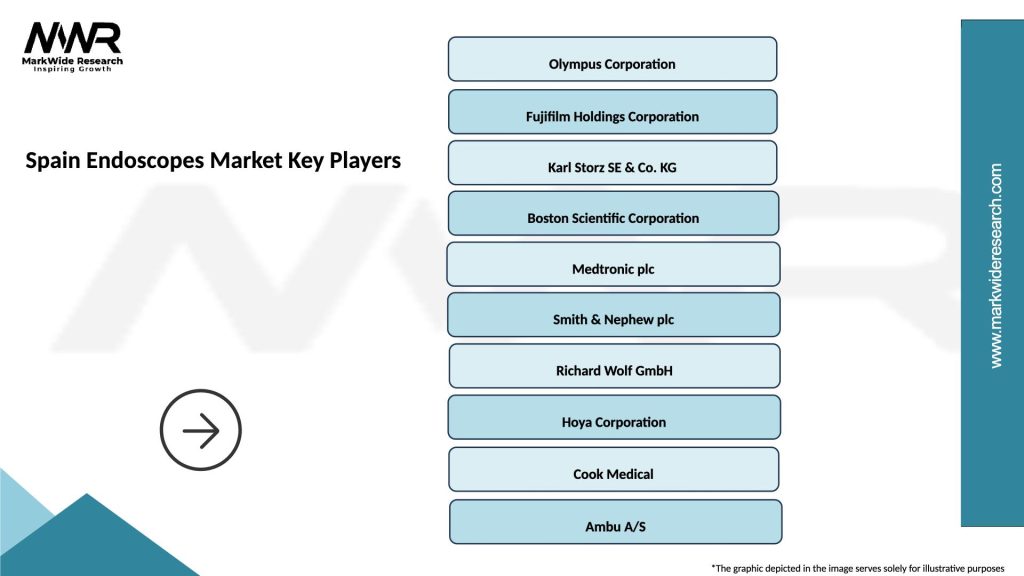

Who are the key players in the Spain Endoscopes Market?

Key players in the Spain Endoscopes Market include companies like Olympus Corporation, Karl Storz, and Medtronic, which are known for their innovative endoscopic technologies and solutions, among others.

What are the main drivers of the Spain Endoscopes Market?

The main drivers of the Spain Endoscopes Market include the increasing prevalence of chronic diseases, the growing demand for minimally invasive surgeries, and advancements in endoscopic technology that enhance diagnostic capabilities.

What challenges does the Spain Endoscopes Market face?

The Spain Endoscopes Market faces challenges such as high costs associated with advanced endoscopic equipment, stringent regulatory requirements, and the need for skilled professionals to operate these devices effectively.

What opportunities exist in the Spain Endoscopes Market?

Opportunities in the Spain Endoscopes Market include the expansion of telemedicine, the development of new endoscopic techniques, and the increasing focus on preventive healthcare, which can drive demand for endoscopic procedures.

What trends are shaping the Spain Endoscopes Market?

Trends shaping the Spain Endoscopes Market include the integration of artificial intelligence in endoscopic procedures, the rise of single-use endoscopes for infection control, and the growing emphasis on patient-centered care in medical practices.

Spain Endoscopes Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Endoscopes, Rigid Endoscopes, Capsule Endoscopes, Surgical Endoscopes |

| Technology | Video Endoscopy, Fiber Optic Endoscopy, Ultrasonic Endoscopy, Robotic Endoscopy |

| End User | Hospitals, Ambulatory Surgical Centers, Diagnostic Laboratories, Specialty Clinics |

| Application | Gastroenterology, Pulmonology, Urology, Otolaryngology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Endoscopes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at