444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea retail sector market represents one of Asia’s most dynamic and technologically advanced retail ecosystems, characterized by rapid digital transformation and evolving consumer preferences. South Korean consumers demonstrate sophisticated shopping behaviors, driving retailers to adopt innovative technologies and omnichannel strategies to remain competitive in this fast-paced market environment.

Digital integration has become a cornerstone of the South Korean retail landscape, with traditional brick-and-mortar stores increasingly incorporating e-commerce platforms, mobile applications, and contactless payment systems. The market exhibits remarkable growth in online retail penetration, reaching approximately 35% of total retail sales, significantly higher than many developed economies worldwide.

Consumer electronics, fashion, beauty products, and food and beverage categories dominate the retail sector, with Korean brands gaining international recognition and driving domestic market expansion. The rise of K-beauty, K-fashion, and Korean food culture has created unique retail opportunities that extend beyond traditional market boundaries.

Technological innovation continues to reshape the retail experience, with artificial intelligence, augmented reality, and Internet of Things applications becoming standard features in modern Korean retail establishments. The market demonstrates exceptional adaptability to emerging technologies, with retailers investing heavily in digital infrastructure to enhance customer experiences and operational efficiency.

The South Korea retail sector market refers to the comprehensive ecosystem of businesses engaged in selling goods and services directly to consumers through various channels including physical stores, online platforms, mobile applications, and hybrid retail formats within South Korea’s geographic boundaries.

This market encompasses traditional department stores, specialty retailers, convenience stores, hypermarkets, discount chains, e-commerce platforms, and emerging retail formats such as pop-up stores and social commerce platforms. The sector includes both domestic Korean retailers and international brands operating within the country’s retail landscape.

Modern retail operations in South Korea integrate advanced technologies, data analytics, and customer relationship management systems to create seamless shopping experiences across multiple touchpoints. The market reflects the unique characteristics of Korean consumer culture, including high smartphone penetration, preference for premium products, and strong brand loyalty.

South Korea’s retail sector demonstrates exceptional resilience and innovation, positioning itself as a regional leader in retail technology adoption and consumer experience enhancement. The market benefits from a highly connected consumer base, with smartphone penetration exceeding 95% among adults, creating unprecedented opportunities for mobile commerce and digital engagement.

Key market characteristics include the dominance of large retail conglomerates, rapid adoption of omnichannel strategies, and increasing focus on sustainability and social responsibility. Korean retailers have successfully leveraged cultural exports, particularly in beauty and fashion, to create distinctive market positioning both domestically and internationally.

The sector’s growth trajectory is supported by strong domestic consumption, urbanization trends, and government initiatives promoting digital transformation. Retail innovation hubs in Seoul and other major cities serve as testing grounds for new retail concepts and technologies that often influence global retail trends.

Challenges facing the market include intense competition, changing demographic patterns, and the need for continuous technological upgrades. However, the sector’s adaptability and innovation capacity position it well for sustained growth and market leadership in the Asia-Pacific region.

Strategic market insights reveal several critical trends shaping the South Korean retail landscape:

Technological advancement serves as the primary driver of South Korea’s retail sector growth, with retailers continuously investing in cutting-edge technologies to enhance customer experiences and operational efficiency. The country’s advanced telecommunications infrastructure, including widespread 5G network coverage, enables sophisticated retail applications and real-time customer engagement.

Consumer sophistication drives retailers to innovate constantly, as Korean consumers demonstrate high expectations for product quality, service excellence, and technological integration. This demanding consumer base pushes retailers to adopt global best practices while developing unique solutions tailored to local preferences and cultural nuances.

Government support for digital transformation initiatives provides significant momentum for retail sector modernization. Policy frameworks promoting e-commerce, digital payments, and small business digitalization create favorable conditions for retail innovation and expansion across all market segments.

Cultural export success in entertainment, beauty, and fashion creates powerful retail opportunities, with Korean brands leveraging global popularity to expand both domestically and internationally. The Hallyu wave continues to drive consumer interest in Korean products and retail experiences.

Urbanization trends and changing lifestyle patterns support retail sector growth, particularly in metropolitan areas where consumers seek convenient, accessible, and experience-rich shopping options. Dense urban populations create economies of scale for both physical and digital retail operations.

Intense competition among retailers creates pricing pressures and margin compression, particularly in commodity categories where differentiation is challenging. The market’s maturity in certain segments limits organic growth opportunities and forces retailers to compete primarily on price and service quality.

Demographic challenges including an aging population and declining birth rates pose long-term concerns for retail sector growth. Changing age demographics require retailers to adapt product offerings and marketing strategies to serve evolving consumer segments effectively.

High real estate costs in prime retail locations, particularly in Seoul and other major cities, create significant barriers to entry for new retailers and pressure existing operators to optimize space utilization and operational efficiency.

Regulatory complexity surrounding e-commerce, data privacy, and consumer protection requires substantial compliance investments and may limit certain retail innovations or business models. Evolving regulations create uncertainty for long-term strategic planning.

Supply chain vulnerabilities exposed during global disruptions highlight the risks associated with international sourcing and just-in-time inventory management. Retailers must balance cost efficiency with supply chain resilience and flexibility.

Emerging technologies present substantial opportunities for retail innovation, including virtual reality shopping experiences, artificial intelligence-powered personalization, and blockchain-based supply chain transparency. Early adopters of these technologies can gain significant competitive advantages in the sophisticated Korean market.

Rural market development offers growth potential as digital infrastructure improvements enable e-commerce expansion into previously underserved areas. Rural consumers increasingly seek access to urban retail options through online platforms and delivery services.

Sustainability initiatives create opportunities for retailers to differentiate through environmental responsibility and social impact programs. Korean consumers show increasing willingness to support brands that demonstrate genuine commitment to sustainability and ethical practices.

Cross-border expansion opportunities exist for successful Korean retail concepts and brands to enter international markets, leveraging the global popularity of Korean culture and products. Digital platforms enable cost-effective international market entry and testing.

Healthcare and wellness retail segments present significant growth opportunities as aging demographics and health consciousness drive demand for specialized products and services. Integration of health monitoring and wellness consulting into retail operations creates new revenue streams.

Market dynamics in South Korea’s retail sector reflect the complex interplay between technological innovation, consumer behavior evolution, and competitive pressures. The sector demonstrates remarkable adaptability to changing conditions while maintaining focus on customer experience excellence and operational efficiency.

Digital transformation continues to accelerate across all retail segments, with traditional retailers investing heavily in e-commerce capabilities and digital-native brands expanding into physical retail spaces. This convergence creates hybrid retail models that leverage the strengths of both online and offline channels.

Consumer behavior patterns show increasing preference for convenience, personalization, and value-added services. Retailers respond by developing comprehensive customer data strategies and implementing advanced analytics to predict and respond to consumer needs proactively.

Competitive landscape evolution features both consolidation among traditional retailers and the emergence of new market entrants leveraging innovative business models. Platform-based retailers and social commerce operators challenge established players while creating new market opportunities.

Supply chain optimization becomes increasingly critical as retailers seek to balance cost efficiency with service quality and sustainability requirements. Advanced logistics networks and last-mile delivery innovations enable rapid order fulfillment and customer satisfaction.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into South Korea’s retail sector dynamics. Primary research includes extensive surveys of retail executives, consumer behavior studies, and in-depth interviews with industry stakeholders across various retail segments.

Secondary research incorporates analysis of government statistics, industry reports, financial statements of major retail companies, and academic studies focusing on Korean consumer behavior and retail trends. This multi-source approach provides comprehensive market understanding and validation of key findings.

Data collection methods include both quantitative and qualitative approaches, utilizing online surveys, focus groups, mystery shopping studies, and retail traffic analysis. Technology-enabled data collection tools provide real-time insights into consumer preferences and shopping patterns.

Market segmentation analysis examines retail performance across different product categories, geographic regions, and consumer demographics. This detailed segmentation enables identification of growth opportunities and market trends specific to various retail subsectors.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. Regular updates and revisions maintain research relevance in the rapidly evolving retail environment.

Seoul Metropolitan Area dominates South Korea’s retail landscape, accounting for approximately 48% of total retail sales and serving as the primary hub for retail innovation and flagship store operations. The capital region’s high population density, affluent consumer base, and advanced infrastructure create ideal conditions for premium retail concepts and technology testing.

Busan and surrounding regions represent the second-largest retail market, with strong performance in fashion, electronics, and food retail segments. The port city’s international connections and tourism industry support diverse retail offerings and cross-border shopping opportunities.

Daegu and Daejeon serve as important regional retail centers, with growing e-commerce penetration and increasing investment in retail infrastructure. These cities demonstrate the expansion of modern retail concepts beyond the Seoul metropolitan area.

Jeju Island presents unique retail opportunities focused on tourism, duty-free shopping, and local specialty products. The island’s special economic zone status and international visitor traffic create distinct retail dynamics and growth potential.

Rural and smaller urban areas show increasing retail activity through e-commerce platforms and mobile commerce, with delivery networks enabling access to urban retail options. Digital retail penetration in these areas reaches approximately 28% of total retail transactions.

Major retail conglomerates dominate the South Korean market through diversified operations spanning multiple retail formats and product categories:

International retailers maintain significant presence through partnerships, joint ventures, and direct operations, contributing to market competition and innovation transfer.

By Retail Format:

By Product Category:

Fashion retail demonstrates exceptional strength in South Korea, with domestic brands gaining international recognition and driving significant export growth. The K-fashion trend supports premium pricing and brand differentiation, while fast fashion retailers adapt global trends to local preferences with rapid inventory turnover.

Beauty and personal care represents one of the most successful retail categories, with Korean cosmetics brands achieving global market leadership. Innovation in product formulation, packaging design, and marketing strategies creates competitive advantages that extend beyond domestic market boundaries.

Consumer electronics retail benefits from South Korea’s position as a global technology leader, with domestic brands like Samsung and LG maintaining strong market positions. Advanced product features and early technology adoption drive premium pricing and customer loyalty.

Food retail evolves rapidly to accommodate changing lifestyle patterns, with increased demand for convenience foods, health-conscious options, and premium ingredients. Traditional Korean food products maintain strong cultural significance while international cuisines gain popularity among younger consumers.

E-commerce across all categories shows robust growth, with mobile commerce representing approximately 72% of online retail transactions. Cross-category shopping behavior and integrated loyalty programs create opportunities for retailers to increase customer lifetime value and market share.

Retailers benefit from South Korea’s sophisticated consumer market through opportunities to test innovative concepts, leverage advanced technologies, and build strong brand loyalty among discerning customers. The market’s openness to new retail formats and services enables rapid scaling of successful concepts.

Technology providers find extensive opportunities to deploy cutting-edge retail solutions including artificial intelligence, augmented reality, and Internet of Things applications. Korean retailers’ willingness to invest in technology creates a valuable testing ground for global retail technology solutions.

Suppliers and manufacturers benefit from efficient distribution networks, sophisticated demand forecasting, and opportunities to participate in global supply chains through Korean retail partners. The market’s quality standards drive supplier excellence and innovation.

Consumers enjoy access to diverse product offerings, competitive pricing, convenient shopping options, and high service standards. The competitive retail environment ensures continuous improvement in customer experience and value proposition.

Investors find attractive opportunities in a stable, growing market with strong fundamentals and innovative retail concepts. The sector’s resilience and adaptation capability provide confidence for long-term investment strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Omnichannel integration accelerates as retailers recognize the need to provide seamless experiences across all customer touchpoints. Traditional retailers invest heavily in e-commerce capabilities while digital-native brands establish physical presence to create comprehensive market coverage.

Personalization technology becomes increasingly sophisticated, with retailers leveraging artificial intelligence and machine learning to create individualized shopping experiences. Customer data analytics enable precise targeting and customized product recommendations that drive sales conversion and customer loyalty.

Social commerce expansion transforms how consumers discover and purchase products, with social media platforms becoming primary retail channels. Live streaming, influencer partnerships, and user-generated content create new marketing and sales opportunities for retailers across all categories.

Sustainability initiatives gain prominence as consumers increasingly consider environmental impact in purchasing decisions. Retailers implement eco-friendly packaging, sustainable sourcing practices, and circular economy principles to meet evolving consumer expectations and regulatory requirements.

Contactless retail experiences become standard practice, with retailers implementing mobile payments, self-checkout systems, and automated customer service solutions. The trend toward minimal physical interaction creates opportunities for technology-enabled retail innovations.

Major retail mergers and acquisitions reshape the competitive landscape as companies seek scale advantages and market consolidation. Strategic partnerships between traditional retailers and technology companies create new capabilities and market opportunities.

Government initiatives supporting small business digitalization and e-commerce development provide funding and resources for retail sector modernization. Policy frameworks promoting innovation and entrepreneurship create favorable conditions for retail startup development.

International brand expansions continue as global retailers recognize South Korea’s attractive market characteristics and consumer sophistication. Foreign investment in retail infrastructure and operations contributes to market development and competitive intensity.

Technology partnerships between retailers and fintech companies enable advanced payment solutions and financial services integration. These collaborations create new revenue streams and enhance customer convenience and loyalty.

Logistics infrastructure investments improve delivery capabilities and supply chain efficiency, with particular focus on last-mile delivery solutions and automated fulfillment centers. According to MarkWide Research analysis, these investments support the growing demand for rapid order fulfillment and customer satisfaction.

Retailers should prioritize omnichannel strategy development to meet evolving consumer expectations for seamless shopping experiences. Investment in integrated technology platforms and customer data management systems will be critical for competitive success in the increasingly digital retail environment.

Technology adoption must focus on solutions that enhance both customer experience and operational efficiency. Retailers should evaluate emerging technologies carefully and implement those that provide clear value propositions and return on investment while maintaining focus on core business objectives.

Market expansion strategies should consider both geographic and demographic opportunities, including rural market development and aging population needs. Retailers must adapt product offerings and service models to serve diverse customer segments effectively.

Sustainability integration should become a core business strategy rather than a peripheral initiative. Consumers increasingly evaluate retailers based on environmental and social responsibility, making sustainability a competitive differentiator and business imperative.

Partnership development with technology providers, logistics companies, and financial services firms can accelerate innovation and capability development. Strategic alliances enable retailers to access specialized expertise and resources while maintaining focus on core retail competencies.

Market growth prospects remain positive despite challenges, with digital transformation and innovation driving continued expansion across retail segments. MWR projects that e-commerce penetration will reach approximately 42% of total retail sales within the next five years, supported by improving logistics infrastructure and changing consumer preferences.

Technology integration will accelerate with artificial intelligence, virtual reality, and blockchain technologies becoming standard retail tools. Early adopters of these technologies will gain significant competitive advantages through enhanced customer experiences and operational efficiencies.

International expansion opportunities for Korean retail brands will continue growing, leveraging global cultural popularity and digital platform capabilities. Cross-border e-commerce and strategic partnerships will enable market entry and growth in key international markets.

Demographic adaptation will require retailers to develop specialized strategies for aging consumers while maintaining appeal to younger demographics. Product offerings, store formats, and service models must evolve to serve changing population characteristics effectively.

Sustainability requirements will become increasingly important for retail success, with consumers and regulators demanding greater environmental responsibility. Retailers that proactively implement sustainable practices will be better positioned for long-term growth and market leadership.

South Korea’s retail sector market demonstrates exceptional dynamism and innovation, positioning itself as a regional leader in retail technology adoption and consumer experience excellence. The market’s sophisticated consumer base, advanced infrastructure, and culture of innovation create unique opportunities for retailers willing to invest in cutting-edge solutions and customer-centric strategies.

Key success factors include embracing digital transformation, developing omnichannel capabilities, and maintaining focus on customer experience quality. Retailers that effectively leverage technology while preserving human connection and cultural relevance will thrive in this competitive market environment.

Future growth will be driven by continued e-commerce expansion, international brand development, and adaptation to changing demographic patterns. The sector’s resilience and adaptability provide confidence for sustained growth and continued market leadership in the Asia-Pacific region, making it an attractive destination for retail investment and innovation.

What is South Korea Retail Sector?

The South Korea Retail Sector encompasses a wide range of businesses involved in the sale of goods and services to consumers. This includes supermarkets, department stores, online retailers, and specialty shops, reflecting diverse consumer preferences and shopping behaviors.

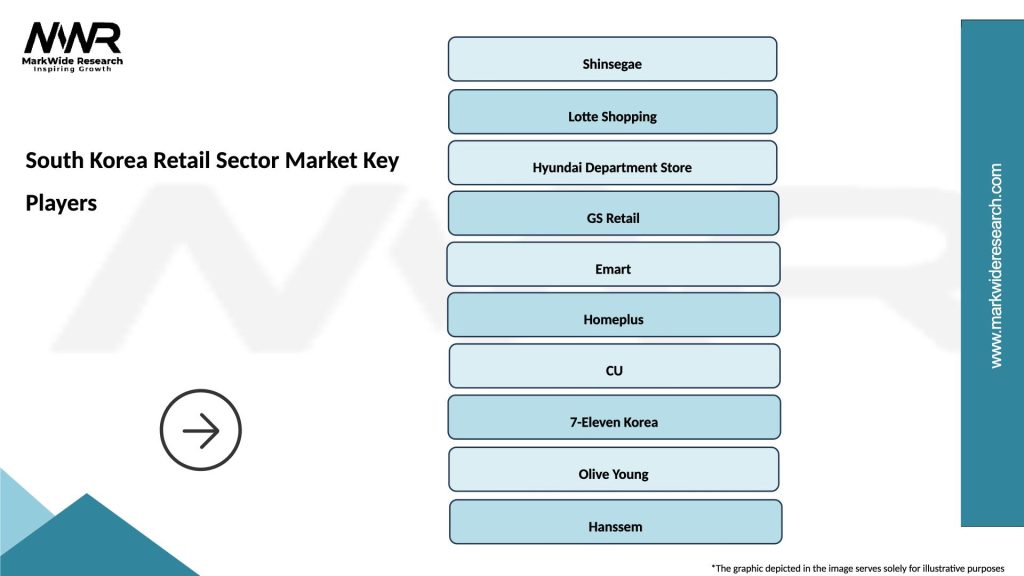

What are the key players in the South Korea Retail Sector Market?

Key players in the South Korea Retail Sector Market include companies like Shinsegae, Lotte Shopping, and GS Retail, which dominate various segments such as department stores and convenience stores. These companies are known for their innovative retail strategies and extensive distribution networks, among others.

What are the main drivers of growth in the South Korea Retail Sector Market?

The main drivers of growth in the South Korea Retail Sector Market include the increasing adoption of e-commerce, changing consumer lifestyles, and a growing emphasis on convenience shopping. Additionally, technological advancements in retail operations are enhancing customer experiences.

What challenges does the South Korea Retail Sector Market face?

The South Korea Retail Sector Market faces challenges such as intense competition from online platforms, changing consumer preferences, and regulatory pressures. These factors can impact profitability and market share for traditional retailers.

What opportunities exist in the South Korea Retail Sector Market?

Opportunities in the South Korea Retail Sector Market include the expansion of omnichannel retailing, the growth of health and wellness products, and the increasing demand for personalized shopping experiences. Retailers can leverage data analytics to better understand consumer behavior.

What trends are shaping the South Korea Retail Sector Market?

Trends shaping the South Korea Retail Sector Market include the rise of mobile shopping, sustainability initiatives, and the integration of artificial intelligence in customer service. These trends are influencing how retailers engage with consumers and manage their operations.

South Korea Retail Sector Market

| Segmentation Details | Description |

|---|---|

| Product Type | Apparel, Electronics, Home Goods, Beauty Products |

| Price Tier | Luxury, Mid-Range, Discount, Value |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Department Stores |

| Customer Type | Millennials, Gen Z, Families, Professionals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Retail Sector Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at