444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea ecommerce logistics market represents one of the most sophisticated and rapidly evolving logistics ecosystems in Asia-Pacific. With the country’s exceptional digital infrastructure and tech-savvy consumer base, South Korea has emerged as a global leader in ecommerce logistics innovation. The market demonstrates remarkable growth momentum, driven by increasing online shopping penetration rates of 85% among internet users and the proliferation of mobile commerce platforms.

Market dynamics in South Korea are characterized by intense competition among domestic and international logistics providers, with companies investing heavily in automation, artificial intelligence, and last-mile delivery solutions. The market benefits from the country’s compact geography, advanced transportation infrastructure, and government support for digital transformation initiatives. Same-day delivery services have become increasingly prevalent, with major cities achieving delivery success rates exceeding 92% within promised timeframes.

Consumer expectations continue to drive innovation in the sector, with demands for faster delivery times, real-time tracking capabilities, and sustainable packaging solutions. The market has witnessed significant adoption of drone delivery trials, autonomous delivery vehicles, and smart locker systems, positioning South Korea at the forefront of logistics technology advancement.

The South Korea ecommerce logistics market refers to the comprehensive ecosystem of services, technologies, and infrastructure that facilitate the storage, handling, transportation, and delivery of goods purchased through online retail channels within South Korea. This market encompasses warehousing operations, inventory management systems, order fulfillment services, transportation networks, and last-mile delivery solutions specifically designed to support electronic commerce activities.

Key components of this market include automated fulfillment centers, cross-docking facilities, urban distribution hubs, delivery networks, reverse logistics systems, and technology platforms that integrate various logistics functions. The market serves multiple stakeholders including online retailers, marketplace platforms, logistics service providers, technology vendors, and end consumers, creating a complex but highly efficient supply chain ecosystem.

South Korea’s ecommerce logistics market stands as a testament to the country’s technological prowess and consumer-centric approach to digital commerce. The market has experienced unprecedented growth, fueled by changing consumer behaviors, urbanization trends, and the government’s commitment to digital innovation. Mobile commerce transactions now account for approximately 73% of total ecommerce volume, driving demand for flexible and responsive logistics solutions.

Key market drivers include the widespread adoption of smartphones, increasing consumer preference for convenience, and the rise of social commerce platforms. The market has responded with innovative solutions such as micro-fulfillment centers, predictive analytics for demand forecasting, and integrated omnichannel logistics platforms. Sustainability initiatives have gained prominence, with companies implementing eco-friendly packaging solutions and optimizing delivery routes to reduce carbon emissions.

Competitive landscape features both established logistics giants and emerging technology-driven startups, creating a dynamic environment that fosters continuous innovation. The market’s maturity is evidenced by sophisticated customer service standards, with average delivery times in major metropolitan areas reaching 24-48 hours for standard deliveries.

Strategic insights reveal several critical trends shaping the South Korea ecommerce logistics market:

Digital transformation serves as the primary catalyst driving the South Korea ecommerce logistics market forward. The country’s exceptional internet penetration rate and smartphone adoption have created an ideal environment for ecommerce growth, directly translating into increased demand for sophisticated logistics services. Consumer behavior shifts toward online shopping have accelerated, particularly following global events that emphasized the importance of contactless commerce.

Government initiatives supporting digital innovation and smart city development have provided substantial momentum to the market. Investment in 5G infrastructure, IoT deployment, and smart logistics systems has enabled logistics providers to implement cutting-edge solutions. The Korean New Deal program’s focus on digital transformation has created favorable conditions for logistics technology adoption and innovation.

Urbanization trends and changing lifestyle patterns have increased consumer expectations for convenience and speed. The concentration of population in major metropolitan areas has created opportunities for efficient last-mile delivery networks while simultaneously presenting challenges that drive innovation in urban logistics solutions.

Cross-border ecommerce growth has emerged as a significant driver, with South Korean consumers increasingly purchasing from international retailers and domestic brands expanding globally. This trend has necessitated the development of specialized international logistics capabilities and customs clearance solutions.

Infrastructure limitations in certain regions pose challenges to uniform market development across South Korea. While major cities benefit from advanced logistics infrastructure, rural and remote areas may experience service gaps that limit market penetration and growth potential.

Labor shortages in the logistics sector have become increasingly problematic, particularly for last-mile delivery services. The physically demanding nature of logistics work, combined with South Korea’s aging population and changing employment preferences, has created recruitment and retention challenges for logistics providers.

Regulatory complexities surrounding data privacy, cross-border trade, and urban delivery restrictions can impede operational efficiency and increase compliance costs. Evolving regulations regarding drone deliveries, autonomous vehicles, and data handling require continuous adaptation and investment from market participants.

Cost pressures from consumer expectations for free or low-cost delivery services create margin challenges for logistics providers. The need to balance service quality with cost efficiency requires significant investment in technology and operational optimization, which may strain smaller market participants.

Emerging technologies present substantial opportunities for market expansion and differentiation. The integration of artificial intelligence, machine learning, and robotics into logistics operations offers potential for significant efficiency gains and service improvements. Autonomous delivery systems and drone technology represent frontier opportunities that could revolutionize last-mile delivery.

Sustainability initiatives create opportunities for companies to differentiate themselves while addressing growing environmental concerns. The development of electric delivery vehicles, sustainable packaging solutions, and carbon-neutral delivery options can attract environmentally conscious consumers and corporate clients.

Rural market penetration offers untapped potential for logistics providers willing to invest in infrastructure and innovative delivery solutions. The development of hub-and-spoke models, mobile fulfillment units, and partnership networks can extend service reach to underserved areas.

B2B ecommerce growth represents a significant opportunity as businesses increasingly adopt digital procurement processes. The development of specialized B2B logistics solutions, including bulk handling, industrial packaging, and supply chain integration services, can capture this expanding market segment.

Competitive intensity within the South Korea ecommerce logistics market continues to drive innovation and service improvements. Market participants are engaged in continuous technology upgrades, service expansion, and strategic partnerships to maintain competitive advantages. The dynamic nature of consumer preferences requires logistics providers to remain agile and responsive to changing demands.

Technology adoption cycles significantly influence market dynamics, with early adopters of new technologies often gaining temporary competitive advantages. The rapid pace of technological advancement requires substantial and ongoing investment in systems, training, and infrastructure upgrades.

Seasonal fluctuations create both challenges and opportunities within the market. Peak shopping periods, such as major sales events and holiday seasons, require flexible capacity management and surge pricing strategies. Companies that successfully manage these fluctuations often achieve capacity utilization rates exceeding 95% during peak periods.

Integration trends are reshaping market structure as companies seek to control more aspects of the logistics value chain. Vertical integration strategies and strategic acquisitions are becoming more common as market participants aim to improve service quality and cost efficiency.

Comprehensive market analysis for the South Korea ecommerce logistics market employs a multi-faceted research approach combining primary and secondary research methodologies. Primary research includes structured interviews with industry executives, logistics managers, technology providers, and key stakeholders across the value chain to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and regulatory documents to establish market context and validate primary findings. Data triangulation methods ensure accuracy and reliability of market insights by cross-referencing multiple information sources.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators. Qualitative assessment provides deeper understanding of market dynamics, competitive strategies, and emerging trends that may not be captured through numerical data alone.

Market segmentation analysis examines various market dimensions including service types, technology categories, end-user segments, and geographic regions to provide comprehensive market understanding and identify specific growth opportunities.

Seoul Metropolitan Area dominates the South Korea ecommerce logistics market, accounting for approximately 45% of total logistics activity due to its high population density and concentration of ecommerce businesses. The region benefits from advanced infrastructure, including multiple fulfillment centers, sophisticated transportation networks, and extensive last-mile delivery capabilities.

Busan and surrounding regions represent the second-largest market segment, driven by the city’s role as a major port and logistics hub. The area’s strategic location facilitates both domestic distribution and international trade, making it crucial for cross-border ecommerce logistics operations.

Incheon and Gyeonggi Province have emerged as significant logistics centers, benefiting from proximity to Incheon International Airport and the development of specialized logistics parks. The region serves as a gateway for international ecommerce shipments and houses numerous fulfillment centers serving the greater Seoul area.

Regional cities including Daegu, Daejeon, and Gwangju are experiencing growing ecommerce logistics activity as consumer adoption increases and logistics providers expand their network coverage. These markets present opportunities for growth but require tailored strategies to address unique local characteristics and infrastructure limitations.

Market leadership in South Korea’s ecommerce logistics sector is characterized by intense competition among both domestic and international players. Major market participants include:

Competitive strategies focus on technology differentiation, service quality improvements, and strategic partnerships. Companies are investing heavily in automation, data analytics, and customer experience enhancements to maintain market position and capture growth opportunities.

By Service Type:

By Technology:

By End User:

Fashion and Apparel logistics represent a significant segment within the South Korea ecommerce logistics market, characterized by high return rates and seasonal demand fluctuations. Specialized handling requirements for clothing items, including size variations and quality control, necessitate sophisticated warehouse management systems and flexible return processing capabilities.

Electronics and Consumer Goods logistics require specialized handling procedures due to product fragility and high value. Security measures and insurance considerations are paramount, while the need for technical support and warranty services creates additional logistics complexity.

Food and Beverage ecommerce logistics have experienced rapid growth, driven by changing consumer preferences and convenience demands. Cold chain logistics capabilities and time-sensitive delivery requirements have become critical success factors, with companies achieving 98% on-time delivery rates for perishable goods.

Beauty and Personal Care products represent a high-growth segment with specific packaging and handling requirements. The popularity of K-beauty products in international markets has created opportunities for specialized cross-border logistics services.

Ecommerce Retailers benefit from access to sophisticated logistics infrastructure without significant capital investment. Scalability advantages allow retailers to expand their operations rapidly while maintaining service quality. Advanced analytics and reporting capabilities provide valuable insights into customer behavior and operational efficiency.

Consumers enjoy enhanced convenience through flexible delivery options, real-time tracking capabilities, and improved service reliability. Cost savings result from efficient logistics operations that enable competitive pricing and often free delivery services.

Logistics Providers gain access to growing market opportunities and can leverage economies of scale to improve profitability. Technology investments in the ecommerce logistics sector often yield benefits across other business segments, creating synergistic value.

Technology Vendors find substantial opportunities to deploy innovative solutions and establish long-term partnerships with logistics providers. The rapid pace of technological advancement creates continuous demand for system upgrades and new capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hyperlocal Delivery Networks are emerging as a key trend, with companies establishing micro-fulfillment centers and local distribution points to enable ultra-fast delivery services. This trend is driven by consumer demand for immediate gratification and the competitive advantage of speed in ecommerce.

Sustainable Logistics Practices are gaining momentum as environmental consciousness increases among consumers and businesses. Electric delivery vehicles, biodegradable packaging materials, and carbon-neutral delivery options are becoming standard offerings rather than premium services.

AI-Powered Optimization is revolutionizing logistics operations through predictive analytics, demand forecasting, and route optimization. Machine learning algorithms are being deployed to improve inventory management, reduce delivery times, and enhance customer satisfaction.

Omnichannel Integration is becoming essential as retailers seek to provide seamless customer experiences across online and offline channels. Click-and-collect services, in-store returns for online purchases, and unified inventory management are driving logistics complexity and innovation.

Technology Partnerships between logistics providers and technology companies are accelerating innovation in the South Korea ecommerce logistics market. Recent collaborations have focused on developing autonomous delivery systems, AI-powered warehouse management, and blockchain-based supply chain transparency solutions.

Infrastructure Investments by major logistics companies have expanded capacity and capabilities across the country. MarkWide Research analysis indicates that automated fulfillment center development has increased by 35% over the past two years, reflecting strong market confidence and growth expectations.

Regulatory Developments have created new opportunities and challenges for market participants. Recent policy changes regarding drone delivery testing, data privacy requirements, and cross-border trade facilitation are shaping operational strategies and investment priorities.

Market Consolidation activities, including mergers, acquisitions, and strategic partnerships, are reshaping the competitive landscape. These developments aim to create synergies, expand service capabilities, and achieve economies of scale in an increasingly competitive market environment.

Investment in Technology remains critical for logistics providers seeking to maintain competitive advantages in the South Korea ecommerce logistics market. Automation technologies, artificial intelligence, and data analytics capabilities should be prioritized to improve operational efficiency and service quality.

Strategic Partnerships with ecommerce platforms, technology providers, and international logistics companies can create valuable synergies and expand market reach. Collaboration strategies should focus on complementary capabilities and shared resources to achieve mutual benefits.

Sustainability Initiatives should be integrated into core business strategies rather than treated as optional add-ons. Environmental considerations are becoming increasingly important to consumers and corporate clients, creating competitive advantages for early adopters of green logistics practices.

Talent Development programs are essential to address labor shortages and build capabilities for future growth. Training initiatives should focus on technology skills, customer service excellence, and operational efficiency to support market expansion objectives.

Market evolution in South Korea’s ecommerce logistics sector is expected to accelerate, driven by continued technological advancement and changing consumer expectations. Growth projections indicate sustained expansion with increasing adoption of advanced logistics technologies and service innovations.

Emerging technologies including autonomous delivery vehicles, drone logistics, and advanced robotics are expected to transition from pilot programs to commercial deployment within the next few years. MWR projections suggest that automation adoption rates could reach 80% among major logistics facilities by the end of the decade.

International expansion opportunities are expected to grow as South Korean ecommerce brands gain global recognition and international retailers seek to enter the Korean market. Cross-border logistics capabilities will become increasingly important for market participants seeking to capitalize on these opportunities.

Sustainability requirements are anticipated to become more stringent, driving innovation in eco-friendly logistics solutions and creating competitive advantages for companies that proactively address environmental concerns. The integration of circular economy principles into logistics operations is expected to gain momentum.

The South Korea ecommerce logistics market represents a dynamic and rapidly evolving sector that exemplifies the country’s leadership in digital innovation and consumer-centric service delivery. With robust growth fundamentals, advanced technological infrastructure, and strong government support, the market is well-positioned for continued expansion and innovation.

Key success factors for market participants include strategic technology investments, sustainable business practices, and the ability to adapt quickly to changing consumer preferences and market conditions. The integration of emerging technologies, development of sustainable logistics solutions, and expansion of service capabilities will determine competitive positioning in this evolving market landscape.

Future opportunities abound for companies that can successfully navigate the challenges of labor shortages, regulatory complexity, and intense competition while capitalizing on trends toward automation, sustainability, and international expansion. The market’s continued evolution promises exciting developments in logistics innovation and service excellence, reinforcing South Korea’s position as a global leader in ecommerce logistics sophistication.

What is Ecommerce Logistics?

Ecommerce logistics refers to the process of managing the flow of goods from the point of origin to the end consumer in the online retail space. This includes warehousing, inventory management, order fulfillment, and shipping, all tailored to meet the demands of online shoppers.

What are the key players in the South Korea Ecommerce Logistics Market?

Key players in the South Korea Ecommerce Logistics Market include CJ Logistics, Hanjin Transportation, and Lotte Global Logistics, among others. These companies provide a range of services from last-mile delivery to warehousing solutions.

What are the main drivers of growth in the South Korea Ecommerce Logistics Market?

The main drivers of growth in the South Korea Ecommerce Logistics Market include the increasing penetration of smartphones, the rise of online shopping, and the demand for faster delivery services. Additionally, advancements in technology and logistics infrastructure are enhancing operational efficiency.

What challenges does the South Korea Ecommerce Logistics Market face?

Challenges in the South Korea Ecommerce Logistics Market include high competition among logistics providers, rising operational costs, and the complexity of managing returns. Additionally, fluctuating consumer demands can strain logistics capabilities.

What opportunities exist in the South Korea Ecommerce Logistics Market?

Opportunities in the South Korea Ecommerce Logistics Market include the growth of cross-border ecommerce, the adoption of automation and AI in logistics operations, and the increasing focus on sustainable delivery solutions. These trends can help companies enhance their service offerings.

What trends are shaping the South Korea Ecommerce Logistics Market?

Trends shaping the South Korea Ecommerce Logistics Market include the rise of same-day delivery services, the integration of technology such as drones and robotics, and the growing emphasis on sustainability in logistics practices. These trends are transforming how logistics companies operate.

South Korea Ecommerce Logistics Market

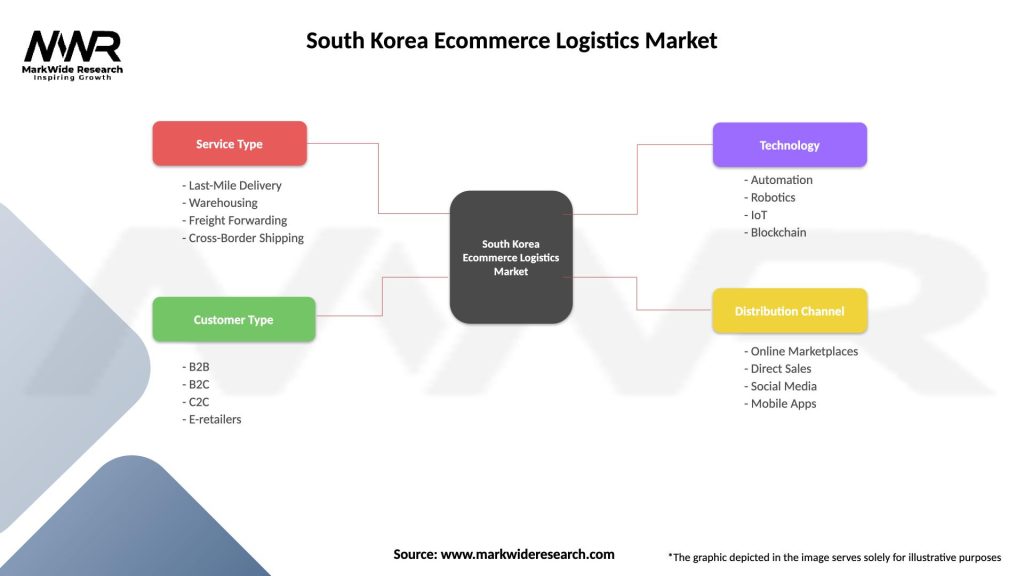

| Segmentation Details | Description |

|---|---|

| Service Type | Last-Mile Delivery, Warehousing, Freight Forwarding, Cross-Border Shipping |

| Customer Type | B2B, B2C, C2C, E-retailers |

| Technology | Automation, Robotics, IoT, Blockchain |

| Distribution Channel | Online Marketplaces, Direct Sales, Social Media, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Ecommerce Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at