444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Southeast Asia, Middle-East and Africa small arms and ammunition market represents a complex and strategically significant sector encompassing military, law enforcement, and civilian applications across diverse regional landscapes. This market spans multiple countries with varying security challenges, regulatory frameworks, and defense modernization initiatives. Regional dynamics are shaped by geopolitical tensions, counter-terrorism efforts, and ongoing military modernization programs that drive demand for advanced small arms systems and ammunition technologies.

Market growth is primarily driven by increasing defense budgets, rising security concerns, and the need for military equipment upgrades across the region. The market encompasses various product categories including assault rifles, pistols, machine guns, sniper rifles, and corresponding ammunition types. Southeast Asian nations are experiencing robust economic growth, leading to increased defense spending and modernization of armed forces, while Middle Eastern countries continue substantial investments in security infrastructure amid regional instability.

African markets demonstrate significant potential for growth, driven by peacekeeping operations, counter-insurgency efforts, and border security requirements. The market is characterized by a mix of domestic production capabilities and international procurement, with several countries developing indigenous manufacturing facilities to reduce dependency on imports. Technological advancement trends include smart ammunition systems, modular weapon platforms, and enhanced accuracy technologies that are gaining traction across the region.

The Southeast Asia, Middle-East and Africa small arms and ammunition market refers to the comprehensive ecosystem of lightweight, portable firearms and their corresponding ammunition designed for individual or crew-served operations across these three distinct geographical regions. This market encompasses the manufacturing, distribution, procurement, and utilization of various weapon systems including handguns, rifles, submachine guns, light machine guns, and specialized ammunition types used by military forces, law enforcement agencies, and authorized civilian users.

Small arms are typically defined as weapons designed for individual use, including pistols, rifles, assault rifles, submachine guns, and light machine guns with calibers up to 20mm. The ammunition segment includes various cartridge types, projectiles, propellants, and specialized rounds designed for specific operational requirements. Market scope extends beyond mere hardware to include training systems, maintenance services, and technological upgrades that enhance weapon system effectiveness and operational readiness.

Strategic analysis reveals that the Southeast Asia, Middle-East and Africa small arms and ammunition market is experiencing sustained growth driven by regional security challenges and defense modernization initiatives. The market demonstrates strong fundamentals with increasing government investments in military capabilities, law enforcement equipment, and border security infrastructure. Key growth drivers include rising terrorism threats, territorial disputes, and the need for advanced weapon systems to address evolving security challenges.

Regional variations are significant, with Middle Eastern countries leading in procurement volumes due to ongoing conflicts and substantial defense budgets, while Southeast Asian nations focus on military modernization and capability enhancement. African markets show promising growth potential, particularly in peacekeeping and counter-insurgency applications. Technology adoption is accelerating, with emphasis on precision-guided munitions, smart weapon systems, and integrated combat solutions.

Market consolidation trends indicate increasing collaboration between international manufacturers and regional partners, fostering technology transfer and local production capabilities. The competitive landscape features established global players alongside emerging regional manufacturers, creating a dynamic environment for innovation and market expansion. Regulatory frameworks continue evolving to balance security requirements with international arms control obligations.

Market intelligence reveals several critical insights shaping the Southeast Asia, Middle-East and Africa small arms and ammunition sector. The following key insights provide strategic understanding of market dynamics:

Primary market drivers propelling growth in the Southeast Asia, Middle-East and Africa small arms and ammunition market stem from multiple interconnected factors. Regional security challenges represent the most significant driver, with ongoing conflicts, terrorism threats, and border disputes necessitating continuous military capability enhancement. Defense modernization programs across the region allocate substantial resources to upgrading small arms inventories and ammunition stockpiles.

Economic growth in Southeast Asian countries enables increased defense spending, while Middle Eastern nations maintain high military expenditure levels due to regional instability. The rise of asymmetric warfare and urban combat scenarios drives demand for specialized weapon systems and ammunition types designed for specific operational environments. Peacekeeping operations across Africa create sustained demand for reliable small arms and ammunition supplies.

Technological advancement serves as a crucial driver, with military forces seeking enhanced accuracy, reliability, and lethality in their weapon systems. The integration of smart technologies, improved materials, and advanced manufacturing techniques creates opportunities for market expansion. Training requirements and professional development initiatives drive demand for training ammunition and simulation systems, contributing to overall market growth.

Regional cooperation initiatives and joint military exercises increase interoperability requirements, driving standardization of weapon systems and ammunition types. Counter-insurgency operations and anti-piracy efforts create specific demand patterns for lightweight, versatile weapon systems suitable for various operational scenarios.

Significant constraints impact the Southeast Asia, Middle-East and Africa small arms and ammunition market, creating challenges for sustained growth and market development. International arms control regulations and export restrictions limit the flow of advanced weapon technologies and create compliance complexities for manufacturers and end-users. Regulatory frameworks vary significantly across countries, creating market fragmentation and increasing operational costs for suppliers.

Budget constraints in several African nations limit procurement capabilities, while economic volatility affects long-term planning and investment decisions. The complexity of international procurement processes, including lengthy approval procedures and diplomatic considerations, creates delays and uncertainty in market transactions. Technology transfer restrictions limit local manufacturing capabilities and increase dependency on foreign suppliers.

Security concerns regarding weapon proliferation and potential misuse create additional regulatory oversight and compliance requirements. The risk of weapons falling into unauthorized hands necessitates enhanced security measures throughout the supply chain, increasing operational costs. Environmental regulations regarding lead content in ammunition and manufacturing processes require costly compliance measures.

Political instability in certain regions creates market uncertainty and affects long-term business planning. Currency fluctuations and economic sanctions impact international trade relationships and pricing strategies. Maintenance challenges in remote locations and limited technical support infrastructure constrain market development in certain geographical areas.

Substantial opportunities exist within the Southeast Asia, Middle-East and Africa small arms and ammunition market, driven by evolving security requirements and technological advancement. The development of indigenous manufacturing capabilities presents significant opportunities for technology transfer partnerships and joint ventures between international manufacturers and regional companies. Modernization programs across military and law enforcement agencies create sustained demand for advanced weapon systems and ammunition technologies.

Smart ammunition technologies represent a high-growth opportunity segment, with increasing demand for precision-guided munitions and programmable ammunition systems. The integration of digital technologies and fire control systems creates opportunities for comprehensive weapon system solutions. Training and simulation markets offer substantial growth potential as professional development requirements increase across the region.

Peacekeeping operations and international security cooperation initiatives create opportunities for standardized weapon systems and interoperable ammunition types. The growing emphasis on border security and maritime patrol operations drives demand for specialized weapon systems designed for specific operational environments. Maintenance services and lifecycle support represent expanding opportunity areas as weapon system complexity increases.

Regional manufacturing hubs development creates opportunities for supply chain optimization and cost reduction. The emergence of defense industrial parks and special economic zones facilitates international collaboration and technology development. Export opportunities for regional manufacturers are expanding as local capabilities mature and international recognition grows.

Complex market dynamics characterize the Southeast Asia, Middle-East and Africa small arms and ammunition sector, influenced by geopolitical factors, technological evolution, and regulatory changes. The interplay between regional security challenges and defense modernization initiatives creates a dynamic environment where demand patterns shift based on emerging threats and operational requirements. Supply chain dynamics are increasingly complex, involving multiple stakeholders including manufacturers, distributors, government agencies, and end-users.

Competitive dynamics feature intense rivalry between established international manufacturers and emerging regional players, driving innovation and price competition. Technology transfer agreements and joint ventures are reshaping market relationships, creating new competitive advantages and market entry strategies. Procurement dynamics vary significantly across countries, with some nations favoring government-to-government agreements while others utilize competitive bidding processes.

Innovation dynamics are accelerating, with rapid development of smart ammunition, modular weapon systems, and integrated combat solutions. The pace of technological change requires continuous investment in research and development, creating both opportunities and challenges for market participants. Regulatory dynamics continue evolving as governments balance security requirements with international obligations and domestic concerns.

According to MarkWide Research analysis, market dynamics indicate increasing integration between weapon systems and supporting technologies, creating comprehensive solution requirements that extend beyond traditional product boundaries.

Comprehensive research methodology employed for analyzing the Southeast Asia, Middle-East and Africa small arms and ammunition market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research involves direct engagement with industry stakeholders including manufacturers, distributors, government procurement officials, and end-users across the three regional markets. Secondary research encompasses analysis of government publications, industry reports, trade statistics, and regulatory documents.

Data triangulation methods validate findings through cross-referencing multiple information sources and analytical approaches. Quantitative analysis includes statistical modeling, trend analysis, and market sizing calculations based on available data points. Qualitative analysis incorporates expert interviews, focus group discussions, and industry forum participation to capture market insights and future projections.

Regional analysis methodology accounts for significant variations in market conditions, regulatory frameworks, and operational requirements across Southeast Asia, Middle-East, and Africa. Country-specific analysis considers local security challenges, defense budgets, procurement processes, and industrial capabilities. Technology assessment evaluates current and emerging technologies, their adoption rates, and potential market impact.

Market segmentation analysis employs multiple classification criteria including product type, application, end-user, and geographical distribution. Competitive landscape analysis utilizes company profiling, market share estimation, and strategic positioning assessment to understand competitive dynamics.

Southeast Asia demonstrates robust growth potential driven by economic development and military modernization programs. Countries including Indonesia, Thailand, Malaysia, and the Philippines are investing significantly in defense capabilities, with emphasis on counter-terrorism and maritime security applications. Regional cooperation initiatives such as ASEAN defense collaboration create opportunities for standardized procurement and joint training programs. The market benefits from approximately 8.5% annual growth in defense spending across major Southeast Asian economies.

Middle-East markets represent the largest segment by procurement volume, driven by ongoing security challenges and substantial defense budgets. Countries including Saudi Arabia, UAE, Turkey, and Israel maintain significant small arms and ammunition inventories while continuously upgrading capabilities. Regional conflicts and counter-terrorism operations sustain high demand levels, with particular emphasis on urban warfare and special operations equipment. The region accounts for roughly 45% of total market share across the three geographical areas.

African markets show promising growth trajectories, particularly in peacekeeping and counter-insurgency applications. South Africa, Nigeria, Egypt, and Kenya lead regional procurement activities, while smaller nations focus on basic security requirements. International peacekeeping operations create sustained demand for standardized weapon systems and ammunition types. The continent demonstrates approximately 12% annual growth in security-related procurement activities.

Cross-regional dynamics include technology transfer initiatives, joint manufacturing projects, and collaborative training programs that enhance market integration and development opportunities across all three regions.

Competitive environment in the Southeast Asia, Middle-East and Africa small arms and ammunition market features a diverse mix of international manufacturers, regional producers, and emerging local companies. The landscape is characterized by strategic partnerships, technology transfer agreements, and joint ventures that facilitate market entry and capability development.

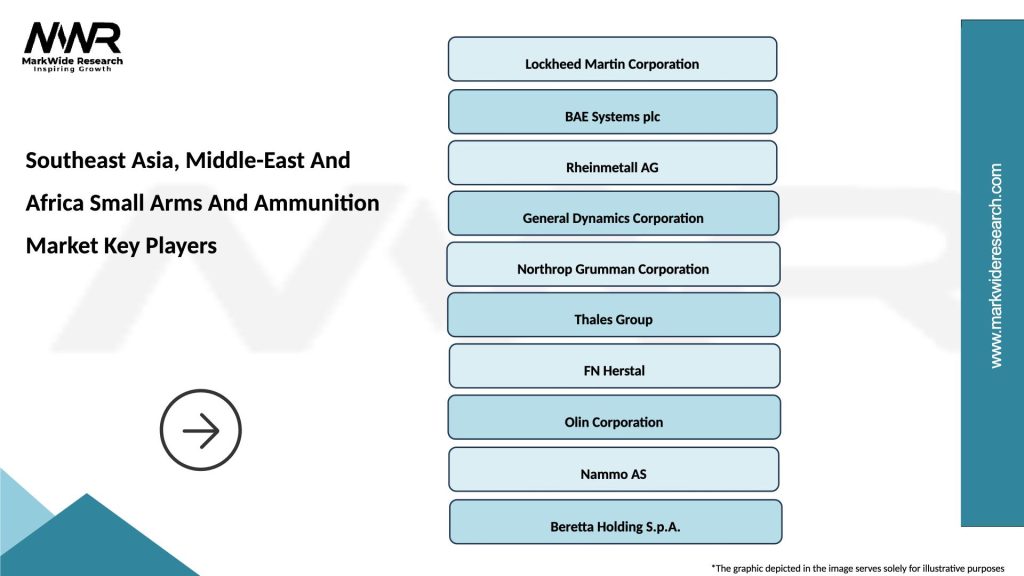

Leading international players include:

Regional manufacturers are gaining market share through government support, technology partnerships, and cost-competitive offerings. Local production capabilities are expanding across all three regions, supported by defense industrial development initiatives and foreign direct investment.

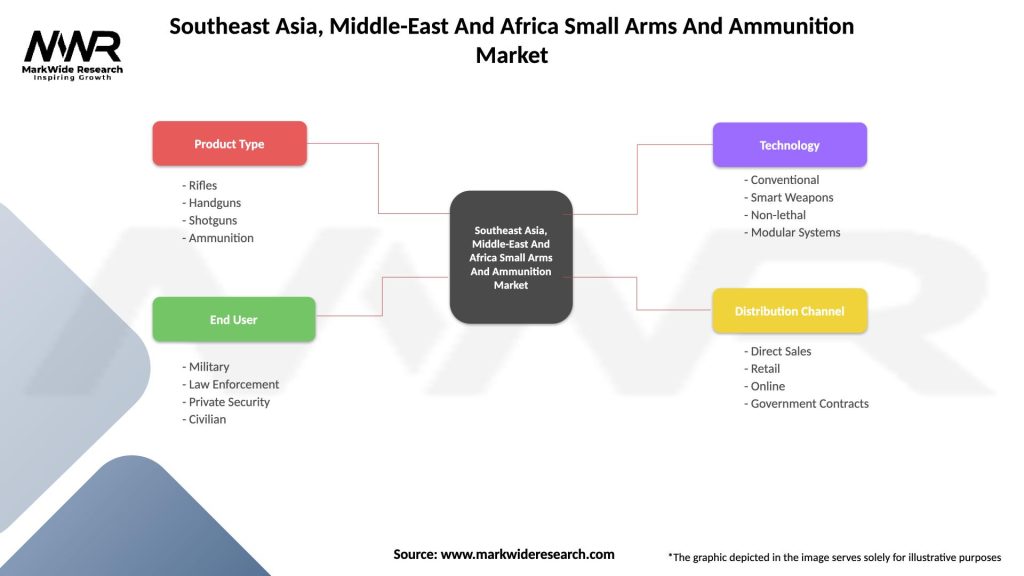

Market segmentation analysis reveals distinct categories based on product type, application, end-user, and geographical distribution. Understanding these segments provides strategic insights for market participants and stakeholders.

By Product Type:

By Application:

By End-User:

Assault rifles category dominates market share due to widespread military adoption and standardization across regional armed forces. Modern assault rifle systems feature modular designs, enhanced ergonomics, and improved accuracy characteristics. Market preference trends toward 5.56mm NATO and 7.62mm calibers, with increasing interest in intermediate cartridges for improved performance. Regional manufacturing of assault rifles is expanding, with several countries developing indigenous production capabilities.

Pistol and handgun segment shows steady growth driven by law enforcement modernization and personal protection requirements. Semi-automatic pistols dominate over revolvers, with emphasis on reliability, magazine capacity, and ease of maintenance. Polymer frame construction gains popularity due to weight reduction and corrosion resistance benefits. Training requirements drive demand for practice ammunition and simulation systems.

Machine gun category experiences strong demand for squad automatic weapons and vehicle-mounted systems. Light machine guns in 5.56mm caliber are preferred for infantry applications, while medium machine guns in 7.62mm serve support roles. Belt-fed systems are favored for sustained fire capability, with emphasis on quick-change barrel designs for enhanced operational flexibility.

Sniper rifle segment represents a high-value, specialized market with emphasis on precision and long-range capability. Bolt-action systems dominate for extreme accuracy, while semi-automatic platforms serve designated marksman roles. Scope integration and ballistic computer compatibility are increasingly important selection criteria.

Ammunition category shows consistent demand across all calibers, with particular growth in specialized rounds including armor-piercing, frangible, and environmentally friendly alternatives. Smart ammunition technologies represent emerging opportunities for advanced applications.

Industry participants in the Southeast Asia, Middle-East and Africa small arms and ammunition market benefit from diverse opportunities and strategic advantages. Manufacturers gain access to expanding markets with growing defense budgets and modernization requirements. Technology transfer partnerships enable international companies to establish local presence while providing regional partners with advanced manufacturing capabilities and technical expertise.

Regional manufacturers benefit from government support initiatives, including preferential procurement policies and industrial development programs. Local production capabilities reduce import dependency, create employment opportunities, and develop indigenous defense industrial capacity. Joint ventures with international partners provide access to advanced technologies and global market networks.

Government stakeholders achieve enhanced security capabilities through access to modern weapon systems and ammunition technologies. Domestic manufacturing development reduces foreign dependency and creates strategic autonomy in critical defense supplies. Economic benefits include job creation, technology development, and export potential for surplus production capacity.

End-users benefit from improved weapon system performance, enhanced training opportunities, and comprehensive support services. Military and law enforcement agencies gain access to advanced technologies that improve operational effectiveness and personnel safety. Standardization initiatives reduce logistics complexity and improve interoperability across different units and organizations.

Supply chain participants including distributors, logistics providers, and support services companies benefit from market growth and increasing complexity of weapon system requirements. Training organizations and simulation companies gain opportunities from enhanced professional development requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological integration represents the most significant trend shaping the Southeast Asia, Middle-East and Africa small arms and ammunition market. Smart ammunition systems incorporating programmable fuzes, guidance systems, and enhanced lethality are gaining traction across military applications. Modular weapon platforms allow users to configure systems for specific missions, improving operational flexibility and cost-effectiveness.

Digitalization trends include integration of fire control systems, ballistic computers, and targeting technologies that enhance accuracy and effectiveness. Weapon systems increasingly feature digital interfaces, data recording capabilities, and connectivity with broader combat systems. Training simulation technologies are advancing rapidly, incorporating virtual reality and augmented reality systems for enhanced learning experiences.

Sustainability initiatives drive development of environmentally friendly ammunition, including lead-free projectiles and biodegradable components. Manufacturing processes are incorporating green technologies and sustainable practices to meet environmental regulations and corporate responsibility requirements. Recycling programs for spent ammunition and weapon components are expanding across the region.

Customization trends reflect increasing demand for application-specific weapon systems and ammunition types. Military and law enforcement agencies seek tailored solutions that address specific operational requirements and threat environments. Regional adaptation of international weapon systems incorporates local requirements and environmental considerations.

Collaboration trends include increasing partnerships between international manufacturers and regional companies, facilitating technology transfer and local production development. Joint research and development initiatives are creating innovative solutions tailored to regional requirements.

Recent industry developments demonstrate the dynamic nature of the Southeast Asia, Middle-East and Africa small arms and ammunition market. Several countries have announced major defense modernization programs incorporating advanced small arms systems and smart ammunition technologies. Manufacturing expansion initiatives include establishment of new production facilities and technology transfer agreements between international and regional partners.

Technology breakthroughs in smart ammunition systems have achieved significant milestones, with successful testing of programmable ammunition and precision-guided munitions for small arms applications. Advanced materials research has produced lighter, stronger weapon components and improved ammunition performance characteristics. Digital integration achievements include successful deployment of networked weapon systems and integrated combat solutions.

Regulatory developments include updated arms control frameworks and standardization initiatives that facilitate regional cooperation and interoperability. Several countries have implemented new procurement policies favoring domestic production and technology transfer requirements. International agreements on ammunition standardization and quality control have been established to improve regional security cooperation.

Market consolidation activities include strategic acquisitions, joint ventures, and partnership agreements that reshape competitive dynamics. Regional manufacturers have achieved significant capability milestones, including international certification and export approval for their products. Investment announcements in research and development, manufacturing expansion, and technology development indicate continued market growth and innovation.

Strategic recommendations for market participants in the Southeast Asia, Middle-East and Africa small arms and ammunition sector focus on leveraging regional opportunities while addressing inherent challenges. International manufacturers should prioritize technology transfer partnerships and local production development to establish sustainable market presence and meet regulatory requirements. Investment priorities should emphasize smart technology integration, modular system development, and comprehensive support services.

Regional manufacturers should focus on capability development through international partnerships while building indigenous research and development capabilities. Quality certification and international standards compliance are essential for market credibility and export potential. Government engagement strategies should emphasize economic benefits, technology transfer, and strategic autonomy advantages of domestic production development.

Market entry strategies should account for regulatory complexity and political sensitivity inherent in arms trade. Comprehensive compliance programs and stakeholder engagement initiatives are essential for successful market participation. Product development should prioritize regional requirements, environmental conditions, and operational preferences of local end-users.

According to MWR analysis, successful market participants will be those who can effectively balance international expertise with regional adaptation, creating solutions that meet specific local requirements while maintaining global quality standards. Long-term success requires sustained investment in relationships, technology development, and market understanding across the diverse regional landscape.

Future market prospects for the Southeast Asia, Middle-East and Africa small arms and ammunition sector remain positive, driven by continued security challenges and defense modernization requirements. The market is expected to experience sustained growth with projected annual expansion of 6.8% over the next five years, supported by increasing defense budgets and technological advancement adoption.

Technology evolution will continue driving market transformation, with smart ammunition systems, artificial intelligence integration, and advanced materials becoming standard features. Digital weapon systems incorporating connectivity, data analytics, and predictive maintenance capabilities will gain widespread adoption. Autonomous systems integration may create new market segments and application opportunities.

Regional manufacturing capabilities are expected to expand significantly, with several countries achieving advanced production capacity and export potential. Technology transfer initiatives will accelerate local capability development, reducing import dependency and creating regional supply chain resilience. Innovation hubs may emerge in key regional centers, fostering collaborative research and development activities.

Market consolidation trends will likely continue, with strategic partnerships and joint ventures reshaping competitive dynamics. Regional champions may emerge through successful technology acquisition and market development strategies. Sustainability requirements will become increasingly important, driving development of environmentally friendly ammunition and manufacturing processes.

Regulatory evolution will continue balancing security requirements with international obligations and domestic concerns. Standardization initiatives may accelerate regional integration and interoperability improvements. Export opportunities for regional manufacturers are expected to expand as capabilities mature and international recognition grows.

The Southeast Asia, Middle-East and Africa small arms and ammunition market represents a dynamic and strategically important sector with substantial growth potential driven by regional security challenges and defense modernization initiatives. Market fundamentals remain strong, supported by increasing defense budgets, technological advancement adoption, and expanding local manufacturing capabilities across all three regions.

Key success factors for market participants include effective regional adaptation, technology transfer partnerships, and comprehensive understanding of diverse regulatory and operational requirements. The market offers significant opportunities for both international manufacturers and emerging regional players, with particular potential in smart technology integration, training systems, and specialized applications.

Strategic positioning requires balancing global expertise with local requirements, creating solutions that address specific regional challenges while maintaining international quality standards. Successful market participation demands sustained investment in relationships, technology development, and market understanding across the complex regional landscape. The future outlook remains positive, with continued growth expected across all major market segments and geographical areas.

What is Small Arms and Ammunition?

Small arms and ammunition refer to firearms and their associated projectiles that are designed for individual use. This includes handguns, rifles, shotguns, and the ammunition that powers them, commonly utilized in military, law enforcement, and civilian applications.

What are the key players in the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market?

Key players in the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market include companies like Lockheed Martin, BAE Systems, and Rheinmetall, which are known for their advanced weaponry and ammunition solutions, among others.

What are the growth factors for the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market?

Growth factors for the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market include increasing defense budgets, rising security concerns, and ongoing conflicts in various regions, which drive demand for small arms and ammunition.

What challenges does the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market face?

The Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market faces challenges such as stringent regulations on arms trade, the risk of illegal arms trafficking, and the need for compliance with international laws, which can hinder market growth.

What opportunities exist in the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market?

Opportunities in the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market include advancements in technology leading to more efficient and safer firearms, increased military collaborations, and the potential for growth in civilian markets for sporting and hunting firearms.

What trends are shaping the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market?

Trends shaping the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market include the rise of smart weapons, increased focus on lightweight materials for firearms, and the growing demand for personalized ammunition solutions tailored to specific user needs.

Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market

| Segmentation Details | Description |

|---|---|

| Product Type | Rifles, Handguns, Shotguns, Ammunition |

| End User | Military, Law Enforcement, Private Security, Civilian |

| Technology | Conventional, Smart Weapons, Non-lethal, Modular Systems |

| Distribution Channel | Direct Sales, Retail, Online, Government Contracts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at