444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain electricity market represents one of Europe’s most dynamic and rapidly transforming energy landscapes, characterized by significant renewable energy integration and progressive regulatory frameworks. Spain’s electricity sector has undergone substantial modernization over the past decade, positioning itself as a leader in sustainable energy transition within the European Union. The market demonstrates remarkable growth in renewable energy capacity, with wind and solar power contributing approximately 47% of total electricity generation as of recent assessments.

Market dynamics in Spain’s electricity sector reflect a strategic shift toward decarbonization and energy independence. The country’s commitment to achieving carbon neutrality by 2050 has accelerated investments in clean energy infrastructure and smart grid technologies. Renewable energy sources continue to expand their market share, with the government’s National Energy and Climate Plan driving ambitious targets for sustainable electricity generation.

Grid modernization initiatives and digital transformation efforts are reshaping Spain’s electricity infrastructure, enabling better integration of intermittent renewable sources and improving overall system efficiency. The market benefits from favorable geographic conditions for renewable energy development, particularly in solar and wind resources, making Spain an attractive destination for international energy investors and technology providers.

The Spain electricity market refers to the comprehensive ecosystem encompassing electricity generation, transmission, distribution, and retail activities within Spanish territory, operating under liberalized market conditions established by European Union directives and national regulatory frameworks.

This market structure includes multiple stakeholders ranging from large-scale power generators utilizing conventional and renewable energy sources to distribution system operators, retail suppliers, and end consumers across residential, commercial, and industrial segments. The market operates through competitive wholesale electricity trading mechanisms, including day-ahead and intraday markets managed by the Iberian Electricity Market Operator.

Regulatory oversight is provided by the National Commission for Markets and Competition, ensuring fair competition, consumer protection, and alignment with European energy policies. The market’s evolution reflects Spain’s commitment to energy transition, incorporating advanced technologies such as energy storage systems, smart meters, and demand response programs to optimize electricity supply and consumption patterns.

Spain’s electricity market stands at the forefront of Europe’s energy transformation, driven by aggressive renewable energy deployment and comprehensive regulatory reforms. The market has achieved remarkable progress in reducing carbon emissions while maintaining energy security and competitive pricing structures. Renewable energy penetration has reached unprecedented levels, with clean energy sources accounting for nearly half of total electricity generation capacity.

Key market developments include substantial investments in grid infrastructure modernization, expansion of energy storage capabilities, and implementation of innovative demand management technologies. The market benefits from strong government support through favorable regulatory policies, financial incentives, and strategic planning initiatives aligned with European Green Deal objectives.

Competitive dynamics continue to evolve as traditional utility companies adapt their business models to incorporate renewable energy portfolios while new market entrants focus on innovative energy services and distributed generation solutions. The market demonstrates resilience and adaptability, successfully managing the integration of variable renewable energy sources while maintaining grid stability and reliability.

Future prospects remain highly positive, with continued growth expected in renewable energy capacity, energy storage deployment, and digitalization of electricity infrastructure, positioning Spain as a regional leader in sustainable energy transition.

Strategic market insights reveal several critical trends shaping Spain’s electricity landscape:

Primary market drivers propelling Spain’s electricity sector transformation include comprehensive government policies supporting renewable energy development and carbon emission reduction targets. The National Energy and Climate Plan provides clear roadmaps for achieving ambitious clean energy goals, creating investor confidence and long-term market stability.

Economic incentives play a crucial role in driving market growth, including feed-in tariffs for renewable energy producers, tax benefits for clean energy investments, and competitive auction mechanisms that have significantly reduced renewable energy costs. These financial mechanisms have attracted substantial domestic and international investment in Spain’s electricity infrastructure.

Technological advancement continues to drive market evolution, with declining costs of solar photovoltaic and wind energy technologies making renewable electricity increasingly competitive with conventional generation sources. Energy storage technologies are becoming more affordable and efficient, enabling better integration of variable renewable energy sources.

Consumer demand for sustainable energy solutions is growing across residential and commercial segments, driven by environmental awareness and corporate sustainability commitments. This trend is supported by increasing availability of green electricity tariffs and distributed energy solutions that empower consumers to participate actively in the energy transition.

European Union policies and directives continue to influence Spain’s electricity market development, promoting cross-border energy trading, renewable energy targets, and grid modernization initiatives that enhance regional energy security and market integration.

Infrastructure limitations present significant challenges for Spain’s electricity market expansion, particularly in grid capacity constraints that can limit renewable energy integration in certain regions. Transmission bottlenecks and distribution network limitations require substantial investments to accommodate growing renewable energy capacity and changing consumption patterns.

Intermittency challenges associated with renewable energy sources create operational complexities for grid management and electricity supply reliability. Variable generation patterns from wind and solar installations require sophisticated forecasting systems and flexible backup capacity to maintain grid stability and meet electricity demand consistently.

Regulatory complexity and evolving policy frameworks can create uncertainty for market participants and investors, particularly regarding long-term revenue mechanisms and market design changes. Administrative procedures for project approvals and grid connections can sometimes delay renewable energy project development and market entry for new participants.

Financial constraints affect some market segments, particularly smaller renewable energy developers and consumers seeking to invest in distributed generation systems. Capital requirements for grid modernization and energy storage deployment represent substantial financial commitments that may strain utility company resources and public budgets.

Technical challenges related to system integration and cybersecurity concerns require ongoing attention and investment to ensure reliable and secure electricity supply in an increasingly digitalized and interconnected energy system.

Renewable energy expansion presents enormous opportunities for market growth, with Spain’s abundant solar and wind resources offering potential for significant capacity additions. Offshore wind development represents a particularly promising opportunity, with coastal areas providing excellent conditions for large-scale wind energy projects that could substantially increase clean electricity generation.

Energy storage deployment offers substantial market opportunities as battery costs continue declining and grid flexibility requirements increase. Utility-scale storage projects and distributed battery systems present attractive investment prospects for enhancing grid stability and optimizing renewable energy utilization.

Electrification initiatives across transportation, heating, and industrial sectors create new electricity demand opportunities and market expansion potential. Electric vehicle charging infrastructure development and heat pump adoption in residential and commercial buildings represent growing market segments with significant long-term potential.

Digital transformation and smart grid technologies offer opportunities for improving operational efficiency, customer engagement, and system optimization. Advanced analytics, artificial intelligence applications, and Internet of Things solutions can enhance electricity market operations and create new value-added services.

Green hydrogen production using renewable electricity presents emerging opportunities for industrial applications and energy export potential, positioning Spain as a potential leader in the developing hydrogen economy within Europe.

Supply-demand dynamics in Spain’s electricity market are increasingly influenced by renewable energy generation patterns and evolving consumption behaviors. Peak demand management has become more sophisticated as utilities implement demand response programs and consumers adopt flexible consumption practices enabled by smart meter deployments reaching approximately 99% household coverage.

Price formation mechanisms reflect the growing influence of renewable energy sources, with marginal cost pricing often determined by zero-fuel-cost renewable generation during periods of high clean energy output. Market volatility has increased due to variable renewable generation, creating opportunities for energy storage and flexible demand resources.

Seasonal variations play an important role in market dynamics, with summer months typically showing higher solar generation and increased cooling demand, while winter periods rely more heavily on wind generation and heating requirements. Hydroelectric generation provides important seasonal flexibility, though output varies significantly based on precipitation patterns and reservoir levels.

Cross-border electricity trading with France and Portugal influences domestic market dynamics, providing additional supply flexibility and price convergence opportunities. Interconnection capacity utilization has increased substantially, enhancing energy security and market efficiency across the Iberian Peninsula.

Technology integration continues to reshape market dynamics as artificial intelligence and machine learning applications improve demand forecasting, generation optimization, and grid management capabilities, enabling more efficient electricity market operations.

Comprehensive market analysis for Spain’s electricity sector employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include structured interviews with key industry stakeholders, including utility companies, renewable energy developers, regulatory officials, and technology providers operating within the Spanish electricity market.

Secondary research encompasses extensive analysis of government publications, regulatory documents, industry reports, and statistical databases maintained by Spanish energy authorities and European institutions. Data validation processes ensure information accuracy through cross-referencing multiple authoritative sources and expert verification procedures.

Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation relationships between various market variables. Time series analysis examines historical electricity generation, consumption, and pricing data to establish baseline trends and project future market developments.

Qualitative research methods include focus group discussions with industry experts and stakeholder workshops to gather insights on market challenges, opportunities, and strategic priorities. MarkWide Research methodology incorporates both bottom-up and top-down analytical approaches to provide comprehensive market understanding and reliable forecasting capabilities.

Market segmentation analysis employs clustering techniques and statistical classification methods to identify distinct market segments and analyze their specific characteristics, growth drivers, and competitive dynamics within Spain’s electricity market landscape.

Regional electricity market characteristics across Spain demonstrate significant variations in generation capacity, consumption patterns, and infrastructure development. Andalusia region leads in solar photovoltaic installations, accounting for approximately 28% of national solar capacity, benefiting from exceptional solar irradiation levels and supportive regional policies.

Castile and León dominates wind energy generation, hosting nearly 25% of Spain’s wind capacity due to favorable wind conditions and extensive rural areas suitable for large-scale wind farm development. Galicia region contributes significantly to both wind and hydroelectric generation, leveraging its coastal location and mountainous terrain.

Catalonia represents the largest electricity consumption region, accounting for approximately 20% of national demand, driven by its industrial base and urban population concentration. The region demonstrates strong commitment to renewable energy development and energy efficiency initiatives.

Madrid region shows high electricity demand density due to its metropolitan character and economic activity concentration, while also implementing innovative smart grid projects and distributed generation initiatives. Valencia region combines significant industrial electricity consumption with growing renewable energy capacity, particularly in solar installations.

Basque Country demonstrates advanced grid infrastructure and high renewable energy integration rates, serving as a testing ground for innovative electricity market technologies and services. Regional interconnections and transmission capacity vary significantly, influencing local electricity pricing and supply security across different Spanish regions.

Market competition in Spain’s electricity sector features a diverse mix of established utilities, renewable energy specialists, and emerging technology companies. Leading market participants include:

Competitive strategies increasingly emphasize renewable energy portfolio expansion, digital transformation initiatives, and customer-centric service offerings that differentiate market participants in an evolving energy landscape.

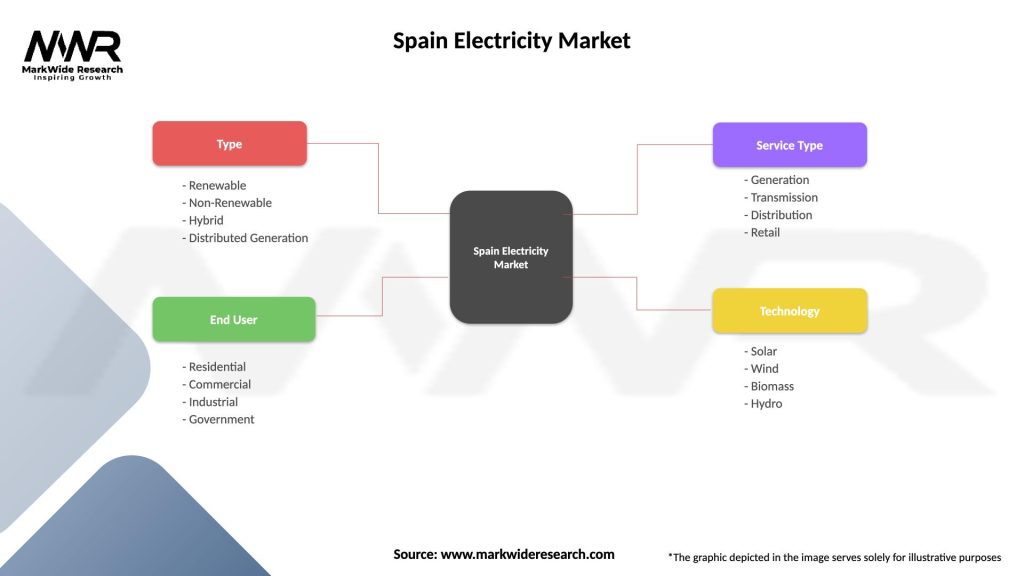

Market segmentation analysis reveals distinct characteristics across multiple dimensions of Spain’s electricity market:

By Generation Source:

By Consumer Segment:

By Market Activity:

Renewable energy categories demonstrate varying growth trajectories and market characteristics within Spain’s electricity sector. Solar photovoltaic installations have experienced exponential growth, with capacity additions reaching record levels due to declining technology costs and favorable regulatory conditions. Utility-scale solar projects dominate new capacity additions, while distributed rooftop installations show increasing adoption among residential and commercial consumers.

Wind energy segment maintains its position as the largest renewable electricity source, with both onshore and emerging offshore developments contributing to capacity expansion. Onshore wind projects benefit from Spain’s excellent wind resources and established supply chains, while offshore wind development represents a significant future growth opportunity along Spain’s extensive coastline.

Hydroelectric generation provides crucial grid stability services and seasonal energy storage capabilities, though capacity expansion is limited by environmental constraints and site availability. Pumped hydro storage facilities play an increasingly important role in balancing variable renewable generation and providing grid flexibility services.

Energy storage category shows rapid development across multiple technologies, including lithium-ion batteries, compressed air systems, and innovative storage solutions. Battery storage deployment is accelerating to support renewable energy integration and provide ancillary grid services.

Smart grid technologies encompass advanced metering infrastructure, distribution automation systems, and demand response platforms that enhance electricity system efficiency and customer engagement capabilities.

Electricity generators benefit from Spain’s supportive renewable energy policies, competitive auction mechanisms, and long-term revenue stability through power purchase agreements. Renewable energy developers enjoy access to excellent natural resources, streamlined permitting processes, and attractive financing conditions that facilitate project development and implementation.

Grid operators gain from modernized infrastructure investments, advanced grid management technologies, and regulatory frameworks that support system flexibility and reliability improvements. Smart grid deployments enable better asset utilization, predictive maintenance capabilities, and enhanced operational efficiency across transmission and distribution networks.

Electricity retailers can leverage competitive market conditions to offer innovative tariff structures, green energy products, and value-added services that differentiate their market positioning. Customer engagement platforms and digital technologies enable more personalized service offerings and improved customer satisfaction levels.

Industrial consumers benefit from competitive electricity pricing, improved supply reliability, and opportunities to participate in demand response programs that can reduce energy costs. Corporate sustainability goals are supported through access to renewable energy certificates and green electricity supply contracts.

Residential consumers enjoy increased choice in electricity suppliers, access to renewable energy options, and opportunities for distributed generation through rooftop solar installations. Smart meter deployments provide better consumption visibility and enable participation in time-of-use pricing programs.

Technology providers find growing market opportunities for renewable energy equipment, energy storage systems, smart grid solutions, and digital energy management platforms in Spain’s evolving electricity market landscape.

Strengths:

Weaknesses:

Opportunities:

Threats:

Decentralization trend is fundamentally reshaping Spain’s electricity market structure as distributed generation, energy storage, and prosumer participation increase significantly. Community energy projects and energy cooperatives are gaining momentum, enabling local communities to develop and operate their own renewable energy installations while participating actively in electricity market activities.

Digitalization acceleration continues transforming electricity market operations through artificial intelligence, blockchain technology, and Internet of Things applications. Smart grid analytics enable predictive maintenance, optimal asset utilization, and enhanced customer service capabilities across generation, transmission, and distribution segments.

Sector coupling emerges as a significant trend connecting electricity markets with transportation, heating, and industrial sectors through electrification initiatives. Electric vehicle integration creates new demand patterns and opportunities for vehicle-to-grid services that can provide valuable grid flexibility resources.

Circular economy principles are increasingly applied to electricity market development, emphasizing resource efficiency, waste reduction, and sustainable lifecycle management across energy infrastructure investments. Green finance mechanisms and sustainability-linked financing instruments support clean energy project development and market transformation initiatives.

Regional specialization trends show different Spanish regions developing competitive advantages in specific renewable energy technologies and electricity market segments, creating complementary regional energy profiles and enhanced overall system resilience.

Major capacity additions in renewable energy continue transforming Spain’s electricity generation mix, with several gigawatt-scale solar and wind projects entering operation and contributing to record-breaking clean energy output levels. Offshore wind development has gained significant momentum with government approval of maritime spatial planning frameworks and initial project announcements.

Grid modernization projects are advancing across multiple regions, incorporating advanced sensors, automated switching systems, and real-time monitoring capabilities that enhance system reliability and operational efficiency. Energy storage deployments have accelerated substantially, with utility-scale battery installations and pumped hydro projects providing crucial grid flexibility services.

Market design reforms continue evolving to better accommodate renewable energy integration and provide appropriate price signals for flexibility resources. Capacity market mechanisms and ancillary service markets are being refined to ensure adequate system reliability while promoting clean energy development.

International cooperation initiatives have expanded, including enhanced electricity interconnections with neighboring countries and participation in European energy market integration projects. Green hydrogen strategies have been formalized with substantial public and private investment commitments for developing renewable hydrogen production capabilities.

Corporate sustainability commitments from major electricity market participants have intensified, with ambitious carbon neutrality targets and substantial renewable energy investment programs announced by leading utility companies and industrial consumers.

Strategic recommendations for electricity market participants emphasize the importance of renewable energy portfolio diversification and energy storage integration to capitalize on Spain’s clean energy transition opportunities. MWR analysis indicates that companies should prioritize flexible generation assets and grid-scale storage capabilities to maximize value creation in evolving market conditions.

Investment priorities should focus on digital transformation initiatives that enhance operational efficiency, customer engagement, and system optimization capabilities. Advanced analytics platforms and artificial intelligence applications can provide competitive advantages in demand forecasting, asset management, and market participation strategies.

Market positioning strategies should emphasize sustainability credentials, innovation capabilities, and customer-centric service offerings that differentiate companies in increasingly competitive market conditions. Partnership development with technology providers, financial institutions, and other stakeholders can accelerate market entry and capability development.

Risk management approaches should address intermittency challenges, regulatory changes, and cybersecurity threats through diversified portfolios, flexible operational strategies, and robust security frameworks. Scenario planning and stress testing can help organizations prepare for various market development pathways and external challenges.

Regulatory engagement remains crucial for influencing policy development and ensuring favorable market conditions for business operations and investment plans. Stakeholder collaboration with government agencies, industry associations, and civil society organizations can support market development and social acceptance of energy transition initiatives.

Long-term prospects for Spain’s electricity market remain exceptionally positive, driven by continued renewable energy expansion, technological innovation, and supportive policy frameworks. Renewable energy capacity is projected to grow substantially over the next decade, with solar and wind installations expected to dominate new capacity additions and achieve even higher market penetration rates.

Energy storage deployment will accelerate significantly as battery costs continue declining and grid flexibility requirements increase with higher renewable energy penetration. Utility-scale storage projects and distributed battery systems will become integral components of Spain’s electricity infrastructure, enabling optimal renewable energy utilization and grid stability maintenance.

Electrification trends across transportation, heating, and industrial sectors will drive substantial electricity demand growth, creating new market opportunities and requiring additional generation capacity and grid infrastructure investments. Electric vehicle adoption is expected to reach 32% of new car sales by 2030, significantly impacting electricity consumption patterns and grid management requirements.

Digital transformation will continue reshaping electricity market operations through advanced technologies, automated systems, and data-driven decision-making processes. Artificial intelligence applications will become standard tools for grid management, demand forecasting, and customer service optimization across all market segments.

Green hydrogen development represents a significant future opportunity for utilizing excess renewable electricity and creating new revenue streams for electricity market participants. MarkWide Research projects that hydrogen production could account for a substantial portion of renewable electricity consumption by 2035, supporting Spain’s position as a European hydrogen hub.

Spain’s electricity market stands as a exemplary model of successful energy transition, demonstrating how supportive policies, abundant renewable resources, and market innovation can drive sustainable transformation while maintaining energy security and competitive pricing. The market’s achievements in renewable energy integration, grid modernization, and competitive market development provide valuable lessons for other countries pursuing similar energy transition objectives.

Future success will depend on continued investment in grid flexibility, energy storage capabilities, and digital technologies that enable optimal system operation with high renewable energy penetration. Stakeholder collaboration between government agencies, market participants, and civil society will remain essential for addressing remaining challenges and capturing emerging opportunities in Spain’s evolving electricity landscape.

The Spain electricity market is well-positioned to achieve its ambitious clean energy goals while serving as a catalyst for broader economic development, technological innovation, and environmental sustainability across the Iberian Peninsula and European Union.

What is Spain Electricity?

Spain Electricity refers to the generation, distribution, and consumption of electrical energy in Spain, encompassing various sources such as renewable energy, fossil fuels, and nuclear power.

What are the key players in the Spain Electricity Market?

Key players in the Spain Electricity Market include Iberdrola, Endesa, and Naturgy, which are involved in electricity generation, distribution, and retail services, among others.

What are the main drivers of growth in the Spain Electricity Market?

The main drivers of growth in the Spain Electricity Market include the increasing demand for renewable energy, government incentives for sustainable practices, and advancements in energy storage technologies.

What challenges does the Spain Electricity Market face?

The Spain Electricity Market faces challenges such as regulatory changes, the need for infrastructure upgrades, and competition from alternative energy sources, which can impact traditional energy providers.

What opportunities exist in the Spain Electricity Market?

Opportunities in the Spain Electricity Market include the expansion of smart grid technologies, investment in renewable energy projects, and the potential for energy efficiency improvements in residential and commercial sectors.

What trends are shaping the Spain Electricity Market?

Trends shaping the Spain Electricity Market include the increasing integration of solar and wind energy, the rise of electric vehicles, and the focus on decarbonization and sustainability initiatives.

Spain Electricity Market

| Segmentation Details | Description |

|---|---|

| Type | Renewable, Non-Renewable, Hybrid, Distributed Generation |

| End User | Residential, Commercial, Industrial, Government |

| Service Type | Generation, Transmission, Distribution, Retail |

| Technology | Solar, Wind, Biomass, Hydro |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Electricity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at