444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Spain’s artificial organs and bionic implants market represents one of the most rapidly evolving healthcare sectors in Europe, driven by an aging population, technological advancements, and increasing prevalence of chronic diseases. The market encompasses a comprehensive range of medical devices including artificial hearts, cochlear implants, prosthetic limbs, neural implants, and various organ replacement technologies. Healthcare innovation in Spain has positioned the country as a significant player in the European medical device landscape, with growing adoption rates of advanced biomedical technologies.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate of 8.2% over recent years. This expansion is primarily attributed to Spain’s robust healthcare infrastructure, government support for medical innovation, and increasing patient awareness about available treatment options. The integration of artificial intelligence and biocompatible materials has revolutionized the development of next-generation implants, offering improved functionality and patient outcomes.

Regional healthcare policies and favorable reimbursement frameworks have created an conducive environment for market growth. Spanish medical institutions are increasingly adopting cutting-edge technologies, while collaboration between research centers and international manufacturers has accelerated product development and market penetration. The market’s evolution reflects broader trends in personalized medicine and precision healthcare delivery systems.

The Spain artificial organs and bionic implants market refers to the comprehensive ecosystem of medical devices, technologies, and services designed to replace, support, or enhance human organ function through artificial means. This market encompasses both temporary and permanent solutions for patients suffering from organ failure, congenital defects, or traumatic injuries requiring advanced medical intervention.

Artificial organs include sophisticated devices such as mechanical hearts, artificial kidneys, liver support systems, and lung assist devices that replicate or supplement natural organ functions. Bionic implants represent advanced prosthetic devices that integrate electronic components with biological systems, including cochlear implants for hearing restoration, retinal implants for vision enhancement, and neural stimulation devices for various neurological conditions.

Market scope extends beyond individual devices to include comprehensive care systems, surgical procedures, post-operative monitoring, and long-term patient management services. The integration of digital health technologies and remote monitoring capabilities has expanded the market definition to include connected healthcare solutions and data analytics platforms supporting patient care optimization.

Spain’s artificial organs and bionic implants market demonstrates remarkable growth trajectory, supported by demographic trends, technological innovation, and healthcare system modernization. The market benefits from Spain’s position as a medical tourism destination and its strong pharmaceutical and medical device manufacturing base. Key growth drivers include an aging population with cardiovascular disease prevalence increasing by 12% annually, rising diabetes rates, and growing acceptance of advanced medical technologies.

Market segmentation reveals diverse opportunities across multiple therapeutic areas, with cardiovascular implants, orthopedic devices, and sensory restoration technologies leading market adoption. The integration of 3D printing technologies and personalized medicine approaches has created new market segments focused on custom-designed implants and patient-specific solutions.

Competitive landscape features a mix of international medical device giants and emerging Spanish biotechnology companies. Strategic partnerships between healthcare providers, research institutions, and technology companies have accelerated innovation cycles and market development. The market’s future outlook remains positive, with projected growth driven by continued technological advancement and expanding clinical applications.

Market intelligence reveals several critical insights shaping the Spain artificial organs and bionic implants landscape. The following key insights demonstrate the market’s evolution and growth potential:

Primary market drivers propelling Spain’s artificial organs and bionic implants market include demographic, technological, and healthcare system factors. The most significant driver remains the country’s rapidly aging population, which creates increasing demand for organ replacement and enhancement solutions. Chronic disease prevalence continues to rise, with cardiovascular diseases affecting approximately 30% of the adult population, creating substantial market opportunities for artificial heart devices and related technologies.

Technological advancement serves as another crucial driver, with innovations in materials science, miniaturization, and biocompatibility significantly improving implant performance and patient outcomes. The development of smart implants with integrated sensors and wireless connectivity has opened new therapeutic possibilities and enhanced patient monitoring capabilities.

Healthcare policy support and favorable reimbursement frameworks encourage adoption of advanced medical technologies. Government initiatives promoting medical innovation and research funding have created an environment conducive to market growth. Additionally, medical tourism contributes to market expansion, as Spain attracts international patients seeking advanced implant procedures and treatments.

Clinical evidence demonstrating improved patient outcomes and quality of life with artificial organs and bionic implants continues to drive physician adoption and patient acceptance. The growing body of long-term clinical data supports the efficacy and safety of these technologies, encouraging broader clinical application.

Market challenges facing Spain’s artificial organs and bionic implants sector include several significant restraints that may impact growth potential. High development costs associated with advanced medical device research and development create barriers for smaller companies and limit innovation speed. The complex regulatory approval process, while ensuring safety, can delay product launches and increase time-to-market for new technologies.

Technical limitations of current artificial organ technologies present ongoing challenges, including device longevity, biocompatibility issues, and the need for frequent replacements or maintenance. Surgical complexity and the requirement for specialized medical expertise limit the number of healthcare facilities capable of performing advanced implant procedures.

Patient acceptance remains a concern, particularly for visible prosthetic devices or implants requiring significant lifestyle modifications. Cultural and psychological factors may influence patient willingness to undergo artificial organ implantation, despite medical necessity. Insurance coverage limitations for certain types of implants or experimental procedures can restrict patient access to advanced technologies.

Competition from alternative treatments such as regenerative medicine, stem cell therapy, and organ transplantation may limit market growth for certain artificial organ categories. The ongoing development of biological alternatives could potentially reduce demand for mechanical replacement devices in specific therapeutic areas.

Emerging opportunities in Spain’s artificial organs and bionic implants market present significant potential for growth and innovation. The integration of artificial intelligence and machine learning technologies offers opportunities to develop smarter, more adaptive implant systems that can learn from patient behavior and optimize performance over time.

Personalized medicine represents a major opportunity, with advances in 3D printing and custom manufacturing enabling patient-specific implant design and production. This approach can improve implant fit, functionality, and patient outcomes while potentially reducing costs through optimized manufacturing processes.

Minimally invasive procedures and robotic surgery applications create opportunities for developing smaller, more sophisticated implant devices that can be inserted through less invasive surgical techniques. This trend aligns with patient preferences for reduced recovery times and improved surgical outcomes.

Digital health integration offers opportunities to develop connected implant systems that provide real-time health monitoring and data collection capabilities. These systems can support preventive healthcare approaches and enable remote patient monitoring, potentially improving long-term outcomes and reducing healthcare costs.

Emerging markets and medical tourism expansion present opportunities for Spanish companies to leverage their expertise and technology in international markets, while attracting foreign investment and partnerships to support domestic market growth.

Market dynamics in Spain’s artificial organs and bionic implants sector reflect complex interactions between technological innovation, healthcare policy, demographic trends, and economic factors. The interplay of these forces creates a dynamic environment characterized by rapid change and continuous evolution.

Supply chain dynamics have evolved significantly, with increased focus on local manufacturing capabilities and reduced dependence on international suppliers. This shift has been accelerated by recent global supply chain disruptions and the desire for greater healthcare security and independence.

Innovation cycles are accelerating, with shorter development timelines and faster technology adoption rates. The integration of digital technologies and data analytics has enabled more rapid product iteration and improvement, while collaborative research models have accelerated breakthrough discoveries.

Competitive dynamics show increasing collaboration between traditional medical device companies and technology firms, creating hybrid solutions that combine mechanical devices with digital capabilities. This convergence is reshaping market boundaries and creating new competitive advantages.

Regulatory dynamics continue to evolve, with authorities balancing the need for patient safety with the desire to encourage innovation and rapid access to beneficial technologies. Adaptive regulatory frameworks are being developed to accommodate the unique characteristics of artificial organs and bionic implants.

Comprehensive research methodology employed in analyzing Spain’s artificial organs and bionic implants market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare professionals, medical device manufacturers, regulatory officials, and patient advocacy groups to gather firsthand insights into market trends and challenges.

Secondary research encompasses analysis of medical literature, clinical trial data, regulatory filings, and industry reports to establish market baseline and identify emerging trends. MarkWide Research utilizes proprietary databases and analytical tools to process large volumes of market data and generate actionable insights.

Quantitative analysis methods include statistical modeling, trend analysis, and market sizing techniques to establish market parameters and growth projections. Qualitative research approaches incorporate expert opinions, case studies, and scenario analysis to understand market dynamics and future possibilities.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review, and statistical verification methods. The methodology incorporates real-time market monitoring and continuous data updates to maintain research relevance and accuracy.

Regional market distribution across Spain reveals distinct patterns influenced by healthcare infrastructure, population demographics, and economic factors. Madrid and Catalonia represent the largest market segments, accounting for approximately 45% of total market activity, driven by concentrated healthcare facilities, research institutions, and higher population density.

Andalusia emerges as a significant growth region, benefiting from government healthcare investments and medical tourism initiatives. The region’s strategic location and developing medical infrastructure create opportunities for market expansion and international collaboration.

Valencia and Basque Country demonstrate strong market potential, supported by advanced manufacturing capabilities and research excellence in biotechnology and medical devices. These regions benefit from established industrial bases and skilled workforce availability.

Northern regions including Galicia and Asturias show growing market adoption, particularly in rural healthcare applications and telemedicine-enabled implant monitoring systems. The focus on healthcare accessibility in these areas drives demand for remote monitoring and support technologies.

Island regions present unique market characteristics, with emphasis on portable and easily serviceable implant systems due to geographic isolation and limited specialist healthcare resources. These markets require specialized distribution and support strategies.

Competitive environment in Spain’s artificial organs and bionic implants market features a diverse mix of international corporations, domestic companies, and emerging startups. The landscape is characterized by intense innovation competition and strategic partnerships.

Emerging Spanish companies are gaining recognition for innovative approaches to artificial organ development, particularly in areas of biocompatible materials and personalized implant design. Strategic partnerships between domestic and international players are accelerating technology transfer and market development.

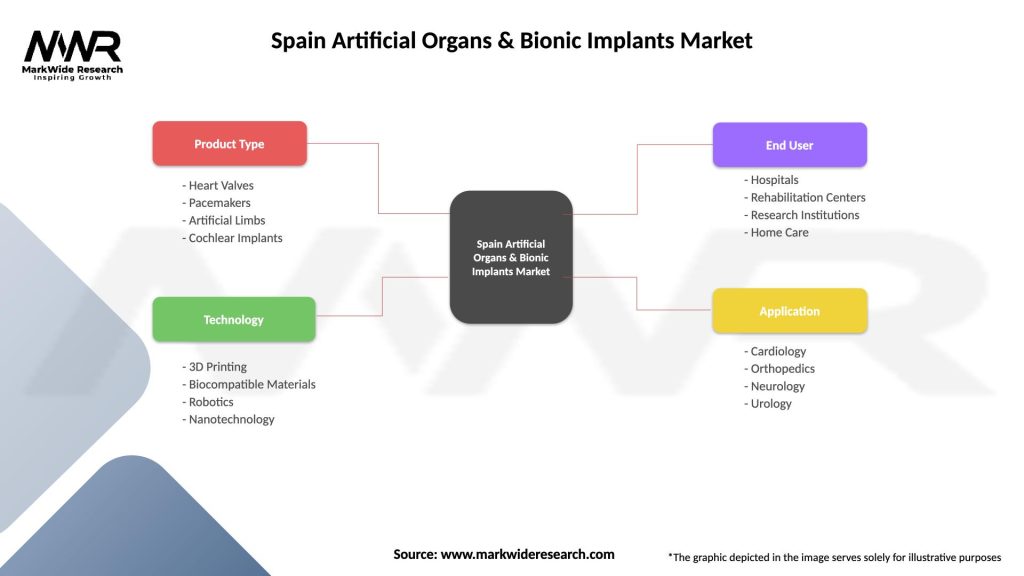

Market segmentation analysis reveals diverse opportunities across multiple categories and applications within Spain’s artificial organs and bionic implants market. By Product Type:

By Technology:

By End User:

Cardiovascular implants dominate the Spanish market, driven by high prevalence of heart disease and advanced cardiac care capabilities. Pacemaker adoption rates have increased by 15% annually, reflecting improved technology and expanded clinical indications. Artificial heart devices show promising growth potential, particularly for bridge-to-transplant applications.

Orthopedic implants represent a mature but evolving market segment, with innovations in materials and design driving replacement cycles and market expansion. Hip and knee replacements account for the majority of procedures, while spinal implants show rapid growth due to aging population demographics.

Sensory restoration devices demonstrate strong growth potential, with cochlear implants leading adoption rates and retinal implants emerging as promising technologies. Hearing implant success rates exceeding 90% patient satisfaction drive continued market expansion and clinical acceptance.

Neural implants represent an emerging high-growth category, with applications in pain management, depression treatment, and neurological disorders. Deep brain stimulation devices show particular promise for treating Parkinson’s disease and other movement disorders.

Organ support systems remain specialized but critical market segments, with artificial kidney and liver support technologies showing potential for significant market expansion as technology matures and clinical evidence accumulates.

Healthcare providers benefit from artificial organs and bionic implants through improved patient outcomes, reduced long-term care costs, and enhanced treatment capabilities. These technologies enable hospitals and clinics to offer advanced treatment options that were previously unavailable, improving their competitive position and patient satisfaction rates.

Patients experience significant benefits including improved quality of life, restored functionality, and increased independence. Long-term survival rates for patients with artificial organs show continuous improvement, with many devices providing decades of reliable service and enhanced life expectancy.

Medical device manufacturers benefit from substantial market opportunities, with growing demand driving revenue growth and innovation investment. The market provides opportunities for both established companies and emerging startups to develop breakthrough technologies and capture market share.

Healthcare systems benefit from cost-effective solutions that reduce long-term care expenses while improving patient outcomes. Artificial organs and bionic implants often provide better cost-effectiveness compared to ongoing medical treatments or repeated procedures.

Research institutions benefit from collaboration opportunities, funding availability, and the ability to translate research discoveries into clinical applications. The market provides a pathway for academic research to create real-world impact and commercial value.

Government and society benefit from reduced healthcare burden, improved population health outcomes, and economic opportunities through medical device manufacturing and export potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trends continue to drive artificial organ and bionic implant development, with devices becoming smaller, more efficient, and less invasive. This trend enables new applications and improves patient comfort and acceptance rates.

Smart connectivity represents a major trend, with implants increasingly incorporating wireless communication capabilities for remote monitoring and data collection. Connected device adoption has grown by 25% annually, enabling better patient management and preventive care approaches.

Biocompatible materials advancement continues to improve implant longevity and reduce rejection rates. New materials and surface treatments are extending device lifespans and improving integration with biological tissues.

Personalized implants using 3D printing and custom manufacturing are becoming more prevalent, offering improved fit and functionality for individual patients. This trend supports better outcomes and patient satisfaction.

Artificial intelligence integration is emerging as a key trend, with smart implants capable of learning from patient behavior and adapting their function accordingly. This technology promises to improve device performance and patient outcomes over time.

Minimally invasive procedures are becoming standard practice, driven by patient preferences and improved surgical techniques. This trend is expanding the eligible patient population and reducing procedure-related risks.

Recent industry developments highlight the dynamic nature of Spain’s artificial organs and bionic implants market. MWR analysis indicates several significant developments shaping market evolution and future growth potential.

Regulatory approvals for next-generation cardiac implants have expanded treatment options for Spanish patients, with several new devices receiving European CE marking and Spanish health authority approval. These approvals represent significant milestones for patient access to advanced technologies.

Research collaborations between Spanish universities and international medical device companies have accelerated innovation in biocompatible materials and smart implant technologies. These partnerships are producing breakthrough technologies with commercial potential.

Manufacturing investments by international companies in Spanish facilities demonstrate confidence in the local market and create opportunities for technology transfer and job creation. These investments strengthen Spain’s position in the global medical device supply chain.

Clinical trial expansions for experimental artificial organs and bionic implants are increasing, with Spain serving as a key location for European clinical research. These trials provide Spanish patients with early access to innovative treatments while supporting market development.

Digital health integration initiatives are connecting implant technologies with broader healthcare systems, enabling comprehensive patient monitoring and care coordination. These developments support improved outcomes and cost-effective care delivery.

Strategic recommendations for market participants focus on leveraging Spain’s unique market characteristics and growth opportunities. Investment in research and development remains critical for maintaining competitive advantage and developing breakthrough technologies that address unmet medical needs.

Partnership strategies should emphasize collaboration between international technology companies and Spanish healthcare institutions to accelerate innovation and market penetration. These partnerships can provide access to clinical expertise, patient populations, and regulatory knowledge.

Market entry strategies for new participants should focus on specialized niches or underserved patient populations where innovative solutions can provide clear value propositions. Regulatory compliance and quality assurance must remain top priorities throughout product development and commercialization processes.

Technology integration approaches should emphasize digital health capabilities and connectivity features that align with broader healthcare digitization trends. Companies should invest in data analytics capabilities to support evidence-based product development and clinical decision-making.

Patient education and awareness initiatives are essential for market development, particularly for newer technologies where patient understanding and acceptance may be limited. Healthcare provider education and training programs support proper device utilization and optimal patient outcomes.

Future market prospects for Spain’s artificial organs and bionic implants sector remain highly positive, supported by demographic trends, technological advancement, and healthcare system evolution. MarkWide Research projects continued strong growth driven by expanding clinical applications and improved technology accessibility.

Technological evolution will continue to drive market expansion, with artificial intelligence, nanotechnology, and advanced materials creating new possibilities for organ replacement and enhancement. Next-generation implants are expected to offer significantly improved functionality and patient outcomes.

Market expansion into new therapeutic areas and patient populations will drive growth, with emerging applications in pediatric care, rare diseases, and preventive medicine creating additional opportunities. Clinical success rates are projected to improve by 20% over the next five years, supporting broader adoption.

International market integration will provide opportunities for Spanish companies to expand globally while attracting foreign investment and technology transfer. The country’s strategic position in Europe and strong healthcare reputation support international growth strategies.

Regulatory evolution is expected to support innovation while maintaining safety standards, with adaptive approval pathways and real-world evidence acceptance facilitating faster market access for beneficial technologies. These developments will support continued market growth and patient access to innovative treatments.

Spain’s artificial organs and bionic implants market represents a dynamic and rapidly evolving sector with substantial growth potential and significant opportunities for innovation and investment. The market benefits from strong demographic drivers, advanced healthcare infrastructure, and supportive regulatory environment that collectively create favorable conditions for sustained expansion.

Key success factors for market participants include technological innovation, strategic partnerships, regulatory compliance, and patient-focused solutions that address real medical needs. The integration of digital technologies and personalized medicine approaches will continue to drive market evolution and create new competitive advantages.

Future growth prospects remain robust, supported by aging population demographics, increasing chronic disease prevalence, and continuous technological advancement. The market’s evolution toward smarter, more connected, and personalized solutions aligns with broader healthcare trends and patient expectations for improved outcomes and quality of life. As the sector continues to mature, Spain is well-positioned to maintain its role as a significant player in the European artificial organs and bionic implants market while contributing to global innovation and patient care advancement.

What is Artificial Organs & Bionic Implants?

Artificial organs and bionic implants are medical devices designed to replace or enhance biological functions in the human body. They include products such as artificial hearts, bionic limbs, and cochlear implants, which aim to improve the quality of life for patients with organ failure or disabilities.

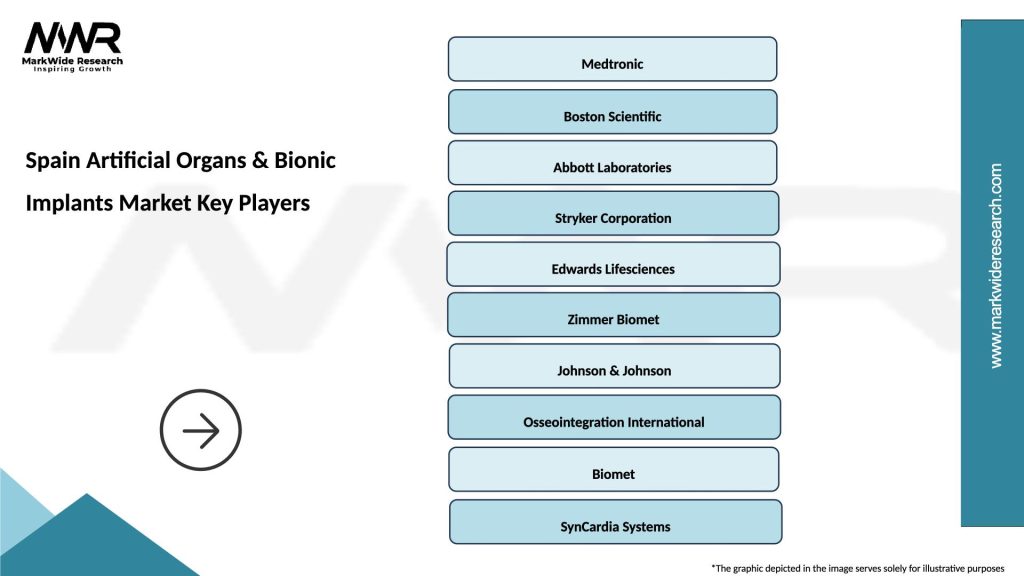

What are the key players in the Spain Artificial Organs & Bionic Implants Market?

Key players in the Spain Artificial Organs & Bionic Implants Market include Medtronic, Abbott Laboratories, and Boston Scientific. These companies are known for their innovative technologies and extensive product portfolios in the field of artificial organs and bionic implants, among others.

What are the growth factors driving the Spain Artificial Organs & Bionic Implants Market?

The growth of the Spain Artificial Organs & Bionic Implants Market is driven by an increasing prevalence of chronic diseases, advancements in medical technology, and a rising aging population. Additionally, the demand for improved healthcare solutions and enhanced patient outcomes contributes to market expansion.

What challenges does the Spain Artificial Organs & Bionic Implants Market face?

The Spain Artificial Organs & Bionic Implants Market faces challenges such as high costs of development and production, regulatory hurdles, and the need for extensive clinical trials. Furthermore, patient acceptance and the risk of complications can hinder market growth.

What opportunities exist in the Spain Artificial Organs & Bionic Implants Market?

Opportunities in the Spain Artificial Organs & Bionic Implants Market include the development of advanced materials and technologies, increasing investment in research and development, and the potential for personalized medicine. These factors can lead to innovative solutions that cater to specific patient needs.

What trends are shaping the Spain Artificial Organs & Bionic Implants Market?

Trends shaping the Spain Artificial Organs & Bionic Implants Market include the integration of artificial intelligence in device design, the rise of minimally invasive surgical techniques, and the growing focus on biocompatible materials. These innovations are enhancing the functionality and safety of artificial organs and bionic implants.

Spain Artificial Organs & Bionic Implants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Heart Valves, Pacemakers, Artificial Limbs, Cochlear Implants |

| Technology | 3D Printing, Biocompatible Materials, Robotics, Nanotechnology |

| End User | Hospitals, Rehabilitation Centers, Research Institutions, Home Care |

| Application | Cardiology, Orthopedics, Neurology, Urology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Artificial Organs & Bionic Implants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at