444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Sudan oil and gas downstream market represents a critical component of the nation’s economic infrastructure, encompassing refining, processing, distribution, and marketing activities. Despite being one of the world’s newest countries, South Sudan possesses substantial petroleum resources that form the backbone of its economy. The downstream sector has experienced significant challenges due to political instability, infrastructure limitations, and regional conflicts, yet it continues to show resilience and potential for growth.

Market dynamics in South Sudan’s downstream sector are characterized by heavy reliance on crude oil exports and limited domestic refining capacity. The country currently operates with minimal downstream infrastructure, processing approximately 15% of its crude oil production domestically while exporting the majority through neighboring Sudan’s pipeline system. This dependency creates both opportunities and vulnerabilities for the emerging downstream market.

Infrastructure development remains a primary focus for stakeholders, with ongoing investments in refining facilities, storage terminals, and distribution networks. The government has prioritized downstream sector expansion as part of its economic diversification strategy, recognizing the potential for value addition and job creation. Recent initiatives include partnerships with international companies to establish modern refining capabilities and improve fuel distribution across the country.

Regional positioning plays a crucial role in South Sudan’s downstream market development. The country’s strategic location in East Africa provides opportunities for serving regional markets, particularly in petroleum products distribution. However, ongoing challenges related to transportation infrastructure, regulatory frameworks, and security concerns continue to impact market growth and investment attraction.

The South Sudan oil and gas downstream market refers to the comprehensive network of activities involved in processing crude oil and natural gas into refined petroleum products, followed by their distribution, marketing, and retail sale within the country and potentially to regional markets. This sector encompasses refining operations, petrochemical production, fuel distribution systems, retail networks, and associated support services.

Downstream operations in South Sudan include crude oil refining processes that convert raw petroleum into various products such as gasoline, diesel fuel, kerosene, lubricants, and other petroleum derivatives. The sector also involves storage facilities, transportation infrastructure, and retail distribution networks that ensure these products reach end consumers across the country’s diverse geographical regions.

Value chain integration represents a key aspect of the downstream market, connecting upstream oil production activities with midstream transportation and downstream processing. This integration is particularly important for South Sudan, where maximizing value from petroleum resources is essential for economic development and revenue generation.

South Sudan’s downstream market presents a unique investment landscape characterized by substantial untapped potential and significant infrastructure development needs. The sector is experiencing gradual expansion driven by government initiatives to reduce dependency on petroleum product imports and create domestic value addition opportunities.

Key market drivers include increasing domestic fuel demand, government support for downstream development, and strategic partnerships with international companies. The market faces challenges related to limited refining capacity, inadequate distribution infrastructure, and ongoing security concerns that impact operational efficiency and investment attraction.

Growth prospects remain positive despite current limitations, with projected expansion in refining capacity and distribution networks. The government’s commitment to downstream sector development, combined with international partnerships and technical assistance programs, is expected to drive market growth at a compound annual growth rate of 8.5% over the forecast period.

Investment opportunities are emerging across various downstream segments, including refinery construction, storage facility development, distribution network expansion, and retail infrastructure establishment. These opportunities align with the country’s broader economic development goals and energy security objectives.

Market structure analysis reveals several critical insights that define South Sudan’s downstream sector dynamics and future development trajectory:

Economic diversification initiatives serve as a primary driver for South Sudan’s downstream market development. The government recognizes the critical importance of moving beyond crude oil exports to create domestic value addition opportunities. This strategic shift aims to capture more value from petroleum resources while reducing economic vulnerability to oil price fluctuations.

Growing domestic demand for refined petroleum products continues to drive market expansion. Increasing urbanization, infrastructure development projects, and economic activities are creating sustained demand for gasoline, diesel, kerosene, and other petroleum products. This demand growth provides a solid foundation for downstream investment and capacity expansion.

Government policy support plays a crucial role in market development through favorable regulatory frameworks, investment incentives, and strategic partnerships. Recent policy initiatives include tax incentives for downstream investments, streamlined licensing procedures, and support for technology transfer agreements with international companies.

Infrastructure development programs are creating enabling conditions for downstream market growth. Road construction, port development, and pipeline projects are improving transportation networks essential for petroleum product distribution. These infrastructure improvements reduce operational costs and expand market reach for downstream operators.

Regional market opportunities provide additional growth drivers through cross-border trade potential. South Sudan’s strategic location offers access to markets in neighboring countries, creating opportunities for petroleum product exports and regional supply chain integration.

Security challenges represent the most significant restraint affecting South Sudan’s downstream market development. Ongoing conflicts, civil unrest, and security concerns create operational risks that discourage investment and disrupt business operations. These challenges increase operational costs and complicate long-term planning for downstream projects.

Limited infrastructure poses substantial constraints on market growth and operational efficiency. Inadequate road networks, insufficient storage facilities, and limited pipeline infrastructure restrict distribution capabilities and increase transportation costs. These infrastructure gaps particularly affect rural areas and remote regions.

Financial constraints limit both government and private sector investment in downstream development. Limited access to international financing, currency instability, and economic uncertainties make it challenging to secure funding for large-scale downstream projects. These financial limitations slow market development and capacity expansion.

Technical capacity gaps create operational challenges and limit market efficiency. Shortage of skilled personnel, limited technical expertise, and inadequate training programs affect downstream operations quality and safety standards. These capacity constraints require significant investment in human resource development.

Regulatory uncertainties create investment hesitation and operational complexities. Evolving regulatory frameworks, unclear licensing procedures, and inconsistent policy implementation create challenges for downstream market participants and potential investors.

Refinery development projects present substantial opportunities for market expansion and value creation. The construction of modern refining facilities could significantly increase domestic processing capacity while reducing import dependency. These projects offer opportunities for technology transfer, job creation, and revenue generation through value-added petroleum products.

Distribution network expansion creates opportunities for infrastructure development and market penetration. Building comprehensive distribution networks, including storage terminals, retail stations, and transportation systems, would improve product availability and market access across the country.

Regional export potential offers opportunities for market expansion beyond domestic boundaries. South Sudan’s petroleum resources and strategic location provide advantages for serving regional markets, particularly in East Africa where demand for refined products continues to grow.

Technology partnerships create opportunities for modernization and efficiency improvements. Collaborations with international companies can bring advanced technologies, operational expertise, and best practices to South Sudan’s downstream sector, enhancing competitiveness and operational standards.

Renewable energy integration presents emerging opportunities for diversified energy solutions. Combining traditional downstream operations with renewable energy projects could create hybrid energy systems that improve reliability and sustainability while reducing operational costs.

Supply chain dynamics in South Sudan’s downstream market are characterized by complex interdependencies between upstream production, midstream transportation, and downstream processing activities. The current system relies heavily on crude oil exports through Sudan’s pipeline infrastructure, creating both opportunities and vulnerabilities for downstream development.

Demand patterns show seasonal variations influenced by agricultural cycles, weather conditions, and economic activities. Peak demand periods typically coincide with harvest seasons and dry weather when transportation and agricultural activities intensify. Understanding these patterns is crucial for downstream capacity planning and inventory management.

Price dynamics are influenced by international oil markets, regional supply conditions, and local economic factors. The lack of domestic refining capacity makes South Sudan vulnerable to regional price fluctuations and supply disruptions, highlighting the importance of downstream development for price stability.

Competitive dynamics are evolving as new players enter the market and existing operators expand their capabilities. International companies are showing increased interest in South Sudan’s downstream opportunities, bringing competition that could drive innovation and efficiency improvements.

Regulatory dynamics continue to evolve as the government develops comprehensive frameworks for downstream sector governance. Recent regulatory developments focus on safety standards, environmental protection, and investment promotion, creating a more structured operating environment for market participants.

Primary research activities for this market analysis included comprehensive stakeholder interviews with government officials, industry executives, and market participants across South Sudan’s downstream sector. These interviews provided firsthand insights into market conditions, operational challenges, and development opportunities from key decision-makers and industry experts.

Secondary research components involved extensive analysis of government publications, industry reports, and international development organization studies related to South Sudan’s energy sector. This research provided historical context, policy frameworks, and comparative analysis with regional markets to understand broader market dynamics.

Data collection methods incorporated both quantitative and qualitative approaches to ensure comprehensive market understanding. Quantitative data focused on production statistics, consumption patterns, and infrastructure capacity metrics, while qualitative insights explored market trends, challenges, and opportunities through expert opinions and stakeholder perspectives.

Analytical frameworks employed industry-standard methodologies for market assessment, including supply-demand analysis, competitive landscape evaluation, and regulatory impact assessment. These frameworks provided structured approaches to understanding complex market dynamics and identifying key success factors for downstream development.

Validation processes ensured data accuracy and insight reliability through cross-referencing multiple sources, expert review, and stakeholder feedback. This validation approach enhanced the credibility and usefulness of research findings for market participants and decision-makers.

Greater Upper Nile region represents the primary hub for South Sudan’s downstream activities, accounting for approximately 55% of current refining capacity and distribution infrastructure. This region benefits from proximity to major oil fields and existing pipeline infrastructure, making it the natural center for downstream development. The area hosts the country’s main refinery facilities and serves as a distribution point for petroleum products to other regions.

Central Equatoria region, including the capital Juba, represents the largest consumption market for refined petroleum products, accounting for 35% of national demand. This region’s downstream infrastructure focuses primarily on storage and distribution facilities rather than refining operations. The area’s economic activities and population concentration drive significant demand for gasoline, diesel, and other petroleum products.

Western regions including Western Bahr el Ghazal and Western Equatoria face significant infrastructure challenges that limit downstream market development. These areas rely heavily on petroleum product imports from neighboring countries and represent 15% of national consumption. However, they offer substantial growth potential as infrastructure development progresses.

Eastern regions including Jonglei and Eastern Equatoria have limited downstream infrastructure but strategic importance for regional trade. These areas serve as potential corridors for petroleum product trade with neighboring countries, particularly Kenya and Uganda. Cross-border trade activities account for approximately 20% of petroleum product flows in these regions.

Northern regions benefit from proximity to Sudan’s pipeline infrastructure and existing trade relationships. These areas have better access to refined products through established supply chains but limited domestic processing capabilities. The regions represent opportunities for distribution network expansion and storage facility development.

Market structure in South Sudan’s downstream sector is characterized by a limited number of active participants due to infrastructure constraints and operational challenges. The competitive landscape is evolving as new entrants explore opportunities and existing players expand their operations.

Key market participants include both domestic and international companies operating across various downstream segments:

Competitive strategies focus on infrastructure development, strategic partnerships, and market positioning. Companies are pursuing vertical integration opportunities, technology partnerships, and regional expansion strategies to establish competitive advantages in the emerging market.

Market positioning varies among participants, with some focusing on upstream integration while others concentrate on downstream specialization. International companies typically bring technical expertise and financial resources, while domestic players offer local knowledge and government relationships.

By Product Type:

By Application:

By Distribution Channel:

Refining Operations represent the most critical category for South Sudan’s downstream development. Current refining capacity is limited to small-scale facilities processing approximately 25,000 barrels per day, far below the country’s crude production capacity. This category offers the greatest potential for expansion and value creation through modern refinery construction and capacity upgrades.

Storage and Terminals category faces significant infrastructure gaps that limit market efficiency and product availability. Existing storage capacity covers only 30% of optimal requirements for stable supply chains. Investment in strategic storage facilities, particularly in major consumption centers, represents a priority for downstream development.

Distribution Networks category requires substantial expansion to serve the country’s diverse geographical regions effectively. Current network coverage reaches approximately 40% of populated areas, leaving significant portions of the country underserved. This category presents opportunities for infrastructure development and market penetration.

Retail Infrastructure category is underdeveloped with limited fuel station networks and retail outlets. The category offers opportunities for franchise development, modern retail concepts, and service diversification to meet growing consumer demands and improve market accessibility.

Petrochemicals category represents an emerging opportunity for downstream diversification. While currently minimal, this category could provide future growth through value-added chemical production and industrial feedstock supply for regional markets.

Economic Development Benefits for South Sudan include substantial revenue generation through domestic value addition, reduced import dependency, and increased foreign exchange retention. Downstream development creates multiplier effects throughout the economy by supporting related industries and services while generating employment opportunities across skill levels.

Energy Security Advantages emerge from reduced reliance on petroleum product imports and improved supply chain resilience. Domestic downstream capacity provides greater control over fuel supplies, price stability, and reduced vulnerability to external supply disruptions or regional conflicts.

Investment Returns for private sector participants include access to growing markets, government support programs, and regional expansion opportunities. The sector offers attractive returns through infrastructure development projects, operational efficiency improvements, and market share capture in an emerging economy.

Technology Transfer Benefits create opportunities for knowledge sharing, capacity building, and industrial development. International partnerships bring advanced technologies, operational expertise, and best practices that enhance overall sector competitiveness and sustainability.

Regional Integration Opportunities provide access to broader East African markets, cross-border trade potential, and regional supply chain participation. These benefits support economic integration and create additional revenue streams through export opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Infrastructure Modernization represents a dominant trend driving South Sudan’s downstream market evolution. Recent initiatives focus on developing modern refining facilities, automated storage systems, and efficient distribution networks that meet international standards. This trend is supported by government policies and international partnerships aimed at creating world-class downstream infrastructure.

Regional Integration is emerging as a significant trend with increasing cross-border trade activities and regional supply chain development. MarkWide Research indicates that regional petroleum product trade has grown by 18% annually over recent years, reflecting increased economic integration and market connectivity with neighboring countries.

Technology Adoption is accelerating across downstream operations with digital systems, automated processes, and advanced monitoring technologies being implemented. These technological improvements enhance operational efficiency, safety standards, and environmental compliance while reducing operational costs and improving product quality.

Sustainability Focus is becoming increasingly important as environmental considerations influence downstream development strategies. Companies are adopting cleaner technologies, environmental management systems, and sustainable practices to meet international standards and stakeholder expectations.

Public-Private Partnerships are expanding as a preferred model for downstream development, combining government support with private sector expertise and financing. These partnerships facilitate large-scale infrastructure projects while sharing risks and benefits among stakeholders.

Refinery Expansion Projects have gained momentum with several major initiatives announced for capacity expansion and modernization. Recent developments include agreements for new refinery construction, existing facility upgrades, and technology transfer partnerships that will significantly increase domestic processing capabilities.

Infrastructure Investment Programs are advancing with substantial commitments from government and international partners. These programs focus on storage facility development, pipeline construction, and distribution network expansion to improve market coverage and operational efficiency.

Regulatory Framework Development has progressed with new legislation and policies supporting downstream sector growth. Recent regulatory developments include streamlined licensing procedures, environmental standards, and safety regulations that create more structured operating environments for market participants.

International Partnership Agreements have expanded with several major energy companies signing cooperation agreements for downstream development. These partnerships bring technical expertise, financing capabilities, and operational experience to support market growth and modernization.

Regional Trade Agreements are facilitating increased petroleum product trade with neighboring countries. Recent agreements focus on cross-border transportation, customs procedures, and trade facilitation measures that support regional market integration and export opportunities.

Infrastructure Investment Priority should focus on developing comprehensive refining capacity that can process at least 50% of domestic crude production within the next decade. This investment would significantly reduce import dependency while creating substantial value addition opportunities and employment generation.

Strategic Partnership Development with established international companies should be prioritized to bring technical expertise, financing capabilities, and operational experience. These partnerships should focus on technology transfer, capacity building, and knowledge sharing to accelerate market development and improve operational standards.

Regional Market Integration strategies should be developed to capitalize on South Sudan’s strategic location and access to growing East African markets. This includes developing cross-border infrastructure, trade facilitation measures, and regional supply chain partnerships that create additional revenue streams.

Regulatory Framework Strengthening should continue with focus on creating stable, transparent, and investor-friendly policies that encourage downstream investment while ensuring safety and environmental standards. Clear regulatory frameworks reduce investment risks and attract international participation.

Human Resource Development programs should be established to address technical capacity gaps and create skilled workforce for downstream operations. These programs should include technical training, international exchange programs, and partnerships with educational institutions to build local expertise.

Market growth prospects for South Sudan’s downstream sector remain positive despite current challenges, with projected expansion driven by infrastructure development, government support, and increasing domestic demand. MWR analysis suggests the sector could achieve sustained growth rates of 9.2% annually over the next decade as major infrastructure projects come online and operational capacity expands.

Infrastructure development is expected to accelerate significantly with several major projects planned for implementation. New refinery construction, storage facility expansion, and distribution network development will transform the market landscape and create substantial capacity increases. These developments could increase domestic processing capacity by 300% within eight years.

Regional integration will likely deepen as South Sudan develops stronger trade relationships with neighboring countries and participates more actively in regional energy markets. Cross-border petroleum product trade could account for 25% of downstream revenues as regional infrastructure and trade agreements facilitate increased market access.

Technology advancement will continue to drive operational improvements and efficiency gains across downstream operations. Digital technologies, automation systems, and advanced monitoring capabilities will enhance safety, reduce costs, and improve environmental performance while meeting international standards.

Investment attraction is expected to increase as political stability improves and regulatory frameworks mature. International companies are likely to expand their presence in South Sudan’s downstream market, bringing capital, expertise, and technology that accelerate sector development and modernization.

South Sudan’s oil and gas downstream market represents a sector with substantial potential for growth and development despite current challenges and constraints. The market’s foundation of abundant crude oil resources, growing domestic demand, and government support creates favorable conditions for downstream expansion and investment attraction.

Key success factors for market development include continued infrastructure investment, strategic international partnerships, regulatory framework strengthening, and regional market integration. These factors will determine the pace and scale of downstream sector growth while influencing the market’s ability to attract investment and achieve operational efficiency.

Future prospects remain encouraging as major infrastructure projects advance, political stability improves, and regional integration deepens. The sector’s potential for value creation, employment generation, and economic diversification makes it a critical component of South Sudan’s development strategy and long-term economic sustainability.

Strategic positioning for market participants should focus on infrastructure development, technology adoption, and regional market access while maintaining flexibility to adapt to evolving market conditions and opportunities. Success in this market will require long-term commitment, strategic partnerships, and comprehensive understanding of local conditions and regional dynamics.

What is Oil & Gas Downstream?

Oil & Gas Downstream refers to the processes involved in refining crude oil, distributing and selling petroleum products, and managing the supply chain. This includes activities such as refining, marketing, and retailing of oil and gas products.

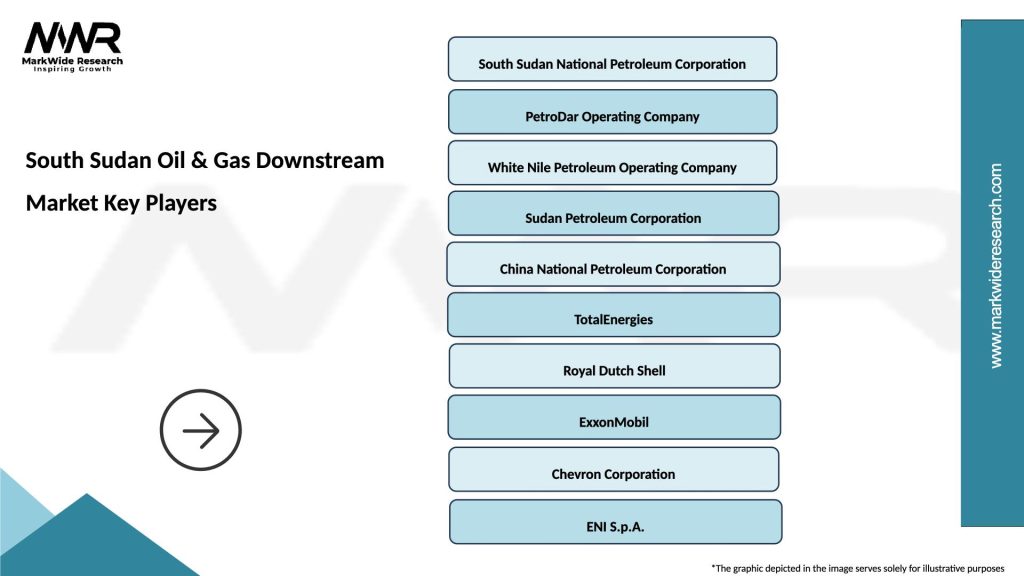

What are the key players in the South Sudan Oil & Gas Downstream Market?

Key players in the South Sudan Oil & Gas Downstream Market include Nile Petroleum Corporation, South Sudan Oil and Gas Company, and various international oil companies operating in the region, among others.

What are the growth factors driving the South Sudan Oil & Gas Downstream Market?

The growth of the South Sudan Oil & Gas Downstream Market is driven by increasing domestic energy demand, the need for infrastructure development, and the potential for export opportunities in neighboring countries.

What challenges does the South Sudan Oil & Gas Downstream Market face?

Challenges in the South Sudan Oil & Gas Downstream Market include political instability, inadequate infrastructure, and regulatory hurdles that can hinder investment and operational efficiency.

What opportunities exist in the South Sudan Oil & Gas Downstream Market?

Opportunities in the South Sudan Oil & Gas Downstream Market include the potential for new refining projects, partnerships with international firms, and the development of renewable energy sources to complement traditional oil and gas.

What trends are shaping the South Sudan Oil & Gas Downstream Market?

Trends in the South Sudan Oil & Gas Downstream Market include a shift towards more sustainable practices, investment in technology for improved efficiency, and increasing interest in alternative energy sources as part of a broader energy strategy.

South Sudan Oil & Gas Downstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Refining, Distribution, Retailing, Transportation |

| End User | Industrial, Commercial, Residential, Government |

| Product Type | Gasoline, Diesel, Jet Fuel, Lubricants |

| Technology | Hydrocracking, Distillation, Gas-to-Liquids, Biofuels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Sudan Oil & Gas Downstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at