444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain Electric Vehicle (EV) Charging Equipment Market represents a rapidly expanding sector within the country’s sustainable transportation infrastructure. Spain’s commitment to achieving carbon neutrality by 2050 has accelerated the deployment of comprehensive EV charging networks across urban centers, highways, and residential areas. The market encompasses various charging solutions including AC charging stations, DC fast chargers, wireless charging systems, and smart charging infrastructure designed to support the growing fleet of electric vehicles.

Market dynamics indicate robust growth driven by government incentives, European Union regulations, and increasing consumer adoption of electric vehicles. The charging equipment market benefits from Spain’s strategic position as a gateway between Europe and Africa, making it a crucial hub for electric mobility infrastructure development. Current market penetration shows approximately 12% adoption rate among new vehicle purchases, with charging infrastructure expanding at a CAGR of 28.5% through the forecast period.

Regional distribution reveals concentrated development in major metropolitan areas including Madrid, Barcelona, Valencia, and Seville, while rural charging networks are experiencing accelerated expansion. The market encompasses both public charging infrastructure and private residential solutions, with commercial and fleet charging segments showing particularly strong growth momentum driven by logistics companies and ride-sharing services transitioning to electric fleets.

The Spain Electric Vehicle (EV) Charging Equipment Market refers to the comprehensive ecosystem of charging infrastructure, hardware, software, and services designed to power electric vehicles across Spanish territories. This market encompasses the manufacturing, installation, operation, and maintenance of various charging solutions ranging from residential Level 1 chargers to high-power DC fast charging stations capable of delivering rapid charging capabilities for commercial and passenger vehicles.

Charging equipment categories include alternating current (AC) charging stations for overnight and workplace charging, direct current (DC) fast chargers for highway and commercial applications, wireless inductive charging systems for convenient automated charging, and smart charging solutions integrated with grid management systems. The market also encompasses supporting infrastructure including payment systems, network management platforms, energy management software, and maintenance services essential for comprehensive charging network operations.

Spain’s EV charging equipment market demonstrates exceptional growth potential driven by ambitious national electrification targets and substantial public-private investment initiatives. The market benefits from favorable regulatory frameworks including the National Integrated Energy and Climate Plan (PNIEC) and the Recovery, Transformation and Resilience Plan, which allocate significant funding for sustainable mobility infrastructure development.

Key market drivers include government mandates requiring 65% reduction in transport emissions by 2030, European Green Deal compliance requirements, and increasing corporate sustainability commitments from major Spanish companies. The charging infrastructure deployment shows accelerated growth with installation rates increasing 45% year-over-year, supported by streamlined permitting processes and standardized technical requirements across autonomous communities.

Market segmentation reveals strong performance across residential, commercial, and public charging categories, with DC fast charging representing the fastest-growing segment due to highway corridor development and urban quick-charging demand. The integration of renewable energy sources with charging infrastructure creates additional value propositions for sustainable transportation solutions while supporting Spain’s broader energy transition objectives.

Strategic market insights reveal several critical factors shaping Spain’s EV charging equipment landscape:

Government policy initiatives serve as the primary catalyst for Spain’s EV charging equipment market expansion. The Spanish government’s commitment to installing 340,000 public charging points by 2030 creates substantial market opportunities for equipment manufacturers and service providers. National and regional incentive programs provide financial support for both infrastructure deployment and consumer EV adoption, creating a favorable ecosystem for market growth.

European Union regulations mandate significant reductions in transportation emissions, compelling Spain to accelerate electric mobility infrastructure development. The Alternative Fuels Infrastructure Directive requires adequate charging coverage along major highways and urban areas, driving systematic infrastructure expansion across the country. These regulatory requirements create predictable demand for charging equipment manufacturers and installation services.

Corporate sustainability commitments from major Spanish companies including Iberdrola, Endesa, and Repsol drive substantial private investment in charging infrastructure. These companies are developing comprehensive charging networks to support their sustainability goals while creating new revenue streams. Fleet electrification initiatives from logistics companies, delivery services, and ride-sharing platforms generate consistent demand for commercial charging solutions.

Consumer adoption trends show increasing acceptance of electric vehicles driven by improved battery technology, expanded model availability, and growing environmental awareness. The reduction in EV purchase prices combined with government incentives makes electric vehicles increasingly competitive with conventional vehicles, driving demand for accessible charging infrastructure throughout Spanish communities.

High infrastructure costs represent a significant challenge for widespread charging equipment deployment, particularly in rural and less densely populated areas where installation economics may be challenging. The substantial upfront investment required for DC fast charging stations and grid connection upgrades can limit deployment speed, especially for smaller operators and municipalities with constrained budgets.

Grid capacity limitations in certain regions may constrain the installation of high-power charging stations, requiring costly grid upgrades and extended permitting timelines. The integration of multiple fast charging stations in concentrated areas can strain local electrical infrastructure, necessitating coordination with utility companies and potentially delaying project implementation.

Regulatory complexity across Spain’s autonomous communities creates challenges for charging network operators seeking to deploy infrastructure across multiple regions. Varying permitting requirements, technical standards, and approval processes can increase deployment costs and timeline uncertainty, particularly for national charging network development initiatives.

Technology standardization challenges related to charging protocols, payment systems, and interoperability requirements may create compatibility issues between different charging networks. The need to support multiple charging standards and payment methods increases equipment complexity and operational costs for charging station operators.

Highway corridor development presents substantial opportunities for charging equipment deployment along Spain’s extensive highway network connecting major cities and neighboring countries. The development of ultra-fast charging hubs at strategic locations can serve both domestic and international electric vehicle traffic, creating high-utilization charging facilities with strong revenue potential.

Tourism infrastructure integration offers unique opportunities given Spain’s position as a leading European tourist destination. The installation of charging stations at hotels, beaches, cultural sites, and tourist attractions can support the growing number of international visitors traveling with electric vehicles, creating specialized market segments for hospitality-focused charging solutions.

Renewable energy integration creates opportunities for innovative charging solutions combining solar panels, battery storage, and smart grid technologies. These integrated systems can provide sustainable charging options while reducing operational costs and supporting Spain’s renewable energy objectives, appealing to environmentally conscious consumers and businesses.

Smart city initiatives across major Spanish cities offer opportunities for advanced charging infrastructure integration with urban planning, traffic management, and energy systems. The development of intelligent charging networks that optimize energy usage, reduce grid stress, and provide data analytics capabilities represents a growing market segment with significant potential for technology providers.

Supply chain dynamics in Spain’s EV charging equipment market reflect the interplay between international manufacturers, local installation services, and supporting infrastructure providers. Major global charging equipment manufacturers are establishing local partnerships and distribution networks to serve the growing Spanish market, while domestic companies are developing specialized solutions for regional requirements and preferences.

Competitive dynamics show increasing market entry from both established electrical equipment manufacturers and specialized EV charging companies. The market benefits from healthy competition driving innovation in charging speeds, user interfaces, payment systems, and grid integration capabilities. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand their geographic coverage and technical capabilities.

Technology evolution continues to reshape market dynamics with advances in charging speeds, wireless charging capabilities, and smart grid integration. The development of bidirectional charging technology enabling vehicle-to-grid services creates new value propositions for charging station operators and utility companies, potentially transforming the economic model for charging infrastructure deployment.

User behavior patterns influence charging infrastructure placement and design decisions, with data showing preferences for convenient locations, reliable equipment, and seamless payment experiences. The integration of mobile applications, reservation systems, and loyalty programs enhances user satisfaction while providing valuable data for network optimization and expansion planning.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Spain’s EV charging equipment market. Primary research includes structured interviews with key industry stakeholders including charging equipment manufacturers, installation companies, utility providers, government officials, and end-users to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research methodology incorporates analysis of government publications, industry reports, regulatory documents, and company financial statements to establish market context and validate primary research findings. The research process includes examination of patent filings, technology developments, and competitive intelligence to understand innovation trends and market positioning strategies.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis of market trends. The methodology includes regional analysis across Spain’s autonomous communities to account for varying market conditions, regulatory environments, and infrastructure development patterns affecting charging equipment deployment.

Market modeling techniques utilize quantitative analysis of installation data, adoption rates, and infrastructure utilization patterns to project future market developments. The research incorporates scenario analysis considering various policy outcomes, technology developments, and economic conditions that may influence market growth trajectories and investment decisions.

Madrid region leads Spain’s EV charging equipment market with the highest concentration of charging infrastructure and the most advanced smart charging initiatives. The region benefits from strong government support, high EV adoption rates among consumers and fleets, and significant corporate investment from major Spanish companies headquartered in the capital. Market share analysis indicates Madrid accounts for approximately 22% of national charging infrastructure, with particularly strong growth in commercial and workplace charging segments.

Catalonia region, centered around Barcelona, represents the second-largest market for EV charging equipment with strong industrial and logistics sector adoption. The region’s manufacturing base and port facilities drive demand for commercial charging solutions, while urban density supports extensive public charging network development. Catalonia demonstrates 18% market share with notable strength in DC fast charging deployment along major transportation corridors.

Valencia region shows rapid growth in charging infrastructure development driven by its strategic location on the Mediterranean corridor and growing tourism sector. The region benefits from renewable energy integration initiatives and smart city projects that incorporate advanced charging solutions. Regional growth rates indicate 35% annual expansion in charging point installations, particularly in coastal tourist areas and industrial zones.

Andalusia region presents significant opportunities for charging equipment deployment given its large geographic area, growing urban centers, and substantial tourism industry. The region’s abundant solar energy resources create opportunities for sustainable charging solutions, while major cities including Seville and Málaga drive urban charging infrastructure demand. Market penetration currently shows 8% regional share with accelerating growth potential.

Market leadership in Spain’s EV charging equipment sector includes both international manufacturers and domestic companies developing comprehensive charging solutions. The competitive environment reflects diverse approaches to market entry, technology development, and service delivery models.

By Charging Type:

By Application:

By Power Output:

Residential charging equipment represents the largest market segment by volume, driven by increasing home EV ownership and government incentives for private charging installation. This category benefits from declining equipment costs, simplified installation processes, and smart charging features that optimize energy usage and costs. Market penetration shows 68% of EV owners have access to home charging, with growing demand for intelligent charging systems that integrate with home energy management.

Commercial charging solutions demonstrate the highest growth rates as businesses recognize the importance of providing charging amenities for employees and customers. This segment includes workplace charging, retail charging, and hospitality charging applications, with increasing demand for branded charging experiences and integrated payment systems. Commercial adoption rates indicate 42% growth in workplace charging installations as companies support employee EV adoption.

Public charging infrastructure focuses on accessibility, reliability, and user experience with emphasis on strategic location placement and network interoperability. This category includes municipal charging stations, highway charging corridors, and destination charging at public facilities. The segment benefits from government funding and regulatory requirements for public charging availability in urban areas and along major transportation routes.

Fleet charging systems represent a specialized high-growth segment driven by commercial fleet electrification initiatives. These solutions require customized charging management systems, depot charging infrastructure, and integration with fleet management platforms. Fleet electrification trends show 25% annual growth in commercial charging installations as logistics companies transition to electric delivery vehicles.

Equipment manufacturers benefit from substantial market growth opportunities driven by government mandates and increasing EV adoption. The Spanish market offers access to both domestic demand and export opportunities to other European and North African markets. Manufacturers can leverage Spain’s strategic location and growing renewable energy sector to develop innovative charging solutions that integrate sustainable energy sources.

Utility companies gain new revenue streams through charging infrastructure deployment while supporting grid modernization and renewable energy integration objectives. The development of smart charging networks provides utilities with demand management tools and energy storage capabilities that enhance grid stability and efficiency. MarkWide Research analysis indicates utilities can achieve 15-20% revenue growth through strategic charging infrastructure investments.

Installation and service providers benefit from consistent demand for charging equipment deployment, maintenance, and upgrade services. The market offers opportunities for specialized technical expertise in electrical installation, permitting, and ongoing maintenance services. Local service providers can establish long-term relationships with charging network operators and equipment manufacturers.

Real estate developers can enhance property values and marketability by incorporating EV charging infrastructure into residential, commercial, and mixed-use developments. The integration of charging facilities supports sustainability certifications and appeals to environmentally conscious tenants and buyers, creating competitive advantages in the real estate market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart charging integration represents a dominant trend with increasing deployment of intelligent charging systems that optimize energy usage, reduce grid stress, and provide enhanced user experiences. These systems incorporate artificial intelligence, machine learning, and IoT connectivity to enable dynamic load management, predictive maintenance, and seamless integration with renewable energy sources and energy storage systems.

Ultra-fast charging deployment shows accelerating adoption along highway corridors and urban quick-charging locations. The development of 350kW and higher power charging stations reduces charging times to minutes rather than hours, addressing range anxiety concerns and supporting long-distance electric vehicle travel. This trend drives demand for specialized electrical infrastructure and cooling systems.

Renewable energy integration becomes increasingly important as charging station operators seek to reduce operational costs and environmental impact. The combination of solar panels, battery storage, and smart charging systems creates sustainable charging solutions that can operate independently from the grid while providing energy storage capabilities for grid stabilization services.

Vehicle-to-grid technology emergence creates new value propositions for charging infrastructure by enabling electric vehicles to provide energy storage and grid services. This bidirectional charging capability allows EV owners to sell energy back to the grid during peak demand periods, creating additional revenue streams and supporting grid stability initiatives.

Major infrastructure announcements include Iberdrola’s commitment to install thousands of charging points across Spain as part of its sustainable mobility strategy. The company’s investment in smart charging technology and renewable energy integration demonstrates the scale of private sector commitment to charging infrastructure development. These initiatives support Spain’s national electrification objectives while creating substantial market opportunities.

Technology partnerships between charging equipment manufacturers and automotive companies accelerate the development of integrated charging solutions. Collaborations focus on optimizing charging protocols, improving user interfaces, and developing vehicle-specific charging features that enhance the overall electric vehicle ownership experience.

Regulatory developments include streamlined permitting processes for charging station installation and standardized technical requirements across autonomous communities. These regulatory improvements reduce deployment timelines and costs while ensuring consistent quality and interoperability standards throughout Spain’s charging network.

International expansion initiatives by Spanish companies include charging network development in Portugal, Morocco, and other European markets. These expansion strategies leverage Spain’s experience and expertise in charging infrastructure development while creating opportunities for Spanish companies in international markets.

Strategic recommendations for market participants emphasize the importance of developing comprehensive charging solutions that address diverse user needs and applications. Companies should focus on creating integrated platforms that combine charging hardware, software, and services to provide complete solutions for residential, commercial, and public charging applications.

Technology investment priorities should focus on smart charging capabilities, renewable energy integration, and user experience enhancements. The development of charging systems that can adapt to varying grid conditions, integrate with energy management systems, and provide seamless user experiences will create competitive advantages in the evolving market landscape.

Partnership strategies should emphasize collaboration between charging equipment manufacturers, utility companies, real estate developers, and automotive manufacturers. These partnerships can accelerate market development, reduce deployment costs, and create comprehensive charging ecosystems that support widespread EV adoption across Spain.

Market entry approaches for new participants should consider regional market characteristics, regulatory requirements, and competitive dynamics. MWR analysis suggests focusing on underserved market segments or geographic areas where established players have limited presence, while ensuring compliance with local technical and regulatory standards.

Long-term market projections indicate sustained growth in Spain’s EV charging equipment market driven by continued government support, increasing EV adoption, and technological advancement. The market is expected to experience compound annual growth rates exceeding 25% through 2030, with particular strength in DC fast charging and smart charging segments supporting the transition to widespread electric mobility.

Technology evolution will continue reshaping the market with advances in charging speeds, wireless charging capabilities, and grid integration features. The development of autonomous charging systems, improved battery technology, and enhanced user interfaces will create new market opportunities while potentially disrupting existing business models and competitive positions.

Infrastructure expansion will focus on achieving comprehensive geographic coverage while improving charging network reliability and user experience. The development of charging hubs that combine multiple charging technologies, retail amenities, and renewable energy generation will create destination charging locations that support both local and long-distance electric vehicle travel.

Market maturation will likely result in consolidation among charging network operators and equipment manufacturers as companies seek to achieve scale economies and comprehensive service capabilities. This consolidation may create opportunities for specialized technology providers and service companies while potentially reducing the number of competing charging networks and standards.

Spain’s Electric Vehicle (EV) Charging Equipment Market represents a dynamic and rapidly expanding sector positioned for sustained growth through the next decade. The convergence of supportive government policies, increasing consumer adoption of electric vehicles, and substantial private sector investment creates a favorable environment for charging infrastructure development across residential, commercial, and public applications.

Market fundamentals demonstrate strong growth drivers including ambitious national electrification targets, European Union regulatory requirements, and growing corporate sustainability commitments from major Spanish companies. The integration of renewable energy resources with charging infrastructure creates additional value propositions while supporting Spain’s broader energy transition objectives and climate goals.

Competitive dynamics reflect healthy market development with diverse participants including international technology companies, domestic utility providers, and specialized charging equipment manufacturers. This competitive environment drives innovation in charging technologies, user experiences, and business models while ensuring comprehensive market coverage and service quality improvements.

Future market development will be characterized by continued technology advancement, geographic expansion, and integration with smart city initiatives and renewable energy systems. The successful deployment of comprehensive charging infrastructure will support Spain’s transition to sustainable transportation while creating substantial economic opportunities for industry participants and stakeholders throughout the Spain Electric Vehicle (EV) Charging Equipment Market ecosystem.

What is Electric Vehicle (EV) Charging Equipment?

Electric Vehicle (EV) Charging Equipment refers to the devices and infrastructure used to charge electric vehicles. This includes various types of charging stations, connectors, and related technologies that facilitate the charging process for electric cars and other electric vehicles.

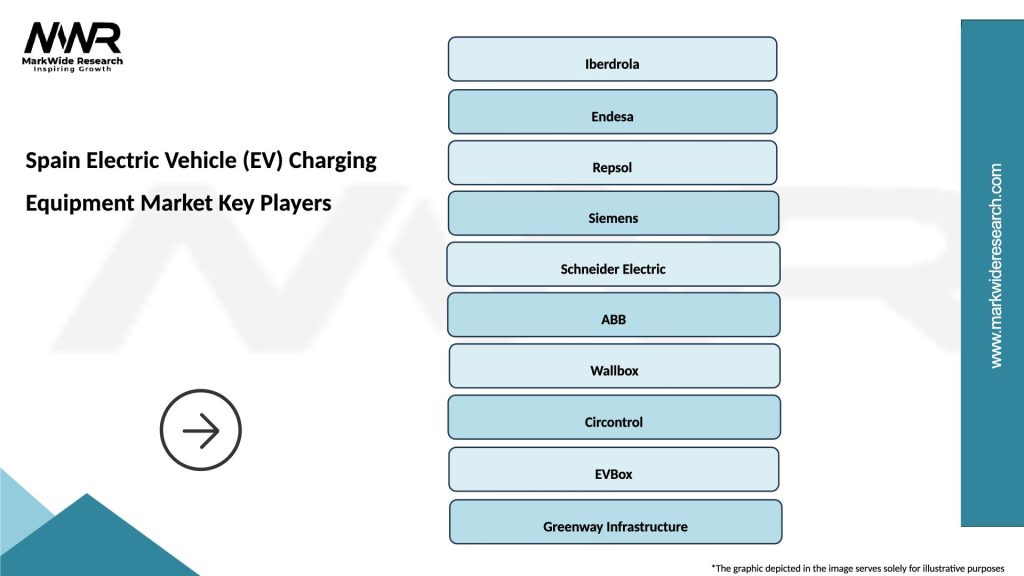

What are the key players in the Spain Electric Vehicle (EV) Charging Equipment Market?

Key players in the Spain Electric Vehicle (EV) Charging Equipment Market include companies like Iberdrola, Endesa, and Siemens, which are actively involved in developing and deploying charging infrastructure. These companies focus on expanding their networks and enhancing charging technologies, among others.

What are the growth factors driving the Spain Electric Vehicle (EV) Charging Equipment Market?

The growth of the Spain Electric Vehicle (EV) Charging Equipment Market is driven by increasing government initiatives to promote electric mobility, rising environmental awareness among consumers, and advancements in charging technology. Additionally, the expansion of the electric vehicle market is contributing to the demand for charging solutions.

What challenges does the Spain Electric Vehicle (EV) Charging Equipment Market face?

The Spain Electric Vehicle (EV) Charging Equipment Market faces challenges such as the high initial investment costs for charging infrastructure and the need for standardization in charging technologies. Additionally, the limited availability of charging stations in certain areas can hinder the adoption of electric vehicles.

What opportunities exist in the Spain Electric Vehicle (EV) Charging Equipment Market?

Opportunities in the Spain Electric Vehicle (EV) Charging Equipment Market include the potential for public-private partnerships to enhance charging infrastructure and the growing trend of smart charging solutions. Furthermore, the increasing adoption of electric vehicles presents a significant opportunity for market expansion.

What trends are shaping the Spain Electric Vehicle (EV) Charging Equipment Market?

Trends shaping the Spain Electric Vehicle (EV) Charging Equipment Market include the rise of fast-charging technologies, the integration of renewable energy sources into charging stations, and the development of mobile charging solutions. These trends are aimed at improving the efficiency and accessibility of EV charging.

Spain Electric Vehicle (EV) Charging Equipment Market

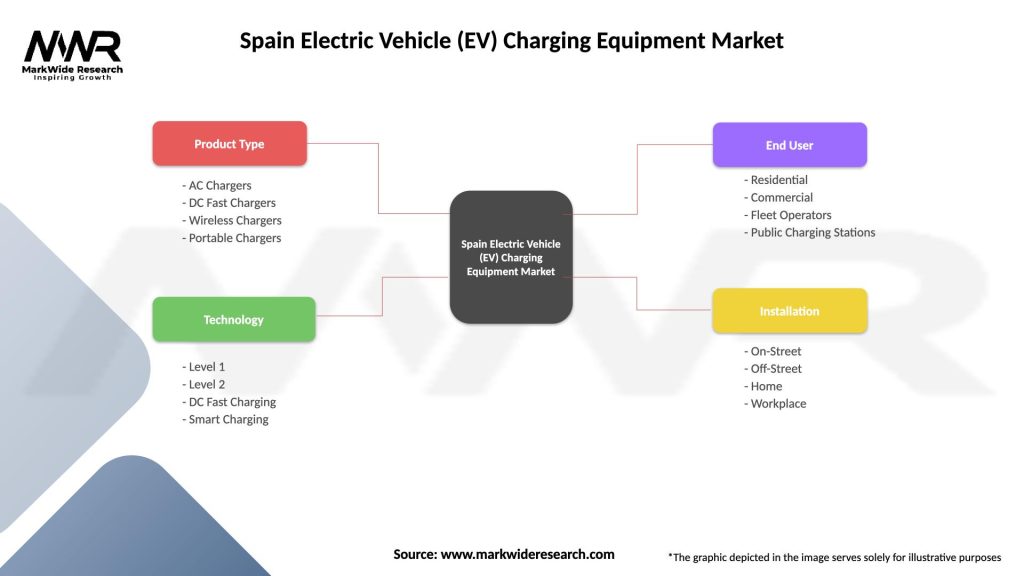

| Segmentation Details | Description |

|---|---|

| Product Type | AC Chargers, DC Fast Chargers, Wireless Chargers, Portable Chargers |

| Technology | Level 1, Level 2, DC Fast Charging, Smart Charging |

| End User | Residential, Commercial, Fleet Operators, Public Charging Stations |

| Installation | On-Street, Off-Street, Home, Workplace |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Electric Vehicle (EV) Charging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at