444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain cement market represents a cornerstone of the nation’s construction and infrastructure development sector, demonstrating remarkable resilience and adaptability in recent years. Spain’s cement industry has evolved significantly, driven by sustainable construction practices, infrastructure modernization projects, and growing demand for eco-friendly building materials. The market encompasses various cement types including Portland cement, blended cement, and specialty formulations designed for specific construction applications.

Market dynamics indicate robust growth potential, with the industry experiencing a steady CAGR of 4.2% over the forecast period. This growth trajectory reflects Spain’s commitment to sustainable urban development and infrastructure enhancement initiatives. The market benefits from strategic geographical positioning, advanced manufacturing capabilities, and strong domestic consumption patterns that support long-term expansion prospects.

Regional distribution shows concentrated activity in major metropolitan areas including Madrid, Barcelona, Valencia, and Seville, where construction activities remain particularly vibrant. The market’s evolution reflects broader European trends toward environmental sustainability, with green cement technologies gaining approximately 28% market adoption among leading manufacturers.

The Spain cement market refers to the comprehensive ecosystem of cement production, distribution, and consumption within Spanish territories, encompassing manufacturing facilities, supply chain networks, and end-user applications across residential, commercial, and infrastructure sectors. This market includes various cement grades, specialty formulations, and sustainable alternatives designed to meet diverse construction requirements while adhering to stringent environmental regulations.

Cement manufacturing in Spain involves sophisticated production processes utilizing advanced kiln technologies, alternative fuel sources, and innovative grinding techniques that optimize quality while minimizing environmental impact. The market encompasses both traditional cement varieties and emerging eco-friendly alternatives including recycled content cement, low-carbon formulations, and specialized products for specific construction applications.

Spain’s cement market demonstrates strong fundamentals supported by robust construction activity, infrastructure investment, and technological innovation in sustainable manufacturing processes. The market benefits from established production capacity, strategic export opportunities, and growing domestic demand driven by urbanization trends and renovation projects across major Spanish cities.

Key market drivers include government infrastructure spending, residential construction growth, and increasing adoption of sustainable building practices. The industry shows 65% capacity utilization rates among major producers, indicating healthy demand-supply balance and operational efficiency. Export activities contribute significantly to market dynamics, with Spanish cement reaching international markets across Europe, Africa, and Latin America.

Technological advancement remains a critical success factor, with manufacturers investing in digitalization, automation, and alternative fuel integration to enhance competitiveness and environmental performance. The market outlook remains positive, supported by favorable regulatory frameworks, sustainable construction trends, and strategic positioning within European supply chains.

Strategic insights reveal several critical factors shaping Spain’s cement market landscape:

Infrastructure development initiatives serve as the primary catalyst for Spain’s cement market expansion, with government commitments to transportation networks, urban renewal projects, and sustainable construction practices creating substantial demand opportunities. The National Infrastructure Plan encompasses significant investments in high-speed rail networks, highway improvements, and port facility modernization that require substantial cement consumption.

Residential construction growth represents another fundamental driver, particularly in major metropolitan areas where housing demand remains robust. Urban population growth, tourism infrastructure development, and renovation activities in historic city centers contribute to steady cement consumption patterns. Commercial construction projects including office complexes, retail centers, and hospitality facilities further strengthen market demand.

Sustainability mandates increasingly drive market evolution, with construction industry adoption of green building standards creating demand for eco-friendly cement alternatives. The transition toward circular economy principles encourages utilization of recycled materials and alternative fuel sources in cement production, supporting both environmental objectives and cost optimization strategies.

Export market opportunities provide additional growth momentum, with Spanish cement manufacturers leveraging competitive advantages in production efficiency, quality standards, and strategic geographical positioning to serve international markets effectively.

Environmental regulations present significant challenges for Spain’s cement industry, requiring substantial investments in emission control technologies, alternative fuel systems, and carbon reduction initiatives. Compliance with EU climate targets necessitates ongoing capital expenditure that impacts operational costs and profitability margins across the industry.

Energy cost volatility represents a persistent constraint, as cement production requires intensive energy consumption for kiln operations and grinding processes. Fluctuating electricity and fuel prices directly impact production costs, creating challenges for pricing strategies and profit margin maintenance. Raw material availability and transportation costs further influence operational efficiency and market competitiveness.

Economic uncertainty and construction market cyclicality create demand volatility that affects production planning and capacity utilization. Seasonal construction patterns in Spain result in uneven demand distribution throughout the year, requiring flexible production scheduling and inventory management strategies.

International competition from lower-cost producers in emerging markets poses challenges for export activities, while domestic market saturation in certain regions limits expansion opportunities for established manufacturers.

Green cement technologies present substantial growth opportunities as construction industry stakeholders increasingly prioritize environmental sustainability and carbon footprint reduction. Development of low-carbon cement alternatives, recycled content formulations, and innovative binding agents creates new market segments with premium pricing potential.

Digital transformation initiatives offer opportunities for operational optimization, predictive maintenance, and supply chain efficiency improvements. Implementation of Industry 4.0 technologies including IoT sensors, artificial intelligence, and automated quality control systems can enhance competitiveness and reduce operational costs.

Infrastructure modernization projects across Spain create long-term demand opportunities, particularly in transportation networks, renewable energy installations, and urban development initiatives. The European Green Deal and associated funding mechanisms support sustainable infrastructure investments that benefit cement market growth.

Export market expansion to Africa, Latin America, and Eastern Europe provides growth opportunities for Spanish cement manufacturers leveraging competitive advantages in quality, technology, and geographical proximity. Strategic partnerships and joint ventures can facilitate market entry and capacity expansion in target regions.

Supply-demand equilibrium in Spain’s cement market reflects balanced production capacity and consumption patterns, with manufacturers maintaining optimal capacity utilization rates that support profitability while meeting market requirements. The industry demonstrates resilience through economic cycles, adapting production schedules and inventory management to match demand fluctuations effectively.

Competitive dynamics emphasize quality differentiation, customer service excellence, and technological innovation rather than price competition alone. Leading manufacturers focus on value-added services including technical support, customized formulations, and logistics optimization to maintain market position and customer loyalty.

Regulatory influences shape market dynamics through environmental standards, building codes, and safety requirements that drive product innovation and manufacturing process improvements. Sustainability reporting and carbon footprint disclosure requirements increasingly influence purchasing decisions and supplier selection processes.

Technology adoption accelerates market evolution, with digital solutions, automation, and alternative fuel integration creating competitive advantages for forward-thinking manufacturers. Collaboration initiatives between industry stakeholders, research institutions, and government agencies foster innovation and sustainable development practices.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research includes extensive interviews with industry executives, construction professionals, and government officials to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and academic publications to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling techniques to project market trends and identify growth patterns across different segments and regions.

Market validation processes include cross-referencing data sources, expert consultations, and industry feedback to ensure research accuracy and relevance. MarkWide Research employs rigorous quality control measures and peer review processes to maintain the highest standards of market intelligence and analytical integrity.

Data collection spans multiple timeframes to capture both historical trends and forward-looking indicators, enabling comprehensive understanding of market dynamics and future growth potential.

Madrid region dominates Spain’s cement consumption patterns, accounting for approximately 22% of national demand driven by extensive construction activities, infrastructure projects, and urban development initiatives. The region benefits from strategic transportation networks, government facility construction, and robust commercial real estate development that sustains consistent cement demand.

Catalonia region, centered around Barcelona, represents another significant market segment with 18% market share, supported by industrial construction, port infrastructure development, and tourism-related construction projects. The region’s economic diversity and international connectivity create stable demand patterns for various cement grades and specialty products.

Valencia region demonstrates strong growth potential with 12% market contribution, benefiting from agricultural infrastructure development, coastal construction projects, and renewable energy installations. The region’s strategic Mediterranean location supports both domestic consumption and export activities.

Andalusia region shows emerging opportunities with infrastructure modernization projects, tourism facility development, and agricultural construction driving cement demand growth. Northern regions including Basque Country and Galicia contribute significantly through industrial construction and infrastructure maintenance activities.

Market leadership in Spain’s cement industry reflects a combination of production capacity, technological capabilities, and strategic market positioning among established manufacturers:

Competitive strategies emphasize operational efficiency, product innovation, and customer relationship management to maintain market position and profitability. Strategic partnerships and vertical integration initiatives enable manufacturers to optimize supply chains and enhance value proposition for construction industry customers.

By Product Type:

By Application:

By End-User:

Portland cement category maintains market dominance with consistent demand across all construction segments, benefiting from established supply chains, competitive pricing, and proven performance characteristics. This category shows stable growth patterns aligned with overall construction industry trends and infrastructure development activities.

Blended cement category demonstrates accelerating growth driven by sustainability mandates and environmental consciousness among construction industry stakeholders. Green building certifications and carbon footprint reduction initiatives increasingly favor blended cement alternatives, creating premium market opportunities for manufacturers.

Specialty cement applications show strong growth potential in niche markets including marine construction, high-temperature industrial applications, and architectural projects requiring specific performance characteristics. These segments typically offer higher profit margins and customer loyalty due to technical expertise requirements.

White cement segment serves premium architectural and decorative applications with steady demand from high-end construction projects and restoration activities. This category benefits from limited competition and specialized production requirements that support pricing power and profitability.

Construction companies benefit from reliable cement supply, consistent product quality, and technical support services that enhance project efficiency and performance outcomes. Strategic partnerships with cement manufacturers provide access to customized formulations, competitive pricing, and logistics optimization that improve project profitability and timeline management.

Ready-mix concrete producers gain advantages through stable raw material supply, quality assurance programs, and technical expertise that enhance product consistency and customer satisfaction. Long-term supply agreements provide cost predictability and operational planning benefits that support business growth and market expansion.

Infrastructure developers benefit from specialized cement products designed for specific applications, technical support services, and quality certifications that ensure project compliance and performance standards. Sustainability credentials of modern cement products support green building objectives and regulatory compliance requirements.

Government stakeholders benefit from domestic cement production capacity that supports economic development, employment generation, and infrastructure development objectives while reducing import dependency and trade balance impacts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping Spain’s cement market, with manufacturers investing heavily in carbon reduction technologies, alternative fuel utilization, and circular economy practices. Carbon capture and utilization technologies show promising development potential, with several Spanish producers piloting innovative solutions for emission reduction.

Digital integration accelerates across the industry, with smart manufacturing systems, predictive maintenance technologies, and automated quality control processes enhancing operational efficiency and product consistency. Supply chain digitalization improves logistics optimization and customer service capabilities.

Product innovation focuses on high-performance cement formulations that address specific construction requirements while supporting sustainability objectives. Self-healing concrete technologies and enhanced durability formulations create new market opportunities and value propositions for construction industry customers.

Circular economy adoption drives utilization of recycled materials, industrial by-products, and alternative raw materials in cement production processes. This trend supports both environmental objectives and cost optimization strategies while creating new supply chain partnerships and business models.

Technology investments by leading Spanish cement manufacturers focus on emission reduction, energy efficiency, and alternative fuel integration to meet environmental targets and enhance competitiveness. Research and development initiatives emphasize sustainable product development and manufacturing process optimization.

Strategic partnerships between cement producers and construction companies create integrated value chains that optimize project delivery and performance outcomes. Collaboration with technology providers accelerates digital transformation and innovation adoption across the industry.

Capacity expansion projects target high-growth market segments and export opportunities, with manufacturers investing in production flexibility and product diversification capabilities. Modernization initiatives upgrade existing facilities with advanced technologies and environmental control systems.

Regulatory developments including updated building codes, environmental standards, and sustainability requirements influence product development priorities and market positioning strategies. Government incentives for sustainable construction practices create market opportunities for eco-friendly cement alternatives.

MarkWide Research recommends that Spanish cement manufacturers prioritize sustainability initiatives and carbon reduction technologies to maintain competitive advantage and regulatory compliance. Investment in alternative fuel systems and emission control technologies will become increasingly critical for long-term market success and profitability.

Digital transformation acceleration should focus on operational efficiency, predictive maintenance, and customer service enhancement to differentiate market position and improve profitability margins. Supply chain optimization through technology integration can provide significant competitive advantages in cost management and service delivery.

Export market development represents a strategic opportunity for growth beyond domestic market constraints, particularly in African and Latin American markets where Spanish producers can leverage competitive advantages in quality, technology, and geographical proximity.

Product innovation should emphasize high-performance and specialty cement formulations that command premium pricing while addressing specific construction industry requirements and sustainability objectives.

Long-term growth prospects for Spain’s cement market remain positive, supported by infrastructure investment commitments, sustainable construction trends, and export market opportunities. The industry is projected to achieve sustained growth rates of 3.8% CAGR over the next decade, driven by modernization projects and environmental technology adoption.

Sustainability transformation will continue reshaping market dynamics, with green cement technologies expected to achieve 40% market penetration by 2030. This transition creates opportunities for manufacturers investing in environmental technologies and sustainable production processes.

Export market expansion provides significant growth potential, with Spanish cement manufacturers well-positioned to serve international markets through competitive advantages in quality, technology, and strategic location. MWR analysis indicates export activities could contribute 25% of total market volume within the forecast period.

Technology integration will enhance operational efficiency, product quality, and customer service capabilities, creating competitive advantages for forward-thinking manufacturers. Digital transformation initiatives are expected to improve operational efficiency by 15-20% while reducing environmental impact and production costs.

Spain’s cement market demonstrates strong fundamentals and promising growth prospects supported by infrastructure development, sustainability initiatives, and technological innovation. The market benefits from established production capacity, strategic geographical positioning, and growing demand for eco-friendly construction materials that align with European environmental objectives.

Key success factors include sustainability leadership, operational efficiency, product innovation, and strategic market positioning that address evolving customer requirements and regulatory standards. The industry’s commitment to environmental responsibility and technological advancement positions Spanish cement manufacturers competitively in both domestic and international markets.

Future growth will be driven by infrastructure investment, export market expansion, and the transition toward sustainable construction practices that favor advanced cement technologies and eco-friendly alternatives. The market outlook remains optimistic, with opportunities for manufacturers that embrace innovation, sustainability, and customer-centric strategies in an evolving construction industry landscape.

What is Cement?

Cement is a binding material used in construction, made from a mixture of minerals that harden when mixed with water. It is a key ingredient in concrete, mortar, and other construction materials, playing a crucial role in building infrastructure and structures.

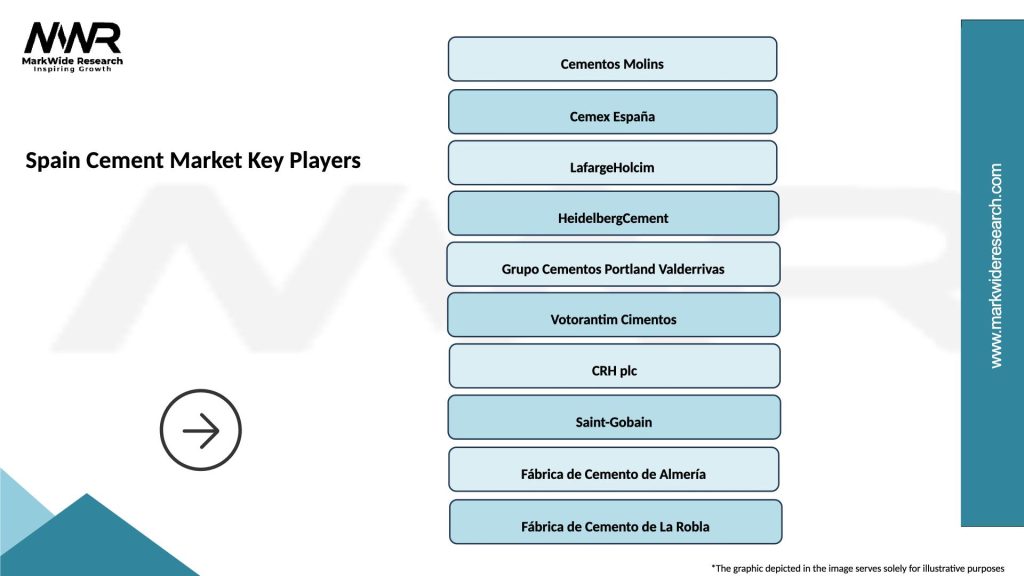

What are the major companies in the Spain Cement Market?

Major companies in the Spain Cement Market include Cementos Molins, Holcim España, and Grupo Cementos Portland Valderrivas, among others. These companies are involved in the production and distribution of cement and related products across various construction sectors.

What are the growth factors driving the Spain Cement Market?

The growth of the Spain Cement Market is driven by increasing urbanization, infrastructure development, and a rise in residential construction projects. Additionally, government initiatives aimed at improving transportation and public facilities contribute to market expansion.

What challenges does the Spain Cement Market face?

The Spain Cement Market faces challenges such as environmental regulations, competition from alternative materials, and fluctuations in raw material prices. These factors can impact production costs and sustainability efforts within the industry.

What opportunities exist in the Spain Cement Market?

Opportunities in the Spain Cement Market include the growing demand for sustainable construction practices and innovations in cement technology. The shift towards eco-friendly materials and energy-efficient production methods presents avenues for growth.

What trends are shaping the Spain Cement Market?

Trends in the Spain Cement Market include the adoption of digital technologies in production processes and the increasing focus on reducing carbon emissions. Additionally, the rise of smart cities and green building initiatives is influencing cement demand and production strategies.

Spain Cement Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portland Cement, Blended Cement, White Cement, Oil Well Cement |

| Application | Residential Construction, Commercial Construction, Infrastructure Projects, Precast Concrete |

| End User | Construction Companies, Real Estate Developers, Government Agencies, DIY Enthusiasts |

| Distribution Channel | Direct Sales, Retail Outlets, Online Platforms, Wholesale Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Cement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at