444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

South Korea’s optoelectronics market represents one of the most dynamic and technologically advanced sectors in the Asia-Pacific region, driven by the country’s robust semiconductor industry and strong consumer electronics manufacturing base. The market encompasses a comprehensive range of products including light-emitting diodes (LEDs), laser diodes, photodetectors, optical sensors, and display technologies that serve diverse applications from smartphones to automotive systems.

Market growth in South Korea’s optoelectronics sector is experiencing remarkable momentum, with the industry expanding at a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory is primarily supported by increasing demand for advanced display technologies, rising adoption of LED lighting solutions, and the country’s leadership in manufacturing premium consumer electronics devices.

Key market drivers include South Korea’s position as a global hub for technology innovation, substantial investments in research and development by major conglomerates, and the government’s strong support for semiconductor and electronics industries. The market benefits from the presence of world-class manufacturers and a highly skilled workforce that continues to push the boundaries of optoelectronic technology development.

Regional dominance is evident as South Korea holds approximately 15% of the global optoelectronics market share, making it one of the leading countries in this sector alongside Japan, China, and the United States. The country’s strategic focus on next-generation technologies such as quantum dots, micro-LEDs, and advanced optical sensors positions it favorably for sustained market leadership.

The South Korea optoelectronics market refers to the comprehensive ecosystem of companies, technologies, and products that convert electrical signals into optical signals and vice versa within the South Korean territory. This market encompasses the design, manufacturing, and distribution of electronic devices that source, detect, and control light for various commercial and industrial applications.

Optoelectronic devices combine optical and electronic functionalities to enable advanced capabilities in communication systems, display technologies, lighting solutions, and sensing applications. In the South Korean context, this market includes major product categories such as light-emitting diodes, laser diodes, photodiodes, optical sensors, image sensors, and sophisticated display panels used in smartphones, televisions, and automotive applications.

Market scope extends beyond traditional consumer electronics to include emerging applications in autonomous vehicles, industrial automation, medical devices, and telecommunications infrastructure. South Korea’s optoelectronics market serves both domestic consumption and global export markets, with the country being a major supplier of advanced optoelectronic components to international technology companies.

Industry significance lies in its critical role supporting South Korea’s broader technology ecosystem, enabling innovations in artificial intelligence, Internet of Things (IoT), and next-generation communication systems. The market represents a convergence of materials science, semiconductor technology, and optical engineering that drives competitive advantages for South Korean technology companies.

South Korea’s optoelectronics market demonstrates exceptional growth potential and technological sophistication, positioning the country as a global leader in advanced optical and electronic device manufacturing. The market benefits from strong domestic demand, robust export capabilities, and continuous innovation in next-generation technologies that serve diverse industry applications.

Market performance indicates sustained expansion driven by increasing adoption of LED lighting solutions, growing demand for high-resolution display technologies, and rising integration of optical sensors in consumer electronics and automotive systems. The industry’s growth is supported by government investments representing 4.5% of GDP allocated to research and development activities across semiconductor and electronics sectors.

Competitive landscape features prominent South Korean companies including Samsung Electronics, LG Display, and SK Hynix, alongside numerous specialized manufacturers focusing on specific optoelectronic components. These companies leverage advanced manufacturing capabilities, extensive patent portfolios, and strategic partnerships to maintain market leadership positions.

Technology trends show increasing focus on quantum dot displays, micro-LED technology, and advanced optical sensors that enable augmented reality applications and autonomous vehicle systems. The market is experiencing rapid evolution toward more efficient, compact, and intelligent optoelectronic solutions that support emerging digital transformation initiatives across multiple industries.

Future prospects remain highly favorable, with market expansion expected to continue as South Korea strengthens its position in 5G infrastructure, electric vehicle manufacturing, and smart city development projects that require sophisticated optoelectronic components and systems.

Market dynamics reveal several critical insights that shape the South Korea optoelectronics landscape and influence strategic decision-making for industry participants and stakeholders:

Market positioning demonstrates South Korea’s unique advantages in combining advanced technology development with large-scale manufacturing capabilities, enabling the country to serve both premium and volume market segments effectively across global markets.

Primary growth drivers propelling South Korea’s optoelectronics market expansion include multiple interconnected factors that create favorable conditions for sustained industry development and technological advancement.

Consumer electronics demand represents the most significant driver, with South Korea’s position as a global leader in smartphone, television, and display manufacturing creating substantial domestic demand for advanced optoelectronic components. The country’s major electronics manufacturers require sophisticated optical sensors, display panels, and LED backlighting systems to maintain competitive advantages in international markets.

Automotive industry transformation drives increasing adoption of optoelectronic solutions as South Korean automotive manufacturers integrate advanced driver assistance systems, LED lighting, and display technologies into next-generation vehicles. The transition toward electric vehicles and autonomous driving capabilities creates new opportunities for optical sensors, LiDAR systems, and advanced lighting solutions.

Government initiatives provide substantial support through the Korean New Deal and semiconductor industry development programs that allocate significant funding for research and development activities. These initiatives include tax incentives, infrastructure investments, and strategic partnerships that strengthen South Korea’s position in global optoelectronics markets.

Technological innovation continues to drive market expansion as South Korean companies develop breakthrough technologies in quantum dots, micro-LEDs, and advanced optical sensors. According to MarkWide Research analysis, innovation activities contribute to sustained competitive advantages and market share growth in premium product segments.

5G infrastructure deployment creates substantial demand for optical communication components, fiber optic systems, and advanced networking equipment that support high-speed data transmission and low-latency applications across telecommunications networks.

Market challenges facing South Korea’s optoelectronics industry include several factors that may limit growth potential and create operational difficulties for market participants across different segments and applications.

Intense global competition from Chinese manufacturers offering cost-competitive alternatives poses ongoing challenges for South Korean companies, particularly in commodity optoelectronic components where price sensitivity remains high. This competitive pressure requires continuous innovation and efficiency improvements to maintain market positions.

Supply chain vulnerabilities became evident during recent global disruptions, highlighting dependencies on critical raw materials and specialized manufacturing equipment sourced from international suppliers. These vulnerabilities can impact production schedules and increase operational costs during supply chain disruptions.

High capital requirements for advanced manufacturing facilities and research and development activities create barriers to entry for smaller companies and limit expansion capabilities for existing market participants. The need for continuous technology upgrades requires substantial ongoing investments that may strain financial resources.

Skilled labor shortages in specialized technical areas present challenges for companies seeking to expand manufacturing capabilities and develop next-generation technologies. Competition for qualified engineers and technical professionals intensifies recruitment costs and may limit growth potential.

Regulatory compliance requirements for environmental standards, product safety, and international trade regulations create additional operational complexities and costs that must be managed effectively to maintain market competitiveness and access to global markets.

Emerging opportunities in South Korea’s optoelectronics market present significant potential for growth and expansion across multiple application areas and technology segments that align with global technology trends and market demands.

Quantum dot technology represents a substantial opportunity as South Korean companies develop advanced quantum dot displays and lighting solutions that offer superior color accuracy, energy efficiency, and performance characteristics compared to traditional technologies. This emerging technology segment shows strong growth potential in premium display applications.

Automotive optoelectronics present expanding opportunities as the automotive industry adopts advanced lighting systems, optical sensors, and display technologies for electric vehicles and autonomous driving applications. South Korean companies can leverage their technology expertise to capture market share in this rapidly growing segment.

Medical device applications offer new market opportunities for specialized optoelectronic components used in diagnostic equipment, surgical instruments, and therapeutic devices. The growing healthcare technology market creates demand for precision optical sensors and advanced imaging systems.

Industrial automation drives demand for optical sensors, machine vision systems, and advanced lighting solutions that support smart manufacturing initiatives and Industry 4.0 implementations across various industrial sectors.

Augmented reality and virtual reality applications create opportunities for specialized display technologies, optical sensors, and advanced imaging systems that enable immersive digital experiences and next-generation computing interfaces.

Smart city infrastructure development presents opportunities for LED lighting systems, optical sensors, and communication technologies that support intelligent transportation systems, environmental monitoring, and energy-efficient urban lighting solutions.

Market dynamics in South Korea’s optoelectronics sector reflect complex interactions between technological innovation, competitive pressures, and evolving customer requirements that shape industry development and strategic positioning.

Technology evolution drives continuous market transformation as companies develop next-generation optoelectronic solutions that offer improved performance, energy efficiency, and functionality. The rapid pace of technological change requires companies to maintain substantial research and development investments while managing product lifecycle transitions effectively.

Competitive intensity influences pricing strategies, innovation priorities, and market positioning as South Korean companies compete against international rivals in both domestic and global markets. This competitive environment encourages continuous improvement and differentiation through advanced technology development.

Customer demand patterns show increasing sophistication as end-users require more advanced functionality, higher performance, and better integration capabilities from optoelectronic components. These evolving requirements drive product development priorities and influence manufacturing strategies.

Supply chain optimization becomes increasingly important as companies seek to improve efficiency, reduce costs, and enhance resilience against potential disruptions. Strategic partnerships and vertical integration initiatives help companies maintain competitive advantages while managing operational risks.

Regulatory environment influences market dynamics through environmental standards, safety requirements, and trade policies that affect manufacturing processes, product development, and international market access. Companies must navigate these regulatory requirements while maintaining operational efficiency and competitiveness.

Research approach for analyzing South Korea’s optoelectronics market employs comprehensive methodologies that combine quantitative analysis, qualitative insights, and industry expertise to provide accurate and actionable market intelligence for stakeholders and decision-makers.

Primary research involves extensive interviews with industry executives, technology experts, and market participants across the optoelectronics value chain. These interviews provide insights into market trends, competitive dynamics, technology developments, and strategic priorities that shape industry evolution and growth prospects.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and government publications that provide quantitative data and market intelligence. This research includes examination of production statistics, trade data, and investment flows that influence market development.

Market modeling utilizes advanced analytical techniques to forecast market growth, segment performance, and competitive positioning based on historical trends, current market conditions, and future growth drivers. These models incorporate multiple variables and scenarios to provide robust market projections.

Technology assessment evaluates emerging technologies, innovation trends, and development pipelines that may influence future market dynamics and competitive positioning. This assessment includes analysis of patent landscapes, research publications, and technology roadmaps from leading companies and research institutions.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review, and market participant feedback. These validation procedures help maintain research quality and reliability for strategic decision-making purposes.

Regional distribution within South Korea’s optoelectronics market reveals distinct geographic concentrations of manufacturing capabilities, research activities, and market development that reflect the country’s industrial structure and strategic priorities.

Seoul Capital Area dominates the market with approximately 45% of industry activity, including major corporate headquarters, research and development centers, and advanced manufacturing facilities. This region benefits from proximity to major electronics companies, universities, and government institutions that support innovation and business development.

Gyeonggi Province represents a significant manufacturing hub with 28% of production capacity, hosting numerous semiconductor fabrication facilities, display manufacturing plants, and component assembly operations. The region’s industrial infrastructure and skilled workforce support large-scale manufacturing operations for both domestic and export markets.

Busan and Ulsan regions contribute approximately 12% of market activity, focusing on specialized manufacturing applications and serving as important logistics hubs for international trade. These coastal regions provide strategic advantages for companies engaged in global supply chain operations and export activities.

Daegu and surrounding areas account for 8% of industry presence, with emphasis on automotive optoelectronics and industrial applications that support the region’s manufacturing base. This area benefits from proximity to automotive manufacturers and industrial companies that utilize optoelectronic components.

Other regions including Gwangju, Daejeon, and smaller industrial centers collectively represent the remaining 7% of market activity, often specializing in niche applications or serving as satellite manufacturing locations for larger companies. These regions contribute to the overall diversity and resilience of South Korea’s optoelectronics ecosystem.

Competitive environment in South Korea’s optoelectronics market features a mix of large conglomerates, specialized manufacturers, and emerging technology companies that compete across different market segments and application areas.

Major market participants include several prominent companies that maintain significant market positions and influence industry development:

Competitive strategies emphasize technology leadership, manufacturing excellence, and strategic partnerships that enable companies to maintain market positions while expanding into new application areas. Companies invest heavily in research and development to create differentiated products and maintain competitive advantages.

Market consolidation trends show increasing collaboration between companies through joint ventures, strategic alliances, and technology licensing agreements that enable access to complementary capabilities and market opportunities.

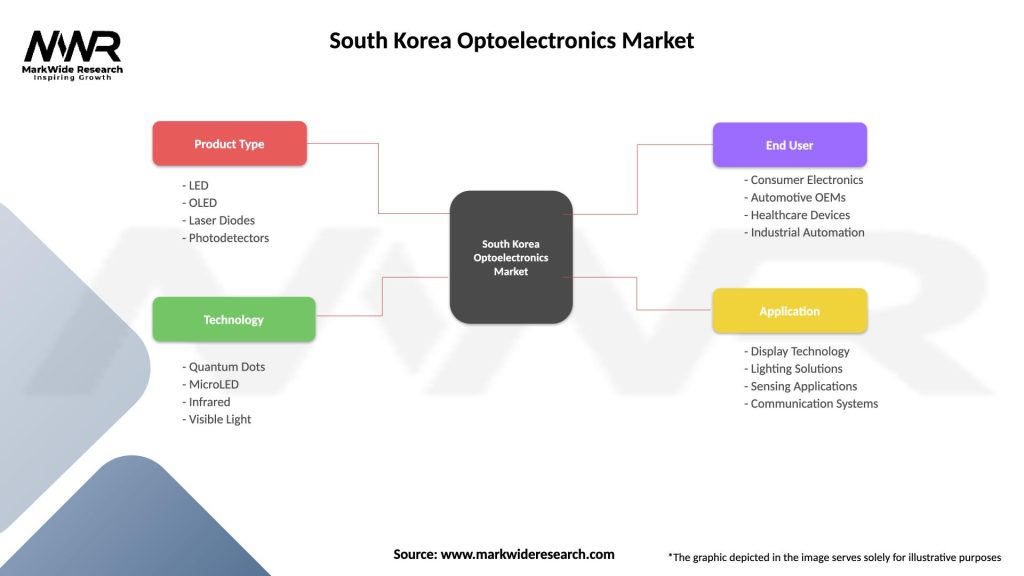

Market segmentation analysis reveals distinct categories within South Korea’s optoelectronics market based on product types, applications, and end-user industries that demonstrate varying growth patterns and market dynamics.

By Product Type:

By Application:

By End-User Industry:

LED technology segment demonstrates the strongest market performance with sustained growth driven by increasing adoption in general lighting, automotive applications, and display backlighting. South Korean LED manufacturers benefit from advanced manufacturing capabilities and strong relationships with major electronics companies that utilize LED components in their products.

Display technology category shows exceptional innovation with South Korean companies leading global development of OLED displays, quantum dot technologies, and flexible screen solutions. This segment benefits from strong domestic demand and substantial export opportunities in premium consumer electronics markets.

Optical sensor segment experiences rapid growth as smartphones, automotive systems, and industrial applications integrate more sophisticated sensing capabilities. South Korean companies develop advanced image sensors, proximity sensors, and specialized optical detection systems that serve diverse market requirements.

Laser diode applications show steady expansion in telecommunications, industrial processing, and consumer electronics applications. South Korean manufacturers focus on high-performance laser solutions that offer superior reliability and efficiency for demanding applications.

Automotive optoelectronics represents the fastest-growing category as vehicle manufacturers adopt LED lighting systems, advanced driver assistance technologies, and sophisticated display solutions. This segment benefits from South Korea’s strong automotive industry and growing electric vehicle market.

Industrial automation applications drive demand for machine vision systems, optical sensors, and advanced lighting solutions that support smart manufacturing initiatives. MWR data indicates this segment shows consistent growth as manufacturers implement Industry 4.0 technologies.

Market participants in South Korea’s optoelectronics industry enjoy numerous advantages that support business growth, competitive positioning, and long-term success across domestic and international markets.

Technology Leadership Benefits:

Market Access Advantages:

Strategic Benefits:

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology trends shaping South Korea’s optoelectronics market reflect broader industry evolution toward more sophisticated, efficient, and intelligent optical and electronic solutions that serve emerging applications and market requirements.

Quantum Dot Technology emerges as a transformative trend with South Korean companies developing advanced quantum dot displays and lighting solutions that offer superior color accuracy, energy efficiency, and performance characteristics. This technology shows strong adoption potential in premium display applications and next-generation lighting systems.

Micro-LED Development represents a significant trend as manufacturers work to commercialize micro-LED displays that promise exceptional brightness, energy efficiency, and durability for various applications including smartphones, televisions, and automotive displays.

Automotive Integration shows accelerating adoption as vehicle manufacturers integrate sophisticated optoelectronic systems for LED lighting, advanced driver assistance, and in-vehicle displays. This trend benefits from South Korea’s strong automotive industry and growing electric vehicle market.

5G Infrastructure drives demand for advanced optical communication components, fiber optic systems, and high-speed networking equipment that support next-generation telecommunications networks and data transmission requirements.

Artificial Intelligence Integration influences product development as optoelectronic devices incorporate AI capabilities for enhanced functionality, adaptive performance, and intelligent automation across various applications and market segments.

Sustainability Focus shapes industry development as companies prioritize energy-efficient technologies, environmentally friendly manufacturing processes, and sustainable product lifecycle management to meet regulatory requirements and customer expectations.

Recent developments in South Korea’s optoelectronics industry demonstrate continued innovation, strategic investments, and market expansion activities that strengthen the country’s competitive position and growth prospects.

Technology Breakthroughs include significant advances in quantum dot display technology, with South Korean companies achieving improved color gamut, energy efficiency, and manufacturing scalability. These developments position South Korea as a leader in next-generation display technologies for premium consumer electronics applications.

Manufacturing Expansion involves substantial investments in new production facilities and capacity upgrades that support growing demand for optoelectronic components. Major companies have announced facility expansions and technology upgrades that enhance manufacturing capabilities and efficiency.

Strategic Partnerships between South Korean companies and international technology firms create opportunities for technology sharing, market access, and collaborative development of advanced optoelectronic solutions. These partnerships strengthen competitive positioning and accelerate innovation cycles.

Government Initiatives include new policy frameworks and financial support programs that promote optoelectronics industry development, research and development activities, and international competitiveness. These initiatives demonstrate strong government commitment to maintaining technology leadership.

Automotive Applications show rapid development as South Korean companies expand their presence in automotive optoelectronics through new product launches, customer partnerships, and technology demonstrations that showcase advanced lighting and sensing capabilities.

Export Growth reflects successful market expansion efforts as South Korean optoelectronic products gain market share in international markets, supported by superior technology, quality, and customer service capabilities.

Strategic recommendations for South Korea’s optoelectronics market participants focus on leveraging competitive advantages while addressing market challenges and capitalizing on emerging opportunities for sustainable growth and market leadership.

Technology Investment Priorities should emphasize next-generation technologies including quantum dots, micro-LEDs, and advanced optical sensors that offer differentiation opportunities and premium market positioning. Companies should maintain substantial research and development investments to stay ahead of technology curves and competitive pressures.

Market Diversification strategies should expand beyond traditional consumer electronics applications to include automotive, healthcare, industrial automation, and emerging technology segments that offer growth potential and reduced market concentration risks. This diversification helps create more resilient business models.

Supply Chain Optimization requires developing more resilient and efficient supply chain strategies that reduce dependencies on single sources while maintaining cost competitiveness. Companies should consider strategic partnerships, vertical integration, and alternative sourcing strategies to enhance supply chain security.

International Expansion efforts should focus on emerging markets and new geographic regions that offer growth opportunities for South Korean optoelectronic products. Companies should develop market-specific strategies that address local requirements and competitive dynamics.

Sustainability Integration should become a core strategic priority as environmental regulations and customer expectations drive demand for energy-efficient, environmentally friendly optoelectronic solutions. Companies should invest in sustainable manufacturing processes and product development approaches.

Talent Development initiatives should address skilled labor shortages through enhanced recruitment, training, and retention programs that ensure access to qualified technical professionals needed for continued innovation and growth.

Future prospects for South Korea’s optoelectronics market remain highly favorable, with multiple growth drivers and technological trends supporting continued expansion and market leadership across various application segments and geographic markets.

Market growth projections indicate sustained expansion with the industry expected to maintain strong growth momentum driven by increasing demand for advanced display technologies, automotive optoelectronics, and emerging applications in artificial intelligence and Internet of Things systems. MarkWide Research forecasts suggest the market will continue growing at a robust CAGR of 8.2% over the next five years.

Technology evolution will focus on quantum dot displays, micro-LED technology, and advanced optical sensors that enable new applications and improved performance characteristics. South Korean companies are well-positioned to lead these technology developments through continued innovation investments and strategic partnerships.

Application expansion into automotive systems, healthcare devices, and industrial automation will create new market opportunities and revenue streams for South Korean optoelectronics companies. The automotive segment alone is expected to show growth rates exceeding 12% annually as electric vehicles and autonomous driving technologies gain adoption.

Global market share is expected to increase as South Korean companies leverage technology advantages and manufacturing excellence to capture market opportunities in emerging economies and new application areas. Export growth will continue to be a significant driver of overall market expansion.

Industry consolidation may accelerate as companies seek to achieve economies of scale, access complementary technologies, and strengthen competitive positions through strategic mergers, acquisitions, and partnerships that create more comprehensive solution offerings.

Sustainability initiatives will become increasingly important as regulatory requirements and customer expectations drive demand for environmentally friendly optoelectronic solutions and sustainable manufacturing practices throughout the industry value chain.

South Korea’s optoelectronics market represents a dynamic and highly competitive industry that combines advanced technology development with large-scale manufacturing capabilities to serve diverse domestic and international market requirements. The market demonstrates strong growth potential driven by continuous innovation, expanding applications, and favorable industry dynamics.

Market leadership positions South Korea as a global hub for optoelectronic technology development and manufacturing, with major companies maintaining competitive advantages through substantial research and development investments, advanced manufacturing capabilities, and strong customer relationships across multiple industry segments.

Growth drivers including automotive industry transformation, 5G infrastructure deployment, and emerging applications in artificial intelligence and Internet of Things create substantial opportunities for continued market expansion and technology development. These trends support optimistic long-term growth prospects for industry participants.

Competitive advantages in technology innovation, manufacturing excellence, and market positioning provide South Korean companies with strong foundations for sustained success in global optoelectronics markets. The combination of government support, skilled workforce, and advanced infrastructure creates favorable conditions for continued industry development.

Future success will depend on companies’ ability to maintain technology leadership, expand into new applications and markets, and adapt to evolving customer requirements while managing competitive pressures and operational challenges. The industry’s strong fundamentals and strategic positioning suggest continued growth and market leadership in the global optoelectronics sector.

What is Optoelectronics?

Optoelectronics refers to the study and application of electronic devices that source, detect, and control light. This field encompasses various technologies, including LEDs, lasers, and photodetectors, which are used in applications such as telecommunications, lighting, and displays.

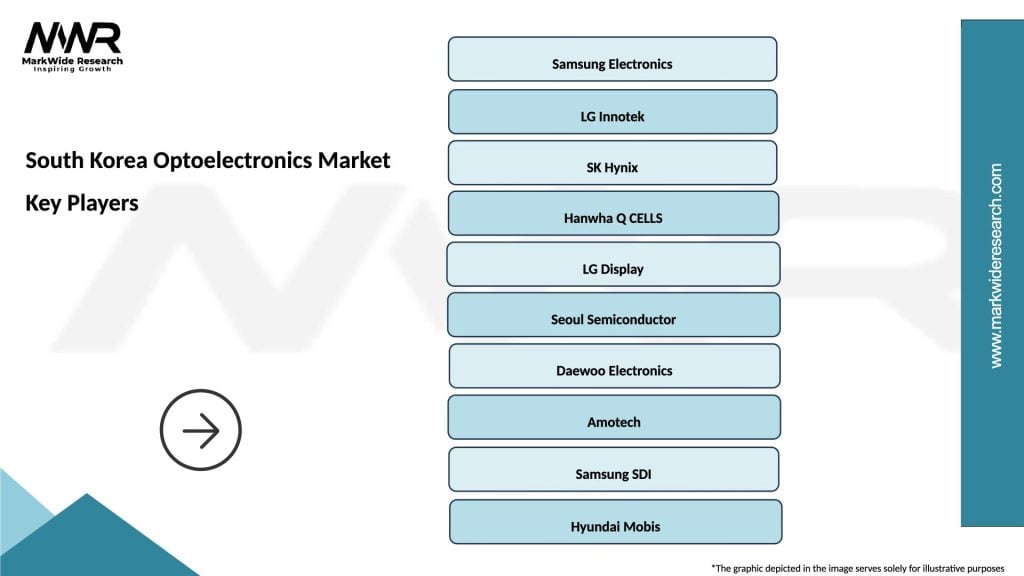

What are the key players in the South Korea Optoelectronics Market?

Key players in the South Korea Optoelectronics Market include Samsung Electronics, LG Innotek, and SK Hynix. These companies are involved in the development and manufacturing of advanced optoelectronic components and systems, contributing significantly to the market’s growth.

What are the growth factors driving the South Korea Optoelectronics Market?

The South Korea Optoelectronics Market is driven by the increasing demand for high-speed communication technologies, advancements in display technologies, and the growing adoption of LED lighting solutions. Additionally, the rise of smart devices and IoT applications is further propelling market growth.

What challenges does the South Korea Optoelectronics Market face?

The South Korea Optoelectronics Market faces challenges such as intense competition among manufacturers, rapid technological changes, and the high cost of research and development. These factors can hinder the ability of companies to innovate and maintain market share.

What opportunities exist in the South Korea Optoelectronics Market?

Opportunities in the South Korea Optoelectronics Market include the expansion of 5G networks, the increasing use of optoelectronic devices in automotive applications, and the growing demand for energy-efficient lighting solutions. These trends present avenues for innovation and investment.

What trends are shaping the South Korea Optoelectronics Market?

Trends shaping the South Korea Optoelectronics Market include the development of organic light-emitting diodes (OLEDs), advancements in laser technology, and the integration of optoelectronics in consumer electronics. These innovations are enhancing product performance and creating new applications.

South Korea Optoelectronics Market

| Segmentation Details | Description |

|---|---|

| Product Type | LED, OLED, Laser Diodes, Photodetectors |

| Technology | Quantum Dots, MicroLED, Infrared, Visible Light |

| End User | Consumer Electronics, Automotive OEMs, Healthcare Devices, Industrial Automation |

| Application | Display Technology, Lighting Solutions, Sensing Applications, Communication Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Optoelectronics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at