444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea rechargeable battery market stands as one of the most dynamic and technologically advanced sectors in the global energy storage landscape. South Korea has emerged as a global powerhouse in battery manufacturing, driven by leading companies such as LG Energy Solution, Samsung SDI, and SK Innovation. The market encompasses various battery technologies including lithium-ion, nickel-metal hydride, and emerging solid-state batteries, serving diverse applications from consumer electronics to electric vehicles and energy storage systems.

Market dynamics in South Korea are characterized by substantial government support, aggressive research and development investments, and strategic positioning in the global supply chain. The country’s rechargeable battery sector is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 12.5% through the forecast period. This growth trajectory is supported by increasing demand for electric vehicles, expanding renewable energy installations, and the continuous evolution of portable electronic devices.

Technological innovation remains at the forefront of South Korea’s battery market development. The nation’s commitment to advancing battery technology is evident through significant investments in next-generation battery solutions, including solid-state batteries, silicon nanowire anodes, and advanced cathode materials. South Korean manufacturers currently hold approximately 35% of the global lithium-ion battery market share, positioning the country as a critical player in the worldwide energy transition.

The South Korea rechargeable battery market refers to the comprehensive ecosystem of battery manufacturing, research, development, and commercialization activities within South Korea’s borders. This market encompasses the production and distribution of various rechargeable battery technologies, including lithium-ion, lithium-polymer, nickel-metal hydride, and emerging next-generation battery chemistries designed for multiple applications across consumer electronics, automotive, industrial, and energy storage sectors.

Rechargeable batteries in the South Korean context represent electrochemical energy storage devices that can be repeatedly charged and discharged through reversible chemical reactions. These batteries serve as critical components in the country’s transition toward sustainable energy solutions, supporting everything from smartphones and laptops to electric vehicles and grid-scale energy storage systems. The market includes raw material processing, cell manufacturing, battery pack assembly, and recycling services, creating a complete value chain that positions South Korea as a global leader in energy storage technology.

South Korea’s rechargeable battery market represents a cornerstone of the nation’s industrial strategy and economic growth. The market is dominated by three major conglomerates that collectively account for a significant portion of global battery production capacity. Government initiatives supporting the K-Battery Belt project and substantial investments in battery technology research have created a favorable environment for sustained market expansion.

Key market drivers include the accelerating adoption of electric vehicles, increasing demand for energy storage solutions, and the continuous miniaturization of electronic devices requiring high-energy-density batteries. The automotive sector represents the fastest-growing application segment, with electric vehicle battery demand increasing by approximately 45% annually. Consumer electronics continue to provide steady demand, while emerging applications in renewable energy storage and industrial automation create new growth opportunities.

Market challenges include intense global competition, raw material supply chain constraints, and the need for continuous technological advancement to maintain competitive advantages. Despite these challenges, South Korean battery manufacturers maintain strong market positions through vertical integration, strategic partnerships, and ongoing innovation in battery chemistry and manufacturing processes.

Strategic positioning in the global battery market has enabled South Korean companies to establish manufacturing facilities worldwide while maintaining core research and development capabilities domestically. The following insights highlight critical market dynamics:

Electric vehicle adoption serves as the primary catalyst driving South Korea’s rechargeable battery market growth. The government’s commitment to achieving carbon neutrality by 2050 has accelerated EV adoption policies, creating substantial demand for high-performance lithium-ion batteries. Domestic automakers including Hyundai Motor Group and Kia Corporation are rapidly expanding their electric vehicle portfolios, requiring advanced battery solutions from local suppliers.

Renewable energy integration represents another significant growth driver as South Korea pursues its Green New Deal initiatives. The increasing deployment of solar and wind energy systems requires sophisticated energy storage solutions to manage grid stability and optimize renewable energy utilization. Battery energy storage systems (BESS) installations are growing at approximately 28% annually, creating new market opportunities for utility-scale battery applications.

Consumer electronics evolution continues to drive demand for compact, high-energy-density batteries. The proliferation of 5G devices, wearable technology, and Internet of Things (IoT) applications requires advanced battery solutions with improved performance characteristics. South Korean manufacturers excel in developing batteries for premium consumer electronics, maintaining strong relationships with global technology companies.

Government policy support through the K-Battery initiative provides substantial backing for market development. This comprehensive strategy includes financial incentives, research grants, infrastructure development, and regulatory frameworks designed to maintain South Korea’s competitive advantage in the global battery market.

Raw material dependency poses significant challenges for South Korea’s rechargeable battery market. The country relies heavily on imported lithium, cobalt, nickel, and other critical materials, creating supply chain vulnerabilities and cost pressures. Geopolitical tensions and trade restrictions can disrupt material flows, impacting production schedules and profitability.

Intense global competition from Chinese manufacturers presents ongoing market pressures. Chinese companies benefit from lower production costs, government subsidies, and proximity to raw material sources, challenging South Korean manufacturers’ market positions. This competition has intensified pricing pressures across multiple battery applications and geographic markets.

Technological transition risks associated with next-generation battery technologies create uncertainty for existing investments. The potential shift toward solid-state batteries, alternative chemistries, or breakthrough technologies could render current manufacturing capabilities obsolete, requiring substantial reinvestment in new production facilities and processes.

Environmental regulations and sustainability requirements are becoming increasingly stringent, necessitating investments in cleaner production processes and comprehensive recycling capabilities. Compliance with evolving environmental standards requires ongoing capital expenditure and operational adjustments that impact profitability.

Next-generation battery technologies present substantial opportunities for South Korean manufacturers to maintain technological leadership. Investments in solid-state batteries, silicon nanowire anodes, and advanced cathode materials could provide competitive advantages in emerging applications. MarkWide Research analysis indicates that early adoption of breakthrough technologies could capture significant market share in premium applications.

Energy storage system expansion offers new revenue streams as utilities and industrial customers seek grid-scale storage solutions. The growing emphasis on renewable energy integration creates demand for large-scale battery installations, representing a market segment with higher margins and longer-term contracts compared to consumer electronics applications.

International market expansion through strategic partnerships and joint ventures enables South Korean companies to establish local manufacturing presence in key markets. This approach helps mitigate trade barriers, reduces transportation costs, and provides closer proximity to major customers in automotive and energy sectors.

Circular economy initiatives in battery recycling and material recovery create new business opportunities while addressing sustainability concerns. Developing comprehensive recycling capabilities can reduce raw material dependency while generating additional revenue streams from recovered materials.

Supply chain evolution continues to reshape the South Korean rechargeable battery market as companies pursue greater vertical integration and supply security. Major manufacturers are investing in upstream capabilities including cathode material production, separator manufacturing, and electrolyte formulation to reduce dependency on external suppliers and improve cost competitiveness.

Innovation cycles in battery technology are accelerating, with new product introductions occurring more frequently to meet evolving customer requirements. The transition from traditional lithium-ion chemistries to high-nickel cathodes and silicon-enhanced anodes demonstrates the industry’s commitment to continuous improvement in energy density and performance characteristics.

Market consolidation trends are emerging as smaller players struggle to compete with the scale and resources of major manufacturers. Strategic acquisitions and partnerships are becoming more common as companies seek to strengthen their technological capabilities and market positions.

Regulatory landscape changes impact market dynamics through evolving safety standards, environmental requirements, and trade policies. Companies must continuously adapt their operations and strategies to comply with changing regulations while maintaining competitive positions in global markets.

Comprehensive market analysis for the South Korea rechargeable battery market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, technology experts, and government officials to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of company financial reports, government publications, industry association data, and academic research papers. This approach provides quantitative data on market size, growth rates, and competitive positioning while validating primary research findings through multiple independent sources.

Data triangulation methods ensure research accuracy by cross-referencing information from multiple sources and methodologies. Statistical analysis techniques identify trends and patterns while accounting for potential biases or inconsistencies in individual data sources.

Expert validation processes involve review of research findings by industry specialists and academic researchers to ensure conclusions accurately reflect market realities and future prospects. This validation step helps identify potential gaps in analysis and confirms the reliability of market projections.

Seoul Metropolitan Area serves as the primary hub for South Korea’s rechargeable battery industry, hosting major corporate headquarters, research facilities, and advanced manufacturing operations. The region benefits from proximity to leading universities, government institutions, and a skilled workforce specializing in battery technology and manufacturing processes.

Gyeonggi Province contains significant battery manufacturing capacity, with multiple production facilities operated by major companies. The province’s strategic location near Seoul provides access to transportation infrastructure while offering lower operational costs compared to the capital region. Manufacturing activities in Gyeonggi account for approximately 40% of national battery production.

North Chungcheong Province has emerged as a key manufacturing center, particularly for automotive battery production. The region’s industrial parks provide dedicated facilities for battery manufacturing with supporting infrastructure for logistics and supply chain operations. Recent investments have increased the province’s share of total production capacity to approximately 25%.

South Gyeongsang Province focuses on specialized battery applications and component manufacturing. The region’s industrial base supports production of battery materials, separators, and other critical components while maintaining strong connections to the broader battery supply chain.

Market leadership in South Korea’s rechargeable battery sector is concentrated among three major conglomerates that dominate global market share and technological innovation. The competitive landscape is characterized by intense rivalry, substantial R&D investments, and strategic positioning across multiple application segments.

Competitive strategies focus on technological differentiation, manufacturing scale, and strategic customer relationships. Companies invest heavily in next-generation battery technologies while expanding global manufacturing footprints to serve international markets effectively.

By Technology:

By Application:

By End-user:

Automotive battery segment demonstrates the strongest growth trajectory, driven by accelerating electric vehicle adoption and government incentives supporting clean transportation. South Korean manufacturers have established strong positions with global automakers through long-term supply agreements and joint venture partnerships. The segment benefits from continuous technological advancement in energy density and fast-charging capabilities.

Consumer electronics batteries maintain steady demand despite market maturity, with growth driven by device proliferation and performance improvements. South Korean manufacturers excel in producing high-quality batteries for premium devices, maintaining strong relationships with leading electronics brands. Innovation focuses on extending battery life and reducing charging times.

Energy storage system batteries represent the fastest-growing application category, with demand increasing by approximately 35% annually. Utility-scale installations and residential energy storage systems create new market opportunities with different performance requirements compared to automotive and consumer applications.

Industrial battery applications provide stable revenue streams with specialized requirements for reliability and longevity. These applications often command premium pricing due to stringent performance specifications and lower volume production requirements.

Manufacturers benefit from South Korea’s advanced industrial infrastructure, skilled workforce, and strong government support for battery technology development. The country’s position as a global technology leader provides access to cutting-edge research capabilities and strategic partnerships with leading companies worldwide.

Suppliers gain from proximity to major battery manufacturers and opportunities to participate in the complete battery value chain. The concentration of battery production creates economies of scale and specialized supplier networks that enhance competitiveness and reduce costs.

Technology companies benefit from access to advanced battery solutions that enable innovation in electric vehicles, renewable energy systems, and consumer electronics. South Korean battery manufacturers provide reliable supply chains and continuous technological advancement to support product development.

Government stakeholders achieve strategic objectives including industrial competitiveness, export revenue generation, and environmental sustainability goals. The battery industry supports South Korea’s transition to a green economy while maintaining technological leadership in critical energy technologies.

Investors find attractive opportunities in a growing market with strong fundamentals, technological leadership, and government support. The battery industry offers exposure to multiple growth trends including electrification, renewable energy, and digital transformation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-state battery development represents the most significant technological trend, with South Korean companies investing heavily in next-generation battery technologies. These batteries promise improved safety, higher energy density, and longer lifespan compared to conventional lithium-ion batteries. Commercial deployment is expected within the next five years for premium applications.

Vertical integration strategies are becoming more prevalent as companies seek greater control over supply chains and cost structures. Major manufacturers are expanding into raw material processing, component manufacturing, and recycling operations to reduce dependency on external suppliers and improve margins.

Sustainability initiatives are gaining prominence as environmental regulations tighten and customers demand more sustainable products. Companies are investing in cleaner manufacturing processes, renewable energy for production facilities, and comprehensive battery recycling programs.

Global manufacturing expansion continues as South Korean companies establish production facilities in key markets including the United States, Europe, and Southeast Asia. This trend helps companies serve local customers more effectively while mitigating trade risks and transportation costs.

Digitalization and Industry 4.0 technologies are being implemented to improve manufacturing efficiency, quality control, and supply chain management. Advanced analytics, artificial intelligence, and automation systems enhance production capabilities and reduce operational costs.

Strategic partnerships between South Korean battery manufacturers and global automakers have accelerated, with multiple joint venture announcements for battery production facilities. These partnerships provide long-term demand visibility while sharing investment risks and technological development costs.

Government investment programs including the K-Battery initiative have allocated substantial funding for battery technology research, manufacturing capacity expansion, and supply chain development. These programs strengthen South Korea’s competitive position in the global battery market.

Technology breakthroughs in high-nickel cathode materials and silicon nanowire anodes have enabled significant improvements in battery energy density and performance characteristics. MWR analysis indicates these developments provide competitive advantages in premium applications.

Recycling infrastructure development has accelerated with new facilities and processes for recovering valuable materials from end-of-life batteries. These initiatives address sustainability concerns while reducing raw material dependency and creating new revenue streams.

International expansion projects have resulted in multiple new manufacturing facilities in key markets, enhancing global supply chain capabilities and customer proximity. These investments demonstrate confidence in long-term market growth and commitment to serving international customers.

Technology investment priorities should focus on next-generation battery technologies including solid-state batteries and advanced materials that provide sustainable competitive advantages. Companies should balance investments between improving current technologies and developing breakthrough solutions for future markets.

Supply chain diversification strategies are essential to reduce dependency on single-source suppliers and geographic concentration risks. Developing alternative supply sources and strategic inventory management can mitigate potential disruptions while maintaining cost competitiveness.

Market expansion approaches should emphasize strategic partnerships and joint ventures that provide access to new customers and markets while sharing investment risks. Local manufacturing presence in key markets becomes increasingly important for long-term success.

Sustainability integration throughout operations and product development will become increasingly critical for maintaining market access and customer relationships. Companies should invest in comprehensive sustainability programs that address environmental concerns while creating business value.

Digital transformation initiatives can provide significant operational improvements and competitive advantages through enhanced manufacturing efficiency, quality control, and customer service capabilities. Investment in digital technologies should be prioritized to maintain technological leadership.

Market growth prospects remain strong for South Korea’s rechargeable battery market, driven by accelerating electric vehicle adoption, expanding energy storage applications, and continuous innovation in battery technology. The market is expected to maintain robust growth rates exceeding 12% annually through the forecast period.

Technological evolution will continue to drive market dynamics, with solid-state batteries and advanced chemistries expected to gain commercial traction within the next decade. South Korean companies are well-positioned to lead these technological transitions through substantial R&D investments and strategic partnerships.

Global market expansion will accelerate as South Korean manufacturers establish additional international production facilities and strengthen relationships with global customers. This expansion strategy helps mitigate trade risks while providing closer proximity to major markets and customers.

Sustainability requirements will become increasingly important, driving investments in cleaner production processes, renewable energy utilization, and comprehensive recycling capabilities. Companies that successfully integrate sustainability into their operations will gain competitive advantages in environmentally conscious markets.

MarkWide Research projects that South Korea will maintain its position as a global leader in rechargeable battery technology and manufacturing, with continued market share growth in key application segments including automotive and energy storage systems.

South Korea’s rechargeable battery market represents a critical component of the global energy transition and technological advancement. The market’s strong fundamentals, including technological leadership, manufacturing scale, and government support, position it for continued growth and global market expansion. Major manufacturers have established dominant positions through continuous innovation, strategic partnerships, and substantial investments in next-generation technologies.

Market opportunities in electric vehicles, energy storage systems, and emerging applications provide multiple growth vectors for South Korean companies. The industry’s commitment to technological advancement, particularly in solid-state batteries and advanced materials, ensures continued competitive advantages in premium market segments. Strategic expansion into international markets through joint ventures and local manufacturing facilities strengthens global market positions while mitigating trade risks.

Future success will depend on continued innovation, supply chain optimization, and adaptation to evolving market requirements including sustainability and digitalization. South Korean battery manufacturers are well-positioned to capitalize on these trends through their strong technological capabilities, financial resources, and strategic partnerships with global customers across multiple industries.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

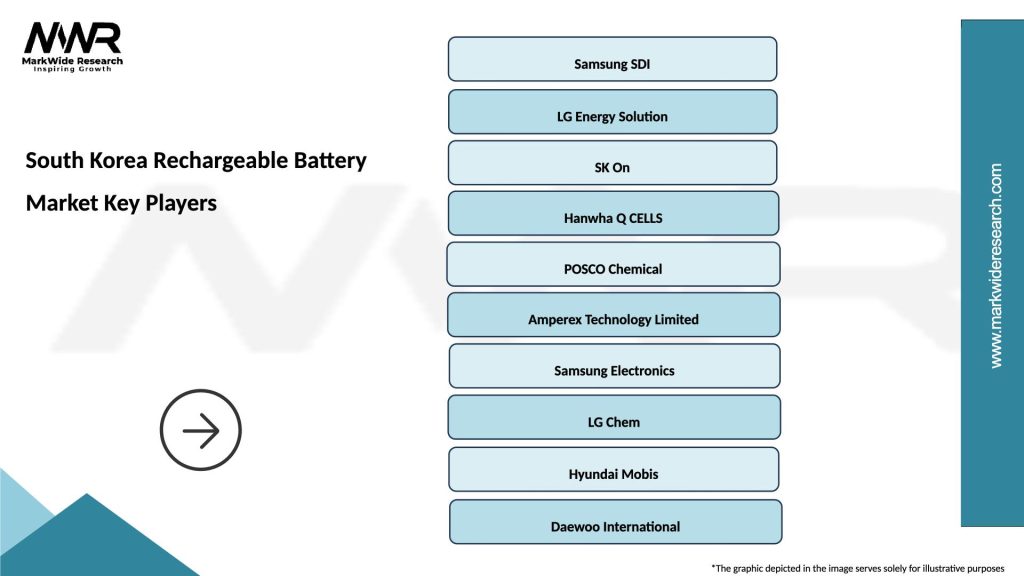

Who are the key players in the South Korea Rechargeable Battery Market?

Key players in the South Korea Rechargeable Battery Market include Samsung SDI, LG Energy Solution, and SK On, among others. These companies are involved in the production and innovation of rechargeable battery technologies for various applications.

What are the growth factors driving the South Korea Rechargeable Battery Market?

The South Korea Rechargeable Battery Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and the growing need for energy storage solutions in renewable energy systems. These factors contribute to the market’s expansion and innovation.

What challenges does the South Korea Rechargeable Battery Market face?

Challenges in the South Korea Rechargeable Battery Market include supply chain disruptions, competition from alternative energy storage technologies, and environmental concerns related to battery disposal and recycling. These issues can impact market growth and sustainability efforts.

What opportunities exist in the South Korea Rechargeable Battery Market?

Opportunities in the South Korea Rechargeable Battery Market include the rising adoption of electric vehicles, the development of solid-state batteries, and government initiatives promoting renewable energy. These factors are likely to enhance market potential and innovation.

What trends are shaping the South Korea Rechargeable Battery Market?

Trends in the South Korea Rechargeable Battery Market include the shift towards higher energy density batteries, the integration of smart technologies in battery management systems, and increased investment in recycling technologies. These trends are crucial for the future of battery technology.

South Korea Rechargeable Battery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Solid-state |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Technology | Fast Charging, Wireless Charging, Energy Density, Battery Management Systems |

| Application | Electric Vehicles, Portable Devices, Grid Storage, Power Tools |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Rechargeable Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at