444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain automotive LED lighting market represents a dynamic and rapidly evolving sector within the European automotive industry, characterized by significant technological advancement and increasing consumer demand for energy-efficient lighting solutions. Market dynamics indicate substantial growth potential driven by stringent regulatory requirements, environmental consciousness, and the automotive industry’s shift toward sustainable technologies. The market encompasses various LED lighting applications including headlights, taillights, interior lighting, and decorative lighting systems across passenger vehicles, commercial vehicles, and motorcycles.

Growth trajectories in the Spanish market reflect broader European trends toward LED adoption, with the technology experiencing accelerated penetration rates of approximately 78% in new vehicle registrations. Automotive manufacturers are increasingly integrating LED lighting systems as standard equipment rather than premium options, responding to consumer preferences for enhanced visibility, aesthetic appeal, and energy efficiency. The market benefits from Spain’s position as a major automotive manufacturing hub in Europe, hosting production facilities for leading global brands.

Technological innovation continues to drive market expansion, with adaptive LED systems, matrix lighting, and smart lighting technologies gaining prominence. Regional market characteristics include strong domestic automotive production, robust aftermarket demand, and increasing adoption of electric vehicles that particularly benefit from LED lighting’s energy efficiency advantages.

The Spain automotive LED lighting market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and installation of light-emitting diode lighting systems specifically developed for automotive applications within the Spanish territory. This market includes both original equipment manufacturer (OEM) installations and aftermarket replacement products, covering diverse lighting functions from essential safety lighting to advanced adaptive systems.

Market scope extends beyond traditional lighting applications to include innovative technologies such as dynamic turn signals, ambient interior lighting, and communication lighting systems. LED technology in automotive applications offers superior energy efficiency, longer lifespan, enhanced durability, and design flexibility compared to conventional halogen and xenon lighting systems. The market encompasses various stakeholder categories including automotive manufacturers, tier-one suppliers, LED component manufacturers, and aftermarket retailers.

Industry definition includes both direct LED lighting products and supporting technologies such as control modules, heat management systems, and integration software that enable optimal LED performance in automotive environments.

Strategic market analysis reveals the Spain automotive LED lighting market as a high-growth sector benefiting from multiple convergent trends including regulatory mandates, technological advancement, and changing consumer preferences. Market leadership is distributed among established automotive lighting specialists and emerging LED technology companies, creating a competitive landscape that drives continuous innovation and cost optimization.

Key growth drivers include Spain’s robust automotive manufacturing sector, increasing vehicle production volumes, and the country’s commitment to environmental sustainability initiatives. Market penetration rates for LED lighting in new vehicles have reached approximately 82% for exterior lighting applications, while interior LED adoption shows growing momentum at 65% penetration rates. Regulatory compliance requirements continue to shape market development, with European Union directives promoting energy-efficient lighting technologies.

Investment trends indicate substantial capital allocation toward research and development, manufacturing capacity expansion, and supply chain optimization. Market consolidation activities reflect industry maturation, with strategic partnerships and acquisitions enhancing technological capabilities and market reach. Future prospects remain highly positive, supported by electric vehicle adoption, autonomous driving technology integration, and continued innovation in LED lighting applications.

Market intelligence reveals several critical insights shaping the Spain automotive LED lighting landscape:

Primary market drivers propelling the Spain automotive LED lighting market include regulatory mandates, technological advancement, and evolving consumer expectations. European Union regulations requiring improved vehicle lighting performance and energy efficiency create mandatory adoption scenarios for LED technology across all vehicle categories. Environmental sustainability initiatives at both governmental and corporate levels drive preference for energy-efficient lighting solutions that reduce overall vehicle power consumption.

Automotive industry transformation toward electric and hybrid vehicles creates natural synergy with LED lighting technology, as manufacturers seek to optimize energy usage across all vehicle systems. Consumer demand for enhanced vehicle aesthetics, improved visibility, and premium features continues to drive LED adoption beyond basic functional requirements. Manufacturing cost reduction in LED technology makes these systems increasingly accessible across all vehicle price segments, expanding market penetration opportunities.

Safety considerations play a crucial role, with LED lighting providing superior illumination quality, faster response times, and improved visibility in adverse weather conditions. Technological innovation in adaptive lighting systems, matrix headlights, and intelligent lighting controls creates new market segments and revenue opportunities. Spain’s automotive manufacturing strength provides domestic market advantages and export potential, supporting sustained market growth.

Market constraints affecting the Spain automotive LED lighting sector include initial cost considerations, technical complexity, and integration challenges. Higher upfront costs compared to traditional lighting technologies can limit adoption in price-sensitive market segments, particularly in the aftermarket replacement sector. Technical complexity of advanced LED systems requires specialized knowledge for installation, maintenance, and repair, potentially limiting service provider capabilities.

Heat management challenges in LED lighting systems necessitate sophisticated thermal management solutions, adding complexity and cost to vehicle designs. Compatibility issues with existing vehicle electrical systems can create integration challenges, particularly in retrofit applications. Supply chain dependencies on specialized LED components and control systems may create vulnerability to disruptions or price volatility.

Regulatory compliance requirements, while driving adoption, also create additional costs and complexity for manufacturers ensuring products meet evolving standards. Market saturation in certain segments may limit growth opportunities as LED penetration rates approach maximum levels. Competition from alternative lighting technologies and price pressure from low-cost manufacturers can impact profit margins and market positioning.

Significant opportunities exist within the Spain automotive LED lighting market across multiple dimensions including technology advancement, market expansion, and application diversification. Electric vehicle growth presents substantial opportunities as LED lighting’s energy efficiency becomes increasingly valuable for extending vehicle range and optimizing battery performance. Autonomous vehicle development creates demand for advanced lighting systems capable of vehicle-to-vehicle and vehicle-to-infrastructure communication.

Aftermarket expansion opportunities exist as vehicle owners seek to upgrade existing lighting systems for improved performance, aesthetics, and energy efficiency. Smart lighting integration with vehicle connectivity systems opens new revenue streams through software-enabled features and subscription services. Export market potential leverages Spain’s automotive manufacturing capabilities to serve broader European and global markets.

Technology convergence opportunities include integration with advanced driver assistance systems, heads-up displays, and augmented reality applications. Customization trends create opportunities for personalized lighting solutions and premium feature packages. Sustainability initiatives drive demand for environmentally responsible lighting solutions with extended lifecycles and recyclable components. Partnership opportunities with technology companies, automotive manufacturers, and research institutions can accelerate innovation and market penetration.

Market dynamics in the Spain automotive LED lighting sector reflect complex interactions between technological innovation, regulatory requirements, competitive pressures, and consumer preferences. Supply and demand balance shows strong demand growth outpacing supply capacity in certain premium segments, creating opportunities for capacity expansion and new market entrants. Competitive intensity varies across market segments, with established lighting manufacturers competing against specialized LED companies and automotive tier-one suppliers.

Price dynamics demonstrate ongoing cost reduction trends in LED technology, making these systems increasingly competitive with traditional lighting solutions. Innovation cycles are accelerating, with new LED lighting features and capabilities being introduced regularly to maintain competitive differentiation. Market consolidation activities continue as companies seek to achieve scale advantages and technological synergies through strategic partnerships and acquisitions.

Regional dynamics within Spain show varying adoption rates between urban and rural markets, with urban areas typically leading in premium LED lighting adoption. Seasonal variations affect aftermarket demand, with peak replacement activity occurring during autumn and winter months when lighting performance becomes more critical. Economic factors including vehicle sales volumes, consumer spending patterns, and manufacturing investment levels significantly influence market dynamics and growth trajectories.

Comprehensive research methodology employed for analyzing the Spain automotive LED lighting market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, automotive manufacturers, LED lighting suppliers, and aftermarket retailers to gather firsthand insights into market trends, challenges, and opportunities. Secondary research encompasses analysis of industry reports, regulatory documents, trade publications, and company financial statements.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing vehicle production data, LED penetration rates, and pricing trends to develop comprehensive market assessments. Competitive analysis examines company market positions, product portfolios, technological capabilities, and strategic initiatives through public information and industry intelligence. Trend analysis incorporates historical data patterns, current market indicators, and forward-looking projections to identify emerging opportunities and potential challenges.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure information accuracy and reliability. Regional analysis methodology considers local market characteristics, regulatory environments, and competitive dynamics specific to the Spanish automotive market. Technology assessment evaluates LED lighting innovations, performance improvements, and adoption timelines through technical literature review and expert consultations.

Regional market analysis reveals distinct characteristics across different areas of Spain, with Catalonia leading market adoption at approximately 32% regional market share due to its concentration of automotive manufacturing facilities and higher consumer purchasing power. Madrid region represents the second-largest market segment with 24% market share, driven by strong aftermarket demand and premium vehicle concentration. Andalusia shows growing market presence with 18% market share, supported by expanding automotive manufacturing investments.

Northern regions including the Basque Country and Asturias demonstrate strong industrial automotive presence, contributing 15% combined market share with particular strength in commercial vehicle LED lighting applications. Valencia region maintains 11% market share with balanced OEM and aftermarket demand patterns. Regional manufacturing distribution shows concentration in areas with established automotive production facilities, creating localized supply chain advantages and market development opportunities.

Urban versus rural market dynamics reveal higher LED adoption rates in metropolitan areas, where premium vehicle concentration and aftermarket service availability support advanced lighting technology penetration. Coastal regions show particular demand for LED lighting solutions due to harsh environmental conditions requiring durable, long-lasting lighting systems. Regional growth patterns indicate expanding market presence in previously underserved areas as LED technology costs decrease and availability improves.

Competitive landscape in the Spain automotive LED lighting market features a diverse mix of global lighting specialists, automotive suppliers, and emerging technology companies. Market leadership is distributed among several key players with distinct competitive advantages and market positioning strategies.

Competitive strategies include technology differentiation, cost optimization, strategic partnerships, and geographic expansion to capture market share and maintain competitive positioning.

Market segmentation analysis reveals multiple classification approaches for understanding the Spain automotive LED lighting market structure and opportunities. By technology type, the market divides into standard LED systems, adaptive LED lighting, matrix LED headlights, and organic LED (OLED) applications, each serving different performance and price requirements.

By application category, segmentation includes:

By vehicle type, market segments include passenger cars, commercial vehicles, motorcycles, and electric vehicles, with each category showing distinct adoption patterns and growth trajectories. By sales channel, the market divides between OEM installations and aftermarket sales, with aftermarket showing growing share of 35% as retrofit solutions become more accessible.

By price segment, classification includes premium, mid-range, and economy LED lighting solutions, reflecting diverse consumer preferences and budget considerations across the Spanish automotive market.

Exterior lighting category dominates the Spain automotive LED lighting market, representing the highest volume and revenue segment due to regulatory requirements and safety considerations. Headlight systems show particular strength with advanced LED adoption rates of 89% in new premium vehicles, driven by superior illumination performance and energy efficiency. Taillight applications demonstrate consistent growth as LED technology becomes standard across all vehicle price segments.

Interior lighting segment exhibits the fastest growth rate, with ambient lighting adoption increasing by 45% annually as consumers seek enhanced cabin experiences and customization options. Dashboard and instrument lighting benefits from LED’s precise control capabilities and longevity advantages. Commercial vehicle lighting shows strong demand for durable LED solutions that reduce maintenance costs and improve operational efficiency.

Aftermarket category demonstrates robust growth as vehicle owners upgrade existing lighting systems for improved performance and aesthetic appeal. Premium segment leads in advanced LED technology adoption, while economy segment shows increasing penetration as LED costs continue declining. Electric vehicle category presents unique opportunities due to LED lighting’s energy efficiency benefits and integration with vehicle energy management systems.

Automotive manufacturers benefit from LED lighting integration through reduced warranty costs, enhanced vehicle differentiation, and improved energy efficiency that supports electric vehicle range optimization. Cost advantages emerge from LED’s extended lifespan, reducing replacement frequency and maintenance requirements. Design flexibility enables innovative vehicle styling and brand differentiation through distinctive lighting signatures.

Consumers gain significant value through improved visibility, enhanced safety, reduced energy consumption, and longer service life compared to traditional lighting technologies. Aesthetic benefits include customizable lighting options and premium vehicle appearance. Environmental advantages align with sustainability goals through reduced power consumption and longer replacement cycles.

Suppliers and manufacturers in the LED lighting ecosystem benefit from growing market demand, premium pricing opportunities, and technological leadership positions. Service providers gain from specialized installation and maintenance opportunities, while retailers benefit from higher-margin LED products and growing aftermarket demand. Government stakeholders achieve environmental and safety objectives through LED adoption, supporting regulatory compliance and sustainability initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Adaptive lighting systems represent a major trend, with intelligent LED headlights automatically adjusting beam patterns based on driving conditions, traffic, and weather. Matrix LED technology enables precise light control, allowing selective illumination while avoiding glare for oncoming vehicles. Communication lighting emerges as vehicles integrate LED systems for vehicle-to-vehicle and vehicle-to-infrastructure communication protocols.

Customization trends drive demand for personalized lighting solutions, including color-changing ambient lighting and programmable lighting sequences. Integration with ADAS (Advanced Driver Assistance Systems) creates synergies between LED lighting and safety technologies. Sustainability focus promotes LED adoption through environmental benefits and energy efficiency advantages.

Smart connectivity enables remote lighting control, diagnostic capabilities, and over-the-air updates for LED lighting systems. Miniaturization trends allow more compact LED designs with improved integration possibilities. Cost reduction continues through manufacturing scale improvements and technology advancement, expanding market accessibility. According to MarkWide Research, these trends collectively drive market evolution toward more sophisticated, efficient, and user-friendly LED lighting solutions.

Recent industry developments highlight accelerating innovation and market expansion within the Spain automotive LED lighting sector. Manufacturing investments by major automotive suppliers have expanded local production capacity for LED lighting systems, reducing supply chain dependencies and improving cost competitiveness. Technology partnerships between automotive manufacturers and LED specialists have accelerated development of advanced lighting features and integration capabilities.

Regulatory developments including updated EU lighting standards have driven technology upgrades and market standardization across the European automotive industry. Product launches of next-generation LED lighting systems featuring improved performance, reduced costs, and enhanced functionality have expanded market opportunities. Acquisition activities have consolidated market positions and enhanced technological capabilities among leading industry participants.

Research and development investments continue expanding, with focus on smart lighting systems, improved energy efficiency, and integration with autonomous vehicle technologies. Supply chain optimization initiatives have improved component availability and cost structures. Market expansion into previously underserved segments and geographic regions has broadened the overall market opportunity and competitive landscape.

Strategic recommendations for market participants include focusing on technology differentiation through advanced LED capabilities such as adaptive lighting, matrix systems, and smart connectivity features. Cost optimization remains critical for expanding market penetration across all vehicle segments, requiring continued investment in manufacturing efficiency and supply chain management. Partnership strategies with automotive manufacturers, technology companies, and research institutions can accelerate innovation and market access.

Market expansion opportunities exist in underserved geographic regions and vehicle segments, particularly commercial vehicles and aftermarket applications. Investment priorities should focus on research and development, manufacturing capacity, and distribution network expansion to capture growing market demand. Quality assurance and regulatory compliance remain essential for maintaining market position and customer confidence.

Sustainability initiatives including environmentally responsible manufacturing and product lifecycle management can provide competitive advantages and align with market trends. Customer education programs can drive adoption by highlighting LED lighting benefits and addressing cost concerns. MWR analysis suggests that companies successfully combining technological innovation with cost competitiveness will achieve the strongest market positions in the evolving automotive LED lighting landscape.

Future market prospects for the Spain automotive LED lighting sector remain highly positive, supported by multiple growth drivers and expanding application opportunities. Technology advancement will continue driving market evolution, with smart lighting systems, improved energy efficiency, and integration with autonomous vehicle technologies creating new revenue streams and competitive advantages. Market penetration is expected to reach near-universal adoption rates of 95% in new vehicle production within the next five years.

Electric vehicle growth will provide sustained demand for LED lighting solutions, as energy efficiency becomes increasingly critical for vehicle range optimization. Aftermarket expansion will continue as vehicle owners upgrade existing lighting systems and replacement demand grows with the aging vehicle fleet. Export opportunities will expand as Spain’s automotive manufacturing capabilities support broader European and global market penetration.

Innovation pipeline includes developments in organic LED technology, laser-assisted lighting, and fully integrated smart lighting systems with artificial intelligence capabilities. Market consolidation may continue as companies seek scale advantages and technological synergies. Regulatory support will maintain favorable conditions for LED adoption through environmental and safety requirements. MarkWide Research projects sustained growth momentum driven by these converging positive factors and expanding market opportunities across all segments of the automotive LED lighting ecosystem.

The Spain automotive LED lighting market represents a dynamic and rapidly growing sector with substantial opportunities for continued expansion and innovation. Market fundamentals remain strong, supported by regulatory drivers, technological advancement, consumer acceptance, and Spain’s robust automotive manufacturing base. Growth trajectories across all market segments indicate sustained momentum, with particular strength in premium applications, electric vehicles, and aftermarket solutions.

Competitive dynamics favor companies that successfully combine technological innovation with cost competitiveness and market accessibility. Future success will depend on continued investment in research and development, manufacturing efficiency, and strategic partnerships that enhance market position and technological capabilities. Market participants who adapt to evolving consumer preferences, regulatory requirements, and technological trends will be best positioned to capture the substantial opportunities within this expanding market ecosystem.

Overall market outlook remains highly positive, with the Spain automotive LED lighting market poised for continued growth, innovation, and market penetration across all vehicle segments and applications, supporting the broader transformation of the automotive industry toward more efficient, sustainable, and technologically advanced lighting solutions.

What is Automotive LED Lighting?

Automotive LED Lighting refers to the use of light-emitting diodes (LEDs) in vehicles for various lighting applications, including headlights, taillights, and interior lighting. This technology is known for its energy efficiency, longevity, and ability to produce bright, high-quality light.

What are the key players in the Spain Automotive LED Lighting Market?

Key players in the Spain Automotive LED Lighting Market include Osram, Philips, and Valeo, which are known for their innovative lighting solutions and extensive product ranges. These companies focus on enhancing vehicle safety and aesthetics through advanced LED technologies, among others.

What are the growth factors driving the Spain Automotive LED Lighting Market?

The growth of the Spain Automotive LED Lighting Market is driven by increasing consumer demand for energy-efficient lighting solutions, advancements in automotive technology, and stricter regulations on vehicle emissions. Additionally, the rising trend of electric vehicles is further propelling the adoption of LED lighting.

What challenges does the Spain Automotive LED Lighting Market face?

Challenges in the Spain Automotive LED Lighting Market include high initial costs of LED technology compared to traditional lighting, potential compatibility issues with existing vehicle systems, and the need for continuous innovation to meet evolving consumer preferences.

What opportunities exist in the Spain Automotive LED Lighting Market?

Opportunities in the Spain Automotive LED Lighting Market include the growing trend of smart lighting systems, integration of LED technology in autonomous vehicles, and the expansion of aftermarket LED lighting products. These factors present avenues for growth and innovation in the sector.

What trends are shaping the Spain Automotive LED Lighting Market?

Trends shaping the Spain Automotive LED Lighting Market include the increasing adoption of adaptive lighting systems, the use of customizable LED designs, and the integration of connected vehicle technologies. These trends are enhancing the functionality and appeal of automotive lighting solutions.

Spain Automotive LED Lighting Market

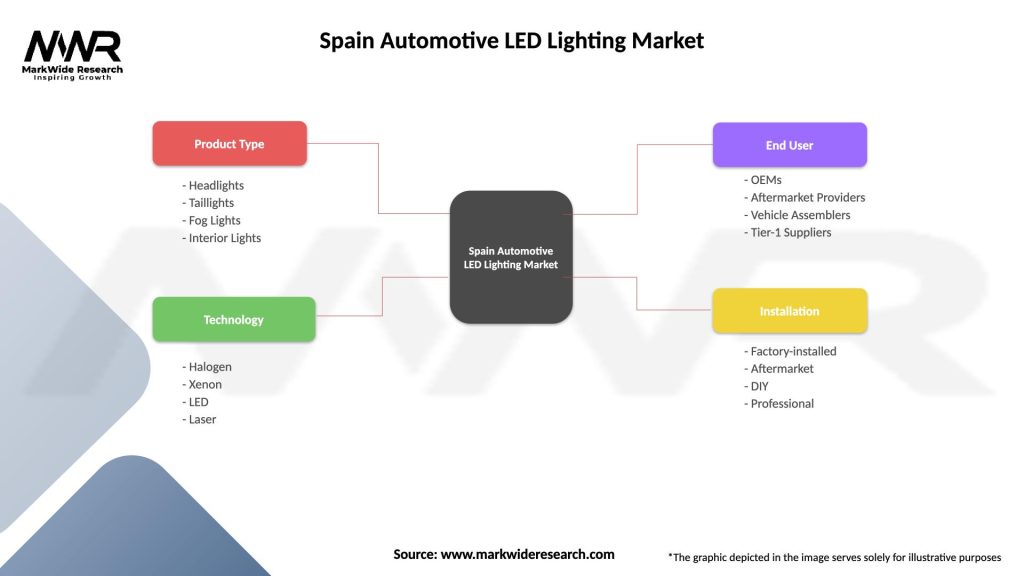

| Segmentation Details | Description |

|---|---|

| Product Type | Headlights, Taillights, Fog Lights, Interior Lights |

| Technology | Halogen, Xenon, LED, Laser |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Installation | Factory-installed, Aftermarket, DIY, Professional |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Automotive LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at