444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain car rental industry market represents one of Europe’s most dynamic and competitive automotive service sectors, driven by robust tourism infrastructure and evolving mobility preferences. Spain’s strategic position as a leading European tourist destination, combined with its extensive transportation networks and diverse geographical landscape, creates substantial demand for flexible vehicle rental solutions across multiple market segments.

Market dynamics in Spain’s car rental sector reflect the country’s economic recovery and tourism resurgence, with the industry experiencing steady growth rates of approximately 6.2% annually over recent years. The sector encompasses traditional car rental services, luxury vehicle rentals, commercial fleet solutions, and emerging mobility-as-a-service offerings that cater to both domestic and international customers.

Tourism-driven demand remains the primary catalyst for market expansion, with Spain welcoming millions of international visitors annually who require reliable transportation solutions. The industry’s resilience is demonstrated through its adaptation to changing consumer preferences, technological integration, and sustainable mobility trends that are reshaping the European automotive landscape.

Digital transformation initiatives have revolutionized customer engagement, with approximately 78% of bookings now processed through online platforms and mobile applications. This technological evolution has enhanced operational efficiency while providing customers with seamless booking experiences and real-time vehicle availability information.

The Spain car rental industry market refers to the comprehensive ecosystem of businesses and services that provide temporary vehicle access to consumers and commercial clients throughout Spanish territories. This market encompasses short-term and long-term vehicle rental solutions, ranging from economy cars to luxury vehicles, commercial vans, and specialized transportation equipment.

Industry scope includes traditional rental agencies operating from airports, city centers, and tourist destinations, as well as emerging peer-to-peer car sharing platforms and subscription-based mobility services. The market serves diverse customer segments including international tourists, business travelers, local residents requiring temporary transportation, and commercial enterprises needing fleet solutions.

Service offerings extend beyond basic vehicle rental to include comprehensive mobility packages featuring insurance coverage, GPS navigation systems, additional driver options, and premium customer support services. Modern car rental operations integrate advanced booking systems, fleet management technologies, and customer relationship management platforms to optimize service delivery and operational efficiency.

Spain’s car rental industry demonstrates remarkable resilience and growth potential, positioning itself as a cornerstone of the country’s tourism and transportation infrastructure. The market benefits from Spain’s status as Europe’s second-most visited country, generating consistent demand for flexible mobility solutions across diverse customer segments and geographical regions.

Key performance indicators reveal strong market fundamentals, with the industry maintaining positive growth trajectories of 5.8% annually despite periodic economic fluctuations and external challenges. The sector’s adaptability is evidenced through successful digital transformation initiatives, sustainable fleet modernization programs, and innovative service delivery models that enhance customer satisfaction and operational efficiency.

Competitive landscape features a balanced mix of international car rental giants, regional operators, and emerging technology-driven platforms that collectively serve millions of customers annually. Market leaders have invested significantly in fleet expansion, technological infrastructure, and strategic partnerships to strengthen their market positions and capture emerging opportunities.

Future prospects remain optimistic, supported by Spain’s tourism recovery, infrastructure development projects, and growing acceptance of shared mobility concepts. The industry is well-positioned to capitalize on evolving consumer preferences, environmental sustainability trends, and technological innovations that are reshaping global transportation markets.

Strategic analysis of Spain’s car rental industry reveals several critical insights that define current market dynamics and future growth trajectories:

Tourism resurgence serves as the primary catalyst driving Spain’s car rental industry growth, with the country’s reputation as a premier European destination generating consistent demand for flexible transportation solutions. International visitor arrivals continue recovering to pre-pandemic levels, creating substantial opportunities for rental operators across all market segments and geographical regions.

Infrastructure development initiatives, including airport expansions, highway improvements, and urban mobility projects, enhance the accessibility and attractiveness of car rental services. These investments create favorable conditions for industry growth while improving customer experiences and operational efficiency for rental operators.

Digital transformation trends accelerate market evolution, with customers increasingly preferring online booking platforms, mobile applications, and contactless service delivery options. Technology adoption reduces operational costs while enhancing customer satisfaction through streamlined processes and real-time service capabilities.

Changing mobility preferences among younger demographics favor flexible, on-demand transportation solutions over traditional vehicle ownership models. This shift creates opportunities for innovative rental products, subscription services, and shared mobility platforms that cater to evolving consumer expectations and lifestyle preferences.

Business travel recovery contributes to market stability, with corporate clients requiring reliable transportation solutions for meetings, conferences, and commercial activities. The business segment provides consistent demand patterns that complement leisure-driven seasonal variations, creating more balanced revenue streams for industry participants.

Seasonal demand fluctuations create significant operational challenges for car rental companies, requiring sophisticated capacity management strategies and flexible pricing models to maintain profitability during low-demand periods. These variations impact fleet utilization rates, staffing requirements, and financial performance across different market segments.

Regulatory compliance costs continue increasing as government authorities implement stricter environmental standards, safety requirements, and consumer protection measures. These regulations, while beneficial for industry standards, create additional operational expenses and administrative burdens for rental operators, particularly smaller regional companies.

Insurance and liability concerns represent ongoing challenges, with rising insurance premiums and complex liability frameworks affecting operational costs and pricing strategies. Risk management requirements necessitate substantial investments in safety systems, driver verification processes, and comprehensive coverage programs that impact overall profitability.

Economic uncertainty influences consumer spending patterns and travel decisions, creating volatility in demand forecasting and business planning processes. Currency fluctuations, inflation pressures, and changing economic conditions affect both domestic and international customer segments, requiring adaptive business strategies.

Competition intensification from alternative mobility solutions, including ride-sharing services, public transportation improvements, and emerging micro-mobility options, challenges traditional car rental business models. These alternatives offer convenience and cost advantages in certain use cases, requiring rental companies to differentiate their value propositions.

Sustainable mobility transition presents substantial growth opportunities as environmental consciousness drives demand for electric and hybrid vehicle rentals. Government incentives and infrastructure investments in charging networks create favorable conditions for rental companies to expand their eco-friendly fleet offerings and capture environmentally conscious customer segments.

Technology integration opportunities enable rental companies to develop innovative service delivery models, including autonomous vehicle trials, artificial intelligence-powered customer service, and Internet of Things-enabled fleet management systems. These technological advances can significantly enhance operational efficiency and customer experiences while creating competitive advantages.

Market expansion potential exists in underserved geographical regions and customer segments, particularly in rural areas, secondary cities, and specialized market niches such as luxury rentals, commercial vehicles, and long-term leasing solutions. Strategic expansion initiatives can capture new revenue streams while diversifying market exposure.

Partnership opportunities with hotels, airlines, travel agencies, and technology platforms create synergistic relationships that enhance customer acquisition, improve service integration, and reduce marketing costs. Strategic alliances can provide access to new distribution channels and customer databases while strengthening competitive positions.

Subscription-based models represent emerging opportunities to capture customers seeking flexible, long-term mobility solutions without traditional ownership commitments. These innovative business models can provide predictable revenue streams while meeting evolving consumer preferences for access over ownership.

Competitive intensity within Spain’s car rental industry reflects the market’s maturity and attractiveness, with established international operators competing alongside regional specialists and emerging technology platforms. This competition drives continuous innovation in service delivery, pricing strategies, and customer experience enhancement initiatives.

Customer expectations continue evolving toward greater convenience, transparency, and personalization in rental experiences. Modern consumers demand seamless digital interactions, flexible booking options, and comprehensive service packages that address their specific mobility needs and preferences.

Operational efficiency improvements through technology adoption and process optimization enable rental companies to reduce costs while enhancing service quality. Fleet management systems provide real-time visibility into vehicle availability, maintenance requirements, and utilization patterns, enabling data-driven decision making.

Pricing dynamics reflect complex interactions between demand patterns, competitive pressures, operational costs, and customer value perceptions. Dynamic pricing algorithms enable rental companies to optimize revenue generation while maintaining competitive market positions across different customer segments and time periods.

Supply chain considerations impact fleet acquisition, maintenance operations, and service delivery capabilities. Manufacturer relationships and vehicle availability influence rental companies’ ability to maintain modern, reliable fleets that meet customer expectations and regulatory requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Spain’s car rental industry dynamics. Primary research initiatives include structured interviews with industry executives, customer surveys, and operational data collection from rental facilities across major Spanish markets.

Secondary research components encompass analysis of government statistics, industry reports, financial statements, and regulatory documentation to establish market size, growth trends, and competitive landscape characteristics. Data triangulation processes validate findings across multiple sources to ensure analytical accuracy and reliability.

Market segmentation analysis utilizes statistical modeling techniques to identify distinct customer groups, geographical patterns, and service category performance metrics. These analytical approaches provide detailed insights into market structure, competitive dynamics, and growth opportunity identification.

Trend analysis methodologies examine historical performance data, seasonal patterns, and emerging market developments to project future growth trajectories and identify potential disruption factors. Scenario planning techniques evaluate multiple potential outcomes under different economic and market conditions.

Quality assurance protocols ensure research accuracy through peer review processes, data verification procedures, and continuous methodology refinement based on industry feedback and analytical best practices.

Madrid region represents the largest car rental market in Spain, accounting for approximately 28% of national industry activity, driven by business travel, airport operations, and urban mobility requirements. The capital’s diverse economy and extensive transportation infrastructure create consistent demand across multiple customer segments and service categories.

Catalonia region, centered around Barcelona, captures 22% of market share through its combination of business activity, tourism attractions, and industrial operations. The region’s Mediterranean coastline and cultural destinations generate substantial seasonal demand while business centers provide year-round stability.

Andalusia region demonstrates strong tourism-driven performance, representing 18% of national market activity through its popular coastal destinations, historical attractions, and airport gateway functions. Cities like Seville, Malaga, and Granada create diverse rental demand patterns throughout the year.

Valencia region contributes 12% of market share through its balanced economy combining tourism, agriculture, and manufacturing activities. The region’s coastal attractions and business centers create steady demand for rental services across different customer segments.

Balearic and Canary Islands collectively account for 15% of market activity, with highly seasonal demand patterns driven by international tourism. These island destinations require specialized logistics and fleet management approaches due to geographical constraints and transportation limitations.

Northern regions including Galicia, Asturias, and the Basque Country represent 5% of combined market share, with growth potential in business travel, cultural tourism, and emerging sustainable mobility initiatives that align with regional development priorities.

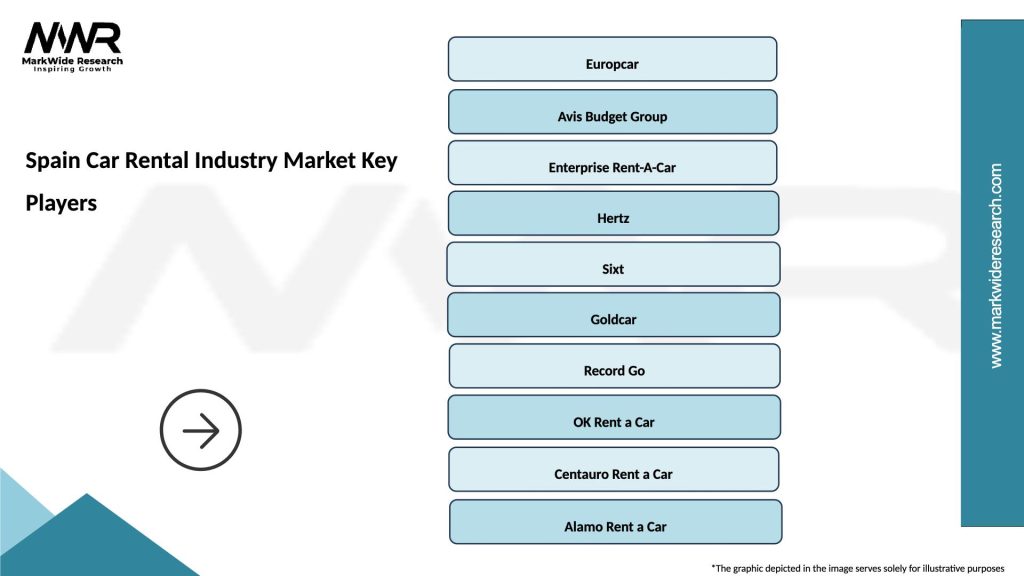

Market leadership in Spain’s car rental industry is distributed among several key players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies focus on differentiation through service quality, technology integration, fleet modernization, and strategic partnerships that enhance customer acquisition and retention capabilities. Market leaders invest significantly in digital platforms, operational efficiency, and brand development to maintain competitive advantages.

Customer segmentation within Spain’s car rental industry reveals distinct market categories with unique characteristics and requirements:

By Customer Type:

By Vehicle Category:

By Rental Duration:

Economy vehicle segment dominates rental volume, representing approximately 42% of total bookings due to price sensitivity among leisure travelers and budget-conscious customers. This category provides essential market foundation while generating consistent revenue streams for rental operators across all geographical regions.

Premium and luxury categories contribute disproportionately to profitability despite lower volume, with higher margin rates of 35-40% compared to economy segments. These categories attract affluent customers seeking enhanced comfort, performance, and prestige during their rental experiences.

SUV and van segments demonstrate strong growth potential, driven by family travel trends, group tourism, and commercial applications requiring larger vehicle capacity. Demand growth rates of 8.5% annually reflect changing customer preferences and diverse transportation requirements.

Electric and hybrid categories represent emerging opportunities with adoption rates increasing by 15% annually as environmental consciousness and government incentives drive customer interest in sustainable mobility solutions. These categories position rental companies for future market evolution and regulatory compliance.

Commercial vehicle segment provides stability and diversification opportunities, serving businesses requiring temporary fleet solutions, delivery vehicles, or specialized transportation equipment. This segment offers predictable demand patterns and longer-term relationship potential with corporate clients.

Rental companies benefit from Spain’s robust tourism industry, diverse economy, and favorable business environment that support sustainable growth and profitability. The market provides opportunities for operational efficiency improvements, technology integration, and service innovation that enhance competitive positioning.

Customers gain access to flexible mobility solutions that eliminate vehicle ownership costs, maintenance responsibilities, and parking challenges while providing freedom to explore Spain’s diverse regions and attractions. Convenience benefits include online booking, airport pickup services, and comprehensive insurance coverage options.

Tourism industry stakeholders benefit from enhanced visitor experiences and increased destination accessibility through reliable transportation options. Car rental services support tourism infrastructure development and contribute to regional economic growth through visitor spending and employment creation.

Government entities realize economic benefits through tax revenue generation, employment creation, and tourism industry support that contributes to regional development objectives. Environmental benefits emerge through fleet modernization initiatives and sustainable mobility promotion.

Technology providers find opportunities to develop innovative solutions for booking platforms, fleet management systems, and customer service applications that enhance industry efficiency and customer satisfaction levels.

Financial institutions benefit from lending opportunities, insurance products, and payment processing services that support industry operations and customer transactions across multiple market segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping customer interactions and operational processes, with rental companies investing heavily in mobile applications, artificial intelligence, and automated service delivery systems. Contactless services have become standard expectations, driving innovation in keyless vehicle access, digital documentation, and remote customer support capabilities.

Sustainability initiatives gain momentum as environmental consciousness influences customer choices and regulatory requirements. Fleet electrification programs expand rapidly, with rental companies partnering with charging infrastructure providers and government agencies to support sustainable mobility transitions.

Subscription-based models emerge as alternatives to traditional rental structures, offering customers flexible access to vehicles without long-term ownership commitments. These innovative approaches target urban professionals and younger demographics seeking convenient, cost-effective mobility solutions.

Personalization trends drive development of customized service offerings based on customer preferences, travel patterns, and historical behavior. Data analytics capabilities enable rental companies to optimize pricing, inventory management, and customer experience delivery through predictive modeling and machine learning applications.

Integration with travel ecosystems creates seamless customer journeys through partnerships with airlines, hotels, and travel booking platforms. These collaborative approaches enhance customer convenience while reducing acquisition costs and improving service delivery coordination.

Fleet modernization initiatives accelerate across the industry, with major rental companies investing substantially in newer, more efficient vehicles that meet evolving customer expectations and environmental standards. Average fleet age reduction to under two years demonstrates industry commitment to safety, reliability, and sustainability.

Technology platform upgrades enhance customer experiences through improved booking systems, mobile applications, and integrated service delivery capabilities. MarkWide Research analysis indicates that technology investments have improved operational efficiency while reducing customer service response times and enhancing satisfaction levels.

Strategic partnerships expansion creates new distribution channels and service integration opportunities, with rental companies forming alliances with travel agencies, hospitality providers, and technology platforms. These partnerships enhance market reach while providing customers with comprehensive travel solutions.

Regulatory compliance adaptations address evolving environmental standards, safety requirements, and consumer protection measures through operational process improvements and policy updates. Industry participants invest in training programs and system upgrades to ensure full compliance with changing regulatory frameworks.

Market consolidation activities continue as companies seek scale advantages, operational efficiencies, and enhanced competitive positioning through mergers, acquisitions, and strategic alliances that reshape industry structure and competitive dynamics.

Diversification strategies should focus on expanding service offerings beyond traditional car rental to include subscription models, corporate fleet management, and specialized transportation solutions that reduce dependency on seasonal tourism demand. Revenue stream diversification enhances financial stability while capturing emerging market opportunities.

Technology investment priorities should emphasize customer-facing applications, operational automation, and data analytics capabilities that improve service delivery while reducing operational costs. Digital transformation initiatives provide competitive advantages and support long-term sustainability in evolving market conditions.

Sustainability integration requires comprehensive approaches encompassing fleet electrification, carbon offset programs, and environmental reporting that address customer expectations and regulatory requirements. MWR recommends proactive sustainability strategies that position companies as industry leaders in environmental responsibility.

Partnership development should target strategic alliances with complementary service providers, technology companies, and distribution partners that enhance customer acquisition and service integration capabilities. These relationships provide access to new markets while reducing operational costs and risks.

Market expansion opportunities exist in underserved geographical regions, specialized customer segments, and emerging service categories that offer growth potential with manageable competitive intensity. Careful market analysis and phased expansion approaches minimize risks while maximizing return potential.

Growth trajectory projections indicate continued expansion for Spain’s car rental industry, supported by tourism recovery, economic stability, and evolving mobility preferences. Industry growth rates are expected to maintain positive momentum of 5-7% annually over the medium term, driven by domestic and international demand recovery.

Technology evolution will fundamentally transform industry operations through autonomous vehicle integration, artificial intelligence applications, and Internet of Things connectivity that enhance efficiency and customer experiences. These technological advances create opportunities for service innovation and competitive differentiation.

Sustainability transformation will accelerate as environmental regulations tighten and customer preferences shift toward eco-friendly transportation options. Electric vehicle adoption rates are projected to reach 40% of fleet composition within the next five years, supported by infrastructure development and government incentives.

Market structure evolution may include continued consolidation, new entrant emergence, and business model innovation that reshape competitive dynamics. MarkWide Research anticipates that successful companies will be those that adapt quickly to changing market conditions while maintaining operational excellence and customer focus.

Customer expectation evolution will drive demand for more personalized, convenient, and integrated mobility solutions that seamlessly connect with broader travel and lifestyle ecosystems. Companies that successfully anticipate and respond to these changing expectations will capture disproportionate market share and profitability.

Spain’s car rental industry demonstrates remarkable resilience and growth potential, positioning itself as a vital component of the country’s tourism infrastructure and transportation ecosystem. The market’s fundamental strengths, including robust tourism demand, excellent infrastructure, and technological advancement, create favorable conditions for sustained expansion and innovation.

Strategic opportunities abound for industry participants willing to embrace digital transformation, sustainability initiatives, and customer-centric service delivery models. The successful navigation of seasonal demand patterns, competitive pressures, and regulatory requirements will determine long-term success in this dynamic market environment.

Future success factors will include operational efficiency, technology integration, environmental responsibility, and strategic partnership development that enhance competitive positioning while meeting evolving customer expectations. Companies that invest in these critical areas while maintaining financial discipline will be well-positioned to capitalize on emerging opportunities and achieve sustainable growth in Spain’s evolving car rental industry market.

What is Spain Car Rental?

Spain Car Rental refers to the service of renting vehicles for short-term use in Spain, catering to both tourists and locals. This industry includes various vehicle types, from economy cars to luxury vehicles, and is essential for facilitating travel and transportation within the country.

What are the key players in the Spain Car Rental Industry Market?

Key players in the Spain Car Rental Industry Market include companies like Europcar, Sixt, and Hertz, which offer a range of rental options across various locations. These companies compete on pricing, vehicle availability, and customer service, among others.

What are the main drivers of growth in the Spain Car Rental Industry Market?

The main drivers of growth in the Spain Car Rental Industry Market include the increasing number of tourists visiting Spain, the rise in domestic travel, and the growing preference for flexible transportation options. Additionally, the expansion of online booking platforms has made car rental services more accessible.

What challenges does the Spain Car Rental Industry Market face?

The Spain Car Rental Industry Market faces challenges such as fluctuating demand due to seasonal tourism, regulatory changes affecting rental agreements, and competition from alternative transportation options like ride-sharing services. These factors can impact profitability and operational efficiency.

What opportunities exist in the Spain Car Rental Industry Market?

Opportunities in the Spain Car Rental Industry Market include the potential for growth in electric vehicle rentals, partnerships with travel agencies, and the expansion of services to underserved regions. Additionally, the increasing focus on sustainability can drive demand for eco-friendly rental options.

What trends are shaping the Spain Car Rental Industry Market?

Trends shaping the Spain Car Rental Industry Market include the integration of technology for seamless booking experiences, the rise of subscription-based rental models, and a growing emphasis on customer experience. These trends reflect changing consumer preferences and advancements in digital solutions.

Spain Car Rental Industry Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Economy, SUV, Luxury, Van |

| Customer Type | Leisure, Business, Government, Corporate |

| Booking Channel | Online, Travel Agency, Direct, Phone |

| Duration | Short-term, Long-term, Weekend, Weekly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Car Rental Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at