444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Southeast Asia credit and risk management market represents a dynamic and rapidly evolving sector that encompasses comprehensive financial risk assessment, credit scoring, fraud detection, and regulatory compliance solutions. This market serves as a critical backbone for the region’s expanding financial services ecosystem, supporting banks, fintech companies, insurance providers, and other financial institutions in their quest to manage credit exposure and operational risks effectively.

Market dynamics in Southeast Asia are characterized by increasing digital transformation initiatives, growing financial inclusion efforts, and rising demand for sophisticated risk management tools. The region’s diverse economic landscape, spanning from developed markets like Singapore to emerging economies such as Vietnam and Cambodia, creates unique opportunities for tailored credit and risk management solutions. Financial institutions across the region are increasingly adopting advanced analytics, artificial intelligence, and machine learning technologies to enhance their risk assessment capabilities.

Digital lending platforms and mobile banking services have experienced remarkable growth, with adoption rates reaching 78% among urban populations across major Southeast Asian markets. This digital transformation has necessitated more sophisticated risk management frameworks to handle the increased volume and complexity of financial transactions. Regulatory compliance requirements continue to evolve, driving demand for comprehensive risk management platforms that can adapt to changing regulatory landscapes across different countries in the region.

The market encompasses various segments including credit risk management, operational risk management, market risk management, and compliance management solutions. Cloud-based solutions are gaining significant traction, with deployment rates increasing by 65% annually as financial institutions seek scalable and cost-effective risk management platforms.

The Southeast Asia credit and risk management market refers to the comprehensive ecosystem of technologies, services, and solutions designed to help financial institutions identify, assess, monitor, and mitigate various types of financial and operational risks while ensuring regulatory compliance across the diverse Southeast Asian region.

Credit risk management involves the systematic approach to evaluating borrowers’ creditworthiness, setting appropriate credit limits, and monitoring ongoing credit exposure to minimize potential losses from defaults. Risk management encompasses broader operational, market, and regulatory risks that financial institutions face in their daily operations, including fraud detection, anti-money laundering compliance, and cybersecurity threats.

This market includes various technological solutions such as credit scoring models, risk analytics platforms, regulatory reporting tools, fraud detection systems, and integrated risk management dashboards. Financial institutions utilize these solutions to make informed lending decisions, comply with local and international regulations, and maintain healthy risk-adjusted returns on their portfolios.

Southeast Asia’s credit and risk management market is experiencing unprecedented growth driven by digital transformation, regulatory evolution, and increasing financial inclusion initiatives across the region. The market demonstrates robust expansion potential as financial institutions modernize their risk management capabilities to address evolving customer needs and regulatory requirements.

Key growth drivers include the rapid adoption of digital banking services, increasing smartphone penetration rates of 85% across major markets, and growing demand for real-time risk assessment capabilities. Fintech innovation continues to reshape the landscape, with traditional banks partnering with technology providers to enhance their risk management infrastructure.

Market segmentation reveals strong demand across multiple verticals, with banking and financial services representing the largest segment, followed by insurance and emerging fintech companies. Cloud adoption is accelerating, with 72% of financial institutions planning to migrate their risk management systems to cloud-based platforms within the next three years.

Regional variations exist across Southeast Asian markets, with Singapore and Malaysia leading in terms of technological sophistication, while countries like Indonesia, Thailand, and Vietnam show the highest growth potential due to their large unbanked populations and increasing digital adoption rates.

Market intelligence reveals several critical insights that shape the Southeast Asia credit and risk management landscape. Digital transformation initiatives are accelerating across the region, with financial institutions investing heavily in advanced analytics and artificial intelligence capabilities to enhance their risk assessment accuracy.

Customer behavior patterns indicate a preference for seamless, automated risk management processes that can deliver quick decisions without compromising accuracy. Financial institutions are increasingly seeking integrated platforms that can handle multiple risk types within a single solution framework.

Digital transformation serves as the primary catalyst driving the Southeast Asia credit and risk management market forward. Financial institutions across the region are modernizing their legacy systems to support digital banking initiatives, mobile lending platforms, and online financial services. This transformation necessitates sophisticated risk management tools capable of processing high volumes of transactions while maintaining accuracy and compliance.

Regulatory evolution continues to shape market demand as governments across Southeast Asia implement stricter financial regulations and compliance requirements. Central banks in countries like Singapore, Malaysia, and Thailand are introducing new guidelines for digital banking, cryptocurrency regulations, and cross-border financial transactions, creating demand for comprehensive compliance management solutions.

Financial inclusion initiatives represent another significant driver, with governments and financial institutions working to bring banking services to underserved populations. Mobile banking adoption has increased by 89% over the past three years, requiring innovative risk assessment methods for customers with limited credit histories.

Fintech growth is accelerating demand for scalable risk management solutions as new market entrants seek to establish credible risk management frameworks quickly. Venture capital investment in Southeast Asian fintech companies continues to grow, with many startups requiring sophisticated risk management capabilities to attract investors and regulatory approval.

Cybersecurity concerns are driving investment in advanced fraud detection and prevention systems as financial institutions face increasing threats from cybercriminals. Data breaches and financial fraud incidents have highlighted the need for robust security measures integrated into risk management platforms.

Implementation complexity poses significant challenges for financial institutions seeking to upgrade their risk management systems. Legacy system integration often requires substantial time and resources, with many institutions struggling to balance operational continuity with modernization efforts. The complexity increases when dealing with multiple regulatory jurisdictions across Southeast Asia.

Cost considerations represent a major restraint, particularly for smaller financial institutions and emerging fintech companies. Advanced risk management solutions require significant upfront investments in technology, training, and ongoing maintenance. Many institutions find it challenging to justify the return on investment, especially in markets with thin profit margins.

Skilled workforce shortage continues to limit market growth as financial institutions struggle to find qualified professionals with expertise in both risk management and advanced technologies. Data scientists and risk analysts with relevant experience are in high demand, driving up operational costs and slowing implementation timelines.

Data quality issues present ongoing challenges, particularly in markets with limited credit bureau coverage and inconsistent data standards. Alternative data sources are not always reliable or standardized across different countries, making it difficult to develop consistent risk models for regional operations.

Regulatory uncertainty in some markets creates hesitation among financial institutions to invest in new risk management technologies. Changing regulations and unclear guidelines can make it difficult to design systems that will remain compliant over time, leading to delayed decision-making and reduced investment in new solutions.

Artificial intelligence integration presents tremendous opportunities for enhancing risk management capabilities across Southeast Asia. Machine learning algorithms can significantly improve credit scoring accuracy and fraud detection rates while reducing processing times. Financial institutions that successfully implement AI-driven risk management solutions can gain substantial competitive advantages.

Open banking initiatives are creating new opportunities for risk management solution providers as financial institutions seek to leverage expanded data access for better risk assessment. API-based solutions that can integrate multiple data sources and provide real-time risk insights are increasingly in demand.

Small and medium enterprise lending represents a significant growth opportunity as governments across the region promote SME financing to support economic development. Alternative credit scoring methods using transaction data, social media information, and other non-traditional sources can help financial institutions serve previously underserved market segments.

Cross-border expansion opportunities exist for solution providers that can offer multi-jurisdictional compliance and risk management capabilities. Regional banks and fintech companies seeking to expand across Southeast Asian markets require solutions that can handle diverse regulatory requirements and local market conditions.

Insurance technology integration offers opportunities to expand risk management solutions beyond traditional banking into insurance underwriting, claims processing, and fraud detection. Insurtech companies are increasingly seeking sophisticated risk assessment tools to improve their underwriting accuracy and operational efficiency.

Competitive dynamics in the Southeast Asia credit and risk management market are characterized by intense competition between established global vendors and emerging regional players. Market consolidation is occurring as larger companies acquire specialized solution providers to expand their capabilities and regional presence.

Technology evolution continues to reshape market dynamics, with cloud computing, artificial intelligence, and blockchain technology driving innovation in risk management solutions. Companies that can successfully integrate these technologies into user-friendly platforms are gaining market share rapidly.

Customer expectations are evolving toward more integrated, real-time solutions that can provide comprehensive risk insights across multiple channels and touchpoints. Financial institutions increasingly prefer vendors that can offer end-to-end solutions rather than point solutions for specific risk management functions.

Partnership strategies are becoming more prevalent as companies seek to combine complementary capabilities and expand their market reach. Strategic alliances between technology providers, consulting firms, and financial institutions are creating new value propositions and market opportunities.

Regulatory influence continues to shape market dynamics as new compliance requirements create demand for specific capabilities while potentially obsoleting others. Solution providers must maintain agility to adapt their offerings to changing regulatory landscapes across different Southeast Asian markets.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to provide accurate and actionable insights into the Southeast Asia credit and risk management market. Primary research involved extensive interviews with key industry stakeholders, including financial institution executives, technology vendors, regulatory officials, and market analysts.

Secondary research encompassed detailed analysis of industry reports, regulatory filings, company financial statements, and market intelligence databases. Data triangulation methods were employed to validate findings across multiple sources and ensure accuracy of market insights and projections.

Market segmentation analysis utilized both top-down and bottom-up approaches to estimate market sizes and growth rates across different segments and geographic regions. Statistical modeling techniques were applied to identify key market drivers and their relative impact on market growth trajectories.

Expert validation processes involved review of findings by industry experts and academic researchers specializing in financial technology and risk management. Peer review mechanisms ensured that conclusions and recommendations align with observed market trends and industry best practices.

Singapore leads the Southeast Asian market in terms of technological sophistication and regulatory maturity, accounting for approximately 28% of regional market activity. The city-state’s advanced financial infrastructure and supportive regulatory environment make it an ideal testing ground for innovative risk management solutions. Monetary Authority of Singapore initiatives continue to promote fintech innovation while maintaining strict risk management standards.

Malaysia represents the second-largest market, with strong growth in Islamic banking and digital payment systems driving demand for specialized risk management solutions. Bank Negara Malaysia’s digital banking framework is creating new opportunities for risk management solution providers targeting the emerging digital bank sector.

Indonesia shows the highest growth potential due to its large population and increasing digital adoption rates. Financial inclusion initiatives are driving demand for alternative credit scoring and risk assessment solutions capable of serving previously unbanked populations. The market is expected to grow at 15.2% annually over the next five years.

Thailand is experiencing rapid growth in mobile banking and digital payments, creating demand for real-time risk management capabilities. Bank of Thailand’s regulatory sandbox program is encouraging innovation in financial technology, including advanced risk management solutions.

Vietnam and Philippines represent emerging markets with significant growth potential as their financial sectors modernize and digital adoption accelerates. Government initiatives promoting cashless payments and digital banking are creating new opportunities for risk management solution providers.

Market leadership in the Southeast Asia credit and risk management sector is distributed among several categories of players, including global technology giants, specialized risk management vendors, and emerging regional providers. Competition intensity varies across different market segments and geographic regions.

Regional players are gaining market share by offering localized solutions that address specific regulatory requirements and market conditions. Strategic partnerships between global vendors and local system integrators are becoming increasingly common to enhance market penetration and customer service capabilities.

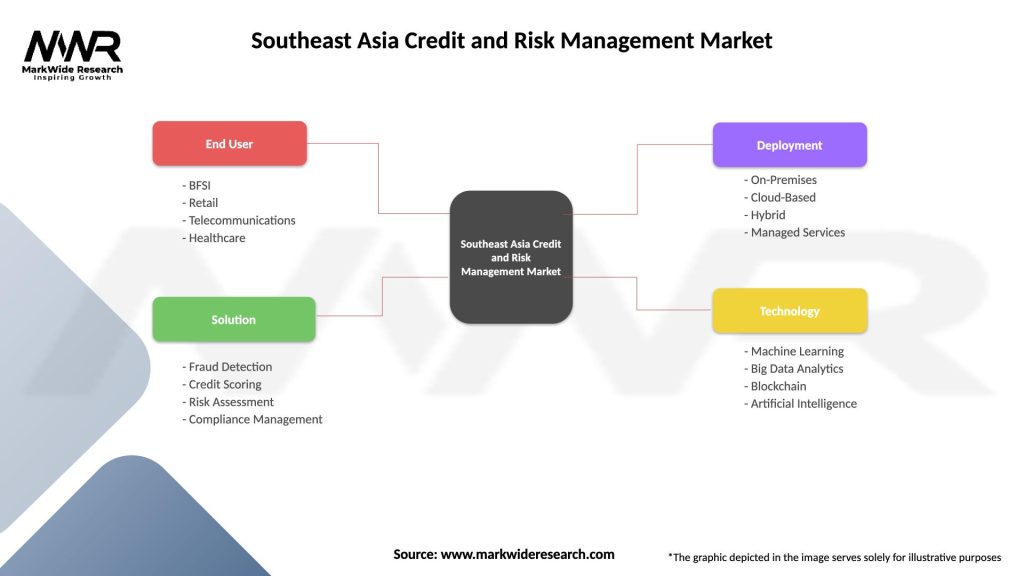

Market segmentation analysis reveals distinct patterns across multiple dimensions, providing insights into growth opportunities and competitive dynamics within the Southeast Asia credit and risk management market.

By Solution Type:

By Deployment Model:

By End-User Industry:

Credit risk management solutions dominate the market landscape, driven by the fundamental need for financial institutions to assess and manage lending risks effectively. Advanced analytics and machine learning capabilities are increasingly integrated into credit scoring models, improving prediction accuracy and reducing default rates. Alternative data integration is becoming more sophisticated, incorporating social media data, mobile phone usage patterns, and transaction histories.

Operational risk management is gaining prominence as financial institutions face increasing cybersecurity threats and regulatory scrutiny. Fraud detection systems are evolving to address sophisticated attack vectors, with real-time monitoring capabilities becoming standard requirements. Process automation is reducing operational risks while improving efficiency and compliance.

Compliance management solutions are experiencing rapid growth due to evolving regulatory landscapes across Southeast Asian markets. Anti-money laundering capabilities are becoming more sophisticated, incorporating artificial intelligence to identify suspicious transaction patterns. Regulatory reporting automation is reducing compliance costs while improving accuracy and timeliness.

Market risk management tools are evolving to address increasing market volatility and complex financial instruments. Real-time risk monitoring capabilities are becoming essential for trading operations and investment management. Stress testing and scenario analysis tools are helping institutions prepare for various market conditions.

Financial institutions benefit significantly from advanced credit and risk management solutions through improved decision-making capabilities, reduced operational costs, and enhanced regulatory compliance. Automated risk assessment processes enable faster loan approvals while maintaining or improving risk quality, leading to increased customer satisfaction and market competitiveness.

Regulatory compliance becomes more manageable with integrated compliance management tools that automatically generate required reports and monitor regulatory changes. Cost reduction is achieved through process automation, reduced manual errors, and improved operational efficiency. Risk-adjusted returns improve as institutions can better price risk and optimize their portfolios.

Technology vendors benefit from growing market demand and opportunities for innovation in artificial intelligence, machine learning, and cloud computing applications. Recurring revenue models through software-as-a-service offerings provide stable income streams and opportunities for customer expansion.

Customers benefit from faster service delivery, more accurate credit decisions, and improved fraud protection. Financial inclusion is enhanced as advanced risk management tools enable institutions to serve previously underserved market segments safely and profitably.

Regulatory authorities benefit from improved market stability, better risk monitoring capabilities, and more effective oversight of financial institutions. Systemic risk reduction is achieved through better risk management practices across the financial sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence adoption is accelerating across the Southeast Asian credit and risk management market, with financial institutions implementing machine learning algorithms to improve credit scoring accuracy and fraud detection capabilities. Natural language processing is being used to analyze unstructured data sources, while deep learning models are enhancing predictive analytics capabilities.

Real-time risk management is becoming the new standard as financial institutions seek to provide instant credit decisions and immediate fraud alerts. Stream processing technologies are enabling continuous risk monitoring and dynamic risk adjustment based on changing customer behavior and market conditions.

Alternative data utilization is expanding beyond traditional credit bureau information to include social media activity, mobile phone usage patterns, e-commerce transactions, and utility payment histories. Data partnerships between financial institutions and technology companies are creating new opportunities for enhanced risk assessment.

Cloud-first strategies are gaining momentum as financial institutions recognize the scalability and cost advantages of cloud-based risk management solutions. Multi-cloud deployments are becoming more common to avoid vendor lock-in and improve system resilience.

Regulatory technology integration is streamlining compliance processes through automated monitoring, reporting, and alert systems. Regulatory sandboxes across the region are encouraging innovation while maintaining appropriate risk controls.

Strategic partnerships between traditional banks and fintech companies are reshaping the competitive landscape, with established institutions leveraging innovative technologies while startups gain access to customer bases and regulatory expertise. Joint ventures are becoming more common as companies seek to combine complementary capabilities.

Regulatory initiatives across Southeast Asian markets are promoting standardization and interoperability in risk management systems. Central bank digital currency pilots in several countries are creating new requirements for risk management and compliance monitoring.

Technology acquisitions are accelerating as larger companies seek to acquire specialized capabilities in artificial intelligence, blockchain, and advanced analytics. Talent acquisition is also driving some acquisitions as companies compete for scarce technical expertise.

Open banking implementations in markets like Singapore and Malaysia are creating new data sharing opportunities and requirements for enhanced risk management capabilities. API standardization efforts are facilitating integration between different systems and service providers.

According to MarkWide Research analysis, cross-border collaboration initiatives are increasing as financial institutions seek to expand their regional presence while maintaining consistent risk management standards across different jurisdictions.

Investment prioritization should focus on artificial intelligence and machine learning capabilities, as these technologies offer the greatest potential for competitive differentiation and operational improvement. Financial institutions should develop comprehensive AI strategies that address both immediate needs and long-term innovation goals.

Partnership strategies should be carefully evaluated to balance innovation benefits with integration complexity and vendor dependency risks. Due diligence processes should thoroughly assess technical capabilities, regulatory compliance, and cultural fit when selecting technology partners.

Regulatory monitoring capabilities should be enhanced to track evolving compliance requirements across multiple jurisdictions. Compliance teams should work closely with technology teams to ensure that system capabilities align with regulatory expectations and future requirements.

Data governance frameworks should be strengthened to support advanced analytics while maintaining privacy and security standards. Data quality initiatives should be prioritized to ensure that risk models are based on accurate and reliable information.

Talent development programs should be implemented to build internal capabilities in advanced risk management technologies. Training investments should focus on both technical skills and business application knowledge to maximize return on technology investments.

Market evolution in the Southeast Asia credit and risk management sector is expected to accelerate over the next five years, driven by continued digital transformation, regulatory modernization, and increasing customer expectations for seamless financial services. Growth projections indicate sustained expansion at 12.8% annually across the region.

Technology integration will deepen as artificial intelligence, blockchain, and quantum computing technologies mature and become more accessible to financial institutions of all sizes. Quantum-resistant security measures will become increasingly important as quantum computing capabilities advance.

Regulatory harmonization efforts across Southeast Asian markets may create opportunities for more standardized risk management solutions that can operate efficiently across multiple jurisdictions. ASEAN initiatives promoting financial integration could accelerate this trend.

Sustainability considerations are expected to become more prominent in risk management frameworks as environmental, social, and governance factors gain importance in investment and lending decisions. Climate risk assessment capabilities will become standard requirements for financial institutions.

MWR projects that market consolidation will continue as successful companies acquire complementary capabilities and expand their geographic reach. Innovation cycles are expected to accelerate, requiring continuous adaptation and investment in new technologies and capabilities.

Southeast Asia’s credit and risk management market stands at a pivotal juncture, characterized by unprecedented growth opportunities driven by digital transformation, regulatory evolution, and increasing financial inclusion initiatives. The market’s diverse landscape offers unique opportunities for both established players and innovative newcomers to develop tailored solutions that address specific regional needs and requirements.

Technology advancement continues to reshape the competitive landscape, with artificial intelligence, machine learning, and cloud computing technologies enabling more sophisticated and efficient risk management capabilities. Financial institutions that successfully integrate these technologies while maintaining strong risk controls and regulatory compliance will be best positioned to capitalize on emerging opportunities.

Strategic success in this market requires a balanced approach that combines technological innovation with deep understanding of local market conditions, regulatory requirements, and customer needs. Partnership strategies and collaborative approaches are becoming increasingly important as the complexity of risk management solutions continues to grow.

The future of the Southeast Asia credit and risk management market promises continued innovation, growth, and evolution as financial institutions adapt to changing customer expectations, regulatory requirements, and technological capabilities. Organizations that invest wisely in advanced risk management capabilities while maintaining operational excellence will be well-positioned to thrive in this dynamic and rapidly evolving market environment.

What is Credit and Risk Management?

Credit and Risk Management involves the processes and strategies used by organizations to identify, assess, and mitigate financial risks associated with lending and credit activities. This includes evaluating borrower creditworthiness, managing loan portfolios, and ensuring compliance with regulatory requirements.

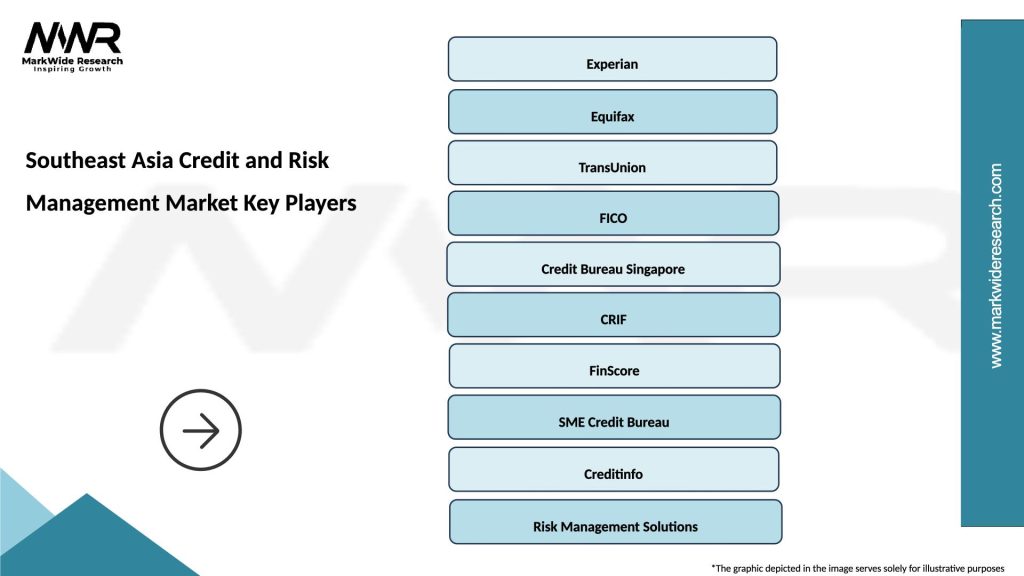

What are the key players in the Southeast Asia Credit and Risk Management Market?

Key players in the Southeast Asia Credit and Risk Management Market include companies like Experian, FICO, and Moody’s Analytics, which provide solutions for credit scoring, risk assessment, and data analytics, among others.

What are the growth factors driving the Southeast Asia Credit and Risk Management Market?

The growth of the Southeast Asia Credit and Risk Management Market is driven by increasing consumer credit demand, the rise of digital banking, and the need for enhanced risk assessment tools to combat fraud and default rates.

What challenges does the Southeast Asia Credit and Risk Management Market face?

Challenges in the Southeast Asia Credit and Risk Management Market include regulatory compliance complexities, the rapid pace of technological change, and the need for accurate data analytics to assess credit risk effectively.

What opportunities exist in the Southeast Asia Credit and Risk Management Market?

Opportunities in the Southeast Asia Credit and Risk Management Market include the adoption of artificial intelligence for predictive analytics, the expansion of fintech solutions, and the growing emphasis on sustainable finance practices.

What trends are shaping the Southeast Asia Credit and Risk Management Market?

Trends in the Southeast Asia Credit and Risk Management Market include the increasing use of big data analytics, the integration of machine learning algorithms for risk assessment, and a shift towards more personalized credit products tailored to consumer needs.

Southeast Asia Credit and Risk Management Market

| Segmentation Details | Description |

|---|---|

| End User | BFSI, Retail, Telecommunications, Healthcare |

| Solution | Fraud Detection, Credit Scoring, Risk Assessment, Compliance Management |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Technology | Machine Learning, Big Data Analytics, Blockchain, Artificial Intelligence |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Southeast Asia Credit and Risk Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at