444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Southeast Asia health and fitness club market represents one of the most dynamic and rapidly evolving sectors in the region’s wellness industry. Growing urbanization, increasing disposable incomes, and heightened health consciousness among consumers are driving unprecedented demand for fitness facilities across major Southeast Asian economies. The market encompasses traditional gyms, boutique fitness studios, wellness centers, and premium health clubs that cater to diverse demographic segments.

Market expansion is particularly pronounced in metropolitan areas of Thailand, Malaysia, Singapore, Indonesia, Philippines, and Vietnam, where modern lifestyle changes have created substantial opportunities for fitness service providers. The sector is experiencing robust growth at a compound annual growth rate (CAGR) of 8.2%, significantly outpacing global fitness industry averages. Digital integration and technology-enhanced fitness experiences are becoming increasingly important differentiators in this competitive landscape.

Consumer preferences are shifting toward comprehensive wellness solutions that combine physical fitness, nutritional guidance, and mental health support. This evolution has prompted fitness clubs to expand their service offerings beyond traditional equipment-based workouts to include specialized classes, personal training, spa services, and holistic wellness programs. The market’s resilience and adaptability were particularly evident during recent global challenges, with many operators successfully transitioning to hybrid models that combine in-person and virtual fitness experiences.

The Southeast Asia health and fitness club market refers to the comprehensive ecosystem of commercial fitness facilities, wellness centers, and health-focused recreational establishments operating across the Southeast Asian region. This market encompasses various business models including membership-based gyms, pay-per-visit fitness centers, boutique studios specializing in specific workout disciplines, and integrated wellness complexes that offer comprehensive health and lifestyle services.

Market participants range from international fitness chains and premium health clubs to local independent operators and specialized studios focusing on activities such as yoga, pilates, martial arts, and high-intensity interval training. The sector includes both traditional brick-and-mortar facilities and innovative hybrid models that incorporate digital fitness platforms, virtual training sessions, and mobile wellness services.

Service offerings typically include cardiovascular and strength training equipment, group fitness classes, personal training services, nutritional counseling, spa and recovery services, and increasingly, mental wellness programs. The market serves diverse consumer segments from budget-conscious fitness enthusiasts to affluent individuals seeking premium wellness experiences, reflecting the region’s varied economic landscape and cultural preferences.

Strategic market positioning in Southeast Asia’s health and fitness club sector reveals a landscape characterized by rapid expansion, technological innovation, and evolving consumer expectations. The market demonstrates exceptional growth potential driven by demographic trends, urbanization patterns, and increasing health awareness among middle-class populations across the region.

Key growth drivers include rising obesity rates prompting preventive health measures, government initiatives promoting active lifestyles, and the influence of social media in popularizing fitness culture. Approximately 73% of urban consumers in major Southeast Asian cities now consider regular exercise essential for maintaining quality of life, representing a significant shift from traditional attitudes toward physical fitness.

Market segmentation reveals distinct preferences across different demographic groups, with millennials and Generation Z consumers showing strong preference for boutique fitness experiences and technology-integrated workouts. Premium segments are experiencing particularly robust growth, with luxury fitness clubs reporting membership increases of 15-20% annually in key metropolitan markets.

Competitive dynamics are intensifying as international fitness chains expand their regional presence while local operators innovate to maintain market share. The sector’s evolution toward comprehensive wellness ecosystems presents both opportunities and challenges for traditional gym operators seeking to differentiate their offerings in an increasingly crowded marketplace.

Consumer behavior analysis reveals several critical trends shaping the Southeast Asian fitness landscape. The following insights highlight the most significant market developments:

Market maturation varies significantly across Southeast Asian countries, with Singapore and Malaysia leading in terms of fitness club density per capita, while emerging markets like Vietnam and Indonesia present substantial untapped potential for expansion.

Demographic transformation serves as the primary catalyst for Southeast Asia’s fitness club market expansion. The region’s growing middle class, with increasing disposable income and changing lifestyle preferences, creates a substantial consumer base for fitness services. Urbanization trends concentrate populations in metropolitan areas where fitness clubs can achieve optimal membership density and operational efficiency.

Health consciousness evolution among Southeast Asian consumers reflects global wellness trends adapted to local cultural contexts. Rising awareness of lifestyle-related diseases, including diabetes and cardiovascular conditions, motivates preventive health measures through regular exercise. Government health initiatives and public awareness campaigns further reinforce the importance of physical fitness in maintaining long-term health outcomes.

Technology adoption accelerates market growth by enhancing user experiences and operational efficiency. Fitness tracking devices, mobile applications, and virtual training platforms appeal particularly to tech-savvy younger demographics who view fitness as an integrated lifestyle component rather than a separate activity.

Social media influence cannot be understated in driving fitness culture adoption across Southeast Asia. Fitness influencers, wellness content creators, and social fitness challenges create aspirational lifestyle models that encourage gym memberships and active participation in fitness communities. This digital influence translates directly into increased demand for photogenic, Instagram-worthy fitness facilities and experiences.

Corporate wellness programs represent an emerging driver as employers recognize the connection between employee health and productivity. Companies increasingly invest in corporate gym memberships, on-site fitness facilities, and wellness programs that create steady revenue streams for fitness club operators while expanding their customer base beyond individual consumers.

Economic sensitivity poses significant challenges for fitness club operators across Southeast Asia, where economic fluctuations can rapidly impact consumer discretionary spending. Fitness memberships often represent non-essential expenses that consumers readily eliminate during economic downturns, creating revenue volatility for operators dependent on subscription-based business models.

Cultural barriers in certain Southeast Asian markets limit fitness club adoption, particularly among older demographics and conservative communities where public exercise, especially for women, may face social resistance. Traditional attitudes toward physical activity and body image can restrict market penetration in specific demographic segments and geographic regions.

High operational costs challenge fitness club profitability, particularly for premium facilities offering comprehensive amenities. Equipment maintenance, facility rent in prime urban locations, qualified trainer salaries, and utility expenses create substantial fixed costs that require consistent membership levels to maintain profitability.

Regulatory compliance varies significantly across Southeast Asian countries, creating operational complexity for regional fitness chains. Licensing requirements, safety regulations, foreign ownership restrictions, and taxation policies can impede market entry and expansion strategies for both domestic and international operators.

Seasonal demand fluctuations affect membership patterns and facility utilization rates. Holiday periods, monsoon seasons, and cultural festivals can significantly impact attendance patterns, creating cash flow challenges for operators who must maintain fixed costs while experiencing variable revenue streams.

Untapped demographic segments present substantial growth opportunities for innovative fitness club operators. Senior fitness programs, women-only facilities, and family-oriented fitness centers address underserved market segments with specific needs and preferences. Market research indicates that specialized programming for these demographics can achieve 30-40% higher retention rates compared to general fitness offerings.

Technology integration opportunities enable fitness clubs to differentiate their services and create additional revenue streams. Virtual reality fitness experiences, AI-powered personal training, biometric health monitoring, and gamified workout programs appeal to technology-enthusiastic consumers while providing valuable data for personalized service delivery.

Franchise expansion models offer scalable growth strategies for successful fitness concepts seeking regional expansion. The franchise approach allows rapid market penetration while minimizing capital requirements and operational risks for parent companies. Successful franchise operations in Southeast Asia report 85% higher expansion rates compared to company-owned facility development.

Corporate partnership opportunities create stable revenue streams through business-to-business relationships. Partnerships with hotels, residential complexes, office buildings, and educational institutions provide consistent membership bases while reducing marketing costs and customer acquisition expenses.

Wellness tourism integration represents an emerging opportunity as Southeast Asia becomes a preferred destination for health and wellness travel. Fitness clubs can partner with hotels, resorts, and tourism operators to offer specialized programs for international visitors seeking comprehensive wellness experiences during their travels.

Competitive intensity in Southeast Asia’s fitness club market continues escalating as both international chains and local operators vie for market share in high-growth urban markets. Market consolidation trends are emerging as larger operators acquire smaller independent clubs to achieve economies of scale and expand their geographic footprint.

Consumer expectations are rapidly evolving toward comprehensive wellness experiences that extend beyond traditional gym equipment and basic fitness classes. Modern fitness club members expect integrated services including nutritional counseling, mental health support, recovery services, and lifestyle coaching, forcing operators to expand their service portfolios and staff expertise.

Pricing strategies vary significantly across market segments, with premium facilities commanding substantial membership fees while budget operators compete primarily on price accessibility. The emergence of flexible pricing models, including pay-per-visit options and short-term memberships, reflects changing consumer preferences for commitment-free fitness access.

Technology disruption continues reshaping operational models and customer experiences. Digital fitness platforms, virtual training sessions, and mobile app integration are becoming standard expectations rather than competitive differentiators. Operators must continuously invest in technology upgrades to maintain relevance with tech-savvy consumer segments.

Supply chain considerations affect equipment procurement, maintenance services, and facility development timelines. International fitness equipment suppliers, construction contractors, and specialized service providers play crucial roles in market expansion capabilities and operational efficiency for fitness club operators across the region.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Southeast Asia’s health and fitness club market. Primary research included extensive surveys of fitness club members, operators, and industry stakeholders across six major Southeast Asian countries, providing firsthand insights into consumer preferences, operational challenges, and market trends.

Secondary research incorporated analysis of industry reports, government statistics, trade association data, and financial disclosures from publicly traded fitness companies operating in the region. This approach ensured comprehensive coverage of market dynamics, competitive landscapes, and regulatory environments across diverse Southeast Asian markets.

Qualitative research methods included in-depth interviews with fitness club owners, franchise operators, equipment suppliers, and industry consultants. These discussions provided valuable insights into operational best practices, market entry strategies, and emerging trends that quantitative data alone cannot capture.

Market segmentation analysis utilized demographic data, consumer spending patterns, and facility utilization statistics to identify distinct market segments and their respective growth potentials. This segmentation approach enables targeted strategic recommendations for different operator types and market entry strategies.

Validation processes included cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and analyzing market trends across comparable international fitness markets to ensure accuracy and reliability of research findings and projections.

Singapore leads Southeast Asia’s fitness club market in terms of penetration rates and premium service adoption. The city-state’s affluent population, limited space constraints, and health-conscious culture create ideal conditions for high-end fitness facilities. Market saturation in prime locations drives innovation toward specialized services and technology-enhanced experiences, with 42% of facilities offering premium wellness services beyond traditional fitness equipment.

Thailand demonstrates robust growth driven by Bangkok’s expanding middle class and the country’s wellness tourism industry. The market benefits from relatively low operational costs and strong government support for health and wellness initiatives. Boutique fitness studios are experiencing particularly strong growth, capturing 28% market share in urban areas compared to traditional large-format gyms.

Malaysia presents a mature market with established international fitness chains and growing local operators. The country’s diverse population creates opportunities for specialized programming targeting different ethnic and cultural groups. Corporate wellness programs are gaining traction, with 35% of major employers now offering fitness-related benefits to employees.

Indonesia represents the region’s largest untapped market potential, driven by its massive population and rapidly growing middle class. Jakarta and other major cities are experiencing significant fitness club expansion, though market penetration remains relatively low compared to regional peers. Local operators currently dominate with 65% market share, presenting opportunities for international expansion.

Philippines shows strong growth momentum in Metro Manila and other major urban centers. The market benefits from high English proficiency, strong social media adoption, and growing health consciousness among younger demographics. Franchise models are particularly successful, accounting for 45% of new facility openings in recent years.

Vietnam emerges as a high-growth market with increasing urbanization and rising disposable incomes in Ho Chi Minh City and Hanoi. The market is still developing, creating opportunities for early entrants to establish strong market positions before competition intensifies.

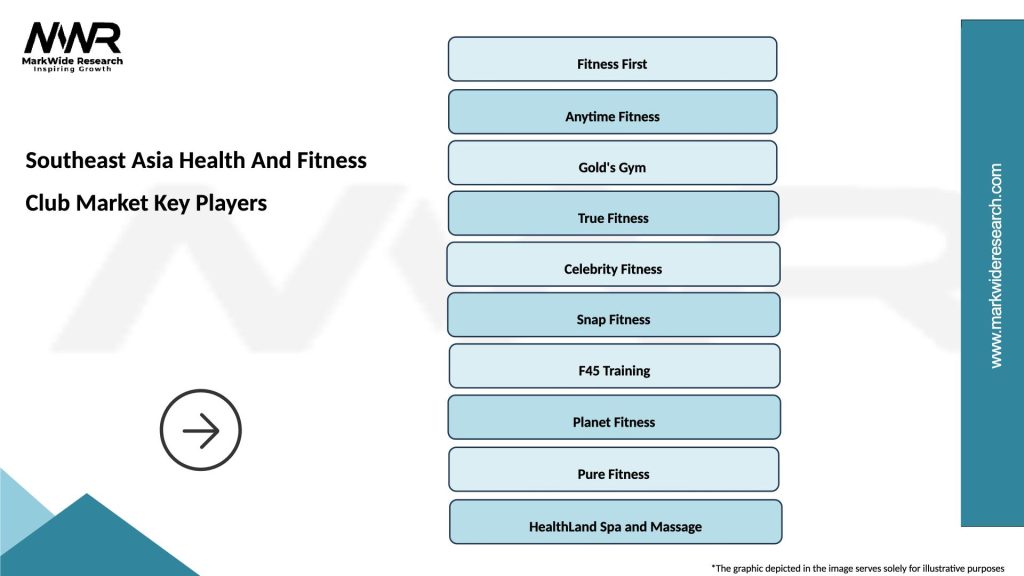

Market leadership in Southeast Asia’s fitness club sector is distributed among several key categories of operators, each serving distinct market segments and geographic areas. The competitive landscape reflects a mix of international fitness chains, regional operators, and local independent clubs.

International fitness chains dominate premium market segments in major metropolitan areas:

Local and regional operators maintain significant market share through cultural understanding and cost-effective operations:

Boutique and specialized operators are gaining market share through targeted programming and premium experiences, representing the fastest-growing segment of the competitive landscape.

By Facility Type: The Southeast Asian fitness club market demonstrates clear segmentation based on facility types and service offerings. Traditional gyms maintain the largest market share but face increasing competition from specialized formats.

By Demographics: Consumer segmentation reveals distinct preferences and behaviors across different demographic groups, enabling targeted marketing and service development strategies.

By Geographic Distribution: Market penetration varies significantly across urban and rural areas, with metropolitan centers driving the majority of growth and revenue generation.

Premium Fitness Clubs represent the highest-growth category in Southeast Asia’s fitness market, driven by affluent consumers seeking comprehensive wellness experiences. These facilities typically offer extensive amenities including swimming pools, spa services, nutrition counseling, and premium equipment. Member retention rates in premium clubs average 78% compared to 52% for budget facilities, justifying higher membership fees and operational investments.

Boutique Fitness Studios demonstrate exceptional growth potential, particularly in urban markets where consumers seek specialized, community-oriented fitness experiences. Yoga and pilates studios lead this category, followed by high-intensity interval training facilities and specialized cycling studios. These facilities achieve higher revenue per square foot compared to traditional gyms through premium pricing and efficient space utilization.

Budget Fitness Centers serve price-sensitive consumers and first-time gym members, playing a crucial role in market expansion and fitness culture development. While profit margins are typically lower, these facilities achieve success through high membership volumes and efficient operations. Market penetration strategies often focus on suburban locations and emerging urban areas.

Corporate Wellness Facilities represent an emerging high-growth category as employers recognize the connection between employee health and productivity. These facilities range from on-site corporate gyms to partnerships with nearby fitness clubs offering employee discounts and specialized programming.

Women-Only Fitness Centers address cultural preferences and comfort concerns in certain Southeast Asian markets, particularly in Malaysia and Indonesia. These facilities often incorporate cultural sensitivity in programming, scheduling, and facility design to serve conservative communities and religious requirements.

Fitness Club Operators benefit from Southeast Asia’s expanding market through multiple revenue opportunities and growth strategies. Membership growth provides predictable recurring revenue streams, while additional services like personal training, nutrition counseling, and retail sales create supplementary income sources. Successful operators can achieve profit margins of 15-25% in mature markets through operational efficiency and premium service positioning.

Equipment Suppliers gain from sustained demand for fitness equipment, technology integration, and facility upgrades. The market’s growth creates opportunities for both international equipment manufacturers and local suppliers serving budget-conscious operators. Technology integration trends drive demand for smart equipment, mobile app connectivity, and virtual training systems.

Real Estate Developers benefit from fitness clubs as anchor tenants in mixed-use developments, shopping centers, and residential complexes. Fitness facilities enhance property values and attract desirable demographics, creating mutually beneficial partnerships between developers and fitness operators.

Healthcare Providers find opportunities for partnerships with fitness clubs in preventive health programs, rehabilitation services, and wellness initiatives. These collaborations create referral networks and integrated health solutions that benefit both healthcare providers and fitness operators.

Government Stakeholders benefit from reduced healthcare costs, improved public health outcomes, and economic development through fitness industry growth. The sector creates employment opportunities, generates tax revenue, and supports government health promotion initiatives.

Consumers gain access to diverse fitness options, improved health outcomes, and enhanced quality of life through regular exercise participation. MarkWide Research indicates that regular fitness club members report 23% higher overall life satisfaction compared to inactive individuals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Fitness Integration represents the most significant trend reshaping Southeast Asia’s fitness club market. Mobile applications for class booking, workout tracking, and social interaction are becoming standard expectations rather than competitive advantages. Fitness clubs are investing heavily in technology infrastructure to provide seamless digital experiences that complement physical facilities.

Boutique Fitness Explosion continues gaining momentum as consumers seek specialized, community-oriented workout experiences. High-intensity interval training, specialized yoga studios, and cycling-focused facilities are expanding rapidly in urban markets. These smaller-format facilities achieve higher revenue per square foot through premium pricing and efficient operations.

Wellness Ecosystem Development reflects consumer demand for comprehensive health solutions beyond traditional exercise equipment. Modern fitness clubs are incorporating nutrition counseling, mental health support, recovery services, and lifestyle coaching to create integrated wellness experiences that justify premium membership fees.

Flexible Membership Models respond to changing consumer preferences for commitment-free fitness access. Pay-per-visit options, short-term memberships, and corporate partnerships provide alternatives to traditional annual contracts, particularly appealing to younger demographics and transient urban populations.

Sustainability Focus emerges as fitness clubs implement environmentally conscious practices in facility operations, equipment selection, and energy management. Green building certifications and sustainable practices are becoming important differentiators for environmentally conscious consumers.

Recovery and Rehabilitation Services integration reflects growing understanding of comprehensive fitness approaches. Massage therapy, physiotherapy, cryotherapy, and specialized recovery equipment are becoming standard amenities in premium fitness facilities.

International Expansion Accelerates as global fitness chains recognize Southeast Asia’s growth potential. Major operators are establishing regional headquarters, developing local partnerships, and adapting service offerings to cultural preferences. This expansion brings international best practices while creating competitive pressure for local operators.

Technology Partnerships between fitness clubs and tech companies are creating innovative workout experiences. Virtual reality fitness, AI-powered personal training, and biometric health monitoring systems are being piloted in premium facilities across major Southeast Asian cities.

Franchise Model Adoption enables rapid market expansion while minimizing capital requirements for parent companies. Successful fitness concepts are leveraging franchise partnerships to penetrate secondary cities and emerging markets throughout the region.

Corporate Wellness Program Growth creates new revenue streams as employers invest in employee health initiatives. Fitness clubs are developing specialized B2B services, on-site facilities, and corporate membership programs to capture this expanding market segment.

Regulatory Framework Development across Southeast Asian countries is creating standardized safety requirements, licensing procedures, and operational guidelines. While increasing compliance costs, these regulations are professionalizing the industry and improving consumer confidence.

Sustainability Initiative Implementation includes energy-efficient equipment, renewable energy adoption, and waste reduction programs. These initiatives respond to environmental consciousness while reducing operational costs through improved efficiency.

Market Entry Strategy recommendations emphasize the importance of local market understanding and cultural adaptation. International operators should prioritize partnerships with local companies who understand regulatory requirements, consumer preferences, and operational challenges specific to each Southeast Asian market.

Technology Investment Priorities should focus on mobile app development, digital payment systems, and member engagement platforms rather than expensive equipment upgrades. MWR analysis indicates that technology-enabled member experiences drive 35% higher retention rates compared to traditional facility-only approaches.

Differentiation Strategies must move beyond price competition toward specialized programming, community building, and comprehensive wellness services. Successful operators are creating unique value propositions through expert instruction, social experiences, and integrated health solutions.

Location Selection remains critical for fitness club success, with proximity to residential areas, public transportation, and complementary businesses driving membership growth. Secondary urban locations often provide better unit economics than prime downtown areas due to lower rental costs and less competition.

Staff Development Investment should prioritize trainer certification, customer service training, and cultural sensitivity education. High-quality instruction and member service create competitive advantages that justify premium pricing and drive member retention.

Partnership Development with healthcare providers, corporate clients, and residential developers creates stable revenue streams while reducing customer acquisition costs. These strategic relationships provide competitive moats that are difficult for new entrants to replicate.

Market expansion across Southeast Asia’s fitness club sector is projected to continue at robust pace, driven by sustained urbanization, rising middle-class incomes, and evolving health consciousness. Growth projections indicate the market will maintain a compound annual growth rate of 8.5% over the next five years, with boutique fitness segments expected to outperform traditional gym formats.

Technology integration will accelerate as fitness clubs compete to provide seamless digital experiences that complement physical facilities. Artificial intelligence, virtual reality, and biometric monitoring systems will become standard features in premium facilities, while budget operators focus on mobile app functionality and digital payment systems.

Market consolidation is anticipated as successful operators acquire smaller competitors to achieve economies of scale and expand geographic coverage. Franchise models will continue driving expansion into secondary cities and emerging markets throughout the region.

Wellness ecosystem evolution will transform fitness clubs into comprehensive health and lifestyle centers offering integrated services including nutrition counseling, mental health support, and preventive healthcare. This evolution will create new revenue streams while justifying premium membership fees.

Sustainability initiatives will become increasingly important as environmental consciousness grows among consumers and regulatory requirements evolve. Energy-efficient operations, sustainable equipment choices, and waste reduction programs will influence facility design and operational strategies.

Demographic shifts will create opportunities for specialized programming targeting senior citizens, women-only facilities, and family-oriented fitness centers. These underserved segments represent substantial growth potential for operators willing to adapt their service offerings and facility designs.

The Southeast Asia health and fitness club market represents one of the region’s most dynamic and promising sectors, driven by powerful demographic trends, increasing health consciousness, and evolving consumer preferences. Market fundamentals remain exceptionally strong, with urbanization, rising disposable incomes, and government health initiatives creating sustained demand for fitness services across diverse market segments.

Competitive dynamics are intensifying as international operators expand their regional presence while local companies innovate to maintain market share. Success in this environment requires strategic differentiation through specialized programming, technology integration, and comprehensive wellness services that extend beyond traditional gym offerings.

Growth opportunities abound for operators who understand local market nuances, invest in technology-enhanced experiences, and develop sustainable business models that can adapt to changing consumer preferences. The sector’s evolution toward integrated wellness ecosystems creates multiple revenue streams while building stronger customer relationships and competitive advantages.

Future success will depend on operators’ ability to balance growth ambitions with operational excellence, cultural sensitivity, and financial sustainability. The Southeast Asia health and fitness club market offers substantial rewards for companies that can navigate its complexities while delivering exceptional value to increasingly sophisticated consumers seeking comprehensive health and wellness solutions.

What is Southeast Asia Health And Fitness Club?

Southeast Asia Health And Fitness Club refers to establishments that provide facilities and services for physical exercise, wellness, and fitness activities in the Southeast Asian region. These clubs often include gyms, fitness studios, and wellness centers that cater to various fitness needs and preferences.

What are the key players in the Southeast Asia Health And Fitness Club Market?

Key players in the Southeast Asia Health And Fitness Club Market include Anytime Fitness, Fitness First, and Gold’s Gym, among others. These companies are known for their extensive networks of fitness clubs and diverse offerings that appeal to a wide range of consumers.

What are the growth factors driving the Southeast Asia Health And Fitness Club Market?

The growth of the Southeast Asia Health And Fitness Club Market is driven by increasing health awareness, rising disposable incomes, and a growing trend towards fitness and wellness among consumers. Additionally, urbanization and the proliferation of fitness-related technology are contributing to market expansion.

What challenges does the Southeast Asia Health And Fitness Club Market face?

The Southeast Asia Health And Fitness Club Market faces challenges such as intense competition, fluctuating consumer preferences, and the impact of economic downturns on discretionary spending. Additionally, the COVID-19 pandemic has posed significant operational challenges for fitness clubs.

What opportunities exist in the Southeast Asia Health And Fitness Club Market?

Opportunities in the Southeast Asia Health And Fitness Club Market include the rise of digital fitness solutions, the growing popularity of boutique fitness studios, and the increasing demand for personalized training programs. These trends present avenues for innovation and expansion within the market.

What trends are shaping the Southeast Asia Health And Fitness Club Market?

Trends shaping the Southeast Asia Health And Fitness Club Market include the integration of technology in fitness experiences, such as virtual classes and fitness apps, as well as a focus on holistic wellness that combines physical fitness with mental health. Additionally, sustainability practices are becoming more prominent in club operations.

Southeast Asia Health And Fitness Club Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fitness Equipment, Group Classes, Personal Training, Nutrition Services |

| Customer Type | Individuals, Corporates, Families, Seniors |

| Service Type | Membership Plans, Pay-Per-Use, Online Coaching, Wellness Programs |

| End User | Health Enthusiasts, Athletes, Rehabilitation Patients, Casual Users |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Southeast Asia Health And Fitness Club Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at