444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea medical digital imaging devices market represents a dynamic and rapidly evolving sector within the country’s advanced healthcare infrastructure. This market encompasses sophisticated diagnostic and therapeutic imaging technologies that have revolutionized medical practice across South Korean hospitals, clinics, and specialized medical centers. Digital imaging devices in this market include computed tomography (CT) scanners, magnetic resonance imaging (MRI) systems, digital radiography equipment, ultrasound machines, and nuclear imaging devices.

South Korea’s healthcare system has embraced digital transformation at an unprecedented pace, with medical imaging technology adoption rates reaching 78% across major healthcare facilities. The country’s commitment to healthcare innovation, combined with substantial government investments in medical infrastructure, has positioned it as a leading market for advanced imaging solutions in the Asia-Pacific region. Healthcare digitization initiatives have accelerated the integration of artificial intelligence, cloud-based imaging solutions, and telemedicine capabilities.

Market growth is driven by an aging population, increasing prevalence of chronic diseases, and the government’s push toward precision medicine. The integration of 5G technology and Internet of Things (IoT) capabilities in medical imaging devices has enhanced real-time diagnostics and remote consultation capabilities. MarkWide Research indicates that technological advancement and healthcare infrastructure modernization continue to fuel market expansion across various medical specialties.

The South Korea medical digital imaging devices market refers to the comprehensive ecosystem of advanced diagnostic and therapeutic imaging technologies utilized within the country’s healthcare system. This market encompasses the development, manufacturing, distribution, and implementation of digital imaging solutions that enable healthcare professionals to visualize internal body structures, diagnose medical conditions, and guide therapeutic interventions with enhanced precision and efficiency.

Digital imaging devices in this context include sophisticated equipment that converts analog medical images into digital formats, enabling advanced image processing, storage, and transmission capabilities. These technologies facilitate improved diagnostic accuracy, reduced examination times, and enhanced patient care outcomes through high-resolution imaging, real-time visualization, and integrated data management systems.

South Korea’s medical digital imaging devices market demonstrates robust growth potential driven by technological innovation, demographic shifts, and healthcare system modernization. The market benefits from the country’s advanced IT infrastructure, high healthcare spending, and strong government support for medical technology adoption. Key growth drivers include the increasing elderly population, rising chronic disease prevalence, and expanding healthcare accessibility initiatives.

Market dynamics are characterized by rapid technological advancement, with artificial intelligence integration showing 65% adoption rates among leading healthcare facilities. The shift toward value-based healthcare delivery models has accelerated demand for efficient, accurate, and cost-effective imaging solutions. Digital transformation initiatives across hospitals and clinics have created substantial opportunities for innovative imaging device manufacturers and technology providers.

Competitive landscape features both international technology leaders and emerging domestic companies developing specialized imaging solutions. The market’s evolution toward integrated healthcare platforms, telemedicine capabilities, and personalized medicine approaches continues to drive innovation and investment in next-generation imaging technologies.

Strategic market insights reveal several critical factors shaping the South Korea medical digital imaging devices landscape:

Primary market drivers propelling growth in South Korea’s medical digital imaging devices sector include demographic, technological, and healthcare system factors. The country’s rapidly aging population creates increasing demand for diagnostic imaging services, particularly in cardiovascular, oncology, and neurological applications. Chronic disease prevalence continues rising, with diabetes, hypertension, and cancer cases requiring regular imaging monitoring and diagnosis.

Government healthcare initiatives play a crucial role in market expansion, with substantial investments in hospital modernization, medical equipment upgrades, and healthcare accessibility improvements. The Korean New Deal includes significant allocations for healthcare digitization, promoting advanced imaging technology adoption across public and private medical facilities. Healthcare quality improvement mandates drive hospitals to invest in state-of-the-art imaging equipment.

Technological advancement serves as a major growth catalyst, with artificial intelligence, machine learning, and cloud computing capabilities enhancing imaging device functionality. The integration of 5G networks enables real-time image transmission, remote diagnostics, and collaborative medical consultations. Patient safety concerns and quality care expectations continue driving demand for advanced, accurate, and efficient imaging solutions.

Market restraints affecting the South Korea medical digital imaging devices sector include high capital investment requirements, regulatory complexities, and technical implementation challenges. Equipment costs represent significant barriers for smaller healthcare facilities, limiting market penetration in rural and specialized medical centers. The substantial financial investment required for advanced imaging systems, including installation, training, and maintenance costs, constrains adoption rates.

Regulatory compliance requirements create complex approval processes for new imaging technologies, potentially delaying market entry and increasing development costs. Data privacy concerns and cybersecurity requirements add complexity to digital imaging system implementation, requiring robust security measures and compliance protocols. Technical expertise shortages in advanced imaging technology operation and maintenance present ongoing challenges for healthcare facilities.

Healthcare budget constraints in certain sectors limit large-scale imaging equipment purchases, particularly affecting public hospitals and smaller medical facilities. Technology obsolescence concerns create hesitation among healthcare providers regarding major imaging system investments, given the rapid pace of technological advancement in the medical device industry.

Significant market opportunities exist within South Korea’s medical digital imaging devices sector, driven by technological innovation, healthcare expansion, and demographic trends. The growing emphasis on preventive healthcare creates substantial demand for advanced screening and early detection imaging technologies. Artificial intelligence integration presents opportunities for developing intelligent imaging systems that enhance diagnostic accuracy and workflow efficiency.

Telemedicine expansion offers substantial growth potential, with remote consultation capabilities requiring advanced imaging device connectivity and data sharing solutions. The development of portable imaging devices creates opportunities for point-of-care diagnostics, emergency medicine applications, and rural healthcare service delivery. Personalized medicine trends drive demand for specialized imaging technologies tailored to individual patient needs and treatment protocols.

Healthcare infrastructure development in emerging medical specialties, including interventional radiology, cardiac imaging, and molecular imaging, presents significant market expansion opportunities. Public-private partnerships in healthcare delivery create collaborative opportunities for imaging technology providers to develop innovative solutions and expand market reach.

Market dynamics in South Korea’s medical digital imaging devices sector reflect the complex interplay between technological advancement, healthcare policy, and demographic changes. Innovation cycles are accelerating, with new imaging technologies emerging regularly to address evolving clinical needs and improve patient outcomes. The market demonstrates strong responsiveness to healthcare digitization trends, with imaging device manufacturers adapting products to integrate seamlessly with electronic health records and hospital information systems.

Competitive dynamics feature intense rivalry between established international companies and emerging domestic technology providers. Market consolidation trends are evident as larger companies acquire specialized imaging technology firms to expand their product portfolios and market presence. Customer preferences increasingly favor integrated imaging solutions that offer comprehensive diagnostic capabilities, workflow efficiency, and cost-effectiveness.

Supply chain dynamics have evolved to support rapid technology deployment and maintenance services across South Korea’s healthcare network. Partnership strategies between imaging device manufacturers, healthcare providers, and technology companies are creating collaborative ecosystems that accelerate innovation and market growth. Regulatory dynamics continue evolving to balance innovation promotion with patient safety and quality assurance requirements.

Research methodology for analyzing South Korea’s medical digital imaging devices market employs comprehensive primary and secondary research approaches to ensure accurate, reliable, and actionable market insights. Primary research includes extensive interviews with healthcare professionals, hospital administrators, imaging device manufacturers, and regulatory officials to gather firsthand market intelligence and industry perspectives.

Secondary research encompasses analysis of government healthcare statistics, medical device registration data, hospital procurement records, and industry publications. Market segmentation analysis utilizes detailed examination of product categories, application areas, end-user segments, and geographic distribution patterns. Competitive intelligence gathering involves comprehensive evaluation of major market participants, their product offerings, market strategies, and financial performance.

Data validation processes include cross-referencing multiple information sources, expert consultation, and statistical analysis to ensure research accuracy and reliability. Trend analysis employs historical data examination, current market assessment, and future projection modeling to identify growth patterns and market opportunities. Quality assurance measures ensure research findings meet professional standards and provide valuable insights for market participants and stakeholders.

Regional analysis of South Korea’s medical digital imaging devices market reveals distinct geographic patterns influenced by healthcare infrastructure, population density, and economic development levels. Seoul Metropolitan Area dominates market activity, accounting for approximately 45% of total imaging device installations due to high concentration of major hospitals, medical centers, and specialized healthcare facilities.

Busan and surrounding regions represent significant secondary markets, with growing healthcare infrastructure and increasing medical tourism activities driving imaging device demand. Daegu and Gwangju demonstrate strong growth potential as regional medical hubs, with government investments in healthcare facility modernization supporting market expansion. Rural areas present emerging opportunities as telemedicine initiatives and mobile imaging services extend advanced diagnostic capabilities to underserved populations.

Regional healthcare policies vary across provinces, influencing imaging device adoption rates and technology preferences. Economic development zones often receive priority for healthcare infrastructure investments, creating concentrated demand for advanced imaging technologies. MWR analysis indicates that regional market dynamics are increasingly influenced by healthcare accessibility initiatives and quality improvement mandates across different geographic areas.

Competitive landscape in South Korea’s medical digital imaging devices market features diverse participants ranging from global technology leaders to specialized domestic companies. Market leadership is characterized by companies offering comprehensive imaging solutions, strong technical support, and established relationships with major healthcare providers.

Competitive strategies emphasize technological innovation, customer service excellence, and strategic partnerships with healthcare providers. Market differentiation occurs through AI integration, workflow optimization, and specialized imaging applications tailored to specific medical specialties.

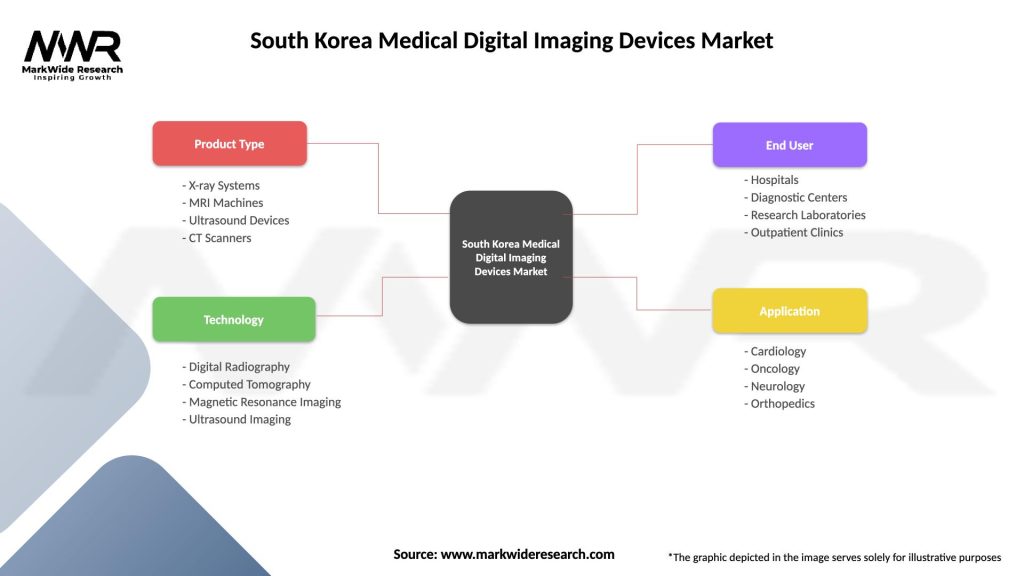

Market segmentation analysis reveals distinct categories within South Korea’s medical digital imaging devices sector, each characterized by specific applications, technologies, and growth patterns.

By Product Type:

By Application:

By End User:

Category-wise analysis provides detailed insights into specific segments within South Korea’s medical digital imaging devices market, revealing unique growth drivers, challenges, and opportunities for each product category.

CT Systems Category: Demonstrates strong growth driven by advanced multi-detector technologies and AI-enhanced image reconstruction. Cardiac CT applications show particularly robust demand, with 35% growth in specialized cardiac imaging procedures. Low-dose CT technologies gain traction due to radiation safety concerns and screening program expansion.

MRI Systems Category: Features increasing demand for high-field systems and specialized applications including functional MRI and cardiac MRI. Workflow optimization becomes critical factor in purchasing decisions, with facilities prioritizing systems offering reduced scan times and improved patient comfort. AI-powered image analysis integration shows 50% adoption rate among new MRI installations.

Digital Radiography Category: Experiences transformation toward wireless, portable systems with enhanced image quality and workflow efficiency. Mobile radiography solutions gain popularity for point-of-care applications and emergency medicine. Dose reduction technologies become standard features addressing radiation safety requirements.

Ultrasound Category: Shows strong growth in portable and handheld devices, expanding applications beyond traditional imaging to include point-of-care diagnostics and interventional guidance. AI-assisted diagnosis features demonstrate increasing adoption rates across various medical specialties.

Industry participants and stakeholders in South Korea’s medical digital imaging devices market realize substantial benefits from market participation and technological advancement. Healthcare providers benefit from improved diagnostic accuracy, enhanced workflow efficiency, and better patient outcomes through advanced imaging technologies. Cost optimization occurs through reduced examination times, improved resource utilization, and decreased need for repeat procedures.

Technology manufacturers gain access to a sophisticated healthcare market with strong demand for innovative imaging solutions. Revenue growth opportunities exist through product differentiation, service offerings, and strategic partnerships with healthcare providers. Research and development collaboration with Korean medical institutions provides valuable insights for product innovation and market expansion.

Patients benefit from improved diagnostic accuracy, reduced examination times, and enhanced comfort during imaging procedures. Healthcare accessibility improvements through telemedicine and mobile imaging services extend advanced diagnostic capabilities to underserved populations. Government stakeholders achieve healthcare quality improvement objectives while optimizing healthcare spending through efficient imaging technology deployment.

Investment opportunities attract venture capital and private equity interest in innovative imaging technology companies. Economic development benefits include job creation, technology transfer, and strengthening of South Korea’s position as a regional healthcare technology hub.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping South Korea’s medical digital imaging devices sector reflect technological advancement, healthcare delivery evolution, and changing patient expectations. Artificial intelligence integration emerges as a dominant trend, with AI-powered imaging analysis showing 60% adoption growth across major healthcare facilities. Machine learning algorithms enhance diagnostic accuracy, reduce interpretation time, and support clinical decision-making processes.

Cloud-based imaging solutions gain momentum as healthcare providers seek scalable, cost-effective data storage and sharing capabilities. Hybrid cloud architectures enable secure image storage while maintaining accessibility for remote consultation and collaborative diagnosis. Mobile imaging technologies expand rapidly, with portable and handheld devices enabling point-of-care diagnostics and emergency medicine applications.

Workflow optimization becomes increasingly important as healthcare facilities prioritize efficiency and productivity improvements. Integrated imaging platforms that seamlessly connect with electronic health records and hospital information systems demonstrate strong market demand. Patient-centric imaging trends focus on comfort, reduced examination times, and improved communication of results.

Sustainability initiatives influence purchasing decisions, with healthcare providers increasingly considering energy efficiency, environmental impact, and lifecycle costs in imaging equipment selection. Dose reduction technologies continue advancing to address radiation safety concerns while maintaining image quality standards.

Recent industry developments highlight significant advancements and strategic initiatives within South Korea’s medical digital imaging devices market. Technology partnerships between international imaging companies and Korean healthcare providers have accelerated innovation and market penetration. Samsung Medison expanded its ultrasound portfolio with AI-enhanced imaging capabilities, strengthening its position in the domestic market.

Government initiatives include substantial investments in healthcare infrastructure modernization, with specific allocations for advanced imaging equipment in public hospitals. Regulatory updates have streamlined approval processes for certain imaging technologies while maintaining safety and efficacy standards. Research collaborations between Korean medical institutions and international technology companies have produced innovative imaging solutions tailored to local healthcare needs.

Market consolidation activities include strategic acquisitions and partnerships aimed at expanding product portfolios and market reach. Digital health platform integration has become a key focus area, with imaging device manufacturers developing solutions that seamlessly integrate with telemedicine and remote monitoring systems. MarkWide Research indicates that these developments collectively contribute to market growth and technological advancement.

Investment activities in Korean imaging technology startups have increased, with venture capital funding supporting innovation in AI-powered diagnostics, portable imaging devices, and specialized imaging applications. International expansion efforts by Korean imaging technology companies demonstrate growing confidence and capability in global markets.

Strategic recommendations for market participants in South Korea’s medical digital imaging devices sector focus on leveraging technological innovation, addressing market challenges, and capitalizing on growth opportunities. Technology manufacturers should prioritize AI integration, workflow optimization, and interoperability features to meet evolving healthcare provider needs. Investment in local partnerships and customer support infrastructure will strengthen market position and customer relationships.

Healthcare providers should develop comprehensive imaging technology strategies that balance clinical needs, cost considerations, and future scalability requirements. Staff training and development programs ensure optimal utilization of advanced imaging technologies and maximize return on investment. Collaboration with technology partners can provide access to latest innovations and technical support services.

Government stakeholders should continue supporting healthcare infrastructure development while ensuring regulatory frameworks keep pace with technological advancement. Public-private partnerships can accelerate imaging technology deployment and improve healthcare accessibility. Research funding for innovative imaging technologies will strengthen South Korea’s position as a regional healthcare technology leader.

Investors should focus on companies demonstrating strong technological capabilities, market understanding, and growth potential in AI-powered imaging solutions. Due diligence should include assessment of regulatory compliance, intellectual property portfolios, and strategic partnerships with healthcare providers.

Future outlook for South Korea’s medical digital imaging devices market indicates continued robust growth driven by technological innovation, demographic trends, and healthcare system evolution. Market expansion is expected to accelerate with projected growth rates of 8.5% annually over the next five years, supported by increasing healthcare investments and aging population dynamics.

Technological advancement will continue reshaping the market landscape, with artificial intelligence, machine learning, and cloud computing becoming standard features in imaging devices. 5G network deployment will enable real-time image transmission, remote diagnostics, and enhanced telemedicine capabilities. Quantum computing applications in medical imaging represent emerging opportunities for breakthrough diagnostic capabilities.

Healthcare delivery transformation toward value-based care models will drive demand for efficient, accurate, and cost-effective imaging solutions. Personalized medicine trends will create opportunities for specialized imaging technologies tailored to individual patient needs and treatment protocols. Preventive healthcare emphasis will expand screening and early detection imaging applications.

Market consolidation is likely to continue as companies seek to strengthen their competitive positions through strategic acquisitions and partnerships. International expansion opportunities will emerge as Korean imaging technology companies develop globally competitive products and solutions. Sustainability considerations will increasingly influence purchasing decisions and product development strategies.

South Korea’s medical digital imaging devices market represents a dynamic and rapidly evolving sector characterized by technological innovation, strong government support, and growing healthcare demands. The market benefits from the country’s advanced healthcare infrastructure, sophisticated IT capabilities, and commitment to healthcare quality improvement. Key growth drivers including demographic changes, chronic disease prevalence, and healthcare digitization initiatives create substantial opportunities for market participants.

Technological advancement continues to reshape the competitive landscape, with artificial intelligence integration, workflow optimization, and telemedicine capabilities becoming critical differentiators. Market challenges including high implementation costs, regulatory complexity, and technical expertise requirements require strategic approaches and collaborative solutions. Future growth prospects remain strong, supported by continued healthcare investments, technological innovation, and expanding healthcare accessibility initiatives.

Success in this market requires understanding of local healthcare needs, regulatory requirements, and technological preferences. Strategic partnerships between international technology providers and Korean healthcare stakeholders will continue driving innovation and market development. The market’s evolution toward integrated, intelligent, and patient-centric imaging solutions presents significant opportunities for companies capable of delivering comprehensive, high-quality medical imaging technologies that meet the sophisticated demands of South Korea’s healthcare system.

What is Medical Digital Imaging Devices?

Medical Digital Imaging Devices refer to technologies used to create visual representations of the interior of a body for clinical analysis and medical intervention. These devices include MRI machines, CT scanners, and ultrasound equipment, which are essential in diagnostics and treatment planning.

What are the key players in the South Korea Medical Digital Imaging Devices Market?

Key players in the South Korea Medical Digital Imaging Devices Market include Samsung Medison, GE Healthcare, Siemens Healthineers, and Philips Healthcare, among others. These companies are known for their innovative imaging technologies and extensive product portfolios.

What are the growth factors driving the South Korea Medical Digital Imaging Devices Market?

The growth of the South Korea Medical Digital Imaging Devices Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technology, and a growing emphasis on early diagnosis. Additionally, the rising demand for minimally invasive procedures is contributing to market expansion.

What challenges does the South Korea Medical Digital Imaging Devices Market face?

Challenges in the South Korea Medical Digital Imaging Devices Market include high costs associated with advanced imaging technologies and regulatory hurdles for new device approvals. Furthermore, the need for skilled professionals to operate these devices can limit their adoption in some healthcare facilities.

What opportunities exist in the South Korea Medical Digital Imaging Devices Market?

Opportunities in the South Korea Medical Digital Imaging Devices Market include the integration of artificial intelligence in imaging processes and the development of portable imaging devices. These innovations can enhance diagnostic accuracy and expand access to imaging services in remote areas.

What trends are shaping the South Korea Medical Digital Imaging Devices Market?

Trends in the South Korea Medical Digital Imaging Devices Market include the shift towards digital imaging solutions and the increasing use of telemedicine. Additionally, there is a growing focus on patient-centered imaging technologies that improve the overall patient experience.

South Korea Medical Digital Imaging Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | X-ray Systems, MRI Machines, Ultrasound Devices, CT Scanners |

| Technology | Digital Radiography, Computed Tomography, Magnetic Resonance Imaging, Ultrasound Imaging |

| End User | Hospitals, Diagnostic Centers, Research Laboratories, Outpatient Clinics |

| Application | Cardiology, Oncology, Neurology, Orthopedics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Medical Digital Imaging Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at