444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea commercial HVAC market represents a dynamic and rapidly evolving sector within the nation’s construction and building management industry. Commercial heating, ventilation, and air conditioning systems have become essential infrastructure components across South Korea’s diverse commercial landscape, spanning office buildings, retail centers, healthcare facilities, educational institutions, and industrial complexes. The market demonstrates robust growth potential driven by urbanization trends, stringent energy efficiency regulations, and increasing demand for smart building technologies.

South Korea’s commitment to sustainable development and carbon neutrality by 2050 has significantly influenced commercial HVAC adoption patterns. The market experiences substantial growth at a CAGR of 6.2%, reflecting the nation’s focus on modernizing its commercial infrastructure. Energy-efficient HVAC solutions dominate market preferences, with businesses increasingly prioritizing systems that offer superior performance while minimizing environmental impact.

Technological advancement serves as a primary catalyst for market expansion, with IoT-enabled systems, variable refrigerant flow technologies, and advanced building automation systems gaining significant traction. The market benefits from South Korea’s advanced manufacturing capabilities and strong emphasis on innovation, positioning the country as both a major consumer and producer of cutting-edge HVAC technologies.

The South Korea commercial HVAC market refers to the comprehensive ecosystem encompassing the design, manufacturing, installation, maintenance, and operation of heating, ventilation, and air conditioning systems specifically designed for commercial applications within South Korean territory. This market includes all HVAC equipment, components, services, and technologies deployed in non-residential buildings to maintain optimal indoor environmental conditions.

Commercial HVAC systems in South Korea encompass various technologies including central air conditioning units, heat pumps, ventilation systems, air handling units, chillers, boilers, and associated control systems. The market extends beyond equipment to include installation services, maintenance contracts, energy management solutions, and system upgrades that enhance operational efficiency and occupant comfort.

Market participants include equipment manufacturers, system integrators, installation contractors, maintenance service providers, and technology developers who collectively contribute to the commercial HVAC value chain. The market serves diverse commercial sectors including office complexes, shopping centers, hospitals, schools, hotels, restaurants, and manufacturing facilities throughout South Korea.

South Korea’s commercial HVAC market demonstrates exceptional growth momentum driven by rapid urbanization, stringent environmental regulations, and increasing adoption of smart building technologies. The market benefits from strong government support for energy-efficient solutions and the nation’s commitment to achieving carbon neutrality goals. Key market drivers include modernization of existing commercial infrastructure, expansion of the service sector, and growing awareness of indoor air quality importance.

Technology integration represents a defining characteristic of the South Korean market, with 72% of new commercial installations incorporating smart controls and IoT connectivity. The market shows strong preference for variable refrigerant flow systems, heat recovery technologies, and integrated building management platforms that optimize energy consumption while maintaining superior comfort levels.

Market segmentation reveals diverse applications across multiple commercial sectors, with office buildings and retail establishments representing the largest demand segments. The market experiences significant growth in healthcare and educational facility applications, driven by enhanced focus on indoor air quality and occupant health considerations. Regional distribution shows concentration in major metropolitan areas including Seoul, Busan, and Incheon, reflecting the country’s urban development patterns.

Strategic market analysis reveals several critical insights shaping the South Korea commercial HVAC landscape:

Government policy initiatives serve as primary market drivers, with South Korea’s Green New Deal and carbon neutrality commitments creating substantial demand for energy-efficient commercial HVAC solutions. Building energy codes mandate minimum efficiency standards, compelling building owners to invest in advanced HVAC technologies that meet or exceed regulatory requirements.

Urbanization trends continue driving market expansion as South Korea experiences ongoing commercial development in major metropolitan areas. The construction of new office buildings, shopping centers, and mixed-use developments creates consistent demand for modern HVAC systems. Economic growth in the service sector, particularly in retail, hospitality, and healthcare industries, generates additional market opportunities.

Technology advancement acts as a significant driver, with businesses increasingly seeking HVAC solutions that offer enhanced control, monitoring, and optimization capabilities. The integration of artificial intelligence, machine learning, and IoT technologies enables predictive maintenance, energy optimization, and improved occupant comfort, making advanced systems more attractive to commercial building operators.

Climate considerations unique to South Korea, including hot, humid summers and cold winters, necessitate versatile HVAC solutions capable of providing both heating and cooling efficiently. This climate profile drives demand for heat pump technologies and systems with superior seasonal performance characteristics.

High initial investment costs represent a significant market restraint, particularly for small and medium-sized commercial establishments. Advanced HVAC systems with smart technologies and high-efficiency ratings require substantial capital expenditure, which can deter adoption among cost-sensitive market segments. Installation complexity associated with modern systems often increases project costs and implementation timelines.

Skilled labor shortage poses challenges for market growth, as advanced HVAC systems require specialized installation, maintenance, and service expertise. The rapid evolution of technology creates ongoing training requirements, and the availability of qualified technicians can limit market expansion in certain regions or application segments.

Economic uncertainties and fluctuating construction activity can impact commercial HVAC demand, as building projects may be delayed or scaled back during economic downturns. Supply chain disruptions and component availability issues can affect system pricing and delivery schedules, potentially constraining market growth.

Regulatory complexity surrounding building codes, energy efficiency standards, and environmental regulations can create implementation challenges for market participants. Compliance requirements may vary across different commercial applications and building types, adding complexity to system design and installation processes.

Retrofit and modernization projects present substantial market opportunities as South Korea’s existing commercial building stock requires upgrades to meet current energy efficiency standards. Building owners increasingly recognize the value proposition of HVAC system upgrades in terms of energy savings, operational efficiency, and tenant satisfaction, creating a robust retrofit market segment.

Smart building integration offers significant growth potential as commercial properties seek to implement comprehensive building management systems. The convergence of HVAC, lighting, security, and other building systems creates opportunities for integrated solutions that optimize overall building performance and occupant experience.

Healthcare facility expansion driven by demographic changes and healthcare infrastructure development creates specialized HVAC opportunities. Healthcare applications require advanced air filtration, precise temperature and humidity control, and specialized ventilation systems, representing a high-value market segment with specific technical requirements.

Data center growth associated with South Korea’s digital transformation initiatives generates demand for specialized cooling solutions. The expansion of cloud computing, 5G networks, and digital services creates opportunities for precision cooling systems and energy-efficient data center HVAC solutions.

Market dynamics in South Korea’s commercial HVAC sector reflect the interplay between technological innovation, regulatory requirements, and evolving customer expectations. Competitive intensity drives continuous product development and service enhancement, with manufacturers focusing on energy efficiency, smart connectivity, and system reliability to differentiate their offerings.

Supply chain relationships play a crucial role in market dynamics, with successful companies developing strong partnerships with component suppliers, distributors, and installation contractors. The market demonstrates increasing vertical integration as companies seek to control quality and delivery throughout the value chain.

Customer behavior patterns show growing sophistication in HVAC system evaluation, with commercial building operators considering total cost of ownership, energy performance, and maintenance requirements in their purchasing decisions. Performance-based contracting models gain traction as customers seek guaranteed outcomes rather than just equipment purchases.

Technology adoption cycles accelerate as digital transformation initiatives drive demand for connected HVAC systems. The market experiences rapid evolution in control systems, monitoring capabilities, and predictive analytics, with adoption rates of smart HVAC systems reaching 58% in new commercial installations.

Comprehensive market research methodology combines primary and secondary research approaches to provide accurate insights into South Korea’s commercial HVAC market. Primary research includes structured interviews with industry executives, equipment manufacturers, system integrators, and end-users across various commercial sectors to gather firsthand market intelligence and trend insights.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market context and validate primary findings. Data triangulation ensures research accuracy by cross-referencing multiple information sources and applying analytical frameworks to identify consistent market patterns.

Market segmentation analysis employs statistical modeling techniques to quantify market opportunities across different application segments, technology categories, and regional markets. The methodology includes trend analysis, competitive benchmarking, and scenario modeling to project future market developments and growth trajectories.

Expert validation processes involve consultation with industry specialists and technical experts to verify research findings and ensure analytical conclusions reflect actual market conditions. The methodology incorporates feedback mechanisms to continuously refine research approaches and maintain analytical rigor throughout the study process.

Seoul metropolitan area dominates South Korea’s commercial HVAC market, accounting for approximately 45% of total market demand due to its concentration of office buildings, retail centers, and commercial developments. The capital region benefits from advanced infrastructure, high construction activity, and strong demand for premium HVAC solutions that meet stringent performance requirements.

Busan region represents the second-largest market segment, driven by port-related commercial activities, manufacturing facilities, and growing service sector establishments. The region shows particular strength in industrial HVAC applications and logistics facility cooling systems, reflecting its role as a major economic hub.

Incheon area demonstrates rapid market growth associated with airport expansion, free economic zone development, and international business facility construction. The region’s focus on modern commercial infrastructure creates demand for advanced HVAC systems with international standard performance capabilities.

Regional market distribution shows Gyeonggi Province capturing 22% market share, benefiting from suburban commercial development and industrial facility expansion. Other significant regional markets include Daegu, Gwangju, and Daejeon, each contributing to overall market growth through local commercial development initiatives and infrastructure modernization projects.

Market leadership in South Korea’s commercial HVAC sector features both international and domestic players competing across various technology segments and application areas. The competitive environment emphasizes innovation, energy efficiency, and comprehensive service capabilities as key differentiation factors.

Competitive strategies focus on technology innovation, local manufacturing capabilities, and comprehensive service networks. Companies invest heavily in research and development to create energy-efficient solutions that meet South Korea’s stringent environmental standards while providing superior performance and reliability.

By Product Type:

By Application:

By Technology:

Heat pump category demonstrates exceptional growth potential in South Korea’s commercial HVAC market, with adoption rates increasing by 15% annually due to their energy efficiency and versatility in the country’s diverse climate conditions. Air-source heat pumps particularly gain traction in medium-sized commercial applications, while ground-source systems find favor in larger installations seeking maximum efficiency.

Variable refrigerant flow systems represent a premium category with strong growth in office buildings and retail applications. These systems offer precise zone control, energy efficiency, and installation flexibility that appeals to modern commercial building operators. VRF technology adoption reaches 38% penetration in new commercial construction projects.

Smart HVAC category experiences rapid expansion as building operators seek enhanced control and optimization capabilities. Integration with building management systems, predictive maintenance features, and energy analytics drive category growth. Connected HVAC systems demonstrate superior performance in energy management and occupant satisfaction metrics.

Service category evolution reflects changing customer preferences toward comprehensive maintenance contracts and performance-based agreements. Predictive maintenance services using IoT sensors and data analytics gain popularity, offering improved system reliability and reduced operational costs for commercial building operators.

Building owners and operators benefit from advanced commercial HVAC systems through reduced energy costs, improved occupant comfort, and enhanced property values. Modern systems provide precise environmental control while minimizing operational expenses through intelligent optimization and predictive maintenance capabilities.

Tenants and occupants experience improved indoor air quality, consistent temperature control, and healthier work environments that enhance productivity and well-being. Advanced filtration systems and ventilation technologies create optimal indoor conditions that support occupant health and satisfaction.

HVAC manufacturers gain access to a growing market with strong demand for innovative, energy-efficient solutions. The market rewards companies that invest in research and development, offering opportunities for premium pricing and market leadership through technological advancement.

Service providers benefit from recurring revenue opportunities through maintenance contracts, system optimization services, and technology upgrades. The shift toward performance-based contracting creates stable, long-term business relationships with commercial building operators.

Environmental stakeholders benefit from reduced carbon emissions and improved energy efficiency as advanced HVAC systems contribute to South Korea’s sustainability goals. The market’s focus on green technologies supports broader environmental objectives while delivering economic benefits to participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trend transforms commercial HVAC operations through IoT connectivity, cloud-based monitoring, and artificial intelligence integration. Smart HVAC systems provide real-time performance data, predictive maintenance alerts, and automated optimization capabilities that enhance system efficiency and reduce operational costs.

Sustainability focus drives adoption of environmentally friendly refrigerants, energy recovery systems, and renewable energy integration. Commercial building operators increasingly prioritize HVAC solutions that support green building certifications and carbon reduction goals, with sustainable HVAC adoption growing at 12% annually.

Indoor air quality emphasis gains prominence following increased awareness of health impacts associated with indoor environments. Advanced filtration technologies, UV sterilization systems, and enhanced ventilation capabilities become standard requirements in commercial HVAC specifications.

Service model evolution shifts from traditional maintenance contracts toward comprehensive performance agreements that guarantee system efficiency and occupant comfort. Performance-based contracting represents 28% of commercial HVAC service agreements, reflecting changing customer preferences for outcome-based relationships.

Integration trend promotes convergence of HVAC systems with other building technologies including lighting, security, and fire safety systems. Unified building management platforms provide centralized control and optimization across all building systems, improving overall operational efficiency.

Technology advancement initiatives include development of next-generation heat pump technologies with improved cold-weather performance and enhanced efficiency ratings. Manufacturers invest heavily in research and development to create systems that meet South Korea’s demanding climate requirements while achieving superior energy performance.

Strategic partnerships between HVAC manufacturers and technology companies accelerate smart system development and market deployment. Collaborations focus on IoT platform integration, data analytics capabilities, and artificial intelligence applications that enhance system performance and user experience.

Regulatory developments include implementation of stricter energy efficiency standards for commercial buildings and enhanced requirements for indoor air quality management. Government initiatives promote adoption of high-efficiency HVAC systems through financial incentives and preferential treatment in public building projects.

Market consolidation activities involve strategic acquisitions and partnerships aimed at expanding technology capabilities and market reach. Companies seek to build comprehensive solution portfolios that address diverse commercial HVAC requirements while strengthening their competitive positions.

Infrastructure investments in service networks and technical training programs support market growth by ensuring adequate installation and maintenance capabilities. Industry participants recognize the importance of skilled workforce development in supporting advanced HVAC technology deployment.

MarkWide Research recommends that commercial HVAC stakeholders prioritize investment in smart technology capabilities and IoT integration to capitalize on growing demand for connected building systems. Companies should focus on developing comprehensive solution portfolios that address both equipment needs and ongoing service requirements.

Market participants should strengthen their service capabilities and technical expertise to support advanced HVAC technologies effectively. Investment in technician training programs and service infrastructure will be critical for capturing growth opportunities in the evolving market landscape.

Strategic partnerships with technology companies and building management system providers offer pathways to enhanced market positioning and expanded solution capabilities. Collaboration enables companies to leverage complementary strengths and accelerate innovation in smart HVAC applications.

Regional expansion strategies should consider opportunities beyond the Seoul metropolitan area, particularly in emerging commercial centers and industrial regions where HVAC infrastructure development creates growth potential. Balanced geographic presence reduces market concentration risks while capturing diverse opportunities.

Sustainability positioning becomes increasingly important as environmental regulations strengthen and customer preferences shift toward green building solutions. Companies should emphasize energy efficiency, environmental performance, and carbon reduction benefits in their market positioning strategies.

Long-term market prospects for South Korea’s commercial HVAC sector remain highly positive, supported by continued urbanization, infrastructure modernization, and strengthening environmental regulations. Market growth is expected to maintain momentum with projected CAGR of 6.8% over the next five years, driven by retrofit opportunities and new construction activity.

Technology evolution will continue shaping market dynamics, with artificial intelligence, machine learning, and advanced analytics becoming standard features in commercial HVAC systems. Smart system adoption is projected to reach 75% penetration in new commercial installations by 2028, reflecting accelerating digital transformation trends.

Regulatory environment will likely become more stringent regarding energy efficiency and environmental performance, creating additional demand for high-performance HVAC solutions. Carbon neutrality commitments will drive adoption of heat pump technologies and renewable energy integration in commercial applications.

Market structure may experience further consolidation as companies seek to build comprehensive capabilities spanning equipment manufacturing, system integration, and ongoing services. Successful companies will develop end-to-end solution portfolios that address evolving customer requirements for performance, efficiency, and sustainability.

MWR analysis indicates that companies investing in innovation, service capabilities, and strategic partnerships will be best positioned to capitalize on market opportunities and achieve sustainable competitive advantages in South Korea’s dynamic commercial HVAC market.

South Korea’s commercial HVAC market presents compelling growth opportunities driven by urbanization trends, environmental regulations, and technological advancement. The market demonstrates strong fundamentals with consistent demand from diverse commercial sectors and supportive government policies promoting energy efficiency and sustainability.

Key success factors include investment in smart technology capabilities, comprehensive service offerings, and strategic partnerships that enhance market positioning and solution portfolios. Companies that prioritize innovation, sustainability, and customer-centric approaches will be well-positioned to capture market opportunities and achieve long-term success.

Market evolution toward integrated, intelligent building systems creates opportunities for companies that can deliver comprehensive solutions addressing both immediate HVAC needs and broader building optimization requirements. The convergence of HVAC with other building technologies represents a significant growth driver for forward-thinking market participants.

Future market leadership will belong to companies that successfully combine technological innovation with operational excellence, providing customers with advanced HVAC solutions that deliver superior performance, energy efficiency, and environmental sustainability while meeting South Korea’s evolving commercial building requirements.

What is Commercial HVAC?

Commercial HVAC refers to heating, ventilation, and air conditioning systems specifically designed for commercial buildings, such as offices, retail spaces, and industrial facilities. These systems are essential for maintaining indoor air quality and comfort in large spaces.

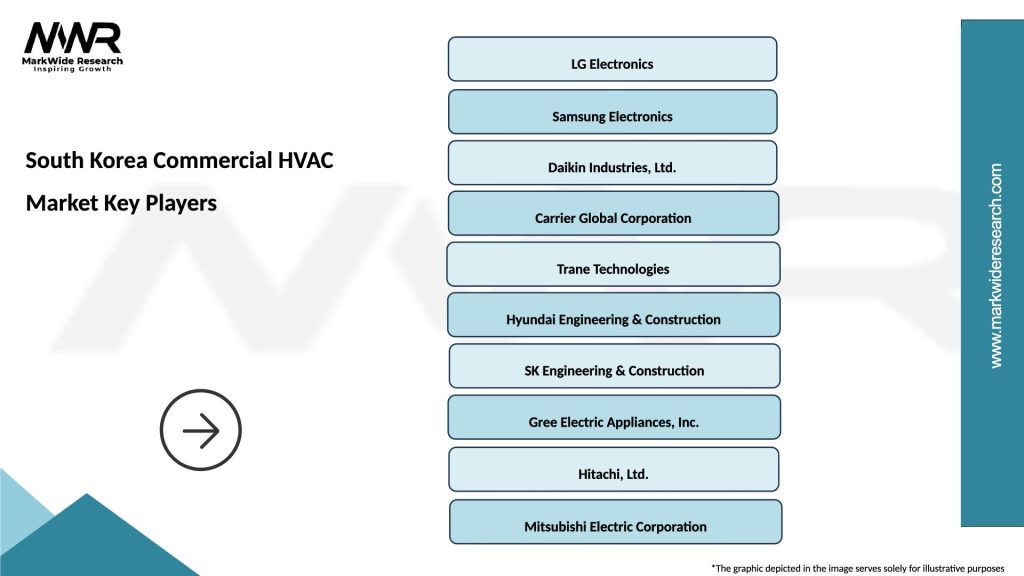

What are the key players in the South Korea Commercial HVAC Market?

Key players in the South Korea Commercial HVAC Market include LG Electronics, Samsung Electronics, Daikin, and Carrier. These companies are known for their innovative HVAC solutions and extensive product offerings, among others.

What are the main drivers of the South Korea Commercial HVAC Market?

The main drivers of the South Korea Commercial HVAC Market include the increasing demand for energy-efficient systems, the growth of the construction industry, and the rising awareness of indoor air quality. Additionally, government initiatives promoting sustainable building practices are also contributing to market growth.

What challenges does the South Korea Commercial HVAC Market face?

Challenges in the South Korea Commercial HVAC Market include high installation and maintenance costs, as well as the need for skilled technicians. Additionally, fluctuating energy prices can impact the overall operational costs for businesses relying on HVAC systems.

What opportunities exist in the South Korea Commercial HVAC Market?

Opportunities in the South Korea Commercial HVAC Market include the increasing adoption of smart HVAC technologies and the growing trend towards green building certifications. Furthermore, the expansion of the hospitality and retail sectors presents additional growth potential for HVAC solutions.

What trends are shaping the South Korea Commercial HVAC Market?

Trends shaping the South Korea Commercial HVAC Market include the integration of IoT technology for better system monitoring and control, as well as a shift towards more sustainable and energy-efficient solutions. Additionally, the focus on improving indoor air quality is driving innovation in HVAC designs.

South Korea Commercial HVAC Market

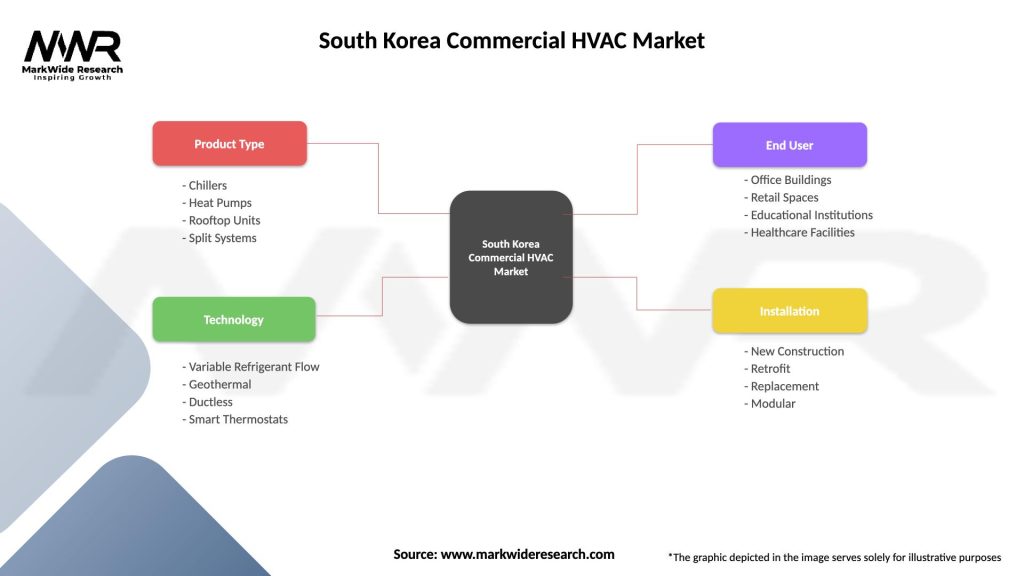

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Heat Pumps, Rooftop Units, Split Systems |

| Technology | Variable Refrigerant Flow, Geothermal, Ductless, Smart Thermostats |

| End User | Office Buildings, Retail Spaces, Educational Institutions, Healthcare Facilities |

| Installation | New Construction, Retrofit, Replacement, Modular |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Commercial HVAC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at