444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea car loan market represents a dynamic and rapidly evolving financial services sector that plays a crucial role in the country’s automotive industry ecosystem. South Korean consumers increasingly rely on automotive financing solutions to purchase both domestic and imported vehicles, driving substantial growth in the car loan segment. The market encompasses various lending institutions, including traditional banks, specialized automotive finance companies, and emerging fintech platforms that offer innovative financing solutions.

Market dynamics in South Korea’s car loan sector are influenced by several key factors, including government policies promoting electric vehicle adoption, changing consumer preferences toward premium vehicles, and the integration of digital technologies in lending processes. The market has experienced robust growth with financing penetration rates reaching approximately 78% of total vehicle purchases, indicating strong consumer acceptance of automotive lending products.

Digital transformation has significantly impacted the South Korean car loan landscape, with online application processes and mobile-first lending platforms gaining substantial traction. Traditional financial institutions are adapting their service delivery models to compete with agile fintech companies that offer streamlined approval processes and competitive interest rates. The market continues to evolve with the introduction of flexible repayment terms, customized loan products, and integrated insurance offerings.

The South Korea car loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate vehicle purchases through various lending mechanisms. This market encompasses secured and unsecured automotive financing options, lease agreements, and specialized lending products tailored to different consumer segments and vehicle categories.

Car loans in South Korea typically involve partnerships between financial institutions, automotive manufacturers, and dealership networks to provide seamless financing experiences for consumers. The market includes both new and used vehicle financing, with loan terms ranging from short-term arrangements to extended repayment periods exceeding seven years. Interest rates vary based on borrower creditworthiness, loan duration, and vehicle type, with electric and hybrid vehicles often receiving preferential financing terms.

Market participants include major commercial banks, specialized automotive finance companies, credit unions, and emerging digital lending platforms that leverage advanced analytics and artificial intelligence to streamline approval processes and risk assessment procedures.

South Korea’s car loan market demonstrates exceptional resilience and growth potential, driven by strong domestic automotive production, increasing consumer purchasing power, and supportive government policies promoting vehicle ownership and electric mobility adoption. The market benefits from a well-established financial services infrastructure and high consumer confidence in automotive financing products.

Key market trends include the rapid digitization of lending processes, with approximately 65% of loan applications now initiated through digital channels. Traditional banks maintain dominant market positions while facing increasing competition from specialized automotive finance companies and innovative fintech platforms that offer enhanced customer experiences and faster approval times.

Electric vehicle financing represents a significant growth opportunity, supported by government incentives and manufacturer partnerships that provide attractive financing terms for eco-friendly vehicles. The market also benefits from strong relationships between domestic automotive manufacturers and financial institutions, creating integrated financing solutions that enhance customer convenience and satisfaction.

Future growth prospects remain positive, with market expansion expected to continue driven by urbanization trends, changing mobility preferences, and the ongoing transition toward electric and autonomous vehicles that require specialized financing approaches.

Market penetration analysis reveals several critical insights that define the South Korean car loan landscape and its future trajectory:

Government policy support serves as a primary driver for South Korea’s car loan market expansion, with various initiatives promoting vehicle ownership and electric mobility adoption. Tax incentives, subsidies for eco-friendly vehicles, and infrastructure development programs create favorable conditions for automotive financing growth. These policies particularly benefit electric and hybrid vehicle financing segments, where government support translates into attractive loan terms and reduced borrowing costs.

Rising disposable income among South Korean consumers enables increased vehicle purchases and supports demand for premium automotive financing products. Economic stability and employment growth contribute to improved creditworthiness profiles, allowing financial institutions to expand their lending portfolios while maintaining acceptable risk levels. Consumer confidence in long-term financial commitments remains strong, supporting extended loan terms and higher loan amounts.

Technological advancement in lending processes drives market efficiency and customer satisfaction. Artificial intelligence, machine learning, and big data analytics enable faster credit decisions, personalized loan products, and improved risk assessment capabilities. Digital platforms reduce operational costs while enhancing customer experiences through streamlined application processes and real-time approval notifications.

Automotive industry partnerships between manufacturers, dealers, and financial institutions create integrated financing solutions that benefit all stakeholders. Captive finance companies offer competitive rates and specialized products, while dealer partnerships provide convenient point-of-sale financing options that enhance customer convenience and increase conversion rates.

Economic uncertainty and potential interest rate fluctuations pose significant challenges to South Korea’s car loan market stability. Global economic conditions, trade tensions, and domestic policy changes can impact consumer confidence and borrowing behavior. Rising interest rates increase borrowing costs and may reduce loan demand, particularly for discretionary vehicle purchases and premium vehicle segments.

Regulatory compliance requirements create operational complexities and increased costs for financial institutions operating in the automotive lending space. Stringent lending standards, consumer protection regulations, and capital adequacy requirements may limit lending capacity and reduce profit margins. Compliance with evolving data privacy and cybersecurity regulations adds additional operational burdens for digital lending platforms.

Market saturation concerns emerge as vehicle ownership rates approach mature market levels in urban areas. Limited parking availability, improved public transportation systems, and changing mobility preferences among younger consumers may reduce traditional vehicle ownership demand. Ride-sharing services and mobility-as-a-service platforms present alternative transportation options that could impact long-term car loan demand.

Credit risk management challenges intensify as lenders expand their customer base and extend loan terms. Economic downturns, employment instability, and changing consumer financial circumstances can lead to increased default rates and portfolio losses. Managing risk while maintaining competitive pricing requires sophisticated underwriting capabilities and continuous portfolio monitoring.

Electric vehicle financing presents substantial growth opportunities as South Korea accelerates its transition toward sustainable mobility solutions. Government incentives, manufacturer partnerships, and consumer environmental consciousness create favorable conditions for specialized green financing products. Financial institutions can develop innovative loan structures that account for electric vehicle residual values, charging infrastructure costs, and battery replacement considerations.

Fintech integration offers opportunities to revolutionize traditional automotive lending through advanced technologies and customer-centric approaches. Partnerships between established financial institutions and innovative fintech companies can combine regulatory expertise with technological capabilities to create superior customer experiences. Open banking initiatives and API integrations enable seamless financial service delivery and expanded product offerings.

Used vehicle market expansion provides significant growth potential as consumers seek value-oriented transportation solutions. Certified pre-owned programs, extended warranties, and flexible financing terms can attract price-sensitive customers while maintaining acceptable risk profiles. Digital platforms can streamline used vehicle financing processes and improve transparency in pricing and vehicle condition assessment.

Cross-selling opportunities through integrated financial products create additional revenue streams and enhance customer relationships. Bundling car loans with insurance products, maintenance packages, and extended warranties provides comprehensive solutions while improving customer retention rates. Loyalty programs and preferential rates for existing customers can strengthen long-term relationships and reduce acquisition costs.

Competitive intensity in South Korea’s car loan market continues to escalate as traditional banks, specialized finance companies, and fintech platforms compete for market share. MarkWide Research analysis indicates that competitive pressures have led to improved customer service standards, reduced processing times, and more flexible loan terms. Financial institutions differentiate themselves through digital capabilities, customer experience enhancements, and specialized product offerings tailored to specific market segments.

Interest rate environment significantly influences market dynamics, affecting both lender profitability and consumer demand patterns. Central bank monetary policies, inflation expectations, and global economic conditions impact borrowing costs and lending margins. Financial institutions must balance competitive pricing with risk management requirements while adapting to changing rate environments through dynamic pricing strategies and hedging mechanisms.

Consumer behavior evolution drives continuous adaptation in product offerings and service delivery models. Younger consumers prefer digital-first experiences, while traditional customers value personal relationships and branch-based services. Financial institutions must develop omnichannel strategies that accommodate diverse customer preferences while maintaining operational efficiency and cost effectiveness.

Regulatory landscape changes create both challenges and opportunities for market participants. Enhanced consumer protection measures, data privacy requirements, and lending standard modifications require ongoing compliance investments while potentially creating barriers for new market entrants. Proactive regulatory engagement and compliance excellence become competitive advantages in the evolving regulatory environment.

Primary research methodologies employed in analyzing South Korea’s car loan market include comprehensive surveys of financial institutions, automotive dealers, and consumer focus groups. Direct interviews with industry executives, regulatory officials, and market participants provide qualitative insights into market trends, competitive dynamics, and future growth prospects. Consumer behavior studies examine borrowing patterns, preference changes, and satisfaction levels across different demographic segments.

Secondary research sources encompass government statistical databases, central bank reports, automotive industry publications, and financial services regulatory filings. Market data aggregation from multiple sources ensures comprehensive coverage of market segments, geographic regions, and product categories. Historical trend analysis provides context for current market conditions and supports future projection modeling.

Quantitative analysis techniques include statistical modeling, trend analysis, and comparative benchmarking against regional and global automotive finance markets. Market sizing methodologies combine top-down and bottom-up approaches to ensure accuracy and reliability. Sensitivity analysis examines various scenario outcomes based on different economic and regulatory assumptions.

Data validation processes involve cross-referencing multiple sources, expert review panels, and statistical verification procedures to ensure research accuracy and reliability. Continuous monitoring of market developments and regular data updates maintain research currency and relevance for strategic decision-making purposes.

Seoul Metropolitan Area dominates South Korea’s car loan market, accounting for approximately 45% of total loan originations due to high population density, elevated income levels, and concentrated automotive dealership networks. The region benefits from advanced financial services infrastructure, competitive lending environments, and strong consumer demand for premium vehicles. Digital lending platforms achieve particularly high adoption rates in Seoul, reflecting tech-savvy consumer preferences and urban lifestyle requirements.

Busan and southeastern regions represent significant market opportunities with growing industrial bases, port activities, and expanding middle-class populations. Commercial vehicle financing shows strong growth in these areas, driven by logistics and manufacturing sector expansion. Regional banks and credit unions maintain strong market positions through localized service offerings and community relationships.

Daegu and central regions demonstrate steady market growth supported by automotive manufacturing clusters and supplier networks. Employee financing programs and manufacturer partnerships create specialized lending opportunities for automotive industry workers. The presence of major automotive production facilities generates demand for both personal and commercial vehicle financing products.

Rural and smaller urban areas present unique challenges and opportunities, with limited financial services infrastructure but growing vehicle ownership needs. Mobile banking and digital lending platforms help bridge service gaps while maintaining cost-effective operations. Agricultural and small business financing programs support commercial vehicle purchases in these regions.

Major commercial banks maintain dominant positions in South Korea’s car loan market through extensive branch networks, established customer relationships, and comprehensive financial product portfolios:

Specialized automotive finance companies provide focused expertise and competitive alternatives to traditional banking solutions:

Emerging fintech platforms challenge traditional players through innovative technologies and customer-centric approaches, gaining market share through superior digital experiences and faster approval processes.

By Loan Type: The South Korean car loan market segments into several distinct categories based on financing structures and customer needs. Secured loans dominate the market, utilizing vehicles as collateral to offer competitive interest rates and extended repayment terms. Unsecured personal loans for vehicle purchases serve customers with limited collateral or preference for flexible usage. Lease financing provides alternative ownership models with lower monthly payments and upgrade flexibility.

By Vehicle Type: New vehicle financing represents the largest segment, supported by manufacturer incentives, warranty coverage, and predictable residual values. Used vehicle financing shows rapid growth as consumers seek value-oriented transportation solutions and certified pre-owned programs expand. Electric and hybrid vehicle financing benefits from government incentives and specialized loan products designed for eco-friendly transportation.

By Customer Segment: Individual consumers comprise the majority of loan originations, with varying needs based on age, income, and lifestyle preferences. Commercial customers require specialized financing for fleet purchases, delivery vehicles, and business transportation needs. Government and institutional customers represent niche segments with specific procurement requirements and financing preferences.

By Distribution Channel: Dealership financing provides convenient point-of-sale solutions with integrated sales and financing processes. Bank branches serve customers preferring personal relationships and comprehensive financial service consultations. Digital platforms attract tech-savvy consumers seeking streamlined applications and rapid approval processes.

Premium Vehicle Financing demonstrates strong growth potential as South Korean consumers increasingly purchase luxury and imported vehicles. This segment requires specialized underwriting approaches, extended loan terms, and competitive rates to accommodate higher purchase prices. Financial institutions develop relationships with premium automotive brands to offer integrated financing solutions and enhanced customer experiences.

Electric Vehicle Loans represent the fastest-growing category, supported by government incentives and environmental consciousness. Lenders develop specialized products that account for unique electric vehicle characteristics, including battery life considerations, charging infrastructure costs, and evolving residual values. Partnerships with charging network providers and renewable energy companies create comprehensive mobility financing solutions.

Used Vehicle Financing expands rapidly as consumers seek affordable transportation options and certified pre-owned programs improve vehicle quality assurance. Digital platforms streamline used vehicle financing through automated valuation tools, condition assessment technologies, and integrated dealer networks. Risk management requires sophisticated analytics to assess vehicle conditions and market values.

Commercial Vehicle Loans serve diverse business needs from small delivery vehicles to large commercial trucks. This segment requires specialized underwriting that considers business cash flows, vehicle utilization patterns, and industry-specific risks. Fleet financing programs offer volume discounts and integrated maintenance packages to attract commercial customers.

Financial Institutions benefit from diversified revenue streams, stable cash flows, and cross-selling opportunities through automotive lending portfolios. Car loans typically offer attractive risk-adjusted returns with collateral security and predictable payment patterns. Digital transformation initiatives reduce operational costs while improving customer acquisition and retention rates.

Automotive Manufacturers gain competitive advantages through captive finance partnerships that facilitate vehicle sales and enhance customer relationships. Integrated financing solutions increase conversion rates, enable premium pricing strategies, and support inventory management through floor plan financing arrangements. Data insights from financing activities inform product development and marketing strategies.

Consumers access affordable vehicle ownership through competitive financing options, flexible repayment terms, and convenient application processes. Digital platforms provide transparency in pricing, rapid approval decisions, and personalized loan products tailored to individual needs and preferences. Integrated insurance and maintenance packages offer comprehensive transportation solutions.

Automotive Dealers increase sales conversion rates and transaction values through point-of-sale financing options. Financing partnerships provide additional revenue streams through referral fees and enhanced customer satisfaction. Digital integration streamlines sales processes and reduces administrative burdens while improving customer experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Lending transforms customer acquisition and service delivery models as consumers increasingly prefer online and mobile application processes. Financial institutions invest heavily in user experience design, artificial intelligence-powered underwriting, and real-time approval systems. Integration with automotive marketplace platforms creates seamless shopping and financing experiences that reduce friction and improve conversion rates.

Sustainable Finance Integration gains momentum as environmental considerations influence lending decisions and product development. Green financing products offer preferential terms for electric and hybrid vehicles while supporting South Korea’s carbon neutrality goals. MWR research indicates that sustainability-linked loans and environmental impact assessments become standard components of automotive financing strategies.

Personalization and Customization drive product innovation as lenders leverage big data analytics and machine learning to create tailored financing solutions. Dynamic pricing models adjust interest rates based on individual risk profiles, while flexible repayment options accommodate diverse customer preferences and financial circumstances. Behavioral analytics inform product recommendations and customer engagement strategies.

Partnership Ecosystem Expansion creates comprehensive mobility solutions through collaborations between financial institutions, automotive manufacturers, technology companies, and service providers. Integrated platforms offer financing, insurance, maintenance, and mobility services through single customer interfaces. Strategic alliances enable market participants to leverage complementary capabilities and expand service offerings.

Regulatory Framework Evolution includes updated lending standards, enhanced consumer protection measures, and digital banking regulations that shape market operations. Recent policy changes promote responsible lending practices while encouraging innovation in financial technology applications. Open banking initiatives facilitate data sharing and API integrations that enable new service models and competitive dynamics.

Technology Infrastructure Investments by major financial institutions focus on cloud computing, artificial intelligence, and blockchain technologies to improve operational efficiency and customer experiences. Digital transformation initiatives include mobile-first platform development, automated underwriting systems, and integrated customer relationship management solutions.

Market Consolidation Activities involve strategic acquisitions, partnerships, and joint ventures that reshape competitive landscapes. Traditional banks acquire fintech companies to enhance digital capabilities, while automotive manufacturers expand captive finance operations. Cross-industry collaborations create new business models and service delivery approaches.

Product Innovation Launches introduce specialized financing solutions for emerging vehicle technologies, subscription-based ownership models, and integrated mobility services. Financial institutions develop flexible loan structures that accommodate changing consumer preferences and evolving automotive technologies.

Digital Transformation Acceleration represents a critical strategic priority for financial institutions seeking to maintain competitive positions in South Korea’s evolving car loan market. Organizations should invest in comprehensive digital platforms that provide seamless customer experiences from application through loan servicing. Integration with automotive marketplace platforms and dealer management systems creates competitive advantages through enhanced convenience and reduced processing times.

Risk Management Enhancement requires sophisticated analytics and monitoring systems to navigate changing economic conditions and evolving consumer behaviors. Financial institutions should implement advanced credit scoring models that incorporate alternative data sources and real-time economic indicators. Portfolio diversification across vehicle types, customer segments, and geographic regions helps mitigate concentration risks and improve overall performance stability.

Partnership Strategy Development enables market participants to leverage complementary capabilities and expand service offerings without significant capital investments. Strategic alliances with automotive manufacturers, technology companies, and service providers create integrated solutions that enhance customer value propositions. Collaboration opportunities include data sharing agreements, co-branded products, and joint marketing initiatives.

Sustainability Integration becomes increasingly important as environmental considerations influence consumer preferences and regulatory requirements. Financial institutions should develop comprehensive green financing strategies that support electric vehicle adoption while creating new revenue opportunities. Sustainability reporting and environmental impact measurement demonstrate corporate responsibility and attract environmentally conscious customers.

Market growth prospects for South Korea’s car loan sector remain positive despite potential challenges from economic uncertainty and changing mobility preferences. The transition toward electric vehicles creates substantial opportunities for specialized financing products, while digital transformation initiatives improve operational efficiency and customer satisfaction. MarkWide Research projects continued market expansion driven by innovation in lending technologies and evolving consumer needs.

Electric vehicle financing will likely become a dominant growth driver as government policies accelerate adoption and automotive manufacturers expand electric model offerings. Financial institutions that develop expertise in electric vehicle residual value assessment, charging infrastructure financing, and battery technology considerations will gain competitive advantages in this emerging segment.

Technology integration will continue reshaping market dynamics through artificial intelligence, blockchain applications, and Internet of Things connectivity. Smart contracts, automated compliance monitoring, and predictive analytics will improve operational efficiency while reducing costs and risks. Integration with connected vehicle technologies may enable usage-based financing models and dynamic risk assessment capabilities.

Regulatory evolution will likely focus on consumer protection enhancement, data privacy strengthening, and sustainable finance promotion. Financial institutions must maintain agility in adapting to regulatory changes while leveraging compliance excellence as competitive differentiation. Proactive engagement with regulators and industry associations helps shape favorable policy environments and ensures operational continuity.

South Korea’s car loan market demonstrates remarkable resilience and adaptation capability in navigating evolving consumer preferences, technological disruptions, and regulatory changes. The market’s foundation of strong financial institutions, advanced digital infrastructure, and supportive government policies creates favorable conditions for continued growth and innovation. Financial institutions that embrace digital transformation, develop specialized expertise in emerging vehicle technologies, and create comprehensive customer solutions will thrive in this dynamic environment.

Strategic success factors include maintaining competitive pricing while managing risk effectively, investing in technology capabilities that enhance customer experiences, and developing partnerships that expand service offerings and market reach. The transition toward electric vehicles presents both opportunities and challenges that require specialized knowledge and innovative financing approaches. Organizations that proactively address these trends while maintaining operational excellence will capture market leadership positions.

Future market evolution will likely emphasize sustainability, digitalization, and customer-centricity as key differentiating factors. The integration of automotive financing with broader mobility services creates opportunities for comprehensive transportation solutions that meet evolving consumer needs. Success in this market requires balancing innovation with risk management while maintaining focus on customer satisfaction and regulatory compliance.

What is Car Loan?

A car loan is a type of financing that allows individuals to borrow money to purchase a vehicle, which they then repay over time with interest. In South Korea, car loans are commonly offered by banks and financial institutions, making vehicle ownership more accessible to consumers.

What are the key players in the South Korea Car Loan Market?

Key players in the South Korea Car Loan Market include major banks such as KB Kookmin Bank and Shinhan Bank, as well as specialized financial institutions like Hyundai Capital and Samsung Card. These companies offer various loan products tailored to different consumer needs, among others.

What are the growth factors driving the South Korea Car Loan Market?

The growth of the South Korea Car Loan Market is driven by increasing vehicle ownership, favorable interest rates, and the rise of online loan applications. Additionally, the growing demand for electric and hybrid vehicles is influencing financing options available to consumers.

What challenges does the South Korea Car Loan Market face?

Challenges in the South Korea Car Loan Market include rising household debt levels and stricter lending regulations. These factors can limit consumer access to loans and may lead to increased default rates among borrowers.

What future opportunities exist in the South Korea Car Loan Market?

Future opportunities in the South Korea Car Loan Market include the expansion of digital lending platforms and the introduction of tailored financing solutions for electric vehicles. Additionally, partnerships between automakers and financial institutions may enhance loan offerings for consumers.

What trends are shaping the South Korea Car Loan Market?

Trends shaping the South Korea Car Loan Market include the increasing adoption of online loan applications and the integration of artificial intelligence in credit assessments. Furthermore, there is a growing emphasis on sustainable financing options as consumers become more environmentally conscious.

South Korea Car Loan Market

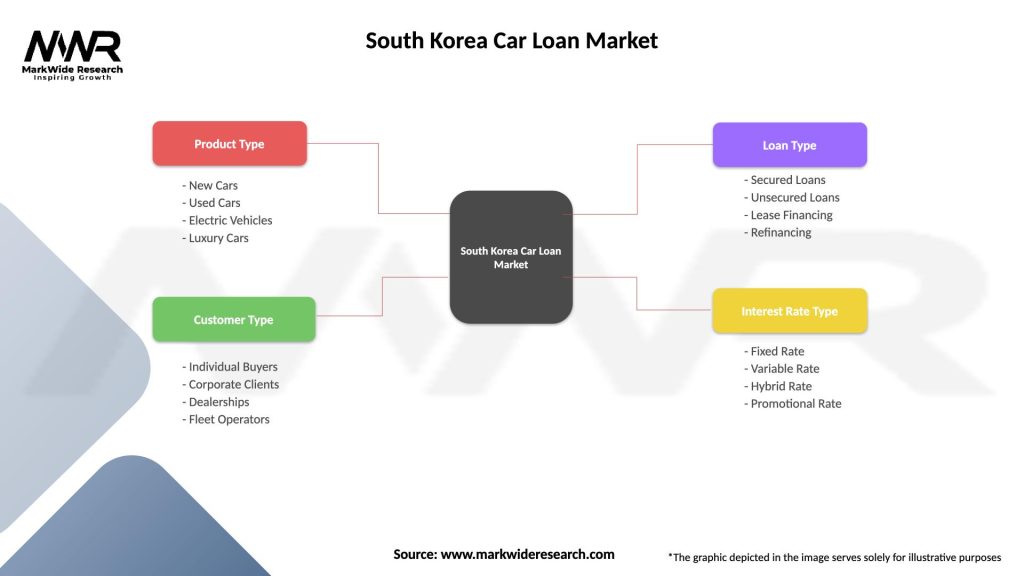

| Segmentation Details | Description |

|---|---|

| Product Type | New Cars, Used Cars, Electric Vehicles, Luxury Cars |

| Customer Type | Individual Buyers, Corporate Clients, Dealerships, Fleet Operators |

| Loan Type | Secured Loans, Unsecured Loans, Lease Financing, Refinancing |

| Interest Rate Type | Fixed Rate, Variable Rate, Hybrid Rate, Promotional Rate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Car Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at