444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea cross-border e-commerce logistics market represents a dynamic and rapidly evolving sector that has become integral to the nation’s digital economy transformation. South Korea’s strategic position as a technological powerhouse and gateway to Asia has positioned it as a critical hub for international e-commerce operations. The market encompasses comprehensive logistics solutions including warehousing, fulfillment, last-mile delivery, customs clearance, and reverse logistics services specifically designed for cross-border online retail transactions.

Market dynamics indicate robust growth driven by increasing consumer demand for international products, government digitalization initiatives, and the expansion of Korean brands globally. The sector has experienced accelerated development following the COVID-19 pandemic, with cross-border e-commerce adoption rates reaching 78% among Korean consumers. Technological integration including artificial intelligence, blockchain, and IoT solutions has enhanced operational efficiency and transparency across the logistics value chain.

Key market characteristics include sophisticated infrastructure development, strategic partnerships between logistics providers and e-commerce platforms, and innovative last-mile delivery solutions. The market benefits from South Korea’s advanced telecommunications infrastructure, high internet penetration rates exceeding 95%, and strong consumer confidence in digital payment systems. Regulatory support through streamlined customs procedures and trade facilitation measures has further accelerated market expansion.

The South Korea cross-border e-commerce logistics market refers to the comprehensive ecosystem of supply chain services, infrastructure, and technological solutions that facilitate the movement, storage, and delivery of goods purchased through international online retail platforms. This market encompasses all logistics activities from the point of origin in foreign countries to final delivery to Korean consumers, as well as outbound logistics supporting Korean businesses selling internationally.

Cross-border e-commerce logistics involves complex coordination of multiple stakeholders including international carriers, customs authorities, local delivery partners, warehousing providers, and technology platforms. The market addresses unique challenges such as customs clearance procedures, international shipping regulations, currency conversion, multilingual customer service, and reverse logistics for returns across international borders.

Market scope includes both business-to-consumer (B2C) and business-to-business (B2B) cross-border transactions, with specialized services for different product categories, shipping methods, and delivery timeframes. The sector has evolved to include value-added services such as product localization, quality inspection, repackaging, and customer support in multiple languages to enhance the cross-border shopping experience.

South Korea’s cross-border e-commerce logistics market has emerged as a cornerstone of the nation’s digital trade infrastructure, demonstrating exceptional resilience and growth potential. The market has experienced transformative expansion driven by changing consumer preferences, technological advancement, and supportive government policies. Consumer adoption of cross-border online shopping has reached unprecedented levels, with 85% of Korean consumers having made at least one international online purchase in the past year.

Market evolution has been characterized by the emergence of specialized logistics providers, integration of advanced technologies, and development of comprehensive service offerings. Major logistics companies have invested significantly in automation, data analytics, and customer experience enhancement to capture growing market opportunities. Strategic partnerships between Korean logistics providers and international e-commerce platforms have created synergistic value propositions for businesses and consumers alike.

Competitive landscape features both established logistics giants and innovative startups, creating a dynamic environment that fosters innovation and service improvement. The market has attracted substantial investment in infrastructure development, technology integration, and human capital development. Future prospects remain highly positive, supported by continued digitalization trends, expanding international trade relationships, and ongoing infrastructure investments.

Strategic market insights reveal several critical trends shaping the South Korea cross-border e-commerce logistics landscape. The market demonstrates strong fundamentals supported by robust consumer demand, technological innovation, and favorable regulatory environment.

Primary market drivers propelling the South Korea cross-border e-commerce logistics sector encompass technological, economic, and social factors that create sustained growth momentum. These drivers reflect fundamental shifts in consumer behavior, business practices, and technological capabilities.

Digital transformation serves as a fundamental catalyst, with Korean consumers demonstrating high digital literacy and comfort with online shopping platforms. The proliferation of smartphones and high-speed internet connectivity has created an always-connected consumer base that expects seamless cross-border shopping experiences. Government initiatives supporting digital trade and e-commerce development have created favorable regulatory frameworks and infrastructure investments.

Consumer demand diversification drives market expansion as Korean consumers seek unique products, competitive pricing, and broader selection available through international e-commerce platforms. Brand globalization efforts by Korean companies, particularly in beauty, fashion, and technology sectors, create outbound logistics opportunities. The rise of social commerce and influencer marketing has further accelerated cross-border shopping adoption.

Technological advancement in logistics automation, tracking systems, and customer communication platforms has reduced operational costs and improved service quality. Strategic location advantages position South Korea as an optimal hub for serving Northeast Asian markets, attracting international logistics investments and partnerships.

Market restraints present challenges that logistics providers and stakeholders must navigate to maintain growth momentum. These constraints reflect regulatory complexities, operational challenges, and competitive pressures inherent in cross-border commerce.

Regulatory complexity remains a significant constraint, with evolving customs regulations, tax policies, and trade restrictions creating operational uncertainties. Compliance requirements across different jurisdictions demand substantial resources and expertise, particularly for smaller logistics providers. Currency fluctuations and international trade tensions can impact cost structures and service reliability.

Infrastructure limitations in certain regions and during peak seasons can create capacity constraints and service disruptions. High operational costs associated with international shipping, customs clearance, and last-mile delivery can impact profitability and pricing competitiveness. The complexity of managing returns and reverse logistics across international borders presents ongoing operational challenges.

Competitive pressure from global logistics giants and emerging technology platforms creates margin compression and requires continuous investment in service enhancement. Cybersecurity concerns and data protection requirements demand ongoing investment in security infrastructure and compliance systems. Labor shortages in key operational areas, particularly during peak shopping seasons, can impact service quality and capacity.

Significant market opportunities emerge from technological innovation, market expansion, and evolving consumer preferences. These opportunities represent potential areas for growth, differentiation, and value creation within the cross-border e-commerce logistics ecosystem.

Emerging market expansion presents substantial opportunities as Korean logistics providers leverage their technological expertise and operational excellence to serve growing e-commerce markets across Asia. Technology integration opportunities include blockchain for supply chain transparency, AI for predictive analytics, and IoT for real-time tracking and monitoring. The development of autonomous delivery systems and drone technology offers potential for revolutionary service improvements.

Sustainability initiatives create opportunities for differentiation through carbon-neutral delivery options, eco-friendly packaging solutions, and circular economy logistics models. Value-added services including product customization, quality assurance, and localization services represent high-margin growth opportunities. The integration of social commerce and live streaming platforms creates new channels for cross-border retail and associated logistics services.

Strategic partnerships with international e-commerce platforms, payment providers, and technology companies can create synergistic value propositions. Niche market specialization in specific product categories, customer segments, or geographic regions offers opportunities for focused growth and premium positioning. The development of integrated omnichannel solutions connecting online and offline retail experiences presents innovative service opportunities.

Market dynamics within the South Korea cross-border e-commerce logistics sector reflect complex interactions between supply and demand factors, competitive forces, and external influences. These dynamics create both challenges and opportunities that shape strategic decision-making across the industry.

Supply-side dynamics include capacity expansion by major logistics providers, technology investments, and service innovation initiatives. The entry of new players, including technology startups and international logistics companies, has intensified competition while expanding service capabilities. Demand-side factors encompass growing consumer expectations for faster delivery, transparent tracking, and competitive pricing.

Technological disruption continues to reshape operational models, with automation reducing labor dependency while improving accuracy and efficiency. MarkWide Research analysis indicates that companies investing in advanced technology solutions have achieved 35% improvement in operational efficiency compared to traditional approaches. Regulatory evolution including trade facilitation measures and digital customs procedures has streamlined cross-border processes.

Seasonal fluctuations create dynamic capacity requirements, with peak shopping periods generating significant volume spikes. Economic factors including exchange rates, fuel costs, and labor expenses impact operational costs and pricing strategies. The increasing importance of sustainability considerations influences service design and operational practices across the industry.

Comprehensive research methodology employed for analyzing the South Korea cross-border e-commerce logistics market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of insights. The methodology combines quantitative analysis with qualitative assessment to provide holistic market understanding.

Primary research includes structured interviews with industry executives, logistics providers, e-commerce platforms, and technology vendors. Survey methodologies capture consumer preferences, behavior patterns, and satisfaction levels across different demographic segments. Focus groups and expert panels provide qualitative insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements. Market modeling utilizes statistical techniques to project growth trends, market share evolution, and competitive dynamics. Cross-validation processes ensure consistency and accuracy across different data sources and analytical approaches.

Data triangulation methods verify findings through multiple independent sources and analytical perspectives. Continuous monitoring of market developments, regulatory changes, and competitive activities ensures research currency and relevance. Quality assurance processes include peer review, expert validation, and methodological consistency checks throughout the research process.

Regional analysis of the South Korea cross-border e-commerce logistics market reveals distinct patterns of development, infrastructure capabilities, and market opportunities across different geographic areas within the country and key international corridors.

Seoul Metropolitan Area dominates the market with approximately 45% market share, benefiting from concentrated consumer population, advanced infrastructure, and proximity to major international airports and ports. The region serves as the primary hub for logistics operations, technology development, and corporate headquarters. Busan and surrounding areas represent the second-largest market segment with 22% market share, leveraging the city’s position as a major port and logistics gateway.

Incheon International Airport corridor has emerged as a critical logistics zone, with specialized facilities for air cargo handling and express delivery services. The area benefits from government investment in logistics infrastructure and free trade zone designations. Regional distribution centers in secondary cities including Daegu, Gwangju, and Daejeon serve local markets while providing cost-effective alternatives to metropolitan area operations.

Cross-border corridors with China, Japan, and Southeast Asia represent key growth areas, with specialized logistics services designed for specific trade routes and product categories. MWR data indicates that Northeast Asian trade corridors account for 68% of cross-border logistics volume, while emerging markets in Southeast Asia and beyond represent rapidly growing segments with significant future potential.

Competitive landscape within the South Korea cross-border e-commerce logistics market features a diverse mix of established logistics giants, specialized service providers, and innovative technology companies. The market structure reflects ongoing consolidation trends alongside continued innovation and service differentiation.

Competitive strategies focus on technology integration, service innovation, and strategic partnerships to differentiate offerings and capture market share. Market consolidation through mergers and acquisitions has created larger, more capable service providers while fostering innovation through competitive pressure.

Market segmentation analysis reveals distinct categories within the South Korea cross-border e-commerce logistics market, each characterized by specific requirements, growth patterns, and competitive dynamics.

By Service Type:

By End-User Industry:

By Delivery Mode:

Category-wise analysis provides detailed insights into specific segments within the South Korea cross-border e-commerce logistics market, highlighting unique characteristics, growth drivers, and competitive dynamics.

Fashion and Apparel Logistics represents the largest segment, driven by Korean consumers’ strong preference for international fashion brands and the global popularity of K-fashion. This category requires specialized handling for size variations, seasonal inventory management, and efficient returns processing. Technology integration including virtual fitting solutions and AI-powered size recommendations has enhanced customer satisfaction and reduced return rates.

Electronics and Technology Logistics demands high-security handling, insurance coverage, and specialized packaging to protect valuable products during international transit. The segment benefits from strong consumer demand for international electronics brands and Korean technology exports. Quality assurance and warranty service coordination represent critical value-added services.

Beauty and Personal Care Logistics has experienced exceptional growth driven by the global K-beauty trend and Korean consumers’ interest in international cosmetics brands. Temperature-controlled storage and handling requirements create specialized logistics needs. Regulatory compliance for cosmetics imports and exports requires specialized expertise and documentation management.

Food and Beverage Logistics represents an emerging high-growth segment with complex cold chain requirements and strict regulatory compliance needs. The category benefits from growing interest in international specialty foods and Korean food exports.

Industry participants and stakeholders across the South Korea cross-border e-commerce logistics ecosystem realize significant benefits through market participation, technological advancement, and strategic collaboration.

For Logistics Service Providers:

For E-commerce Merchants:

For Consumers:

SWOT Analysis provides comprehensive assessment of the South Korea cross-border e-commerce logistics market’s internal capabilities and external environment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the South Korea cross-border e-commerce logistics landscape reflect technological advancement, changing consumer expectations, and evolving business models.

Automation and Robotics Integration has accelerated across warehousing and sorting operations, with major logistics providers achieving 50% reduction in processing times through automated systems. Artificial Intelligence applications in demand forecasting, route optimization, and customer service have enhanced operational efficiency and service quality.

Sustainability Initiatives are gaining prominence, with logistics providers implementing carbon-neutral delivery options and eco-friendly packaging solutions. Consumer awareness of environmental impact is driving demand for sustainable logistics practices. Circular economy principles are being integrated into reverse logistics and packaging reuse programs.

Real-time Visibility and tracking capabilities have become standard expectations, with advanced IoT sensors and blockchain technology providing end-to-end supply chain transparency. Predictive analytics enable proactive issue resolution and improved delivery reliability.

Omnichannel Integration connects online and offline retail experiences, with logistics providers supporting click-and-collect services, in-store returns for online purchases, and flexible delivery options. Social commerce integration enables direct purchasing through social media platforms with seamless logistics fulfillment.

Recent industry developments highlight the dynamic nature of the South Korea cross-border e-commerce logistics market, with significant investments, partnerships, and innovations shaping the competitive landscape.

Infrastructure Investments include major expansions of automated sorting facilities, cold chain capabilities, and last-mile delivery networks. Technology partnerships between logistics providers and tech companies have accelerated digital transformation initiatives. Strategic acquisitions have consolidated market capabilities and expanded service offerings.

Regulatory developments include streamlined customs procedures, digital documentation systems, and trade facilitation measures supporting cross-border commerce growth. Government initiatives promoting digital trade and logistics innovation have created favorable operating environments.

International expansion by Korean logistics providers has accelerated, with new facilities and partnerships established across Southeast Asia and other emerging markets. Service innovations including same-day international delivery pilots and drone delivery trials demonstrate ongoing technological advancement.

Sustainability commitments by major industry players include carbon neutrality targets, renewable energy adoption, and circular economy initiatives. Workforce development programs address skills gaps in technology and logistics management.

Strategic recommendations for stakeholders in the South Korea cross-border e-commerce logistics market focus on sustainable growth, competitive positioning, and value creation opportunities.

For Logistics Service Providers: MarkWide Research recommends prioritizing technology investment, particularly in automation and AI capabilities, to maintain competitive advantages. Strategic partnerships with e-commerce platforms and technology providers can create synergistic value propositions. Sustainability initiatives should be integrated into core business strategies to meet evolving customer expectations.

For E-commerce Merchants: Diversification of logistics partnerships can reduce dependency risks and improve service reliability. Investment in customer experience through enhanced tracking, communication, and returns management will drive customer loyalty. Data analytics capabilities should be developed to optimize inventory management and demand forecasting.

For Technology Providers: Focus on developing integrated solutions that address multiple logistics challenges simultaneously. Scalability and flexibility should be prioritized to accommodate varying customer needs and growth trajectories. Security and compliance features are essential for cross-border applications.

For Investors: Opportunities exist in specialized logistics technology, sustainability solutions, and regional expansion initiatives. Due diligence should emphasize technology capabilities, regulatory compliance, and management expertise.

Future outlook for the South Korea cross-border e-commerce logistics market remains highly positive, supported by continued digitalization trends, technological advancement, and expanding international trade relationships. The market is positioned for sustained growth driven by fundamental shifts in consumer behavior and business practices.

Technology evolution will continue reshaping operational models, with autonomous delivery systems, advanced AI applications, and blockchain integration becoming mainstream. Sustainability requirements will drive innovation in packaging, transportation, and energy usage, creating new competitive differentiators. The market is expected to achieve compound annual growth rates exceeding 12% over the next five years.

Regional expansion opportunities will accelerate as Korean logistics providers leverage their technological expertise and operational excellence to serve growing Asian markets. Service innovation will focus on ultra-fast delivery options, personalized customer experiences, and integrated omnichannel solutions.

Market consolidation is expected to continue, creating larger, more capable service providers while fostering innovation through competitive pressure. Regulatory evolution will further streamline cross-border processes and reduce operational complexity. The integration of emerging technologies including 5G, IoT, and quantum computing will create new possibilities for logistics optimization and customer service enhancement.

The South Korea cross-border e-commerce logistics market represents a dynamic and rapidly evolving sector that has become fundamental to the nation’s digital economy infrastructure. Market fundamentals remain strong, supported by advanced technological capabilities, favorable regulatory environment, and robust consumer demand for international products and services.

Strategic positioning as a Northeast Asian logistics hub, combined with world-class infrastructure and technology leadership, provides South Korean logistics providers with significant competitive advantages. Innovation momentum in automation, AI, and sustainability solutions continues to drive operational efficiency improvements and service differentiation opportunities.

Future growth prospects are underpinned by expanding regional markets, evolving consumer expectations, and ongoing digital transformation initiatives. The market’s ability to adapt to changing conditions, integrate new technologies, and develop innovative service offerings positions it for continued success in the global cross-border e-commerce logistics landscape. Stakeholder collaboration across the ecosystem will be essential for realizing the full potential of this dynamic and strategically important market segment.

What is Cross-Border E-Commerce Logistics?

Cross-Border E-Commerce Logistics refers to the processes and services involved in the transportation and delivery of goods purchased online from one country to another. This includes warehousing, customs clearance, and last-mile delivery, which are essential for facilitating international online shopping.

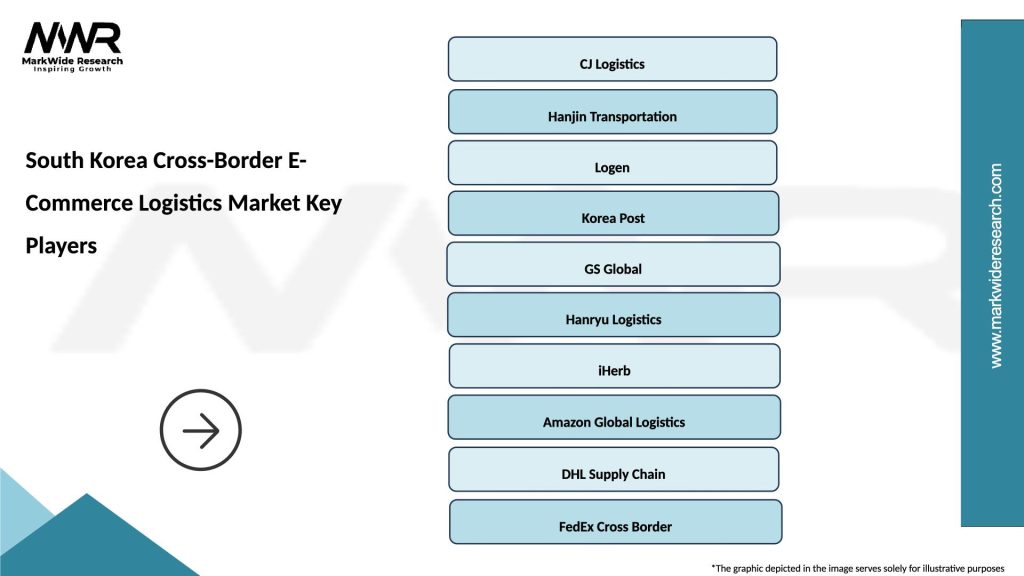

What are the key players in the South Korea Cross-Border E-Commerce Logistics Market?

Key players in the South Korea Cross-Border E-Commerce Logistics Market include CJ Logistics, Hanjin Transportation, and Logen, among others. These companies provide various logistics solutions tailored to the needs of e-commerce businesses operating across borders.

What are the growth factors driving the South Korea Cross-Border E-Commerce Logistics Market?

The growth of the South Korea Cross-Border E-Commerce Logistics Market is driven by increasing online shopping trends, the rise of mobile commerce, and the demand for faster delivery services. Additionally, improvements in logistics technology and infrastructure are enhancing operational efficiency.

What challenges does the South Korea Cross-Border E-Commerce Logistics Market face?

Challenges in the South Korea Cross-Border E-Commerce Logistics Market include complex customs regulations, varying international shipping standards, and potential delays in delivery. These factors can complicate the logistics process and impact customer satisfaction.

What opportunities exist in the South Korea Cross-Border E-Commerce Logistics Market?

Opportunities in the South Korea Cross-Border E-Commerce Logistics Market include the expansion of e-commerce platforms, the integration of advanced technologies like AI and blockchain, and the growing demand for sustainable logistics solutions. These trends can lead to innovative service offerings and improved customer experiences.

What trends are shaping the South Korea Cross-Border E-Commerce Logistics Market?

Trends shaping the South Korea Cross-Border E-Commerce Logistics Market include the increasing use of automation in warehousing, the rise of omnichannel logistics strategies, and a focus on sustainability in shipping practices. These trends are influencing how logistics companies operate and meet consumer expectations.

South Korea Cross-Border E-Commerce Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Express Delivery, Standard Shipping, Freight Forwarding, Warehousing |

| Customer Type | B2B, B2C, C2C, E-retailers |

| Technology | Blockchain, IoT, AI, Cloud Computing |

| Distribution Channel | Online Platforms, Marketplaces, Direct Sales, Third-party Logistics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Cross-Border E-Commerce Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at