444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain e-brokerage market represents a dynamic and rapidly evolving sector within the country’s financial services landscape. This digital transformation has revolutionized how Spanish investors access financial markets, execute trades, and manage their investment portfolios. The market encompasses online trading platforms, mobile applications, and digital investment services that enable retail and institutional investors to participate in various financial instruments including stocks, bonds, derivatives, and exchange-traded funds.

Digital adoption in Spain’s financial sector has accelerated significantly, with e-brokerage platforms experiencing substantial growth in user registrations and trading volumes. The market benefits from Spain’s robust technological infrastructure, high internet penetration rates of approximately 94% of the population, and increasing financial literacy among younger demographics. Traditional brokerage firms have embraced digital transformation, while new fintech entrants continue to disrupt the market with innovative solutions and competitive pricing structures.

Regulatory frameworks established by the Spanish National Securities Market Commission (CNMV) and European Securities and Markets Authority (ESMA) provide a stable foundation for market growth. The implementation of MiFID II regulations has enhanced transparency and investor protection, contributing to increased confidence in digital trading platforms. Spanish e-brokerage providers are experiencing growing demand for sophisticated trading tools, real-time market data, and comprehensive research capabilities.

The Spain e-brokerage market refers to the comprehensive ecosystem of digital platforms and services that facilitate online securities trading and investment management within the Spanish financial market. This market encompasses web-based and mobile trading applications, robo-advisory services, digital wealth management platforms, and automated investment solutions that enable investors to buy, sell, and manage financial securities without traditional face-to-face broker interactions.

E-brokerage services in Spain include equity trading, fixed-income securities, derivatives trading, foreign exchange, cryptocurrency trading, and portfolio management tools. These platforms provide real-time market data, advanced charting capabilities, research reports, and educational resources to support informed investment decisions. The market serves diverse customer segments ranging from individual retail investors to sophisticated institutional clients seeking efficient and cost-effective trading solutions.

Spain’s e-brokerage market demonstrates remarkable resilience and growth potential, driven by technological advancement, changing investor preferences, and favorable regulatory conditions. The market has witnessed significant transformation as traditional financial institutions adapt to digital-first approaches while innovative fintech companies introduce disruptive solutions that challenge conventional brokerage models.

Key market drivers include increasing smartphone penetration, growing financial awareness among millennials and Generation Z, and demand for low-cost investment solutions. The COVID-19 pandemic accelerated digital adoption, with many investors transitioning from traditional brokerage services to online platforms. Spanish e-brokerage providers are expanding their service offerings to include robo-advisory services, social trading features, and comprehensive financial planning tools.

Market competition intensifies as domestic banks, international brokerage firms, and fintech startups compete for market share. The sector benefits from Spain’s position as a gateway to Latin American markets, attracting international investors seeking exposure to Spanish and regional securities. Technological innovations including artificial intelligence, machine learning, and blockchain technology are reshaping service delivery and creating new opportunities for market expansion.

Strategic market insights reveal several critical trends shaping Spain’s e-brokerage landscape:

Technological advancement serves as the primary catalyst for Spain’s e-brokerage market expansion. The widespread adoption of high-speed internet, 5G networks, and sophisticated mobile devices enables seamless trading experiences that rival traditional brokerage services. Cloud computing infrastructure allows e-brokerage platforms to scale operations efficiently while maintaining robust security and reliability standards.

Changing investor demographics significantly influence market dynamics. Millennials and Generation Z investors prefer digital-native solutions that offer transparency, low costs, and user-friendly interfaces. These demographics demonstrate higher risk tolerance and interest in alternative investments, driving demand for diverse product offerings and innovative trading tools. Social trading features and community-driven investment strategies appeal particularly to younger investors seeking peer insights and collaborative investment approaches.

Cost efficiency remains a compelling driver as investors seek to minimize trading expenses and maximize returns. E-brokerage platforms typically offer lower commission structures compared to traditional full-service brokers, making frequent trading more economically viable. The elimination of physical branch networks and reduced personnel costs enable competitive pricing that attracts cost-conscious investors across all demographic segments.

Regulatory support from Spanish and European authorities creates a favorable environment for e-brokerage growth. Harmonized regulations across European Union markets facilitate cross-border trading and investment opportunities. Open banking initiatives and PSD2 regulations enable innovative financial services integration, allowing e-brokerage platforms to offer comprehensive financial management solutions.

Cybersecurity concerns represent significant challenges for Spain’s e-brokerage market development. High-profile data breaches and cyber attacks on financial institutions create investor apprehension about digital platform security. E-brokerage providers must invest substantially in advanced security measures, including multi-factor authentication, encryption technologies, and continuous monitoring systems to maintain customer trust and regulatory compliance.

Regulatory complexity poses operational challenges as e-brokerage firms navigate evolving compliance requirements across multiple jurisdictions. MiFID II implementation, GDPR data protection regulations, and anti-money laundering directives require significant compliance infrastructure investments. Smaller fintech companies may struggle to meet comprehensive regulatory obligations, potentially limiting market entry and competition.

Market volatility and economic uncertainty can negatively impact trading volumes and customer acquisition. During periods of market stress, retail investors may reduce trading activity or withdraw from equity markets entirely. E-brokerage platforms dependent on transaction-based revenue models face particular vulnerability to market downturns and reduced investor participation.

Technology infrastructure requirements demand continuous investment in platform development, data management, and system reliability. E-brokerage providers must maintain high-performance trading systems capable of handling peak trading volumes while ensuring minimal latency and maximum uptime. Legacy system integration challenges and the need for real-time market data feeds create ongoing operational complexities.

Artificial intelligence integration presents substantial opportunities for enhancing e-brokerage services in Spain. AI-powered portfolio optimization, predictive analytics, and personalized investment recommendations can differentiate platforms and improve customer outcomes. Machine learning algorithms enable sophisticated risk assessment, fraud detection, and automated trading strategies that appeal to both retail and institutional investors.

Sustainable investing trends create new market segments as Spanish investors increasingly prioritize environmental, social, and governance (ESG) factors in investment decisions. E-brokerage platforms can capitalize on this trend by offering specialized ESG investment products, sustainability scoring tools, and impact measurement capabilities. The European Union’s sustainable finance regulations further support this market opportunity.

Cryptocurrency integration offers significant growth potential as digital asset adoption accelerates among Spanish investors. E-brokerage platforms can expand their offerings to include cryptocurrency trading, digital asset custody services, and blockchain-based investment products. Regulatory clarity around digital assets in Spain creates opportunities for compliant cryptocurrency trading solutions.

Cross-border expansion opportunities exist in Latin American markets where Spanish language and cultural connections provide competitive advantages. Spanish e-brokerage firms can leverage their expertise and technology platforms to serve growing investor populations in Mexico, Colombia, and other regional markets. Strategic partnerships with local financial institutions can facilitate market entry and regulatory compliance.

Competitive intensity in Spain’s e-brokerage market continues to escalate as traditional banks, international brokers, and fintech startups compete for market share. Established players leverage their brand recognition and regulatory expertise, while new entrants focus on innovative features and competitive pricing. This dynamic environment drives continuous improvement in service quality, technology capabilities, and customer experience.

Customer expectations evolve rapidly as investors demand increasingly sophisticated tools and services from e-brokerage platforms. Real-time market data, advanced charting capabilities, social trading features, and comprehensive research resources have become standard expectations rather than differentiating factors. Platforms must continuously innovate to meet rising customer demands while maintaining competitive pricing structures.

Technology disruption reshapes market dynamics as emerging technologies create new possibilities for service delivery and customer engagement. Blockchain technology enables new forms of asset tokenization and decentralized trading, while artificial intelligence powers personalized investment advice and automated portfolio management. E-brokerage providers must balance innovation with regulatory compliance and operational stability.

Market consolidation trends emerge as larger players acquire smaller competitors to gain market share, technology capabilities, or regulatory licenses. Strategic acquisitions enable rapid expansion into new market segments or geographic regions while eliminating competitive threats. This consolidation dynamic may reduce the number of independent e-brokerage providers while strengthening the market position of surviving firms.

Comprehensive market analysis for Spain’s e-brokerage sector employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, regulatory officials, and key market participants to gather firsthand insights into market trends, challenges, and opportunities. Survey research captures investor preferences, usage patterns, and satisfaction levels across different e-brokerage platforms.

Secondary research incorporates analysis of regulatory filings, financial statements, industry reports, and market data from authoritative sources. MarkWide Research analysts examine trading volume statistics, customer acquisition metrics, and platform performance indicators to identify market trends and competitive positioning. Regulatory documentation provides insights into compliance requirements and policy developments affecting market dynamics.

Quantitative analysis utilizes statistical modeling and data analytics to identify correlations, trends, and predictive indicators within the e-brokerage market. Market sizing methodologies incorporate multiple data sources and validation techniques to ensure accuracy of growth projections and market opportunity assessments. Competitive analysis examines market share distribution, pricing strategies, and service differentiation among key market participants.

Expert validation processes involve consultation with industry specialists, academic researchers, and regulatory experts to verify research findings and analytical conclusions. Peer review mechanisms ensure research quality and methodological rigor throughout the analysis process. Continuous monitoring of market developments enables real-time updates to research findings and market projections.

Madrid region dominates Spain’s e-brokerage market, accounting for approximately 42% of total trading activity due to its concentration of financial institutions, corporate headquarters, and high-net-worth individuals. The capital’s sophisticated investor base drives demand for advanced trading platforms and comprehensive research capabilities. Major e-brokerage providers maintain significant operations in Madrid to serve institutional clients and affluent retail investors.

Catalonia region, centered around Barcelona, represents the second-largest market segment with strong entrepreneurial culture and technology sector presence. The region’s 23% market share reflects high adoption rates of fintech solutions and digital banking services. Catalonian investors demonstrate particular interest in international markets and alternative investment products, driving demand for diverse e-brokerage offerings.

Andalusia and Valencia regions show rapid growth in e-brokerage adoption, particularly among younger demographics and small business owners. These regions benefit from increasing internet penetration and growing financial literacy initiatives. Mobile-first trading platforms experience strong uptake in these markets, with users preferring simple, intuitive interfaces over complex desktop applications.

Northern regions including the Basque Country and Galicia demonstrate conservative investment approaches but growing interest in digital trading solutions. Industrial wealth concentration in these areas creates opportunities for sophisticated e-brokerage services targeting high-value clients. Regional banks’ digital transformation efforts support broader e-brokerage market development.

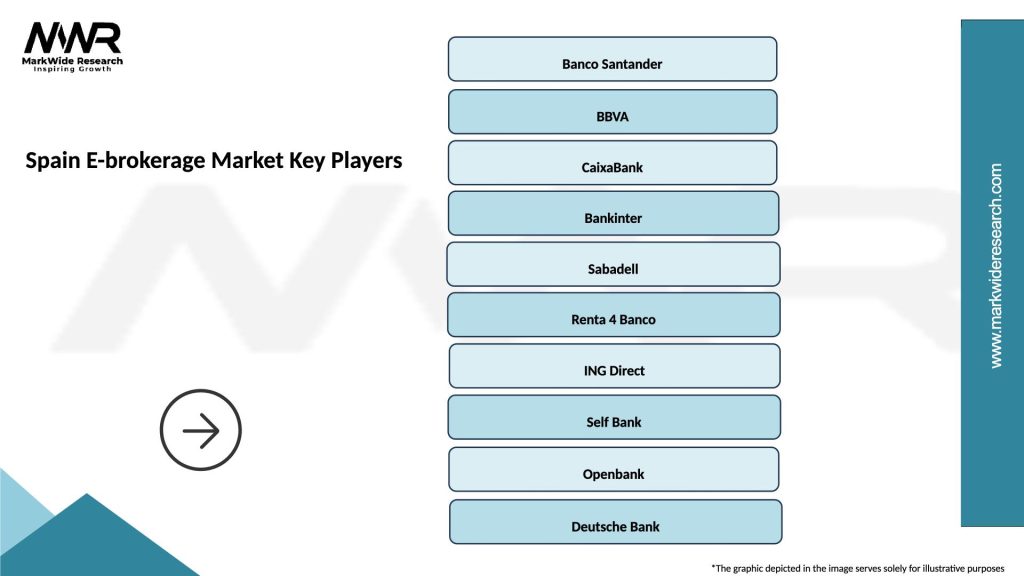

Market leadership in Spain’s e-brokerage sector involves a diverse mix of domestic banks, international brokers, and fintech innovators competing across different market segments:

Competitive differentiation strategies focus on technology innovation, pricing competitiveness, product diversity, and customer service quality. Market leaders invest heavily in mobile application development, artificial intelligence capabilities, and educational content to attract and retain customers in the increasingly competitive landscape.

By Service Type:

By Customer Type:

By Platform Type:

Equity trading remains the cornerstone of Spain’s e-brokerage market, with domestic and international stock trading generating the highest transaction volumes. Spanish investors show strong preference for domestic equities, particularly IBEX 35 components, while also seeking exposure to European and US markets. Commission-free equity trading has become increasingly common, with platforms monetizing through payment for order flow and premium service tiers.

Derivatives trading attracts sophisticated investors seeking leveraged exposure and hedging capabilities. CFD trading experiences particular growth among retail investors, though regulatory restrictions on leverage and marketing have moderated expansion. Options and futures trading remain primarily institutional, with growing retail interest in structured products and warrants.

Cryptocurrency integration represents a rapidly evolving category as Spanish e-brokerage platforms adapt to growing digital asset demand. Regulatory uncertainty initially limited offerings, but increasing clarity from Spanish authorities enables broader cryptocurrency trading services. Bitcoin and Ethereum dominate trading volumes, with growing interest in alternative cryptocurrencies and DeFi tokens.

Robo-advisory services gain traction among younger investors and those seeking passive investment strategies. Algorithm-driven portfolio management appeals to cost-conscious investors preferring automated rebalancing and tax optimization. Integration with traditional e-brokerage platforms creates comprehensive wealth management solutions combining active trading with passive investment strategies.

For Investors:

For E-brokerage Providers:

For Market Ecosystem:

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile-first strategy dominates e-brokerage platform development as Spanish investors increasingly prefer smartphone-based trading. Advanced mobile applications now offer comprehensive functionality previously available only through desktop platforms. Push notifications, biometric authentication, and intuitive user interfaces enhance mobile trading experiences, with mobile trading volume growing 67% annually.

Social trading integration transforms how Spanish investors discover and execute investment strategies. Copy trading features enable novice investors to replicate successful traders’ portfolios automatically. Social sentiment analysis and community-driven research complement traditional fundamental and technical analysis. These features particularly appeal to younger demographics seeking peer validation and collaborative investment approaches.

Artificial intelligence adoption accelerates across Spanish e-brokerage platforms, enhancing customer service, risk management, and investment advisory capabilities. Chatbots handle routine customer inquiries, while machine learning algorithms detect fraudulent activities and optimize trade execution. AI-powered robo-advisors provide personalized investment recommendations based on individual risk profiles and financial goals.

Fractional investing gains popularity as e-brokerage platforms enable Spanish investors to purchase partial shares of expensive stocks. This democratization of investing allows smaller investors to build diversified portfolios without requiring substantial capital. Fractional shares particularly benefit younger investors and those seeking exposure to high-priced technology stocks and international markets.

Cryptocurrency mainstream adoption continues as Spanish e-brokerage platforms integrate digital asset trading alongside traditional securities. Regulatory clarity from Spanish authorities enables broader cryptocurrency offerings, while institutional adoption legitimizes digital assets as investment vehicles. Cryptocurrency trading activity increased 156% among Spanish retail investors over the past year.

Regulatory evolution shapes Spain’s e-brokerage landscape as authorities adapt frameworks to address digital innovation and investor protection. The Spanish National Securities Market Commission (CNMV) has introduced guidelines for cryptocurrency trading, robo-advisory services, and social trading platforms. These regulations provide clarity for market participants while ensuring appropriate investor safeguards.

Strategic partnerships between traditional banks and fintech companies accelerate digital transformation in Spain’s brokerage sector. Major Spanish banks acquire or partner with technology firms to enhance their digital capabilities and compete with pure-play e-brokerage platforms. These collaborations combine established financial expertise with innovative technology solutions.

International expansion initiatives see Spanish e-brokerage firms pursuing growth opportunities in Latin American markets. Cultural and linguistic connections provide competitive advantages, while growing middle-class populations in regional markets create substantial investor bases. Strategic acquisitions and joint ventures facilitate market entry and regulatory compliance in target countries.

Technology infrastructure investments focus on cloud computing, artificial intelligence, and cybersecurity capabilities. E-brokerage providers migrate to cloud-based architectures for improved scalability and reliability. Advanced security measures including multi-factor authentication, biometric verification, and behavioral analytics protect customer assets and data.

Product innovation drives competitive differentiation as platforms introduce new investment products and services. Thematic investing, ESG-focused portfolios, and alternative investment access expand beyond traditional securities. Integration with banking services creates comprehensive financial ecosystems serving diverse customer needs.

Technology investment should remain a top priority for Spanish e-brokerage providers seeking sustainable competitive advantages. MarkWide Research analysis indicates that platforms investing heavily in artificial intelligence, mobile optimization, and cybersecurity demonstrate superior customer acquisition and retention rates. Continuous platform enhancement ensures relevance in rapidly evolving market conditions.

Customer education initiatives represent underutilized opportunities for market expansion and customer loyalty building. E-brokerage platforms should develop comprehensive educational programs covering investment fundamentals, market analysis, and platform features. Educational content marketing can attract new customers while improving existing customer engagement and trading activity levels.

Regulatory compliance requires proactive approaches as Spanish and European authorities continue evolving financial services regulations. E-brokerage providers should establish robust compliance frameworks capable of adapting to regulatory changes without disrupting operations. Early compliance with emerging regulations can provide competitive advantages and reduce implementation costs.

Partnership strategies should focus on complementary service providers and technology companies that enhance platform capabilities without direct competition. Collaborations with financial data providers, educational institutions, and technology firms can expand service offerings while sharing development costs and risks.

International expansion opportunities merit serious consideration for established Spanish e-brokerage firms with proven domestic success. Latin American markets offer substantial growth potential, while European expansion can leverage regulatory harmonization and cross-border investment trends. Strategic market entry approaches should prioritize regulatory compliance and local partnership development.

Market evolution in Spain’s e-brokerage sector will be characterized by continued technological advancement, regulatory adaptation, and changing investor preferences. The integration of artificial intelligence, blockchain technology, and advanced analytics will create more sophisticated and personalized investment experiences. Digital platform adoption is projected to grow at 12% annually over the next five years, driven by demographic shifts and technological improvements.

Competitive landscape consolidation may accelerate as larger players acquire smaller competitors to gain market share, technology capabilities, or regulatory licenses. This consolidation could reduce the number of independent e-brokerage providers while strengthening the market position of surviving firms. Strategic partnerships between traditional financial institutions and fintech companies will likely increase, combining established expertise with innovative technology solutions.

Product diversification will expand beyond traditional securities to include alternative investments, digital assets, and structured products. Spanish e-brokerage platforms will likely offer more comprehensive wealth management services, including tax optimization, estate planning, and retirement planning tools. Integration with banking services and payment systems will create seamless financial ecosystems serving diverse customer needs.

Regulatory developments will continue shaping market dynamics as Spanish and European authorities balance innovation promotion with investor protection. Clear guidelines for cryptocurrency trading, robo-advisory services, and cross-border investment will provide stability for market participants. Enhanced data protection requirements and cybersecurity standards will drive continued investment in security infrastructure.

International expansion opportunities will attract Spanish e-brokerage firms seeking growth beyond domestic markets. Latin American countries with growing middle classes and increasing financial market sophistication present attractive expansion targets. European market integration will facilitate cross-border trading and investment opportunities, supported by harmonized regulations and technological standards.

Spain’s e-brokerage market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, changing demographics, and supportive regulatory frameworks. The market has successfully transitioned from traditional brokerage models to sophisticated digital platforms that serve diverse investor needs across multiple asset classes and investment strategies.

Key success factors for market participants include continuous technology investment, comprehensive regulatory compliance, customer-centric service development, and strategic partnership formation. The integration of artificial intelligence, mobile optimization, and cybersecurity capabilities will determine competitive positioning in an increasingly crowded marketplace. Educational initiatives and customer support services will play crucial roles in market expansion and customer retention.

Future market development will be shaped by ongoing digital transformation, regulatory evolution, and international expansion opportunities. Spanish e-brokerage firms are well-positioned to capitalize on growing demand for cost-effective, accessible, and sophisticated investment solutions. The market’s continued evolution toward comprehensive financial ecosystems will create new opportunities for innovation and growth while serving the diverse needs of Spanish investors in an increasingly digital financial landscape.

What is E-brokerage?

E-brokerage refers to the online platforms that facilitate the buying and selling of financial securities, such as stocks and bonds, through electronic means. These platforms provide investors with tools for trading, research, and portfolio management.

What are the key players in the Spain E-brokerage Market?

Key players in the Spain E-brokerage Market include companies like Banco Sabadell, Renta 4, and Self Bank, which offer various online trading services. These firms compete by providing innovative trading platforms and customer support, among others.

What are the growth factors driving the Spain E-brokerage Market?

The Spain E-brokerage Market is driven by factors such as the increasing adoption of digital trading platforms, a growing number of retail investors, and advancements in technology that enhance trading experiences. Additionally, the rise of mobile trading applications is attracting more users.

What challenges does the Spain E-brokerage Market face?

Challenges in the Spain E-brokerage Market include regulatory compliance issues, cybersecurity threats, and intense competition among brokers. These factors can impact profitability and customer trust in online trading platforms.

What opportunities exist in the Spain E-brokerage Market?

Opportunities in the Spain E-brokerage Market include the potential for expanding services to underserved demographics, such as younger investors, and the integration of advanced technologies like AI for personalized trading experiences. Additionally, partnerships with fintech companies can enhance service offerings.

What trends are shaping the Spain E-brokerage Market?

Trends in the Spain E-brokerage Market include the rise of commission-free trading, increased focus on user-friendly interfaces, and the growing importance of social trading features. These trends are reshaping how investors engage with online trading platforms.

Spain E-brokerage Market

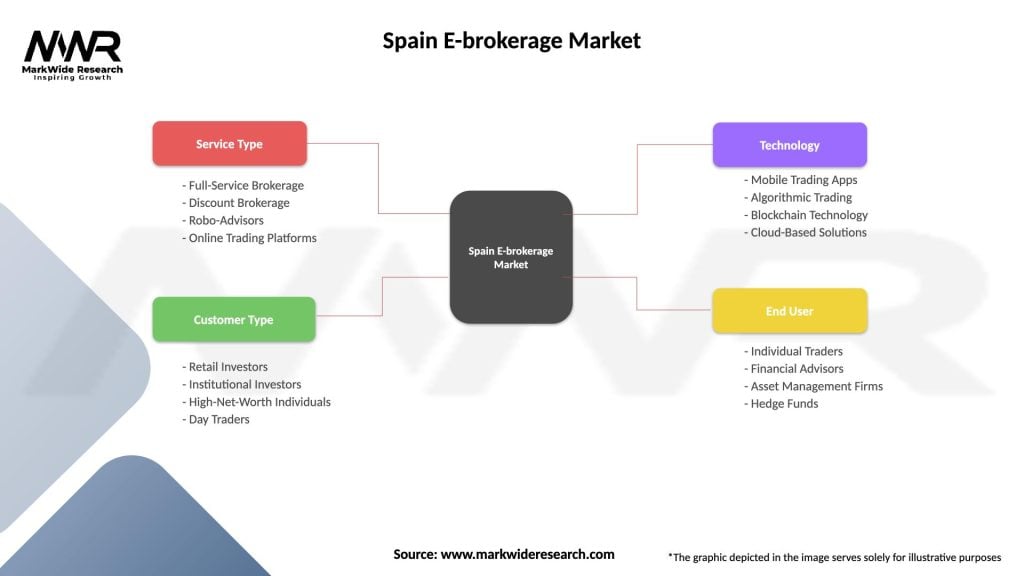

| Segmentation Details | Description |

|---|---|

| Service Type | Full-Service Brokerage, Discount Brokerage, Robo-Advisors, Online Trading Platforms |

| Customer Type | Retail Investors, Institutional Investors, High-Net-Worth Individuals, Day Traders |

| Technology | Mobile Trading Apps, Algorithmic Trading, Blockchain Technology, Cloud-Based Solutions |

| End User | Individual Traders, Financial Advisors, Asset Management Firms, Hedge Funds |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain E-brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at