444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain cloud computing market represents one of the most dynamic and rapidly evolving technology sectors in the Iberian Peninsula. Cloud computing adoption across Spanish enterprises has accelerated significantly, driven by digital transformation initiatives, remote work requirements, and the need for scalable IT infrastructure. The market encompasses various service models including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), serving diverse industries from banking and healthcare to manufacturing and retail.

Market growth in Spain has been particularly robust, with cloud adoption rates reaching 78% among large enterprises and 65% among small and medium enterprises as organizations recognize the strategic value of cloud technologies. The Spanish government’s digitalization agenda, coupled with European Union initiatives promoting digital sovereignty, has created a favorable environment for cloud service providers and technology vendors.

Key market characteristics include increasing demand for hybrid cloud solutions, growing emphasis on data security and compliance with GDPR regulations, and rising adoption of artificial intelligence and machine learning capabilities delivered through cloud platforms. The market demonstrates strong potential for continued expansion as businesses across Spain continue their digital transformation journeys.

The Spain cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions delivered to Spanish businesses, government entities, and individual consumers through internet-connected platforms and data centers located both domestically and internationally.

Cloud computing in the Spanish context encompasses the delivery of computing services including servers, storage, databases, networking, software, analytics, and intelligence over the internet to offer faster innovation, flexible resources, and economies of scale. This market includes public cloud services provided by global hyperscalers, private cloud solutions deployed within organizational boundaries, and hybrid cloud architectures that combine both approaches.

Service delivery models within the Spanish market span Infrastructure as a Service (IaaS) providing virtualized computing resources, Platform as a Service (PaaS) offering development and deployment environments, and Software as a Service (SaaS) delivering applications directly to end users. The market also encompasses specialized cloud services such as disaster recovery, backup solutions, and industry-specific applications tailored to Spanish regulatory requirements and business practices.

Spain’s cloud computing landscape has experienced transformational growth, positioning the country as a significant player in the European cloud services market. The convergence of digital transformation initiatives, regulatory compliance requirements, and economic recovery efforts has created unprecedented demand for cloud-based solutions across all sectors of the Spanish economy.

Market dynamics reveal that Spanish organizations are increasingly adopting multi-cloud strategies, with 42% of enterprises utilizing services from multiple cloud providers to optimize performance, reduce vendor lock-in, and enhance resilience. The financial services sector leads adoption rates, followed closely by telecommunications, healthcare, and public sector organizations.

Technological advancement in areas such as edge computing, artificial intelligence, and Internet of Things integration has expanded the scope and capabilities of cloud services available to Spanish customers. The market benefits from strong telecommunications infrastructure, favorable government policies, and increasing digital literacy among business leaders and IT professionals.

Competitive landscape features both global cloud giants and regional service providers, creating a diverse ecosystem that offers Spanish customers various options for cloud deployment models, pricing structures, and service levels. The market continues to mature with enhanced focus on data sovereignty, security, and compliance with European regulations.

Strategic insights from the Spanish cloud computing market reveal several critical trends and developments that are shaping the industry’s trajectory:

Primary growth drivers propelling the Spanish cloud computing market include a combination of technological, economic, and regulatory factors that create compelling business cases for cloud adoption across various industry sectors.

Digital transformation imperatives represent the most significant driver, as Spanish organizations recognize that cloud computing provides the foundation for modernizing IT infrastructure, improving operational efficiency, and enabling new business models. The COVID-19 pandemic accelerated these initiatives, with remote work requirements demonstrating the critical importance of cloud-based collaboration and productivity tools.

Cost optimization pressures continue to drive cloud adoption as organizations seek to reduce capital expenditure on IT infrastructure while gaining access to enterprise-grade technologies and services. Cloud computing enables Spanish businesses to convert fixed IT costs into variable expenses, improving cash flow management and financial flexibility.

Scalability requirements have become increasingly important as Spanish businesses experience rapid growth or seasonal fluctuations in demand. Cloud services provide the ability to scale computing resources up or down quickly, enabling organizations to respond effectively to changing market conditions without significant infrastructure investments.

Innovation enablement through cloud platforms allows Spanish companies to access cutting-edge technologies such as artificial intelligence, machine learning, and advanced analytics without requiring substantial internal development capabilities or infrastructure investments.

Market challenges facing the Spanish cloud computing sector include several factors that may limit adoption rates or create barriers to market expansion, requiring strategic attention from service providers and customers alike.

Data sovereignty concerns remain a significant restraint, particularly among government agencies and organizations handling sensitive information. Spanish entities often prefer cloud services that guarantee data storage within national or European Union boundaries, limiting options and potentially increasing costs.

Security apprehensions continue to influence cloud adoption decisions, with some organizations maintaining concerns about data protection, privacy, and compliance when migrating sensitive workloads to cloud environments. These concerns are particularly pronounced in highly regulated industries such as banking and healthcare.

Skills shortages in cloud technologies create implementation and management challenges for Spanish organizations. The lack of qualified cloud architects, engineers, and administrators can slow adoption rates and increase the risk of suboptimal cloud deployments.

Legacy system integration complexities present technical and financial challenges for organizations with substantial investments in existing IT infrastructure. The cost and complexity of modernizing or integrating legacy systems with cloud platforms can delay or limit cloud adoption initiatives.

Regulatory compliance requirements, while generally supportive of cloud adoption, can create complexity and additional costs for organizations operating in heavily regulated industries, potentially slowing the pace of cloud migration projects.

Emerging opportunities within the Spanish cloud computing market present significant potential for growth and innovation, driven by technological advancement, changing business requirements, and evolving customer expectations.

Edge computing integration represents a substantial opportunity as Spanish businesses seek to deploy applications requiring low latency and real-time processing capabilities. The convergence of cloud and edge technologies creates new market segments in areas such as autonomous vehicles, industrial IoT, and augmented reality applications.

Artificial intelligence and machine learning services delivered through cloud platforms offer significant growth potential as Spanish organizations seek to leverage data analytics, automation, and intelligent decision-making capabilities. Cloud-based AI services democratize access to advanced technologies for businesses of all sizes.

Industry-specific cloud solutions present opportunities for specialized service providers to develop tailored offerings for sectors such as healthcare, education, agriculture, and tourism. These vertical solutions can address specific regulatory requirements, workflow needs, and integration challenges.

Sustainability-focused services are gaining traction as Spanish organizations prioritize environmental responsibility. Cloud providers offering carbon-neutral services, renewable energy-powered data centers, and sustainability reporting tools can capture market share among environmentally conscious customers.

Small and medium enterprise cloud adoption represents an underserved market segment with significant growth potential, as SMEs increasingly recognize the competitive advantages that cloud technologies can provide in terms of cost reduction, scalability, and access to enterprise-grade capabilities.

Market dynamics in the Spanish cloud computing sector reflect the interplay of various forces that influence competitive positioning, customer behavior, and industry evolution. These dynamics create both challenges and opportunities for market participants.

Competitive intensity has increased significantly as global cloud providers expand their presence in Spain while local and regional players develop specialized offerings to compete effectively. This competition benefits customers through improved service quality, competitive pricing, and innovative solutions tailored to Spanish market requirements.

Customer sophistication has evolved rapidly, with Spanish organizations developing more nuanced understanding of cloud technologies, deployment models, and vendor evaluation criteria. This sophistication drives demand for more specialized services and higher levels of support and consultation.

Technology convergence is reshaping market boundaries as cloud computing integrates with emerging technologies such as 5G networks, Internet of Things platforms, and blockchain solutions. This convergence creates new service categories and business models while expanding the total addressable market.

Regulatory evolution continues to influence market dynamics as European and Spanish authorities develop new frameworks for data protection, digital services, and cybersecurity. These regulatory changes create both compliance requirements and opportunities for specialized service providers.

Partnership ecosystems are becoming increasingly important as cloud providers collaborate with system integrators, software vendors, and consulting firms to deliver comprehensive solutions to Spanish customers. These partnerships enable more effective market penetration and customer success.

Comprehensive research methodology employed for analyzing the Spanish cloud computing market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of insights. The methodology combines quantitative and qualitative research approaches to provide a holistic view of market conditions and trends.

Primary research activities include structured interviews with key stakeholders across the Spanish cloud computing ecosystem, including cloud service providers, enterprise customers, system integrators, and industry experts. These interviews provide firsthand insights into market dynamics, customer requirements, and competitive positioning.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and regulatory documents to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market factors and trends.

Data validation processes involve triangulation of information from multiple sources, expert review of findings, and statistical analysis to ensure accuracy and reliability of market insights. The methodology includes regular updates to reflect changing market conditions and emerging trends.

Market segmentation analysis employs both top-down and bottom-up approaches to accurately assess market size, growth rates, and competitive dynamics across different service categories, industry verticals, and customer segments within the Spanish market.

Regional distribution of cloud computing adoption across Spain reveals significant variations in market penetration, service demand, and growth patterns, influenced by factors such as economic development, industry concentration, and digital infrastructure availability.

Madrid region dominates the Spanish cloud computing market, accounting for approximately 35% of total market activity due to its concentration of large enterprises, government agencies, and technology companies. The region benefits from excellent telecommunications infrastructure, skilled workforce availability, and proximity to decision-making centers.

Catalonia represents the second-largest regional market with 28% market share, driven by its strong manufacturing base, technology sector, and international business presence. Barcelona serves as a major hub for cloud service providers and system integrators serving the broader Mediterranean region.

Andalusia demonstrates rapid growth in cloud adoption, particularly among small and medium enterprises and public sector organizations. The region’s focus on tourism, agriculture, and renewable energy creates specific demand patterns for cloud services tailored to these industries.

Valencia region shows strong growth in cloud adoption among manufacturing and logistics companies, benefiting from its strategic location and port facilities. The region’s emphasis on innovation and technology development supports continued market expansion.

Northern regions including the Basque Country and Galicia demonstrate high cloud adoption rates among industrial companies and financial institutions, with particular strength in private cloud and hybrid cloud deployments.

Competitive dynamics in the Spanish cloud computing market feature a diverse mix of global hyperscalers, European service providers, and local technology companies, each competing across different market segments and customer categories.

Global cloud providers maintain strong market positions through comprehensive service portfolios, extensive geographic coverage, and significant investment in local infrastructure and partnerships:

European and regional providers compete effectively by offering data sovereignty, local support, and specialized services tailored to Spanish market requirements. These providers often focus on specific industry verticals or service categories where they can differentiate from global competitors.

Local Spanish providers maintain competitive positions through deep market knowledge, regulatory expertise, and close customer relationships, particularly in the small and medium enterprise segment and public sector markets.

Market segmentation of the Spanish cloud computing market reveals distinct patterns of adoption, growth, and competitive dynamics across various dimensions including service type, deployment model, organization size, and industry vertical.

By Service Type:

By Deployment Model:

By Organization Size:

Detailed analysis of specific categories within the Spanish cloud computing market reveals unique characteristics, growth patterns, and competitive dynamics that influence overall market development.

Enterprise Applications represent the largest category within the SaaS segment, with Spanish organizations increasingly adopting cloud-based ERP, CRM, and human resources management systems. This category benefits from improved functionality, reduced maintenance requirements, and enhanced integration capabilities compared to traditional on-premises solutions.

Data and Analytics services demonstrate exceptional growth as Spanish businesses recognize the strategic value of data-driven decision making. Cloud-based analytics platforms enable organizations to process large datasets, implement machine learning models, and generate actionable insights without significant infrastructure investments.

Collaboration and Productivity tools experienced accelerated adoption during the pandemic and continue to show strong growth as remote and hybrid work models become permanent features of the Spanish business landscape. These tools provide essential capabilities for distributed teams and digital workplace initiatives.

Security Services delivered through cloud platforms are gaining traction as Spanish organizations seek to enhance their cybersecurity posture while reducing the complexity and cost of security infrastructure management. Cloud-based security services offer access to advanced threat detection, incident response, and compliance management capabilities.

Backup and Disaster Recovery services represent a mature but stable category, with Spanish organizations increasingly recognizing the importance of cloud-based data protection and business continuity solutions.

Stakeholder benefits from the Spanish cloud computing market extend across multiple participant categories, creating value for customers, service providers, partners, and the broader technology ecosystem.

For Enterprise Customers:

For Cloud Service Providers:

For System Integrators and Partners:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the Spanish cloud computing market reflect broader technological evolution, changing business requirements, and evolving customer expectations that influence market development and competitive dynamics.

Multi-cloud strategies are becoming increasingly prevalent as Spanish organizations seek to avoid vendor lock-in, optimize performance, and enhance resilience. This trend drives demand for cloud management platforms and integration services that can effectively manage complex multi-cloud environments.

Edge computing convergence with cloud services is creating new market opportunities as applications requiring low latency and real-time processing become more common. Spanish telecommunications providers and cloud service providers are investing in edge infrastructure to support these emerging use cases.

Artificial intelligence integration into cloud platforms is accelerating as Spanish businesses recognize the competitive advantages of AI-powered applications and services. Cloud providers are expanding their AI and machine learning service portfolios to meet growing demand.

Sustainability initiatives are influencing cloud provider selection as Spanish organizations prioritize environmental responsibility. This trend drives investment in renewable energy-powered data centers and carbon-neutral cloud services.

Industry-specific solutions are gaining traction as cloud providers develop specialized offerings for sectors such as healthcare, financial services, and manufacturing. These solutions address specific regulatory requirements and workflow needs.

Security-first approaches are becoming standard as Spanish organizations prioritize cybersecurity in their cloud strategies. This trend drives demand for cloud-native security services and zero-trust architecture implementations.

Recent developments in the Spanish cloud computing market demonstrate the dynamic nature of the industry and the continuous evolution of service offerings, competitive positioning, and market structure.

Infrastructure investments by major cloud providers have expanded significantly, with new data center facilities and edge computing deployments enhancing service availability and performance for Spanish customers. These investments demonstrate long-term commitment to the Spanish market and support for growing demand.

Partnership announcements between global cloud providers and Spanish system integrators have created new go-to-market channels and enhanced local service delivery capabilities. These partnerships enable more effective customer support and specialized service development.

Government initiatives promoting digital transformation and cloud adoption have created new opportunities for service providers while establishing frameworks for secure and compliant cloud deployments in public sector organizations.

Acquisition activities in the Spanish market have consolidated certain segments while creating opportunities for specialized service providers to expand their capabilities and market reach through strategic partnerships and acquisitions.

Technology launches by cloud providers have introduced new services and capabilities specifically designed for Spanish market requirements, including industry-specific applications and compliance-focused solutions.

Skills development programs launched by cloud providers, educational institutions, and government agencies are addressing workforce development needs and supporting the growth of cloud expertise in the Spanish market.

Strategic recommendations for stakeholders in the Spanish cloud computing market focus on key areas that can drive success and competitive advantage in this dynamic and evolving industry landscape.

For Cloud Service Providers: MarkWide Research analysis suggests focusing on industry-specific solutions and local partnership development to differentiate from global competitors. Providers should invest in Spanish-language support, local data centers, and compliance expertise to better serve the domestic market. Developing specialized offerings for key sectors such as healthcare, financial services, and manufacturing can create competitive advantages and higher customer loyalty.

For Enterprise Customers: Organizations should develop comprehensive cloud strategies that align with business objectives and consider multi-cloud approaches to optimize performance and reduce vendor dependency. Investment in cloud skills development and change management capabilities is essential for successful cloud transformation initiatives.

For System Integrators: Building deep cloud expertise across multiple platforms and developing industry-specific capabilities can create significant competitive advantages. Partnerships with cloud providers and investment in certification programs are essential for maintaining relevance in the evolving market.

For Government and Regulators: Continued support for digital transformation initiatives and development of clear regulatory frameworks for cloud computing can accelerate market growth while ensuring appropriate protection of sensitive data and critical infrastructure.

For Investors: The Spanish cloud computing market presents attractive opportunities across multiple segments, with particular potential in edge computing, artificial intelligence services, and industry-specific solutions. Investment in local service providers with strong market positioning and growth potential can generate significant returns.

Future prospects for the Spanish cloud computing market remain highly positive, with multiple growth drivers supporting continued expansion and evolution of the industry over the coming years. Market projections indicate sustained growth across all major segments, with particularly strong performance expected in emerging areas such as edge computing, artificial intelligence, and industry-specific solutions.

Technology evolution will continue to drive market expansion as new capabilities such as quantum computing, advanced artificial intelligence, and enhanced security services become available through cloud platforms. Spanish organizations will increasingly leverage these advanced technologies to drive innovation and competitive advantage.

Digital transformation acceleration across all sectors of the Spanish economy will create sustained demand for cloud services, with particular growth expected in small and medium enterprises as these organizations recognize the strategic value of cloud technologies. MWR projections suggest that SME cloud adoption rates will reach 85% by 2028, representing significant market expansion opportunity.

Regulatory evolution will continue to shape market dynamics, with new frameworks for data protection, digital services, and cybersecurity creating both challenges and opportunities for market participants. Organizations that proactively address regulatory requirements will be well-positioned for continued growth.

Sustainability considerations will become increasingly important in cloud provider selection, driving investment in renewable energy-powered data centers and carbon-neutral service offerings. This trend will create competitive advantages for providers that prioritize environmental responsibility.

Innovation ecosystems will continue to develop around cloud platforms, with increased collaboration between cloud providers, software vendors, system integrators, and customers driving the development of new solutions and business models.

The Spain cloud computing market represents a dynamic and rapidly evolving sector that continues to demonstrate strong growth potential and strategic importance for the country’s digital transformation objectives. The market benefits from favorable government policies, strong telecommunications infrastructure, and increasing recognition among Spanish organizations of the competitive advantages that cloud technologies provide.

Key success factors for market participants include developing deep understanding of Spanish customer requirements, building strong local partnerships, and investing in specialized capabilities that address specific industry needs and regulatory requirements. The market rewards providers that can demonstrate expertise in areas such as data sovereignty, security, and compliance while delivering innovative solutions that drive business value.

Market evolution will continue to be driven by technological advancement, changing business requirements, and evolving customer expectations. Organizations that embrace cloud technologies strategically and invest in the necessary skills and capabilities will be well-positioned to capitalize on the significant opportunities that the Spanish cloud computing market presents.

Future growth prospects remain highly positive, with multiple drivers supporting continued market expansion across all segments and customer categories. The convergence of cloud computing with emerging technologies such as artificial intelligence, edge computing, and Internet of Things will create new opportunities for innovation and competitive differentiation in the Spanish market.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing power, and applications. It allows businesses and individuals to access and manage data remotely, enhancing flexibility and scalability.

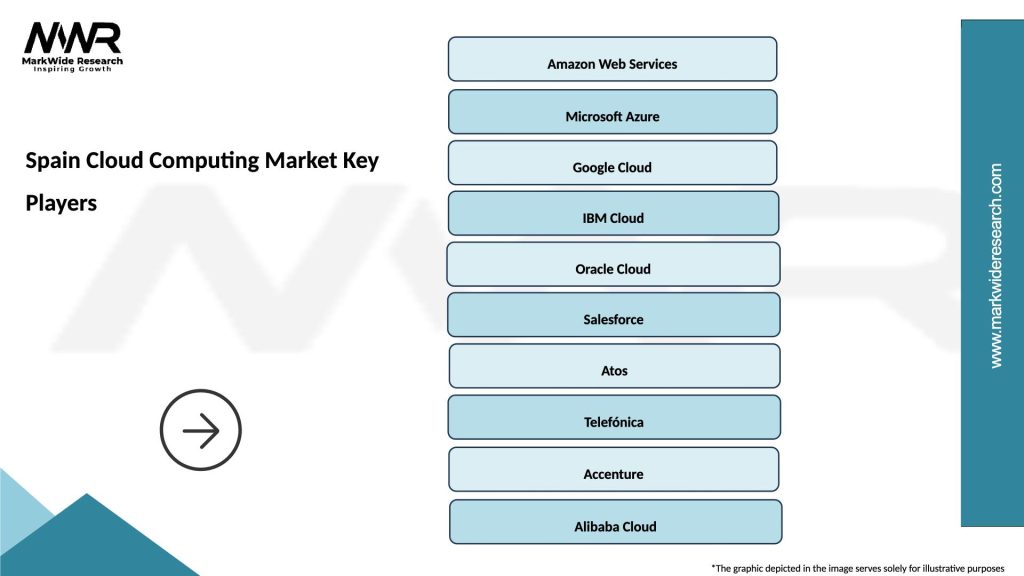

What are the key players in the Spain Cloud Computing Market?

Key players in the Spain Cloud Computing Market include Amazon Web Services, Microsoft Azure, Google Cloud, and IBM Cloud, among others. These companies provide a range of cloud services, from infrastructure to software solutions.

What are the main drivers of growth in the Spain Cloud Computing Market?

The main drivers of growth in the Spain Cloud Computing Market include the increasing demand for digital transformation, the rise of remote work, and the need for scalable IT solutions. Additionally, businesses are adopting cloud services to enhance operational efficiency and reduce costs.

What challenges does the Spain Cloud Computing Market face?

The Spain Cloud Computing Market faces challenges such as data security concerns, regulatory compliance issues, and the complexity of cloud migration. These factors can hinder the adoption of cloud services among businesses.

What opportunities exist in the Spain Cloud Computing Market?

Opportunities in the Spain Cloud Computing Market include the growth of artificial intelligence and machine learning applications, the expansion of Internet of Things (IoT) solutions, and the increasing adoption of hybrid cloud models. These trends are expected to drive innovation and investment in the sector.

What trends are shaping the Spain Cloud Computing Market?

Trends shaping the Spain Cloud Computing Market include the rise of multi-cloud strategies, increased focus on sustainability in cloud operations, and the growing importance of edge computing. These trends reflect the evolving needs of businesses and consumers in a digital-first world.

Spain Cloud Computing Market

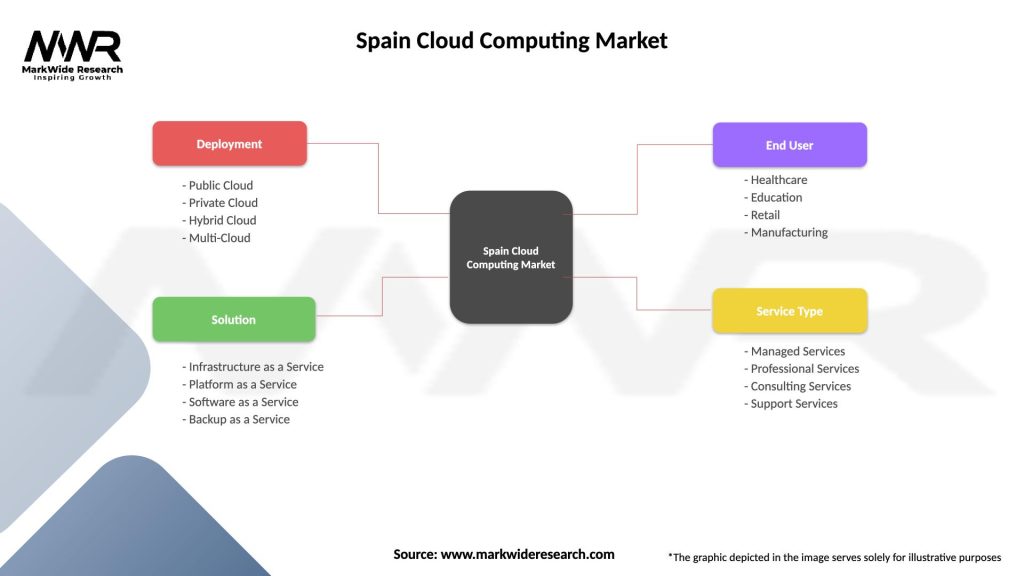

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Solution | Infrastructure as a Service, Platform as a Service, Software as a Service, Backup as a Service |

| End User | Healthcare, Education, Retail, Manufacturing |

| Service Type | Managed Services, Professional Services, Consulting Services, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at