444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea analog integrated circuits market represents a critical segment of the nation’s semiconductor industry, characterized by robust technological advancement and strategic positioning in the global electronics supply chain. South Korea has established itself as a dominant force in semiconductor manufacturing, with analog integrated circuits serving as essential components across diverse applications including consumer electronics, automotive systems, industrial automation, and telecommunications infrastructure.

Market dynamics in South Korea reflect the country’s commitment to technological innovation and manufacturing excellence. The analog IC sector benefits from substantial government support, advanced research and development capabilities, and strong partnerships between academic institutions and industry leaders. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 8.2%, driven by increasing demand for sophisticated electronic devices and emerging technologies such as 5G networks and electric vehicles.

Key market characteristics include the presence of major global semiconductor companies with significant manufacturing operations in South Korea, alongside innovative domestic firms specializing in analog circuit design and production. The market demonstrates strong integration with global supply chains while maintaining competitive advantages in manufacturing efficiency and technological sophistication.

The South Korea analog integrated circuits market refers to the comprehensive ecosystem encompassing the design, manufacturing, and distribution of analog semiconductor devices within South Korea’s borders. Analog integrated circuits are semiconductor devices that process continuous signals, converting real-world phenomena such as sound, light, temperature, and pressure into electrical signals that can be manipulated and processed by electronic systems.

These circuits differ fundamentally from digital integrated circuits by handling continuously variable signals rather than discrete binary data. In the South Korean context, the market includes operational amplifiers, voltage regulators, power management ICs, analog-to-digital converters, digital-to-analog converters, and specialized mixed-signal devices that combine analog and digital functionalities.

Market scope encompasses both the production capabilities of South Korean manufacturers and the domestic consumption of analog ICs across various industry sectors. The definition extends to include research and development activities, intellectual property creation, and the supporting ecosystem of equipment suppliers, materials providers, and design service companies that contribute to the analog IC value chain.

South Korea’s analog integrated circuits market demonstrates exceptional growth momentum, positioning the country as a global leader in semiconductor innovation and manufacturing. The market benefits from strong domestic demand across multiple sectors, including consumer electronics, automotive, industrial applications, and emerging technologies such as Internet of Things (IoT) devices and artificial intelligence systems.

Key growth drivers include the rapid adoption of electric vehicles, which require sophisticated power management and battery management analog ICs, representing approximately 23% of total market demand. Additionally, the expansion of 5G infrastructure and smart city initiatives contributes significantly to market growth, with telecommunications applications accounting for substantial market share.

Competitive landscape features both international semiconductor giants with major operations in South Korea and innovative domestic companies specializing in niche analog IC applications. The market demonstrates strong export orientation, with South Korean analog IC manufacturers serving global customers while maintaining robust domestic market presence.

Future prospects remain highly positive, supported by continued government investment in semiconductor research and development, strategic partnerships with global technology companies, and the country’s leadership position in advanced manufacturing technologies. Market participants anticipate sustained growth driven by emerging applications in autonomous vehicles, renewable energy systems, and next-generation consumer electronics.

Strategic market insights reveal several critical trends shaping the South Korea analog integrated circuits landscape. The market demonstrates strong alignment with global technology trends while maintaining unique characteristics that reflect South Korea’s specific industrial strengths and market dynamics.

Primary market drivers propelling the South Korea analog integrated circuits market include the country’s leadership position in consumer electronics manufacturing and the rapid adoption of advanced technologies across multiple industry sectors. The consumer electronics sector, dominated by global brands with significant South Korean operations, generates substantial demand for sophisticated analog ICs.

Automotive electrification represents a major growth driver, with electric vehicle adoption rates in South Korea reaching 15.7% of total vehicle sales. This transition requires advanced power management ICs, battery management systems, and motor control circuits, creating significant opportunities for analog IC manufacturers. The automotive sector’s evolution toward autonomous driving capabilities further amplifies demand for sensor interface circuits and signal processing ICs.

5G infrastructure deployment across South Korea drives substantial demand for radio frequency (RF) analog ICs, power amplifiers, and mixed-signal devices. The country’s position as a global leader in 5G technology implementation creates both domestic market opportunities and export potential for specialized analog IC solutions.

Industrial automation and smart manufacturing initiatives contribute to market growth through increased demand for precision analog ICs used in sensor systems, motor control applications, and process monitoring equipment. The government’s Industry 4.0 initiatives support this trend by encouraging adoption of advanced manufacturing technologies.

Renewable energy expansion creates demand for power management ICs used in solar inverters, wind power systems, and energy storage solutions. South Korea’s commitment to carbon neutrality by 2050 supports continued growth in this application segment.

Market restraints affecting the South Korea analog integrated circuits market include intense global competition, particularly from other major semiconductor manufacturing regions such as Taiwan, China, and the United States. This competition creates pressure on pricing and market share, requiring continuous innovation and efficiency improvements to maintain competitive positioning.

Supply chain vulnerabilities represent a significant constraint, as the global semiconductor industry experienced disruptions that highlighted dependencies on specific suppliers and geographic regions. Raw material availability and pricing fluctuations for specialized semiconductor materials can impact production costs and market dynamics.

Talent shortage in specialized analog IC design and engineering poses challenges for market growth. The complexity of analog circuit design requires highly skilled engineers, and competition for talent remains intense both domestically and internationally. This constraint affects the ability to expand research and development capabilities and bring new products to market quickly.

Regulatory compliance requirements across different export markets create complexity and costs for South Korean analog IC manufacturers. Varying standards and certification requirements in different regions can limit market access and increase development costs for companies serving global markets.

Technology transition challenges arise as the industry moves toward more advanced process nodes and new materials. The high costs associated with developing and manufacturing analog ICs using cutting-edge technologies can strain resources and limit participation to well-funded companies.

Significant market opportunities exist in emerging application areas that align with South Korea’s technological strengths and strategic priorities. The Internet of Things (IoT) ecosystem presents substantial growth potential, with demand for low-power, high-efficiency analog ICs expected to grow at 12.4% annually as smart device adoption accelerates across consumer and industrial applications.

Artificial intelligence and machine learning applications create opportunities for specialized analog ICs that interface between the physical world and digital processing systems. Edge AI implementations require sophisticated sensor interface circuits and power management solutions, areas where South Korean companies can leverage their expertise.

Healthcare technology represents an expanding opportunity, particularly in medical devices and wearable health monitoring systems. The aging population in South Korea and globally drives demand for advanced medical electronics that rely heavily on precision analog ICs for sensor interfaces and signal processing.

Space and satellite applications offer high-value opportunities as South Korea expands its space program and satellite capabilities. Radiation-hardened analog ICs for space applications command premium pricing and align with the country’s strategic technology development goals.

Quantum computing and advanced research applications present long-term opportunities for ultra-precision analog ICs used in quantum control systems and scientific instrumentation. Early investment in these emerging areas could position South Korean companies advantageously as these technologies mature.

Market dynamics in the South Korea analog integrated circuits sector reflect the complex interplay between technological innovation, global competition, and domestic market conditions. The market demonstrates cyclical characteristics typical of the semiconductor industry, with periods of rapid growth followed by consolidation phases that drive efficiency improvements and technological advancement.

Competitive dynamics feature both collaboration and competition among market participants. Companies often collaborate on research and development initiatives while competing in specific market segments. This dynamic creates a robust innovation ecosystem that benefits the overall market development while maintaining competitive pressure for continuous improvement.

Technology evolution drives market dynamics through the continuous development of new analog IC architectures and manufacturing processes. The transition to smaller process nodes, new materials, and advanced packaging technologies creates both opportunities and challenges for market participants. Companies must balance investment in new technologies with the need to maintain profitability in existing product lines.

Customer relationships play a crucial role in market dynamics, as analog IC suppliers often work closely with customers to develop customized solutions for specific applications. These partnerships create stable revenue streams but also require significant engineering resources and long-term commitments from suppliers.

Global market integration influences domestic market dynamics through export opportunities and international competition. South Korean analog IC companies must navigate global market conditions while maintaining their domestic market positions, creating complex strategic considerations for business development and resource allocation.

Comprehensive research methodology employed for analyzing the South Korea analog integrated circuits market incorporates multiple data sources and analytical approaches to ensure accuracy and completeness. The methodology combines quantitative analysis of market data with qualitative insights from industry experts and market participants.

Primary research includes structured interviews with key industry stakeholders, including analog IC manufacturers, design companies, equipment suppliers, and end-user companies across various application sectors. These interviews provide insights into market trends, competitive dynamics, and future growth prospects that complement quantitative market data.

Secondary research encompasses analysis of industry reports, company financial statements, government statistics, and academic research publications. This approach ensures comprehensive coverage of market dynamics and provides historical context for current market conditions and future projections.

Market modeling techniques incorporate statistical analysis and forecasting methods to project market growth and identify key trends. The models consider multiple variables including economic indicators, technology adoption rates, and industry-specific factors that influence market development.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert review of findings. This rigorous approach provides confidence in market insights and projections presented in the analysis.

Regional analysis of the South Korea analog integrated circuits market reveals significant concentration in key industrial and technological centers, with the Seoul Capital Area accounting for approximately 42% of market activity. This region benefits from the presence of major semiconductor companies, research institutions, and a skilled workforce that supports analog IC development and manufacturing.

Gyeonggi Province represents another major regional hub, hosting significant semiconductor manufacturing facilities and research and development centers. The province’s strategic location and industrial infrastructure support both domestic market service and export operations, contributing approximately 28% of regional market share.

Chungcheong region has emerged as an important semiconductor manufacturing center, with several major companies establishing production facilities to take advantage of available land, government incentives, and proximity to transportation infrastructure. This region contributes significantly to the country’s analog IC production capacity.

Busan and the southeastern region play important roles in the analog IC ecosystem through port facilities that support international trade and specialized companies serving niche market segments. The region’s industrial base and logistics capabilities complement the national analog IC market development.

Regional development policies support balanced growth across different areas of South Korea, with government initiatives encouraging semiconductor industry development in various regions. These policies help distribute economic benefits and create resilient supply chains that support market stability and growth.

Competitive landscape in the South Korea analog integrated circuits market features a diverse mix of global semiconductor leaders and innovative domestic companies, creating a dynamic and highly competitive environment that drives continuous innovation and market development.

Competitive strategies focus on technological differentiation, customer relationships, and operational efficiency. Companies invest heavily in research and development to maintain competitive advantages while building strong partnerships with key customers across various industry sectors.

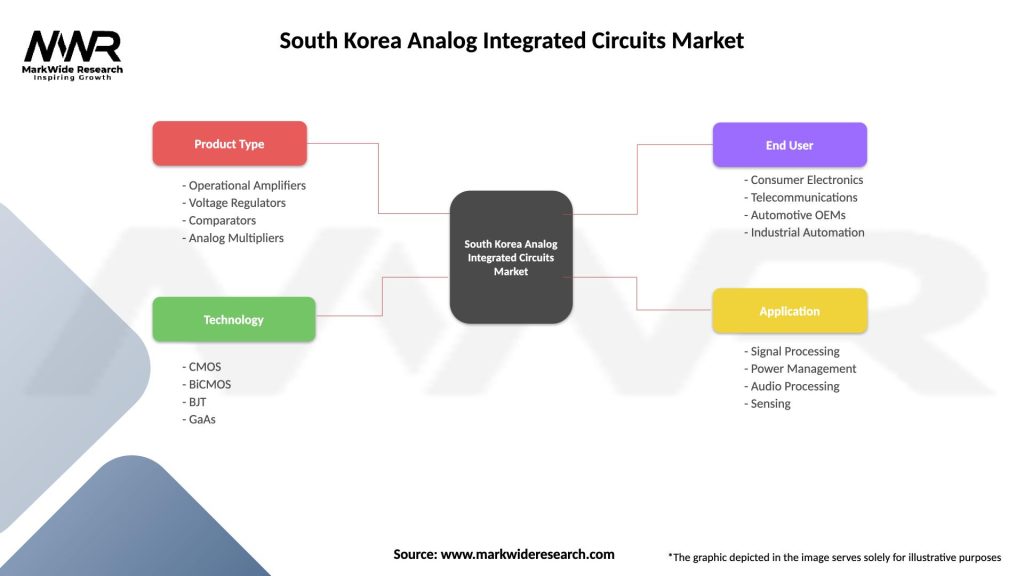

Market segmentation analysis reveals the diverse nature of the South Korea analog integrated circuits market, with multiple dimensions including product type, application, end-user industry, and technology node. This segmentation provides insights into market dynamics and growth opportunities across different market segments.

By Product Type:

By Application:

By Technology Node:

Power Management ICs represent the largest category within the South Korea analog integrated circuits market, driven by the proliferation of battery-powered devices and the need for energy-efficient solutions across all application sectors. This category benefits from strong demand in consumer electronics, automotive applications, and industrial systems, with growth rates exceeding 9.5% annually.

Signal Chain ICs demonstrate steady growth driven by increasing sensor adoption and the need for precise signal processing in various applications. The category includes operational amplifiers, instrumentation amplifiers, and specialized interface circuits that serve critical functions in measurement and control systems.

Data Converters experience robust demand growth as digital systems require increasingly sophisticated interfaces with the analog world. High-resolution analog-to-digital converters and precision digital-to-analog converters serve applications ranging from audio systems to industrial measurement equipment.

RF and Microwave ICs benefit from 5G infrastructure deployment and the expansion of wireless communication systems. This specialized category requires advanced design expertise and manufacturing capabilities, creating opportunities for companies with strong RF analog capabilities.

Automotive-specific analog ICs represent a rapidly growing category driven by vehicle electrification and the adoption of advanced driver assistance systems. These applications require automotive-qualified components that meet stringent reliability and safety requirements, commanding premium pricing and creating barriers to entry for new competitors.

Industry participants in the South Korea analog integrated circuits market benefit from the country’s advanced semiconductor ecosystem, which provides access to cutting-edge manufacturing technologies, skilled workforce, and strong government support for research and development activities.

Manufacturers benefit from economies of scale achieved through high-volume production capabilities and access to global markets through South Korea’s strong trade relationships. The country’s reputation for quality and reliability in semiconductor manufacturing provides competitive advantages in international markets.

Design companies benefit from access to advanced design tools, intellectual property resources, and collaboration opportunities with leading global technology companies. The concentration of semiconductor expertise in South Korea creates a supportive environment for analog IC innovation and development.

End-user companies benefit from proximity to leading analog IC suppliers, enabling close collaboration on product development and rapid time-to-market for new applications. Local sourcing capabilities provide supply chain advantages and reduced logistics costs.

Investors benefit from the market’s strong growth prospects and the strategic importance of analog ICs in emerging technologies. The market’s resilience and diverse application base provide attractive investment opportunities with balanced risk profiles.

Research institutions benefit from industry collaboration opportunities and access to real-world applications for academic research. These partnerships enhance the quality and relevance of research while providing pathways for technology commercialization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the South Korea analog integrated circuits market include the accelerating adoption of artificial intelligence and machine learning technologies, which require sophisticated analog interfaces for sensor data acquisition and processing. This trend drives demand for high-precision, low-noise analog ICs that can handle the demanding requirements of AI applications.

Miniaturization trends continue to influence analog IC design and manufacturing, with customers demanding smaller, more integrated solutions that combine multiple functions in single packages. This trend requires advanced packaging technologies and design techniques that South Korean companies are well-positioned to address.

Energy efficiency has become a critical requirement across all application segments, driving innovation in low-power analog IC design and manufacturing. Companies are developing new circuit architectures and process technologies to achieve better performance per watt, particularly important for battery-powered and mobile applications.

Customization and application-specific solutions represent a growing trend as customers seek differentiation through specialized analog ICs tailored to their specific requirements. This trend favors companies with strong design capabilities and flexible manufacturing processes.

System-level integration trends drive demand for analog ICs that can interface seamlessly with digital systems and provide complete signal chain solutions. According to MarkWide Research analysis, integrated solutions account for approximately 34% of market growth as customers seek to reduce system complexity and improve performance.

Recent industry developments highlight the dynamic nature of the South Korea analog integrated circuits market and the continuous evolution of technologies and business models. Major companies have announced significant investments in research and development facilities, expanding their capabilities in emerging application areas such as automotive electronics and 5G infrastructure.

Strategic partnerships between South Korean companies and international technology leaders have accelerated technology development and market access. These collaborations combine South Korean manufacturing expertise with global market reach and complementary technologies, creating competitive advantages for all participants.

Government initiatives supporting semiconductor industry development have resulted in new research programs and funding opportunities for analog IC companies. The K-Semiconductor Belt project and related initiatives provide substantial support for industry growth and technological advancement.

Acquisition activity in the market reflects consolidation trends and the strategic importance of analog IC capabilities. Companies are acquiring specialized design firms and technology assets to strengthen their competitive positions and expand their product portfolios.

Technology breakthroughs in areas such as gallium nitride (GaN) and silicon carbide (SiC) analog ICs have opened new application opportunities in power electronics and high-frequency applications. South Korean companies are investing in these emerging technologies to maintain their competitive advantages.

Industry analysts recommend that South Korean analog IC companies focus on strengthening their positions in high-growth application segments while maintaining their manufacturing excellence and cost competitiveness. The automotive and industrial automation sectors offer particularly attractive growth opportunities that align with South Korea’s technological strengths.

Investment priorities should emphasize research and development in emerging technologies such as wide-bandgap semiconductors and advanced packaging solutions. These technologies will be critical for maintaining competitive advantages as the market evolves toward more demanding applications and performance requirements.

Strategic partnerships with global technology companies and end-user customers can provide access to new markets and applications while sharing development costs and risks. Analysts suggest that collaborative approaches will be essential for success in increasingly complex and capital-intensive technology development.

Talent development initiatives should focus on building expertise in emerging technology areas and strengthening the pipeline of skilled engineers. Companies should invest in training programs and partnerships with universities to ensure adequate human resources for future growth.

Market diversification strategies should balance growth opportunities with risk management, avoiding over-dependence on any single application segment or customer. MWR analysis suggests that companies with diversified portfolios demonstrate greater resilience during market fluctuations and achieve more sustainable growth rates.

Future outlook for the South Korea analog integrated circuits market remains highly positive, with sustained growth expected across multiple application segments and technology areas. The market is projected to maintain robust expansion driven by continued innovation in consumer electronics, automotive electrification, and emerging technologies such as artificial intelligence and Internet of Things applications.

Technology evolution will continue to drive market development, with advances in process technologies, materials science, and circuit design enabling new applications and improved performance. The transition to more advanced manufacturing nodes and the adoption of new materials such as gallium nitride will create opportunities for companies with strong technology capabilities.

Market expansion opportunities exist both domestically and internationally, with South Korean companies well-positioned to serve growing global demand for sophisticated analog ICs. The country’s reputation for quality and innovation provides competitive advantages in international markets, particularly in high-value applications requiring reliable performance.

Industry consolidation trends may continue as companies seek to achieve scale advantages and broaden their technology portfolios through mergers and acquisitions. This consolidation could create stronger, more competitive companies capable of investing in advanced technologies and serving global markets more effectively.

Long-term growth prospects are supported by fundamental trends including digitalization, electrification, and the increasing sophistication of electronic systems across all industry sectors. MarkWide Research projects that the market will continue expanding at healthy rates, with growth acceleration expected in emerging application areas that leverage South Korea’s technological strengths and manufacturing capabilities.

The South Korea analog integrated circuits market represents a dynamic and strategically important sector within the country’s semiconductor industry, characterized by strong technological capabilities, robust manufacturing infrastructure, and excellent growth prospects across diverse application segments. The market benefits from South Korea’s position as a global technology leader and its commitment to innovation and manufacturing excellence.

Key success factors for market participants include maintaining technological leadership, building strong customer relationships, and adapting to evolving market requirements in emerging application areas. The market’s diversity across product types and applications provides resilience against sector-specific fluctuations while creating multiple growth opportunities for companies with appropriate capabilities and strategies.

Future growth will be driven by continued innovation in consumer electronics, the accelerating adoption of electric vehicles and autonomous driving technologies, the expansion of 5G and next-generation communication systems, and the emergence of new applications in artificial intelligence and Internet of Things devices. These trends align well with South Korea’s technological strengths and strategic priorities, positioning the country advantageously for continued market leadership and growth in the global analog integrated circuits industry.

What is Analog Integrated Circuits?

Analog Integrated Circuits are electronic circuits that process continuous signals. They are widely used in applications such as audio processing, signal amplification, and sensor interfacing.

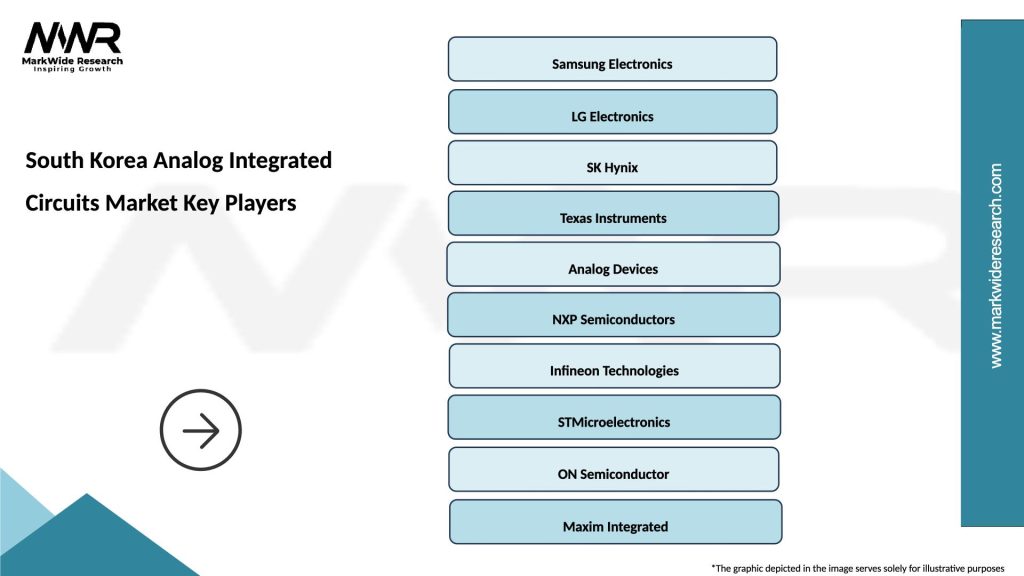

What are the key players in the South Korea Analog Integrated Circuits Market?

Key players in the South Korea Analog Integrated Circuits Market include Samsung Electronics, LG Electronics, and SK Hynix, among others.

What are the growth factors driving the South Korea Analog Integrated Circuits Market?

The growth of the South Korea Analog Integrated Circuits Market is driven by the increasing demand for consumer electronics, advancements in automotive electronics, and the rise of IoT applications.

What challenges does the South Korea Analog Integrated Circuits Market face?

Challenges in the South Korea Analog Integrated Circuits Market include the high cost of R&D, rapid technological changes, and intense competition among manufacturers.

What opportunities exist in the South Korea Analog Integrated Circuits Market?

Opportunities in the South Korea Analog Integrated Circuits Market include the growing adoption of electric vehicles, the expansion of smart home technologies, and the increasing integration of AI in electronic devices.

What trends are shaping the South Korea Analog Integrated Circuits Market?

Trends in the South Korea Analog Integrated Circuits Market include the miniaturization of components, the shift towards energy-efficient designs, and the increasing use of mixed-signal ICs in various applications.

South Korea Analog Integrated Circuits Market

| Segmentation Details | Description |

|---|---|

| Product Type | Operational Amplifiers, Voltage Regulators, Comparators, Analog Multipliers |

| Technology | CMOS, BiCMOS, BJT, GaAs |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Signal Processing, Power Management, Audio Processing, Sensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Analog Integrated Circuits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at