444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea used car market represents a dynamic and rapidly evolving segment of the automotive industry, characterized by sophisticated consumer preferences and advanced digital infrastructure. Market dynamics in South Korea reflect a unique blend of technological innovation, changing mobility patterns, and evolving consumer attitudes toward vehicle ownership. The market has experienced significant transformation in recent years, driven by digital platform adoption, enhanced vehicle inspection standards, and shifting demographic preferences.

Consumer behavior in South Korea’s used car sector demonstrates increasing sophistication, with buyers leveraging comprehensive online platforms and mobile applications to research, compare, and purchase pre-owned vehicles. The market benefits from robust infrastructure supporting vehicle history verification, financing options, and warranty programs that enhance consumer confidence in used car purchases.

Digital transformation has fundamentally reshaped how used cars are bought and sold in South Korea, with online platforms capturing approximately 68% market share in digital transactions. The integration of artificial intelligence, virtual reality showrooms, and comprehensive vehicle assessment technologies has created a more transparent and efficient marketplace for both buyers and sellers.

The South Korea used car market refers to the comprehensive ecosystem encompassing the sale, purchase, financing, and servicing of pre-owned vehicles within South Korea’s automotive landscape. This market includes various distribution channels such as authorized dealers, independent dealers, online platforms, and direct consumer-to-consumer transactions, all supported by regulatory frameworks ensuring transaction transparency and consumer protection.

Market participants include traditional automotive dealerships, specialized used car retailers, digital marketplace platforms, financial institutions providing automotive loans, and service providers offering vehicle inspection, certification, and warranty services. The market encompasses various vehicle categories including passenger cars, commercial vehicles, luxury automobiles, and electric vehicles, each serving distinct consumer segments with specific requirements and preferences.

South Korea’s used car market demonstrates remarkable resilience and adaptability, positioning itself as one of Asia’s most sophisticated pre-owned vehicle markets. The sector benefits from advanced technological infrastructure, comprehensive regulatory oversight, and evolving consumer preferences that prioritize value, reliability, and digital convenience in vehicle purchasing decisions.

Key market characteristics include the dominance of domestic automotive brands, increasing acceptance of certified pre-owned programs, and growing demand for eco-friendly vehicles including hybrid and electric models. The market has successfully integrated digital technologies to enhance transparency, reduce transaction costs, and improve overall customer experience throughout the vehicle purchasing journey.

Strategic developments indicate continued market expansion driven by urbanization trends, changing mobility preferences among younger demographics, and increasing availability of flexible financing options. The market shows strong potential for sustained growth, supported by technological innovation and evolving consumer attitudes toward sustainable transportation solutions.

Market intelligence reveals several critical insights shaping South Korea’s used car landscape:

Economic factors significantly influence South Korea’s used car market dynamics, with rising new vehicle prices encouraging consumers to explore pre-owned alternatives offering better value propositions. Cost considerations drive many consumers toward used vehicles, particularly as advanced safety features and technology become standard across multiple model years, reducing the premium associated with new vehicle purchases.

Technological advancement serves as a major market driver, with sophisticated vehicle inspection systems, comprehensive vehicle history databases, and advanced financing platforms reducing traditional barriers to used car purchases. Digital infrastructure enables transparent pricing, detailed vehicle information sharing, and streamlined transaction processes that enhance consumer confidence and market efficiency.

Demographic shifts contribute to market growth, as younger consumers demonstrate greater comfort with digital purchasing processes and show increased environmental consciousness favoring fuel-efficient and electric pre-owned vehicles. Urbanization trends support market expansion, with city dwellers seeking cost-effective mobility solutions that align with urban lifestyle requirements and parking constraints.

Regulatory support through enhanced consumer protection laws, standardized vehicle inspection protocols, and transparent pricing requirements creates a more trustworthy marketplace that encourages consumer participation and reduces transaction risks associated with used car purchases.

Economic uncertainties can impact consumer spending on discretionary purchases like vehicles, potentially reducing market demand during periods of economic volatility or employment instability. Interest rate fluctuations affect financing costs and accessibility, influencing consumer purchasing power and overall market activity levels.

Supply chain challenges in the new vehicle market can create complex dynamics in used car availability and pricing, as production delays and inventory shortages in new vehicles affect trade-in volumes and used car supply patterns. Semiconductor shortages and manufacturing disruptions continue to influence overall automotive market dynamics.

Consumer perception barriers regarding used vehicle reliability and warranty coverage may limit market penetration among certain demographic segments, particularly those prioritizing long-term vehicle ownership and comprehensive manufacturer support. Quality concerns about vehicle history, maintenance records, and hidden defects can deter potential buyers despite improved inspection standards.

Regulatory compliance costs associated with enhanced inspection requirements, certification processes, and consumer protection measures may increase operational expenses for market participants, potentially affecting pricing strategies and profit margins across the value chain.

Digital transformation opportunities present significant potential for market expansion through enhanced online platforms, virtual reality showrooms, and artificial intelligence-powered vehicle matching systems that improve customer experience and operational efficiency. Technology integration enables new service models including subscription-based vehicle access and flexible ownership arrangements.

Electric vehicle transition creates substantial opportunities as early electric vehicle adopters begin replacing their vehicles, generating supply of used electric and hybrid vehicles for environmentally conscious consumers seeking sustainable transportation options. Green mobility trends support market growth in eco-friendly vehicle segments.

Export market potential offers opportunities for South Korean used car dealers to expand into regional markets, leveraging the country’s reputation for quality automotive manufacturing and advanced vehicle technology. Cross-border trade in certified pre-owned vehicles presents growth opportunities in Southeast Asian markets.

Financial services innovation through flexible financing options, extended warranty programs, and comprehensive insurance packages can attract new customer segments and increase transaction values while improving customer satisfaction and loyalty throughout the ownership experience.

Supply and demand dynamics in South Korea’s used car market reflect complex interactions between new vehicle production cycles, consumer replacement patterns, and economic conditions affecting purchasing decisions. Market equilibrium depends on balanced inventory levels, competitive pricing strategies, and efficient distribution channels connecting sellers with qualified buyers.

Competitive dynamics intensify as traditional dealerships compete with digital platforms and direct-to-consumer sales models, driving innovation in customer service, pricing transparency, and value-added services. Market consolidation trends indicate increasing integration between online platforms and physical dealership networks to provide comprehensive customer experiences.

Technology adoption rates continue accelerating across all market segments, with artificial intelligence, blockchain verification systems, and mobile applications becoming standard tools for vehicle evaluation, pricing, and transaction processing. Digital transformation reshapes traditional business models and creates new opportunities for market differentiation.

Consumer behavior evolution demonstrates increasing sophistication in vehicle research, comparison shopping, and financing decisions, supported by comprehensive information availability and transparent pricing mechanisms that empower informed purchasing decisions across all demographic segments.

Comprehensive market analysis employs multiple research methodologies including primary data collection through consumer surveys, dealer interviews, and industry expert consultations to develop accurate market insights and trend identification. Data collection processes ensure representative sampling across geographic regions, demographic segments, and vehicle categories.

Secondary research integration incorporates government statistics, industry association reports, and automotive registration databases to validate primary research findings and provide comprehensive market context. Statistical analysis employs advanced analytical techniques to identify correlations, trends, and predictive indicators affecting market development.

Market modeling approaches utilize econometric analysis, regression modeling, and scenario planning to project future market conditions and assess potential impacts of various economic, regulatory, and technological factors on market performance. Forecasting methodologies incorporate multiple variables to ensure robust predictive accuracy.

Quality assurance protocols include data verification procedures, cross-referencing multiple sources, and peer review processes to ensure research accuracy and reliability throughout the analysis and reporting phases of market research activities.

Seoul Metropolitan Area dominates South Korea’s used car market, accounting for approximately 45% of total market activity due to high population density, elevated income levels, and concentrated automotive infrastructure supporting both buyers and sellers. Urban dynamics in Seoul drive demand for compact, fuel-efficient vehicles suitable for city driving and parking constraints.

Busan and southeastern regions represent significant market segments with strong industrial presence and port activities supporting commercial vehicle demand alongside passenger car markets. Regional preferences reflect local economic conditions, with higher demand for commercial and utility vehicles supporting regional business activities and logistics operations.

Gyeonggi Province surrounding Seoul demonstrates robust market activity driven by suburban growth, new residential developments, and increasing commuter populations requiring reliable transportation solutions. Suburban market characteristics include preference for larger vehicles, family-oriented features, and longer-term ownership patterns.

Provincial markets throughout South Korea show distinct characteristics influenced by local economic conditions, demographic profiles, and transportation infrastructure, with rural areas demonstrating preference for practical, durable vehicles suitable for varied terrain and weather conditions. Regional distribution networks adapt to local market requirements while maintaining consistent service standards.

Market leadership in South Korea’s used car sector reflects diverse competitive dynamics among traditional dealerships, digital platforms, and integrated automotive service providers. Competitive positioning strategies focus on customer experience, pricing transparency, and comprehensive service offerings that differentiate market participants.

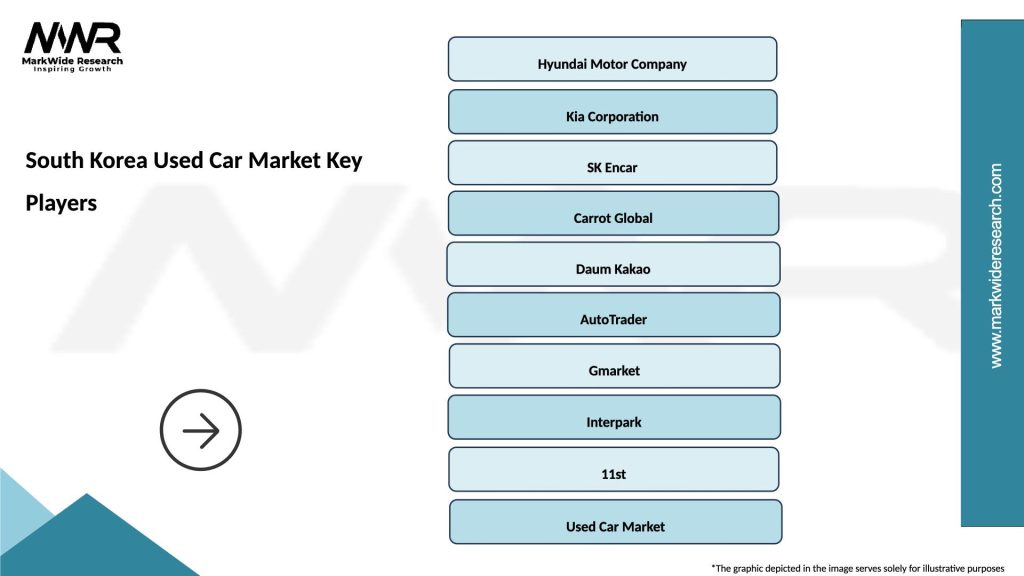

Major market participants include:

Competitive strategies emphasize technology integration, customer service excellence, and comprehensive value propositions that address evolving consumer expectations for transparency, convenience, and reliability in used car transactions.

Vehicle category segmentation reveals distinct market dynamics across different automotive segments:

By Vehicle Type:

By Age Category:

By Sales Channel:

Compact car segment demonstrates consistent demand driven by urban mobility requirements, parking constraints, and fuel efficiency priorities among South Korean consumers. Market preferences favor reliable, well-maintained vehicles with comprehensive service histories and reasonable mileage accumulation patterns.

SUV and crossover categories show accelerating growth as consumer preferences shift toward versatile vehicles offering enhanced safety features, cargo capacity, and all-weather capability. Premium positioning in this segment supports higher transaction values and improved profit margins for dealers and platforms.

Electric and hybrid vehicle segments represent emerging opportunities with increasing consumer awareness of environmental benefits and government incentives supporting eco-friendly transportation adoption. Technology integration in these categories attracts tech-savvy consumers seeking advanced automotive features.

Luxury vehicle segment maintains strong performance supported by brand prestige, advanced technology features, and comprehensive certified pre-owned programs that preserve vehicle values and provide consumer confidence in premium purchases. Market dynamics in luxury segments reflect different consumer motivations and purchasing patterns compared to mainstream categories.

Automotive manufacturers benefit from robust used car markets that support new vehicle sales through trade-in programs, maintain brand presence across multiple price points, and provide additional revenue streams through certified pre-owned programs and extended warranty services.

Financial institutions gain opportunities to expand automotive lending portfolios, develop specialized financing products for used car purchases, and build long-term customer relationships through comprehensive automotive financial services including insurance and maintenance programs.

Technology providers find significant opportunities to develop innovative solutions for vehicle inspection, pricing algorithms, customer relationship management, and digital marketplace platforms that enhance market efficiency and customer experience throughout the transaction process.

Consumers benefit from increased vehicle selection, transparent pricing mechanisms, comprehensive vehicle history information, and flexible financing options that make vehicle ownership more accessible and affordable across diverse demographic segments and income levels.

Regulatory authorities achieve improved market oversight, enhanced consumer protection, and better environmental outcomes through systematic vehicle inspection programs and transparent transaction reporting that supports policy development and market stability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping South Korea’s used car market through advanced analytics, artificial intelligence integration, and comprehensive mobile applications that streamline vehicle search, comparison, and purchase processes. Technology adoption enables personalized recommendations, automated pricing, and virtual vehicle inspections that enhance customer experience.

Sustainability focus drives increasing demand for fuel-efficient, hybrid, and electric used vehicles as environmental consciousness grows among South Korean consumers. Green mobility trends influence purchasing decisions and create new market segments focused on eco-friendly transportation solutions.

Subscription and flexible ownership models emerge as alternatives to traditional vehicle ownership, particularly among younger demographics seeking mobility solutions without long-term commitment. Service innovation includes vehicle subscription programs, short-term rentals, and flexible lease arrangements.

Cross-platform integration between online marketplaces, physical dealerships, and financial services creates seamless customer journeys that combine digital convenience with traditional automotive retail expertise. Omnichannel strategies provide consumers with multiple touchpoints and service options throughout their vehicle purchasing experience.

Platform consolidation activities indicate market maturation as major players acquire smaller competitors and integrate complementary services to create comprehensive automotive marketplaces. Strategic partnerships between technology companies and traditional automotive retailers enhance service capabilities and market reach.

Regulatory enhancements include updated consumer protection laws, standardized vehicle inspection protocols, and enhanced transparency requirements that strengthen market integrity and consumer confidence. Government initiatives support digital transformation and sustainable transportation adoption through various incentive programs.

Technology investments by major market participants focus on artificial intelligence, blockchain verification systems, and virtual reality applications that improve operational efficiency and customer experience. Innovation initiatives include automated vehicle assessment, predictive pricing models, and enhanced customer service platforms.

International expansion efforts by leading South Korean used car platforms target regional markets with similar consumer preferences and regulatory environments. Cross-border initiatives leverage South Korea’s automotive expertise and digital platform capabilities to serve broader Asian markets.

MarkWide Research recommends that market participants prioritize digital transformation initiatives while maintaining strong customer service standards to differentiate their offerings in an increasingly competitive marketplace. Strategic focus should emphasize technology integration, transparent pricing, and comprehensive customer support throughout the vehicle purchasing journey.

Investment priorities should include advanced analytics capabilities, mobile application development, and customer relationship management systems that enable personalized service delivery and efficient operations. Technology infrastructure investments will determine long-term competitive positioning and market share retention.

Market expansion strategies should consider regional diversification within South Korea and selective international expansion to markets with compatible regulatory environments and consumer preferences. Geographic expansion requires careful market analysis and localized service adaptation to ensure successful market entry and sustainable growth.

Partnership development with financial institutions, technology providers, and automotive manufacturers can create synergistic relationships that enhance service capabilities and expand customer reach. Collaborative approaches enable resource sharing and risk mitigation while accelerating market development and innovation adoption.

Market projections indicate continued growth in South Korea’s used car market, driven by digital platform adoption, evolving consumer preferences, and increasing acceptance of pre-owned vehicles as viable alternatives to new car purchases. Growth trajectory reflects positive demographic trends, technological advancement, and supportive regulatory environment.

Technology evolution will continue transforming market operations through enhanced artificial intelligence applications, blockchain verification systems, and virtual reality experiences that improve customer engagement and operational efficiency. Digital innovation remains a critical success factor for sustained market leadership and customer satisfaction.

Sustainability trends will increasingly influence market dynamics as electric and hybrid vehicles become more prevalent in the used car market, supported by government incentives and growing environmental awareness among consumers. Green mobility adoption creates new opportunities for specialized service providers and financing solutions.

MWR analysis suggests that successful market participants will be those who effectively combine digital innovation with traditional automotive expertise, providing comprehensive customer experiences that address evolving mobility needs and preferences across diverse demographic segments.

South Korea’s used car market represents a sophisticated and rapidly evolving sector that successfully integrates advanced technology with traditional automotive retail expertise. The market demonstrates remarkable adaptability to changing consumer preferences, regulatory requirements, and technological innovations that continue reshaping the automotive landscape.

Strategic opportunities abound for market participants who can effectively leverage digital transformation, sustainability trends, and evolving consumer behaviors to create differentiated value propositions. Success factors include technology integration, customer service excellence, transparent operations, and comprehensive service offerings that address diverse consumer needs across multiple demographic segments.

Future market development will be characterized by continued digital innovation, increased sustainability focus, and enhanced customer experience standards that reflect South Korea’s position as a leader in automotive technology and consumer market sophistication. The market’s strong foundation positions it for sustained growth and continued evolution in response to changing mobility patterns and consumer expectations.

What is Used Car?

The Used Car refers to vehicles that have had previous owners and are sold in the secondary market. In South Korea, the used car market has been growing due to increasing consumer demand for affordable transportation options.

What are the key players in the South Korea Used Car Market?

Key players in the South Korea Used Car Market include Hyundai Motor Company, Kia Motors, and SK Encar, among others. These companies play significant roles in the distribution and sale of used vehicles across the country.

What are the main drivers of the South Korea Used Car Market?

The main drivers of the South Korea Used Car Market include rising vehicle ownership rates, increasing urbanization, and a growing preference for cost-effective transportation solutions. Additionally, the availability of financing options has also contributed to market growth.

What challenges does the South Korea Used Car Market face?

The South Korea Used Car Market faces challenges such as regulatory hurdles, fluctuating vehicle prices, and competition from new car sales. These factors can impact consumer confidence and purchasing decisions.

What opportunities exist in the South Korea Used Car Market?

Opportunities in the South Korea Used Car Market include the rise of online platforms for buying and selling used cars, increasing demand for electric and hybrid vehicles, and potential growth in export markets. These trends can enhance market dynamics and consumer engagement.

What trends are shaping the South Korea Used Car Market?

Trends shaping the South Korea Used Car Market include the growing popularity of online car sales, the integration of technology in vehicle assessments, and a shift towards more sustainable vehicle options. These trends reflect changing consumer preferences and advancements in the automotive sector.

South Korea Used Car Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, 1-3 Years, 4-6 Years, 7+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at