444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain automotive lubricant market represents a dynamic and evolving sector within the broader European automotive industry landscape. Spain’s strategic position as a major automotive manufacturing hub in Europe, combined with its robust vehicle fleet and growing emphasis on sustainable mobility solutions, creates a compelling environment for automotive lubricant demand. The market encompasses a comprehensive range of products including engine oils, transmission fluids, hydraulic fluids, and specialty lubricants designed to meet the diverse needs of passenger vehicles, commercial trucks, and industrial applications.

Market dynamics in Spain reflect the country’s transition toward more environmentally conscious automotive solutions, with increasing adoption of synthetic lubricants and bio-based formulations. The Spanish automotive sector benefits from strong domestic manufacturing capabilities, with major international automakers maintaining significant production facilities throughout the country. This industrial foundation drives consistent demand for high-performance lubricants that meet stringent European emission standards and fuel efficiency requirements.

Growth trajectories indicate the market is expanding at a steady CAGR of 4.2%, driven by factors including fleet modernization, increased vehicle maintenance awareness, and regulatory compliance requirements. The market demonstrates particular strength in the commercial vehicle segment, where heavy-duty lubricants command premium pricing due to their specialized performance characteristics and extended service intervals.

The Spain automotive lubricant market refers to the comprehensive ecosystem of specialized fluid products designed to reduce friction, dissipate heat, and protect mechanical components within automotive engines, transmissions, and related systems throughout the Spanish territory. This market encompasses the manufacturing, distribution, and retail of various lubricant formulations specifically engineered to meet the performance requirements of modern vehicles operating under Spanish climatic and operational conditions.

Automotive lubricants serve critical functions including engine protection, fuel economy enhancement, emission reduction, and component longevity extension. The Spanish market specifically addresses the needs of diverse vehicle categories ranging from compact passenger cars to heavy commercial trucks, agricultural machinery, and specialized industrial vehicles. Product categories include conventional mineral oils, semi-synthetic blends, full synthetic formulations, and emerging bio-based alternatives that align with Spain’s environmental sustainability objectives.

Spain’s automotive lubricant market demonstrates robust fundamentals supported by the country’s position as Europe’s second-largest automotive producer and a significant consumer market for vehicle maintenance products. The market benefits from a mature automotive infrastructure, established distribution networks, and increasing consumer awareness regarding the importance of quality lubricants for vehicle performance and longevity.

Key market drivers include the growing commercial vehicle fleet, which accounts for approximately 28% of total lubricant consumption, and the increasing adoption of high-performance synthetic lubricants that offer superior protection and extended service intervals. The passenger car segment remains the largest consumer category, driven by Spain’s vehicle density of over 500 vehicles per 1,000 inhabitants and regular maintenance requirements.

Competitive dynamics feature a mix of international oil majors, regional specialty manufacturers, and emerging sustainable lubricant producers. Market consolidation trends favor companies that can offer comprehensive product portfolios, technical support services, and innovative formulations that meet evolving regulatory standards and consumer preferences for environmentally responsible products.

Strategic market insights reveal several critical trends shaping the Spain automotive lubricant landscape:

Primary market drivers propelling growth in Spain’s automotive lubricant sector stem from both macroeconomic factors and industry-specific developments. The country’s robust automotive manufacturing base, which produces over 2.8 million vehicles annually, creates substantial demand for factory-fill lubricants and establishes Spain as a key consumption market within Europe.

Fleet modernization initiatives across commercial transportation sectors drive demand for advanced lubricant formulations that meet Euro VI emission standards and provide enhanced fuel economy benefits. The growing e-commerce sector and last-mile delivery services contribute to increased commercial vehicle utilization, resulting in higher lubricant consumption rates and more frequent service intervals.

Regulatory compliance requirements mandate the use of specific lubricant grades that meet stringent environmental and performance standards. Spanish implementation of European Union directives regarding vehicle emissions and fuel efficiency creates ongoing demand for specialized lubricant formulations that help vehicle operators achieve compliance while maintaining operational efficiency.

Consumer awareness trends regarding vehicle maintenance importance drive premium lubricant adoption, particularly among younger demographics who prioritize vehicle longevity and performance optimization. The growing popularity of extended service intervals increases demand for high-quality synthetic lubricants that can maintain protection properties over longer operational periods.

Market constraints affecting Spain’s automotive lubricant sector include economic pressures that influence consumer spending patterns on vehicle maintenance and premium product adoption. Price sensitivity among cost-conscious consumers often leads to preference for conventional lubricants over higher-performing synthetic alternatives, potentially limiting market value growth despite volume increases.

Extended drain intervals enabled by advanced lubricant formulations paradoxically constrain market growth by reducing overall consumption frequency. While beneficial for consumers and environmental sustainability, longer service intervals decrease the replacement frequency of lubricants, requiring manufacturers to focus on value-added services and premium product positioning to maintain revenue growth.

Supply chain disruptions and raw material cost volatility create operational challenges for lubricant manufacturers and distributors. Fluctuating base oil prices, additive availability constraints, and transportation cost increases can compress profit margins and affect product pricing strategies, particularly in competitive market segments.

Regulatory complexity surrounding environmental standards and product specifications requires continuous investment in research and development, testing, and compliance documentation. Smaller market participants may struggle to meet evolving regulatory requirements, potentially leading to market consolidation that could reduce competitive dynamics and innovation incentives.

Significant opportunities emerge from Spain’s commitment to sustainable transportation and the growing adoption of alternative fuel vehicles. The expanding hybrid and electric vehicle market creates demand for specialized lubricants designed for unique operating conditions, including enhanced thermal management fluids and gear oils optimized for electric drive systems.

Industrial sector growth in renewable energy, particularly wind power generation, creates new applications for specialized lubricants in wind turbine gearboxes and hydraulic systems. Spain’s leadership in renewable energy infrastructure development provides lubricant manufacturers with opportunities to develop and market high-performance products for demanding industrial applications.

Digital transformation initiatives enable innovative service models including predictive maintenance programs, lubricant condition monitoring, and customized product recommendations based on vehicle usage patterns. These technology-enabled services create opportunities for premium pricing and enhanced customer relationships while providing valuable data for product development and market insights.

Export market potential leverages Spain’s strategic geographic position and established automotive industry relationships to serve growing markets in North Africa and Latin America. Spanish lubricant manufacturers can capitalize on cultural and linguistic connections to expand their market reach beyond domestic boundaries while diversifying revenue sources.

Market dynamics in Spain’s automotive lubricant sector reflect the interplay between traditional automotive maintenance practices and emerging technological innovations. MarkWide Research analysis indicates that market evolution is characterized by increasing sophistication in product formulations and growing emphasis on total cost of ownership rather than initial purchase price considerations.

Competitive intensity varies significantly across market segments, with premium synthetic lubricants experiencing robust growth rates of approximately 6.8% annually while conventional mineral oil segments face pricing pressures and volume declines. This segmentation creates opportunities for market participants to differentiate through product innovation, technical support services, and specialized applications.

Distribution channel evolution reflects changing consumer preferences and service delivery models. Traditional automotive service centers maintain strong market positions, but quick-lube facilities and online retail channels are gaining market share of approximately 15% annually. This diversification requires lubricant manufacturers to develop flexible go-to-market strategies that serve multiple channel partners effectively.

Technology integration increasingly influences product development and customer engagement strategies. Advanced additive technologies, condition monitoring systems, and data analytics capabilities enable lubricant manufacturers to offer value-added services that extend beyond traditional product sales to encompass comprehensive maintenance solutions and performance optimization consulting.

Comprehensive research methodology employed in analyzing Spain’s automotive lubricant market incorporates multiple data collection approaches and analytical frameworks to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, technical specialists, and key stakeholders across the automotive lubricant value chain, from raw material suppliers to end-user customers.

Secondary research components encompass analysis of industry publications, regulatory documents, company financial reports, and trade association data to establish market baselines and identify emerging trends. Quantitative analysis utilizes statistical modeling techniques to project market growth trajectories, segment performance, and competitive dynamics based on historical data patterns and identified market drivers.

Market validation processes include cross-referencing multiple data sources, conducting expert panel discussions, and performing sensitivity analyses to test key assumptions and projections. Geographic segmentation analysis considers regional variations in vehicle demographics, industrial activity, and regulatory requirements to provide localized market insights that reflect Spain’s diverse economic landscape.

Competitive intelligence gathering involves systematic monitoring of market participant activities, product launches, pricing strategies, and strategic partnerships to maintain current understanding of market dynamics and competitive positioning. This ongoing research approach ensures that market analysis reflects real-time developments and emerging opportunities within Spain’s automotive lubricant sector.

Regional market distribution across Spain demonstrates significant concentration in areas with high automotive manufacturing activity and dense commercial transportation networks. Catalonia region commands the largest market share at approximately 32% of national consumption, driven by extensive automotive production facilities, major ports, and concentrated industrial activity around Barcelona and surrounding metropolitan areas.

Valencia Community represents another critical market region, accounting for roughly 18% of total lubricant demand, supported by automotive manufacturing plants, agricultural machinery operations, and significant commercial vehicle traffic serving Mediterranean trade routes. The region’s diverse industrial base creates demand for specialized lubricant applications beyond traditional automotive uses.

Madrid region demonstrates strong market presence with approximately 16% market share, primarily driven by high vehicle density, extensive commercial fleet operations, and the concentration of corporate headquarters that influence fleet management decisions. The region’s role as a transportation hub connecting northern and southern Spain creates consistent demand for commercial vehicle lubricants.

Andalusia contributes significant market volume through its agricultural machinery sector, commercial fishing fleet, and growing automotive manufacturing presence. Northern regions including the Basque Country and Asturias maintain steady market demand supported by industrial manufacturing, mining operations, and commercial transportation serving European export markets.

Competitive landscape in Spain’s automotive lubricant market features a diverse mix of international oil majors, regional specialty manufacturers, and emerging sustainable product developers. Market leadership positions are established through comprehensive product portfolios, extensive distribution networks, and strong technical support capabilities that serve diverse customer segments effectively.

Competitive strategies increasingly emphasize sustainability credentials, digital service integration, and specialized technical solutions that address specific customer requirements. Market participants invest heavily in research and development to create differentiated products that command premium pricing while meeting evolving regulatory and performance standards.

Market segmentation analysis reveals distinct patterns of demand and growth across various product categories, application areas, and customer segments within Spain’s automotive lubricant market. Product-based segmentation demonstrates the dominance of engine oils, which account for approximately 65% of total market volume, followed by transmission fluids, hydraulic oils, and specialty lubricants serving specific automotive applications.

By Product Type:

By Application Segment:

Engine oil category demonstrates the most dynamic growth patterns within Spain’s automotive lubricant market, with synthetic formulations gaining market share of approximately 42% annually as consumers increasingly recognize the performance and economic benefits of premium products. Synthetic engine oils offer superior protection under extreme operating conditions, extended drain intervals, and improved fuel economy that appeals to cost-conscious consumers and environmentally aware vehicle owners.

Transmission fluid segment experiences steady growth driven by increasing automatic transmission adoption in Spanish vehicle markets and the complexity of modern transmission systems requiring specialized lubricants. Continuously Variable Transmission (CVT) fluids represent a high-growth niche as automotive manufacturers adopt this technology for improved fuel efficiency and smoother operation.

Commercial vehicle lubricants command premium pricing due to their specialized formulations and the critical importance of equipment reliability in commercial operations. Heavy-duty diesel engine oils meeting Euro VI specifications represent the highest-value products within this category, with customers willing to pay premium prices for proven performance and extended service capabilities.

Specialty lubricant categories including greases, coolants, and application-specific formulations demonstrate strong growth potential as automotive systems become more sophisticated and require specialized maintenance products. These niche segments often provide higher profit margins and create opportunities for technical differentiation and customer loyalty development.

Industry participants in Spain’s automotive lubricant market benefit from multiple value creation opportunities across the supply chain, from raw material suppliers to end-user customers. Manufacturers gain access to a stable, mature market with predictable demand patterns and opportunities for premium product positioning through technical innovation and brand development.

Distribution partners benefit from diverse product portfolios that serve multiple customer segments and application areas, creating opportunities for cross-selling and customer relationship development. Service providers including automotive repair shops and quick-lube facilities gain competitive advantages through partnerships with reputable lubricant suppliers that provide technical support, training programs, and marketing assistance.

End-user benefits include access to advanced lubricant technologies that improve vehicle performance, extend component life, and reduce total cost of ownership. Commercial fleet operators particularly benefit from specialized lubricant programs that optimize maintenance schedules, reduce downtime, and improve fuel economy across their vehicle operations.

Environmental stakeholders benefit from industry trends toward sustainable lubricant formulations, improved fuel economy, and extended service intervals that reduce waste generation and environmental impact. The growing adoption of bio-based lubricants and recycling programs contributes to Spain’s environmental sustainability objectives while creating new market opportunities for innovative companies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability trends dominate Spain’s automotive lubricant market evolution, with increasing emphasis on bio-based formulations, recycled content, and environmentally responsible packaging solutions. MWR analysis indicates that sustainable product offerings are experiencing growth rates of approximately 8.5% annually as consumers and commercial operators prioritize environmental responsibility in their purchasing decisions.

Digitalization trends transform traditional lubricant marketing and service delivery models through predictive maintenance technologies, condition monitoring systems, and data-driven product recommendations. Smart lubrication systems that monitor oil condition in real-time and optimize change intervals are gaining adoption in commercial fleet applications where operational efficiency is critical.

Premium product trends reflect growing consumer awareness of lubricant quality impact on vehicle performance and longevity. Synthetic lubricant adoption continues expanding beyond premium vehicle segments into mainstream applications as price differentials narrow and performance benefits become more widely recognized.

Service integration trends see lubricant manufacturers expanding beyond product sales to offer comprehensive maintenance solutions, technical consulting, and fleet management services. This evolution creates opportunities for enhanced customer relationships and recurring revenue streams while differentiating companies in competitive market environments.

Recent industry developments highlight the dynamic nature of Spain’s automotive lubricant market and the continuous innovation required to meet evolving customer needs and regulatory requirements. Product innovation initiatives focus on developing next-generation formulations that meet increasingly stringent emission standards while providing enhanced performance characteristics and extended service capabilities.

Strategic partnerships between lubricant manufacturers and automotive OEMs create opportunities for factory-fill specifications and aftermarket product endorsements. These relationships provide competitive advantages through technical validation and brand credibility while ensuring product formulations meet specific vehicle requirements and warranty conditions.

Distribution channel expansion includes growth in online retail platforms, quick-lube service facilities, and mobile maintenance services that bring lubricant products and services directly to customer locations. These channel innovations respond to changing consumer preferences for convenience and service accessibility while creating new market opportunities.

Sustainability initiatives encompass development of bio-based lubricant formulations, implementation of circular economy principles through lubricant recycling programs, and adoption of sustainable packaging solutions. These environmental responsibility programs align with Spain’s climate change commitments while creating differentiation opportunities in environmentally conscious market segments.

Strategic recommendations for market participants emphasize the importance of balancing traditional market strengths with emerging opportunities in sustainable products and digital services. Product portfolio optimization should focus on high-performance synthetic formulations that command premium pricing while meeting evolving regulatory requirements and customer performance expectations.

Distribution strategy enhancement requires developing multi-channel approaches that serve diverse customer segments effectively while maintaining brand consistency and technical support quality. Digital transformation investments in customer relationship management, predictive analytics, and service delivery platforms create competitive advantages and improve customer retention rates.

Sustainability integration should encompass product development, manufacturing processes, and supply chain operations to meet growing environmental expectations while creating market differentiation opportunities. Innovation partnerships with research institutions, technology companies, and automotive manufacturers accelerate product development and ensure alignment with industry trends.

Market expansion strategies should leverage Spain’s geographic and cultural advantages to develop export opportunities in growing markets while maintaining strong domestic market positions. Customer education programs that demonstrate the total cost benefits of premium lubricants help overcome price sensitivity barriers and drive market value growth.

Future market projections indicate continued growth in Spain’s automotive lubricant market, with particular strength in premium synthetic products and specialized applications serving emerging vehicle technologies. Market evolution will be characterized by increasing sophistication in product formulations, growing emphasis on sustainability, and enhanced integration of digital technologies in product development and customer service.

Technology advancement trends will drive development of lubricants optimized for hybrid powertrains, electric vehicle auxiliary systems, and advanced engine technologies that operate under increasingly demanding conditions. Regulatory developments will continue pushing the industry toward more environmentally friendly formulations and improved fuel economy contributions.

Competitive landscape evolution will favor companies that successfully combine technical innovation with sustainable practices and comprehensive customer service capabilities. Market consolidation trends may accelerate as smaller participants struggle to meet regulatory requirements and invest in necessary technology development while larger companies leverage scale advantages and technical resources.

Growth opportunities will emerge from Spain’s continued role as a major automotive manufacturing center, expanding commercial transportation sector, and growing emphasis on vehicle maintenance optimization. The market is projected to maintain steady growth rates of approximately 4.2% annually through the forecast period, driven by these fundamental demand drivers and ongoing product innovation.

Spain’s automotive lubricant market presents a compelling combination of stability and growth potential, supported by the country’s strong automotive manufacturing base, mature distribution infrastructure, and evolving consumer preferences toward premium products and sustainable solutions. Market fundamentals remain robust despite challenges from extended service intervals and economic sensitivity, with opportunities for value creation through technical innovation and service enhancement.

Strategic success factors in this market environment include maintaining product quality leadership, developing sustainable formulations that meet environmental expectations, and creating comprehensive customer service programs that extend beyond traditional product sales. Companies that effectively balance these requirements while leveraging Spain’s strategic advantages will be well-positioned for continued growth and market leadership.

Future market development will be shaped by ongoing technological advancement, regulatory evolution, and changing customer expectations regarding environmental responsibility and total cost optimization. The Spain automotive lubricant market offers significant opportunities for companies that can successfully navigate these trends while maintaining operational excellence and customer focus in an increasingly competitive and sophisticated marketplace.

What is Automotive Lubricant?

Automotive lubricant refers to substances used to reduce friction between surfaces in automotive engines and machinery, enhancing performance and longevity. These lubricants include engine oils, transmission fluids, and greases, which are essential for the smooth operation of vehicles.

What are the key players in the Spain Automotive Lubricant Market?

Key players in the Spain Automotive Lubricant Market include Repsol, Castrol, and TotalEnergies, which offer a range of products for various automotive applications. These companies focus on innovation and sustainability to meet the evolving needs of consumers, among others.

What are the growth factors driving the Spain Automotive Lubricant Market?

The Spain Automotive Lubricant Market is driven by the increasing vehicle production and sales, along with the growing demand for high-performance lubricants. Additionally, advancements in automotive technology and a rising focus on vehicle maintenance contribute to market growth.

What challenges does the Spain Automotive Lubricant Market face?

Challenges in the Spain Automotive Lubricant Market include stringent environmental regulations and the rising popularity of electric vehicles, which require different lubrication solutions. Additionally, fluctuating raw material prices can impact production costs.

What opportunities exist in the Spain Automotive Lubricant Market?

Opportunities in the Spain Automotive Lubricant Market include the development of bio-based lubricants and the expansion of product lines to cater to electric and hybrid vehicles. The increasing awareness of vehicle maintenance also presents growth potential for lubricant manufacturers.

What trends are shaping the Spain Automotive Lubricant Market?

Trends in the Spain Automotive Lubricant Market include a shift towards synthetic lubricants and a growing emphasis on sustainability. Additionally, the integration of smart technology in vehicles is influencing lubricant formulations to enhance performance and efficiency.

Spain Automotive Lubricant Market

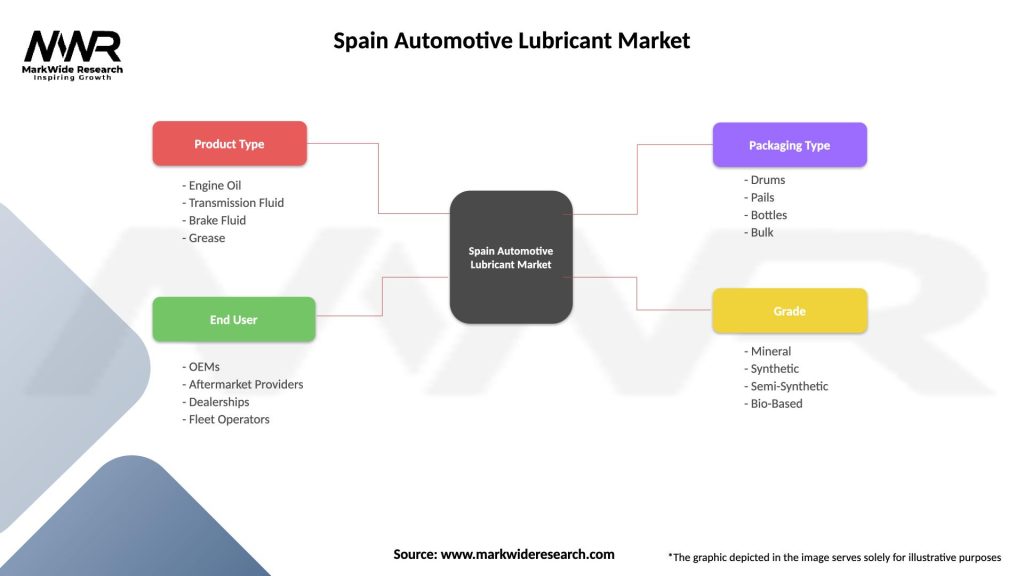

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Brake Fluid, Grease |

| End User | OEMs, Aftermarket Providers, Dealerships, Fleet Operators |

| Packaging Type | Drums, Pails, Bottles, Bulk |

| Grade | Mineral, Synthetic, Semi-Synthetic, Bio-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Automotive Lubricant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at